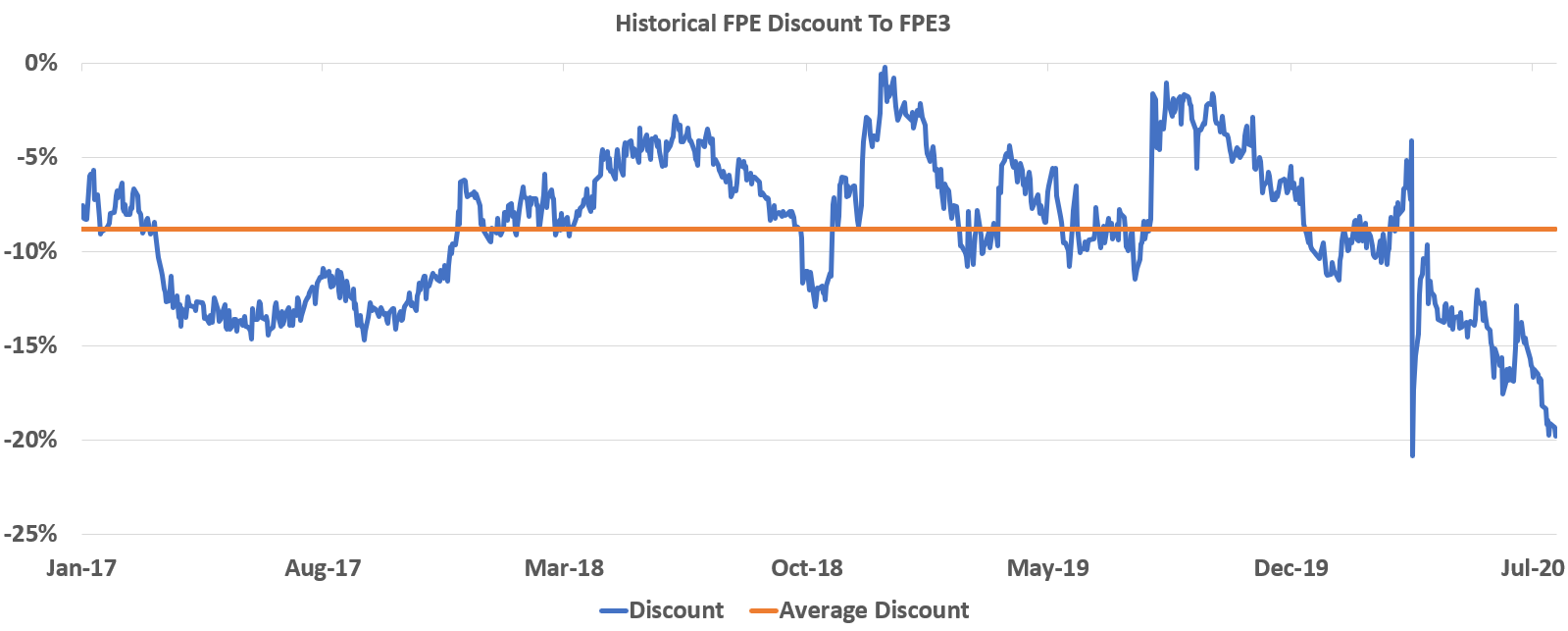

Fuchs Petrolub (FPE.DE) – Discount Mean Reversion – 11% Upside

Current Discount: 20%

Average Discount: 9%

Upside: 11%

Expiration Date: TBD

This idea was shared by DiSam

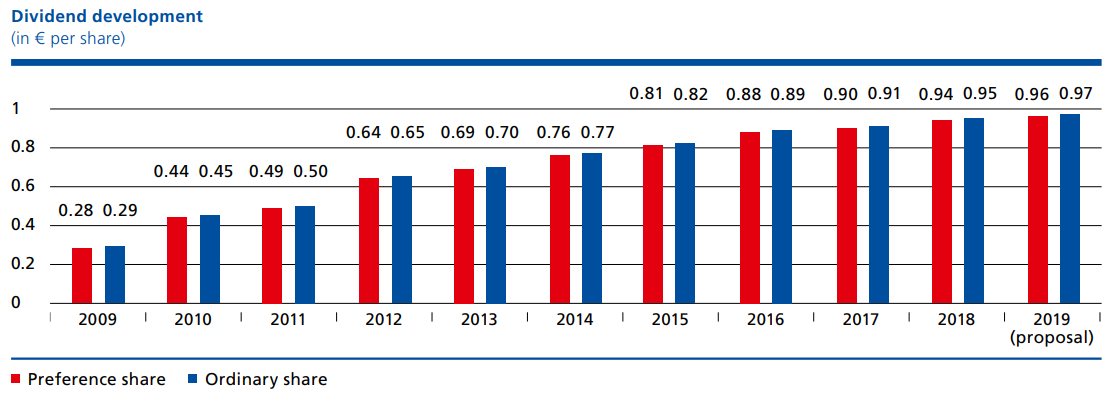

Fuchs Petrolub is a German manufacturer of automotive lubricants (engine motor oils) for motor cars, motorcycles, agricultural vehicles, etc. The company has two classes of shares with pretty much identical economic value and dividends – ordinary voting shares (FPE) and preference shares (FPE3) with no voting but preference on dividends. Both classes have the same amount of securities issued (69.5m) and receive the same amount in dividends (actually FPE receives €0.01/share more, see below). Despite that, FPE shares (the ones with voting power) are trading at a large discount to FPE3, which is quite uncommon in Germany (see here) where the voting shares usually trade at a premium to non-voting shares. This discount fluctuated around 9% on average. However, the spread has increased to 20% with the recent COVID-19 outbreak and volatility in the markets.

We think that there’s a play here on the discount mean reversion, with the current spread eventually returning close to the average of 9% as besides the recent volatility there seems to be no other reason for the wider than usual discount to persist.

FPE3 borrow for hedging is available (315k shares on IB) and cheap (1% fee/year).

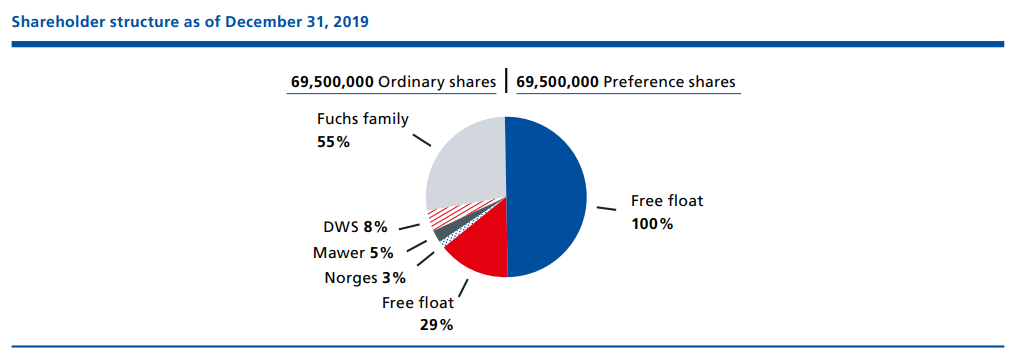

Part of the discount can probably be explained by significantly larger free float (3x, see chart below) and higher liquidity (148k average daily volume vs 24k) of the preference non-voting shares vs ordinary voting shares. Also, preference shares are included in major indexes such as MDAX, STOXX EU 600, etc. This coupled with the seniority of the preferred non-voting shares are the only reasons I found to explain FPE3 premium over FPE.

Voting benefits of ordinary shares are probably worthless as the founder’s family controls 55% of the voting shares so clearly no incremental benefit.

From the annual report:

Thanks for the write-up, looks interesting! What exactly are the dividend preferences for the preferred in this case? The higher spread may reflect expectations of dividend cuts (which may affect the preferreds less if dividends are cumulative).

Dividend preference refers to this (from the annual report):

In accordance with the company’s Articles of Association, the unappropriated profit is used in the following order:

a. For payment of any remaining profit shares on the non-voting preference shares from previous years;

b. For payment of a preference profit share of € 0.03 per non-voting preference share of no par value;

c. For payment of an initial profit share of €0.02 per ordinary share of no par value;

d. For equal payment of further profit shares on the ordinary shares and the non-voting preference shares, unless the Annual General Meeting decides on another use.

Thus dividends on preference shares will always be higher than the ones on the ordinary shares.

I am really puzzled by the fact that these preference shares trade at a premium to voting shares. 1% difference in dividends and higher liquidity should not be responsible for such a large spread.

What other pros/cons are there for holding preference instead of ordinary shares and how that might differ company by company? (as in some other German cases I looked at preference shares were trading at a discount and not premium to voting shares).

Could anyone with more knowledge on German markets and peculiarities of these different share class structures chip in?

Correct me if I’m wrong, but theoretically doesn’t it make sense for the prefs to trade at least in-line (if not at a premium) with the voting shares given their superior claim in the capital stack? Especially, because the voting shares are redundant anyway due to the ownership structure.

I know in practice the prefs often trade at a discount, but I’d be interested if anyone thinks they should logically.

Thank you for the write-up DiSam.

Another similar example is Henkel – voting shares (HEN.DE) are also trading at a discount to non-voting shares (HEN3.DE). The average discount for 5 years (since 2015) is 11%, which during the COVID crisis in March increased to 20%, but only for a short time and now has returned to the average (current discount stands at 12%). Other than that, capital structure is very similar – 61% of the voting shares are controlled by the founder’s family, while preferred shares receive 1-2ct higher dividends.

Volkswagen also shows a similar trend – average discount (since 2015) of voting shares to non-voting stands at 3%. In March it widened to 17% and now shrunk to 5%.

If these examples are any good, it speaks well for this thesis and it seems that FPE discount should narrow down sooner or later as well. Discount stands at 21% now.

Could you share the excel with the historical discount?

Downloading historical data from Yahoo Finance might do the trick.

I quickly went thru some German pref share divergences and found these .

Prefs Common discount

Fuchs Petrolab 22.6%

Henkel 11.7%

Volkswagen -6.2%

BMW -25.6%

If there’s any other of particular interest, happy to hear those!

In my view, the reason for the increased spread is because of the different indices both stocks are in. There are was a spike in ETF inflows and some of those exclude FPE. So betting on the spread to narrow is in part a bet against passive investment vehicles.

The spread between the preferred (FPE3.DE) and common (FPE.DE) shares widened further, with common shares now trading at 28% discount to the preferreds. No apparent reasons for this move except maybe for continued inflows into index funds (Fuchs preferreds are included in indices and common ones not).

The trend has finally reversed and the spread between preferred and common started to narrow – now the discount stands at the same 20% level as it was at the time of the write-up.

Is there a good way to graphically see the history of this spread without having to create it in a spreadsheet?

You can try plotting both stocks on yahoo finance. 6 months chart seems to show the trends well (or pick any other starting point where the spread was close to zero).

Closing out Fuchs Petrolub idea. At the time of the write-up there seemed to be a play on swift discount mean reversion between two classes of shares (discount widened with Mar’20 markets turmoil). However, in half a year the discount narrowed only slightly. With no apparent catalysts ahead, I am closing this one. It is very likely the discount will revert to the average eventually, but not clear when will this happen.