Sirius International Insurance Group (SG) – Merger Arbitrage – 24% Upside

Current Price: $11.07

Offer Price: $13.73

Upside: 24%

Final Payment: Q1 2023

The transaction is fresh, so information is limited. Due to the prolonged timeline IRR stands at 10%.

Reinsurance provider Sirius International Insurance Group is subject to acquisition by its peer Third Point Reinsurance. Closing is expected in Q1’21. Conditions include approval from shareholders of both companies (it seems that only the majority will be needed). The controlling shareholder of Sirius, China Minsheng Investment Group (owns 96% of common shares and 87% of voting power) is supporting the transaction. The largest individual shareholder of TPRE Daniel S. Loeb (TPRE co-founder and also one of the most successful investors in the US – runs Third Point hedge fund) owns 9.36% and has also agreed to vote in favor of the transaction. Management of TPRE holds another 9% of the company. The buyer will finance the transaction with cash on hand + $50m equity commitment from Dan Loeb.

The consideration comes in 1 of the 3 options with no proration among them:

- $9.50 in cash (14% discount to the current price).

- 0.743 of TPRE + two-year contingent value right (CVR), which guarantees that on the second year anniversary of the closing date, shareholders will have received a total sum of equity and cash of $13.73/share (24% upside). CVR value will be calculated based on the SiriusPoint (combined company) trading price at the settlement date (2 years after closing).

- A mixed consideration (adds up to less than $10/share using current TRPE prices) of 1) $0.905/share in cash + 2) 0.521 of TPRE common shares (subject to +/- 5% collar) + 3) 0.111 of TPRE preferred share subject to adjustment based on COVID-19 losses (the number will be fixed at closing) + 4) 0.19 5-year warrant issued by TPRE with a strike price of $11/share + 5) $0.905/share paid in stock if in one year since closing SiriusPoint share price trades above $20/share for 30 consecutive days.

China Mingsheng (largest Sirius shareholder) has already chosen the third option. Nonetheless, for an average retail investor, the second option looks the most secure and attractive so far.

The whole situation encompasses two main risks – the merger will get terminated (downside to pre-announcement is 36%) or SiriusPoint won’t be able to pay out the CVR in Q1 2023. Despite that, it seems that both risks are relatively minor/small enough to make this situation attractive.

Merger Rationale

This transaction is believed to be one of the first in insurance/reinsurance space after COVID-19 outbreak as in the face of a potential wave of claims the industry is expected to consolidate – some companies are expected to start divesting non-core businesses, while others will be looking to acquire cheap assets.

The offer seems to be priced favorably for TPRE. The first option ($9.50/share) comes at 0.72x to Q2 BV, while the 2nd option ($13.73/share in 2023) stands at 1.04x to BV (albeit to be paid out in full only 2.5 years later). Overall, this is considerably lower than the median of peer acquisitions for the last 7 years – 1.45x P/BV (of course COVID has significantly impacted valuations of insurance companies).

Aside from the scale and larger capital base, which will also position the company better for the possible future acquisitions (as hinted by Daniel Loeb), this merger will boost TPRE’s transformation started in 2019 (more info below). As stated by TPRE:

“In addition to the work we’ve done organically, we have been looking for a partner, to allow us to advance and accelerate our progress.”

The company seems to be determined to close the valuation gap (discount to BV) and get closer to peer performance (both were the goals of the transformation). In order to reach these goals, the company intends to expand into more profitable underwriting while moving towards more traditional investment allocation. The merger with Sirius Point will create a more diversified portfolio and alongside Sirius’ specialty reinsurance business will add new insurance lines (Global A&H), which will allow the combined company to have less reliance on property catastrophe products to drive profitability. CEO of TPRE stated:

This will be a strategic differentiator on the return side, while also reducing volatility and creating a portfolio of mix more in line with pure property casualty reinsurers.

The combination will also eliminate certain negative market overhangs – Chinese parent control for SG, while TPRE will get rid off the “captive vehicle” image:

Third Point Re has had legacy perception as a captive vehicle, that’s because traditionally, we’ve had a large portion of our invested assets in Third Point LLC is enhanced fund.

Going forwards the company intends to reduce the number of investments held in the Third Point fund – the majority of traditional investments will be outsourced to a range of other asset managers, while the legacy hedge fund will continue to manage investments in specialty asset classes.

The company expects that all these changes will result in increased attractiveness of SiriusPoint for the traditional insurance/reinsurance investors, driving re-rating, and improved P/BV valuation.

The transaction is expected to be accretive alongside all traditional financial metric lines (EPS, ROE, etc.) and have a short payback time:

While issuing a significant number of Third Point Re shares at a significant discount to book value is expected to result in some dilution to book value per share. We expect a relatively short payback period, with only a modest improvement in the valuation profile required for us to breakeven.

(…)

We’ve discussed our plans with the rating agencies and believes strongly that given all these factors, as well as our strong pro forma financial performance, and capitalization with further ability to reposition our risk profile, the strategic transformation we are executing will have positive credit implications for the combined company.

Also, in essence, SG assets will receive a new (and better) management – no directors of Sirius will join the combined company’s board. It will be comprised of TPRE directors and new Chairman/CEO (previous CFO and chief risk officer of AIG). Given that SG business performance is mainly handicapped by poor property catastrophe product performance (more info below), any improvements in the underwriting process/decisions for this category should result in significantly better overall returns. Additionally, return from current Sirius investments should see an improvement as well.

So overall, taking all these points above it seems that TPRE should proceed with this merger.

Future CVR payment

Due to the prolonged timeline, it is difficult to handicap the risk of not getting the CVR payment in Q1 2023. However, the prospects look relatively stable so far (also, the leverage of SiriusPoint is expected to be quite limited – 30% and decrease with time). Furthermore, if all remaining shareholders (aside from China Mingsheng) choose the 2nd option of the consideration, then assuming the TPRE price remains unchanged in 2.5 years, the total CVR payment would amount to $122m, which is not very material compared to the combined company BV of $2.9bn.

Both companies have already been operating for many years, while the current changes are poised only to increase the stability of the businesses. The backing and support from the Third Point hedge fund (and Daniel Loeb’s $50m equity commitment) give a bit of confidence as well. So all in all, currently, I don’t see any prominent risk here.

Sirius International Insurance Group

SG operates reinsurance and primary insurance (accident and health space) business. In 2016 it was acquired by China Mingsheng for $2.6bn (current market cap = $1.2bn) and got listed in Nov’18 the company through a SPAC (first trading day opened at $12/share).

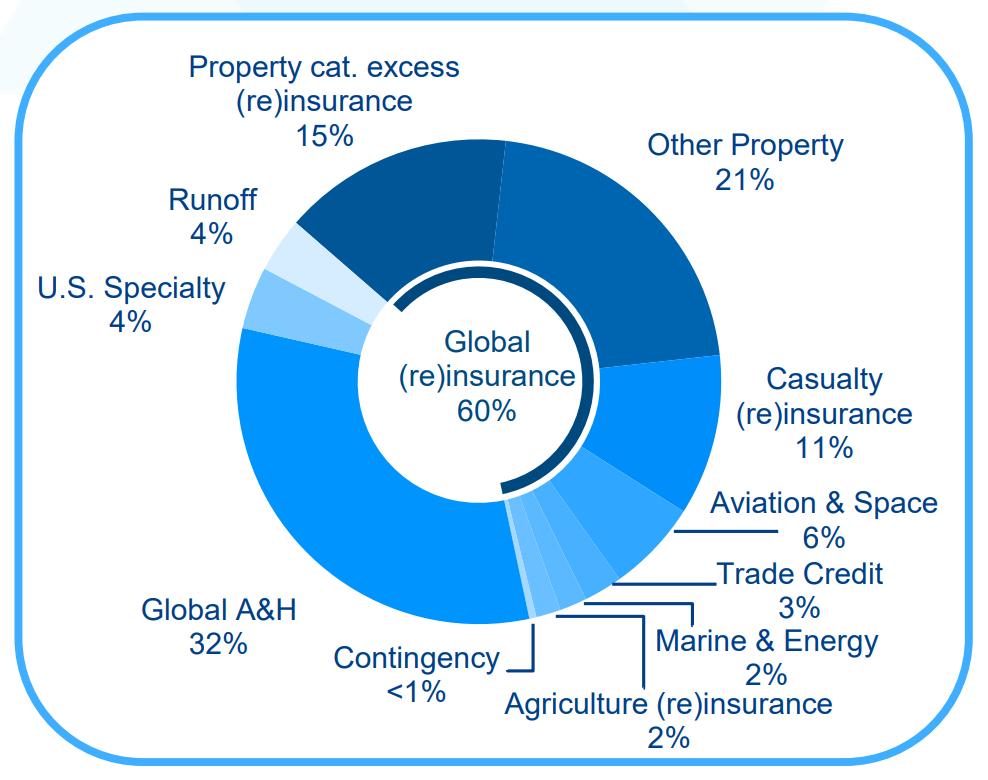

Business mix by segments:

Geographies – 61% US, 18% EU, 7% Canada, 14% Asia.

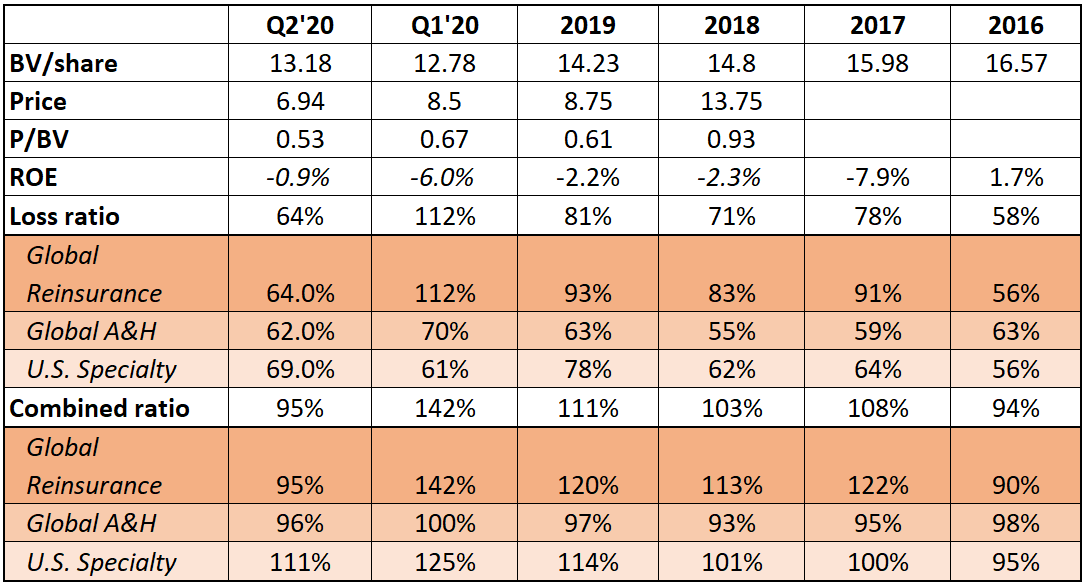

Since the IPO the company has significantly underperformed its peers and trades at a wide discount to BV – apparently, since 2017 company’s financial performance has been strongly impacted by losses incurred in the property catastrophe products, part of the Global Reinsurance category below.

Sirius performance:

Investment results:

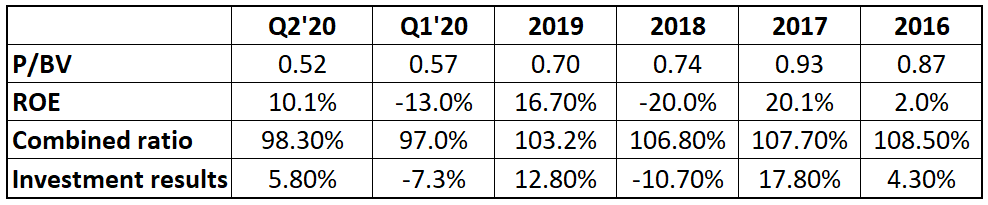

Average peer results (source):

With the COVID outbreak, the company has experienced additional negative pressure due to concerns over its Chinese parent. In early March’20 Sirius shares dropped 17% after being downgraded by a certain rating agency because of debt and liquidity issues and lack of financial transparency of Chinese Mingsheng. At the end of March, the company has launched a sale process in collaboration with its majority shareholder.

It seems that Chinese Mingshend really wants to get this deal done and this time they’ve agreed to a voting cap of 9.9% (despite controlling 36%/39% of SiriusPoint common shares).

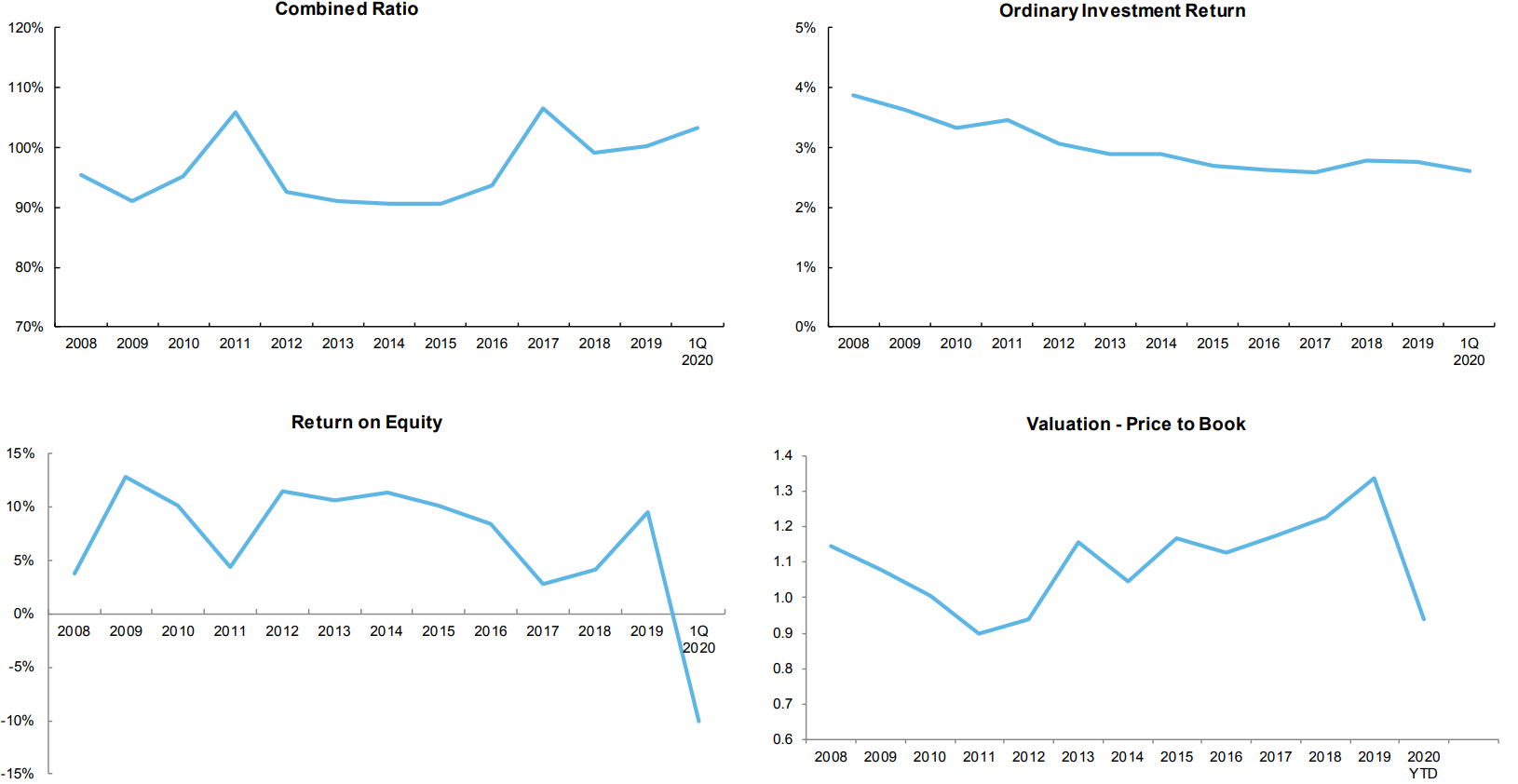

Third Point Reinsurance

The company was co-founded by Daniel Loeb in 2011. It went public in 2013 with an IPO price of $12.50/share.

The company operates in the reinsurance business and has Third Point hedge fund managing their investments. Over the years TPRE tried to combine safer low volatility underwriting and superior investment management by Third Point fund, which resulted in higher, but way more volatile returns in their investment performance. TPRE is an important and valuable asset to the hedge fund, which not only acts as an investment manager but also has 28% of TPRE float investments allocated in the Third Point fund, making around 5% of the Third Point fund portfolio ($14.5bn AUM).

Despite that, this related party structure appeared to have certain handicaps as it became difficult to find profitable low volatility underwriting business, while the inherent volatility of the investment strategy was off-putting traditional insurance investors. So since 2019, the company has been transforming into specialty reinsurance and focusing on more profitable reinsurance lines. In Q1’19 the company has started its property catastrophe products (the most profitable, but also the most volatile business line in the industry).

The company operates in these geographies: 52% US, 24% UK, 23% Bermuda.

Performance:

I think that you may have misinterpreted the 2nd consideration. Although the initial PR, the TPRE’s investor presentation, and the CFO used phrases similar to what you have written I think they were subject to interpretation. I also initially read the PR and interpreted it as meaning that a share of SG would not pay less than $13.73 in 2 years. The initial PR and other documents use the following language, “2) 0.743 of a Third Point Re share and a two-year Contingent Value Right (CVR) which, taken together, guarantee that on the second anniversary of the closing date, the electing shareholders will have received equity and cash of at least $13.73 per share”. I initially purchased stock around $10 and thought that I had fallen into a great trade. Unfortunately, I later became convinced that the “per share” referred to in the prior sentence did not refer to a share of SG, but to a share of TPRE (to which the SG holder is only receiving 0.743 shares for each share of SG. So for each share of SG, the shareholder will receive a minimum of $10.20 (0.743 * $13.73) in two years.

The parties did not immediately release the Merger Agreement. Subsequently, I was able to review a Summary of Terms (that was filed as an 8K) and the Merger Agreement. The Merger Agreement includes the following definition: “Maturity Payment” means an amount equal to (i) $13.73 minus (ii) (A) the volume weighted average price of the Shares (as reported by Bloomberg L.P. or, if not reported therein, in another authoritative source selected by the Company) measured over the Maturity Valuation Period multiplied by (B) 0.743 (pg 208 of 493 in 8K filed on 8/10/20). The Shares in the case definitely refer to the TPRE traded shares (what other shares could a CVR refer to). Since SG shareholders selecting the 2nd consideration option receive 0.743 shares plus a CVR that pays 0.743 * (13.73 – TPRE’s price), they are only assured of receiving $10.20 per share of SG.

I now believe that the current price reflects a misinterpretation of the terms and believe it is a short opportunity.

Tom, I think you are misreading that sentence. All sources clearly state that shareholders will receive stock + CVR (not only CVR based on some ratio), while as for the value of the CVR, the 17th page of the investor’s presentation says “CVR settles in cash after two years representing the difference between $13.73 and SiriusPoint share price at settlement multiplied by 0.743”.

https://s1.q4cdn.com/849943712/files/doc_downloads/2020/08/Third-Point-Re-and-Sirius-Group-Merger-Presentation.pdf

I dont see any verbiage that suggests mathematically putting the .743 outside of parens and putting (13.73-TPRE) in parens

I see verbiage that supports 13.73- (tpre price * .73)

typo there……in parens (SPG price times .743)

Ilja,

I think you are proving my point. The CVR pays out based upon the new shares of which the SG holder only receives 0.743 shares per share of SG. The return indicated in the above recommendation is based upon buying something for $11 today and being able to collect $13.73 in 2 years. However, you are paying $11 today for 0.743 of $13.73.

The language in the PR, presentations, etc are irrelevant. All that matters is the Merger Agreement. I don’t think there is anyway to interpret the language in the MA other than how I have interpreted it. Please explain how you interpret the language in the MA.

The only other justification I can think of for the shares trading so high is that what you own is zero coupon bond that pays $10.20 in 2 years and 0.743 call options on the new company struck at $10.20. However, the value of these has to be adjusted for the lack of liquidity (I don’t know if the CVR is going to be listed) and the probability of the merger not being completed (i.e., the stock falls back to $6).

I don’t think they (PR, presentations) are irrelevant if they all indicate the same point – that the overall value of the consideration is $13.73, guaranteed by the CVR, which value will be based on (as noted by g4734g above) $13.73 – (SiriusPoint share price at the settlement date * 0.743). So shareholders will receive both the stock consideration, which is 0.743 TPRE + CVR, that guarantees the eventual total value of $13.73/share in two years. That is my interpretation of the merger agreement as well. I think that the way CFO said it in the conf. call backs this up as well: “the electing shareholders will have received equity and cash of at least $13.73 per share in value” – indicates that $13.73/share is meant for the value of the whole 2nd option and not TPRE shares.

https://seekingalpha.com/article/4365814-third-point-reinsurance-ltd-tpre-third-point-re-and-sirius-groups-merger-announcement-call?part=single

Tom, your quote from the CVR agreement (Maturity payment) also says that the value of the CVR is $13.73 – SiriusPoint * 0.743. And on top of that shareholders will receive 0.743x TPRE (or SiriusPoint) as well.

I agree the wording is highly ambiguous (in the sense that my interpretation differs per document). What bugs me though is the lack of rationale to offering shareholders two options which are worth less than $10, and then a third option which is worth over 40% more (with a major shareholder NOT choosing the 40% higher option). Where’s the logic in that?

Of course, the third option requires a two-year-wait but still a 40% high offer in a zero-interest rate environment with a company that does not have any particular bankruptcy concern seems extremely odd to me and a bit too-good-to-be-true (as is the 24% spread).

Btw, for me the value of the call option in the CVR does explain the current share price close enough not to see it as an attractive short opportunity either.

Yeah, I think the CVR agreement is pretty clear: ““Maturity Payment” means an amount equal to (i) $13.73 minus (ii) (A) the volume weighted average price of the Shares (as reported by Bloomberg L.P. or, if not reported therein, in another authoritative source selected by the Company) measured over the Maturity Valuation Period multiplied by (B) 0.743.”. Multiplication takes precedence over subtraction (or however you say that in English) so it’s 13.73 – (share price * 0.743).

As merger consideration you receive 0.743 shares and 1 CVR per share of SG. If you hold on until redemption the total consideration is 0.743 * share (share consideration) + 13.73 – (share price * 0.734) (CVR consideration) = 13.73 per share of SG. I think it is pretty obvious but if you don’t believe us by far the easiest thing would be to contact SG / TPRE IR.

Also, are the shares really trading that high? The CVR will mature in two years, so probably around March 2023. That leads to an ~8% IRR if you have to hold on to completion. I’d say that is a pretty fair number given the complexity of the deal, deal risk and the fact that you own an instrument ranked as subordinated debt. TPRUSA is currently borrowing money at 7% and those notes are senior.

Assuming a March 2021 payment date of the stock component and a March 2023 payment date of the CVR component I’m getting a 15% IRR.

But if you sell the stock component the moment you receive it there is no guaranteed $13.73 anymore: if the stock goes up the CVR expires worthless.

Essentially you’re buying a put with ~8% IRR (excluding dealbreak etc.) and if TPRE goes ~2.1x or higher before Q1 2023 you get some extra upside.

Sounds somewhat interesting, although it would need to trade at ~$18.7 or higher at current prices and eyeballing their chart they’ve never traded for this price. So atm I would say odds of that are too small, and 8% IRR for the downside is too optimistic either.

Yes, you get the stock in 2021 but you don’t accrue any incremental value to your investment unless and until it passes $18 per share….so I don’t think you can bake in the 2021 date for IRR purposes as though it was cash

Ah, yes, true.

Wrister, IIja, g4734g

Thank you! You have turned me around. I agree that I have been misreading the CVR payout and it is 13.73 – (share price * 0.743).

Anyone have any idea why they offered these terms and at the same time offered the clearly inferior $9.5?

I think the presentation was quite clear. Bullet #2 “CVR settles in CASH (my emphasis) after two years representing the difference between $13.73 and SiriusPoint share price at settlement multiplied by 0.743”

Agree that option #1 is puzzling and who would take it unless SG is below that.

Could y’all share your thoughts on option 3? How does one conclude that it’s worth less than $10 when there are options involved?

It looks from the writeup like its only .19 of a warrant. So although its 5 years, its currently over $2 out of the money….so if you take a rough stab and say the warrant could be worth $2 or $3, .19 of that still pretty negligible.

I am looking for the preferred issue……is this out there now or to be issued along with the deal?

A few observations (if they weren’t obvious to someone) and questions:

1) the CVRs are extinguished if “the volume weighted average price of the Shares … is greater than $18.50 per Share over any fourteen (14) consecutive Trading Day period after the Effective Time and prior to the CVR Payment Date.” So if you hold on past $18.50 for 2 weeks then you lose the put option provided by the CVR.

2) the CVRs will be listed on NYSE or OTC. I wonder if there will be selling pressure from people dumping the CVRs indiscriminately? Option 2 is the default option for shareholders of SG who do make an election, so there will be apathetic investors receiving CVRs who don’t want them (or maybe institutions who aren’t allowed to own them?). See this quote (my emphasis):

“Each Company Share with respect to which an election to receive a combination of Parent Shares and CVR consideration (a “Share & CVR Election”) has been effectively made and not revoked or lost pursuant to Section 2.03 (each, a “Share & CVR Electing Company Share”) ***AND EACH NON-ELECTING COMPANY SHARE*** shall be converted into the right to receive the combination of {0.743 of a share and one CVR}”

At the current prices of $11.42 per share of SG and $8.64 per share of TPRE, option 2 implies a price for the CVR of $5, whereas I guess it’s worth at least the amount that it’s in-the-money, which would be 18.5 – 8.64 = $9.86 (ignoring the fact the CVR can be extinguished above $18.50/share). Perhaps it will end up more lucrative to buy the CVRs post-merger.

3) In light of possibly depressed CVR prices shortly after merger, let’s get creative. Suppose you elect option 3, and then buy CVRs at a bargain price shortly after they are issued (let’s say $5). That bumps up the share value of the consideration in option 3 from 0.521 * 8.64 = $4.50 to 0.521*(18.50 – 5) ~ $7.

4) The filings state that the warrants can be sold, but I don’t see any mention of listing it on an exchange.

Typo: Option 2 is the default option for shareholders of SG who do *NOT* make an election

I don’t think the in the in the money amount is 9.86…you’re getting stock worth a bit more than 6 and the guarantee is 13, so the in the money amount is 7 and change. In your formula if you multiply 18.5 and 8.64 by the .743 factor I think you will get the exact number.

If the cvrs do trade at a discount my preference would be to buy the cvrs and .743 tpre shares for every warrant

Great idea on your part….thank for sharing

Ah right, I forgot that one CVR guarantees only .743 of a share.

So are you considering taking option 3, then buying enough shares and CVRs post-merger to bring your position to be (close to) divisible by {1 cvr, .743 tpre, 1 warrant}?

One could also just dump the TPRE shares and own only the warrants and CVRs in the correct proportion. You tie up less capital that way. I thought about LEAPs+CVRs but I only see calls going out to April ’21. The warrants would do the job.

Haven’t had my coffee so this isn’t crystal clear to me. Would like your thoughts.

no ill just do option two….then as a seperate trade I would buy the warrants if they appear to be mispriced, and pair them with .74 tpre to lock in the hedge

The warrant document doesn’t mention that they will be listed on an exchange though. Although it does say they are transferable.

Re point 2: even IF you make an election you are pretty much forced to choose option 2, because it is worth far more than the other options. So there might be selling pressure even from investors who did make an informed choice but don’t want to or can’t tie up their capital in the CVR. That’s what I am hoping for, at least ..

Good point. When you say you’re hoping for it, does that mean you’ll be waiting until post-merger to try to scoop up shares and/or CVRs?

Also why would the largest shareholder commit to option 3? Seems like they know something we don’t. I know it’s only 0.19 of a warrant, but 5 years is a long time.

On a side note, anyone have any experience with Rights Offerings? Liberty Latin America (LILA or LILAB) is doing a Rights Offering at a 25% discount. This seems like an opportunity but I’ve never practiced a Rights Offering before.

In order to be granted the rights through stock ownership you would have to purchase the LILA stock by the 9th of Sep as ex rights day is Sep 11. There is generally no free lunch, however, as the stock will be adjusted by the value of the rights, (given the dilution that will occur) on ex day……having said that, once the rights themselves start trading, they can and often do, trade at a discount to their intrinsic value as folks who don’t want to exercise attempt to sell their rights and depress price if there is not sufficient demand on the buy side for the rights. Thanks for the heads up, always game for a John Malone deal, he has another one going with QRTEA.

If one of the reasons for the merger is that tpre is a better operator, (The writeup points out zero Sirius board members are joining new board) what is the rational to rebrand newco under the Sirius nameplate?

Shareholder meetings to vote on the merger will be held on 19th and 23rd of Nov (for SG and TPRE respectively).

https://www.sec.gov/Archives/edgar/data/1744894/000174489420000037/annualmeeting8-k2020.htm

https://www.sec.gov/Archives/edgar/data/1576018/000157601820000152/sgmpressreleaseyoga.htm

would have liked to see a bigger move up from SG on TPRE up 10%…….TPRE increase reduces the cash outlay the combined company with actually have to make…(albeit two years from now)

Quarterly results of both firms were released. SG results showed a significant impact of COVID and catastrophe losses: ROE -6.3%, loss ratio 83% combined ratio 115%, investment income 2% and BV fell to $12.66/share from $13.18/share. CEO stressed the importance of the upcoming merger for the company:

TPRE showed much more solid performance, although the impact from COVID and catastrophe losses was also significant. ROE 5.1% (driven by investment income of 4.8%), loss ratio 78%, combined ratio 120% (32% attributed to COVID and catastrophe losses). BV actually increased to $15.06/share vs $14.37/share in Q2. TPRE management also seemed very positive about the merger and expects closing in Q1’21:

Overall, despite the lackluster results of SG, the strategic rationale remains strong and successful closure seems very likely. Meetings are set for the 19th and 23rd of Nov (for SG and TPRE respectively).

I’m not able to find results of either SG or TPRE shareholder votes, both of which should have concluded by now…..Anyone have insight?

SG vote results in. Large majority approved the merger and related bylaw changes. However, almost as large majority voted against, on an advisory basis, certain proposed payments to management in connection with the merger.

I’m assuming they will go ahead anyway regardless of not carrying the advisory vote. It’s been my assumption that voters will vote reflexively against compensation to management proposals. Other thoughts?

Third Point Re and Sirius Group shareholders voted to approve all proposals required to complete the merger (a couple of proposals regarding by-laws and exec compensation have been rejected, but these do not affect the merger).

CEO of TPRE said that they are on track to close the transaction in line with the previously announced target of Q1 2021.

https://www.sec.gov/Archives/edgar/data/1576018/000157601820000183/shareholdervotepressrelease.htm

Spread remains at 18% with minimal risks for the transaction to close. The main reason for such a large spread is now due are the opportunity costs of locking-in capital for 2 years and some small risk that TPRE will fail to pay out the required amount. Upon merger SG shareholders will receive only $7.23/share in stock and will need to wait 2 years for $6.49/share CVR payout. If during this time TPRE stock price increases to $18.5 no cash payment will be due. So investors need to hold on the newly received TPRE stock for the whole perdiod to capture the remaining spread. The risk of CVR not paying out seems minimal at this point in time, but that might change within 2 years.

CVR is marked as transferable, so I am guessing (but not entirely sure) it will be tradeable in the market and the spread will close gradually over-time. Assuming TPRE stock price remains unchanged, then the tobe receievd CVR become similar to zero coupon fixed income instrument.

Just looking at option number two, isn’t it pretty attractive? At current price, as a simple holder, you will achieve a 17% return in two years. That’s an IRR of a little over 8%. I believe that’s significantly better then a typical two-year subordinated note.

Also, the stock and associated CVR will have a market, so there will be liquidity. How many other liquid investments like this are available? I’m asking the question naively; I just don’t know.

As to credit quality, it seems to me, without a lot of analysis, that it’s pretty good, and Dan Loeb’s participation gives some comfort. I I own a bunch of TPOU, so maybe I’m prejudiced.

I agree that there may be even better opportunities once the transaction closes to buy the CVR at a discount etc.But even at these prices, the opportunity looks pretty good.

I would certainly welcome thoughts on this.

As to liquidity of the CVRs, this is from the merger proxy statement:

“The CVRs to be issued to Sirius shareholders who make the Share & CVR election will be traded on a stock exchange or in the over-the-counter market and thus will be liquid securities that will provide Sirius shareholders the ability to sell the CVRs for their fair market value while the CVRs remain outstanding;”

Thus, the investment is not tied up for the two year period.

This SG / TPRE merger arbitrage has so far generated 13% return. The closing of the transaction is pretty much guaranteed now. Those who hold on to SG/TPRE shares and the CVR for two years have an option to generate an additional guaranteed 10% return (assuming there is no risk that TPRE does not pay-out).

Will be interesting to see at what price the CVRs will trade after the merger and this might offer further arbitrage opportunities. But for now I am closing this idea with 13% gain.

Only 4% of holders got the Share + CVR option. I don’t see a ticker for the merged company (SPNT) or the CVRs yet.

https://sec.report/Document/0001576018-21-000031/spnt-20210225.htm

I choose the CVR-option, but that does raise the interesting question how much the “Mixed Consideration” was actually worth compared to the CVR option, considering this was apparently such a popular option. To be honest, I didn’t put much research into that option and TPRE did rally quite a bit these last few months, so the math might have been different than at the time of the write up.

I think a large portion of the mixed option is due to that large holder who expressed intention to do so. I forget how much % that was. It puzzled me why they opted for it, maybe there was copycat behavior.

Also when we were discussing things before, if I recall correctly there wasn’t much info out about the preferred shares. I skimmed the preferred share agreement yesterday, and they had some hard numbers about protections against covid losses. Maybe that’s an alluring aspect. Didn’t dig deeply though, as I was more interested in finding out whether the warrants and CVRs would be listed, and whether the warrants could be exercised with something other than cash.

That is surprising, but not as surprising as the 32,00 shares that were submitted for $9.30 when you could sell for $12 on any given day prior….Please advise if anyone sees the CVR ticker

New symbol spnt has hit the fido account, I dont see the cvr yet?

https://www.sec.gov/Archives/edgar/data/1576018/000157601821000052/siriuspointinvestorprese.htm

Check out slide 12. The CVR status is: “OTCQX listing in progress”

Notably, and unexpectedly to me, they are also going to list the warrants(!): “Pink sheet listing in progress”

Time to gear up for some potential fire-sale prices of these things. We need a rough estimate of their value in order to recognize whether there is opportunity.

There is also some info on how the preference shares would work, in the next slide(s).

Here is my best shot at the value…..please check my math…….you are guaranteed $13.73 of the old SG price, but you only got .73 shares of newco. (SPNT) So, you are guaranteed 13.73 divided by .73 in SPNT or $18.80 per SPNT share. SPNT shares right now $10.50 so intrinsic value of CVR 8.30?

Seems to me you have to buy SPNT and the CVR if you are opening a new trade and want to be hedged……CVR would need to be at a massive discount to get a decent return since you have to factor in the $ allocated for establishing the SPNT position. For example if you bought it at $6.30 and paid $10.50 for SPNT youd be in at $16.80 for a payoff of $18.80…..That $2.00 profit over two years, 12% profit but only 6% annualized. Now if the CVR trades at 4-5 thats a different story.

SPNT does have options, so perhaps there is a synthetic way to play this that is more advantageous.

This is wrong. 0.734 shares + a CVR is worth $13.73. With SPNT at $10.50 that means the CVR is worth 13.73 – 10.5 * 0.734 = $6.02.

For a rough estimate of the value of the CVR I would suggest the following:

– For every share of SG we got 0.743 share of SPNT and 1 CVR, the combination of which is guaranteed to pay out 13.73 in 2 years.

– The combination of this is theoretically equal (if you look at the cashflows) to owning a combination of 0.743 of a share of SPNT and 0.743 of a put option with a strike of 18.48 (13.73/0.743) and maturity of 2 years.

So basically the CVR should be worth 0.743 of a put option on SPNT with a strike of 18.48 and maturity of 2 years.

If I use http://www.option-price.com/index.php to value the put option, I get a value of 7.4 (parameters: underlying price 10.5, exercise price 18.48, days until expiration 720, interest rate 2, dividend yield 0, volatility 25%). So the CVR is then roughly worth 0.743 * 7.4 = 5.5.

Of course you can play around with the parameters in the option price calculator. Also maybe some discount is appropriate since it’s a CVR and not an option contract? Nonetheless I think this is a good framework to estimate the value the CVR.

I think a discount is justified. The CVR ranks equal with the subordinated debt of the combined company. Unlike a put option, if you buy stock and CVR’s you have credit risk. If the company collapses the whole position is worth zero.

Also, there is no risk-free upside in owning stock and the CVR because the company is extremely likely to redeem the CVR when its intrinsic value approaches zero. What is the time value of a put that can be redeemed at any point by the counterparty? It’s an interesting theoretical question that I don’t have a clear answer to, but I’m sure it should trade at a discount to a normal put. When SPNT trades at $20 the company can redeem the CVR for free and there’s no way they won’t do that. The flip side of this argument is of course that you are happy to see the CVR being redeemed because it reduces the duration of the trade. (also, note that the company will discount the payment by 2.5% p.a. in case of early redemption).

The way I am valuing the position is as a debt instrument. 0.743 shares and a CVR is an unsubordinated bond with a face value of $13.73 and a duration of two years. Other unsubordinated debt of the company yields ~5%. So the present “fair” value of this bond is about 13.73 / 1.05^2 or ~$12.45. That gives me a $4.63 value for the CVR. But I am not interested at all in owning this position if it yields 5%. Personally I think it is getting interesting at an implied IRR of 10% ($3.54) or 15% ($2.58).

My valuation is probably too conservative because I assign no value to the probability of early redemption of the CVR. You can assign some probability to that and add that back to your model.

Where I say ‘unsubordinated’ I mean ‘subordinated’, of course.

I def agree on the credit risk after your explanation and also the company can indeed redeem the CVR if the share price rises to the strike price. To get to a valuation with BS using both viewpoints I adjust the parameters with:

– Using a 10% risk free rate to account for the credit risk.

– Deducting the value of a call option with 18.48 from the Put option value, so that the upside above 18.5 share price is eliminated from the value.

If I do all that I get to a value of $3.47 for the CVR. Basically the same as your estimated value of $3.54 at 10% IRR. Apparently the volatility is worth very little here because the strike price is still so far away from the current price and also because of the redeemable option the company has.

Yes, looking from “my bond perspective” I think the chance that this bond is called early is worth very little because that will only happen when the share price is up almost 80% in a couple of months. Could happen, but I don’t have a fundamental view of the underlying company and for a ‘random insurer’ I’d say that chance is pretty close to zero.

So I think you can basically view the combined position as a bond and then say that it is perhaps worth a tiny bit more because the bond will be called if the share price is up 80%. I don’t think there is a simple way to model such a bond, you’d probably have to make a Monte Carlo model or play around with your Bloomberg terminal if you have one (I don’t). Building a Monte Carlo model seems like an interesting exercise but I doubt it will add that much value.

I think you should just decide for yourself at what yield you’d be happy to own a 2-year unsubordinated SPNT bond, perhaps subtract 0.5% to give some credit to the possibility of an early call and reverse engineer what CVR price that implies. The quick and dirty solution.

Also, note that the 5% yield on unsubordinated debt I said off the top of my head, I quickly looked at that a few months ago. Could be more. I think TPRE has some senior 7% notes and a quick look in IB suggests these trade at a 6% yield, which suggests that 5% for unsubordinated is actually way too optimistic. Something you’d have to check for yourself, I’d be happy to hear about it. I’m no bond expert, I don’t know where junior SPNT trades nor where it should trade. Personally I’m probably not interested in owning the CVR unless the yield is double digits anyway.

I’m curious about buying CVR + warrant combos, rather than CVR + common stock. Haven’t had time to think it through yet.

The CVR is now trading.