LF Capital Acquisition (LFACW) – Warrant Exchange – 16% Upside

Current Price: $1.75

Offer Price: $2.035

Upside: 16%

Expected Closing: Q4 2020

This idea was shared by John.

On August 31, 2020, SPAC LF Acquisition Corp (LFAC) has agreed to merge with the privately-owned California-based green technologies homebuilder Landsea Homes. In connection with the merger, the parties want to limit the future potential dilution from warrants and therefore all public warrants (LFACW) are to be bought back by the company at $1.85 per warrant, plus a new warrant equivalent to 0.1 of the current one. Since the warrants currently trade at $1.75, this presents an opportunity to make $0.10 per warrant, plus the value of the new warrant, which at the cashout price is worth $0.185 (eventual price will depend on where LFAC trades after the merger). This sums up to $2.035 per warrant offering a 16% upside to current prices. The deal is expected to close in Q4 of 2020.

LF Acquisition Corp is a Special Purpose Acquisition Company (SPAC) which has agreed to make an attractive acquisition in Landsea Homes. Landsea is a fast-growing builder of entry-level, modern homes in desirable growth markets in California and Arizona. Shareholders will vote on the 17th of September to extend the date by which the company has to consummate a business combination from September 22, 2020, to December 22, 2020. The vote on the business combination itself should happen at a later point. If redemptions are minimal during this vote, then both LFAC shares as well as warrants are likely to increase in price. During the previous extension vote (before the target was announced) 15% of shareholders redeemed.

As investors in SPACs know, in connection with a deal, all common shareholders are given the opportunity to redeem their shares for cash, which is the per-share cash held in a trust that was raised in the SPAC’s IPO. In addition, if no target is found during the SPAC’s prescribed lifetime (usually 2 years), a SPAC will liquidate. Upon liquidation, the trust fund is paid to prorate to the holders of the common, but all SPAC warrants expire worthless. An unpopular deal may lead to redemptions, depleting the SPAC’s cash, and causing the deal to fail. However, the vast majority of all SPAC deals close.

Multiple aspects of the Landsea deal point to a higher than average chance of a successful close:

- The sponsor agreed to give up a lot of the upside to get the transaction closed: “LF Capital intends to forfeit 2.26 million of our private warrants and 600,000 of our promote shares and place an additional 500,000 of our promote shares into an earnout with a $14 per share hurdle. We will also transfer 2.2 million private warrants and 500k sponsor promote shares to Landsea Green with the same share price hurdle”. For reference sponsor currently has 7.2m warrants and 3.6m shares.

- Landsea is bringing in an additional $204m in cash on the balance sheet to fund future growth.

- LF Acquisition Corp has secured a $35m backstop agreement to support the deal, and this backstop was oversubscribed: “We have also entered into a forward purchase agreement with certain institutional investors to purchase up to $35 million shares of LF’s common stock in the aftermarket at a price of up to $10.56 per share. The FPA Agreement was well-received by institutional investors and was oversubscribed.”

- All insiders, including Landsea and the sponsor, are waiving anti-dilution and redemption rights in connection with the deal.

- The common is trading at the redemption value of the trust fund, approximately $10.56 per share, making a buy/redemption arbitrage of the common unprofitable, and therefore unlikely.

- The current private owner of Landsea will retain 67% of the public company’s equity.

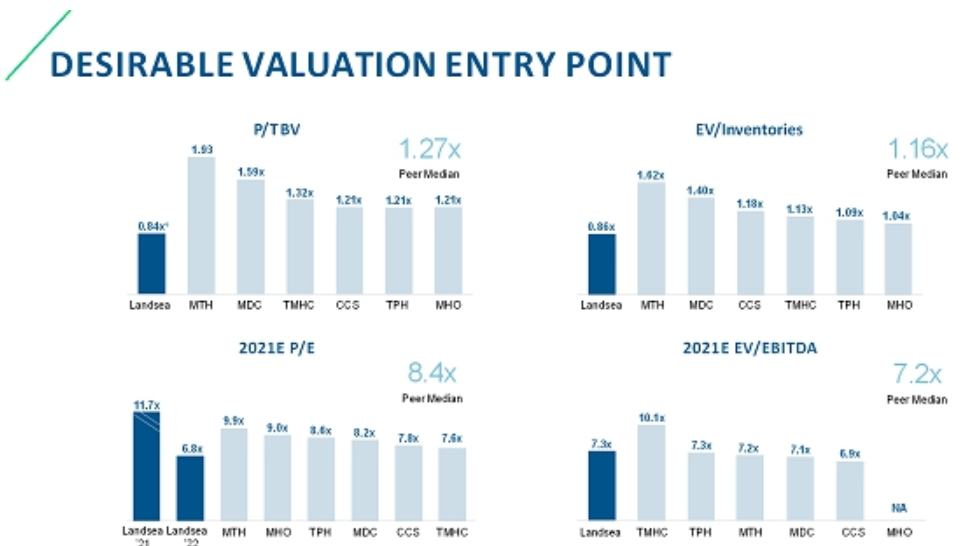

- Regarding the pricing – peer comparison charts show that the current merger is priced favorably relative to peers – valuation at 0.84x TBV is considerably below the peer median (1.27x), while other metrics (P/E, EV/ Inventories) reflect a similar trend (investor presentation).

Worth noting that in light of the currently booming US home building market (as well as SPAC bubble), the timing for the Landsea merger seems to be very favorable. US homebuilder index is currently at its all-time highs. Therefore, at least in the short term, any significant value destruction of the combined company seems unlikely and the current valuation of the new warrant (0.1x common) at $0.185 is justified.

Investment in LACF directly rather than only playing the warrant exchange arbitrage also seems to be an interesting opportunity given the dynamics of the agreement.

LFAC Background

LF Capital Acquisition conducted an IPO in June 2018 in which it issued 15.5m units at a price of $10 per unit. In parallel, it also made a private placement of 7.8m private placement warrants at a price of $1 per each warrant. The private placement was almost fully subscribed by the sponsor (7.2m warrants), while the remaining were bought by Blackrock. So through both IPO and private placement, LFAC raised $158m.

The SPAC was originally intended to be focused on financial services/fintech. However, as LFAC struggled to find a suitable target within this industry (the deadline was extended from the 22nd of June to the 22nd of September with 15% of shareholder’s redeeming their shares as a result) and the eventual agreement was signed with homebuilder Landsea on the 31st of August. Vote on another extension is upcoming on the 17th of September.

LFAC is run by a team of experienced investment bankers/financiers led by chairman Baudoin Pot, ex-chairman, and ex-CEO of BNP Paribas (one the largest bank groups in the world) for 2003-2014.

Current shareholder equity of LFAC consists of 13.4m class A shares, 3.9m class B shares, and 23.3m warrants including 15.5m public warrants and 7.8m private placement warrants.

Risks

I see two main risks in holding a long position LFACW position.

First, there is a very small risk that the deal will not close, in which case the SPAC will liquidate, and the warrant will expire worthless. However, as explained above, the actions taken by the sponsor and Landsea indicate this one has higher chances of closing than average. For the merger to close there must be at least $90m cash on the balance sheet vs the current $140m + $35m backstop agreement (not entirely sure if warrant cashout capital also needs to be deducted from this amount). So it seems that there is plenty of cushion for shareholder redemptions.

Second, the warrant exchange terms could be amended or the offer retracted altogether. However, if the original warrants remain outstanding after the deal closes, they will still have significant value. The original warrants have a 5-year term, $11.50 strike price for 1 share of the common. Based on a Black Scholes model, and a post-deal stock price of between $8 and $11, the original warrants may be worth between $1.04 and $2.67 per warrant, post-close. The warrant amendment requires the approval of holders of at least 65% of the outstanding public warrants, and the closing of the merger is not conditioned on approval of the warrant amendment.

Love the idea and great write up. Thanks John and dt.

Not sure why you use the cash-out price (1.85) to estimate the value of the warrant post exchange offer. At that time, the offer is not available anymore, so the cash-out price is irrelevant. A better proxy seems to be the pre-announcement price on August 31 which was quite bit lower (0.75), especially since around the deal announcement the price of the underlying did not change much.

That’s not right either I think? Warrants can be exercised 30 days after a Business Combination. If you use the backstop price of $10.56 as an indication for post-close price then a warrant value of >$1 seems conservative enough.

I might be misunderstanding (SPAC and warrant noob) but pre-announcements these warrants had a decent chance of turning worthless since deadline for a deal was set at 9/22.

SPAC and warrant noob here as well 🙂 But if the post close price is 10.56 and warrant strike 11.50, and given short time to exercise (30 days?), shouldnt the warrant be nearly worthless?

What I find overall strange is that the SPAC itself did not move much upon announcement. If it is a good deal that is worth voting for, shouldn’t the value go up? This concerns me, given that as noted by others below, this needs a fairly high probability of going through in order to just break even in expectation.

The warrant is exercizABLE in 30 days after deal close. It has a term of 5 years, hence a pretty hefty time premium.

Interesting idea, although the way I would frame it is that the market is pricing the Warrants with a ~86% probability of the deal closing under the current terms. So the bet you’re making is that you think it has a much higher probability of closing.

Any idea what the base rate of SPAC deals closing is for a benchmark?

Base rate would be nice to know.

Also I guess there’s the risk of the market ‘bubble’ popping, or at least a lot of volatility and uncertainty which might spill over into the SPAC market forcing a lot of shareholders to redeem their shares for cash. I don’t think SPACs are safe in another liquidity event, although the odds of this might be very low it’s worth considering.

Yeah, I think that’s a better way of looking at the situation. I’ll just add: be very careful with this type of situation. If I am an institutional holder and I don’t like this deal I’d be very happy if I could dump some of my warrants before voting against a deal and redeeming my shares for a risk-free profit. The risk / reward of such a trade with an institutional counterparty (because who else is selling these warrants at a discount?) doesn’t look too attractive to me.

No thoughts about this specific deal though, maybe it’s legit a great opportunity. The writer has certainly done better due diligence than me. But the sponsor already making huge concessions, an extension and large redemptions suggest that institutional shareholders are not too happy with this deal. In such a case I’d be very wary to buy the warrants for a little bit of upside but a zero in case the deal doesn’t pass. Are very sure you are not the patsy at the table? What is your edge?

Just for fun, a bit of game theory. Consider a very basic scenario. Suppose there are 10 institutional buyers buying $10 units (e.g. a share and a warrant). The sponsor doesn’t take a fee and gets no equity. If a ‘fair’ deal is done, nobody gains or loses anything. So the institutional buyers end up still owning $10 per unit in value. The common is worth $9.50 or whatever, due to warrant dilution, but the warrants are worth $0.50.

If the company buys back all warrants for $2, all institutional buyers still have $10 per unit. They still have proportionally the same ownership in the same company but the common is now worth $8 because the company distributed a ton of cash to warrant holders. The common is worth $8 but everybody received $2 for his or her warrant. Total still $10.

However, when one of the institutional buyers sells his warrants for $1.90, votes against a deal and redeems his shares, he ends up with $11.90! The buyer of the warrants tenders his warrants and ends up with a $0.10 profit per warrant. What does that imply for the other institutional holders assuming the deal still goes through? That their stake has just been diluted .. Because some of the $10 per unit they paid has been used to cash out somebody else for $12 per unit. Which means that holding on to your warrants is actually stupid! This generates a ‘race to the bottom’ dynamic, where all unit holders have a perverse incentive to sell their warrants and vote against the deal.

Or, another scenario, a guy like Phil Goldstein from Bulldog buys units for $10 in the offering, sells the common for $9.99 to some suckers in the open market and keeps the warrants for free upside in case the deal goes through. Check the reports from SPE ( https://specialopportunitiesfundinc.com/wp-content/uploads/sites/40/2020/08/SOF-Semiannual-f.pdf ), you can see a huge collection of free SPAC warrants.

These are the types of market forces you are betting against. The incentives of investors who participated in the placement are unclear, not necessarily aligned with your incentives, by buying a warrant you are essentially making it more likely somebody is going to vote against the deal, etc. etc. Because of this I think it is very hard to judge whether a crappy SPAC deal is a ‘done deal’ or not. On top of that your handicapping has to be pretty good because even with a small chance of a busted deal your expected return will turn negative very quickly due to the warrants being a hard zero in that case.

I Just wanted to highlight the risks of situations like this, not saying it will happen here. It looks like John did good due diligence but I’ve been burned by situations like this before and I’ll probably pass at the current spread.

And, on top of that: SPAC’s are one of the worst performing asset classes in the world, due to the perverse incentive sponsors have to get a deal done AT ANY PRICE. If they don’t do a deal they have to return all the money to shareholders. If they do a deal they get tons of free equity, founder shares, warrants, you name it. It’s basically “no cure, no pay”, but the doctor decides whether you have been cured.

If you are interested: https://www.econstor.eu/bitstream/10419/177392/1/2017-02-12%20SPAC%20IPOs%20Chapter%20SSRN.pdf .

Jog and Sun (2007) report return on investment of 1,900% TO MANAGEMENT TEAMS for successful acquisition. In the same time, annual

return to investors is -3%. Jenkinson and Sousa (2011) report -24% return for six-month postacquisition and -55% for a year post-acquisition. Howe and O’Brien (2012) find that the average half year return is -14%, one-year return is -33% and three years return is -54%.

It is REALLY a shit show in general. This just for color, but also to point out that I would consider it very optimistic to value the new warrant at the buyout price.

Wrister,

I agree that in your example the investor that sells their warrants in the market and redeems their shares receives $11.90 (actually, I think he will get a bit more because the current redemption value of the shares is $10.57). However, I don’t think the sale of the warrant in the market has any impact on the other investors. It’s simply a secondary market trade that does not impact the company’s capital structure or dilute its shareholders. I agree that the tender results in dilution. However, all of the investors are likely to tender and receive the $2 (in your example). I think the only reason for an investor to sell their warrants in advance of the tender is if they believe the tender will not be completed.

My thoughts on the transaction:

– Approval is extremely likely. The threshold for a deal approval is 65%. Founders are FOR with 21%, if we take into account forward purchase agreement (FPA) for $35m (c.25%) then we get roughly c.46%, moreover, FPA was oversubscribed. Another point that over 50% percent of FF hold by institutions, many of them increased their ownership during the last year at roughly the current spot price. Given all of that to secure 65% looks easy.

– I am not familiar with SPAC, but buying units themselves look more secure with roughly the same upside as for warrants, but zero downside. As I read it, you still have the right to redeem shares before the deal consumption for $10.57 (current spot), while if the price increase after the extension approval (likely 10-15% increase) you may sell the units on the market.

How does this have zero downside? Your risk profile remains basically the same.

I meant that after SPAC deadline extension price likely will bump a bit, if not, you can redeem @ current spot. After the deal closed – agree, the risk profile gets different.

over2u,

I didn’t look at the FPA agreement (if it is available), but the press release only seems to indicate that the FPA Investors will vote in favor of the merger. I don’t think they have an obligation to vote in favor of the extension and I don’t think they were record holders prior to the record date for the extension. What do you think?

interesting thoughts, over2u- How did you calculate the estimated 10-15% increase? Also, are you talking about the LFAC units- LFACU or the SPAC, LFAC?

10%-15% It is just my guess based on the undervaluation of the warrant. I don’t know will the price increase at all, but again, I believe you have a zero risks of losing money before the deal closed, as you can still redeem the shares (I believe you can just sell to the market, as if spot gets lower than redeemable price arbs will quickly eliminate this situation)

Sorry for the confusion, I meant buying shares instead of warrants looks more secure – no risk of 100% loss of capital (though it is a tiny risk).

Fund extension has been approved by 75% of votes.

On September 21, 2020, LF Capital Acquisition Corp. (the “Company”) filed with the Secretary of State of the State of Delaware an amendment (the “Extension Amendment”) to the Company’s amended and restated certificate of incorporation to extend the date by which the Company has to consummate a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or similar business combination with one or more businesses from September 22, 2020 to December 22, 2020 (the “Extension”). The Company’s stockholders approved the Extension Amendment at a special meeting of stockholders of the Company (the “Special Meeting”) on September 17, 2020. The foregoing description of the Extension Amendment is qualified in its entirety by the full text of the Amendment, which is filed as Exhibit 3.1 hereto and incorporated herein by reference.

Less than 10% of Class A shareholders chose redemption.

Dt, writser and others, does this Redemption amount improve the risk/return Profile materially in your view? I have not invested in SPACs previously.

I think it improves the likelihood that shareholders will vote for the merger (and for the warrant exchange) in the next meeting instead of choosing the redemption – those who wanted to get out after seeing Landsea acquisition had a chance either to do so in the open market over the last three weeks or by asking for the stock to be redeemed. Thus the remaining shareholders are more likely to be pro-merger – otherwise, why keep your money locked in only to redeem it 3 months later?

Major incremental news release before the vote will be detailed Landsea financials (potentially also including Q3 earnings). And if these turn out worse than what investors expected then a further lot of shareholders might choose to redeem.

The only other incentive not to redeem now but wait for another 3 months would be in order to keep warrant price elevated – this kind of follows Writser’s logic per comments above. If a large holder of units, which converted to shares and warrants, does not intend to approve Landsea acquisition, but still has a considerable stake in the warrants, he/she is incentivized to postpone his share redemption (as that increases the likelihood of transaction break prematurely) and try to sell warrants in the open market. However, this assumes that the investor in question is large enough to think that his decision to redeem or not might have affected the outcome of last week’s vote.

After the recent redemption, there is still $129m of cash on the balance sheet vs $90m minimum. I do not think the backstock agreement amount should be added to that. Likewise amounts to exchange warrants should not be deducted. This suggests that up to 30% of the remaining shareholders can redeem and the transaction would still be consummated.

Shareholders already had chances to redeem – one before the transaction was announced and one after. Couple that with the backstop agreement and we have high chances that remaining owners are in favor of the transaction.

Just my 2 cents, have not invested in many SPACs either so might be reading this too positivelly. Interested in hearing other views.

I have no clue. I just gave some rules of thumb explaining why I think this is a tricky area. I consider this idea too difficult to judge for myself.

Is anyone bothered by the fact that the stock price seems to be pinned to the trust liquidation value? If there was value in the proposed deal wouldn’t you expect the price to be bid up, at least a bit?

LF Capital published a slightly updated investor presentation for Landsea transaction.

Main changes:

– Page 16 – previous presentation showed a steep and steady increase in net orders during Apr-Jun period. However, apparently, this trend has reversed during July and August with net orders declining from the peak (potentially due to seasonality)

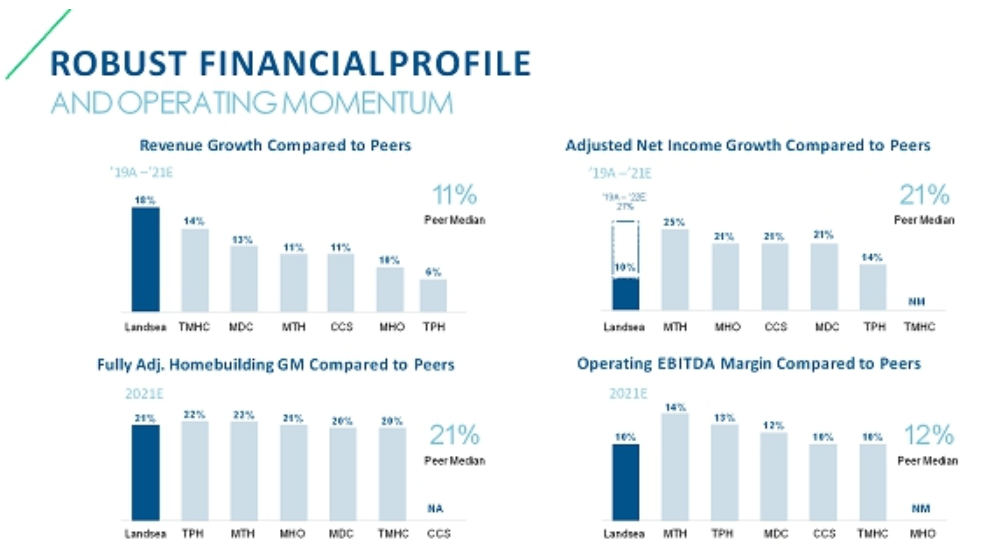

– Page 27 – revenue and profitability growth expectations have accelerated for all the peers and Landsea. With the new growth projections, Landsea stands even more ahead of the peers.

– Page 28 – peer median valuation multiples have improved and the difference between Landsea valuation and peer median is now higher.

New: https://www.sec.gov/Archives/edgar/data/1721386/000173112220001037/e2153_ex99-1.htm

Previous: https://www.sec.gov/Archives/edgar/data/1721386/000173112220000925/e2098_ex99-2b.pdf

The meeting date has not been set yet.

Thanks for the update. Any idea on the merger vote date?

A couple of updates:

LFAC has filed the preliminary proxy. No meeting date yet.

Landsea Homes just reported a blowout quarter, earnings up 71%.

LFAC is asking for another extension from 12/22/20 to 01/22/20. Not sure what it taking so long or if this is a negative sign

LFAC will hold a special meeting on the 14th of December to vote on the merger and warrant exchange.

Additionally, there will be a second special meeting on the 21st of December to vote for another extension of merger completion deadline from December 22, 2020 to January 22, 2021. The extension would allow LFAC more time to complete its initial business combination in case the company doesn’t finalize the merger by the 21st of December. I don’t view the extension as something negative – the deadline has been quite tight and the company might need more than a week to close the merger if shareholders successfully approve it.

The merger and warrant exchange was approved. The vote for the merger deadline extension will take place on the 21st of Dec. Approval from 65% of common stockholders (including Founder shares) will be required, which should be easily satisfied given the 78% participation (98% of them voted in favor) in the previous merger vote. With this support from the shareholders, there should be no issues regarding the potential redemptions and the minimum cash condition as well.

https://www.sec.gov/Archives/edgar/data/1721386/000173112220001285/e2283_8k.htm

It’s still not a done deal. I read the proxy for the extension meeting. Sharesholders can still ask for redemption so there is still a risk that trust fund drop below $90m. Moreover, their HK parent still has not filed the proxy yet.

Shareholders have approved the extension and the merger is expected to close in the first half of January 2021. Warrants now trade significantly above the cash portion with the remaining upside dependant on the eventual price of the new warrants. Warrants now trade close to the initial target price and the remaining spread is limited (2% – 3%).

I am closing this idea with +13% in 4 months.

The new Landsea warrants now trading and at a much higher levels than I expected – $0.28/warrant.

Holding on to this trade for another couple of weeks would have resulted in a further 8% gain.