BBX Capital (BBXIA) – Spin-off – 50%+ Upside

Current Price: $3.90

Target Price: $6.00+

Upside: 50%+

Expiration Date: TBD

This idea was shared by Ilja.

BBX Capital is a fresh spin-off that trades below cash with several favorable spin-off dynamics that make the situation really interesting. The stock has already appreciated by 40% yesterday (5th of October), however, there still seems to sufficient upside left.

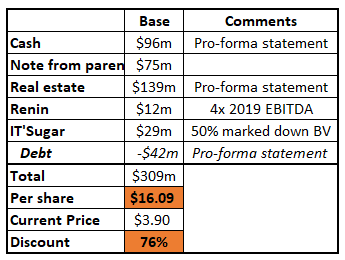

- The company currently trades at a 22% discount to cash ($5/share) and a 76% discount to estimated SoTP valuation. The majority of the value lies in cash and real estate development projects which so far saw minimal impact from the COVID-19 outbreak.

- BBXIA was spun-off as OTC stock whereas parent Blue Green Vacations (BBX) is NYSE listed stock. This likely caused (and might still be causing) considerable selling pressure due to OTC holding restrictions for some investors.

- Concurrent with the spin-off controlling family chose to transfer $75m of value from the parent to BBX Capital in form of a promissory note. The reasons for this move are unclear.

Despite all the attractive points, the offsetting factor here is the controlling ownership of Levan family and affiliates, who have a long and flashy track-record of operating companies for their own benefit, not caring at all about minority shareholder value creation, and always finding a way to screw them. More discussions on the background and track record of the management can be found here and here.

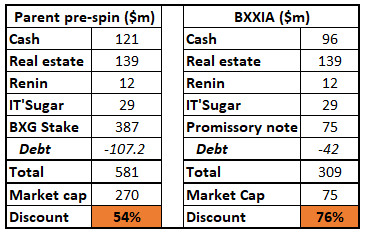

Due to this bad track record, a large discount to sum of the parts is definitely warranted here, however, 76% looks excessive. Before the spin-off, the parent was trading at 54% discount to some of the parts (if the same asset valuation for pre- and post-spin). Applying the same discount to BBXIA would result in $7.4/share.

And while my target is below this (at $6/share) I think the key point is that the shares are likely to eventually settle at substantially higher levels.

Spin-off Background

The whole parade is orchestrated by Alan Levan and his affiliates that control and manage (about 79% voting power and 42% economic interest) both BXX (parent) and BXXIA. After the spin-off, BXX is left with pretty much only one asset – a 93% stake in Bluegreen Vacations (BXG, vacation timeshare business), another entity of Mr. Levan. All the other assets/businesses including the large portion of cash balance have been transferred to the new BBX Capital (BBXIA and BBXIB). Following the spin, a bit of reshuffling was done between the management/board of three companies, however, overall the management remained the same, with A. Levan & friends remaining in key positions of BXX and BXXIA, with the role of CEO position in BXXIA (talk about nepotism).

Levan family is known for screwing minority shareholders and for many years has destroyed shareholder value at their entities. Stories of their mismanagement are vast and wide-ranging from bankrupting BankAtlantic (as a result of which A. Levan received a fraud lawsuit from SEC) and ridiculously sized compensation, to the most recent efforts of trying to cash up by privatizing BXG.

Valuation

A quick sum of the parts valuations (some more details on individual assets is provided in the next section):

Aside from the cash, the remaining assets are a bit tricky to evaluate. However, I believe, the provided SoTP can be taken for the base case (before applying any discount for Levan family control). Going for the more conservative approach and discounting the real estate value by 30% and marking Renin and IT’Sugar values at 0, I still arrive at a 67% discount to SoTP – which seems a sufficient margin of safety.

A comparison with the parent company prior to the spin-off also shows that the current discount size of BXXIA is unwarranted. BBX/BXG market cap was used as of the 15th of July’20.

Real estate businesses

Most valuable operating assets of the company lie in the real estate businesses – acquisition, development, and construction. The company holds numerous small investments (either through JV or alone) in many real estate projects primarily in Florida. The company also reports the investments made for most of them – a total of $40m (vs $128m on the balance sheet).

The RE business includes:

- 9 JV investments (2017-2019) in various multifamily apartment projects. The total invested amount is $27m, while most of the projects are expected to be finished in 2020-2021.

- 3 single family projects. $8.3m was reportedly invested in the two of them.

- 2 mixed-use projects with $4.6m investments.

- Other assets – certain investments in real estate joint ventures in which a majority of the assets have been sold. Also holds various legacy assets, including loan receivable and real assets with an aggregate carrying amount of $21.8m.

Adding 50% of the value of the legacy assets to the balance sheet value of RE ($128m) I arrive at $139m.

Historically, the real estate business performance of the company was rather good – most project sales since 2015 were done with a considerable IRR (page 40). These gains likely reflect the quickly ascending Florida real estate market – from 2015 to 2020 Florida house price index appreciated 44%.

BBX Sweet Holdings

BBXIA also owns 3 candy/chocolate retailers with the largest being specialty candy retailer IT’Sugar (100 stores pre-COVID). IT’Sugar was acquired in 2013 for $57m. Due to COVID-19 all its stores were closed during March-April. In Q2 the retailer reported $39m operating losses and in September, it filed for bankruptcy.

B. Riley recently (25th Sep) valued IT’Sugar at $29m, which is a 50% discount to its recently marked down BV.

Renin

Renin offers design, manufacturing, and distribution of sliding doors and door systems. This segment is operationally profitable and saw a negligible impact from COVID. Q2 sales stayed in line with last year’s numbers. Applying 4x to 2019 EBITDA we get $12m value for Renin.

Some comments (likely biased) from B. Riley:

“Just as BBX currently trades at a discount to SoTP value, we expect the split companies to trade at some discount to NAV, though we expect aggregate

value creation given it is hard to see New BBX Capital trading with a negative EV given its expected $130M in cash, over $100M of real estate investments, an EBITDA-positive Renin business, and a reduced-liability IT’SUGAR. Even if New BBX Capital only traded at a $20M EV (and $150M market cap) the stock would trade at over $8/sh”.

They also note that current BV of real estate ($128m) is below the market value.

https://brileysecurities.bluematrix.com/sellside/EmailDocViewer?encrypt=24ec37d1-9ebd-4c96-8bd6-819b393c44f9&mime=pdf&co=brileysecurities&id=research@brileyfbr.com&source=mail

Also, I don’t really know why they’ve added a $75m note to their cash estimates, as it will likely be paid only in 5 years at the earliest. From proxy: “All outstanding amounts under the note will become due and payable in five years or upon certain events.”

https://www.sec.gov/Archives/edgar/data/315858/000119312520233193/d65684ddef14a.htm

The “over $100m in real estate investments” is also not really clear here – does it mean the actual investment in the projects (their cost basis) or the value of real estate business? Because it doesn’t coincide with the value of investments provided in form 10, while $100m is also quite far away from $128m of real estate provided on the balance sheet.

I’m not experienced in spinoffs, so hopefully someone will tell me what is wrong with the following thought. You have used BBX’s historical discount of 54% as a indication of what a fair value discount for BBXIA should be. The 54% is a blended rate of the discounts for each of the individual assets. However, what if the appropriate discount for BXG is significantly lower than the discount for the other assets? Then it would make sense that BBXIA should trade at a higher discount to SOTP than BBX did. I think this argument is supported by the fact that BBX is now trading at a 3% discount to the value of it’s holding in BXG, net of its $65mm in debt. Is it possible that the value of the assets spun off is significantly less than indicated by the SOTP?

Good question. I’d say there is no ‘correct’ discount in case such as this (bunch of crooks owning lots of assets). All you can do is guess where it will or should trade. I don’t think the comparison with old BBX makes much sense either, but you have to start somewhere ..

I guess another way to tackle the problem is to start with the ridiculous insider salaries, page 128 / 129 of the proxy ( https://www.sec.gov/Archives/edgar/data/315858/000119312520233193/d65684ddef14a.htm ).

“each of Mr. Alan Levan and Mr. Abdo will initially receive from New BBX Capital annual cash compensation, including salary and bonuses, of up to $1.2 million in the aggregate and that each of Mr. Jarett Levan and Mr. Wise will initially receive from New BBX Capital annual cash compensation, including salary and bonuses, of up to $1.4 million in the aggregate. The Named Executive Officers may also receive grants of equity awards as from time to time determined by our Compensation Committee as well as perquisites and other personal benefits.”.

“It is expected that, following the spin-off, Mr. Alan Levan and Mr. Abdo will enter into employment agreements with New BBX Capital, which will be in addition to their respective employment agreements with Parent, and that Mr. Jarett Levan and Mr. Wise will enter into employment agreements with New BBX Capital in lieu of their respective employment agreements with Parent. The employment agreements with New BBX Capital are expected to contain terms substantially similar to those contained in the Named Executive Officers’ respective current employment agreements with Parent, as described above. The compensation of the Named Executive Officers following the spin-off and the other terms of the employment agreements will be subject to the approval of New BBX Capital’s Compensation Committee following the spin-off.”

These three guys earned ~$22m in 2019 and ~$24m in 2018 … While they are not even involved in the day-to-day management of Bluegreen Vacations.

Make an estimate of the new overhead and continued looting ($10m / year? $20m?) , capitalize that, 8% discount rate: $125m – $250m and subtract that from your SoTP analysis.

The top 2 looters are nearly 80 years old. Perhaps Covid reminded them of their mortality. Maybe the large discount of BBX is embarrassing, they will behave better in the other two vehicles to close the discount there somewhat to improve their legacy a bit, and focus all their looting on this more out of sight OTC vehicle? After all it isn’t so strange that a OTC stock trades at a large discount, is it?

When the discount to the assumed SoTP is mostly due to management looting rather than uncertainty regarding the real valuations of the assets, then as Writser suggests, there is no correct answer. And I do not think different discounts on various assets individually are playing any major role here. Also not sure cash on the balance sheet or promissory note should deserve a higher discount vs BXG investment (would even argue it should be the other way round). And for real estate valuation, historical real estate project sales (with 2x – 3x gains on investment) suggest that balance sheet BV for these assets should be at least directionally correct.

Discount comparison to pre-spin and post-spin is meant to serve as a reference only. Another way to look at this is to take absolute values rather than percentages of the discount (also likely to be flawed but in another direction). Before the spin the market attached $311m discount due to managements’ looting and after the spin the discount is lower at $234m. However, I think the market usually looks at percentages rather than absolute terms and that’s what I have used as a reference. Also keep in mind that the difference between 76% discount and 54% discount is actually almost 2x in terms of potential share price appreciation.

In theory, lower absolute discount could also be justified by the lower compensation expenses as indicated in the spin-off document (not sure if they will actually end up lower eventually, as there seems to be no reason for Levan & Co to start being generous). Compensation for the two key execs is due to drop from $8m to $3m and for the other two from $4m to $3m (refer to pages 126-129 of From 10 or the quotes Writser added above).

As for BBX Holding (the owner company of 93% BXG stake) – based on my calculations it trades at 18% discount to SoTP. And this lower discount (vs. 54% pre-spin) is due to the majority of exec compensation getting transferred out to BBX Capital. Holding company admin expenses were lowered to $2.2m – $2.7m annually, which is still excessive for a company that does nothing besides owning a stake in BXG.

Isn’t it an issue that this is not a vehicle that generates recurring, steady cash flows? If you loot x % of steady cash flow streams, than the pile you are looting from does not dwindle, it simply reduces profits that accrue to minority shareholders. So it is more predictable exactly how much you are impaired as a minority holder. But looting a finite pile of assets that do not generate significant cash flows, of what will mostly be cash within a few years, means that what might eventually accrue to shareholders will slowly shrink to zero over time. So possibly an extra discount is warranted?

Compensation is absolutely the issue, but they have bought back stock to offset stock comp and more over the years.

I view them as skilled real estate investors. They’ve highlighted IRR on projects in past investment decks and the results are quite good. IMO, the discount is more than generous; 76% is ridiculous, 40% would be $9-$10. I see the Q as a catalyst for people to more simply understand what is here. I also believe they will buy back stock, if not directly. A history of tender offers does exist. And finally, I view the selling as likely just the larger funds that owned BBX punting the OTC name they have no interest in owning.

Thanks for posting the interesting idea llga. No doubt it is incredibly cheap. Here is how I’m thinking about it. They are issuing large amounts of stock to themselves annually at a fraction of the real value of the business, i.e. issuing at ~$4 with a TBV of $16. The compensation is actually understated because they are getting shares worth 4x the price they are being issued to them. As you can see below, the four horsemen will receive about 1.5MM shares annually at this price, which has a market value of $6MM but a real intrinsic value of $24MM! As a result, the stock comp is incredibly dilutive to the per share value of the business.

Anticipated comp (from Form 10, in MM’s)

Cash Stock

Levan $1.2 $1.6

Abdo $1.2 $1.6

Levan Jr. $1.4 $1.5

Wise $1.4 $1.5

Total $5.2 $6.2

# shares issued annually (at $4) 1,550,000

Shares outs. 19,260,000

Annual dilution 8%

Total annual comp as % of mkt. cap 15%

I also noticed they are filing under “emerging growth company” status as a newly public co, allowing them to limit disclosures on compensation, which it sounds like they intend to do. So you won’t even know if you’re being screwed and how badly.

Outside of real estate capital allocation appears questionable. Between suspect capital allocation and the dilution from equity comp it is difficult to see them achieving any growth in the value of the business. Having said all this there is a price for everything. In this case I think you just have to play it for a trade because time is working against you. Personally I haven’t been able to bring myself to pull the trigger…just getting in bed with slime…but it tempts me everyday.

BBX Capital announced a $10m open market buyback. At current levels, it trades with a 79% discount to SoTP.

https://ir.bbxcapital.com/news-events/press-releases/detail/5176/bbx-capital-inc-s-board-approves-share-repurchase-program

Buyback has not boosted price, maybe not yet?

$10m buyback, vs $70 mkt cap (19.2m shares per write up, $3.60 price). Quite meaningful 14%.

$10m was only authorized, there’s no commitment to do it. Given the self-interested management, one can’t rule out this being a hollow attempt to boost the share price. Unless I’m wrong about the nature of the buyback authorization.

This last comment is simply incorrect and one that should not be made unless it can be backed up with facts. They have a long history of announcing buybacks and a long history of executing them in size. (the tables below might not paste over well – perhaps admin can clean up – but the facts are the facts)

On September 21, 2009, our board of directors approved a share repurchase program which authorizes the repurchase of up to 20,000,000 shares of Class A Common Stock and Class B Common Stock at an aggregate cost of up to $10 million. The share repurchase program authorizes management, at its discretion, to repurchase shares from time to time subject to market conditions and other factors. From April 1, 2016 through April 19, 2016, the Company repurchased 1.0 million shares of its Class A Common Stock under this repurchase program for approximately $3.0 million, which are the only shares that have been repurchased under the share repurchase program as of the date of the filing of this report on Form 10-K. The share repurchase program does not have an expiration date and may be modified or discontinued at any time in the discretion of our Board of Directors.

On June 13, 2017, our board of directors approved a share repurchase program which replaced the September 2009 share repurchase program and authorizes the repurchase of up to 5,000,000 shares of the Company’s Class A Common Stock and Class B Common Stock at an aggregate cost of up to $35 million. The June 2017 repurchase program authorizes management, at its discretion, to repurchase shares from time to time subject to market conditions and other factors. During April 2017, the Company repurchased 1.0 million shares of its Class A Common Stock under the September 2009 share repurchase program for approximately $6.2 million. During April 2016, the Company repurchased 1.0 million shares of its Class A Common Stock under the September 2009 share repurchase program for approximately $3.0 million.

As of December 31, 2017, 321,593 shares of the Company’s Class A Common Stock have been repurchased for approximately $2.4 million under the June 2017 share repurchase program.

From September 30, 2017 through October 8, 2017, a total of 2,394,492 shares of the Company’s Class A Common Stock and 176,132 shares of the Company’ Class B Common Stock previously owned by certain executive officers were surrendered to the Company by the executive officers as payment in satisfaction of tax withholding obligations relating to the vesting of certain previously reported restricted stock awards and units granted to the executive officers. Further information can be found here:

https://www.sec.gov/Archives/edgar/data/315858/000031585818000018/c858-20171231x10k.htm

As of December 31, 2018, 1,521,593 shares of the Company’s Class A Common Stock have been repurchased for approximately $10.0 million under the June 2017 share repurchase program, of which 321,593 shares were repurchased in November 2017 for an aggregate purchase price $2.4 million and 1,200,000 shares were repurchased in November and December 2018 for an aggregate purchase price $7.6 million.

From September 30, 2018 through October 5, 2018, a total of 789,729 shares of the Company’s Class A Common Stock and 505,148 shares of the Company’s Class B Common Stock previously owned by certain executive officers were surrendered to the Company by the executive officers as payment in satisfaction of tax withholding obligations relating to the vesting of certain previously reported restricted stock awards and units granted to the executive officers. Further information:

https://www.sec.gov/Archives/edgar/data/315858/000031585819000023/c858-20181231x10k.htm

On June 13, 2017, BBX Capital’s board of directors approved a share repurchase program which authorizes the repurchase of up to 5,000,000 shares of the Company’s Class A Common Stock and Class B Common Stock at an aggregate cost of up to $35 million. The June 2017 repurchase program authorizes management, at its discretion, to repurchase shares from time to time subject to market conditions and other factors.

As of December 31, 2019, 4,750,483 shares of the Company’s Class A Common Stock have been repurchased for approximately $25.4 million under the June 2017 share repurchase program, of which 321,593 shares were repurchased in 2017 for an aggregate purchase price of $2.4 million, 1,200,000 shares were repurchased in 2018 for an aggregate purchase price of $7.6 million, and 3,228,890 shares were repurchased in 2019 for an aggregate purchase price of $15.4 million.

From October 1, 2019 through October 5, 2019, a total of 748,357 shares of the Company’s Class B Common Stock and 222,848 of the Company’s Class A Common Stock previously owned by certain executive officers were surrendered to the Company by the executive officers as payment in satisfaction of tax withholding obligations relating to the vesting of certain previously reported restricted stock awards and units granted to the executive officers. Further information:

https://www.sec.gov/Archives/edgar/data/315858/000031585820000029/c858-20191231x10k.htm

What exactly is incorrect in my comment?

And BBXIA is not the same as the pre-spin company.

“Given the self-interested management, one can’t rule out this being a hollow attempt to boost the share price. Unless I’m wrong about the nature of the buyback authorization.” I have refuted your comment calling it “hollow” by providing factual data to support they routinely follow up on their buyback announcements.

And there is no reason to believe that a pattern with BBX old would not hold true with BBXIA. It’s contradictory to hammer management/Levan like many do, but then also say they’re different. I’m not saying management is great, but 1) they execute buybacks, and 2) we’re just debating whether the discount should be 70-80% where it is now or 20-30% (a much higher PPS). I vote PPS is much higher and am long. When the buyback is activated, I suspect the stock will move to $4-$5 and/OR as it continues to churn through volume (now 25%+ of its float), it will move towards that range as well.

Well I agree with you that it’s *unlikely* to be disingenuous, and I am long too, but your comments do not rule it out. And at issue is what investors in general believe, not what you and I believe, since Terence was inquiring about what he perceived to be a muted response to the news. I provided a possible interpretation why, which is not refuted by your reply. Nor have I made any contradiction: the management could be bad with the parent and worse with the spin, because the spin has different assets with different prospects and different compensation. There may be better ways for them to get money into their own pockets now than by buying back stock, and the possibility of that (whether or not it’s obvious how) could very well be dissuading investors.

“There is no reason to believe that a pattern with BBX old would not hold true with BBXIA.”

Was this statement meant seriously? What would be the point of a spinoff if management patterns remained invariant?

They acquired a building products company for 6x EBITDA.

https://finance.yahoo.com/news/bbx-capital-subsidiary-renin-holdings-003900625.html

BBXIA released Q3 results. Overall, the discount to SOTP remains largely unchanged and currently stands at around 70%. It’s likely that new buybacks will be announced soon.

In Q3 the company made some minor sale of real estate inventory with 3% net gain. IT’Sugar is still in the process of bankruptcy and in Q3 reported sales -46% YoY. Renin continues to perform well, with +20% revenue growth YoY. In October Renin acquired Colonial Elegance – a supplier and distributor of building products, including barn doors, closet doors, and stair parts, and its customers include various big-box retailers in the United States and Canada which are complementary to and expand Renin’s existing customer base. Consideration was $39m, funded by term and operating loan.

https://www.sec.gov/Archives/edgar/data/1814974/000181497420000067/c974-20200930x10q.htm

I am closing BBXIA trade as my confidence in the case has diminished. The initial spin-off driven sell-off is long gone and after the buyback announcement, the discount has slightly narrowed. However, it’s clear that Levan’s involvement is a bigger factor here than I thought initially. Even though, substantial discount still remains, at this point it is hard to tell what should be the appropriate level (could easily stay at current or higher levels forever, if shareholders are never going to see any value from the assets). Given this uncertainty and the further risk of being involved with Levan’s family, I am closing the position with 16% gain in 2 months.

BBXIA has definitely outperformed my expectations and announced some big news this week. Maybe the concern’s over Levan’s family was overstated after all and it might be worth to keep an eye on the stock going forwards. A few days ago the company announced a major tender offer for 26.6% of its outstanding class A shares at $6.75.share. Shares are trading just slightly above the offer price. Most recent reported BV stands at $16.31/share, so shares are still trading at a pretty wide discount – 58%. After the tender, the reported BV/share will increase to $19/share (64% discount). Directors, Levan’s family own 36% of Class A shares and won’t participate in the tender.

Major components of the BV (as of March’21) after the tender:

– Cash: $4.08/share

– Real estate: $7.23/share (likely undervalued due to depreciation)

– Investment in IT’Sugar – $1.56/share. IT’Sugar is still in the bankrupcy and was deconsolidated last year. Even if you assume it’s worth 0, the discount is still very substantial.

– Note from Bluegreen: $5.04/share

– Other assets: $9.96/share

– Debt: $4.63/share

– Other liabilities: $4.26/share

On a small note – Angelo Gordon (big alternative investment firm) recently increased their stake from 6.35% (acquired in Feb’21) to 7.76% of class A shares (13D filing)

Tender – https://www.bamsec.com/filing/119312521172057?cik=1814974

Recent 10Q – https://www.bamsec.com/filing/181497421000025?cik=1814974

Angelo Gordon – https://www.bamsec.com/filing/101143821000129?cik=1814974

jwestern. i was off the site for awhile, thus the lack of response. my comment previously was serious. management has a tendency to do buybacks/tender offers. in my opinion, the spin off doesn’t change their actions in the past re this strategy. i know it’s easy for me to say this today because the tender was just announced but it always made sense they would do so after the 10-k was filed for 2020. historically, that is when they have done them in the past on the calendar. regardless, stock is super thin now and trading above the tender price. my current view is that they raise the tender but it’s anyone’s guess to what price. maybe 7.50? maybe 8? i don’t think this deserves to trade at it’s book value, but certainly higher than where it is now in the $7’s. if they bought 4M shares, book would likely exceed $19/share. i think the action post tender says something and that is they’ll need to pay significantly more to get any size. we’ll see. it’s still very cheap here but what other catalysts remain to unlock value?

Thanks Neil

BBXIA trades at 8% over the tender price, so it’s likely that the company won’t be able to purchase many shares at $6.75/share. As noted by Neil above, it’s quite possible that the offer price will get raised and there definitely is enough headroom to do that.

The offer was amended to $8/share (from $6.75/share), however, the amount to be purchased was lowered from 4m shares to 3m. This time shares have been trading mostly around the offer price with a few spikes north.

By the way, as of June 23rd, only 34k shares were tendered (at the old $6.75/share price).

https://www.bamsec.com/filing/119312521198586?cik=1814974

BBXIA has also recently sold one of its properties for $5.8m ($4.9m gain).

https://www.bamsec.com/filing/181497421000047?cik=1814974

Only 1.4m shares out of 3.5m (tender size) were tendered at $8/share price. BBXIA now trades slightly below the offer price.

https://www.sec.gov/Archives/edgar/data/1814974/000119312521215977/d194675dex99a5b.htm