Ambase (ABCP) – Litigation Stub – Multibagger Upside

Current Price: $0.35

Expected Price: $2.75

Upside: 660%

Expiration Date: H2 2022

This idea was shared by Dave.

This is an updated write-up of Ambase, Inc. (ABCP) litigation reflecting the most recent developments. This follows up on the earlier post from 2017 where additional background can be found.

At current prices, the market undervalues the probabilities of litigation success for ABCP, in my view. This opportunity is a complex litigation situation born out of ABCP’s $70 million non-controlling investment in the now nearly-completed condominium tower at 111 West 57th Street in New York City.

In the face of undisputed construction budget overages that ultimately led to a foreclosure by Jr. Mezzanine lender, Spruce Capital Partners, Ambase filed lawsuits against the developers of 111 West 57th, certain lenders and an insurance broker. Out of all the litigations, which commenced in April 2016, only one suit has apparently been settled (Custom House), and even that settlement is contingent on the defendant’s compliance with certain undisclosed conditions. The timing of future judgments/settlements is unknown. In addition, COVID has slowed an already ponderous process.

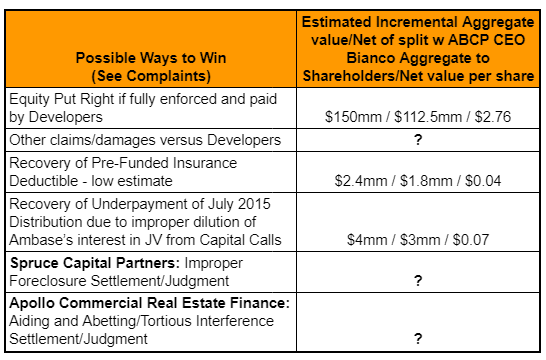

Despite the slow pace, there remains the possibility of a significant litigation win for Ambase and its shareholders here. Ambase’s Equity Put Right, if enforced by the courts and paid by the counterparties, could result in $150mm in aggregate for Ambase. After a split of proceeds with the CEO due to an earlier litigation funding agreement, the net payment to Ambase could be more than $112 million (or $2.75 per share), tax-sheltered at least in part by NOLs. Possible litigation wins against the Developers on other claims, against the foreclosing lender, and the Senior Mezzanine lender, if achieved, could result in additional proceeds for Ambase shareholders.

At its current price of $0.30, ABCP’s valuation implies an extended judgment/settlement timeline and roughly a 10% probability of success on the Put Right claim and a 0% probability of success in all other matters. Those probabilities are too low, in my opinion.

Select Litigation Overview

Ambase’s SEC filings provide helpful background and the overview below represents my summary update of certain key cases currently in the courts. Ambase has historically been parsimonious in their disclosure, so tracking the cases demands that one follow the respective dockets.

Plaintiff: Ambase

Defendant: Developers (JDS-Stern/PMG-Maloney)

Index Number: NY State Court: 652301/2016, Appellate Court – First Department: 2018-1166

Status – estimated next steps: A November 2020 Stipulation and Order provides an update. There are three complaints in play currently, the Second, Third, and Proposed Fourth Amended Complaints.

- Ambase is appealing dismissal of certain Second Amended Complaint (10/14/16 filing date for “SAC”) claims. This is pending oral argument before the First Department appeals court (“FD”). The FD calendar has been slowed by COVID. Expect oral argument as soon as March 2021 and a decision thereafter.

- NY State court is still considering Developers’ motion to dismiss the remaining state claims presented in the 4/26/18 Third Amended Complaint (“TAC”). Federal RICO claims in TAC have already been dismissed by SDNY. The timing is unclear.

- Ambase is seeking leave to file a Proposed Fourth Amended Complaint (“PFAC”) based on new information obtained in discovery. Timing is unclear, but it is conceivable that Justice Sherwood, who has the TAC and FAC questions before him, is waiting for the appellate level to rule on the SAC before he acts on the other two.

Plaintiff: Ambase

Defendant: Apollo (Senior Mezzanine Lender)

Index Number: NY State Court: 653251/2018, Appellate Court – First Department (“FD”): 2019-05391

Status – estimated next steps:

- NY State Court dismissed this action and Ambase is appealing the dismissal to the First Department (“FD”).

- Ambase recently requested an extension of time for argument before the appeals court based on new Apollo-related evidence found in the litigation against foreclosing Jr. Mezz. lender, Spruce.

- Ambase apparently intends to amend its complaint against Apollo based on this newly discovered information.

- FD should rule on the requested delay in the next few months.

Plaintiff: Ambase

Defendant: Spruce Capital (Jr. Mezzanine and Foreclosing Lender)

Index Number: NY State Court: 655031-2017, Appellate Court – First Department: 2020-01600

Status – estimated next steps:

- In Jan 2020, NY State court denied, in part, Spruce’s motion to dismiss Ambase’s complaint against them. Spruce has appealed this decision and Ambase has cross-appealed.

- Despite the in-process appeal and cross-appeal, discovery has proceeded in this matter and, as noted above, Ambase alleges that it uncovered information related to Apollo’s alleged improper actions (and presumably Spruce’s improper actions as well.).

- A proposed scheduling order is on the docket but is unsigned as of now. Not sure if it is in effect or not.

Plaintiff: Ambase

Defendant: Custom House (Insurance Broker)

Index Number: 1:20-cv-02763-VSB -Federal Court SDNY

Status – estimated next steps:

- From 9-30-20 ABCP 10Q: “In an agreement dated July 31, 2020, the Company and the Custom House Defendants agreed to certain terms for a settlement and entered into a settlement agreement which requires that the Custom House Defendants satisfy certain conditions prior to any dismissal of the Custom House Action. This process is currently ongoing.” [My emphasis].

- The nature of these “conditions” is not clear, nor is the timeline for completing them. However, it is possible that Custom House is required to assist Ambase in their litigation against JDS, one of the developers who is at the center of the allegations against Custom House.

Potential ways to win

Note: calculations are made based on 40.7m outstanding shares

Equity put right update

The public dockets present extensive records for the aforementioned cases. Each of the cases has the potential for judgment or settlement in Ambase’s favor. However, each matter is complex and difficult to handicap precisely from the outside.

As a result, I keep my focus on the Equity Put Right and the Developers’ alleged conduct under the express terms of the Amended Joint Venture Agreement that governs the relationship between Ambase and the Developers. The issues associated with the budget and the alleged hard cost growth are subtle, but, as I describe below, new details in the Proposed Fourth Amended Complaint provide numeric support for some puzzling (to put it kindly) budget manipulations by the Developers. From my viewpoint, if you can find value in the Equity Put Right, positive outcomes in the other cases would simply be a bonus.

Let me summarize the contractual issues which appear to be undisputed:

- Ambase, with no real estate development expertise, ceded operational control in the development and construction of the tower to the Developers (JDS/Michel Stern and PMG/Kevin Maloney);

- In exchange for giving up operational control, Ambase received the contractual right to “put” their stake in the project back to the Developers if, at any time, Ambase declines to approve a proposed budget in which the “hard costs” exceed an amount equal to 110% of the hard costs set forth in the prior approved budget – this is the Equity Put Right. This right is set forth in the Amended Joint Venture Agreement at Section 11.5 (page 455 here). [Ambase also negotiated some Major Decision rights which are at issue in the improper foreclosure litigation.];

- Per the JV Agreement, Developers were *required* to submit a proposed new Business Plan and Budget no less frequently than within 60 days of the end of each fiscal year and whenever it became apparent that the previously approved budget no longer accurately reflected the costs necessary to complete the project (page 438 as shown in the box at the top here). Absent a new approved budget, Developers were required to work under the last approved budget.

- Despite this requirement, Developers did not “submit” a budget between June 2015 and December 2016, despite growing construction costs.

- (A budget was obtained by Ambase via discovery in August 2016 — and the amounts therein apparently triggered the Equity Put Right — but Justice Bransten ruled it was not “submitted for approval” and therefore did not meet a strict interpretation of the condition precedent to exercising the Equity Put Right.);

In the only court decision related to the Equity Put Right thus far, Justice Bransten wrote this in her 1/29/18 ruling on the Motion to Dismiss the SAC:

“Plaintiffs [Ambase] have sufficiently pled that defendants’ [Developers’] refusal to timely submit a proposed budget for [Ambase’s] approval as required by the JV Agreement has frustrated [Ambase’s] rights under section 11.5 [of the Amended JVA], and, as such, [Ambase] may maintain this [breach of contract] claim as a violation of the implied covenant of good faith and fair dealing.” [My emphasis].

With respect to the implied covenant of good faith and fair dealing, NY courts hold that “[i]n New York, all contracts imply a covenant of good faith and fair dealing in the course of performance.” 511 W. 232nd Owners Corp. v. Jennifer Realty Co., 98 N.Y.2d 144, 153 (2002); see also Dalton v. Educ. Testing Serv., 87 N.Y.2d 384, 389 (1995). That covenant is a pledge that “neither party shall do anything which will have the effect of destroying or injuring the right of the other party to receive the fruits of the contract.” 511 W. 232nd Owners Corp., 98 N.Y.2d at 153. [My emphasis].

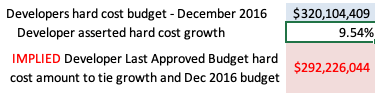

In December 2016, ten months after the JVA-mandated due date, Developers finally “submitted” a budget for approval (the “December Proposed Budget”). Ambase refused to approve it. Ambase alleges that “properly calculated the December Proposed Budget included hard costs in excess of 110% of the hard costs reflected in the prior approved budget” (page 78 here).

Ambase further states that:

“Sponsor [Developers], however, represented that hard costs had increased by only 9.54%. Sponsor could make this false representation only by manipulating the budget and once again misrepresenting the costs of completing construction.” (ibid).

So, what has changed since my first write up with respect to the Equity Put Right?

Most significantly, in my view, we now have the Proposed Fourth Amended Complaint (“PFAC”), which has added detail, presumably based on discovery. Below, I refer to paragraphs in the “PFAC” (which can be found here). Note that Ambase is currently seeking leave from the court to file the PFAC while developers oppose that effort.

Paragraphs 339-351 of the PFAC address the Equity Put Right. I find this information significant:

- Paragraph 341 indicates the evidently important distinction between the “Last Approved Budget” and the “prior approved budget.” In other words, Ambase alleges that Developers are using an improper starting value in the dispositive change-in-hard-cost percentage calculation.

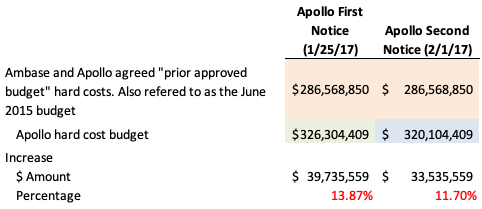

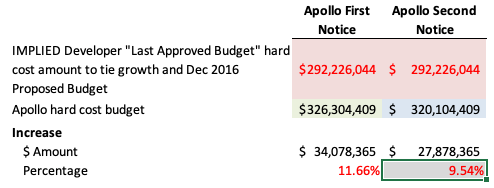

- Importantly, Ambase is also suing Apollo Commercial Real Estate Finance, Inc. (“ARI”) (the Senior Mezzanine Lender) alleging, in part, that Apollo reissued an “out-of-balance default letter” to the Developers to help Developers assert that the budget-to-budget hard cost increase was insufficient to trigger the Equity Put Right – see page 62, paragraph 3 of Ambase’s complaint against Apollo here. See the analysis below of Apollo’s First Notice versus Second Notice.

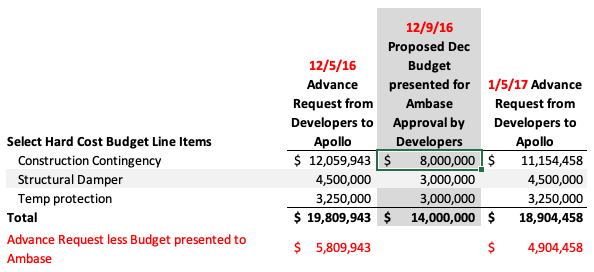

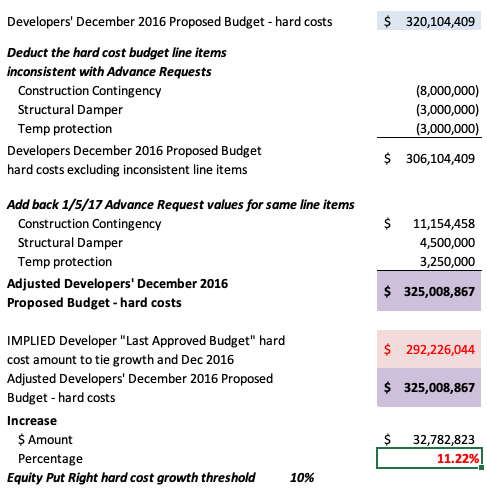

- Paragraph 342 alleges that the format used by Developers in the December Proposed Budget was a one-time aberration compared to all other budget presentations. Note that “Advance Requests” are apparently formal requests made to lenders for advances under the existing loan agreements which likely include representations by the Developers as to the accuracy of the numbers contained therein.

- Paragraph 344 alleges that Developers “artificially depress[ed] hard costs” in the December Proposed Budget. The paragraph also contains data not seen in the previous complaints, and presumably acquired via discovery, to make this very important comparison – note the dates:

Shown below, in pale orange, is the June 2015 hard cost budget that both Apollo (in their First Notice) and Ambase assert is the proper initial value (the “prior approved budget”) for comparing hard cost growth for purposes of the Equity Put Right. Note that using the $286.6mm value would trigger the Put Right with either the First or Second Notice Apollo hard cost budget values as hard cost growth exceeds 10% in both cases. Apollo makes this point as a defense against the aiding and abetting charges Ambase levels against them.

What Apollo does not discuss, however, is that unlike the First Notice, the Second Notice, which reduces the out-of-balance amount by adopting the Developers’ December Proposed Budget hard cost budget, is formatted differently such that it is silent as to the appropriate starting hard cost value for the Put Right calculation. Instead, the Second Notice refers to an aggregate “direct and soft cost” starting value thereby enabling Apollo to avoid specifying the hard cost line item. This, Ambase argues, gives Developers some leeway to (erroneously) re-allocate certain costs to assert a starting hard cost value other than $286,568,850 while leaving the grand total of the “prior approved budget” unchanged at $390,962,428.

In submitting the December Proposed Budget to Ambase for approval, the Developers claim that hard costs have increased by only 9.54% budget to budget – or a mere 46 bps below the Equity Put Right trigger threshold. We know the Developers’ December Proposed Budget hard costs were $320,104,409 (see last page here). So, given their asserted hard cost growth we can back into their implied hard cost starting value, which is higher than the amount shown in pale orange above.

What is the explanation for the $292.2mm value that neither Ambase nor Apollo appear to recognize? In Paragraph 341 of the PFAC Ambase states:

…despite repeatedly representing to [Ambase] that a lower, reallocated budget finalized at closing of the Construction Loan [June 2015] was the operative budget for the project (presumably the $286.6mm), [Developers] represented in the December 2016 Proposed Budget that an earlier, draft budget was the “Last Approved Budget. [My emphasis]

Now, let’s come back to Apollo for a moment. If you replace the $286.6mm starting value with the IMPLIED Developer Last Approved Budget value of $292.2mm Apollo’s First Notice hard cost budget triggers the Put Right and the Second Notice hard cost budget does not…That’s convenient for the Developers, isn’t it? This is the main reason why Ambase is suing Apollo for tortious interference.

For argument’s sake, let’s assume the $292.2mm “Last Approved Budget” is the appropriate hard cost starting value. Now, recall the inconsistencies Ambase points out in the PFAC between certain December Proposed Budget hard cost line items and the Advance Request values. Let’s back out the inconsistent line item amounts from the Developers’ December Proposed Budget and replace them with the 1/5/17 Advance Request values (the lower of the two AR budget values):

Based on this analysis, even if we assume the “IMPLIED Developer Last Approved Budget hard cost amount” ($292.2mm) is the appropriate starting value, the use of the seemingly more reasonable Advance Request hard cost values triggers the Equity Put Right. I say seemingly more reasonable because we have yet to hear an explanation for the variance between consecutive Advance Request amounts and the December Proposed Budget Select Hard Cost Budget Line Items. If the court grants leave for Ambase to amend the TAC and file the PFAC, we will get a formal response from Developers that may speak to this particular issue.

Another matter related to the Equity Put Right is the question of Manager Overruns. I won’t attempt to summarize the argument here as you can read it in the complaint, but Ambase makes a case that at least some of the explosive growth in the construction budget was attributable to Manager Overruns and therefore should have been financed by the Developers and not by capital calls issued to all members of the LLC. The capital calls, both those that were funded and those not funded, are the crux of a debate about the proper dilution, if any, of Ambase’s interest in the LLC that formerly owned the equity in the project.

Conclusion

In summary:

- Developers ignored a requirement to provide timely budget updates, even as expenses ballooned, seemingly injuring the right of Ambase to receive the fruits of the contract;

- When Developers finally submitted a budget for approval (at least 10 months late), it apparently deviated materially from (i) a budget provided to a lender just 4 days before and (ii) a budget provided to the same lender 27 days later.

- Is there a reasonable explanation for this conduct other than frustrating Ambase’s exercise of the Equity Put Right?

The current market cap of Ambase is roughly $12mm. The company has $9.3mm of cash net of current liabilities (@9/30/20). Depending on legal expenses, the company is burning about $1.1mm per quarter. If we assume an end to the litigation at 9/30/22 and $1.1mm burn per quarter until then, NAV excluding any litigation recoveries would be $500k or $0.01 per share.

Should extended litigation result in legal expenses out-stripping cash resources, it is likely that CEO Bianco will again offer to finance the litigation in exchange for a split of recoveries. How fair the split will be is an open question, to be sure.

Under the modified litigation fee agreement with CEO Bianco, Ambase is entitled to the first $7.5mm in any recovery to cover legal expenses (assuming they are $7.5mm or greater, which I expect they are) and thereafter split 75/25, Company/Bianco. So, if one buys ABCP at $0.30 today, at least $13mm or $0.29 per share in recoveries is needed to break even under this timeline assumption.

Put another way, assuming 18 months to a resolution, the market is valuing the Equity Put Right enforcement/recovery probability at roughly 10% (10% of $2.76 = $0.276) and all other possible recoveries at 0% probability. Based on the documents currently available, I believe those probabilities are too low.

Interesting idea, have been following it for a while and I think Dave is really on top of the story. The update is appreciated. I guess it’s a very compelling investment when you assume that the case is resolved within 18 months. But that seems optimistic to me. I think the case that Ambac presents is somewhat compelling but there’s so much money at stake that the defendants will probably stall and counter-sue until eternity. I mean, they’re rich assholes.

If you assign, just ballpark, a 25% chance of litigation working out, the litigation proceeds have an expected value of ~$25m. Add 9m in cash: $34m. Subtract three years of litigation costs: ~$20m remains. Discount back to the present at a 15% rate: $13m or $0.32 / share. And that’s ignoring the fact that cash runs out in the meantime, which probably results in more dilutive financing by Bianco.

Seems to me that for this to work out you need to be pretty sure that this is resolved favorably -but also that it is resolved quickly.

I know this is an impossible question to answer, but if I put a gun to your head and ask you: what are the chances of Ambac getting paid for the put right, what would you say? As for myself, I wouldn’t like to bet on the fact that it is much more than 25%. I’m also not very confident that IF they win this case, they win it quickly.

Curious about your thoughts. What do you see as ‘fair value’ here?

Hi Writser – that is the $150mm question, isn’t it?

Other than what I laid out above, any guess as to fair value at this stage is just that, a guess. The vagaries of the court/legal system are well established and yes, there is a lot of money at stake and people will fight. In fact, in my view, that is precisely why Developers withheld the required budgets ;o).

However, I take some convert in inverting your question – what do I have to believe such that I don’t expect to lose money – or wont lose a lot? At these prices, I like the trade off, but everyone has to find their balance.

Just reading this now. Definitely seems interesting. Have a couple questions:

1. Why is the legal burn so high? Aren’t the lawyers just sitting on their hands since courts are slowed down? Are they actively looking at more docs? Do they need to?

2. Let’s say they win the put. Which entities have to pay and will there be any cash left in them by then? (I never trust developers). They could just take all the cash and bail to some non extradite country and retire.

1. There is discovery underway in the Spruce matter; there are appellate briefs and preparation; there is limited discovery in Sponsor matter – see November 2020 Stipulation and Order in Developer matter; Ambase is preparing an amended Apollo complaint, etc.

2. Put Right is against Sponsor (as defined) but you should also review indemnification provisions in Section 8.7 of the Amended JV Agreement and the Limited Joinder and “Seventeenth Claim for Relief – Contractual Indemnification” in the Third Amended Complaint

I don’t have a position here, but I’ll share an anecdote. About a year ago I met a (small-time) hedge fund manager / lawyer who specialized in stocks where the company was involved in complex, important litigation. I asked him about Ambase — he didn’t give a bull/bear rating, but he did describe Bianco as an “absolute amateur” in navigating the politics and cross-currents of the NYC construction world.

I would not disagree. Ambase and Bianco were sitting on a pile of cash from their previous litigation win (Carteret) and rather than send it back to shareholders, they decided to become real estate developers with apparently zero experience. Here is a good article from the Real Deal from Nov. 2017 that is now behind a paywall. Obviously parts of the article are out of date now, but it provides some of the deal’s backstory, as it was known at the time. Notably, the article was published before Ambase secured a huge cash tax refund. https://www.dropbox.com/s/k7s2bdxh3scwegr/DWA%20The%20obscure%20investor%20who%20could%20sabotage%20NYC%E2%80%99s%20tallest%20planned%20condo%20tower.pdf?dl=0

Dave — thanks for the great write-up and contributions over the last few years on this situation.

This article popped up on my google alerts; thought it was worth sharing here: https://www.law360.com/commercialcontracts/articles/1347406/covid-construction-files-jds-new-york-building

I get the sense the article is biased to paint Kasowitz (lawyers for JDS) is a good light, but I am curious if this is new news: “And in November 2020, Kasowitz achieved an appellate victory for the property owner in a related dispute. Plaintiffs 111 West 57th Investment LLC, of which AmBase was a part, had alleged the owner of the property aided and abetted breaches of fiduciary duty in connection with AmBase’s loss of an equity stake in the project, and the plaintiffs had sought to gain a trust in the tower. A New York Supreme Court appellate division unanimously dismissed those claims.”

Article also mentions some interesting construction accidents, but also that demand has been hot even during the pandemic:

“Even so, sales have continued at a strong clip at the luxury tower during the pandemic.

“A listing on StreetEasy shows 10 sales of units at the property since March 1, 2020, with prices ranging from roughly $1.7 million to a whopping $57 million for a penthouse unit. The $57 million penthouse has four bedrooms and more than five bathrooms across 7,130 square feet, according to StreetEasy.

“StreetEasy also shows one sale in 2021, for $26.5 million.”

Hi Joe – thanks.

Yeah, I saw that article. The “property owner” case reference is to Index: 653067/2019 and Appellate index: 2020-01922. The article refers to property owner (lower case /p/ and lower case /o/). In fact, at issue in the case were the alleged actions of 111 WEST 57TH PROPERTY OWNER LLC (“Property Owner”), an entity that held title to the property but was effectively controlled by Developers. The case brought by Ambase entities was dismissed at the NY Supreme Court (lower level) and that dismissal was affirmed at the First Department.

You can read Supreme Court Justice Sherwood’s Decision here: https://iapps.courts.state.ny.us/fbem/DocumentDisplayServlet?documentId=CV7LSR_PLUS_oTX0CblP_PLUS_nS2Rlw==&system=prod

Got it. Thank you, Dave! That makes sense and does not seem to be thesis-changing if I am reading it correctly.

Thanks for the article. How did you come up with the following: At its current price of $0.30, ABCP’s valuation implies an extended judgment/settlement timeline and roughly a 10% probability of success on the Put Right claim and a 0% probability of success in all other matters. Those probabilities are too low, in my opinion.

Thanks!

Ignore that, I just read the last two sentence.

Apollo (“ARI”) is the Sr Mezz lender to 111 West 57th and the seller of the Jr Mezz tranche to Spruce *at par* immediately prior to Spruce’s strict foreclosure.

The following is an interchange from the 2/11/21 Q4 2020 ARI earnings call between an analyst (Hayes) and Apollo CEO Rothstein, in which Rothstein states, unequivocally, that Apollo has never taken a reserve against their loan to 111 West 57th. That would mean even when the loan was “out-of-balance,” immediately prior to foreclosure, Apollo was still confident there was value in excess of their loan.

It strikes me that this statement provides additional support to Ambase as they continue to argue that the Developers’ decision to “hand over the keys,” rather than require a foreclosure sale of the equity in the building, was indefensible. Unless, as Ambase alleges, the Developers were promised a way back into the deal for acquiescing, and in so doing, wiping out Ambase’s equity in the deal.

With Rothstein’s public statement, a judge can simply note that a sophisticated lender, who had the most junior debt in the capital stack, says their loan was never, ever, impaired.

=========

Question: Tim Hayes (BTIG)

Yes, that’s good to hear. And one question broadly about these assets and then I’ll hop back in the queue. But just whether it was material or not, I mean, did you see movements in your specific reserves against these assets? I’m just curious if we added additional reserves to any of these loans or by 1 have released some given some of the positive comments you just made.

Answer: Stuart Rothstein (ARI)

No, there’s no movements – no movements on the reserves at Liberty Center or Mayflower – sorry Jai. And just to be clear, **we’ve never taken a reserve at 111 West 57th street**. [my emphasis]

========

Nice find! Thank you!

12-31-20 10K recently filed with a summary of the various lawsuits.

Appellate arguments scheduled for both April (Sponsor SAC) and May (Apollo dismissal).

Earlier in March, the Appellate Court heard arguments on the motion to dismiss (Sherwood) ruling in the Spruce matter. Ruling expected in the coming weeks/months.

A bit of selling coming in today. Can’t find any news on it.

Decision in Spruce appeal(Index No. 655031/2017 Case No. 2020-01600):

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=wbTkuFT8gscxAcSOusNKwg==

“Order, Supreme Court, New York County (O. Peter Sherwood, J.), entered on or about January 29, 2020, which granted so much of defendant’s motion as sought to dismiss the causes of action for conversion and breach of the covenant of good faith and fair dealing and denied the motion as to the causes of action for a declaration that the UCC strict foreclosure is void, breach of article 9 of the UCC, aiding and abetting breach of fiduciary duty, and constructive trust/permanent injunction, unanimously modified, on the law, to deny the motion as to the good faith and fair dealing cause of action and grant the motion as to the remaining causes of action, and otherwise affirmed, without costs.”

It’s amazing how unreadable these passages are. I cannot reconcile that paragraph with the remainder of the document.

Are you able to translate the ruling into English?

Same here. I read it as the only thing that will be ruled on in a trial is “breach of good faith and fair dealing” and all other claims by all parties are dismissed without costs. I don’t see anything that materially changes the bet.

Oh, I see now. I didn’t realize it was first quoting a past ruling and then describing the modifications to that ruling. Thanks.

In accordance with the recent First Department ruling in the Spruce matter (see 3/30/21 above), Ambase is moving for leave to file a Second Amended Complaint against Spruce (and now including Apollo, AIG and Becker/Atlantic as defendants).

You can find the docket here: https://iapps.courts.state.ny.us/nyscef/DocumentList?docketId=_PLUS_tVY4u/ObSeTFkrvUpIhRA==&PageNum=3&narrow=

The proposed complaint includes a number of redacted sections which, based on the redline (also provided on the docket), contain new information received via the ongoing discovery in the Spruce matter.

Among other items, the new complaint includes this new assertion (para. 15):

” …. discovery has revealed that the strict foreclosure was no foreclosure at all, but merely a ruse to cover the theft of the value of Plaintiff’s equity. **Every other principal investor, including Becker, was permitted to “carry over” his equity, albeit through different entities**. When the dust settled, only Plaintiff was left empty-handed. The defendants then sold part of Investment’s equity to fund the budgetary shortfall and kept the rest for themselves.” (my emphasis)

As expected, Ambase withdrew (4/21/21) its appeal of the dismissal of its original complaint against Apollo. Ambase intends to include Apollo as a defendant in the Second Amended Complaint (“SAC”) against Spruce et al.

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=7uqiT5rX3X6jwAoYldPjUg==

While key parts of the SAC are redacted, the significance of the evidence apparently found via discovery is plain to see: Ambase, alone, was wiped out by the “foreclosure” while the other equity partners “carried forward” their equity interest post-foreclosure.

Highlights from the SAC, in my view, include the following:

1. Stern, Maloney and Becker are alleged to have received credit for their pre-foreclosure equity investments post-foreclosure (paragraphs 71-84, much of which is redacted). However, Ambase the only other pre-foreclosure equity holder, was wiped out post-foreclosure. I have never heard of a foreclosure in which only certain (presumably pari passu) equity holders retain equity post-foreclosure.

2. There is new information in paragraphs 75 and 85 that there were financial models provided by Apollo, and other “calculations” presumably by Stern/Maloney, that there was surplus equity value at the time of foreclosure, casting further doubt on Stern/Maloney’s defense that they were avoiding (deficiency judgment) liability by not objecting to the strict foreclosure. With the prospect of equity recovery, what rational borrower would agree to hand over the keys rather than seek a foreclosure auction, unless they were being treated differently than other equity holders/J.V. partners post-foreclosure.

3. Paragraphs 87 and 88 of the Second Amended Complaint provide new detail on the modifications to the inter-creditor agreement that we seemingly required to permit the transaction that ultimately took place.

New article with Developer (Maloney) indicating a $3,500 per sf blended aggregate sales price to “break even”.

https://www.bisnow.com/new-york/news/construction-development/111-west-57th-st-109294

Davea500: why do you believe ABCP has enough cash to win on the Equity Put Right against the Developers?

If needed, CEO (and 40% holder) Richard Bianco will most likely fund litigation expenses over and above the current cash on the balance sheet via a somewhat dilutive “litigation funding agreement” as he did in the past (before the AMT refunds). Maybe, just maybe, the company would consider a rights offering or other less dilutive means to raise cash, but I am not holding my breath.

The context has changed significantly since the last litigation funding agreement was announced in Sept 2017. In my view, thanks to discovery, the case against the developers is stronger today than in Sept 2017, and it may get even stronger before a new litigation funding agreement is needed. In addition, there is now a seemingly compelling case against Jr Mezz lender, Spruce, (and potentially Apollo and AIG) for tortious interference. All of this is to say that terms of a second Bianco litigation funding agreement in, say, Q2 2022, should it be needed, *might* be less onerous due to Ambase’s improved litigation prospects – though the Board is not particularly independent.

This language in the 6-30-21 may be setting the stage for a new Bianco-funded litigation funding agreement: “Over the next several months, the Company will seek to manage its current level of cash and cash equivalents, through various ways, including but not limited to, reducing operating expenses, possible asset sales and/or long term borrowings which may include additional borrowings from affiliates of the Company, although this cannot be assured.”

Brief Update – Fourth Amended Complaint filed in the Sponsor matter, Motion to Dismiss expected shortly. Conference on whether to “consolidate” the Sponsor and Spruce matters expected in Sept 2021. JDS recently sued the crane operator, US Cranes, for last year’s accident (https://therealdeal.com/2021/08/20/michael-sterns-jds-sues-crane-company-at-111-west-57th-street-for-50m/).

Amidst all the legal noise, the exterior of 111 West 57th is very near completion. Here are some recent photos: https://newyorkyimby.com/2021/08/finishing-touches-underway-on-111-west-57th-street-in-midtown-manhattan.html

Transcript of 10/27/21 arguments before Justice Cohen re: Defendants (Sponsor/Developers) motion to dismiss portions of the Fourth Amended Complaint posted today: https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=XnQXI65JXcUoA7QqPBbv9w==

New contract announced at or above asking price (depending on the allocation of cost to furnishings): https://www.mansionglobal.com/articles/21-5-million-unit-at-new-yorks-slender-supertall-111-west-57th-st-finds-buyer-01638399712

By my tracking sheet there have been roughly $400mm in publicly announced/reported contracts to date.

Update: Ambase filed its opposition to Spruce and other Defendants’ MTD the Second Amended Complaint in the lender matter yesterday (12/13/21) and the reply briefs are expected on or before 12/28/21. At that point, Lenders’ Motion to Dismiss SAC will be fully briefed.

With respect to the Motion to Dismiss the Fourth Amended Complaint in the Developers’ case, we could see a decision at any time as it was fully briefed on 10/12/21 and oral argument took place on 10/27/21.

While we await Justice Cohen’s decision on the two Motions to Dismiss before him, here in an interesting decision related to the early (pre-Ambase) days of the 111 W57th project. Ambase also is seeking to pierce the corporate veil.

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=S8zMOvb47Z1NItlAj4fVvw==

FWIW, Ambase’s counsel mentioned this decision to Justice Cohen during a recent oral argument (page 46):

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=XnQXI65JXcUoA7QqPBbv9w==

UPDATE: Decision from Judge Cohen on Motion to Dismiss certain claims in Sponsor matter.

Link to the 5/9/22 Decision :

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=L/gPXOJkWgjYtCdAXMjfZA==

In my view, the thesis remains intact. The Fourth Amended Complaint (“FAC”) contains many as yet undisputed allegations in support of Ambase’s contractual right to exercise the Equity Put Right ($150mm +/-) and, despite the dismissal of the veil piercing claims, there remains a path to Stern and Maloney (as opposed to entity “Sponsor”) to collect a judgment via the FAC’s Seventh Claim for Relief – Contractual Indemnification.

Here are the claims Defendants moved to dismiss in the context of all the claims in the FAC:

https://www.dropbox.com/s/uastn1g13sk33pq/Ambase%20FAC%20Decision%20Summary.pdf?dl=0

With this decision, hopefully the pace will pick up. I expect that Judge Cohen will order a discovery schedule shortly. Cohen has indicated he will insist on a tight discovery timeline given the length of this case already. He had better. Here is an indication of how the timeline might look based on a letter to Cohen from Plaintiffs on 2/14/22.

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=3w7ILMwpUtwdEMzki6/4IQ==

I also anticipate a decision from Cohen relatively soon on the motions to dismiss certain claims in the Second Amended Complaint in the lender case. Given the Decision in the Sponsor matter, I think the Tortious Interference with Contract claims may be dismissed.

The need for cash still has to be addressed; I still expect Bianco will fund somehow. Shareholder meeting on 6/2/22 in Stamford CT.

Thank you very much for the summary posted to the dropbox. Very, very helpful!

Case summary in (somewhat) plain language offered here by Ambase Counsel to Judge via July 2021 hearing transcript:

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=Fzv5QsCGBqQSDsuWI/MggA==

Important to note that when Stern/Maloney’s counsel states the following on page 25: “the contract claim as to the Equity Put has already been dismissed;” the “claim” he is referring to was from the Second Amended Complaint and was related to a budget produced in August 2016 (via discovery), and was not related to the December 2016 Budget, which is the basis for a new Equity Put Right claim as set forth in the Fourth Amended Complaint (and Defendants did not seek to dismiss).

Seems interesting, from my uninformed perspective, that the defense talks so much about how long everything is taking, the costs, exaggerating the number of amendments (fourth, fifth, sixth), etc. Almost looks like confession-through-projection. Which side actually has the incentive to drag out the case?

What’s your high-level impression of who holds the winning hand at this point?

jwestern –

As to your first question, both parties are responsible for the timeline. Ambase pursued a Federal RICO claim (very hard to prove) that cost at least 18 months. On the other hand, the Developers have dragged their feet in discovery and they can see Ambase’s cash balance quarterly and I suspect they play on that.

Who has the winning hand? It won’t surprise you to hear that I believe Ambase does. I would welcome pushback from anybody on this.

Why do I think that? At a high level, here is what is, thus far, UNDISPUTED:

1. Ambase has a 20% IRR put right;

2. Ambase was entitled to an updated budget at least once per year;

3. Ambase did not receive a budget between June 30 2015 and December 2016 despite there being budget overages in many line items following June 2015 budget, which itself may have been knowingly understated (fictitious contracts, huge pending change orders (see Parkside Construction litigation) and other manipulations)

4. Draft updated budgets provided by developers to lenders/Apollo in fall of 2016 would have triggered Put Right (see FAC para 200 – as produced by Apollo). These budgets were provided to Apollo without Ambase’s knowledge and despite the deadline for giving a budget to Ambase having passed.

5. The disputed Dec 2016 budget DOES trigger the Put Right when compared to the June 2015 budget (“prior approved budget”) that BOTH Ambase and **Apollo** agree is the operative baseline budget. Developers, however, assert a different, higher hard cost budget, is the operative baseline budget against which to measure hard cost growth budget to budget – that is how they get to 9.54% hard cost growth budget-to-budget.

Looked at another way, let’s invert – how would one expect the Developers to act if the budget growth didn’t trigger/hadn’t triggered the Put Right?

– They would have complied with the budget update/proposal requirements, i.e one would have been provided in 2015 as Maloney disclosed overages. Further, one would have been provided no later than late February 2016 as the annual update.

– They would not have contravened the JVA by sharing unapproved budgets with lenders without Ambase’s knowledge.

– They would have not complained about/disputed the August 2016 budget provided in discovery. In other words, a budget, even if disclosed per Discovery would not have been problematic. Developers never disputed that the Aug 2016 budget did, in fact, trigger the Put Right, and this is consistent with what we now know about the budgets being shared with the lenders (but not Ambase) at this time.

– The December 2016 budget would have been entirely consistent in format with requisition budgets before and after; it was not. It was a unique format. As I set forth above in the write up, the Advance Requests just days before and days after the disputed Dec 2016 Budget had hard values that would trigger Put Right.

– They would not have objected to Apollo’s First Shortfall notice (see dismissed Apollo case).

In sum, I see no innocent explanation for developers conduct related to the Equity Put Right. Does anyone?

Thanks Dave. I also believe the developers’ conduct was nefarious. But I’m wary of what I don’t know. In the interest of helping to “steelman” the bear case, I’ll share some thoughts.

First, I wouldn’t be surprised if the developers’ conduct is typical of New York City real estate developers, and so I wonder whether they know the nuances of litigating these shenanigans well enough that they get away with it often enough to make such shenanigans worthwhile. Morally speaking, the case looks clear, but legally speaking, the level of nuance I read in these filings is way beyond my appreciation. So I cannot necessarily see a favorable legal ruling through the thick fog of legalese.

Second, I worry about the competence and/or ethics of the Ambase counsel; namely, the unusual number of amendments, the apparently unnecessary padding of the complaint in order to preserve claims on appeal (if I read that right), and the pursuit of the RICO claim. Even considering that the facts seem to be on Ambase’s side, one wonders whether these lawyers can ultimately win, and if so, without dragging the case out until financing becomes perilous.

I, too, welcome any pushback for/against the investment thesis here.

jwestern- thanks for your comments. they echo some of my thoughts as I construct my own bear thesis.

Your points on the developers and “typical” conduct is fair. And frankly, in reading other cases against Stern, withholding certain information appears to be his modus operandi. However, the other cases I have reviewed did not include the Equity Put Right. Say what you will about Bianco’s naiveté in NY real estate, but his ability to negotiate the put *may* prove genius. From a legal standpoint, you can withhold required info from me, but what is my claim unless I can prove damages resulting from that act. In this case, the withholding (and, possibly, manipulating) of information indisputably results in frustrating Ambase’s contractual right the exercise the Put. See FAC Claim 3: i, j, k , n, o. The damages resulting from not being able to exercise the Put are self-evident. Perhaps, just perhaps, this is a case where Stern’s usual tactics are upended by the unique Equity Put Right provision.

As for counsel, Stephen Meister (Meister, Seelig) used to be co-counsel on the case with Cooper Kirk. Meister left the case a while back. Hard to know what transpired, but I have found Thompson and Proctor (Cooper and Kirk) to be effective. I cannot opine on the merits of preserving claims in the complaint, but I do agree with Thompson that the number of Complaints (with the exception of the RICO detour) may legitimately be a function of new evidence from discovery.

RICO was a mistake in hindsight, and I obviously was not in the room when they weighed the pros and cons. The half-full perspective is Bianco et al were so stunned by the pattern of misconduct that they thought there was a chance; the half-empty perspective is Bianco over-reached and Thompson was more than happy to bill for it.

FWIW, David Thompson successfully litigated Bianco’s/Ambase’s last big legal victory (Carteret), so they have a successful history.

Share price has been falling off a cliff these last weeks/days. Any ideas why?

I am not aware of any new developments in the litigation. Future liquidity needs to be addressed. But, as stated above, I think Bianco underwrites another litigation funding deal of some kind.

Oral argument on the lenders’ and Becker motions to dismiss was held before Justice Cohen on Friday 7/22/22. I could not attend the in person argument and no transcript is available yet.

However, docket was updated subsequent to the 7/22/22 hearing to now show that Motions 7, 8, 9, and 10 are “fully submitted,” which suggests that Cohen did not rule from the bench at the hearing and has taken the motions under advisement.

On 7/28/22 JDS lost a 111 W57-related case against a surety on Summary Judgment. Here is a link to the decision:

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=sUnW9_PLUS_K2K1pUeLdz2vqKzQ==

With respect to the Equity Put Right, what is of particular interest in this case is not the decision, per se, but some of the documents disclosed on this docket. For example, there is reference in Justice Masley’s decision, on the bottom of page 7, to an Oct 2017 change order between the then-concrete sub, Parkside, and JDS in the amount of $19mm. This change order was related to an original contract in the amount of $40mm – so the change order represented a nearly 50% increase in the contracted amount.

Other than being an eye-popping percentage increase, the more important issue is that the original $40mm Parkside contract was executed immediately prior to the June 2015 closing of the construction financing. Ambase alleges that the value of this contract, among others presented to the construction lenders by Stern/Maloney at closing, *knowingly* understated the cost to build the building – see FAC paragraphs 164-165. This enormous concrete change order conveniently impacts the project budget just a few months after the Foreclosure that squeezed out Ambase had been completed.

As Ambase points out in FAC paragraph 169: “Had even a small portion of the overruns [concrete and others] been included in the June 2015 Budget, Plaintiffs could have and would have exercised their Equity Put Right. Instead, on the basis of Defendants’ misrepresentations, Investment approved the June 2015 budget.”

You can see Stern try to explain the Parkside change order, which was un-executed (a frequent JDS ploy) in this deposition from the Parkside matter on deposition page 56.

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=p7Y9KLYBALlGL1DHj07cGQ==

Sorry if you already updated this but has the litigation fee with Bianco been amended or how are they funding this? Still burning 1M per quarter last I checked.

Additional funding still an open question. I suspect Bianco will, again, provide some type of financing. Terms TBD.

As mentioned in today’s 10Q, you can find the two briefs re tortious interference with contract on the last page of the Lender matter docket: https://iapps.courts.state.ny.us/nyscef/DocumentList?docketId=_PLUS_tVY4u/ObSeTFkrvUpIhRA==&PageNum=6&narrow=

A new data point just appeared in a court filing in the Liberty Mutual v. JDS matter related to the pre-funded insurance loss fund. This fund, which represents pre-funding of insurance deductibles, is in dispute as set forth in the FAC.

The filing (https://www.dropbox.com/s/wyccm5rlvnkkw6k/Liberty%20Mutual%20v%20JDS%20Letter%20Update%202022-10-3.pdf?dl=0) indicates that the loss fund had a balance at 9/13/22 of roughly $8mm. With construction nearly complete and the likelihood of new claims accordingly reduced, one might conclude that a good portion of this loss fund will be refunded as it represents a pre-payment of deductibles. The dispute is to whom shall it be refunded.

In the FAC, Ambase claims (reasonably in my view) that it should share in any refund and that JDS misrepresented the beneficiary of the fund. If Ambase succeeds with this claim, and Ambase represented 60% of the capital contributed to the loss fund (pro rata to early capital contributions), that would amount to a refund to Ambase of $4.8mm ($0.12 per share before any adjustments).

Decision on Motions to Dismiss in lender matter (655031/2017):

Docket: https://iapps.courts.state.ny.us/nyscef/DocumentList?docketId=_PLUS_tVY4u/ObSeTFkrvUpIhRA==&display=all&courtType=New%20York%20County%20Supreme%20Court&resultsPageNum=1

Decision on Motions 7, 8,9, and 10: https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=xXNHBBgDumm6wvvo_PLUS_7YHRw==

“Plaintiff [Ambase] has sufficiently alleged facts, that if true, could demonstrate that the Apollo Defendants exercised its discretion under the Pledge Agreement in bad faith to the detriment of the company (Legend Autorama, Ltd. v Audi of Am., Inc., 100 AD3d 714, 716 [2d Dept 2012]; Lehman Bros. Intern. (Europe) v AG Fin. Products, Inc., 38 Misc 3d 1233(A) [Sup Ct, NY County 2013]). Therefore, the motion to dismiss the second cause of action for breach of the implied covenant of good faith and fair dealing under the Pledge Agreement is denied.” (NYSCEF DOC. NO. 422 page 15)

@davea500, do you think the prior litigation funding agreement is a decent guide for a potential new amendment to the funding agreement? I.e. Bianco puts up ~$3.7mm and his share of legal proceeds goes from 25% up to 30-45%? I know the situation has changed since the original funding agreement, just wondering if you think new terms would be directionally higher or lower.

@jwestern Personally, I think the terms should be less expensive for the company and shareholders, but I am not particularly optimistic.

When the Board approved the first litigation funding agreement on 9/26/17, the operative complaint in the Sponsor litigation was the Second Amended Complaint and Justice Bransten had yet to rule on a Motion to Dismiss. Her decision, which is dated four months later (1/29/18), guarantees that some very important claims are moving forward.

Compare 9/26/17 to today: thanks to discovery in the intervening years, the facts set forth in the, now operative, Fourth Amended Complaint, are more fleshed out and significantly more compelling in my view, and new claims have been added. For example, we now know that in 2016, Sponsor/developers secretly shared proposed budgets with the lenders that triggered the Put Right while simultaneously refusing to share a required budget proposal with Ambase (FAC paragraph 200). In addition, we now know that Apollo will stay in the litigation thanks to Cohen’s recent ruling in the lender matter. So, since the last litigation funding agreement was negotiated, we have more facts, more claims, and two more defendants in play (Spruce and Apollo). This is good news.

The bad news is that the Board has not demonstrated a lot of independence. While I believe (and hopefully the board believes) that the chance of a positive recovery for Ambase has improved significantly since Sept 2017, if the company has been unable to identify potential sources of capital other than Bianco, non-Bianco shareholders may find themselves in a similar situation.

At the time of the last litigation funding deal, the Company noted the following in its 8K filing (my emphasis added):

“After review of the recent developments, the Company’s executive officers and its Board of Directors have concluded that it is in the Company’s interest to **rapidly obtain without delay** a litigation funding commitment to finance litigation with respect to the ongoing disputes.” (26-Sep-17 8K)

The need for capital now has been clear for more than a year, and has nothing to do with a “review of recent developments”; Bianco even mentioned it at the June 2022 shareholder meeting. The fact that we have not heard a solution yet makes me wonder if the Board was waiting to see how Justice Cohen would rule on the Lender motions to dismiss prior to making a final decision on litigation funding. Now that he has ruled, and Apollo is still in play, perhaps any terms can improve when compared to having had the second cause of action against Apollo in the lender case dismissed.

One way or another, I believe we will hear something relatively soon as the legal work is about to heat up and the lawyers will want to get paid.

As you are closely following the litigation and with the market cap now only around $3m, why wouldn’t you/group of shareholders just approach the board with a better funding alternative (or at least one that prevents you/minority shareholders from being overly diluted)?

Excerpt:

ORDERED that the Sponsor Defendants’ motion, brought by Order to Show Cause, to disqualify Blank Rome from representing Plaintiffs in this action is DENIED; it is further

ORDERED that the parties appear for a status conference on May 9, 2023, at 10:00 a.m., with the parties circulating dial-in information to chambers at SFC-Part3@nycourts.gov in advance of the conference. The parties shall meet and confer prior to the conference and shall submit joint or separate proposals setting forth an expeditious discovery schedule (including Note of Issue);

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=ofy8pJBozHx12ed1MjEvaQ==

Bianco continues to fund the litigation by loaning the company additional funds. From yesterday’s 10-Q:

“In April 2023, the Company and Mr. R.A. Bianco entered into an additional agreement pursuant to which Mr. R.A. Bianco made an additional loan to the Company of $325,000 for use as working capital in accordance with the same terms of the loan(s) payable noted herein.”

https://www.bamsec.com/filing/114036123022379?cik=20639

Looks like a favorable arrangement for shareholders, 6.5% interest rather than a larger percentage of any future settlement. Do you read it the same way, David/dt?

Is developers’ conduct a feature or a bug? A recent ruling by Judge Cohen in a dispute related to another development project:

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=LeIXzXa/iZxh8EbtEWjNFg==

Judge Cohen’s recent Order establishing timeline for resolution of outstanding discovery disputes and therefore resumption of remaining discovery in Sponsor/Developer matter.

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=_PLUS_TSww5GuJDjSdKUpn9VtRQ==

Million shares traded 10c on Friday the 26th. Tiny trades before the close 12-15c.

That is all….?

Purchaser of 745,000 of the shares from Camac was Ambase CEO, Dick Bianco per 5/30/23 Form 4.

Although this is clearly a vote of confidence from the CEO, the share purchase was carried at a token amount of only $74k (745k shares at $0.1/share) and pales in comparison to the size of loans Bianco is providing the company to fund the continuation of litigation.