Nam Tai Property (NTP) – Activist Control – 45%+ Upside

Current Price: $11.75

Net Asset Value: $17.0-$27.0

Upside: 45%+

Expiration Date: TBD

This idea was shared by Ilja.

Important Update: The situation has seen several major updates since the initial write-up (written in Sep’20). For updates see comments on the 9th of March and on the 9th of December. The last trade was closed on the 12th of May’21 with +70% return. The idea was brought back among active cases on the 9th of December at $11/share price. The upside is still material but could’ve changed due to falling Shenzhen RE prices. The downside risk has increased substantially due to potential bankruptcy risk.

Nam Tai Property is a mismanaged real estate developer in China (listed on NYSE) that trades at a substantial discount to its conservative sum-of-the-parts valuation. Large discounts are nothing new for Chinese RE companies, however, what makes this situation attractive is that an activist IsZo Capital (with 50% of the portfolio invested in NTP) is trying to oust the board and has already collected 40% shareholder support (30% was needed) to convene the meeting. Moreover, just a few days after this announcement, the CEO/Chairman of NTP resigned, pretty much rubber-stamping the fact that the remaining affiliated members (5/8) are done here as well. The management/board change is very likely to help close the valuation gap. However, the reaction of NTP share price to these events was rather muted – currently, it is up only 10% relative to pre-announcement prices indicating a potential opportunity for further play.

The company is developing several properties with the major two being multi-building tech parks in Shenzhen (12m people). Just the valuation of the land of these two projects (without the buildings and other assets of NTP’s balance sheet) stands at $14/share (37% upside) based on the estimates made by 3 independent evaluators in 2017. Quite conservative SOTP valuation indicates value between $17 and $27/share (70% and 160% upside).

Further key points/risks:

- Since 2017 the company has been run (5/8 board seats) by Kaisa Group Holdings – a previously large real estate developer with a shady history. It owns 24% of NTP and the majority of it was acquired at $17/share (which was more than 100% premium to share prices at that time). Since then, NTP was managed very silently (no conference calls and limited promotion/communication with investors), which led to a significant share price deterioration and expanded the valuation gap between its share price and the intrinsic value. Overall, the shady history of Kaisa and the unexpected resignation of NTP CEO/Chairman, who is also a younger brother of Kaisa’s CEO, leave some uncertainty regarding the current state of NTP and its projects.

- However, the involvement of two activists and Peter R. Kellogg – US billionaire that holds 20% of NTP (mostly through his insurance company) and has been on the board since 2000 – give some reassurance. Although, it is rather strange that despite the unfortunate situation that has been going on for the past several years at NTP, Mr. Kellogg remained quiet and made no moves himself.

- As mentioned above, the activist has collected 40% support (including Mr. Kellogg’s) for the meeting and has presented a slate of its nominees to replace the current board. Despite the support to initiate the meeting, it is not exactly clear how exactly the other shareholders are going to vote (Peter Kellogg stated support only for the meeting, but hasn’t noted any further intentions so far).

- The downside seems to be protected rather well by the value of land and buildings.

Timeline

- 1975 – Nam Tai Electronics (previous name) is founded in Shenzhen and continues to operate as an electronic parts manufacturer.

- 2014 – over the years, Shenzhen has become one of the largest/fastest-growing cities in China (population increased from 35k in 1975 to 12.5m today). As a result, the government has asked Nam Tai to put its land to better use – change it from industrial to commercial/residential. Nam Tai exited the electronic manufacturing business, changed its name to Nam Tai Property, and transformed into a developer of technology parks.

- July 2017 – Chinese property developer Kaisa Group Holdings acquires an 18% stake in NTP from its CEO/chairman at $17/share (while the day before shares closed at $8.20/share). Subsequently, Kaisa bumps its stake in the open market to 25%, which is their current ownership level. Previous CEO/Chairman is demoted to a president, while the new CEO/Chairman place is taken by the younger brother of Kaisa’s CEO.

- 2017-2020 – NTP shares are significantly underperforming the market and are trading at a substantial discount to the value of its two major projects (more on this below).

- May 2020 – IsZo Capital increases its stake to 9.8% (from 6.7 at Dec’19) and starts an activist campaign to overturn the board.

- June 2020 – another activist Railroad Ranch Capital (owns 3%) releases an open letter supporting the issues raised by IsZo Capital.

- July 2020 – IsZo seeks to convene a general meeting and proposes a slate of its nominees to replace the Kaisa’s affiliates. Support from 30% of shareholders is needed to call the meeting.

- August 2020 – NTP responds rejecting IsZO claims but states that it remains open to constructive dialog.

- 11th Sep’20 – IsZO delivers requests to call the meeting with the support of over 40% of NTP shareholders.

- 14th Sep’20 – NTP CEO/chairman resigns.

Activist Campaign

IsZo Capital provides several arguments for their campaign, which can also be found on the fixntp.com website. Basically, they’re noting share price deterioration (currently down 21%) since Kaisa CEO’s brother took the wheel, failure to optimize the company’s assets, poor capital allocation steps, and self-dealing.

Their main point is that NTP is trading at a significant discount to the intrinsic value of the two major projects. The activist does not provide any details on how they arrive at the valuation targets, but rather bases its statements on the independent valuation of the two major NTP projects that was done back in 2017 (more info in SOTP section below):

Based on raw land valuations alone, the stock should be trading higher than $20 per share. The Company has not promoted these facts in the market, let alone attempted to realize the value of the Company’s assets.

Railroad Ranch, a privately held investment firm that also supports the change in NTP, has provided their calculations for the two projects based on the rent prices in Shenzhen and their base case (projects’ value at $19.6/share) also suggests that there is still a significant amount of unrealized value in NTP.

We have been shareholders of Nam Tai since 2017 and believe the current market value of the two Shenzhen properties translates to a per share value of between $20.00 and $30.00 for the common stock

SOTP Valuation

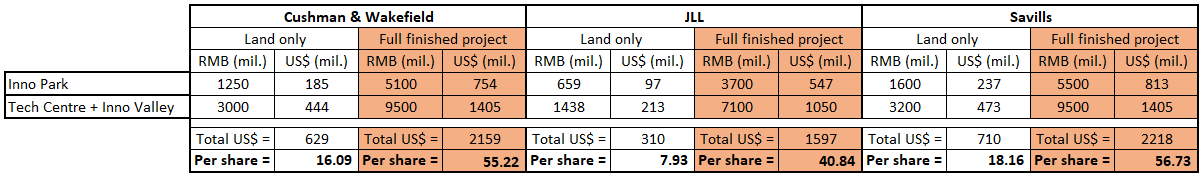

The most recent independent valuations for the two major NTP projects were carried out in 2017 by Cushman & Wakefield, JLL (Part 1 and Part 2), and Savills (Part 1 and Part 2). At that time the construction work hasn’t been started yet and the evaluators put their estimates for the raw land and for the value of finished projects (current USD/RMB exchange rate used for conversion).

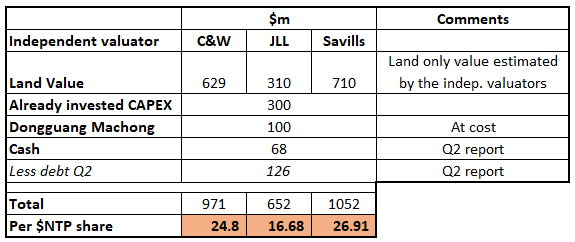

So what strikes here first is that apparently the raw land value of these two projects alone (without the buildings and other assets) might be worth more than the current price of NTP shares. Net debt is quite low and more than covered by other assets aside from the land (see the table with calculations below)

The values of the full finished projects seem very elevated and it’s actually beyond me why the estimates were/are so high and I am not using these to build my conservative valuation case. If we take land value estimated by JLL ($310m) + total estimated budget for the two projects (in 2017 it was around $556m vs $439m current, as Inno Park was initially expected to be more expensive), we arrive at the land+’at cost’ building valuation of the projects at $866m, whereas market value estimated by JLL is almost double that $1597m (seems too much for real estate developer’s mark-up). The former number excludes the budget for the Inno Valley reconstruction, as the permit has not been received yet and the cost estimates are not available yet, however, Inno Valley is a much smaller property with rather tiny expected impact on the total projects’ costs/value.

Ignoring these elevated finished project valuation estimates, I have looked only at land value + already invested CAPEX to construct SOTP table. The resulting figures also indicate a substantial remaining upside and stand in line with the valuation mentioned by the activists. I believe these figures are conservative enough as they do not take into account any incremental the developer creates by raising these buildings and creating tech parks (the assumption being that NTP simply does not loose money with its capex, whereas independent valuators suggest there might be substantial value creation).

* Worth noting that the Dongguang Machong acquisition (made in March’20) is noted by the Railroad Ranch capital as a potential self-dealing and its true value could be somewhat lower – with 50% haircut for Dongguang property the overall valuation would be 5%-8% lower.

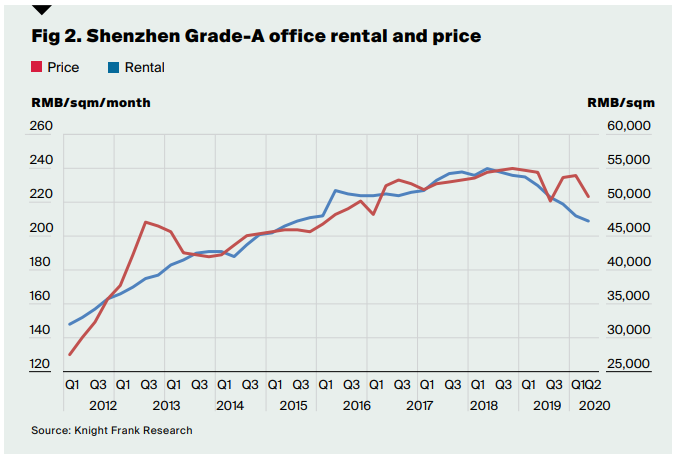

Office real estate prices in Shenzhen (even post-COVID) have not changed that much since 2017, so the independent valuation estimates in the tables above should still be more or less up to date:

NTP Properties

Nam Tai develops two major projects, technology parks in Shenzhen:

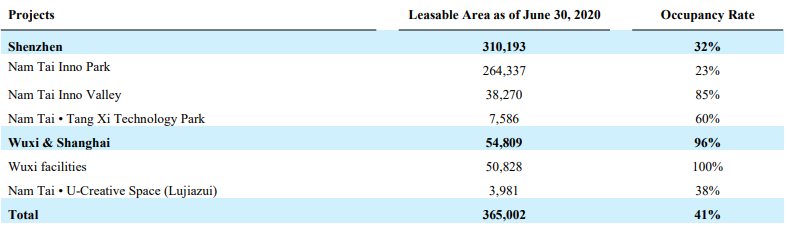

- Nam Tai Inno Park – located in Guangming District and covers 104k sq.m. land and has a total floor area of 332k sq.m. The project includes five industrial R&D buildings, two industrial service centers, and three dormitory buildings. The targeted tenants are companies in artificial intelligence, IT, and materials industries. Inno Park construction was started in May’18, while the opening is intended in Q3/Q4 of 2020. Q2 report also states that leased units should be delivered to the tenants gradually from Q3’20 to 2021. As of June’20 – 23% of the available area was already leased. The estimated budget costs of the whole project stand at $195m and as of Dec’19, $140m had already been invested.

Picture of the project (May’20):

- Technology Center – located in Baoan District. This is a higher-level location than Inno Park, however, is smaller as well – 22k sq.m. land area with 195k sq. m. floor area. The project includes three industrial R&D buildings, one dormitory, and some commercial spaces as well. The main tenant targets are artificial intelligence companies. Tech Center construction started in mid-2019 and as of Jun’20, the company was completing the baseplate construction. Application for a pre-sale permit (to start the sale before finishing the project) in Q4’20/H1’21 is being considered. The total budget cost stands at $244m and as of Dec’19, $100m had already been invested. The company was expecting to put another $33m into the project during 2020. The completion deadline is unknown yet.

Construction from the company’s website:

Sattelite pictures seem to confirm the location and the construction process:

- Inno Valley – this is a second part of the Tech Center and is located just nearby it. Land size is 22 sq.m. with 42 sq.m. floor area. Inno Valley is an already existing building, which is currently mostly leased to third party companies. NTP intends to reconstruct it and has already applied to be included in the city’s urban renewal plan.

- Dongguan Machong – the most recent heavy asset residential project purchased (to the resentment of activists) for $100m in March’20. Dongguang is a city nearby Shenzhen. During Q2’20 preparation works were started. The estimated development costs are $163m.

And a few smaller projects:

- Tang Xi Tech Park – 7.5k sq.m. located in Baoan District, Shenzhen. It is not owned by NTP, the company re-leases it to third party tech firms. As of Q2, occupation stands at 60%.

- Wuxi facilities – previously manufacturing facilities of Nam Tai Electronics sized at 43.6k sq.m. The property was leased to a third-party firm in Feb’19.

- Shanghai – Nam Tai Creative space – the company is leasing the 4k sq.m. property (doesn’t own).

Occupation of NTP properties as of Q2:

Activists

IsZo Capital is a New York-based investment firm with roughly $100 million in assets and 10 investments in the portfolio. NTP is currently the largest position (almost 50% of the portfolio). Not much information is available on the company, however, some minor things of note:

– In 2012 they’ve successfully battled off an undervaluing offer ($1.75bn value) for Taro Pharmaceutical (here and here).

– In 2018/2019 IsZo was also involved in Ambase (ABCP) litigation stub trying to sue the management for self-dealing. The case was dropped as IsZo exited its stake in 2019, seemingly due to tax reasons.

Railroad Ranch Capital is a private Dallas based investment firm with almost no information available as well.

Kaisa’s Background

Kaisa has a mildly put “interesting” history of fraud/corruption/fishy accounting allegations, etc. It used to be a big real estate developer (current market cap = $3.3bn) favored by international firms and over the years raised 35bn RMB ($5bn) for its land purchases. In 2015, it got into conflict with Chinese officials on the corruption probe. As a result, its assets were frozen and its shares trading on HKEX got suspended for two years. Kaisa then defaulted on its debt – in fact, it was the first Chinese company to default on overseas debt. According, to IsZo Capital, Kaisa’s CEO and his brother even had to flee to Hong Kong in order to escape detention. All in all, corruption matters eventually got resolved and in 2017 trade suspension got lifted, however, late filings of Kaisa’s own annual reports left many questions. FT wrote an interesting article on this, but the essence is:

Put another way, would you buy the bonds or shares of a company that admitted just five months ago that it cannot explain how almost $9bn flowed into and out of its coffers over the course of three financial years.

In Kaisa’s case, following the money is like wandering through a maze with many dead ends. Relative to the amount of cash involved, the developer’s apparent losses were relatively modest. But the number of still unanswered questions is shocking.

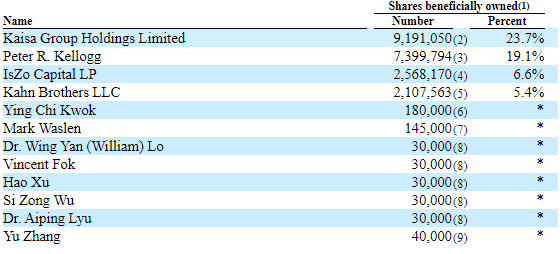

NTP Shareholders and Management

NTP shareholders:

Board members (5/8 are affiliated with Kaisa):

Gross rental yields are very low in Shenzhen, 2-3%. So you will really need a sale of those properties, and liquidation to unlock value here. Majority of RE value still needs to be built, so could easily take 4-5 years before value is unlocked there? And if they sell Inno park, most of cash will be paid in taxes, pay down debt, and invested in development of their other properties. So that means you might get a small distribution somewhere in 2022, and then have to wait several more years.

Assuming total RE value is $22 per share (in middle of your estimated range) and liquidation happens within 5 years, but subtracting 25% tax rate over difference in BV and liquidation value, I get a IRR of only around 10-12% though. This might explain lack of enthusiasm of the market?

I modeled out NTP to completion, it is trading at an implied cap rate approaching 50% as soon as both properties are built. I don’t think its the value of the properties that is the issue, it is frankly the unknown with Kaisa at this point. It is also micro-cap, illiquid, China real estate.

How do you get a cap rate of 50%? What is your monthly rent assumption? From doing a bit of googling I get a range of $12-$72 per sqm per year in rent for industrial properties:

http://www.szdaily.com/content/2019-10/23/content_22565611.htm

They will have about 580k sqm in commercial properties when all is finished. So that is between $7-42m in annual rent assuming 100% occupancy. Going right in the middle that is about $25m in rent. But assuming 80% occupancy, $20m Or between $10-15m in net income (depending on taxes, interest and various other corporate costs).

This would imply a 2.5-3% cap rate?

This was when the stock was at $8, and my net debt was only $5M, and assuming full occupancy, so things have changed. My monthly rent for Inno Park is $25-30, Inno City $45-$50…. Important to remember to blend in residential which is far more expensive than other types of land. At 60% NOI margin we are earning around $145M/year over what was an EV of 311M.

Simply, my rates are much higher than that source given my reference checks and research. If rates were that low, the properties would not be very valuable.

https://www.colliers.com/-/media/images/apac/hong%20kong/2019_images/radar/shenzhen_report/20190404_colliers_radar_shenzhen_the_curtain_is_rising.pdf This is one of many, but prices are far higher, especially in Inno City area. Can also check out the big China property developers for more clues…

I think your numbers are way too optimistic, they are almost an order of magnitude higher than what these type of properties are generally rented out for.

They received $800k in rental revenue in Q1, and in Q4 they said they had rented out 34k square feet of Inno Park and 33k in Inno Valley. Given total current rent of $3.2 million give or take (annualizing that $800k), that is not even $50 per sqm per year.. So why would the remaining parts be rented out at rents between 6-10x higher?

That’s okay to have that opinion, but you should not be in the stock if that is the case. How would you get to $20/share with those numbers…. you’d just be betting on an increase into an already speculative market. I do believe that will continue espeically in NTP land areas. Additionally, they aren’t recognizing a ton of rent revenue right now. They also have $100M in cash advances from customers (future revenues). Inno Valley rents aren’t something you can compare to the future buildings. Current revenue is not indicative as a forward looking indicator and I have to use what is being paid in the markets.

No just trying to paint a pessimistic picture, try to do that will all my potential investments. With low cap rates for real estate in Shenzhen I was ready to dismiss this. But I did miss the advance rental payments for some reason, so thanks for bringing my attention to that :). Any reason why they did not recognize revenue, despite counting these properties as leased out already?

Looking at latest $28m advance they got from leasing out 27k sq meters of Inno Park in Q2, it does support your argument that rent could be at least $100-200 per sq meter (assuming advance is 50% of a 10 year lease). It would be nice if they provided more info on the terms of the leases signed.

IsZo has issued another letter on the 18th of September. The meeting date is not set yet. A few details from the letter:

– Apparently IsZo is also concerned about the current state of NTP (after a few years of Kaisa’s control). After getting the control of the board it intends to launch a full strategic review of the portfolio: “Once a reconstituted Board and fresh management team have been installed at Nam Tai, it will be necessary to test legacy assumptions held by Kaisa insiders. Our slate believes it has an obligation to conduct a strategic review of Nam Tai’s portfolio and assess potential strategic alternatives for all four properties under development. There may be previously unexplored avenues, such as joint ventures or partial or full asset sales, that can accelerate the realization of value and lower risk to shareholders.”

– Regarding the future strategy; “As Nam Tai begins to realize the value of its projects, the reconstituted Board would likely seek to return capital to long-suffering shareholders in the form of buy-backs or dividends. It is critical for Nam Tai to rebuild its cash position and regain the trust of its shareholder base prior to investing in another project – beyond the four it currently has – over the long-term.”

– Prior to the meeting, IsZo will provide a comprehensive and more detailed presentation.

https://www.businesswire.com/news/home/20200918005270/en/%C2%A0IsZo-Capital-Issues-Letter-to-Nam-Tai-Shareholders-Regarding-its-Slate%E2%80%99s-Strategic-Vision

Meeting date has not been set yet – apparently NTP is still “working” on the request, while simultaneously wrangling with IsZo. On the 21st of Sept, NTP appointed 3 new board members including a new CFO. The fact that all 3 are affiliates of Kaisa, was not left unnoticed by IsZo, which issued a complaining letter on the 22nd of Sept. Then the next day NTP issued a big PR trying to defer all IsZo claims. Management also states that Kaisa is an important source of bank financing to NTP and their relationship helps to secure better lending terms, etc. Apparently, after the resignation of the CEO some banks “expressed concerns that our relationship with Kaisa would be weakened”.

More importantly, NTP also commented on the valuation aspects stating that the valuation range often mentioned by IsZo ($15-$23/share) is groundless. Besides that, it claimed that the independent valuations made a few years ago no longer reflect the current reality:

In April 2018 […] valuation reports of JLL, Savills and DTZ assigned a total land value for the two commercial projects at, approximately, $505 million, $788 million and $685 million, respectively. However, these valuations relied on a host of varied and complex assumptions, some of which were later found to be inadequate. Rules governing the redevelopment of industrial land projects in Shenzhen have been evolving. Since 2017, and in contrast to the current residential market, the market for re-developed industrial land projects in Shenzhen has also been deteriorating with industrial office space in over-supply and dormitory sale and leasing subject to escalating restrictions. Furthermore, IsZo’s previous target share price based on the valuation reports was between $15 and $23, contradicting to $40 indicated in the above statement from its September 18, 2020 shareholder letter. Again, no valuation methodology is provided.

Of course, NTP management doesn’t back up these vague statements with any supporting data and they have all the incentives to discredit IsZo and their valuation targets. However, the comment that IsZo does not explain either how it arrives at its valuation targets is very much to the point.

All in all, I think the thesis still remains intact and the closest potential catalyst remains to be the announcement of the special meeting and reelection of the board. Hopefully, in the meantime, IsZo will elaborate and provide additional support for their target estimates.

Bad news: NTP issued 18.7m shares to Kaisa and affiliates at $9.15 in a private placement. Kaisa’s ownership is now almost 50%.

https://www.sec.gov/Archives/edgar/data/829365/000156459020045781/ntp-6k_20201005.htm

This reduces the ownership of IsZo supporting group to 25%, which is no longer sufficient to call the meeting let alone make changes to the board.

NTP down 24%.

Is there still a reason to hold the stock?

I was strongly considering buying some shares, but I think this is now uninvestable for me. This risks becoming one of those left for dead Chinese stocks that has could potentially generate significant earnings, but does not pay much of a dividend wasting or hoarding the cash they generate.

The original thesis was that IsZo and its affiliates will take over control of the company and start some kind of monetization strategy. Now this thesis is out of the window and we are closing this idea on SSI.

The case could be made that NTP shares are currently oversold as many minority investors are rushing for the exit. However, with Kaisa now permanently in control there might be no value at all left for minority shareholders.

I did not foresee this kind of ending.

Anyone with more knowledge in these type of situations – when can such a private share sale be carried out to dilute existing shareholders and prevent management/board change? Does this depend on jurisdiction, company bylaws, etc.?

Nam Tai Property is a mismanaged real estate developer in China (listed on NYSE) that continues to trade at a substantial discount to its sum of the parts – potentially up to $40/share as recently highlighted by the activist vs current price of $11.75/share. We posted NTP case last year, when major shareholder/activist IsZo Capital was trying to oust the board with the support of 40% of the shareholders. NTP board change was supposed to be a major catalyst for closing the gap to SoTP. However, their attempt to convene a shareholder’s meeting was blocked by NTP share issuance to its ‘parent’ Kaisa, which increased Kaisa’s stake from 24% to 44%, virtually nullifying any chances of the board change.

However, the situation has developed favorably recently and we are putting this situation back among active ideas at a price of $11.75/share. The activist went to court and, surprisingly, the judge has fully supported IsZo’s case, voided the share issuance transaction, and ordered to convene shareholder’s meeting in April. NTP plans to appeal the decision. Overall, the tide has now completely turned for the activist and it seems that the chances of success have increased dramatically. In the meantime, IsZo has almost doubled its stake in the company.

Timeline:

– 3rd of March – Eastern Caribbean Supreme Court showed full support for IsZo (the activist) side highlighting all the wrongdoings of NTP management over the past several years (affiliation of NTP directors with Kaisa, nepotism, shady history of Kaisa, etc). Most importantly, the Court has voided the recent NTP share issue, which increased Kaisa’s ownership in the company from 24% to 44% and, moreover, ordered NTP to convene shareholders meeting to reconstitute the board, while stating that the current chair should not even lead the meeting. Some comments from the judge are quoted below. Full judgement of the Court can be found here: https://www.eccourts.org/iszo-capital-lp-v-nam-tai-property-inc-et-al/

– 3rd of March – NTP issued a response stating that they will appeal the decision. https://www.sec.gov/Archives/edgar/data/829365/000156459021010470/ntp-6k_20210303.htm

– 4th of March – Vincent Fok, one of the NTP directors and Kaisa’s affiliate, resigned from the board effective immediately. https://www.sec.gov/Archives/edgar/data/829365/000156459021010743/ntp-6k_20210304.htm

– 4th of March – IsZo issued an update stating that the Court has ordered to convene a shareholders meeting on the 26th of April with the record date set on the 15th of March. Interestingly, IsZo also mentioned that NTP assets are worth up to $40/share (up from the $20/share they had been communicating previously). The activist has almost doubled its ownership in NTP – from 7.2% in mid-Feb and to 13% on the 4th of March (at around $11/share). NTP stake constitutes around 50% of total IsZo portfolio (around $130m AUM). https://www.businesswire.com/news/home/20210304005710/en/IsZo-Capital-Provides-Important-Update-Regarding-Special-Meeting-of-Nam-Tai-Shareholders

– 8th of March – NTP announced that Bank of China (BoC) has issued a demand letter asking for a full repayment of the loan ($96m principal) within 5 days after receiving the Demand Letter. The request was made due to “recent significant uncertainty relating to the share ownership and strategic decision-making situation of the Company”. The demand letter suggests that the BoC sees a high likelihood of Kaisa’s affiliates getting removed from the NTP board. After the announcement, the share price went up by 14%.

So the developments have been extremely positive for the activist and NTP shareholders. Even before the stake increase and court’s judgement IsZo had a support of 40% of NTP shareholders. Thus, if the meeting is convened, they should have no problem ousting the remaining Kaisa-affiliated directors and taking full control of the company. As detailed in the write-up above the assets are likely worth around $20+/share (or even $40/share as per latest IsZo communication) and the meeting should act as a catalyst for significant price appreciation.

The downside seems to be protected – pre-announcement price stands at $9.50/share. NTP share price has been appreciating since the end of Dec without any public announcements and was lifted even more by positive Q4 results.

That being said, the market is still relatively sceptical of the whole situation – shares are trading at $11.75/share, up only 24% from the court decision pre-announcement price. This is still significantly below the intrinsic value of the assets. Part of the discount is attributed to NTP being a Chinese RE company, however, there are 3 more major uncertainties to note:

– NTP appeal. The company is incorporated in British Virgin Islands, which is the jurisdiction of Eastern Caribbean Supreme Court, which consists of two divisions – Court of Appeal and High Court of Justice. Current decision was made by the High Court of Justice and can now be appealed to the Court of Appeal. The Court of Appeal can then be further appealed to the Judicial Committee of the Privy Council (the highest court of appeal for this territory) in the United Kingdom. So the whole process can drag on putting significant uncertainty on the timing of this situation. Outcome wise, the case looks strong for IsZo. I am not a lawyer, however, the High Court’s Judge comments seemed quite elaborate and strongly in favour of the activist. It clearly highlighted that NTP had no financial need for the share issuance and that it was done purely to block minority shareholders from changing the board. The sudden resignation of one of NTP directors, who is also an independent director of Kaisa, and Bank of China’s payment demand, also suggests that Kaisa’s case might be weak.

– Payment demand from the Bank of China. This wasn’t a huge surprise as NTP board has previously mentioned that Kaisa’s relationship with Bank of China is important and helps to secure better lending terms, etc. It is not clear to what extent this could impact the current situation and the company’s valuation. As of Dec’20, NTP had $211m of cash including the $170m from the recent share issuance to Kaisa, which will need to be returned, if IsZo’s case prevails. After the bank payment, NTP will have around $115m left, so it will have to secure financing elsewhere in order to repay Kaisa and fund the ongoing project development. After the debt and Kaisa repayments, NTP will be left with very little debt ($30m), so it doesn’t seem that getting further financing elsewhere is going to be a problem.

– The current state of NTP and its projects after years of being managed by Kaisa. This concern was also raised by IsZo, which intends to launch a full strategic review of the assets “to test legacy assumptions held by Kaisa insiders”. This is not a new risk and while it contributes to the overall discount in the share price, any further positive developments in the IsZo campaign should still result in share price appreciation.

Additional points:

– As the delivery of leased units has already started, NTP finally began to generate meaningful revenue in Q4’20 – 68.5m vs. $1m in Q3’20. Q4 net income was $35m.

– Occupancy levels are steadily increasing – Shenzhen occupancy went from 32% in Q3 to 48% in Q4, Wuxi & Shanghai from 96% to 98% in the same periods.

– Office real estate market pressure in Shenzhen is continuing due to elevated vacancy rates. Q4 saw a price drop in rent prices of 1.6% QoQ and 6.3% YoY. The trend is expected to continue during 2021. https://www.caixinglobal.com/2021-01-08/shenzhen-office-rent-drops-for-ninth-straight-quarter-101648404.html

The previous share issuance has been voided – Kaisa now owns 23.9% of NTP shares. https://www.sec.gov/Archives/edgar/data/829365/000089843221000244/sc_13da.htm

NTP also received two demand letters from Bank of Beijing and Xiamen International Bank for a combined payment of $23m. The company is in discussions with the lenders.

https://www.sec.gov/Archives/edgar/data/829365/000156459021012201/ntp-6k_20210311.htm

Special meeting 4-26, 10am, for holders of record 3-15. Preregister 15 minutes early for virtual meeting, to replace current board with Izso candidates.

http://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20210322:nBw3lfS2ra&default-theme=true

http://archive.fast-edgar.com/20210322/A7B8L22CZC22Q9AE222R2ZZ2W5GPZY22Z232/

I thought NTP will do everything possible to avoid or at least adjourn this meeting, so I’m quite surprised they haven’t appealed court’s decision yet. Maybe they are still preparing it? Because if not, it’s almost guaranteed that the activists will easily win the votes. Kaisa knows it and, as stated in the proxy, spoke with IsZo and “expressed willingness of the board to work constructively with IsZo and to extend an invitation for the representative of IsZo to meet with the Executive Chairman of the Board”. All of this looks positive for the thesis.

Regarding the demand letters from the lenders, NTP is still negotiating and has recently changed its CFO. So far the banks have restricted remittance from the accounts ($25m have been affected).

ISS and Glass Lewis recommended NTP shareholders to vote for IsZo nominated directors:

https://www.reuters.com/article/us-nam-tai-property-iszo-iss-idUSKBN2BY0UH

NTP management saw a ‘slightly’ different angle in the recommendation of the proxy firms.

https://www.sec.gov/Archives/edgar/data/0000829365/000156459021018416/ntp-6k_20210412.htm

Shareholder meeting is set for the 26th of April.

Meeting postponed (as expected by Ilja a month ago). To reschedule.

https://finance.yahoo.com/news/nam-tai-property-announces-issuance-111200346.html

Informative piece by Corpgov editorial on the current situation:

https://finance.yahoo.com/news/caribbean-court-american-billionaire-chinese-224049534.html

Thanks for the link – a really good summary of the situation and what to expect going forward:

IsZo made a short response to the delay of the shareholders’ meeting.

A few things of note:

– apparently 83% of the oustanding shares voted in the preliminary voting. Excluding Kaisa shares, 97% of shareholders (57% of total outstanding) voted to reconstitute the board. The court of appeal was made aware of that. The court also prohibited NTP from carrying out significant transaction without first providing notice to IsZo.

– the board continues to waste shareholders money despite being short on cash. This further adds to the risk of “the current state of NTP”:

“In the meantime, IsZo calls on Nam Tai to provide a full explanation regarding its $150.2 million investment into a Supply Chain Fund managed by Credit Suisse, ostensibly connected to Greensill Capital, which has since been terminated as disclosed in the Company’s 20-F. How does a company purportedly facing a liquidity crisis make such an investment? Who was responsible for making the investment, why was it made and why wasn’t such a material investment disclosed to shareholders at the time it was made? Why wasn’t the default promptly disclosed to shareholders? What is the timing and amount of Nam Tai’s expected recovery? Shareholders deserve answers.”

https://www.sec.gov/Archives/edgar/data/829365/000092189521001125/ex991to13da612713002_042321.htm

$18.81 close today. Stock rose almost steadily since 4/29 after news of 1Q results, but without any news since then. Reached $20+ at noon today before dropping. Big volume especially the last two trading days. Any thoughts?

NTP is up around 70% over the last few weeks. It seems that the initial run up was driven by Q1 results, tailwinds in Shenzen real estate market, but not really clear what caused the last leg of the share price spike. NTP share price is now substantially above the lower valuation range indicated in the write-up. Given the likelihood of a prolonged timeline of the litigation and potential second appeal in the future, we are closing the idea with 69% return in 2 months.

It is worth keeping an eye on the situation in case the price drops down.

$32, amazing run-up since April 28, with no news except the Q1 results per Ilja above as well as IsZo letter on secured financing (linked below). I guess we have to wait a while for the 2nd bite.

https://finance.yahoo.com/news/iszo-capital-updates-fellow-shareholders-121500113.html

Anyone still following this? Price fluctuated about $20-30 the last 6 months.

It’s not clear how the property crisis ongoing in China is a positive/negative/neutral for NTP and this thesis.

Positive: Kaisa Group (the controlling shareholder of NTP and the antagonist of the activist) is in trouble, and may be distracted and weakened.

Negative: Harder for NTP (under control of Kaisa or new owner) to find loans to fund its development projects.

NTP shares dropped 15% yesterday. Shareholders meeting is set for the 30th of Nov and if IsZo wins, the share price is likely to spike upwards. However, there are a few uncertainties involved.

A short update on the recent developments:

– First of all, Kaisa’s appeal has failed and management has filed three applications (conditional leave to appeal, application for a stay, and one to amend the record date of shareholders’ meeting).

– On the 8th of November, the court denied the latter two but allowed management 90 days to appeal to the Judicial Committee of the Privy Council (the highest court of appeal for this territory). NTP share price dropped by 14% to $20.2/share.

– On the 10th of November, IsZo (the activist) released a PR saying it is pleased by the court’s decision, although nothing was mentioned regarding the final appeal. The meeting date was set at the 30th of November and IsZo stated that 60% of shareholders “have already voted to remove the Kaisa-affiliated directors”. That is enough to oust the board. Subsequently, NTP share price has retraced higher to $26.21/share.

– On the 17th of November – management released a PR agitating shareholders to vote for the current board again saying that due to difficult market conditions it is not a good time for a management switch.

– On the 24th of November (yesterday) – NTP shares suddenly dropped by 15% despite only minor movement in Chinese real estate ETFs. It seems that the movement was caused by the news regarding Kaisa’s debt problems. Apparently, Kaisa warned that it may default on $400m international debt unless creditors agreed to a bond swap. RE market issues and Evergrande’s scandal has killed Chinese developers’ bond market – several have already defaulted on dollar debt and some others have managed to do bond swaps. Kaisa’s bonds now trade 33ct on a dollar.

So although yesterday’s pullback looks interesting in light of a looming shareholders meeting next Tuesday, knowing the current board I’d be very surprised if they didn’t go for a final appeal. It’s basically guaranteed that IsZo will win the votes, so why not extend the timeline by another 6 months and receive a salary in the meantime – litigation expenses come out of NTP’s pocket anyways. So most likely we will hear about the appeal in the upcoming days. However, it’s quite strange that IsZo didn’t mention this. It’s even more strange that NTP’s board made that PR knowing that they can’t win the votes (and especially if they plan to make an appeal).

Valuation is another question – shares trade just slightly above NTP’s land value estimated in 2017 and way below full-project value estimations, however, office real estate prices are also now substantially below 2017 levels:

I wonder if IsZo still thinks this is worth $40/share. At least at the end of June, they did:

Source – https://www.businesswire.com/news/home/20210627005056/en/IsZo-Capital-Provides-Update-on-Nam-Tai%E2%80%99s-Appeal-of-Voided-Private-Placement

Kaisa’s debt problems https://www.wsj.com/articles/chinese-property-developer-kaisa-proposes-400-million-debt-swap-11637815334?mod=markets_lead_pos2

Applications’ dismissal – https://finance.yahoo.com/news/nam-tai-issues-statement-regarding-151500281.html

IsZo’s comment on dismissal – https://www.businesswire.com/news/home/20211004005781/en/IsZo-Capital-Pleased-by-Dismissal-of-Nam-Tai%E2%80%99s-Appeal-of-March-2021-Court-Ruling-That-Voided-the-Company%E2%80%99s-170-Million-Private-Placement

IsZo wins, but price continued its drop from a week ago, down 30% to $17.70. Maybe a good speculative play at this level.

https://finance.yahoo.com/news/kaisa-loses-control-nam-tais-093000239.html

Great news and very strange price movement indeed. Volumes are not that big though. Maybe some speculators that were expecting shares to jump on the news are exiting?

wonder if the China delist thing isnt the mover here

Destroyed . Value or dead money ?

Hi Ilja, where did you get the already invested Capex figure of $300M that you mention in the writeup?

Thanks!

Hi AG, I rounded up accumulated capitalization on project investment as of Q2’19 + expected investment in Q3.

We are bringing back NTP among the active ideas at an $11/share price. Keep in mind this is a very risky/speculative position and there is a real chance of bankruptcy. This is not investment advice. Please do your own due diligence. Essentially, this is a bet on IsZo (the activist, which managed to overturn the board) having a much better knowledge of the situation with its fund largely dependent on the NTP stake (60% of AUM before the sell-off) and having made sizeable incremental open market purchases (for $1m total) just a couple of weeks ago at far higher prices.

The reasons for a dramatic fall in NTP share price over the last three weeks are likely three-fold: (1) China’s real estate industry-wide crisis and credit crunch with both Kaisa and Evergrande on the verge of bankruptcy, and (2) looming NTP debt maturities in December with no updates from old or new management on refinancing and/or (3) Kaisa’s forced sell-off of NTP stake in the open market to maintain its own liquidity.

Kaisa’s bond swap deal, which would’ve extended the maturity date by 18 months failed as bondholders have voted against it. Some bondholders have sent a formal letter to give Kaisa more time to repay. The largest bondholder (50%+ of the US$400m defaulted debt) offered several financing options, but so far it’s not clear if Kaisa will accept and discussions are ongoing. Yesterday, Kaisa’s shares were suspended “pending the release by the company of an announcement containing inside information”. The risk of bankruptcy seems high. Kaisa has already started selling down properties and recently put 18 Shenzen projects (US$12.8bn) for an auction. There are rumors that Kaisa is also forced to sell NTP shares on the open market, while others say that part of NTP shares held by Kaisa was pledged under a loan and are now being sold involuntarily. If the current sell-off is really due to some kind of forced selling, then this is a fantastic buying opportunity. But.

There’s a strong chance that the current sell-off is simply a result of China’s real estate industry credit crunch and NTP might be at risk of bankruptcy as well. NTP currently has about $121m+ of bank loans from several China banks that are maturing at the end of December 2021 (this month). Given the short timeline new management (IsZo) might face issues refinancing these loans with Chinese banks and all of this could end up pretty bad unless they will able to somehow attract funds from overseas. The timeline is short and there have been problems with the current debt before – current loan providers didn’t like the potential change of management (the new management is not Chinese) and issued repayment demand letters earlier this year. The banks also restricted remittances from the bank accounts of NTP subsidiaries. The old management has been negotiating with the banks for quite some time already and it is not known where the current situation stands. If IsZo fails to refinance this debt promptly, the downside could be massive.

The industry-wide issues were there for quite some time already – Kaisa’s signal on potential default was issued on the 24th of November and the bond swap failed on the 2nd of Dec. IsZo is a major shareholder with over 60% of its AUM in NTP shares (before the recent sell-off). The whole fund is largely dependent on how the NTP saga plays out. IsZo should be aware of the credit market situation and refinancing prospects better than any of us. If everything was really that bad, they could’ve dropped the campaign many times before and walked away citing “change in the market environment, uncertainty, etc.”. Instead, right before the shareholder meeting, on the 26th-26th of November, IsZo acquired further $1m+ NTP shares at a $19+/share average price, almost 2x higher than the current price. IsZo has just taken over the control of the company and I would expect some kind of an update on the business/debt refinancing matters shortly. Positive news could double the share price in an instant.

https://www.scmp.com/business/china-business/article/3158861/trading-embattled-chinese-developer-kaisa-suspended-over

https://www.bamsec.com/filing/92189521002784?cik=829365

https://www.bamsec.com/filing/156761921019966?cik=1607925

https://www.theguardian.com/world/2021/dec/08/trading-halt-for-china-developer-kaisa-stokes-fresh-jitters-in-property-sector

Several developments announced here.

https://finance.yahoo.com/news/nam-tai-property-provides-corporate-231500347.html

So after all it looks like the recent sell-off might have been a little forced. On the 3rd of December, Deutsche Bank foreclosed Kaisa’s NTP shares (9.1m or 23.4% outs.). Kaisa doesn’t own NTP shares anymore. The sell-off also started on the 3rd of Dec (also coincided with general China’s RE market sell-off due to Kaisa’s issues).

“The Company has been informed that Deutsche Bank AG, Hong Kong Branch (“Deutsche Bank”), has foreclosed on the nearly 24% position in the Company previously held by Kaisa Group Holdings Limited’s (“Kaisa”) wholly-owned affiliate, Greater Sail Limited (“Greater Sail”), and that transaction has been exempted from the Rights Plan.”

The ownership change made NTP quickly adopt a one-year poison pill with a 20% threshold.

The recently announced CEO has ties in the Chinese government – “previously worked in the ministry of foreign affairs and also held private sector positions in the investment and real estate sectors”. Overall, this looks positive as well.

Nothing was said about the debt refinancing yet. No announcements from Kaisa so far either (shares are still suspended).

The stock is up 20%+ since the idea was reopened last week.

https://www.bamsec.com/filing/119312521356231?cik=829365

https://www.bamsec.com/filing/94804621000185?cik=829365

IsZo has recently acquired another 618.5k shares, paying $7.1m at $11.5/share on average, and raised the stake to 16.7%. Definitely doesn’t look like they think refinancing/bankruptcy is going to be a problem here.

This looks really interesting here. Are Deutsche selling shares already? Or has the share price simply fallen in anticipation of that?

Them owning a quarter of the company could also mean a potential line of credit? If that is what is holding the share price down, all they need to do is provide a low risk loan to give them an exit at a significantly higher price. Or connect the company to someone who is willing to do this.

The unwillingness of Chinese banks to loan money seems strange to me as well, as Nam Tai has plenty of room to borrow here.

Today’s spike generated by Andrew Walker’s blog or by DB ending their sale or both?

Update from IsZo/NTP

https://finance.yahoo.com/news/nam-tai-property-provides-local-230000446.html

So what is worse case scenario here? If this was some small private company, Id say Kaisa would win. But this is probably too high profile?

And Kaisa wasn’t exactly in favor of the CCP back in 2015:

https://www.ft.com/content/e92fd3a2-b1ce-11e4-b380-00144feab7de

I was directed to ARM China situation by one the Twitter followers. This case is for joint venture that was 51% owned by local Chinese investors, so NTP situation might be somewhat different (just guessing here). But this is suggestive of potential struggles ahead.

“In June 2020, the board of Arm China voted overwhelmingly to remove CEO Allen Wu following an investigation that concluded that he had failed to disclose conflicts of interest, notably his creation of a rival to Arm China’s own investment firm. One day later, Wu’s supporters within Arm China refuted the findings and refused to replace Wu. In practice, Wu remains the chairman and CEO of Arm China. He has been able to retain control of the Chinese unit because he holds the company seals, or “chops.” It could take years of lawsuits to resolve the dispute. ”

https://technode.com/2021/09/22/silicon-can-arm-fend-off-allen-wus-latest-autonomy-moves/

Yeah that was ugly. Although microchips hold strategic value and are a major area of focus for CCP.

This is just some real estate. And arguable Kaisa is quite weak politically as well. So then this NTP situation will be a struggle between local CCP and central CCP. If it causes too much embarrassment internationally then central will step in and it will be resolved in NTP shareholders favor.

On sidelines for now though.

Im nibbling sub $10. I really need more study on what ‘controlling the chops’ looks like in the real world. Can he actually empty bank accounts and sign over assets? There must be a legal mechanism to ‘freeze’ transactions so an ex employee can’t go rogue. The communication coming from the company about what is happening is very encouraging imo. OTOH I’ve booked 2 total losses in the past buying cheap Chinese frauds. This at least doesn’t look like those ones did.

Yes, with the chops he has total and absolute control over the business in China.

If the 80M bank account in Hong Kong is empty, if/when they get control back, I don’t know how easy it would be to collect here. Does this ex-CEO have enough assets to seize? What if he converts to crypto and gives this to friends/relatives? Imho it will depend on CCP how much recourse shareholders will have here (courts are not independent).

From memory this ‘chops’ problem was also present in Japan. https://en.wikipedia.org/wiki/Seal_(East_Asia)

“We are now engaging with China’s Administration for Industry and Commerce and other local government authorities to receive local recognition for the Board’s designated legal representative and obtain the Company’s chop to facilitate a speedy transition. We have also reported Mr. Wang’s illegal activities to the Shenzhen Municipal Public Security Bureau, Gong Le Police Substation”.

It is good to ask for the authorities’ intervention. I hope that the new Board has good relations with and inside the institutions because these will probably make a difference in solving this mess.

https://www.sec.gov/Archives/edgar/data/829365/000094804622000061/0000948046-22-000061.txt

So Deutsche Bank still owns 22% (8.8m shares) and continues to liquidate its stake in the open market at around $9/share. Looks like Deutsche sales were almost half of the daily NTP trading volume:

Open market sales – February 8, 2022 100,000 $9.0665

Open market sales – February 9, 2022 100,000 $9.1853

Open market sales – February 10, 2022 100,000 $9.1374

Open market sales – February 11, 2022 39,452 $9.0573

Open market sales – February 14, 2022 16,850 $9.0245

Open market sales – February 15, 2022 50,000 $8.8024

The selling pressure is likely to continue without any further positive news from IsZo.

Does anyone know what specific threshold caused DB to file the 2/17 amendment? Was it based on the length of time since 12/13/21 initial 13D? Based on change in ownership (declined from 23.4% to 22.4%)? Thanks, trying to anticipate when we may see next amendment if sales continue.

@RW

13D has to be updated within 45 days after year end, or within 10 days after a 1% change event.

Since DB’s initial 13D was filed on Dec 13, 2021 (for an Dec 3, 2021 event) , the 13D/A above was filed to fulfil the year-end update requirement.

It was a coincidence that DB happened to have reduced NTP stake by about 1% and crossed the threshold 2 days prior to this filing.

During the remainder of the year, DB will have to file update after every 1% change event. However, if the event takes place today, we will not see the filing until 10 days after, in March.

Thanks snowball, appreciate the reply

IsZo is continuing in its effors to regain control of the operating entities – the company appointed Yu Chunhua to interim CEO:

On the other hand, Deutsche Bank continues to slowly liquidate its position. As of the most recent update, it owns 21.41% of shares vs 22.38% about a month ago.

https://www.bamsec.com/filing/94804622000063?cik=829365

i think Deutsche Bank just liquidated the rest of their position after hours today at $5.81/shr. Stock indicated up now.

Seems so, per Nasdaq.com afterhours 16:07:46 $5.81 7,835,000, later back up to $6.56. Total shares about 40m, so 7.8m is roughly the 20% Deutsche still owns.

Two developments from NTP, a negative one, and a positive one. Starting with the former:

The new 6k filling shows that NTP’s attempt to lower the amount to be returned to PIPE investors was rejected by the court. Apparently, when NTP was still controlled by Kaisa, the management put $150m of the $170m received PIPE funds (received from Kaisa affiliates) into a speculative fund (managed by Credit Suisse). The fund promptly defaulted. NTP has recovered only $100m so far and IsZo now estimates that the remaining $50m will be lost. IsZo is now objecting the repayment of the PIPE funds in court saying that NTP should not be liable to return the full amount as the money was wasted by the previous management.

If I understand correctly, the remaining $50m from the defaulted fund was sitting on the balance sheet as a short-term investment. Assuming it is now worth 0, the company’s BV has been reduced by $1.3/share. Immaterial to the value of the real estate that NTP tries to regain control of.

Probably a more serious issue is how the whole situation reflects the criminal behavior of the previous Kaisa-affiliated management and what other tricks they might’ve left within the business.

https://www.bamsec.com/filing/119312522102337/2

On a positive note, it seems that nearly all of the Deutsche stake was acquired by one of the most prominent Asian activists Oasis Management (now has 20% ownership) at around the current price levels. Oasis has a solid track record, e.g. Nintendo campaign and, more recently, the RENN litigation settlement. The activist believes shares are undervalued and calls for strategic alternatives such as a sale of the company.

This seems like a huge positive for the thesis as I highly doubt that smart money like Oasis would acquire 20% of NTP if they did not see the light at the end of the tunnel. The two biggest issues with NTP are now Kaisa’s reluctance to fully transfer properties and the remaining debt with Chinese banks (which we haven’t heard an update on in a while). Oasis clearly has the cash and competence to help with both issues here.

https://www.bamsec.com/filing/90266422002499?cik=829365

I was just reading through the latest litigation/access updates…it doesn’t seem like this is going to be resolved quickly.

“Trading halted on regulatory concern” Any insight?

Halted due to control of the ‘chops’ issue.

https://www.sec.gov/Archives/edgar/data/0000829365/000119312522159795/d345021d6k.htm

DT, in the first part of the NTP write up you wrote “The initial case was closed on the 12th of May with +70% return.”

The idea wasn’t initially closed on 10/6/20 with a 60-70% loss? See your 10/6/20 post.

My remark refers to the trade back in March-May of 2021, please have a look at the comments below:

Opened: http://ssi.wpdeveloper.lt/2021/12/nam-tai-property-ntp-activist-control-70-upside/#comment-10455

Closed: http://ssi.wpdeveloper.lt/2021/12/nam-tai-property-ntp-activist-control-70-upside/#comment-11142

https://finance.yahoo.com/news/nam-tai-property-obtains-injunction-200000082.html

Chinese court has frozen the bank accounts and assets of two former Kaisa-affiliated directors in what seems to be another positive step towards NTP regaining control of operating entities. That said, it is not clear how many of NTP’s assets the former directors have already dissipated. Apparently, the two individuals emptied their accounts before the court’s order (via Twitter).

Meanwhile, trading halt continues as NTP is yet to access corporate seals, books and records which are needed to file reports with NYSE.

https://www.bamsec.com/filing/119312522225449?cik=829365

https://twitter.com/KonekoResearch/status/1561029174109822976

RE “it is not clear how many of NTP’s assets the former directors have already dissipated”, my best guess is RMB 2,138,968,681.90 / ~USD 310m. The freezing orders all include the wording “…with the maximum amount of RMB 2,138,968,681.90 to freeze”

The court dismissed an appeal for freezing of the company’s ex-directors (Kaisa affiliates’) bank accounts. While the former directors are prohibited from using NTP’s chops, it is still not clear if and how much NTP assets they had been able to dissipate. Apparently, IsZo remains optimistic: ‘It demonstrates that we are making continued progress and sustaining momentum with our legal strategy. […] Our Board continues to advance its plans to obtain on-shore control and achieve sustained value for stakeholders.’

https://www.bamsec.com/filing/119312522250927?cik=829365

NTPIF, pink sheet, trading started yesterday at $4.88, now 75c. See news earlier this week.

NTP released an update – nothing new so far on the legal front. The battle for NTP control drags on, without any positive outcome in sight so far. This whole saga has been significantly more complicated and time-consuming than expected due to Kaisa affiliate’s criminal behavior. Despite some favorable legal rulings over the last couple of months, the company is yet to take control of corporate seals and licenses from Kaisa-affiliated directors.

Issues with unsettled bank debt continue as well. One of the lending banks has informed that conditions for the acceleration of an $81m loan have been triggered. Meanwhile, NTP’s account in the same bank only has enough funds to cover the next three months’ interest payments. NTP is currently in discussions with the bank to satisfy the lender’s concerns without exhausting the entire liquidity of the company. On top of that, another lender bank issued a demand letter to one of NTP’s subsidiaries, requiring additional security for a $140m loan.

NTP stock has also been delisted from NYSE and now trading has resumed in OTC Expert Market with a ticker NTPIF. After a 6-month trading halt during which little positive developments have happened many investors dumped their shares outright when trading resumed. NTPIF share price dropped below $1/share initially and then rebounded with the last closing price at $2.5/share (vs $4.22/share at the time of the trading halt).

https://www.bamsec.com/filing/119312522288753?cik=829365

What’s the procedure for delisting? Will it continue to be tradable on OTC expert market?

Bad news continue at Nam Tai. Recently, management has been made aware that some time ago one Kaisa-affiliated executive, without consent from the board, settled a case with China Construction First Group over certain construction project contracts. And now the construction firm is trying to enforce the disputed funds from NTP equal to RMB 67m (US$9.8m). Meanwhile, the company’s cash is running out fast and had only US$3m of cash on hand as of Jan 3. Management has formed a special committee and is reviewing all strategic options, including equity or debt financings or court/administrative protection.

https://www.bamsec.com/filing/119312523001141?cik=829365

I am folding on this clearly failed and highly speculative bet on IsZo Capital’s conquest of NTP. All of the recent updates were strongly negative, new management’s attempts to get back the chops/control of the company are not moving anywhere and there are no hopeful signs on the horizon. Frozen bank accounts and dried-up liquidity suggest that bankruptcy is a very real possibility in the short term. Overall, this saga has been a very educational case study of just how risky and difficult investing in China/Chinese assets is, especially when you have some shady players with bad track records involved. Marking 82% loss in 1.5 years.

anyone know why Nam Tai is up 36% today? arbitration settlement news I guess recently. wondering if folks still think has any hope?

Here is the announcement: https://www.sec.gov/Archives/edgar/data/829365/000119312523095362/d398003d6k.htm

I’m a bag holder but glad to see Oasis is throwing more capital after this.

It appears that the board has control of the “chop” in China. The CEO is instated as the legal representative of the mainland entity.

Not so fast!

“The Company is now in the process of registering its Chief Executive Officer, Yu Chunhua, as the Legal Representative for its subsidiaries with the Administration for Market Regulation of the PRC. ”

“The Company is working to promptly register Mr. Yu as the Legal Representative for its subsidiaries with the Administration for Market Regulation, but it cannot make assurances as to how long it will take to secure registration.”

Vince or Terence: can you guys explain what next steps will look like and how long it might take for NTP to realize value? I am trying to learn about what is going on with Nam Tai. Thx so much.

Expo, I have no idea. I just relay the news. And rely on DT, Ilja, etc for their insight and judgement.

Can you guys trade this? It’s on closing position only on my IB account

Yes, looks like this is a dark stock that only trades on the expert market now. The new CEO Chunhua Yu is already the legal representative of the main entity Namtai Investment (Shenzhen) as indicated by Chinese business registration system (qcc.com). I saw that the switch of legal representative from Jiabiao Wang to Chunua Yu started about a month ago to a few days ago for various Namtai subsidies in China. I’m cautiously optimistic but the transition can still take time. Especially they need to regain compliance with the Exchange. It’s also hard to evaluate how much the previous managed had done to destroy value.

In case anyone is still following, Nam Tai finally got full control of the chops and China operations and has settled all litigation with Kaisa, Credit Suisse, and West Ridge. They are working on completing their audit and getting current.

https://www.businesswire.com/news/home/20241216298479/en/