Transcontinental Realty Investors (TCI) – Asset Sale – Multi-bagger Upside

Current Price: $22.11

Target Price: $72.00

Upside: Multibagger Potential

Expiration date: TBD

This idea was shared by Value9.

Transcontinental Realty Investors is an externally managed real estate company with a portfolio of Class A multifamily apartments in Southeast, several commercial buildings and land. Despite virtually no impact from the pandemic on the company’s assets (occupancy is 91%) and the currently booming real estate market TCI share price saw limited recovery from the COVID lows and trades just a fraction above the March’20 levels. In comparison REZ (US residential RE ETF) currently trades at pre-COVID levels and 41% above the March’20 lows. TCI also trades at only 0.50xBV ($44.5/share) and at just at 11.9x FFO, substantially below the 20x for residential REITs. Moreover, due to the US accounting requirements (i.e. historical cost basis less depreciation), the reported BV significantly undervalues the company’s real estate. TCI also reports in the Tel Aviv Stock Exchange, where an independent mark-to-market valuation of the company’s assets indicates that the actual book value of TCI is likely above $71.8/share. This translates into a 69%+ discount to BV at the current prices.

But wait, there’s more – besides the straightforward under-valuation TCI is also a potential special situation play. Most of the company’s multifamily assets are held in a JV with Macquarie Group. Apparently, both parties were planning monetisation of the JV assets as the partnership agreement included “major provision” called “Potential initial public offering; sale of properties”, which states that before Nov’20 the JV shall hire an IPO advisor, and the IPO itself would have to be approved by both parties. The advisor has not been engaged yet – most likely due to the pandemic. However, after Nov’21 either party can singlehandedly initiate an IPO or put all of the JV assets on sale at any time.

88% of TCI shares are held by insiders – most of it through a trust by the late founder’s children. The company recently had management’s shakeup and took some steps to make its corporate structure leaner. The founder of the company passed away in Aug’19 and there seems to be no good reason for TCI to remain public. I believe that this coupled with currently booming real estate market and large discount points to potential liquidity event later on this year. This, in turn, would help to narrow the spread to the BV.

These arguments are rather speculative and the catalyst (IPO or sale of the JV) could eventually fail to materialize. However, at this point, I see the special situation play here as a bonus only. Whether it does or doesn’t work out, at current prices downside seems to be fully protected. TCI is incredibly cheap and it looks difficult to lose money here in the long run. If it does work out, though, shareholders could be facing multibagger returns in less than a year.

There are many potential factors on why this situation exists:

- micro-cap size;

- virtually no coverage in the media or among the retail investor forums (the most recent article in SA is from 2014);

- very tight float and limited liquidity;

- and, most importantly, the essential information regarding the JV and the actual value of the company’s real estate reported not with the SEC, but on Tel Aviv Stock Exchange, where most filings are in Hebrew. This makes the whole situation as least partially hidden from the eyes of U.S. investors.

TCI background

The company owns:

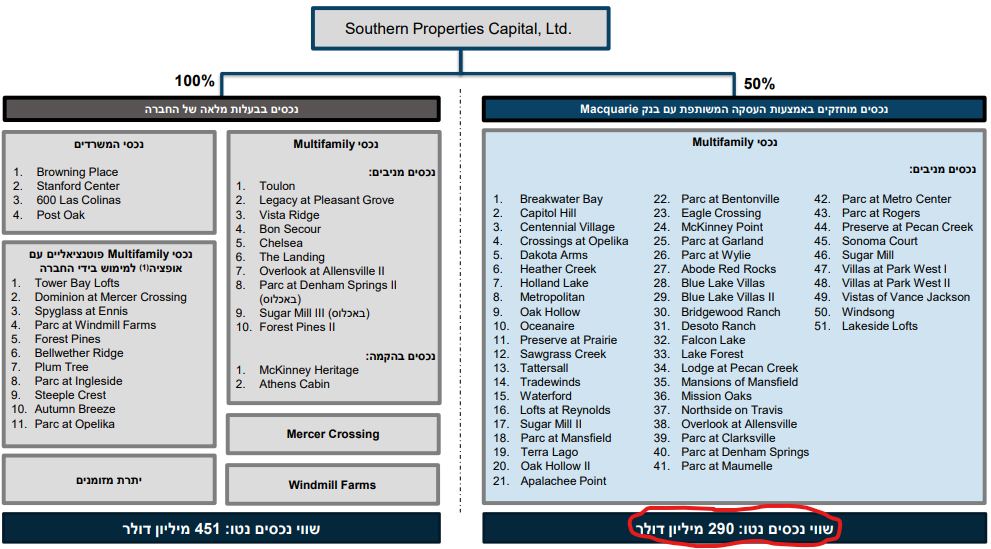

- 51 multifamily complexes with 9888 units in the JV with Macquarie.

- 10 fully owned multifamily properties with 1636 units.

- 6 commercial buildings – 5 offices and 1 retail. All leased.

- Land – 1961 acres of developed and undeveloped land.

- 81.1% stake in IOR – mortgage loan trust.

All of TCI assets are held by its subsidiary Southern Properties Capital (ref. SPC), formed in 2016 to raise funds by issuing non-convertible bonds that are listed and traded on the Tel-Aviv Stock Exchange.

The company is indirectly controlled (85% share) by May Trust, created by a late prominent real estate investor Gene E. Philips for his children. Gene E. Philips passed away in August’19. Over 3% are owned by the ex-CEO/ex-chair Daniel Moos.

TCI is externally managed by Pillar Income Asset Management, which is also indirectly owned by May Trust.

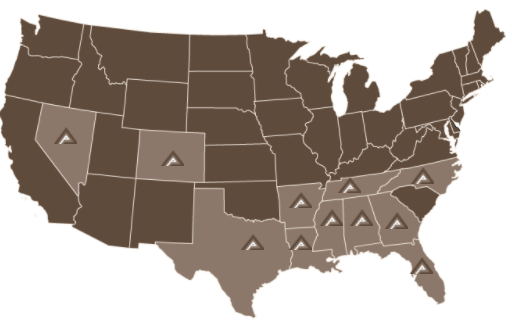

The geographical footprint of TCI properties:

JV and recent events

November’18 – TCI formed a JV with Macquarie Group – sold 50% of ownership in certain multifamily apartments for $237m. The agreement foresees (p. 211):

The Class A Members and the Class B Member have agreed that prior to November 19, 2020, the Company shall engage a nationally-recognized financial advisor acceptable to both Class A Members (“the IPO Advisor”) to advise the Company with respect to a potential initial public offering (“IPO”) of the Company’s portfolio of assets. Any such IPO shall be acceptable to the unanimous consent of the Class A Members. Notwithstanding the potential for an IPO, either Class A Member, at any time after November 19, 2021, may cause the Company to engage in an IPO without the approval of the other Class A Member. As an alternative to an IPO of the Company’s portfolio of assets, either Class A Member, at any time after November 19, 2021, may cause the Company to offer all of its properties for sale.

Class A members are TCI and Macquarie, while Class B member, whith 2% profit participation interest, is Daniel Moos, manager of the JV company and ex-CEO/ex-Chair of TCI.

So, the advisor had not been engaged before Nov’20, which is quite understandable as this period coincided with covid outbreak. What seems quite strange that in August’20, there was some kind of a conflict in the management, which resulted in the management shake-up at TCI and ARL (another real estate firm owned by May Trust). Daniel Moos, who is the Class B member, was forced to resign initially from TCI and ARL, and then from SPC by Brad Phillips (son of the late Gene E. Phillips), the beneficiary of the May Trust (letter):

At the meeting of SPC’s Board on August 17, 2020 (the “Board Meeting”), Phillips stood behind the termination of Mr. Moos’s positions in the Group. In addition, as part of the personnel changes in the Group, led by Phillips, it was decided that Mr. Eric Johnson (“Johnson”) would serve as successor for Mr. Moos, and take over all of his positions with SPC

The move resulted in an unfriendly correspondence between Daniel Moos and the company. Several more directors and managers were replaced, however, it is also quite interesting that despite being forced out from everywhere, Moos was kept as the manager of the JV. Then in March’21 Brad Phillips became an independent director of TCI and ARL.

I can only speculate what it all means and why D. Moos (who apparently has good reputation and knowledge of the Israelian markets) was forced out after 10 years of service, but at the same time has remained to manage the JV. The whole timing of these events (not long from the founder’s death/during post-COVID recovery) really makes it look like something could be in the works here – potentially an upcoming IPO or sale of the JV assets.

In the meantime, TCI has also somewhat streamlined its corporate structure and sold all of its 0.90% shares in ARL in October’20 and in December, sold all of ARL preferred shares held by the JV to another subsidiary of the May Trust (p.42).

Valuation

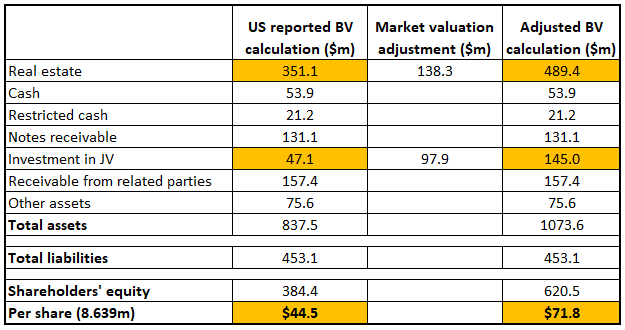

The most recent Q1 BVof the company is stated at $44.5/share. Due to the US accounting standards, which include real estate assets at cost less the depreciation, the reported BV significantly understates the true value of the assets and the company. TCI’s wholly-owned real estate properties alone have accumulated depreciation of $84m, which if added back would increase BV by almost $10/share. Most of these depreciated properties were acquired 6-16 years ago and their actual market value has likely gone up significantly since then. All of this is clearly illustrated in the company’s Tel Aviv filings, where real estate valuation is reported at the independent mark-to-market valuation, as per the the European accounting standards (from the annual report in Tel Aviv):

The most probable price which a property should bring in a competitive and open market under all conditions requisite to a fair sale, the buyer and seller each acting prudently, knowledgeably and assuming the price is not affected by undue stimuli. Implicit in this definition is the consummation of a sale as of a specified date and the passing of title from seller to buyer

BV adjustments are provided in the table below

More details on the adjustments

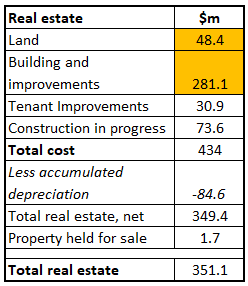

Breakdown of real estate assets on the balance sheet:

Building and improvements

Building and improvements reported in the recent 10Q (Q1 ending March) at $281.1m. It includes:

- 10 wholly owned multifamily complexes

- 2 projects in development

- 6 commercial properties (5 offices and 1 retail) and land.

- Land (Mercer Crossings and Windmill farm)

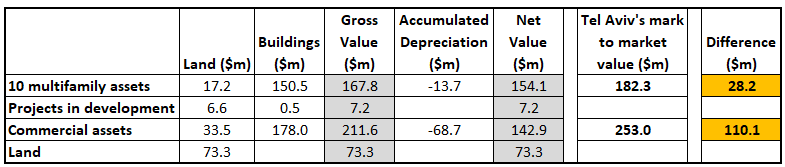

The exact breakdown of these assets is available in the latest 10K. The most recent 10Q values will likely be a bit lower (building and improvements were reported at $297m in 10K), however, the variation with Tel Aviv’s statements should be directionally correct:

April’21 presentation in Tel Aviv is available here. Asset values are provided on the page 7. You can easily translate most of it with the Google Translate. The same numbers can also be found in the Tel Aviv’s annual report.

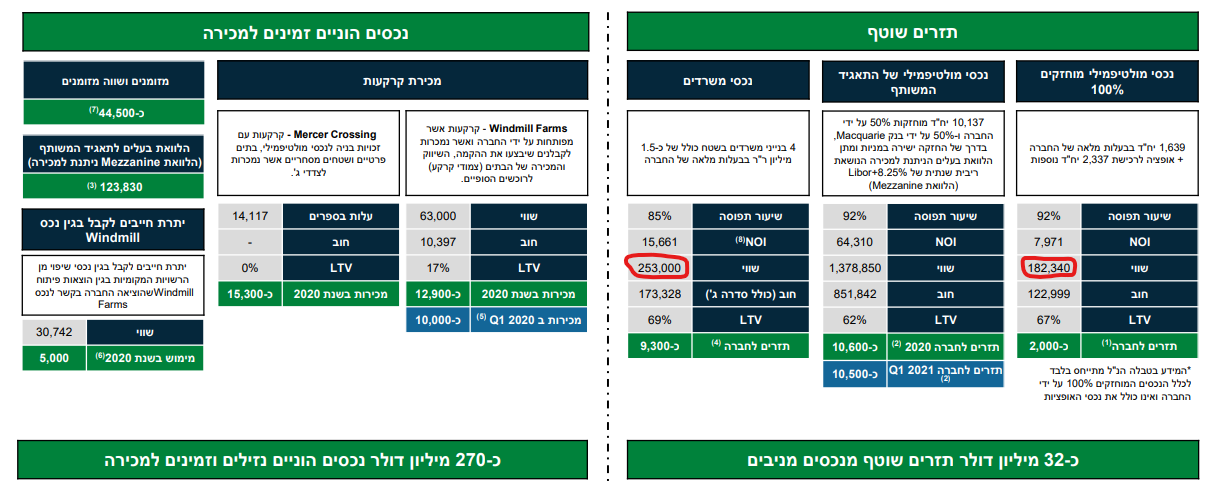

Note: the text to the right of the red circles says: “value”. “253,000” refers to office properties and “182,340” to wholly owned multifamily properties.

By the way, $253m value is reported only for the 4 office buildings. TCI owns 5 office buildings and 1 retail, therefore it’s likely that the actual value of the commercial properties is even higher than calculated in the table above.

The fact that US financial statements significantly undervalue TCI real estate properties can also be seen from the recent transactions, all of which were done at a very significant premiums to the reported book value by US accounting standards:

On March 30, 2021, we sold a 50% ownership interest in Overlook at Allensville Phase II, a 144 unit multifamily property in Sevierville, Tennessee to Macquarie bank for $2.6 million resulting in gain on sale of assets of $1.4 million.On May 1, 2020, we sold Villager, a 33 unit multifamily property in Fort Walton, Florida for $2.4 million, resulting in a gain on sale of $1.0 million.

On July 16, 2020, we sold Farnham Park, a 144 unit multifamily property in Port Arthur, Texas for $13.3 million, resulting in a gain on sale of $2.7 million.

On September 14, 2020, we sold Bridge View Plaza, a 122,205 square foot retail property in La Crosse, Wisconsin for $5.3 million, resulting in a gain on sale of $4.6 million.

During 2016, the Company sold one apartment community located in Irving, Texas to an independent third party for a total sales price of $8.1 million and one apartment community located in Topeka, Kansas to an independent third party for a total sales price of $12.3 million. We recorded an aggregate gain of $16.2 million from the sale of these two properties.

Adjusting real estate valuations for the $138.3m difference would increase the BV per share by $16/share to $60.5/share.

Joint venture

JV with Macquarie stands in the US books at $47m value. This seems grossly undervaluing as just 2.5 years ago, on the 19th Nov’18 Macquarie paid $236.8m for their 50% stake. Tel Aviv’s presentation states that their 50% stake has a net asset value of $290m (p. 6):

Note: the text in the red circle states: “Net asset value: $290m”. The text above the listed 51 multifamily assets reads: “Assets are held through the joint transaction with Bank Macquarie”.

My understanding is, that the $290m number represents the value of the whole JV, meaning that 50% or $145m belongs to TCI. The difference from the US reported $47m, would increase the BV of TCI equity by another $11.3/share to $71.8/share. Worth repeating that Macquarie paid $237m for 50% of JV back in 2018, so I might be incorrect in saying that $290m figure indicated in the chart is for 100% of JV – it might actually be only for the half belonging to TCI, which would add further upside to my thesis.

Land

The company has two developed land projects with building rights for multifamily apartments – Mercer Crossing and Windmill Farms. The most recent reported land value in the 10K was $48.4m.

Recent transactions also indicate that the value for the land properties could be significantly understated:

During the three months ended March 31, 2021, we sold a total of 32.2 acres of land from our holdings in Windmill Farms for $9.1 million, in aggregate, resulting in gains on sale of $3.7 million. In addition, we sold 5.7 acres of land from our holdings in Mercer Crossing during the three months ended March 31, 2021 for $3.3 million, resulting in a gain on sale of $2.3 million.

During the year ended December 31, 2020, we sold a total of 58.8 acres of land from our holdings in Windmill Farms for a total of $12.9 million, resulting in a total gain on sale of $11.1 million. In addition, we sold a total of 26.8 acres of land from our holdings in Mercer Crossing during the year ended December 31, 2020 for a total of $15.8 million, resulting in a total gain on sale of $10.3 million.

During the period August 23, 2018 through December 31, 2018 additional Mercer Crossing real estate was sold for $11.7 million resulting in a net gain on sale of real estate of $5.6 million.

To stay conservative, I am not going to assume any adjustments for the land properties.

FFO/AFFO

The company has reported FFO/AFFO at $16m/$29.4m for the year 2020. This would put the P/FFO multiple at 11.9x and P/AFFO at 6.6x. This seems quite low, especially given that TCI assets were virtually unimpacted by the pandemic and Southeast region being one of the fastest growing regions in terms of apartment rent prices. In comparison, Nareit data shows that historically residential REITS used to trade at around 20x FFO multiple valuations. I would expect the multiples should be similar now, given that the whole residential market is booming and trades significantly above 2018 levels. For example, NXRT – small-cap multifamily REIT with most assets in Southeast and Texas, trades at 22x 2020 FFO and 20x AFFO.

Do you know what are the $157.4 million of receivables from related parties? I couldn’t find any footnotes on them.

They seem to be receivables from ARL, which is the main shareholder of TCI.

https://www.bamsec.com/filing/138713120009742/1?cik=733590&hl=83361:83454&hl_id=n1j5ejj_9

Additionally, $68.56M of the notes receivables are also from related parties.

https://www.bamsec.com/filing/73359021000009/1?cik=733590&hl=3698:3787&hl_id=ekv_ujjuc

What if the JV is sold and TCI uses the proceeds to make another loan to ARL/Pillar?

I’ve followed this one for quite some time and have been a shareholder over the past year. The story is detailed well here, but the main flaw in the valuation framework (which it seems to be acknowledged) is the true value of the JV with Macquarie. It is not $290M where they’re carrying it on the books, rather it is likely $800M+. If you adjust the math accordingly, book value would increase north of $80/share.

Re Wu, that is a risk. If the JV is sold, they could use the capital anyway they want, but one would think they might face shareholder pushback without a large special dividend. I’d argue they could also tender for the stock and simply try to clean it up vs. giving shareholders a $30-$40/share distribution. There are a few different scenarios and really no reason for TCI to even be public at this point.

Neil, would you mind clarifying on:

– How do you arrive at $800m+ JV valuation?

– What is your estimated BV? If I take your number of $800m for the JV (which means $400m for TCI) I arrive at BV of $101/share rather than $80 something.

If you google translate the Southern Properties slide deck from Israel, you’ll see the JV has a NAV of $290M, plus they owe themselves the Mezz debt which is $123M so $400M+ seems reasonable.

Re book value over $100, my # is lower but no reason to debate $80 v $90 v $100 right now with PPS at $30. I’ll happily take any of the three.

Thanks Neil, missed this earlier as i’m new to this thread. I’m still not following how you get to $800m?

Are you basically saying that the $290m is not 100% of the JV and represents the 50% value that is TCI’s and then adding in the mezz piece?

Separately, have you taken a look at ARL – is that (more?) interesting given it owns a substantial portion of TCI and seems to be trading at a large discount as well

Value9 – thank you for the great idea and thorough analysis. Curious to know your take on this announcement a few days ago. Should we interpret this as meaning that the 10 properties subject to earn-out are performing quite well, thus triggering a larger than previously anticipated earn-out payment? Thus this bodes well for the potential value realized in the JV monetization scenario? Am I thinking about this correctly?

https://www.sec.gov/Archives/edgar/data/733590/000101054921000146/transcontinental8k.htm

I’m not reading through this disclosure to the potential financials being a barometer of increased JV value. I think the market in general around multi family speaks to the space being red hot and the value is likely around what I previously stated and/or higher. However, the read through to me, albeit anecdotal, is that the two parties don’t seem too friendly if they’re going to arbitration, therefore the likelihood of monetization and an “event” by year end ticks higher IMO.

If TCI (the seller) owes Macquarie (the buyer) money in an Earn Out Obligation, is it possible that the re-measurement of the 10 properties has resulted in a lower appraisal value vs. underwriting assumption in Nov 2018 when TCI sold 50% stake to Macquarie.

I don’t have details about the Earn Out Obligation, but I guess such a provision usually claws back some money from the seller (and/or manager of assets) if performance is lower than expected, and awards the seller additional money if performance is higher.

I know the multi-family market is red hot. However, I am trying to figure out why the earn-out provision resulted in liability for TCI, which is even more puzzling in light of the favorable market condition.

Any news behind recent sell off in the stock?

Tan – No news that I’ve seen anywhere. All signs point to multifamily rents and RE values only going higher, and as the clock ticks closer to the Nov/Dec timeframe, I believe the likelihood for positive news only increases.

Positive news flow for TCI continues – office building sold at $74m resulting in BV gain of $32m and cash proceeds (after mortgage repayment) of $39m. This is a significant amount relative to the current market cap of $310m and continues to show that TCI BV significantly understates the value of the assets.

Also worth noting that the building was sold below the mark-to-market valuations of $87m as shown on the Israeli regulatory fillings.

https://www.sec.gov/Archives/edgar/data/733590/000101054921000198/transcontinental8k.htm

Good news.

I guess at such a big discount doesn’t matter as much but guess the mark-to market valuation analysis could be too aggressive on the upside target?

I disagree. If anything, I think the upside target is actually low. Book value is likely close to $90/share. The JV holds multi family real estate. Rents are up significantly. The value of what the JV holds is likely higher than its ever been. How it’s monetized and whether Macquarie pulls the trigger on doing so is the big question but with November approaching, I’m speculating we will see some action in the next few months that could be a further catalyst for shares.

Ah, got it, so maybe the office values are overstated given this sold at a 15% discount vs. mark to market value but more than offset by the understatement of the multi-family assets?

thanks

Transcontinental Realty: Brixton Capital and The Shidler Group seek to acquire 100% of the outstanding capital stock of Transcontinental Realty Investors for $44.40/share in cash.

TC Acquisition Group believes its proposal would deliver a meaningful premium to TCI’s shareholders that also represents an attractive opportunity for shareholders to obtain immediate liquidity at what TC Acquisition Group believes is a full and fair valuation based on its extensive review of TCI’s publicly available information. The $44.40 offer price represents a 48% premium to TCI’s year-to-date volume-weighted average stock price (VWAP) of $30.00 and a 28% premium to TCI’s last closing stock price of $34.77 as of September 20, 2021.

No chance that price sticks. I applaud the release and their desire to get vocal. They likely want to take it before the November deadline comes into play. TCI/ARL should just clean up the remaining float at $50+ and put this thing to bed. Therefore, I think there is significant upside from $40 in the near term. Anything short of $50 seems too cheap to me.

I don’t understand the legal/ficuciary obligations of a large controlling shareholder, so I don’t understand why the family accept this offer, or even bother countering if they control 88%?

If their plan was to monetize all the value and get $70-$90 a share out of it by the time they were done, why not just reject and keep doing what they were doing.

Full Disclosure: The reason I say this is I’m mad I didn’t buy more because I anchored over missing the $22 price, and now I’m trying to find reasons to justify anchoring again at $40. I don’t want to buy a slug more and have them reject and the stock trade at $35 for another year while they slowly realize value.

Great call. What’s the most likely path of events to get you to $50+? Mgmt taking this out or running a process and putting it up for sale?

I think they have to respond. Even if it’s just to say it’s undervalued. But if they ignore it, they open the door for a lawsuit. Fiduciary duty comes into play here. Normally a company would explain why it’s an inferior bid. That’s why I think if this becomes a problem, why not retire the stock and buy up the remaining float. That’s a path of least resistance. Maybe a tender for $48 or $50 and see what you get? Either way, the scenarios for higher prices seem good to me. Assets are worth more.

Thanks – agree. The buyer group are real RE players too, makes it harder to ignore

I don’t see any press release or Sec Filing from TCI about this offer?

Yeah, surprising that we haven’t seen any response yet or any follow on press release from Brixton.

Few things I’m still struggling with if anyone has any answers.

1) I still don’t understand the JV valuation being $800m plus and how that assumption is penciled out. I had my colleague who is fluent in Hebrew read the Southern Properties slide deck and it wasn’t clear whether the $290m referred to the entire JV value or just their portion. It also wasn’t clear from presentation how the $123m mezz debt should be treated.

2) I noticed that Brixton in their press release mentioned “ongoing liquidity constraints” and “highly needed liquidity for the company’s ongoing capital obligations”; does anyone know how much capital the company needs and whether these concerns are real?

3) when this was originally posted, it was cheap on an NAV and FFO basis. Now the P/FFO basis seems more in line with peers but still cheap on NAV basis, any reason that these assets are under earning vs. comps and deserve to trade at a premium P/FFO basis?

$290 million net equity for the whole JV (~10k units of apartments in Sunbelt states) would translate into about $29k/unit in net equity.

Their apartments are financed by HUD-insured loans, which may allow higher loan-to-value. And $123 million mezz debt adds another $12k/unit to gross value.

However, even after taking into account higher leverage, $29k/unit in net equity seems too cheap for typical Garden-style apartments in similar locations.

List of their portfolios:

http://abodeproperties.com/current-porfolio.html

I think the idea presented was excellent but the analysis of the JV was not up to par with the rest of the article. For the JV, the easiest thing to do is to look in the financials. I have translated the H1 2021 financials using Google, you can find them here: https://drive.google.com/file/d/15ibIk-_M5uFIUerlfrGhI5lR-GOKpf9s/view?usp=sharing . The relevant stuff is on page 68 and 69.

Page 68: 1414m in real estate, 859m in debt. Divided by two (Macquarie owns half) implies a ballpark $278m for TCI (excluding other assets).

Page 69: You can see that Southern Properties Capital carries the JV stake (using IFRS, so with real estate at fair value) at $258m. However, that includes the $39.6m earn-out liability from the dispute with Macquarie. You should add that back when looking at TCI, because the earn-out liability is consolidated in TCI’s balance sheet. So, $297m.

Note that (I assume for tax reasons) Macquarie and Southern Properties Capital both own ~50% of the equity as well as 50% of the mezzanine debt in the JV. Practically speaking that means that you can just ignore the mezzanine, i.e. treat it as equity. It is not external debt.

The US multifamily market has been very active lately (see the 3 transactions below), with large-size portfolios similar to the JV’s changing hands.

Note that the deadline of November 19, 2021 has passed on last Friday , after which either TCI or Macquarie may cause the JV to offer all of its properties for sale. Any new development on this front?

* Morgan Properties LLC bought two portfolios totaling 18 apartment communities in Georgia, Florida, North Carolina and South Carolina for a total of $780.5 million.

* Greystar Real Estate Partners LLC intends to sell its flagship U.S. multifamily value-add fund for roughly $3.6 billion. The fund consists of 30 multifamily properties.

* The multifamily division of RREAF Holdings LLC, along with DLP Capital Partners LLC and 3650 REIT, bought a portfolio of 21 multifamily assets in the U.S. Sun Belt region for $534 million, REBusinessOnline reported.

Multi-family market has remained very active lately, with another large portfolio (>10k units) transaction recorded.

“Privately held real estate investment management company Strata Equity Group has sold a 62-asset multifamily portfolio with a total of 15,460 units across 10 states to Starwood Real Estate Income Trust Inc., a non-listed REIT managed by a Starwood Capital Group subsidiary.”

Filing in Israel stating TCI and Macquirie will find a broker to market all but 7 JV properties, and that TCI will buy the 7 properties from the JV. https://maya.tase.co.il/reports/details/1412327

Although the US filing in English has also been posted, I am trying to learn how to do Google Translate of TASE filings properly, in case I need to do it next time.

The PDF version of the filing does not work well with Google Translate. The output is kind of a mess, I guess because PDF formatting issues. Anyone with similar experience as mine?

For the HTLM version , Google Translate (in Chrome browser) translates everything on the page but the filing itself (contained in a framed window). Also , the HTML version seems to show only the first page of the filing (or maybe I should click on some link)?

Similar filing just posted in US

to save friends from spending time locating the announcement, I have copied it below.

Southern Properties Capital Ltd (the “Company”) is pleased to update that on November 17, 2021, the Company and Macquarie (hereinafter: the “Parties” or the “Class A Rights Holders”, as applicable1), entered into a letter agreement to invoke a Major Decision under the JV Agreement, as defined in Section 1.14.1 (on the Macquarie Transaction) of the Periodic Report2, to cooperate with each other in a contemplated process of selling the joint venture’s assets, as described below (hereinafter: the “Major Decision” or the “Major Decision Letter”)3. Terms in this report have the meaning assigned to them in the periodic report for 2020, unless stated otherwise.

Below are the major terms of the Major Decision Letter:

1.The Parties authorized working together to sell all or most of the joint venture’s assets (hereinafter: “Sale”). For this purpose, the Parties agree that as long as the Major Decision Letter is in effect and is not revoked, neither Party may obligate the joint venture or the other joint venture Party to execute a sale transaction.

2.The Parties will work together cooperatively to select a broker to market the JV assets for sale (except the seven assets not offered for sale, as described below) and to plan the Sale Transaction’s schedule and structure. The Parties expect to complete the broker selection by the end of 2021 and commence the sale process in early 2022.

3.The parties further agreed that seven (7) of the assets held by the joint venture will not be offered for sale, but rather acquired by the Company, subject to completing the Sale Transaction. The Major Decision Letter also stated that these assets will be purchased by the Company according to the formula provided in the Major Decision Letter.

4.Also, in the Major Decision Letter, the Parties agreed to include one property held by the Company in the sale transaction, the consideration from its sale will be transferred to the Company.

5.The Major Decision Letter will terminate on August 1, 2022, and its content will be void. [answer: see next paragraph]

The Major Decision Letter was made in light of the separation and sale mechanism under the JV agreement coming into effect; under this mechanism, 3 years of the entering into the JV Agreement, each of the Class A Rights Holders (i.e. the Company and Macquarie) may demand the joint venture to sell all its assets. Note for this purpose that within the Major Decision Letter, the parties agreed not to exercise their right under that mechanism before the Major Decision Letter expires, as stated above in Section 5. See also Section 1.14.1.9 of the Periodic Report (in the table describing the JV Agreement in the separation and sale section).

Its surprising that they are not going down the previously planned IPO path, especially when the multifamily market is hot. Maybe it’s because of those previous disagreements they’ve decided to liquidate the JV this way (they would still remain owners in case of the IPO). Not sure how to look at the fact that they didn’t sell the portfolio as a whole – either they didn’t manage to find a buyer or maybe they think that the piecemeal sale will bring more value. Anyways, a sale of the JV is better than nothing and will definitely help to unlock value.

TCI is still cheap – the latest BV is $44/share (vs $38.8/share current price). The depreciated JV investment was valued at $49.9m in the US filings. On TSE, the market value of JV is reported at $297m. It still isn’t obvious to me whether that is only TCI’s stake (50%) or the whole value of the JV. In any case, the incremental value to TCI’s BV would be $14.30/share at 50% or $28.60/share at 100%.

On top of that, you have additional incremental value from the market valuation adjustment of the remaining RE portfolio (not JV) – about $16/share, which will probably get realized only in case of a full company sale or as the market gets more educated about the company and finally finds the hidden value. With both the JV and other RE portfolio market value adjustments, TCI’s BV stands at $74.3-$88.6/share. TCI now trades at 9x run-rate 9M FFO and 13.5x LTM FFO. Meanwhile, multifamily REITs trade at an average of 25x LTM FFO. Overall, there’s clearly plenty of upside left.

I follow the commercial real estate markets (both public and private) quite closely.

The public market is currently not very receptive to a REIT IPO, even if it is a multi-family or logistics portfolio (the so called “hot” sectors).

Sales to the private market can bring a clean exit (100% cash, immediately) vs sell-down of remaining shares over 1-3 years post IPO. Multi-family is hot, but the sentiment in public market is lagging behind the private market.

So this decision is actually very natural a choice.

In fact, the Decision Letter prevents either party from acting unilaterally until Aug 2022. Under the JV agreement, Macquarie has the right to and could’ve initiated the sales unilaterally, but they decided to work together for another eight months. This says something about the two partners’ current relations.

I don’t think they intend to sell the individual properties piecemeal. They exclude 7 properties in the JV and include one property from

TCI balance sheet, but mostly likely they will find a single buyer for this JV-7+1 new portfolio.

By the way, where can I find info on these 7 and 1 properties? I am trying to figure out the size of this new portfolio, and the expected net amount of cash proceeds to TCI (note that TCI will have to pay for Macquarie’s stake in the 7 properties).

I don’t think the 7+1 properties are disclosed.

It’s strange that TCI stock price hasn’t moved anywhere in recent months, despite one large acquisition after another in the news confirming the resiliency of the apartment sector.

Last week Blackstone announced acquisition of Preferred Apartment Communities Inc (APTS) for $5.8 billion. Note that APTS also has investments in grocery-anchored shopping centers as well, so this news bodes well for WHLRD also.

Blackstone is acquiring APTS on behalf of its core plus fund BREIT. This means Blackstone believes that these apartments (very similar to TCI’s) are very stable assets.

anything causing the move today?

From earnings report March 29th. This is why stock moved I think.

http://www.transconrealty-invest.com/assets/tci-2021-12-31-earnings-release.pdf

On November 17, 2021, we entered into a Major Decision with Macquarie to engage a broker and initiate a sale of all the properties held by the VAA joint venture. In connection with the sale, VAA will distribute seven of its existing properties to us, and we in turn, will contribute one of our properties into the VAA Portfolio. The remaining forty-five properties will be sold to third party.

The Major Decision agreement will expire on August 1, 2022, if the VAA Portfolio has not been sold.

Finally, the JV sale has moved forward. TCI, Macquarie, and two third-party PE firms have entered into a series of agreements to sell 45 JV properties + 1 asset held by TCI (separately from the JV). The remaining 7 JV properties will be acquired by TCI.

The transactions are expected to close in 75 days.

Total consideration is $2bn, way more than the recently appraised fair value of $1.4bn outlined in the recent Q1. Net cash flow to TCI (distributable funds from the transaction net of the cost of holdback properties – as I understand the 7 remaining JV assets) will be $420m. Southern Properties (TCI sub which holds the JV) will distribute a dividend to TCI equal to $100m to cover tax liability arising from the transaction. So it seems that the overall net proceeds here will be $320m. After all, it seems that Neil and Writser were right about the JV value being much larger than estimated in the write-up.

The interesting thing is that despite a temporary share price jump, the market has barely reacted to this announcement. The transaction is supposed to be a catalyst to unlock/reveal how undervalued the JV investment was in TCI’s US financial reports. The latest reported BV in the US financials was $365m or $44.7/share. Reported JV investment was $50m. So as I understand this transaction alone should lift TCI’s BV by $31/share to $76/share. The discount to updated BV is 41%.

On top of that, there should be some further remaining upside left from the remaining depreciated TCI real estate. Previously the difference between the fair market value reported on TASE and depreciated value reported in the US was around $16/share. Not sure what are the latest numbers – translating Israelian filings is a mess and it seems that the company did not make an easy-to-understand presentation this year.

So overall, it seems like a highly positive update, but why is the market still so skeptical? Not sure what other catalysts might be needed to narrow the discount.

Looking at recent performance, rent collection and occupancy has been strong in Q1’22 (98% and 90% respectively). However, on an FFO basis TCI no longer trades at that big of a discount to peers. P/TTM FFO is at 18x vs similar peer NXRT at 22x.

Value9, Neil – your insight would be highly appreciated (especially on the current financials on TASE).

Sale announcement – https://www.bamsec.com/filing/101054922000160?cik=733590

Q1 – https://www.bamsec.com/filing/73359022000009?cik=733590

Short update on TCI – Q2 filings suggest that the gap between Israeli- and US-reported book values has widened. US book value stood at $44/share compared to MTM value of $95/share reported in Tel Aviv Stock Exchange. Q1 MTM was at $72/share. The increase is largely explained by a higher recorded JV value – $551m compared to $258m in Q1. Meanwhile, US-reported JV investment remained at $52m. The sale of around 45 properties is expected to close in early September, suggesting that we may see an upward price adjustment then.

On the operational side, the business continued to display strong performance with occupancy and rent collection at high levels – 90% and 97%. The company trades at 11.4x TTM FFO – much lower than peer NXRT who is valued at 23.4x FFO.

https://www.bamsec.com/filing/73359022000015?cik=733590

Anyone seeing updates on the JV sale process? I couldn’t find anything recently but believe the 75 day post signing expected closing deadline has passed.

The sale of 45 JV portfolio assets has finally been completed. The press release came out yesterday before market open, yet TCI share price closed only 7% higher and a huge discount to mark-to-market BV still persists – again, quite puzzling. I still want to believe the lack of reaction is because this is a rather illiquid and underflowed stock. Hence, the market will likely stay blind to the story until sale proceeds hit accounts in Q3 and Q4 reports. Hopefully, as the BV soars and TCI starts screening much better, the stock will finally re-rate.

Gross proceeds to the JV were $1.8bn and after repayment of debt + closing costs net proceeds were $974m.

Southern Properties (TCI subsidiary, which owns 50% of the JV) will now receive two distributions:

– The initial – $184m. Press release says these funds will be used to cover the mezzanine loan and repayment of the contributed capital less Earn Out Obligation to Macquarie. As I understand, coverage of the mezz loan and contributed capital is purely an accounting formality which won’t impact the cash. So deducting around $17m remaining earn out obligation, the distribution should amount to $167m.

– Second – $185m will be paid 45 days after the closing date (September 16).

– Out of these proceeds, Southern Properties will transfer $100m to TCI to cover capital gain taxes at the parent level. $100m seems quite excessive, but conservatively assuming all of it will be used, we get the total net proceeds at $252m.

– Southern Properties will also receive control of the 7 remaining JV properties.

So let’s run through the updated numbers:

– Latest TCI BV as of Q2 was $382m or $44/share. JV value was $52m.

– Total net proceeds from the JV sale will be $252m, which should raise TCI BV to $67/share.

– Add the incremental upside from the remaining depreciated portfolio – around $13/share and you get the TCI’s mark-to-market BV of around $80/share. This pretty much stands in line with the recent mark-to-market BV reported on TASE less the $100m sale tax.

– Finally we need to add the net book value of the to-be-received 7 JV properties. Israeli fillings show this at $120m (after assumed debt), or $13/share. So in total around $90/share in BV pro-forma for the sale proceeds.

So currently, the company trades at 50%+ discount to its mark-to-market BV.

https://www.bamsec.com/filing/73359022000019/2?cik=733590

Any word on what TCI intends to do with the sale proceeds? In the end, shareholders only make money if/when dividends or buybacks occur. Many companies are run more with the insiders in mind, rather than the shareholders, hopefully this is not one of them

I do not think management has provided any more details regarding capital allocation after the sale completes, so that’s one the risks. But I think this additional cash simply appearing on TCI books and everyone seeing plainly that BV/share is materially higher might be sufficient for re-rating.

From June 19 press release:

b. Further to the aforesaid in section 1.15 of the Periodic Report, the Company intends to use of most of the cash flow it will receive from the aforesaid in subsection 3 above to make new investments and to expand its multifamily residential property portfolio.

Does anyone have any insights into what strategy May Trust might have? Are they in a position to tender for TCI and force a squeeze out of the minority shareholders? I don’t know much about the ownership structure, but according to Yahoo TCI is 89% owned by insiders.

About 85%+ of TCI is owned by May Trust plus a little over 3% is in hands of the ex-CEO/ex-chair Daniel Moss who was also a manager at the JV company. Regarding the squeeze-out, your guess here is as good as mine but back in August, Phillips Family (May trust beneficiaries) filled a 13D, which noted that at least at the time the intentions were to keep the status quo.

https://www.bamsec.com/filing/101054922000187?cik=733590

This idea was also posted on VIC in September last year at a price of ~40USD.

The author issued an exit recommendation in June this year when the stock was about 46USD. i.e. possible with a total gain of around 15%, but before the thesis also presented here had played out.

Do you have any idea as to why?

https://www.valueinvestorsclub.com/idea/TRANSCONTINENTAL_RLTY_INVS/3897382371#messages

No idea why that particular VIC poster marked his idea as closed. He has not responded to a similar question on VIC either.

10-Q filed, BV approx. $88 now. By my calculation LTM AFFO is 13.9x. What do you guys think is a reasonable target price now? NXRT P/2022 AFFO is 14.4x. Is a sum of the parts more appropriate, applying AFFO multiple + JV proceeds?

https://www.sec.gov/ix?doc=/Archives/edgar/data/0000733590/000073359022000025/tci-20220930.htm

Yes, all as expected.

Now remains to be seen if the higher BV/share and a clearly visible discount to it in the financial statements will have any effect on the market price. Might turn out that the 50%+ discount to NAV is here to stay due to governance issues (controlling shareholder and external manager with high fees). Before the received cash is fully deployed, I do not think the FFO multiples comparison will produce a meaningful result of where TCI is should be trading relative to other industry names.

One way to think about TCI now is that the pro-forma cash is approximately equal to the current market cap. So in a way investors are getting all the real estate assets and receivables (together with the property level and company level debt) for free. If that cash were to be returned to shareholders, TCI would trade far higher than today. However, this cash is to be deployed in new property investments or receivable notes. So some discount should apply. Whether it should be 50% or some smaller figure, remains to be seen.

recent pullback…..on no news? good opp for those late to the party?

Has anyone looked at an ARL sum of the parts (i.e. TCI stake vs. everything else)? Since the Sept announcement of the JV sale closing, ARL +88% vs TCI +9%. I see at the time of that announcement the ARL market cap was substantially less than TCI’s which is no longer the case.

I just have a question that why the NAV of TCI had fallen from 30 to 21 between 2020-6 and 2021-3??? If the NAV of the TCI will fall down?If so, why?How about the risk factor?

Are you sure you’re looking at the correct numbers? I see that in the period you’ve mentioned the NAV went up, not down – from $38.6/share to $42.3/share. The current NAV is mostly RE and cash, so any big swings are unlikely. Governance issues and deployment of current cash balances are the main remaining risks/uncertainties here.

You can see the NAV of every quarter.Sure, it went up finally but up and down during the period.

On 1/17/23, ARL market cap x 78% (TCI ownership) equaled TCI market cap to within approx. $1mm. Since then ARL is up 33% while TCI down 3%. Any reason why ARL market cap ($422mm) should be higher than TCI ($392mm)?

I am not aware of any developments that might have driven this – as you suggest substantially all of the business of ARL is its 78% ownership of TCI. Historically, ARL market cap was always below that of TCI, and that changed only at the beginning of this year. However, keep in mind, both ARL and TCI have tightly held stocks with limited float and limited trading liquidity, so high volatility is expected. Note the 25% up and down swings in ARL stock YTD without any news. A bet on mean reversion (short ARL, long TCI) could be an interesting trade, but there is no catalyst, borrow is tight, and the stocks could continue trading this way for a prolonged period.

Historical ARL/TCI market cap comparison:

https://seekingalpha.com/comparison/new/MCxhcmw=?axis=linear&compare=ARL,TCI&interval=10Y&metric=marketCap

Thanks dt. I found it interesting to chart ARL market cap minus (78.4% x TCI market cap) – over the last 5 years the range is approx. -$100mm to +$100mm. From 12/29/22 to 1/17/23 the gap closed from a 5y high of +$130mm to nearly zero (one of the -25% ARL swings you mentioned) in a span of 11 trading days, only to widen back to $130mm+ (fresh 5y high) 8 trading days later. Still around +$120mm today, but the 5y chart shows that historically this difference has not remained around the +$100mm or -$100mm level for long before mean reversion.

I don’t see any but just want to make sure there hasn’t been any news, otherwise this seems like a good opp to start backing up the truck?

10-K was filed last week. Book value is now almost $95/share, although today’s $41.61 closing price was only 44%/BV. ARL continues to trade at a higher market cap than TCI and significantly higher BV multiple (68%) as of today.

Speaking of earnings, in addition to transactions, these were mentioned as some potential catalysts. TCI hasn’t moved much, if at all, in a year now. Value9, ilja, DT, anyone – thoughts, catalysts?

Clark St holding as well, comment below but no mention of catalyst. Does there come a time it seems like it will never close the NAV discount?

Yes, I’m glad to see they didn’t sweep the excess cash back to the manager via the “receivable from related parties” line item. That would have caused me to re-think owning it.

It’s not a sell-off and TCI is trading within its ‘usual’ price range at a very low volume (only around $50k/say). The recently released Q4 results were a bit of a mixed bag. The earnings power of the remaining portfolio is still not visible as the JV sale was completed only in November. I intend to hold until Q1 before reassessing the situation. A few more details from the Q4:

– Book value increased from $88/share in Q3 to $96/share as of Q4, mainly due to the gain on re-measurement on the 7 multifamily properties that TCI acquired from the JV in Nov’22. The company currently trades at 0.42x BV.

– As per a small note in the 10K, management still plans to use the cash for property acquisitions. Given the macro uncertainty, they are taking it slow.

– One concerning thing was a drop in commercial RE occupancy from 68% in Q3 to 60%. The decline was driven by major commercial properties at Browning Place and Stanford Center. Management gave no explanation and its not clear whether it’s just a temporary issue or not. Commercial RE revenue was also down by 30% in 2022 compared to 2021.

any news today causing the sell-off?

I don’t see anything, but TCI (down 7%) outperformed ARL (down 20%) by 13% today. They closed with an almost identical market cap. In the last 10 trading days, the TCI vs ARL book value multiples have converged significantly. Based on 3/31 BV, since 3/20 ARL has declined from 80% to 55%. TCI down from 48% to 41%. Uncertain what the appropriate multiple is here but makes sense to me that these two are converging.

I don’t see any news either

Gibberish to me but Google Translate tells me:

The CEO resigned, effective immediately.

The CFO became chairman and CEO.

The company decided to redeem early all outstanding Israeli bonds, to ‘leave the Israeli market’.

Is this good? Bad? Not sure. Maybe leaving the Isreali market makes it easier to go for some sort of merger / deal. But given the history here probably best to assume that no such thing is happening.

At least it seems like a sensible thing to redeem those bonds, rather than paying 7% interest and lending out all excess cash to the manager.

https://maya.tase.co.il/reports/company?q=%7B%22DateFrom%22:%222021-04-01T21:00:00.000Z%22,%22DateTo%22:%222023-09-22T22:00:00.000Z%22,%22Page%22:1,%22entity%22:1670,%22events%22:%5B%5D,%22subevents%22:%5B%5D%7D

nice spot. 10k noted that they paid the C bonds at the end of Jan. Redeeming the rest seems to make sense. No clue regarding the CEO, it does seem he is gone on the website as well. Would think they’d be required to file something in the US if the CEO left thought right?

http://transconrealty-invest.com/?page_id=274

Yeah, they usually file a bit earlier in Israel (they will probably stop doing that once all the bonds there are delisted). 8K is out today. Interesting that it notes that the CEO has left, but not any of the other items (i.e. CFO becomes new CEO, bond redemption, etc.).

10Q filed a few days back.

http://transconrealty-invest.com/wp-content/uploads/2023/05/TCI-2023-03-31-10-Q.pdf

As noted above C bonds paid of. There is a note in there that the A and B bonds were paid of in early May.

Looks like they have started to use some of the cash for new development also w/ a 240 MF development for $55m in Lake Wales FL (funded by a $33M I/O loan at S+300) ($230 a unit)

Unfortunately, the JV sale completion and the marked-to-market BV becoming clearly visible on TCI’s balance sheet did not catalyze a stock rerate closer to its full valuation. The market continues to put a large discount (currently over 60% to BV) on TCI due to governance issues as well as management’s reluctance to return cash to shareholders. As again highlighted in the most recent Q1 result, management still plans to invest in new property acquisitions and developments. Some new developments have already been started.

The stock remains kind of cheap (although on P/FFO basis it trades in line with peer NXRT – both at 14x). However, the whole case has now shifted into a RE company valuation thesis and bet on TCI management’s ability to prudently invest the cash.

Hence, I am removing this idea from actionable Portfolio Ideas and marking a 66% gain in 2 years. A decent result overall, however, in hindsight, the idea could’ve been closed much earlier, e.g. in the Autumn of last year after the JV sale has been completed. Nonetheless, a bet on a more substantial re-rate seemed worth a shot at the time.

Is anyone still following this one? Would be curious for an update.

Very strange trading, especially the -16% share price drop yesterday. However, I don’t see any news from the company or media. Maybe some large shareholder is exiting. The company also doesn’t have TASE listing anymore (since May). TCI’s discount to BV is now around 70%. Nonetheless, without knowing what caused yesterday’s drop, it’s difficult to get very excited here based on the BV discount alone. It’s pretty clear the market doesn’t care about the book value. Meanwhile, based on earnings TCI still trades in line with NXRT – around 11x FFO. Since the idea was closed in May, TCI dropped 19% and NXRT dropped by around 10%.

For now, the thesis at TCI essentially remains the same. If you believe management will prudently invest the pile of cash that’s sitting on TCI balance sheet right now, the stock is cheap. Yet, it’s pretty difficult to have any confidence here given the governance and other issues at TCI, as highlighted previously by DT.

See below proxy excerpts for recent changes to TCI’s Articles of Incorporation referencing potential business combinations to clean up the corporate structure:

Background and Reasons:

The Board of Directors believes that the change pursuant to the TCI Amendment is desirable to provide greater flexibility with respect to the consideration of potential future actions involving the Company and its controlling stockholder and affiliates. The Company currently does not have any specific agreements or plans that would involve a Business Combination involving the Company and IOR or any other entity, although the Company intends to consider transactions in the future from time to time that might involve IOR and TCI or one of TCI’s affiliates.

Potential Effect:

Authorizing the Company to effectuate the TCI Amendment will not affect materially any substantive rights, powers or privileges of holders of shares of Common Stock of the Company. The TCI Amendment could make it easier (and less confusing) for TCI to propose and/or engage in a transaction or Business Combination with the Company.

https://www.sec.gov/ixviewer/ix.html?doc=/Archives/edgar/data/733590/000121465924001239/r1252408k.htm