Tribune Publishing (TPCO) – Bidding War – 6%+ Upside

Current Price: $17.42

Offer Price: $18.50+

Upside: 6%+

Expected Closing: TBD (potentially in two weeks)

This idea was shared by Xavier.

This is a fairly interesting bidding war situation with a clear catalyst and a short timeline of less than two weeks. Downside is protected at the current levels, which basically offers a free option on further bid increases.

Tribune Publishing (owns newspapers Chicago Tribune, The Baltimore Sun, the Hartford Courant, the Orlando, and more) is subject to an acquisition by a hedge fund Alden Capital. Consideration stands at $17.25/share in cash. Alden already owns 32% of TPCO. The transaction will need approval from 2/3rds of disinterested TPCO shareholders and the meeting date is set for the 21st of May.

TPCO is also being targeted by the chairman of Choice Hotels Stewart W. Bainum Jr., who previously made an $18.50/share bid together with his partner Swiss billionaire Hansjoerg Wyss. Wyss dropped out from the deal after a week of due diligence, however, Bainum remains committed and has already found buyers for all TPCO newspapers except Chicago Tribune, which is the largest one.

Besides that, Chicago Tribune itself has reported that apparently another suitor – the CEO of Sun-Times Media is currently in the process of raising funds and intends to make a fully financed bid.

Despite large Alden’s stake, it seems that the board is open to a fully financed offer at a higher price. The buyers have to present the offer by the 21st of May so the time is limited. I think there is some chance that we may see a competing bid, which could potentially result in 6.2% in a week. However, if it doesn’t work out, the downside is protected at $17.25/share (1% loss) and at least you won’t have to keep your money frozen for long (the transaction is expected to close this month).

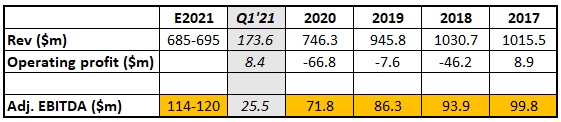

Another small positive – last week the company released Q1 results, beating the guidance and showing improved adj. EBITDA margins (outperformed its peers). TPCO also raised its previous adj. EBITDA guidance for 2021.

The major risk is, of course, that Alden’s proposal gets rejected, especially when a large labor union is opposing the offer and is advocating to wait for Bainum’s bid. However, the offer comes at a large premium to the average TPCO prices over the last couple of years ($8-$12/share).

Aside from Alden, there are 3 other larger shareholders – Nant Capital (23.7%), BestReviews (5.2%), and Maison P. Slaine Revocable Trust (3.4%). The hedge fund’s offer has been lying on the table for about half a year now and none of the shareholders have opposed it so far. Nant Capital is a vehicle of South American billionaire Patrick Soon Shiong, who was strongly in favor of selling TPCO in 2018 and backed 2 of the potential bidders at that time.

Overall, I think that without a competing bid, Alden’s proposal is likely to go through, but even if it doesn’t, there is a decent chance that other potential suitors (including Bainum and Sun-Time Media) will continue to pursue TPCO and might eventually manage to place a bid.

Further background details are provided in the timeline below.

A bit on valuation

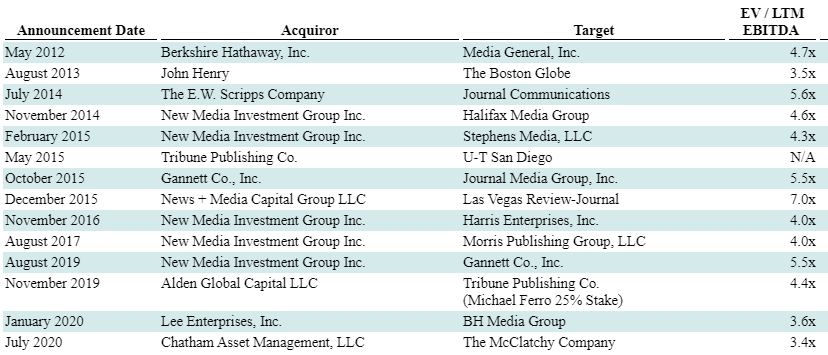

Alden’s offer comes at 4.9x adj. LTM EBITDA multiple vs GCI valuation of 4.6x adj. LTM EBITDA and LEE 6.2x adj. LTM EBITDA (two closest peers). Historically TPCO had lower adj. EBITDA margins, however, seem to be catching up and has outperformed the peers in the latest Q1’21. Moreover, GCI and LEE are packing significant debt, while TPCO is debt-free.

LTM results were affected by COVID and for 2021 TPCO guides adj. EBITDA at $114-$120 (vs $72m in 2020). This would value the company at 3.6-3.8x forward EBITDA. This multiple seems quite low – despite the gradually declining top-line, adj. EBITDA remained relatively stable over the years (with exception of covid impact). TPCO is still in transition from the traditional newspaper business model, closing down unprofitable operations, cutting costs, and increasing margins.

3.6x-3.8x forward adj. EBITDA multiple is also below the historical peer acquisitions and to 4.4x multiple for which Alden has acquired its 25% stake in Nov’19.

All in all, this indicates that there is definitely some chance that Bainum will be able to find partners for the $18.50/share bid (4x-4.2x forward adj. EBITDA), and there is even some headroom for further bid increase from Sun-Times Media.

Timeline

- December 2020 – Alden made a bid for Tribune Publishing at $14.25/share.

- 16th February 2021 – the company agreed to be acquired by the hedge fund for an increased price at $17.25/share (21% raise). The merger was expected to close in Q2 2021. Originally, Bainum made a deal with Alden to buy The Baltimore Sun (TPCO newspaper) from the hedge fund after the transaction is completed. However, apparently, both parties disagreed on something, and “Bainum grew skeptical of Alden’s intentions in the deal”.

- 5th April – TPCO announced a competing non-binding offer from Stewart Bainum and Hansjoerg Wyss at $18.50/share and stated that it is expected to lead to a “superior proposal”. Bainum aimed for The Baltimore Sun and Wyss intended to make Chicago Tribune into a national paper. The remaining papers were intended to be sold off.

- 16th April – after over a week of DD, Wyss informed that he is no longer interested in financing the acquisition, however, remains interested in assisting the potential transaction to make it successful. Reportedly, the original agreement was that Bainum would finance $100m and Wyss $500m.

- 17th April – Bainum wrote a letter to TPCO board announcing the news and highlighted that he remains committed to pursuing Tribune at $18.50/share:

I remain committed to pursuing a potential acquisition of Tribune for $18.50 in cash per share, including providing through one or more of my affiliates $100 million of the required equity financing to complete such acquisition. My intention is to continue to have discussions with other potential equity financing sources […] as well as other potential equity financing sources who have contacted me on an unsolicited basis […] My advisers have substantially completed the necessary due diligence of Tribune and there remain only a few issues to be negotiated in the definitive transaction documentation. I remain confident that there is significant interest in joining this effort and expect the necessary arrangements among one or more additional equity financing sources can be completed expeditiously.

- 19th April – TPCO determined that Bainum and Wyss’ proposal is no longer expected to lead to a “superior proposal”.

- 28th April – several reports came out that Bainum is making progress on sourcing new financing for his offer.

- 30th April – Bainum tripled his commitment in the buy-out – $200m plus $100m in debt financing – and, reportedly, found buyers for all TPCO papers, except Chicago Tribune (1/3rd of the deal). Apparently, Bainum himself put 50% chance on successfully finding the remaining buyer within the given time. Additionally, it was reported that the CEO of Sun-Times Media is in the process of raising money for a fully financed bid.

- 4th May – NewsGuild – Communications Workers of America, which represents over 20k news industry employees (including TPCO), issued a letter to TPCO shareholders advising to reject Alden’s proposal. NewsGuild stated that there is “no need to rush to Alden” as its offer is undervaluing and that shareholders should wait for Bainum’s superior offer. It was also noted that TPCO CEO has apparently voted against Alden’s offer in the board meeting on the 19th of April.

- 6th May – TPCO releases quite positive Q1 results beating the previous adj. EBITDA guidance and increasing the forecast for 2021.

- 6th May – NewsGuild issues another letter highlighting the recent earnings report and again advocating to vote against Alden’s proposal.

Now that shareholder approval has been obtained for the Alden offer, can there still be any (very small) optionality left, that a competing offer may emerge to derail the Alden offer in the last minute before the deal closes?

I am considering whether to exit now or just wait for the payment to arrive.

Apparently Bainum’s efforts to convince the potential buyers to bid for the Chicago Tribune have failed and no competing offers were made for TPCO. Alden’s offer has been approved by shareholders and will likely close this/next week. 0.3% spread remains. It’s probably not worth to keep the position open given the additional waiting time of the consideration payment. The idea is closed with 1% loss in 2 weeks.

Expected to close May 25, per PR below.

https://www.prnewswire.com/news-releases/tribune-publishing-stockholders-approve-proposed-merger-with-alden-global-capital-301297192.html