Altisource Asset Management (AAMC) – Preferred Equity Elimination – 96% Upside

Current Price: $17

Target Price: $33 (updated: $30)

Upside: 100%

Expiration Date: TBD

This idea was shared by Neil.

This is a special situation with a few moving parts. AAMC is (was) an asset management company spun out of Altisource Portfolio Solutions (ticker: ASPS) almost ten years ago. AAMC was formerly the external advisor to a single-family housing REIT called Front Yard (ticker: RESI). In August of 2020, Front Yard and AAMC entered a termination agreement after which Front Yard was acquired by Pretium and Ares Management. Currently the company has no operations and sits on cash and investment portfolio of several REITS.

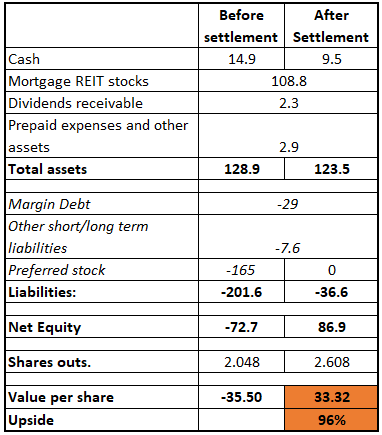

The company trades at $17/share, despite having a negative reported BV of -$39/share. The equity is severely depressed due to $165m (c. $80/share) of remaining preferred stock. However, the main point here is that the preferred stock is completely neutered and is basically worth close to zero from AAMC perspective (more details provided below). Recently, the company settled with one of the major pref. holders (large and credible investment manager) to convert it to common stock for 12 cents on a dollar. Assuming that other pref. holders eventually settle for similar amounts we think that the stock could have over $33/share in tangible book value. The situation offers upside of nearly 100% based on a series of catalysts – settlements with other pref. holders, elimination of preferred stock overhang, reported BV turning positive, etc.

Assets

Post Front Yard termination, there is no business operations currently with AAMC. The company however took the vast majority of its cash and deployed it in to a portfolio of publicly traded (and liquid) mortgage REITs that have already provided significant appreciation, not to mention will continue to provide a material dividend stream going forward.

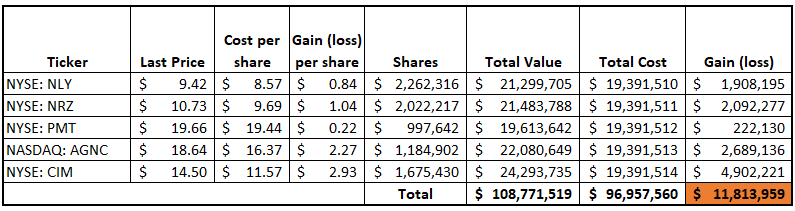

As of the start of June 2021, the portfolio looks like this:

This portfolio has a value of $109m versus a cost of $97m. AAMC used $29m in low-cost margin debt to enhance its ROI. They have net equity (excluding preferreds) of approximately $80M today vs. a common equity market cap of approximately $35M.

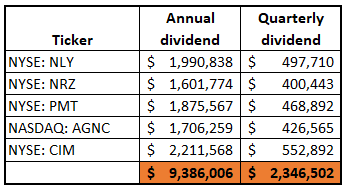

Based on the size of AAMC’s investment in REITs, this portfolio also throws off over $2.3m/quarter and $9m/yr in dividends. This dividend income (for now) represents the only revenue at AAMC. Illustration of dividend income:

Liabilities

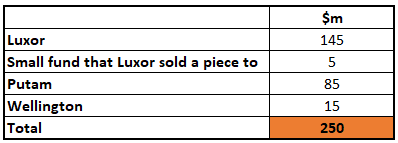

This is where the story takes a turn. In May of 2014, AAMC issued a $250M Preferred to a few large asset managers, Luxor, Putnam and Wellington.

At the start of 2021 here is who owned the Pref:

The rough terms of this Pref were as follows:

- No dividend;

- Converts to common at $1,250/share (yes, you are reading that right, $1,250/share);

- Mandatory redemption March 2044;

- NO voting rights;

- NO ability to appoint BOD members.

We think the Preferred is basically worthless and Putnam, a firm that oversees approx. $200bn in assets, agrees. Putnam recently settled their $85M claim for a “package” that equated to 12c on the dollar. In Feb 2021, Putnam exchanged their Preferred stake for 288,283 shares of common stock, plus $1.6M and $1.2M to be paid in February of 2022. Total value of the settlement at the time was approx. $10M with the common stock north of $20/share.

Following the Putnam settlement, the Company now has $165m of face Preferred left to contend with. At $145m of the $165m, Luxor is the important piece and the possible catalyst that will unlock significant value in the common going forward. If AAMC can settle with Luxor at anything similar to that as Putnam, the AAMC common will be worth a lot more than the $17/share it is today. One note, the Putnam settlement has a clause that gives them a most favored nations status, ie. if Luxor does better on a settlement, Putnam gets the benefit of the same deal Luxor gets).

In the meantime, AAMC cash burn should be limited, strongly reduced by the dividend income from REIT investments. During Q1’21 the company incurred $6m of opex, however, going forwards employee salaries/benefits and professional fees will likely be much lower due to the recent resignation of several senior executives and assuming the company eventually settles its litigations with Luxor and ex-CEO.

It is also worth noting that Putnam used the same law firm that Luxor is using in their litigation against AAMC for breach of contract aiming to return its initial pref. purchase price of $150m (more details below).

What would the common be worth if other pref. holders settle?

If Luxor and Wellington were also to accept 12c on the dollar for their claim, this would equate to $5m in cash and $12m worth of common (using the same allocation as Putnam) payout in exchange for the elimination of preferreds. This would decrease AAMC’s cash by $5m and increase its shares out by 705k shares (using $18/share).

The balance sheet of AMC would look like this (also incorporates “clean up” from the other holders):

Management reshuffles and Bill Erbey

The Company seemed like it was on a path to create a true asset manager under the previous leadership of CEO Indroneel Chatterjee, who joined the Company in Jan 2020 and was largely responsible for negotiating the Putnam settlement (which of course was very favorable to common holders).

In April 2021, however, the Company dismissed Chatterjee for reasons unknown. Other members of senior management also left the firm. Over the course of a few weeks in May and June, the company lost its CFO, General Counsel, and Controller. AAMC has appointed an interim CEO (Thomas K. McCarthy) and is currently looking for replacements to the senior management positions. The fact that Chatterjee was abruptly dismissed after the board recently awarded him with a substantial bonus after the completion of Putnam settlement seems quite strange.

What is even stranger is that apparently, the new interim CEO used to work at Altisource Portfolio Solutions (ASPS) as senior vice president in 2013-2015 and could very well be a Bill Erbey’s man put to control of AAMC on his behalf.

Bill Erbey is the largest shareholder (39%) of AAMC via his holding company, Salt Pond Holdings. He is most famous for building Ocwen (ticker OCN) into one of the largest mortgage servicers in the country and was Chairman for a period of time. He agreed to step down from that role in 2014 after a probe (same year) into the company by the top financial regulator in NY. Ocwen agreed to pay a $150M fine after servicing misconduct and conflict of interest issues. As a result, Erbey is barred from being an officer or Director of a public company. If Erbey is still involved and runs AAMC behind the scenes, there is an obvious risk of potential shareholder value destruction going forward.

Apparently, Luxor is also wary of this and has recently filed a demand for AAMC for books and records, basically alleging that Erbey was influencing the Board (10Q):

On April 26, 2021, Luxor, which holds 144,212 shares of Series A Shares, sent a letter to the Company demanding, under the common law of the USVI, the right to inspect certain books and records of the Company (the “Demand”). According to Luxor, the purpose of the Demand is to investigate whether the Company’s Board of Directors may have considered or engaged in transactions with or at the direction of a significant shareholder of the Company or whether the Company’s Board of Directors and/or Company management may have mismanaged the Company or engaged in wrongdoing, may not have properly discharged their fiduciary duties, or may have conflicts of interest. Luxor further alleges that it seeks an inspection of the Company books and records to determine whether the current directors should continue to serve on the Company’s board or whether a derivative suit should be filed.

Erby’s control question is particularly concerning given his track record and AAMC intentions of using its cash to explore entry into new businesses, including cryptocurrencies:

In addition to the fund management and mortgage businesses more closely related to the Company’s history, management intends to explore new businesses. While no decision has been made on the new businesses that the Company will pursue, management intends to explore, in the near term, fee based real estate investment banking and opportunities in cryptocurrency related businesses.

Luxor Lawsuit

Luxor has started litigation against the company “for breach of contract, specific performance, unjust enrichment, and related damages and expenses”. The complaint states that AAMC’s position not to redeem preferred shares in March’20 (pref shares can be redeemed every 5 years if AAMC has enough cash to redeem all of them at once) is a material breach of AAMC’s redemption obligations and seeks recovery of $144m in damages and return of its initial pref. shares purchase price of $150m.

It is unlikely Luxor would win this litigation as the pref. share agreement states that AAMC can redeem pref. shares every 5 years with the “funds available thereof” and all pref. shares must be redeemed at the same time. At the time of the last redemption (March’20) AAMC clearly did not have sufficient funds to carry out the redemption of all preferreds.

Risks

- Remaining pref. holders do not settle and management wastes money on new business ventures.

- AAMC settles with Luxor for a much higher amount than what they previously agreed to with Putnam. This is unlikely because 1) Putnam is a huge asset manager and thought they were getting a good deal + saw the value with common shares. 2) Luxor has no voting rights and no Board representation. The longer the wait they risk the company does something with the assets they do have.

- Lack of management or oversight.

- Erbey’s control – it is not clear if Erby is still in control of the company de facto, but if he is then planned investments into new businesses (especially crypto) doesn’t sound very promising and might explain part of the current discount to the expected post-settlement NAV.

Potential outcomes

- Best case scenario – preferreds settle and the company distributes all/part of cashback to shareholders. There is no reason for the company to remain public as is today. Who is exploring their strategic alternatives after all with management all but gone from the company?

- Situation is ripe for activism. Given Erbey’s DFS order, he is somewhat limited as to what he can do. However, as explained above, he could still be controlling AAMC management behind the scenes.

- The company uses their balance sheet to acquire another business – while the investments into REITs have so far paid off handsomely (potentially due to lucky timing), the outcomes on future investments might be different.

- The company simply trades closer to book value which should happen if and when a Luxor settlement is disclosed. Timing is uncertain but Putnam occurred in February which in theory should push this ball further down the road – the expected settlements and pref. stock overhang elimination should catalyze the narrowing of the spread between BV and the share price.

Seems like the market recognized this when the Putnam deal went through in Feb and share price went to 30 then quickly retreated. What is Luxor’s incentive to settle promptly at the same terms? Putnam has ‘favored nation’ status so they are free-rolling on Luxor’s settlement upside and getting cash in hand now without more litigation costs. AAMC should have to settle with Luxor at a premium to the Putnam deal all other things being equal.

Good point. What I wonder about is how easily Putnam obtained this settlement? How long was the litigation going for, and is that considered a short time frame or not?

Also turning the question around: how big of a Luxor settlement would it take to lose money at current $19.50/share price?

“The fact that Chatterjee was abruptly dismissed after the board recently awarded him with a substantial bonus after the completion of Putnam settlement seems quite strange.” Seems like he and current management were given a bribe by Putnam managers otherwise they wouldn’t get a dime out of AAMC.

I also don’t really understand why investors bought preferreds in 2014 – since preferreds had no rights and had no good perspectives?

If AAMC issued preferreds and they state:

“We issued 250,000 shares of Series A Convertible Preferred Stock, par value $0.01 per share, to institutional buyers in a private transaction exempt from the registration requirements of the Securities Act of 1933, as amended. This prospectus relates to the resale, from time to time, of up to 250,000 shares of our Series A Convertible Preferred Stock and any shares of our common stock, par value $0.01 per share, that may be issued upon conversion of the Series A Convertible Preferred Stock by the selling securityholders. We will not receive any proceeds from the sale of any of these securities that may be sold by the selling securityholders.”

Where did the proceeds from sale go to?

Worth noting that according to this press release Mr. Chatterjee was fired for a real cause, potentially a sexual harassment or something like that. I guess this is a small positive for the thesis as the dismissal wasn’t all that random and likely wasn’t a case of Erbey cleaning the management to put his man to the wheel.

https://www.globenewswire.com/news-release/2021/04/19/2212284/24694/en/Altisource-Asset-Management-Corporation-Terminates-Chief-Executive-Officer.html

@rc99ar, Luxor’s incentive is that they’re holding something with no value or rights and all the value is in the common equity. The incentive is to find some value and settle or not and hope a court sees things differently, but a court isn’t going to melt down a public common to satisfy an outstanding preferred with no rights IMO.

@sambor, no idea why they wanted to buy the Preferred in 2014, but that seems irrelevant to me now.

A new CFO (Stephen R. Krallman) was appointed to AAMC a few days ago. I found no connection between him and Erbey, which seems positive again. However, a pretty generous signing bonus, and $300k annual salary with up to 200% bonus seems quite excessive for a shell company. Makes me think to what extent they will really be able to control the cash burn going forward, especially if the company hires a few more executives.

https://www.sec.gov/ix?doc=/Archives/edgar/data/0001555074/000114036121022580/brhc10026327_8k.htm

https://www.linkedin.com/in/stephen-krallman-0977605/

AAMC out with Q2 earnings today.

They sold about 2/3 of their reit investments and paid off their margin loan.

$52mm in cash and about $40mm in equity investments (value probably down a bit since 6/30) on balance sheet.

I don’t see any updates about potential settlement with Luxor in quick 10q read,

however there is more talk about getting in to other businesses:

“the Company is in different stages of

discussion with several potential acquisition or merger targets including the fix and flip lending space, fee based real estate investment banking and

cryptocurrency related businesses.”

In addition to hiring a new (temporary) CEO and a new CFO the company has also (7/29) hired a new General Counsel, Kevin Sullivan.

Mr. Sullivan spent 15 years at Goldman Sachs. He has served as vice president and Senior Counsel at GS. His first day of employment is not until 9/20 and he is relocating to USVI.

Seems like a pretty solid hire, and he has to move to USVI. He must see something worthwhile (I’d like to think).

There is an 8k out today for AAMC, they have settled the Wellington portion of the preferred stocks for $2.1mm (in cash I believe), or about 11.5 cts on the dollar.

The face value of the Wellington preferred is $18.2mm?? I thought it was $15mm. Anyway the 8k says Wellington $18.2mm settles for $2.1mm, AAMC will show a gain of $16mm.

There is $150mm left with Luxor (and an affiliated fund?).

This would explain today’s strength in the stock.

Positive as another company agrees to settle. I would have thought Wellington would wait to see what Luxor gets but maybe they got tired of waiting?

Stock up $2 today because: “On August 27, 2021, Altisource Asset Management Company (the “Company”) entered into a settlement agreement (the “Settlement Agreement”) with certain funds managed by Wellington Management Company LLP (collectively, “Wellington”). Under the Settlement Agreement, the Company has agreed to pay Wellington approximately $2.1 million in exchange for $18.2 million of liquidation preference of the Company’s Series A Convertible Preferred Stock (the “Series A Shares”) held by Wellington. As a result of this settlement, the Company estimates an approximate $16.0 million gain will be recognized to additional paid in capital in the third quarter of 2021. The resulting outstanding remaining liquidation preference of Series A Shares will be $150 million.”

From 8K filed which states : “ On August 27, 2021, Altisource Asset Management Company (the “Company”) entered into a settlement agreement (the “Settlement Agreement”) with certain funds managed by Wellington Management Company LLP (collectively, “Wellington”). Under the Settlement Agreement, the Company has agreed to pay Wellington approximately $2.1 million in exchange for $18.2 million of liquidation preference of the Company’s Series A Convertible Preferred Stock (the “Series A Shares”) held by Wellington. As a result of this settlement, the Company estimates an approximate $16.0 million gain will be recognized to additional paid in capital in the third quarter of 2021. The resulting outstanding remaining liquidation preference of Series A Shares will be $150 million.”

This is about $.12 on the liquidation dollar, so I assume does not trigger Putnam MFN.

Luxor is the big piece of the puzzle, however.

With two down and one to go, I’m not sure how much leverage Luxor has. The bigger question to me is what will they do going forward – make an acquisition or return some of the cash?

Did someone mistake AAMC for AMC?

Up $5.25 today after being up big yesterday.

I found a March 2016 report about Luxor Capital.

Luxor Capital, a hedge fund, faced significant redemption requests in 2016 due to poor performance in 2015, and had to place four illiquid investments (including AAMC preferred) into a side pocket SPV for LPs who requested redemption.

https://www.reuters.com/article/us-hedgefunds-luxor-exclusive/exclusive-hedge-fund-luxor-capital-alters-terms-of-withdrawal-plan-idUSKCN0WU1SH

I guess Luxor should be very motivated to settle with AAMC, otherwise its ex-LPs would be very unhappy after a delay of more than five years in getting their money returned in full.

Now that Putnam and Wellington, two major asset managers, have both settled for 12 cents on the dollar, it should be quite safe for Luxor to settle on the same terms, without much legal risk re fiduciary duty. In fact, if they don’t settle as soon as possible, they are more likely to be sued by ex-LPs.

However, I found the price appreciation to >$25 today hard to understand, unless there is some non-public info re. imminent settlement with Luxor.

AAMC could be worth the full value of $33 in the end, but currently we have both the risk of Luxor holding up for much longer and the risk of AAMC management wasting cash on value-destroying acquisitions, both of which should be compensated with a large discount to $33.

Peaked at $26.66, up nearly $10 before retrenching back to $23 range. I sold some above $24 thinking this can’t signal a legal settlement since they would have held the 8k up, right?

I can’t find the New York case filings (though I can find the Virgin Islands case). I’m looking for Luxor Capital Group LP et al v. Altisource Asset Management Corporation, 650746/2020 in New York State, New York County, Supreme Court, Jennifer Schecter presiding, filed 02/03/2020.

Can’t find it by plaintiff or defendent name, or by index, or in Jennifer Schecters current cases, searching at:

https://iapps.courts.state.ny.us/webcivil/FCASMain

Anyone have a link to the case so we can see most recent filings?

Hit 30.50 today, I got out at $28. My thinking is that even when the final settlement is made that there is enough uncertainty around managements future actions that that it warranted a discount.

hi Dt, I am seeing generous holdco costs (legal, rental, G&A and salaries) of around USD 9-11m for every 6 months. If litigation falls away than it still would project as USD 6m per 6 months. Looks too generous to me. I know this has rallied so might all be moot but wondering if you had any thoughts. Thanks.

For a good YouTube summary of the AAMC thesis….

Andrew Walker (of Yet Another Value Blog) did a podcast on AAMC with Thomas Braziel (of 507 Capital) and Jeff Moore. I have not been following Jeff, but I am a big fan of both Thomas and Andrew and the ideas they have written up before. I think this episode provides a great summary: https://www.youtube.com/watch?v=0JojC9Cd13c

This VIC article (accessible with guest account) has a much more favourable view on AAMC and Erbey’s capital allocation skills.

https://www.valueinvestorsclub.com/idea/ALTISOURCE_ASSET_MGMT_CORP/6577489352

Knowing this, Luxor will be less likely to settle too early for too little?

Luxor may just wait for the injection of ForumPay business into AAMC.

Luxor is in a hurry, but Erbey is in a hurry too.

AAMC fell sharply in recent days to $21.6, after staying above $24 most of the time for almost three months.

Any views on the Q3 results?

Looks like management has converted AAMC into a special purpose acquisition company:

“All remaining equity securities were divested during the quarter. The Company is no longer an “investment company” as defined under the Investment Company Act of 1940, as amended, and expects to principally remain invested in cash and government securities until it commences new businesses.”

https://ir.altisourceamc.com/news-releases/news-release-details/altisource-asset-management-corporation-reports-third-quarter-7

Any idea about Erbey’s ownership percentage in ForumPay?

This number may be relevant for assessing the odd of AAMC’s acquisition of ForumPay, and the expected form of payment (cash vs AAMC stock) to Erbey, ForumPay founder, and other investors.

Firstly, let’s put this sell-off in perspective – a total of 20k shares traded over the last two days, equivalent to $0.5m of dollar volume. That’s c. 1% of market cap – AAMC is illiquid and likely to have wide swings to one side or another not necessarily reflecting any fundamental changes.

Now on Q3’21 results – the core investment thesis here remains the same expected settlement with Luxor. Having said that, it is not clear how much of the settlement expectation is already incorporated in the stock price and what should be the appropriate discount to NAV given ongoing large cash burn as well as pending settlement and M&A uncertainties. Some things from Q3 results are concerning:

– Legal and consulting fees continue to be expensed at very high levels, $3.7m during the quarter. Coupled with other admin expenses resulted in $5.2m charge against BV or more than 10% of the current market cap. Needless to say, at these levels any upside to NAV would evaporate in the coming quarters.

– Pending M&A – in the press release management explained that elevated expenses were due to the hiring of an investment bank and a law firm to assist in identifying potential M&A opportunities in crypto or brokerage. The sale of equity securities (now at least 2 months ago already) might have been done in preparation for a certain transaction and some kind of announcement might be imminent. It’s doubtful any M&A would be received with excitement by current AAMC shareholders who are looking at the company from a discount to cash perspective. However, Erbey had a good track record in growing businesses previously and might shine again, especially if he manages to buy something that attracts meme corwd (refer to VIC article linked in the previous comment for a super positive review of Erbey’s perspectives).

– As it has been 2 months since the quarter-end and no acquisition has been announced yet, it is probably reasonable to expect similar expense levels in Q4’21.

– I would expect AAMC to settle with Luxor before (or together with) the announcement of any acquisition – it might be harder to convince anyone to sell the business into a structure with preferred overhang, especially if part of the acquisition consideration is in stock or key employees of the target need to incentivized with stock options and etc. Obviously, that is probably far less relevant in all-cash deal between two financial investors.

The updated NAV calculations below. Deduct any expected cash burn since Sep from these numbers.

Looking back at the Sep’21 run up in share price (touching $31/share) after settlement with Wellington was a great point to close the case. Captain hindsight always helps. Snowball’s comment was spot on “AAMC could be worth the full value of $33 in the end, but currently, we have both the risk of Luxor holding up for much longer and the risk of AAMC management wasting cash on value-destroying acquisitions, both of which should be compensated with a large discount to $33.” Hope members had a chance to exit at elevated levels.

With shares back at $21 I am tempted to wait for an acquisition or settlement announcement. Interested in hearing other thoughts.

The preferred shares have been in the side pocket SPV of Luxor for almost six years.

I guess Luxor will prefer some upside optionality to just recovering some principal and winding down the account, now that it has already waited for so long.

So Luxor will likely prefer more stock vs cash in the settlement, and will likely ask to be involved in the acquisition process. The acquisition will likely be done simultaneously with the settlement.

There will be more dilution to equity as a result, but the new AAMC may actually look quite attractive after such a restructuring, with:

(1) Luxor and Erbey as major shareholders;

(2) No legacy assets;

(3) A new business and a new start, that is crypto related.

AAMC price fell sharply by 13% to $19 on Wednesday.

Less than 50k shares (or $1 million) changed hands, and most of them took place in the last hour.

I speculate it could be someone who had to liquidate (for unrelated reasons) before Thanksgiving (market will be closed on Thursday and open only half day on Friday).

The current price of around $20 implies that the market expect:

(1) Luxor and AAMC will settle for around 20-30 cents on the dollar. Or,

(if we assume all cash settlement, and re-rating to 1.0x NAV after the restructuring)

(2) Re-rating to 0.7x NAV after restructuring. Or,

(if we assume they settle for 12 cents on the dollar)

(3) A mix of (1) and (2), e.g., Lower recovery for Luxor but also lower P/B multiple .

I agree that they probably can’t get a deal done until the prefs are settled. As such, I think it makes sense to include some estimate of cash burn in your NAV calculations. I’d assume two quarters of cash burn. Also, you should factor in the very low probability of an unexpected ruling in Luxor’s favor that could bk AAMC. e.g a 5% probability x 100% loss = 5% = ~$1.50/share.

I can see the market getting hyped over a crypto-related acquisition; however, I struggle to see how they will complete a deal on attractive terms when they’re competing with hundreds of pre-deal SPACs that are on the clock and with massive incentives to do a deal. And a crypto deal would be heavily bid for imo.

My two cents.

AAMC’s edge in sealing a deal could be its size (only $85 million cash to spend). So it can go after a small start-up business.

Most SPACs probably won’t write checks of this small size.

But I am not sure whether this is positive or negative to shareholders, as a smaller crypto business likely has not gained much traction yet(could be just a dozen guys with a three month old business plan).

Trading halted!

What could “regulatory concern” mean?

https://www.nyse.com/trade-halt-current

New 8K out.

“On November 30, 2021, the New York Stock Exchange (the “NYSE”) notified Altisource Asset Management Corporation (the “Company”) that it was halting trading in the Company’s common stock as it had regulatory concerns about the Company’s compliance with the NYSE’s continued listing standards.”

Any ideas what this means and is this a signal that delisting to OTC is coming? Have not seen this kind of a sudden halt before due to concerns on listing standards.

I’ve never seen anything like this. I had thought that usually there was a headsup and it almost immediately would begin trading OTC. I wonder if this is an effect of those bizarre new SEC rules on OTC stocks.

I’m also wondering if someone got a headsup this was coming and dumped their shares last week.

SEC filing 1-4-22: “While the trading halt is in place, the Company understands that its common stock cannot be traded on any other exchange or in the over-the-counter market.”

https://www.sec.gov/ix?doc=/Archives/edgar/data/1555074/000155507422000004/aamc-20211230.htm

Maybe company just refuses to work on getting into OTC trading? Strange.

https://ir.altisourceamc.com/news-releases/news-release-details/altisource-asset-management-corporation-announces-settlement-0

Settlement with preferred holders at 11.5c per dollar.

https://finance.yahoo.com/news/altisource-asset-management-corporation-announces-145100844.html

Fund manager who owns 40k+ shares complained about management’s lack of explanation for the delisting, 3 days ago. Management merely replied “working on it”.

https://www.sec.gov/edgar/browse/?CIK=1555074&owner=exclude

Savage

For some reason I don’t feel bothered by this. I’m reminded of the notion that one shouldn’t care if the market closed for a long while.

I am not worried either, if the whole market is closed for a year.

But it’s a totally different matter if the market remains open for every company but one.

I’ve not seen any precedent like this in the past decade, but the company has remained silent as if this were not uncommon.

AAMC expects to begin trading on Monday, March 21!!! Conference call also Monday 5am pacific time.

“AAMC has created a new alternative Lending Group with an initial capital caommitment of up to $40mm.”

“AAMC has hired Jason Kopcak as its president and CEO to lead the new Alternative Lending Group”

Also: “AAMC has secured an opportunity in crypto-enabled ATMs with a right of first refusal with ForumPay”

No mention of Luxor and the rest of the preferreds.

Who knows, might be good!

For members’ convenience: https://finance.yahoo.com/news/altisource-asset-management-corporation-announces-193400213.html

And conference call info:

Conference Call Information

Management of AAMC will host an investor call on March 21, 2022, at 8:00 a.m. EST to discuss the investor presentation which is available on http://www.altisourceamc.com. Please submit any questions in advance of the call to ir@altisourceamc.com prior to 3:00 p.m. EST, Sunday, March 20, 2022.

For those who wish to participate, the domestic toll-free access number is 1-877-270-2148, or for international callers, 1-412-902-6510. A telephone replay will be available shortly after the call and can be accessed by dialing 1-877-344-7529, or for international callers, 1-412-317-0088 (Replay Access Code: 2196424). We will also host a live webcast of the investor call on http://www.altisourceamc.com.

Can someone explain this sentence from the presentation on the new ALG lending business? (slide 6)

“Anticipated sales of acquired and originated loans are assumed to be facilitated through forward commitment contracts, with the loans turning on average every 15-30 days”

Is this a very short-term duration lending?

https://ir.altisourceamc.com/static-files/f83cb4d5-2eae-4515-8027-e8d8ae14e5b7

Not sure about this sanguine idea that the preferred is “completely neutered and is basically worth close to zero.” AAMC and Luxor have crossed swords only once on the merits, in briefing on a Luxor attachment order in 2020 that was subsequently withdrawn for unrelated reasons. You can read the filings here:

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=dPRDDSrzO_PLUS_tS/KGVxy5aAA==

https://iapps.courts.state.ny.us/nyscef/ViewDocument?docIndex=sltLQ_PLUS_iziaW_PLUS_pZt3jha28Q==

Seems Luxor has a rather colorable argument that AAMC’s interpretation is, in a word, absurd.

To be sure, I agree that the Wellington and Putnam settlements at 12 cents on the dollar suggest those investors didn’t put much stock in the legal case either — but whether that’s because of a weak legal position, or that those investors were simply happy to get any cash off a sinking ship, isn’t so clear. Luxor certainly seems to be fighting this tooth and nail: the parties are now deep in discovery, fighting over docs and privilege and so forth.

The real driver of settlement may simply be that Luxor faces a bit of a winner’s curse: win and AAMC goes BK. Almost a game of chicken. But how that pencils out to a final settlement number is unclear.

JESQ, you said, regarding Putnam and Wellington settlements,

“but whether that’s because of a weak legal position, or that those investors were simply happy to get any cash off a sinking ship, isn’t so clear.”

Wellington’s settlement was for $2.1mm in cash, but Putnam’s much larger settlement was 70% in AAMC stock. Why do you think Putnam took such a large amount of stock “off a sinking ship”? I believe (although I can’t be sure) that Putnam could have received the entire amount in cash if they had preferred to.

Although they probably regret that choice now.

I can’t figure why Luxor doesn’t take the whole settlement in stock now, with AAMC price now at $9.80.

If Luxor received $144mm * 12% = $17.28mm settlement value/$9.80 per share = 1,745, 454 shares.

If AAMC went to $20/shr on this news their stock would be worth $35mm.

If AAMC went to $30/shr it would be worth over $50mm.

I don’t see the benefit of continuing to fight/litigate.

@GypsyP

Wouldn’t the share issuance halve the share price? (Ignoring the re-rate)

BV as 3/31/22 is about $70mm.

2mm shs o/s plus 1.75mm shs = 3.75mm shs

$70mm/3.75mm shs = $19/share BV.

Stock would trade up b/c big liability (the pfd shs) would be removed. Might trade over BV if they can execute on their other businesses.

Why do you think Putnam took 70% shares instead of all cash in their settlement?

@GypsyP

Got it, thank you.

Price down steadily from $15 to $10 now since trading resumed on 3-21. Any updates on our target price of $30?

News today about directors and officers buying shares, but only a total of 10k shares, so probably just for show.

https://finance.yahoo.com/news/altisource-asset-management-corporation-announces-122500628.html

AAMC reported its Q1 2022 results providing very little incremental information on the new business except that the company has made an initial commitment of up to $40m for the purchases and origination of ALG’s mortgage loans. As of March’31, AAMC acquired a total commitment of $18.5m in loans, of which $17.8m was outstanding.

The company also secured a right of first refusal with the technology company, ForumPay, to deploy crypto-enabled ATMs/Kiosks worldwide. AAMC has earmarked up to $2.0 million initially to fund both the acquisition of ATMs and build the operational capabilities of the business line.

Luxor litigation saga is still continuing and AAMC is preparing new litigation against its former director (Partner at Luxor Capital), Nathaniel Redleaf, and Luxor Capital for breach of fiduciary duty and a contract. Not sure what to think of this, no further details were provided.

As of March, AAMC held $54.3m in cash, net of the $17.8m spent on the acquired loans.

https://www.bamsec.com/filing/155507422000025?cik=1555074

GypsyP, my brain ran right over the fact that 70% of the Putnam deal was common share issuance. I agree that militates against my comment that “maybe the settling Ds were happy to get cash from a sinking ship,” and towards the Putnam settlement being a bit more about the merits (which I have not done a deep dive into yet).

I do want to echo jwestern’s point that the Putnam settlement (and thus presumably any similar Luxor settlement) involved dilutive share issuance.

If the common keeps trading at 10.35$ a 70/30 common/cash settlement with Luxor would not seem too exciting (10-15% return given a 12% settlement ratio as used above). Or have I missed something here?

Please disregard that comment of mine above. Mistakenly left out the acquired loans in the valuation.

A nice overview from Jeffrey Moore of recent developments with AAMC.

– On April 22nd, AAMC announced that it intends to sue its former director and partner at Luxor for insider trading and a breach of fiduciary duty. This may incentivize Luxor to finally settle with AAMC. The timeline for settlement may be as close as July 19 when summary judgment motions must be submitted.

– On June 3, AAMC received a deficiency letter from NYSE. The author believes that the reason was insufficient stockholder equity – should be at least $2m-$6m if the company reported losses from continuing operations in the last 2-5 fiscal years. He is optimistic that the company will resolve this as soon as it settles with Luxor.

– Author sees the recent sell-off as a result of “investor exhaustion” because of NYSE delisting back in November and Luxor settlement taking far longer than might have been expected initially.

– On the business side, the mortgage lending business seems to be growing and should thrive in a higher interest rate environment.

https://seekingalpha.com/article/4519876-altisource-developing-value-lending-space-stock-down-on-lawsuit-risk

AAMC price down to $4.60 in after-hours trading? I don’t see any new filings for AAMC or Luxor Capital Group on the SEC website…

I see it at $9,11. General market turmoil?

CHRISTIANSTED, U.S. Virgin Islands, July 22, 2022 (GLOBE NEWSWIRE) — Altisource Asset Management Corporation (NYSE: AAMC) announced today that it purchased 286,873 shares of its common stock from Putnam Focused Equity Fund, a series of Putnam Funds Trust, at $10 per share.

“This is a unique opportunity for the company to purchase its common stock below its trading price, which we believe provides excellent value to our shareholders,” said Chief Executive Officer Jason Kopcak. “This transaction reflects our confidence in the new direction of the firm and we look forward to updating our shareholders and the market on recent developments in our business.”

https://ir.altisourceamc.com/news-releases/news-release-details/altisource-asset-management-corporation-announces-repurchase

Closed the trade at 16.50$. Let’s see if that was the right decision.

I have decided to close AAMC case on SSI. The last 3 days saw +50% spike in the share price, which was triggered by the repurchase of 286k shares (14% of the company) from Putnam. That is a big positive in itself, but the shares are already trading 70% above the $10/price at which Putnam agreed to sell. Even if Putnam was not a natural holder of these commons, I doubt they would have sold if there was a clear path to $20/share.

That’s the main reason for the exit – people with more info than me agreed to exit at much lower prices. The secondary reason is I do not feel comfortable by AAMC launching new businesses and have kind of regretted not selling when the trading resumed at $17/share. Now i have the opportunity to do that again, thus my decision.

Maybe there is an imminent settlement with Luxor and maybe shares are spiking upwards on that expectations. Have no idea about that. But even if there is a settlement, the remaining upside from $17/share is way lower than what we had just 3 days ago.

Closing this at the write-up prices, 0% return in a year-long holding period.

Niel, thanks for sharing this idea, and let us know if you have a different take on the situation.

Looks like AAMC is going to be buying back some shares: https://ir.altisourceamc.com/node/9831/html

I wonder if Luxor settlement is near? Or if something else may be coming.

Not an active idea anymore, but FYI, AAMC prevailed in the NY appellate court this morning. The court found the contract was “unambiguous” in favor of AAMC’s reading, and directed judgment to be entered for AAMC.

does anyone know why it’s trading so high? I know they are getting into private credit but a new line of business + luxor overhang isn’t necessarily a homerun…

All you had to do was ask ;o)