Semapa (SEM.LS) – Going Private – Upside TBD

Current Price: €11.68

Offer Price: €11.66 (expected to be increased)

Upside: TBD

Expiration Date: TBD

This idea was shared by Pedro.

Semapa – a holding company listed in Lisbon and tradeable on IB – is in the process of being taken private by its largest shareholder at a very low valuation. The remaining shareholders are unwilling to sell at the offered price, suggesting there is a high chance of an improved bid.

Family-owned investment vehicle Sodim owns 81% of Semapa (and 83% of voting rights) and is now attempting to take the company private at €11.66/share in cash – at this price the buyer would be receiving the unlisted Semapa assets at a negative valuation. Two largest shareholders and reputed value investing firms Bestinver and Cobas AM (own 5% combined) have rejected the offer, publicly stating that the price is unacceptable, while another 2% are owned by Norges Bank, which has a cost basis above the offer price and will also likely not sell.

A privatization tender offer expired on the 4th of June and, as expected, Sodim increased its stake only from 73% to 81% (partly through open market purchases while the tender was ongoing) and failed to reach the minimum 90% voting control threshold necessary to carry out the delisting. The buyer has now announced an open market purchase running from the 8th to the 15th of June aiming to acquire the remaining shares at the same €11.66/share price.

Given that most shareholders are clearly dissatisfied with the price it’s unlikely that the buyer will manage to collect enough shares during this week. Therefore, the bet here is that after the current bid in the market expires on the 15th of June, Sodim will continue to pursue its opportunistic privatization attempt and will eventually be forced to increase the price for a second time to persuade Semapa shareholders into selling. There is substantial headroom for positive price adjustment from a valuation perspective.

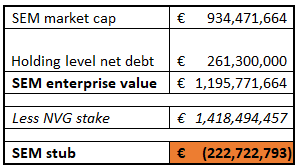

At the offer price of €11.66/share Semapa appears very cheap from SoTP perspective – excluding its main listed holding (69% ownership of Navigator) the two remaining high cashflow generating businesses carry a negative €222m valuation. It’s no surprise that the buyer looks strongly motivated to privatize Semapa now and has already increased the price once (see more in the timeline below). One of the interesting things of note is how in the recent press release Sodim tried to persuade SEM shareholders to sell shares by suggesting them to buy Semapa’s major holding The Navigator Company instead (PR):

Sodim reminds that, with this Offer, it intends to concentrate the Group’s presence in the market through its main participated company, The Navigator Company, S.A. (“Navigator”) and to provide to Semapa’s shareholders a liquidity event and an exit premium that is relevant in light of the market price (ref. Prospectus) also allowing the shareholders who wish to do so to reinvest in Navigator. Sodim reminds that between 2016 and 2020, Semapa’s market performance presented a correlation of 0.97 with that of Navigator, which in turn presented in the same period dividend yield and liquidity levels (measured by the daily trades average volume) respectively 2.3 and 4.5 times higher than those of the Semapa share.

The argument doesn’t make much sense but clearly highlights how desperately Sodim tries to cover up the low-ball offer price.

If the bet doesn’t work out – i.e. there is no higher offer – the downside seems protected. Assuming the buyer somehow manages to reach 90% threshold (unlikely) and squeezes the remaining shareholders at the offer price, losses is negligible. If the threshold is not reached and the buyer withdraws its current offer for the remaining shareholders, then in the longer term the stock provides exposure to an undervalued, family-owned industrial group in which the majority shareholder appears motivated to unlock value and has been buying in large quantities at current prices.

Short timeline

- 18th February 2021 – Sodim expressed intentions to launch a tender offer for the remaining shares at €11.40/share in cash. At the time, the buyer held 72.7% of SEM shares.

- 12th April – the offer was revised to €12.17/share (6.7% increase), including €0.512/share dividends (record date has already passed).

- 26th April – offer prospectus was released. The offer was launched on the 27th of April with an expiration date on the 25th of May.

- 25th May – expiration extended to the 4th of June.

- 1st June – the buyer waived the 90% condition and agreed to accept all tendered shares. At the time, 7.7% of shares tendered in the offer and 1.1% additional shares were purchased in the open market. The buyer controlled 80.7% of shares.

- 7th of June – tender resulted in Sodim owning 81.3% of SEM shares. Open market purchase at €11.66/share from the 8th to 15th of June was also announced.

Current order book shows Sodim’s open market bid for the remaining 12m shares.

Semapa background

Semapa is an industrial group founded in 1991 by the Portuguese industrial family Queiroz Pereira, later listed in the Euronext Lisbon in 1995. The group has evolved to become a portfolio of industrial assets that includes:

- The Navigator Company (69% stake, 60% of consolidated EBITDA adjusted to remove portion not owned by Semapa): integrated paper & pulp producer leader in bleached eucalyptus kraft pulp in Europe; listed in the Euronext Lisbon, the company focuses on office paper (68% 2020 revenue) and pulp sales (11%) but has been diversifying into tissues (10%) and also sells co-generated energy (10%);

- Secil (100% stake, 37% of consolidated EBITDA): cement producer with 9,750 K ton cement production capacity and operations across Portugal (72% of Secil 2020 EBITDA), Brazil (17%), Tunisia (10%), and Lebanon and Angola (2%); the company grew revenues and EBITDA 8% and 13% p.a. 17-20 on a constant FX basis, respectively, but suffered from large devaluations in the Lebanese pound and Brazil Real, resulting in actual revenue and EBITDA growth of -3% and +9% p.a.

- ETSA (100% stake, 3% of consolidated EBITDA): waste management and food / animal protein recycling company with residual contribution to the Semapa portfolio.

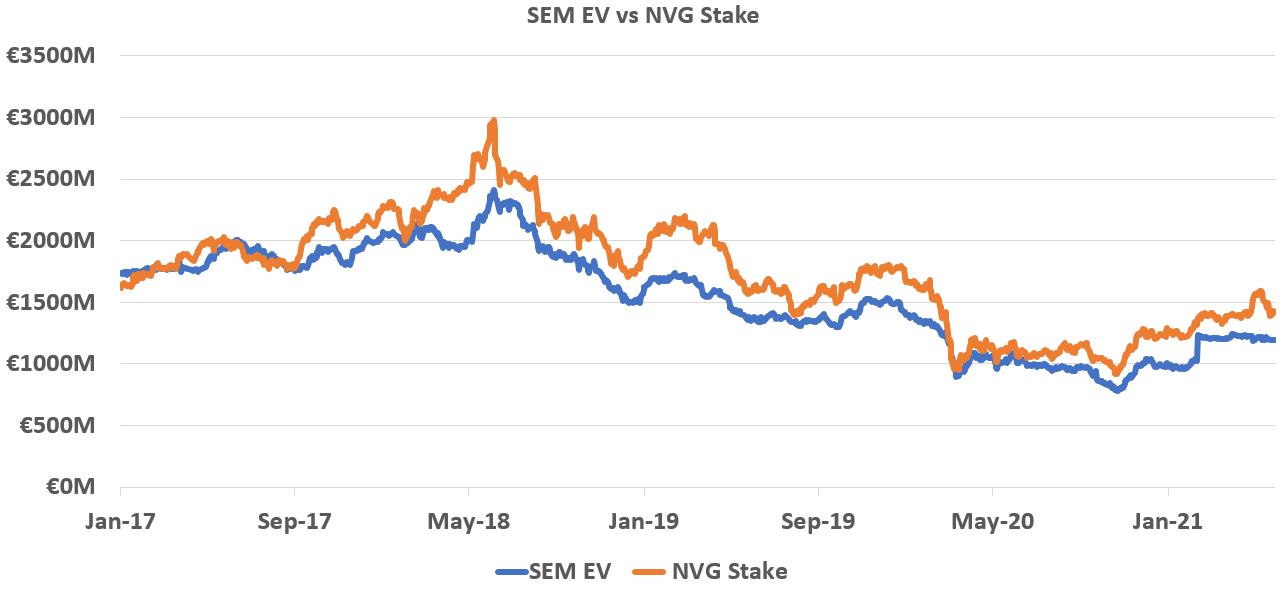

Till 2017 Semapa used to trade at a slight premium to its NVG stake, however the discount appeared in 2018 coinciding with the passing away of chairman Pedro Queiroz Pereira and general weakness in Portuguese paper & pulp stocks (see graph below).

Valuation

Excluding the 69% NVG stake, the market and Sodim are currently valuing Semapa stub (Secil and ETSA) at a negative €222m. Keeping in mind that these businesses consistently generate plenty of cash and that at a hold-co level Semapa only burns €10-€13m annually, such holding discount seems to be unwarranted.

Secil and ETSA generated on average €90-100m of EBITDA and on average €50-60m of cash flow over the last 8 years. In 2020 the performance was even better – €134m EBITDA and €112m FCF, but given the company’s cyclical and commoditized nature I believe looking at long-term average earnings power is safer. At a conservative 6x EBITDA multiple and less the subsidiary-level debt the equity of these two businesses is likely to be worth at least €300m+. So even after deducting capitalized hold-co level cash burn (let’s say -€100m), there is still considerable equity value left – instead, Sodim wants to get these assets at a negative €220m, leaving plenty of space for an improved offer to convince the remaining 19% of Semapa shareholders.

Secil has more leverage than the typical cement peer, however, this does not seem enough to justify the discount as distress risk appears limited (3x ND / EBITDA, 4x at the Semapa consolidated holding level, with well-distributed maturity profile and +€1B in available liquidity between cash and undrawn commitments). Western Euroepean cement peers are trading at around 6x EBITDA. Peer multiples are directional as taken directly from Bloomberg, but the point remains that relative undervaluation is significant.

While the stub is clearly undervalued, I believe the market is valuing Navigator at a relatively fair price – the company is trading at 7.5x its 8-year average EBITDA (2020 EBITDA suffered from the impact of Covid on office paper). This is not far from its historical valuation and looks fair for a business that earns ~10% return on capital, grows at most with GDP, and suffers from the overhang of the long term decline in demand for its key product, office paper. As such, one may potentially consider shorting partially or fully the exposure to Navigator as part of this trade.

The stub businesses have also performed better than Navigator during Covid lockdowns. During 2020 NVG was impacted quite strongly due to fall in paper consumption and temporary factory shutdowns – in 2020 revenues went down 18% and EBITDA 23% YoY. Secil and ETSA, performed much better. In 2020 Secil’s revenue decreased 12% YoY, mostly due to negative FX impact, whereas EBITDA went up by 15%. ETSA was largely unaffected (essential services) and showed 30% YoY EBITDA growth YoY 2020. Same trends continued in Q1’21 – paper demand remained in line with Q4’21 and partly due to certain maintenance shutdowns NVG again reported 16% YoY revenue drop and 20% EBITDA decrease, whereas Secil showed 3% revenue and 17% EBITDA growth YoY, while ETSA – 15% revenue growth and 29% EBITDA growth YoY.

Risks

Shorter term, I view risk as limited – one could always sell to Sodim at the current offer price, resulting in minimal to no loss. If the bid fails and Sodim does not make a new, higher offer, holding Semapa for the long term carries more risk, despite the undervaluation and well-aligned majority shareholder, namely:

- Exposure to the Portuguese construction sector (70% of Secil EBITDA);

- Potential for further deterioration of the economies of Lebanon, Tunisia, and Brazil and/or further currency devaluations (30% of Secil EBITDA);

- The decline of office paper (70% of Navigator’s sales) may occur faster than expected, preventing firm from diversifying its operations in time;

- Governance – management seems to disregard the interest of minority shareholders in favor of the family – e.g. biased support of the Sodim bid.

Sodim acquired another 374,558 shares of Semapa on the open market between 8 and 5 of June. Not much.

“Sodim informs the market that, between 8 and 15 of June, both including, it acquired, under the Order, 374,558 shares representing the share capital of Semapa which add to the shares acquired during the Offer, thus representing, in aggregate, 10.054% more Semapa voting rights than those held at the date of the launch of the Offer. ”

https://www.semapa.pt/sites/default/files/comunicados/Comunicado_Semapa_OPA%20Sodim_EN_1.pdf

Indeed. They are far from the 90% threshold. I believe the biggest risk right now is them trying to launch a dilutive equity raise to dilute the minority holders and reach the 90% (happened with another Portuguese company recently). With that said, in my view, the presence of some large institutional holders should prevent that and force them to increase the bid if they do want to take the company private.

I am thinking when will be the right time to start the short leg of the trade (i.e. pairing the long Semapa position within a short Navigator position).

I think adding the short leg is more appropriate for a long-term convergence trade than the current event-driven thesis.

If we are betting on a higher offer from Sodim, then a short leg on Navigator may actually introduce more and unnecessary volatility to the trade:

For the next several weeks/months until Sodim decidedly communicate against a new offer , Semapa price will respond mostly to the changing odd of a higher offer (and detached from volatility in Navigator price for a while), while only the short leg will respond to conditions in the Navigator business.

Maybe a deep out of money put on Navigator (or other more liquid European peers) may be more appropriate as a tail insurance against collapse in the paper & pulp market?

Good point, I agree the short is optional given the short term nature of the thesis and the fact that it is unlikely that Navigator will experience very large fluctuations in value – the outlook for the pulp market is good (tight supply due to capacity that was reduced in 2020 / machines that were stopped) and since Navigator is an integrated player (i.e. produces own pulp, and in fact they usually sell some excess over their needs for paper production) it should fare well in this environment.

If this trade works out, are you expecting to owe capital gains taxes to Portugal? It looks like Portugal taxes non-resident capital gains at 28%.

disregard, the prospectus covers this pretty clearly

jk3, can you share your findings please? 🙂

open the prospectus included in the write up. Go to page 36. tldr: Portugal taxes non-resident capital gains at 28% unless there is a tax treaty between your country which reduces the rate. If you live in a “tax haven” your Portuguese capital gains are taxed at 35%.

I would expect most countries to have tax treaties with Portugal but not sure and I am not a tax adviser. This should be clearly stated online if you search for your country. It is true that if you are resident in a tax haven you suffer tax penalties – there is a list of these countries somewhere online but from what I recall it is only places like Cayman, Bermuda, Channel Islands, etc.

Are there any updates or ideas on this? Seems like since the deal fell through, the market has not been pricing Semapa as though Bestinver and Cobas will be able to negotiate something better for us. The stocks just keeps dropping. Wondering if I should close this and assume failure?

I think it is likely that management is working on a new offer, because even if they increased the price substantially it would still be a good deal – both the pulp market and construction in Portugal are booming, so it is likely that both Secil and Navigator will report good results going forward. Even if this is not the case and there is no new bid, I would argue the shares are good value as they are trading below a price that the majority shareholder, who has all the information, thought was attractive enough to try to buy the company at. I would say the main risk is management trying to dilute the ownership of the minority shareholders through an equity raising, but I would hope the presence of large institutionals would prevent that from working.

Semapa is currently trading at nearly 10% above previous tender offer price. Any new development?

Navigator’s shares have jumped 7% after a strong earnings report and are continuing their uptrend since last November. In contrast, Semapa’s stock has been moving sideways since February. The market seems to be valuing the remaining Sepama’s stub ever more pessimistically – currently at a negative €450m.

Although valuation wise Semapa appears even more attractive now than at the time Pedro shared this idea, there have been no updates from Sodim regarding the buyout of minority shareholders. So it’s not clear how much more time will be required for the thesis to materialize.

A quick overview of Q3 results:

Navigator has been the best performer with solid Q3 results:

– €404.9m revenue in Q3 vs €373.9m past quarter and €348.4m in Q3 2020, mainly due to the recovery of paper volumes and improved pulp prices.

– €95.5m EBITDA in Q3 vs €79.9m past quarter and €70.4m in Q3 2020.

The remaining 2 “free” stub businesses:

Secil (cement production and other building materials) performance was a bit weaker YoY but strong vs sequential quarter. The results were impacted by FX, and market pressure to lower sales prices:

– Revenues of €128.8m in Q3 2021 vs €124.7m last quarter and €149m in Q3 2020

– EBITDA of €40.1m in Q3 2021 vs €33.8 in last quarter and €48.9m in Q3 2020

Etsa (waste management) is continuing steady growth:

– Revenues of €10.2m in Q3 2021 vs €9.2m last quarter and €7.7m in Q3 2020

– EBITDA of €4.3m in Q3 2021 vs €3.8 in last quarter and €2.7m in Q3 2020

https://www.semapa.pt/sites/default/files/comunicados/2021%2011%2004%20SEM%20PR%209M%202021%20EN%20VF.pdf

Semapa issued Q4 results and the company continues to trade significantly below its sum of the parts. Excluding 69% stake in listed Navigator (NVG.LS) the remaining businesses are trading at a negative Eur540m EV. Still no updates from Sodim regarding buyout of minority shareholders.

These remaining businesses (Secil and Etsa) delivered great results with continued growth in revenues and EBITDA. Both segments are profitable on both EBITDA and net income basis. Navigator also continues to grow revenues and improve profitability and is trading at only 15xPE for 2021 ernings.

Semapa holdco net debt has been reduced to $175m and the company is proposing a dividend of Eur0.51/share, a 4.5% yield.

https://www.semapa.pt/sites/default/files/comunicados/2022%2002%2018%20SEM%20PR%2012M%202021%20EN%20VF.pdf

Semapa’s share price volatility has increased during the last month as a result of run-up in Navigator share price as well as resumed coverage of Semapa and Navigator by JB Capital Markets. The analysts put a price target of Semapa at €20.10/share vs the current price of €13.1/share and for Navigator – €3.90/share, which is around the current price levels.

https://www.jornaldenegocios.pt/mercados/bolsa/research/detalhe/jb-capital-retoma-cobertura-da-navigator-e-semapa-ve-valorizacoes-de-6-e-62

Semapa’s share price has appreciated around 10% during the month, however, due to even swifter price increase in NVG.L, the remaining stub value dropped even further to negative €580m.

Semapa remains cheap, trading at a negative -€600m Enterprise Value excluding its main public listed asset (NAV.LS).

Q1’22 results showed continued strong performance across all segments. The stub businesses that trade at negative EV have actually generated €33m in EBITDA during Q1’22 or €154m during the whole of 2021.

https://www.semapa.pt/sites/default/files/comunicados/2022%2005%2027%20SEM%20PR%201T%202022%20EN.pdf

I continue to be puzzled by where the SEM.LS stock is trading, but at least it is up +37% from the write-up levels. Stock might trade down again if NAV.LS shares start declining – Navigator seems to be close to fairly valued at 10x 2021 EBITDA – albeit Q1 showed strong growth with revenues +44% YoY and EBITDA +72% YoY. It seems the only thing that can close this valuation gap is another offer from the controlling shareholder Sodim (no further updates on that).

We are removing Semapa from SSI Active ideas and closing it in the tracking portfolio. The company is still very cheap trading at a negative EV excluding its main publically listed asset (albeit the discount has somewhat narrowed over the last couple of months). However, there is no catalyst to close the valuation gap. More than a year has passed from the controlling shareholder’s attempt to take the company private, and there has been no further news on this.

18% gain over one year.

Pedro, thanks again for sharing this and let us know if you have a different view on the situation.