Wheeler Real Estate Investment Trust (WHLRD) – Expected Tender Offer – 19% Upside

Current Price: $15.95

Target Price: $19.00+

Upside: 19%

Expiration Date: Q3/Q4 2021

This idea was shared by Alan.

Nano cap grocery stores REIT Wheeler Real Estate Investment Trust has recently completed its rights offering raising $29m of net proceeds. The company intends to use the cash to repurchase its Series D preferred stock (Nasdaq: WHLRD), which is a major overhang to WHLR balance sheet due to its 10.75% cumulative dividends, $32.27/share liquidation value and Sep’23 redemption date. Management has already completed two tender offers for the series D preferreds this year – both with a price range of $15.50 – $18.00/share. The last tender was for $12m (21%-25% of D pref shares), but ended up extremely undersubscribed – only 15.5% of the intended amount was repurchased. Management is highly incentivized to eliminate the existence of WHLRD at a discount to liquidation value as soon as possible. Hence, I expect that the upcoming offer will be much larger than the previous two as the company might use most of its $40m cash balance for this purpose. The price might also be set higher to persuade shareholders to tender. Shares are currently trading at $15.95/share, while during both previous tenders, it was hovering around the upper limit price of $18/share. Even if the consideration remains unchanged from the previous two offers, the risk/reward seems very favorable at the current price levels.

The show is run by a prominent hedge fund manager Joseph Stilwell (director), who made his name with numerous activist campaigns in the financial sector. Stilwell owns 13.2% of common shares. Besides him, other top 6 shareholders own around 56% of WHLR shares, which includes prominent ex-fund managers like Daniel Khoshaba (KSA Capital, now defunct) with 11% and Richard S. Strong (Strong Capital Management, now defunct) with 9.7%. So common shares are tightly held and investors at the front seem competent. Given how highly accretive WHRLD buybacks are, I expect there to be no unexpected hurdles in the process. The tender offer should be announced shortly, within a few weeks’ time.

Background

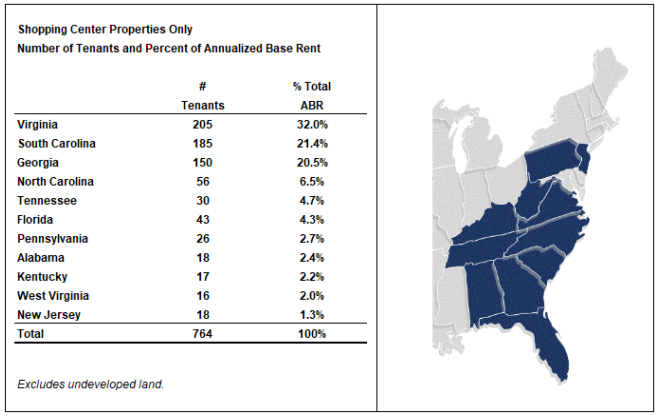

At the moment the company owns 59 shopping center properties:

Wheeler Real Estate Investment Trust IPO’ed in 2012 at $42/share (adjusted for a 1 for 8 reverse split in 2017) vs current price is $3/share) under the management of Jon Wheeler, who over the years proved to be one of the most impressive self-dealers and shareholder value destroyers I’ve seen. After the IPO the company has engaged in numerous value-destroying and dilutive transactions aimed to expand WHLR property portfolio (and management fees) at the cost of common shareholders. By 2017, the common share count has increased by almost 21x since the listing. Luckily, in mid’17 Joseph Stilwell begun an activist campaign and managed to oust Jon Wheeler. Even then, the company was still moving in the wrong direction under the new CEO, so in 2019 Joseph Stilwell got 3 board seats and gave the CEO role to Daniel Khoshaba (former manager of the hedge fund KSA Capital). Khoshaba owns 11%. Since then, they’ve been trying to turn the company around. Recently, in July, Khoshaba resigned from the CEO position and the board for personal reasons. He was replaced by the previous Wheeler COO.

One of the worst overhangs left by the legacy Wheeler’s management is the issuance of Series D preferred stock in 2016/2018. WHLRD has a liquidation value of $25/share and an interest rate of 8.75%. Since the end of 2018, the company has suspended all dividend payments in order to strengthen its liquidity. Unpaid dividends are now accruing at 10.75% or $2.69/share annually. The current liquidation value (including unpaid dividends) stands at around $99m or $32.72/share. D pref. shares can be converted at the option of the holders to common shares at a price of $16.96. On September 2023 WHLRD holders can force the company to redeem its shares for cash, stock, or a mixed consideration (as I understand at the option of the company). Stock consideration will be calculated using 10-day VWAP of the common shares. If this happens, Series D holders would become majority owners of the company.

Aside from that, the company also has around 9.7m of common shares (WHLR) and 1.88m series B preferred shares (WHLRP). B shares have a 9% interest rate and no redemption date. Dividends have been suspended since the end of 2018 as well. The current liquidation value stands at around $59m or $31.56 per WHLRP share.

Recent events

Management has been open about the threat of WHLRD redemption date and since Dec’20 has been continuously raising cash in order to repurchase D pref. shares at a discount. Quote from the recent rights offering:

There is a significant risk that we will not have sufficient cash to pay the aggregate redemption price, and would not be able to meet our redemption obligation without liquidating assets and/or substantial dilution of our Common Stock, which in turn would significantly reduce the value of any Common Stock paid to settle the redemption amount.

- 23rd of Dec’20 – the company raised $25m at a 13.5% interest rate + 0.5m common stock warrants exercisable at $3.12/share in order to repay KeyBank loan ($4.4m, maturing in Dec’20) and tender for WHLRD.

- 23rd of Dec’20 – tender offer for $19m (30%-35% outstanding) of WHRLD shares was announced. The price range was set for $15.50 – $18.00 per share. The expiration date was the 25th of January.

- 26th of Jan – the offer was amended to $20m and extended until the 16th of February due to oversubscription (1.5m shares had tendered, 43.5% of outs.).

- 17th Feb – surprisingly, the offer was amended one more time – to only $6m in size and extended until the 12th of March. The remaining proceeds from the $25m loan were decided to cover certain debt maturing in 2021.

- 12th of March – 387k shares accepted (11% outstanding) at the lower limit of $15.50/share.

- 12th of March – WHLR raises $35m at 8% + 1m warrants (ex. at $3.43, $4.13, and $6.88/share in tranches) to repay the previous $25m loan and make another tender for WHLRD.

- 19th of April – tender offer for $12m of WHLRD is announced (21%-26% oust.) for the same $15.50-$18.00 per share consideration.

- 17th May – the offer was heavily undersubscribed and the company repurchased only 103k shares (3.3% outs.) for $1.86m. The final price was set at the upper limit.

- July 22nd – announced the commencement of the rights offering. Common share stockholders received the rights (1 right for 8 shares) to purchase 7% senior notes for $25/share. Senior notes will trade on Nasdaq under the WHLRL ticker.

- 13th of August – rights offering expired. Out of the $30m raised, $6.3m were raised from the basic subscription, $21.5 from the over-subscription (shareholders were able to purchase additional remaining shares), and $2.2m from the backstop parties. So it seems that only 20% of shareholders were interested in the notes and were ready to pick up the remaining non-exercised rights.

During the recent rights offering, the company made it clear that it will use the proceeds primarily for WHLRD buybacks.

We intend to use the net proceeds of this Rights Offering for one or more of the following: repurchases of our Series D Preferred Stock; repurchases of our Series B Preferred Stock; repayment of our outstanding indebtedness; purchases of real estate assets; or working capital.

Accretion of WHLRD buybacks

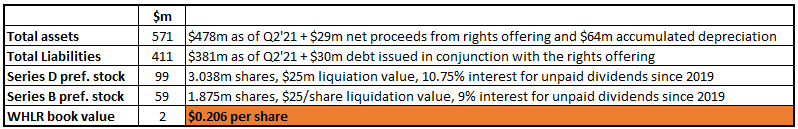

At the moment, Series D share overhang nearly pushes common shares under the water. The table below shows current WHLR book value calculations:

Keep in mind that from now until Sep’23 WHLRD will accrue another ~$18m of unpaid dividends.

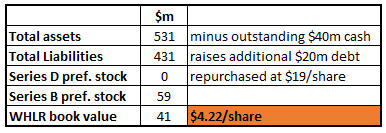

To illustrate the accretion of the repurchases, let’s say if the company manages to buy back all of the remaining WHLRD shares at $19 per share (by using exiting cash and taking on additional debt). This way, the common share book value would instantly skyrocket from $0.206 to $4.22/share:

Risks and other thoughts

- Management could keep the same price range and/or the offer could get oversubscribed and priced at the lower limit (below the current price). I don’t think either of these is likely. The upcoming offer should be very large and management is unlikely to risk another failed tender offer (as happened with the last tender). Aside from that, the company has been successfully recovering from the COVID impact and recently announced positive Q2 results – % of space leased is now at 91% (above pre-COVID levels) and property NOI is now in line with pre-COVID. Judging from the share price movement of peer grocery REITS, the overall industry situation has also been quite stable/improving since the last tender offer. WHLR share price fall in early July is explained below.

- The recent exit of Daniel Khoshaba (ex-CEO) is quite strange, however, no details have unveiled regarding that except that it was done for personal reasons. Interestingly, just two months before the announcement, in May, he bought 33k shares at $4.17/share, significantly above the current price. He was clearly one of the main persons to drive WHLR turnaround and WHLR plummeted 20% on the news (5th of July, see graph above). Khoshaba’s exit might incentivize more WHLRD holders to exit in the upcoming tender offer.

- Management owns common stock and seems to have converted WHRLD into common recently. This move was strange and I find it hard to explain. At first, management noted that they will tender their 2.2% stake (mostly Stilwell’s) of WHRLD in the second offer this year. However, despite the offer being undersubscribed and WHRLD trading at $18/share, management converted preferred shares (one day after the offer expiration) into common shares at an unfavorable $16.96/ common share exchange losing a substantial amount of money in the process.

- As management now owns only common stocks, they are incentivized to push D shares buybacks at the lowest possible price. Nonetheless, the potential elimination of overhand should provide a meaningful offset here.

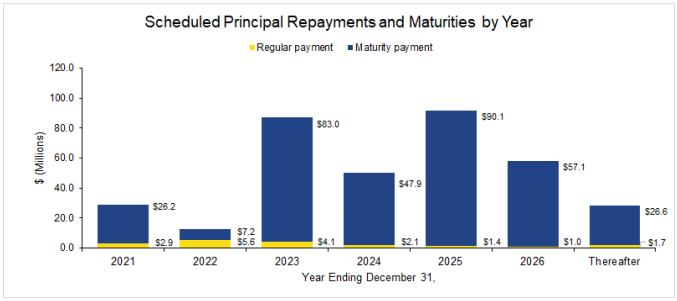

- The risk of upcoming tender getting serious amendments is minimal. The first tender this year was adjusted due to near-term debt maturities. Looking at the $29m of remaining debt maturities in 2021, $20.8m is attributed to Rivergate shopping center. The loan had already been extended a dozen times from Dec’19 to October’21 as of now, so it’s quite likely that further extensions will occur. If not, the company should be able to refinance (at least part of) the Rivergate debt, if needed given the improving industry environment, earnings recovery and minimal maturities in 2022.

I’m probably an idiot, but in the form 4 you link to I don’t see that Stilwell converted his prefs. The way I read it he closed out his swap positions and footnote 10 suggests to me that he tendered his prefs.

Thank’s for spotting, my mistake. Made a quick glance and somehow got misled by that conversion price.

I see that they are amending the terms of some of the other classes of preferred shares to make dividends noncumulative. Any risk of this happening to D shares?

It would behoove you to read the protective covenants in the D shares and compare them to A&B if you are a holder.

Thanks for bringing this up, Michael. I believe there is no risk that management will mess with D pref. shares as despite parity ranking of A and B and D pref. shares, D shares are able to vote on the matters of it own charter, while A and B shareholders aren’t. Any amendment to D pref. share terms will need approval from 2/3rds of D shareholders. From the 2016 prospectus on “Limited voting rights”:

“In addition, the affirmative vote or consent of the holders of at least two-thirds of the outstanding shares of the Series D Preferred Stock and the Parity Preferred Stock upon which like voting rights have been conferred (voting together as a single class) is required for us to authorize or issue any class or series of capital stock ranking, as to payment of dividends and the distribution of assets upon our liquidation, dissolution or winding up, senior to the Series D Preferred Stock or to amend any provision of our charter so as to materially and adversely affect the terms of the Series D Preferred Stock.”

“In addition, so long as any shares of Series D Preferred Stock remain outstanding, we will not, without the affirmative vote or consent of the holders of at least two-thirds of the outstanding shares of Series D Preferred Stock, amend, alter or repeal our charter, including the terms of the Series D Preferred Stock, whether by merger, consolidation, transfer or conveyance of substantially all of our assets or otherwise, so as to materially and adversely affect any right, preference, privilege or voting power of the Series D Preferred Stock, except that with respect to the occurrence of any of the events set forth above, so long as the Series D Preferred Stock remains outstanding with the terms of the Series D Preferred Stock materially unchanged”

Whereas, B shares prospectus clearly states that B shares have no voting rights at all and that’s it. It seems that’s why yesterday’s announcement notes that A/B shares dividends matter will be voted not by A and B pref holders, but common shareholders. A very strange situation indeed.

So overall, D shares seem to be more or less protected from any potential management’s tricks further on. And even it they weren’t, it wouldn’t change the already huge liquidation D pref. shares liquidation value or the looming redemption date. It would make a minor impact on the thesis as WHLRD elimination would still remain the top priority for the management.

On a side note, alongside being more privileged, D shares also do a great job at illustrating the complete incompetence of the previous management led by Jon Wheeler. In 2016 they issued 1.6m D shares at $25/share. Two years later, in 2018, they issued another 1.3m D pref. shares but at $16.50 (at 34% discount to liquidation value).

2016 D prospectus – https://www.bamsec.com/filing/119312516713476?cik=1527541

2018 D prospectus – https://www.bamsec.com/filing/119312518009619?cik=1527541

2014 B prospectus – https://www.bamsec.com/filing/119312514162627?cik=1527541

Timely 13D filed this afternoon by Khoshaba. Looks like he was forced out and may seek to “improve the composition of the Board”.

“However, the approximately 40% decline in the Issuer’s stock price in just over a month since he was forced out as CEO is, Mr. Khoshaba believes, a clear reflection that the Issuer’s shareholders share his concerns. In addition, Mr. Khoshaba believes that the extremely large number of withheld votes for the Board at the recent Annual Meeting of Shareholders is also a clear sign that Shareholders are concerned about the course being pursued by the Issuer’s Board and Management.

As he determines what steps he may take to protect the interests of the Issuer and its Shareholders, Mr. Khoshaba may seek to improve the composition of the Board of Directors. Mr. Khoshaba intends to closely monitor the actions of the Issuer’s management and the Board of Directors as he determines potential next steps. Mr. Khoshaba reserves the right to speak with the Issuer’s Board and Management, other shareholders and third parties as he determines the appropriate steps necessary to correct the Issuer’s problems caused by the current management and Board.”

https://www.sec.gov/Archives/edgar/data/1457592/000091957421005525/d8924962_13d-a.htm

Thanks for sharing. This is a strange situation indeed and I wonder what went wrong between him and Stilwell. Anyways, Koshaba’s activist position looks somewhat positive for shareholders as it should keep the board more “in check” going forwards.

Just one more point on WHLRD buybacks accretion and management incentives. WHLR currently trades at around 8.4% cap rate ($43m NOI), quite a bit lower than the average pre-COVID grocery supermarkets’ rate of 5-7%. However, it probably deserves that due to its size, history and various caveats. If they manage to buyback all WHLRD at let’s say $19/share, at the same 8.4% cap rate WHLR common shares would more than double to $7.18/share. On top of that, the stock should clearly re-rate a bit higher once the overhang drops.

Is it fair to say, if we believe that the tender will be oversubscribed, then the common share (properly sized for higher risk) might be a better bet than Pref D?

(and in an undersubscribed scenario, Pref D offers the best risk-reward)

In case of tender over/under subscription I would expect the common to move in the directions you indicated. However, with common already trading materially above its BV it is hard to guess markets reaction accurately

It seems like it might be better to actually hold Series D to the 2023 conversion privilege rather than taking a short term gain on a tender. What are your thoughts on this?

@Buffett:

The annualized return can be much higher for tending one’s shares (if the price is attractive) and moving on.

Sep 2023 is almost two years away, and the freed up capital can be recycled into many other deals during the two years.

And the illiquid WHLRD shares also consume a lot more margin requirement and risk budget, reducing return on equity. (I assume many arb traders do employ leverage).

If I’m reading the following correctly, it looks like the various Stilwell entities bought a whopping $25M of WHLRL (out of $30M).

https://ir.stockpr.com/whlr/sec-filings-email/content/0001213900-21-044381/ownership.html

Next month, common shareholders are voting to remove the cumulative dividend from the A and B Preferred’s. Unlike the D’s, there is no protective language to stop this Preferred abuse.

“Common stockholders of record as of the close of business on Wednesday, September 22, 2021 (the “Record Date”) will be entitled to vote at the special meeting. At the special meeting, the Company’s common stockholders as of the Record Date will be asked to consider and vote on a proposal to amend the terms of the Company’s Series A Preferred Stock (the “Series A Preferred Stock”) and Series B Convertible Preferred Stock (the “Series B Preferred Stock” and, together with the Series A Preferred Stock, the “Preferred Stock”) so that dividends on the Preferred Stock are non-cumulative and will be paid only when, as and if declared by the Company’s Board of Directors.

As of June 30, 2021, there was an aggregate of $139,095 and $11,606,191 of accrued but unpaid dividends on the Company’s Series A Preferred Stock and Series B Preferred Stock, respectively. The Company believes that removing the cumulative dividend from the Preferred Stock will further optimize the capital structure of the Company.”

There is no question that the capital structure of the company would be improved and it’s highly likely that a majority of shareholders will vote for this, but it doesn’t seem quite fair to move the goal posts late in the game. I’m not familiar with this company, but I am familiar with Joe Stilwell and if he owned these pfd’s, he wouldn’t take it lightly. I suppose one can rationalize it’s “buyer beware and read the docs”. Still, I’m curious about Uncle Joe’s future actions and what the ultimate endgame is here.

The $25M in Notes that Stilwell owns has some unusual provisions, both when interest is paid and when converted.

“Interest on the Notes will be payable semi-annually on each of June 30 and December 31, commencing on December 31, 2021. Interest on the Notes will be payable, at our election, in cash, in shares of our 9% Series B Preferred Stock based on the Fair Market Value of a share of Series B Preferred Stock (using a trailing average 15-day Volume Weighted Average Closing Price (“15-day VWAP”)), less a 45% discount per share, in an amount equal to the applicable amount of interest for the interest period (rounded up to the nearest whole dollar), or in shares of our 8.75% Series D Cumulative Convertible Preferred Stock based on the Fair Market Value of a share of Series D Preferred Stock (using a trailing average 15-day VWAP), less a 45% discount per share, in an amount equal to the applicable amount of interest for the interest period (rounded up to the nearest whole dollar). After January 1, 2024, we may redeem the Notes at any time (in whole or in part) at par plus accrued and unpaid interest for cash or shares of our Common Stock (using a trailing average 15-day VWAP) (less a 45% discount per share). The Notes will mature on December 31, 2031 (the “Maturity Date”), at which time the Notes shall be settled in cash or shares of the Company’s Common Stock (based on the Fair Market Value of the Common Stock (using a 15-day VWAP)), to be determined at the Company’s election. The Notes are convertible, in whole or in part, at any time, at the option of the holders thereof, into shares of our Common Stock at a conversion price of $6.25 per share of our Common Stock (the “Conversion Price”) (4 common shares for each $25.00 of principal amount of the Notes being converted); provided, however, that if at any time after September 21, 2023 holders of the Series D Preferred Stock have required us to redeem (payable in cash or stock) in the aggregate at least 100,000 shares of Series D Preferred Stock, then the Conversion Price shall be adjusted to the lower of (i) a 45% discount to the Conversion Price or (ii) a 45% discount to the lowest price at which any holder of Series D Preferred Stock converted into our Common Stock.”

I believe Stilwell would prefer to collect his interest in 45% discounted “D” shares, but the company would prefer paying in lower interest non-cumulative “B” shares. Shareholders will find out just who is running the show and exactly how shareholder-friendly Joe is. Khoshaba has a dog in this fight, so he will be watching.

The company will very likely take out a chunk of “D” share in a tender, so this special situation should work. I think it’s also likely there will still be “D” shares around on 9-2023 and incentives matter. When at least 100K of these “D” shares convert to common (it could also be cash, but it’s doubtful they pay in cash), then the noteholders can also convert to common with a 45% discount on the lowest “D” conversion price to common.

If the price of common is still low on September 2023 and half the “D”s, are still outstanding, it’s not inconceivable that there could be massive dilution with Stilwell owning a controlling stake after note conversion. I think there is too much risk owning the common now, but owning it at a 45% discount in 2 years as a WHLRL noteholder looks like a good bet.

Looks like we know who is running the show. From 10-K:

“During the year ended December 31, 2021, interest related to the Convertible Notes was $886 thousand and paid with 113,709 shares of Series D Preferred, which when adjusted for the VWAP discount represents interest expense of $1.61 million.”

I suspect Stilwell is picking up D shares for basically half price in anticipation of a payoff through common shares in Sep 2023. Depending on the price at the time of conversion of WRHLRD, there will likely be massive dilution whereas 60+ million new shares could be added (at today’s price, before any further interest payments on WHLRL, it would be about 57 million). On top of which, on Jan 1, 2024, another 30+ million shares could be added to the pot (about 27 million at today’s price) based the WHLRL conversion terms.

While a decent chunk of the dilution should just be a wash given it will be more or less a cash neutral swap of senior positions for common, a good bit will be pretty dilutive because all of the shares issued to Stilwell and other note holders ($35+ million if you include interest payments) will be at basically half price. In theory there will be the added equity in the new CDR properties which should provide some cushion, but I would think that there is a good chance the common trades down 40%+ after the dilution. Especially if there is a big selloff from “D” holders wanting to exit.

Quick math: Let’s just say after everything converts we’re left with 100 million shares of common outstanding (10mm current + 60mm for “D” conversion + 30mm for Note conversion). An 8.5% cap on today’s NOI implies $490 million market value, less $350 million in property mortgages and $14 million for “A” and “B” liquidation prefs gets us to $126 million in equity value, or $1.26 per share not including the value of any new CDR equity. Let’s say the price stays at $2/share – at conversion, “D” shares will be owed roughly $38/share, so each holder would receive 19 shares of common per “D” share. After conversion and dilution the new shares are worth $24 per “D” share ($1.26 x 19), so roughly 75% increase to today’s price of $13.67 or ~40% IRR from today.

Still a shot at a pretty good IRR and low downside from today in my opinion but those who participated in the rights offering last summer are getting a heck of a deal.

appreciate the write up…..now that the dust has settled a bit on the cedar deal, and their preferred are trading not far from 1/3 to 1/2 where there were prior, was it as blatant as it seems to just acquire the company and stop paying the preferreds.? As badly as the Cedar pref have been bludgeoned I do wonder why they are not trading more in line with WHRLP if that is the trash heap they are destined for?

@g4734g After re-evaluating the Cedar deal in more depth, I think I was wrong on my previously posted conclusion. I’ll re-run some math below that includes CDR. Things to note: CDR should add roughly $15 million of NOI to the current portfolio and basically $291 million in liabilities including the CDR prefs and the new loan.

Let’s start with potential new shares added through conversions of WHLRD and WHLRL assuming a $2 per share common stock price at the time of the conversion.

– Current common shares outstanding: 9.7 million.

– New WHLRD shares added from interest payments on WHLRL: 538,000 – 113,709 shares added on Dec 31, 2021, plus $3.15 million in interest payments owed between now and maturity. Assume average WHLRD share price of $13.50 over that time, converted at 45% discount, that’s roughly 424,000 shares of WHLRD paid out for interest before maturity. Which would bring the total WHLRD shares outstanding to about 3.6 million at maturity.

– New common shares from WHLRD conversion: 67 million. Amount owed at maturity will be roughly $133.5 million (3.6mm shares x 37.33 per share), divided by $2 conversion price.

– New common shares from WHLRL conversion: 30 million. Principal amount of $33 million divided by $1.10 ($2 per share common less 45% discount).

Total new common shares outstanding: 107 million

Now a couple of valuation scenarios based on that new share count.

PE/DIVIDEND VALUATION

Current Property NOI: $41 million

Added Property NOI: $15 million

New Property NOI: $56 million

Less G&A: $8 million

Less capex: $5 million

Less debt service: $28 million (assumes 5% interest rate on new $130mm loan)

Less CDR pref divs: $11 million

Distributable income: $4 million

Distributable income per share: $.04

Earnings/dividend value at 5% yield: $0.75 per share

If WHLRD conversion is at $2 you get 18 shares of common for each share of WHLRD. 18 shares x $0.75 = $13.50 in value vs. $13.90 current price.

LIQUIDATION VALUATION

New property NOI: $56 million

Market cap rate: 7.5% (possibly generous)

Sale proceeds: $715 million (net of 5% sales costs)

Less current mortgages: $313 million

Less new loan: $130 million

Less WHLR A&B liq pref: $47 million

Less CDR B&C liq pref: $161 million

Liquidation value: $64 million ($0.60 per share)

Same WHLRD conversion rate as above gets you 18 shares x $0.60 = $10.80 in value vs $13.90 current price.

You get a little bit less dilution the higher the common share price at conversion but it doesn’t do a ton. This scenario is even worse if the price drops after the WHLRD conversion on 9/21/2023 and the WHLRL conversion is at a lower price on 1/1/2024.

Obviously there are lots of moving parts here and other ways this could go. Defaulting on the CDR prefs doesn’t seem like a great option because they have some teeth similar to WHLRD (2/3 vote to amend charters) so they can’t really get thrown completely in the trash bin like the WHLR As and Bs, and this would put the common right back into the same predicament it’s in now (after Stilwell and other note holders have just received a bunch of common) so it seems doubtful.

The thing to remember is that Stilwell and others that seem to be driving the boat here are getting all of their shares at essentially half price, so the downside for them is much more limited than the scenarios above and there is probably even some decent upside left for them. But for us muggles, it seems the deal maybe isn’t so good.

Let me know if I am completely missing something or if anyone disagrees.

Really interesting idea, thanks for posting.

Any ideas on fact pattern around previous tenders? March tender massively oversubscribed, think something like ~1.47m D shares tendered across $15.50-18 (only 387k cleared at $15.50); but then only 103k shares tendered in the May tender that was massively undersubscribed at the high end of the range ($18), so close to 1m shares were willing to tender back in March at $18 (or lower) and then decided not to in May…

Also, realize this is a short term tender trade, but curious how you think about the leverage D shareholders have? If liquidation value is in the $30s and D shareholders have such a dilutive impact to current common shareholders, why not hold out for much higher tender prices over the 12-18months?

Last point that was interesting from D prospectus, maybe the shareholder base is really fragmented, haven’t seen ownership breakdown (does anyone have that?), but if we get 20% of the holders to write in, we can demand 2 board seats…could be a further catalyst if a large holder decides to push for that

“Holders of shares of the Series D Preferred have no voting rights. Pursuant to the Company’s Articles Supplementary, if dividends on the Series D Preferred are in arrears for six or more consecutive quarterly periods (a “Preferred Dividend Default”), the number of directors on our Board of Directors will automatically be increased bytwo, and holders of shares of the Series D Preferred and the holders of Series A Preferred and Series B Preferred (the Series A Preferred and Series B Preferred together, being the “Parity Preferred Stock”), shall be entitled to vote for the election of two additional directors (the “Series D Preferred Directors”). A Preferred Dividend Default occurred on April 15, 2020. The election of such directors will take place upon the written request of the holders of record of at least 20% of the Series D Preferred Stock and Parity Preferred Stock. The Board of Directors is not permitted to fill the vacancies on the Board of Directors as a result of the failure of the holders of 20% of the Series D Preferred Stock and Parity Preferred Stock to deliver such written request for the election of the Series D Preferred Directors. The Series D Preferred Directors may serve on our Board of Directors, until all unpaid dividends on such Series D Preferred and Parity Preferred Stock, if any, have been paid or declared and a sum sufficient for the payment thereof set apart for payment”

It has been about five weeks or so since this has been posted. Any thoughts as to timing of tender?

No insights about the timing either. Something might be announced together/after Q3 results – these came out in the first half of November last year.

I haven’t read any of the underlying security documents related to this investment, so what I am about to suggest may be inconsistent with the docs.

It seems to me that it’s likely that the big common holders are also the major senior note holders (it’s mentioned above that Stilwell has a significant position in the notes). What is to stop Stilwell, et al from not undertaking a tender, letting the liqudiation date occur, not paying the preferred D liquidation, forcing a bankrutpcy, and in their position as the senior note holders come away owning most of the company without any (or very little) going to the preferred holders?

this is a good question. Certainly management has no qualms about doing unkind things to minority shareholders and noteholders.

I wonder if the play here is just a pairs trade of long the pref, short the common, so you de-risk this hairy outcome.

Seems to be headed lower over the past few days, any news?

I have not seen any news that might have caused the 10% decline over the last couple of weeks – WHLR common declined by similar magnitude, so maybe that was the driving force behind it.

The only news in the meantime were:

1) Glass, Lewis & Co., has recommended in its report issued on October 7, 2021 that WHLR common stockholders vote “FOR” all of the proposals in the Definitive Proxy Statement filed by the Company on October 4, 2021 relating to the removal of any cumulative dividend rights of holders of the Company’s Series A Preferred Stock and Series B Preferred Stock (likely already anticipated by the market). Shareholders meeting will be held on the 3rd of November

2) Wheeler Real Estate Investment Trust has appointed M Andrew Franklin as Chief Executive Officer and President. He was the interim CEO and long-standing member of Wheeler.

This is from Alluvial Capital’s latest letter.

On the other hand, Series D preferred shares of Wheeler REIT trended slightly downward. The company and certain shareholders are at loggerheads over the treatment of Series A and B preferred shares, with a large holder threatening litigation. The most likely scenario in the months ahead remains a large repurchase of the Series D preferred shares, though it is also possible that a negotiated exchange agreement is reached with holders of the various series. Wheeler’s underlying properties must be worth at least $390 million or so for Series D preferreds to be worth at least their current trading price of $16. That is equal to 87% of gross property value and an implied cap rate of 9.5%. Wheeler’s grocery-anchored strip malls are nobody’s trophy assets, but they produce cash flow and are worth more than that. With a hard catalyst in the 2023 conversion option on the Series D preferreds, I am willing to wait for resolution.

Last week Wheeler announced Q3 results that were in line with the previous quarter in terms of lease rate and occupancy. Management noted that lease collections are returning to pre-covid levels.

Nothing was mentioned about any tender for Series D preferreds.

Also in the beginning of November common shareholders voted to amend the Company’s Articles Supplementary to remove the cumulative dividend rights of the Series A Preferred Stock and the Series B Preferred Stock. D Series are protected from such a move.

Any thoughts about how much longer to be patient before closing this position, as it does not seem that there is a pending tender at this time?

As it was noted in Alluvial’s letter in your previous comment, the hard catalyst date is Sep’23 when Series D holders can force redemption. I would expect the company to act earlier than that. Some kind of buyback announcement is still likely in the coming months/quarters. As the convertible note financing was raised for Series D redemption (at least that was the first stated intent) I was also expecting this sooner, but still comfortable holding this.

Also as the Sep’23 date approaches the preferreds are likely to start rerating to par + unpaid dividends gradually.

DT,

Why do you think the company will pay back the Series D preferred? Since the primary equity holder is also the primary holder of the senior notes it seems that it is in their interest to force the company into bankruptcy and take the company over as the senior note holder.

If the grocery-anchor retail market has recovered by late 2023, there’s no guarantee that they as senior notes holders will be the only bidder for the Company’s assets in a bankruptcy proceedings, and they may just lose the assets to someone else in an auction.

Yes, they as senior note holders will get repaid in that scenario, but I don’t think they are in this just to get their principals repaid.

Equity currently represents an extremely levered claim on the assets, and they as equity holders can make astronomically high return if they are able to restructure the Series D. This is likely their Plan A, I think.

Tom, how do you see Stilwell forcing the company into bankruptcy? To do that, notes would need to default on interest payments as there seem to be no other covenants attached to these notes.

WHLRL is currently trading above par at 6.5% yield – the market is clearly not factoring any default scenario. The company is also delivering positive FFO and AFFO and shopping centers are only expected to recover further over the next 1.5 years.

Series D can be redeemed not only for cash but also for stock – so seems like possibilities to default the company due to the inability to redeem the preferreds are also limited/non-existent.

Yes, Series D can be redeemed not only for cash but also for stock. However, the form of payment is at the option of the company.

So can the company simply refuses to pay neither cash (quoting lack of means to pay) nor stock (quoting “distorted” stock prices at the time and unfair dilution as the reason), and file for bankruptcy protection?

I am not really sure if the company can:

(1) elect to pay cash for Series D when preferred holders request redemption.

(2) right-away put the company into bankruptcy because the company is unable to meet redemption request.

As I understand the possibility of redemption in stock was specifically included to ensure the Series D redemption or conversion into common at a favourable rate if cash balances are insufficient for redemption.

Have you guys ever looked at the preferred shares (DTLA-P) of Brookfield DTLA Fund Office Trust Investor? @dt

Better quality assets (although downtown Los Angeles is out of flavor right now) and sponsor.

Huge amount of accumulated/unpaid dividends, but trading significantly below par.

No hard catalyst as in WHLRD; can’t force company to redeem.

Soft catalyst in Oct 2023:

*JV partner (53% of common equity) can force Co to redeem with cash at fair value in Oct 2023 (and every five years thereafter).

*If redemption is requested, the check size will be huge, so Co will likely have to monetize properties .

*And Co has to pay preferred shares (i.e. resume dividend/make good on unpaid dividends) before making pay-out to others.

* The sponsor (Brookfield) has recently announced five-year target to cut real estate exposure on its balance sheet to below the level prior to its recent privatization of BPY (which owns 47% of DTLA). So sponsor will likely do something about this $3.6 billion portfolio.

East72 Capital had a write-up (page 5-7) in their 2019Q3 Investor Report, and all of the investment cases remain valid:

http://east72.com.au/wp-content/uploads/2019/10/E72-Quarterly-Report-Sept-2019.pdf

There’s also a Nov 2019 write-up on Seeking Alpha website:

https://seekingalpha.com/article/4308863-waiting-for-godots-dividend-pay-off-for-patient-investors-in-brookfield-dtla-office-trust

I looked at this today, and man, this looks pretty ugly. Seems like Mr Market says BAM will drag this vehicle into bankruptcy, and issue new commons somewhere lower in the capital stack. For once, I’m inclined to agree with him.

Some rough math: ~$35m in run rate NOI less $3m maintenance capEx (rough guess) gets you to ~$32m NOI. The entire debt stack through WHLRL is trading at a cap rate of 9.25% & you need to assume a cap rate of sub 8% for the prefs to be worth par.

@Alan, regarding your point about the prefs almost pushing the common underwater: what leads you to conclude that the prefs are money good & have any intrinsic value beyond nuisance value here? Management is now in front of you with WHLRL, so presumably the game theory here is to let the D prefs keep accruing & then threaten to file BK and argue the biz is only worth $360m (9% cap rate) leaving the prefs with nothing as an enticement to tender…

WHLRL holders can also dilute the Pref holders via the 45% discount provision. What am I missing here?

That is one of the possibilities how this could play out. However, on what basis do you think the company could declare bankruptcy if the assets are generating sufficient levels of cash to cover interest payments? (see discussion above on the 24th of Nov).

If there is a way out of redeeming (in stock) the Series D, then my thesis obviously fails.

In a BK scenario, so long there’s a competitive auction for the assets and the grocery-anchored retail sector does not deteriorate further, I don’t think the D series will get paid less than $60 million (its current market value) after repaying debts/senior notes and wiping out existing commons.

We may not be able to get to the par value or the par+ accumulated unpaid dividend. However, so long as our cost basis for WHLRD is far below par, we are not assuming/relying on a full recovery to turn a profit.

So with WHLRL ahead, and this:

https://www.sec.gov/Archives/edgar/data/0001527541/000121390021062369/ea151438ex3-1_wheelerreal.htm

Stilwell basically is putting on pressure on the D shares. If you don’t tender your shares, he is going to be ahead of you, and could further dilute you with his WHLRL holding?

Isn’t there a risk of dilution from another rights offering to common shareholders of convertible notes with similar attractive conversion features, thus diluting pref-D ownership upon conversion in 2023?

Any further dilution would likely cause a decline in WHLR share price. However, as the redemption of preferreds would be done in stock based on average 10-day common share prices preceding the redemption request, the preferred holders would simply receive more shares of the common resulting in the same dollar amount (par + unpaid dividends).

Shareholders want to fight for his interest. I dont know if it benefit us. What’s your opinion?

Here is an interesting twist to an already complex situation. The original prospectus says the D’s can be redeemed for cash or stock, the company’s option. But the 2020 10K states the election of cash or stock is at the holders option. p.51 –

“On September 21, 2023, the holders of the Series D Preferred may, at their option, elect to cause the Company to redeem any or all of their shares at a redemption price of $25.00 per share, plus an amount equal to all accrued and unpaid dividends, if any, to and including the redemption date, payable in cash or in shares of Common Stock, or any combination thereof, at the holder’s option.”

I’m not an attorney but how would this not hold up in court? And if it does, then the only way the Ds lose is if the company files for bk prior to 9/21/23. And that would wipe out the common, who are also the L note holders, so it probably wouldn’t be in the note holders best interest to cheer on bk (unless they exit their common position prior to redemption date). Besides, there is currently no case for bk as the company is current and should remain so unless fundies deteriorate.

So to me, the company should tender for max Ds now at a price that would attract a large chunk of holders…something in the low $20’s. Buyback as many as possible after the tender until redemption date with FCF, then suffer some dilution on redemption day.

Of course the game theory here has multiple elements. Here’s one – after going through all the stress of being a D holder, you’ll want to redeem for cash on redemption day and move on from this pig, right? But a request for cash may tilt the co into bk. You might then want to choose stock, but if others choose cash where does that leave you?

I’m not specifically up to speed on the terms but no, what is stated in the 10-K would not hold up in court. The indenture for the pref’s are the governing docs and an error in drafting elsewhere does not change that.

D pref. shares are still trading at 55% discount to the intrinsic value. A few weeks ago Daniel Khoshaba has written a letter to the board once again noting his discontent with the share price performance and the way he was kicked out of the board. He seems to be hinting of a potential proxy war if such performance continues, however, the annual meeting is still far away. As before, the only hope is that Khoshaba’s activism will keep WHLR management in check and they will start increasing shareholder value sooner than later. One of the moves could be a tender for D pref. shares.

https://www.bamsec.com/filing/91957421007405?cik=1527541

Additionally, one of the major D share shareholders Bruce and William Derricks (owns 8% of D shares) has recently filed a 13G showing that he has acquired 11.4% of common WHLR shares. Derricks are apparently veteran commercial/industrial RE investors.

https://www.bamsec.com/filing/110465921146688?cik=1527541

On a more negative note, another major D pref. share shareholders Steamboat Capital Partners (owns 13% of D shares) has been selling shares on the open market and since November has disposed around 27k shares at around $15.88/share average price. Steamboat is a hedge fund, which specializes in commodities, maritime policiy, shipping etc.

https://www.bamsec.com/filing/121390021065636?cik=1527541

Just going through at today’s levels, every tranche here is solidly in the money, including the common (current 8.8 yield on common, market for small grocery-anchored is closer to mid 7s, maybe even lower). Even with a decrease in NOI of 10% – 15%, it’s likely everyone is still in the money. I think this basically takes the idea of Stilwell aiming for bankruptcy off the table, and even if that is what happens the return here should be excellent. At today’s prices this seems like a no-brainer, and may be worth holding through maturity, assuming operations don’t drastically falter before then.

whlr up 20% after hours on news of acquisition of CDR remainco. Anyone following this closely have insight into this?

https://seekingalpha.com/news/3808764-cedar-realty-trust-stock-gains-postmarket-on-acquisition-by-wheeler-reit

So CDR is trading at $27.74 after market, but the expected special dividend alone will be worth $29 per share? Or the $29 amount already includes the expected $291.3 million payment from WHLR, and that CDR shareholders will receive only $29?

Interestingly the two CDR preferreds (CDR-B and CDR-C) are down after market, to around $22.5 per share. They will remain listed after the merger.

Will WHLRD price converge to CDR preferreds?

Wheeler announced the acquisition of Cedar (after certain asset divestitures). Seems to be a positive, at least from a signaling perspective. However, the previously anticipated tender offer for the D shares – which was the purpose of Aug’21 rights offering – is now clearly out of the window (probably not a surprise given the long silence since the rights issue. Series D redemption chances 2023 have somewhat increased. Interested in hearing other views

What I like here:

– Even while being over-levered and with preferred overhang WHLR is able to raise $130m in debt for the acquisition.

– The transaction will increase size.

– WHLR with a market cap of only $19m is able to acquire assets worth $291m.

– Cedar is getting acquired at 5.6% cap rate (NOI over purchase price). At the same cap rate, all of WHLR debt and preferreds would be in the money, even leaving multi-bagger upside for the common. Having said that, WHLR cap rate probably needs to be higher to account for lower quality of the assets.

Too little detail at the moment on:

– What assets is WHLR actually acquiring, as 33 of the Cedar’s shopping malls and 2 further assets are taken by other buyers.

– Cedar’s preferred shares with $161m par value will come on WHLR balance sheet. These preferreds were current and trading above par – which is very different from the WHLR preferred shares, with no dividends and way below par. Cedar preferreds had conversion right into common upon change of control, not sure if tat is still applicable in this case.

– Not clear if Cedar preferreds will have liquidation preference over existing WHLR preferreds.

Cedar preferreds are dropping like a rock and are already close to the levels of Wheeler preferreds.

Can someone explain why the conversion rule does not apply in this case? From Cedar preferred prospectus:

https://www.sec.gov/Archives/edgar/data/761648/000119312512236072/d349492d424b5.htm

If I am reading that prospectus correctly, a change of control doesn’t apply if acquired by a NYSE or NASDAQ listed company (see below)

A “Change of Control” is when, after the original issuance of the Series B Preferred Stock, the following have occurred and are continuing:

(x) the acquisition by any person, including any syndicate or group deemed to be a “person” under Section 13(d)(3) of the Securities Exchange Act of 1934, as amended, or the Exchange Act, of beneficial ownership, directly or indirectly, through a purchase, merger or other acquisition transaction or series of purchases, mergers or other acquisition transactions of shares of our capital stock entitling that person to exercise more than 50% of the total voting power of our capital stock entitled to vote generally in elections of directors (except that such person will be deemed to have beneficial ownership of all securities that such person has the right to acquire, whether such right is currently exercisable or is exercisable only upon the occurrence of a subsequent condition), and (y) following the closing of any transaction referred to in clause (x), neither we nor the acquiring or surviving entity has a class of common securities (or American Depositary Receipts (“ADRs”), representing such securities) listed on the NYSE, the NYSE Amex Equities (the “NYSE Amex”) or the NASDAQ Stock Market (“NASDAQ”), or listed or quoted on an exchange or quotation system that is a successor to the NYSE, the NYSE Amex or NASDAQ; or a change of control occurs pursuant to the provisions of any shareholder rights plan that we may adopt in the future.

Thanks Dennis. This seems to explain it in then. Cedar preferred holders were simply thrown under the bus.

https://www.youtube.com/watch?v=-DT7bX-B1Mg

Very surprised to see such a definition of ‘change of control’ (is this common?). Bizzare. Will be double-checking this for every preferred from now on.

DT are these CDR preferreds a buy here down 60% in a day? Seems really stinky to sell yourself to someone who is going to abandon your preferreds?

No idea, but I think market is pricing these correctly. See my comment/questions above.

If there is no conversion right (not sure why it is gone), then these preferreds have to trade in line Wheeler preferreds, which is about correct now.

For a couple of hours in pre-market trading there was decent enough volume to short these at $22-$23/share – sadly, I did not press the button after having found this conversion right in the prospectus. As per above, still not sure what I missed and why it no longer applies.

What are y’all doing with WHLRD? Seems the thesis was blindsided by this development.

See my thoughts in the comment above.

for me I exited……the common being down was red flag for me……..DT raises a great point on the conversion provision on the CDR preferreds…..the whole situation is odd

Need to understand the Cedar deal a little better but it really seems like the thesis is still in tact and maybe even better now. WHLRD still has the set maturity date and plenty of equity to cover the obligations (and in theory even more at this point). I suspect the Cedar prefs are getting killed because they effectively just fell behind WHLRD in the cap stack because of the impending maturity.

Kind of surprising that they are paying a sub 6 cap when their common was trading substantially above that. I’m surprised the common isn’t down more.

It will be interesting to see if they continue to keep the Cedar prefs current. I suppose they will unless they are planning to pull some sort of switcheroo and use the money that is owed those to help pay down WHLRD.

I bought this, and then sold it again. Even after doing quite a bit of work on it. The reason? I can’t shake the feeling I might be missing something, and they somehow find a way to screw the preferred holders. Maybe ideas like this you should buy a 1% position and then forget you own it?

I’ve spent a reasonable amount of time trying to think through the ways the pref could get screwed here. Haven’t yet thought it through too much with the new deal (although at first blush I’m not sure the answer changes). It seems like really the only way WHRLD could get fleeced here is if the major owners of the common provided enough debt to push WHLRD out of the money and then filed for bankruptcy. That wouldn’t seem to make a whole of economic sense however and would likely be met with lawsuits.

Would love to know if anyone else has any thoughts.

Brett, thanks for your post on Wheeler’s valuation post the Cedar transaction. There are a lot of unknowns here, and as we all know, securities can trade at wildly different values then we logically assume. I’m reminded of Soros’ theory of reflexivity, as investor actions may trump valuation in this case.

The one thing we know is true is that the common stock will be diluted, but the scale of that dilution is unknowable. The last security in the Wheeler corporate stack I’d want to own now is the common equity because there is just too much uncertainty. That may change in the future, but right now, I’d much prefer being a WHLRL noteholder.

I’m trying to put myself in Stilwell’s shoes because he’s going to set the tone in how this plays out. I know Pfd shareholders have a right to be upset, but Stilwell is a hedge fund manager with sharp elbows, and he couldn’t care less about optics. I read the Steamboat lawsuit and while I’m not a lawyer, it sure looks like Stilwell is on firm legal ground. So, if it’s legal and he can make his investors money, he will play hardball. So how is he thinking about this?

From his recent letter:

“Wheeler Real Estate Investment Trust (WHLR) is a REIT that owns 58 largely grocery-anchored strip shopping centers in the Southeast. Joe and E. J. Borrack (our general counsel) sit on the board of directors. Operations are now cleaned up; the undesirable centers have either been sold or fixed, and WHLR generates a good amount of free cash. All that remains to be done is a balance sheet clean-up, which involves several preferred issues (and their aggressive and overly confident owners) who threatened to take much of the Company’s value.

To that end, the Company offered a convertible debt security through a rights offering to its common shareholders last summer. We made a large investment in that security. WHLR also successfully held a shareholder vote to change the terms of two of its preferred issues. There’s a bit more work to do, but the balance sheet issues are structured now to be resolved within the next two years. Although our original investment in common stock is materially underwater (based on the share price), we’re confident that we’ll make a substantial profit either through our new convertible debt investment (bought via our underwater share position) or through a combination of the convertible debt and common stock.”

This is truly game theory because we know there is value here, but we don’t know how it will end up being divided up among the various securities. “D” shareholders will be paid in a security of unknown value because we don’t know how many shares will be outstanding. We also don’t know how the mechanics of the Pfd conversion works, so timing it right won’t be easy.

If lots of “D” shareholders head for the exits on 9-21-23, how much time does it take to get the common in our accounts after conversion? What price is used in the conversion? Is it actually better to wait during the 3 months prior to 1-1-24 to initiate the conversion? The common stock has attributes of a toxic security because if lots of “D” holders convert and sell the common, who will buy knowing that noteholders get a 45% discount on the common’s lowest price. Can the selling push this to less than $1/share and possibly even penny stock territory? If even one common share trades at a very low price in those 3 months, how will “D” shareholders react knowing a tsunami of common shares is about to swamp the market.

As a “D” shareholder, I would want to convert at the lowest price of the common. There is no question that at least 100K “D’ shares will convert shortly after 9-21-23, which will allow the noteholders to buy at “a 45% discount to the lowest price at which any holder of Series D Preferred Stock converted into our Common Stock.”

So in the 3 months prior to 1-1-2024, the common stock price will be very interesting to watch, as the timing of conversion and sale of this hot potato could be all over the board during that time period.

Agree, this will be interesting to watch unfold. I think, and I failed to mention above, bottom line is that no matter what you can hold out for the cash you are owed as a WHLRD shareholder and if Stilwell’s goal is to recoup his losses on the common (which it feels like it is) they really won’t have much option but to pay.

On a similar note, I think this makes the CDR Bs and Cs a pretty interesting play after they’ve tanked. Those will need to be kept current as well for the common to retain value and the new properties should generate the cash to achieve this. If the payments are kept current throughout this process (next payment date is May 20) and as people realize that they will likely need to remain current, the beaten down shares could undergo a pretty significant bounce back relatively soon. I picked up a few Bs today.

I was thinking through the execution of this a little more today. I think you’re right about the 3 months between the ‘D’ redemption date and 1/1/24, there will be really big execution risk. Maybe the best thing to do here is to try to let the dust settle and wait until mid 2024 to convert.

My interest is also in the cdr pfds Thanks for the insight. CDR common sold off badly last two days especially today. Wonder if there are issues with the deal

Is there any way for the CDR Bs and Cs to get screwed and the common still retain value?

I suppose anything is possible, but there is some pretty clear protective language in the prospectus for a situation like this.

“In addition, the affirmative vote of the holders of at least two-thirds of the outstanding Series B Preferred Stock (voting as a separate class) is required for us to authorize, create or increase the authorized or issued amount of any class or series of our equity securities ranking senior to the outstanding Series B Preferred Stock as to distributions and amounts upon liquidation or to amend our charter (whether by merger, consolidation or otherwise), in a manner that materially and adversely affects the rights of the holders of the Series B Preferred Stock, unless the Series B Preferred Stock remains outstanding with its terms materially unchanged or, if the Corporation is not the surviving entity, the Series B Preferred Stock is exchanged for a security of the surviving entity with terms that are materially the same as the Series B Preferred Stock.”

Another thing to note here is that obviously the CDR prefs seem to be getting screwed out of their liquidation preference, as this is essentially a liquidation of Cedar but the prefs aren’t being paid out so their liquidation pref is accruing to the common. There are already class action suits in the making and I think there is definitely a non zero chance that either CDR will have to payout the prefs or the deal will be blocked. Both of those cases should be good for CDR prefs as it means they should either get a liquidation payout well above today’s prices or the deal will die and I would think that Cedar would continue paying the pref dividends as they have in the past, and even if the other transactions take place, the remaining properties should still be able to adequately cover preferred dividends and at today’s CDR pref prices would be well in the money from a liquidation value perspective so downside would be adequately protected.

Below is some language I found interesting from the CDR proxy released today. Interestingly, there is mention of “liquidation” or a “plan of liquidation” more than once. I would think language like that could give the prefs some leverage to either get paid out their liquidation preference or block the merger. I know there is a law firm that is preparing an to file an action and request an injunction on behalf of preferred shareholders, so it will be interesting to see how this unfolds. Still haven’t sold the ‘B’s I bought a couple weeks ago as I think the outcome for the CDR prefs will be pretty good either way here.

– “Capital Stock. Upon completion of the Mergers, the issued and outstanding shares of the Company’s common stock will be cancelled and

converted into the right to receive the merger consideration described above. Following the Mergers, the Company’s common stock will no longer

be publicly traded. The Company’s currently outstanding 7.25% Series B Preferred Stock and 6.50% Series C Preferred Stock (collectively, the

“Company Preferred Stock”) will remain outstanding as shares of preferred stock in the Surviving Company following the Mergers and will not be

exchanged for preferred shares of Wheeler. Accordingly, immediately following the Mergers, the Company Preferred Stock will remain senior to

Wheeler and all of Wheeler’s securityholders with respect to the cash generated from the 19 shopping center assets that will remain in the Company at the time of the Mergers.

For the year ended December 31, 2021, these assets generated net operating income in excess of $19 million. Both classes of Company Preferred

Stock are expected to remain listed on the New York Stock Exchange following closing of the Mergers, and the Surviving Company will continue

to be an independent filer of periodic reports with the Securities and Exchange Commission (“SEC”) under the Securities Exchange Act of 1934, as

amended.”

The court denied CDR preferred holder’s motion to stop the CDR-WHLR transaction. Preferred holders had filed a class action against both in April. Apparently, this was the last major hurdle for the merger. CDR B and C preferreds have plunged by ~26% since the announcement.

Meanwhile, WhHLRD continues to trade at a 61% discount to the liquidation value of $33.97.

https://seekingalpha.com/news/3850927-cedar-realty-dropsjumps-after-judge-temporarily-blocks-sale-to-wheeler

Brett, a few thoughts regarding your calculations (from the 17 of March comment).

I get distributable income at $7m with the main difference being debt service – $25m vs yours at $28m. Current interest expense run-rate is $18.9m/year + $6.4m from the two new loans ($75m at 4.25% rate and $60m at 5.31% rate). With these numbers, even a 7% yield would result in a $20/share post-conversion price for WHLRD.

But a far more important nuance here is the CDR pref. dividend payments. It has no safety/protection mechanisms and the market clearly thinks that WHLR will not be paying it (that’s why they trade at 65% and 74% discount to par). Given the recent developments with WHLR, that wouldn’t be surprising. So if you add back that $11m from CDR pref. dividend payments, WHLRD-post conversion price skyrockets to multiples above the current price levels. Another way to think about it is that you have a nice $11m margin of safety for any changes in NOI/operating expenses, etc.

Any thoughts on this would be appreciated.

Back in this. It is a funny situation, in a way I am now cheering for the CDR prefs to get screwed.

Just a thought, but wasn’t WHLRL set up to dilute the hell out of newly converted D shares into common in 2023?

An extra incentive to accept the likely coming tender offer of D shares?

wheeler has offered conversion to a 16$ par, 6% subordinated note. Should 2/3 of Ds tender, the D’s will be stripped of their cumulative dividends and rights.

Classic cram down. Will be interesting to see if pref holders can get organized and vote this down.

Any indication what notes would trade at ? 90c on the $?

.96c coupon, five year duration, 16 dollars at maturity is something like a 13% YTM at 12$, right?

You can mark the credit however you like, but 90 cents on the dollar seems maybe optimistic to me.

There is mandatory paydown of >10% of original amount every year. Notes are due 2027. So if you can reinvest the proceeds + interest at say 5-6%, total IRR is about 12% if refinancing is near end of 2027. If they get refinanced in 2026 somewhere, IRR is about 15% here.

So not a bad deal actually.

I would argue it’s a pretty bad deal given what is owed.

Oh yeah it is. For people buying now or recently it is an okish deal though. It depends on how much can be bought back on the open market. And how much needs to be paid out at 102% of principal amount every year.

I don’t get Stilwell’s stinginess here. If he had offered the same deal, but at $18-20, it would be close to certain that most would tender. Given the pay-off + risk of not tendering.

What options do we have here? Simply not tender and hope enough will do the same?

I wonder if this lowball offer is a strategy to get a second offer accepted.

Offer a bad deal, followed by a mediocre one and it is more likely to be accepted than if you offered a mediocre deal in the first place.

JCP has settled.

https://ir.stockpr.com/whlr/sec-filings-email/content/0001011438-22-000276/form_sc13da-wheeler.htm

Pappas controlled just under 10% of the ‘D’s and presumably settled on terms that were not favorable to the rest of us WHLRD holders.

Yeah I sold again, I am really struggling with the game theory here. It is such a complicated scenario.

In theory it sounds nice to convert your shares come September, and it appears D holders have leverage over Stilwell. But in practice, who the hell will they sell their shares to? If there is still a meaningful amount of D shares outstanding come September, everyone is going to want to dump their common shares the moment they are converted. As potential future dilution will be near infinite there will be no buyers. The common could have 5 billion shares outstanding a few years from now.

It really is criminal that you can issue convertible debt with conversion that depends on Preferred stock conversion. It basically renders any protections on any preferred stock that depends on conversion to common, worthless. Unless they have a majority of voting power.

In practice what could happen is that a lot of D holders are not going to want to convert after Sept next year because the stock is constantly plumetting/extremely illiquid as there are no buyers. The value of D shares would then plummet. Stilwell could then issue new D shares, or just buy them on the cheap and change the terms. Set some kind of limit on the number of common stock they can convert into. Causing an avalanche of conversion holdouts, probably some at very low prices. And He could then convert all his convertible debt at 45% of the lowest price, effectively giving him almost full ownership of common shares.

In this scenario the D shares will be a zombie preferred stock that will steadily plummet in value going into 2024, until Stilwel castrates it and uses WHLRL to take full control of the equity.

This means there isn’t really a strong incentive to buyout most D shares at a somewhat fair multiple. Since that would come out of WHLRL’s share when they take most of the common.

This also means that a couple years from now WHLRL could be worth multiples from what it is now?

Steamboat Capital, which owns a lot of the ‘D’s, has also started buying the common the past week.

https://www.bamsec.com/filing/121390022072693?cik=1635663

Anybody care to guess why?

because a cram down on the prefs is accretive to the common?

Shareholders who tender their WHLRD for the newly issued debt will also be consenting to a slew of adverse amendments for remaining D shareholders. This is very aggressive and something I have never seen before.

https://d1io3yog0oux5.cloudfront.net/sec/0001213900-22-073670/0001213900-22-073670.pdf

“Concurrently with and as an integral part of the Exchange Offer, we are also soliciting consents (the “Consent Solicitation”) from the Series D Preferred Holders, upon the terms and conditions set forth in this Prospectus/Consent Solicitation, to certain amendments to our charter that will modify the terms of the Series D Preferred Stock (the “Proposed Amendments”) in order to, among other things:

● Eliminate provisions relating to cumulative dividend rights;

● Eliminate provisions relating to the mandatory redemption of Series D Preferred Stock in the event of the Company’s failure to maintain an asset coverage of at least 200%;

● Eliminate the right of the Series D Preferred Holders to cause the Company to redeem any or all of the Series D Preferred Stock;

● Eliminate the increases in the dividend rate applicable to the Series D Preferred Stock that would commence on September 21, 2023;

● Eliminate the right of the Series D Preferred Holders to elect two directors to the Board of Directors of the Company (the “Board of Directors”) if dividends on the Series D Preferred Stock are in arrears for six or more consecutive quarterly periods;

● Provide for the mandatory conversion of Series D Preferred Stock if the 20-trading day volume-weighted average closing price of Common Stock exceeds $10.00 per share;

● Eliminate the special redemption rights of the Company and Series D Preferred Holders upon a change of control of the Company or delisting of the Common Stock from a national securities exchange in the United States; and

● Provide that the Company shall not be restricted from redeeming, purchasing or otherwise acquiring any shares of the Series D Preferred Stock.

If the Proposed Amendments are approved, we will file Articles of Amendment with SDAT that will have the effect of amending the Series D Articles Supplementary and, thus, our charter. A valid tender of Series D Preferred Stock into the Exchange Offer shall automatically constitute a consent to the Proposed Amendments and tendering holders may not validly tender their Series D Preferred Stock without also providing a consent to the Proposed Amendments.

As the Amended Series D Preferred Stock may be deemed to constitute a new security, the Company is registering the offer and sale of such new security under this Registration Statement on Form S-4. Series D Preferred Holders who have validly tendered their shares of Series D Preferred Stock into the Exchange Offer may only revoke their consents to the Proposed Amendments by validly withdrawing all of their previously tendered Series D Preferred Stock from the Exchange Offer, and such withdrawal will automatically constitute a revocation of the related consents.

You may not consent to the Proposed Amendments without tendering your Series D Preferred Stock into the Exchange Offer, and you may not tender your Series D Preferred Stock into the Exchange Offer without consenting to the Proposed Amendments. By validly tendering your Series D Preferred Stock into the Exchange Offer, you will be deemed to have validly delivered your consent to the Proposed Amendments with respect to such tendered Series D Preferred Stock.”

Does any single person or group own more than 1/3 of the ‘D’s that could vote down the exchange? Without that this is a coin flip at this point with really bad risk/reward.

around 11, the risk/reward here seems OK to just buy and tender, right? The note is probably worth more than ~70% of par…

Unfortunate if your cost basis is way above the current price, and seemingly madness to hold and not tender given managements apparent willingness and ability to screw you, but I don’t know that the risk/reward is awful here if you do.

Could easily see this trading at double digit yield and 20% lower than current price, especially if notes are dumped after the exchange. I see it as a coin flip to make or lose a couple bucks so not very asymmetric. Might be wrong though.

I guess I would personally think the note was quite attractive at ~9$, which is ~18% ish on a YTM basis, pretty high for even a loosey goosey subordinated note.

You’re right, though, folks buying, tendering, dumping could absolutely grant me my wish to buy it cheap.

The exchange offer has been launched on November 22 and is set to expire on December 22.

https://www.bamsec.com/filing/121390022074391?cik=1527541

better to tender?

I don’t plan on tendering my shares. Everybody will decide for themselves, but if shareholders acted in their interest as a group vs. individually, it would work out, but obviously many investors will not act in the interest of the group.

“The prisoner’s dilemma refers to a paradox in the decision-making and modern game theory that exemplifies how two rational individuals trapped in the same situation are likely to respond to it without knowing other’s take on the same. They either act in their self-interests or refuse to cooperate, leading to a sub-optimal or non-optimal outcome.”

I think there is a decent chance of a class action lawsuit over this tender. Most of these CA suits pay a few pennies per share when the ambulance chasers get involved, but that is not always the case in the more egregious deals.

I did the DVMT tender at the close of 2018 and it looks like a potentially decent settlement ($3+/share).

https://www.reuters.com/legal/dell-reaches-1-billion-lawsuit-settlement-2022-11-16/

Delaware Chancery hasn’t finalized the settlement, but it should go through as is. I’ve been involved in a half dozen of these CA settlements where I owned the stock in size and the settlements were meaningful (DBMG, DOLE, ALC, CVET, etc…) CVET is currently paying a nice settlement, so not all class action suits pay peanuts. It looks like $9.61/share (gross) is the least amount I’ll get if everyone who qualifies sends in for settlement.

DBMG was an interesting situation because Phil Falcone (prior CEO of HC2) was on the slimy side and pretty much coerced shareholders to tender. His plan was to get the parent company, HCHC, above 90% ownership in DBMG post tender and then take out the remaining shareholders in a squeeze-out at the same price. So most shareholders either decided to tender or sell their shares (I was offering to buy shares at 10 cents above the tender price). I figured I’d wait until the squeeze out and then perfect my appraisal rights because the price was far too low.

The class action lawsuit dragged on for years, but it was settled at a premium price. Shareholders who tendered were to receive an additional $35.95/share gross ($25.76/share net). I had never seen such a large settlement, but when reading the details, I was stunned because existing shareholders were helping to pay this settlement to shareholders who tendered.

Existing shareholders mobilized and sued HC2. The proposed settlement was adding insult to injury, so we made sure existing DBMG shareholders were not paying for the sins of the HC2 parent. We received $3.51/share for the shares we currently owned.

I learned a very expensive lesson in another similar situation. Boardwalk (BWP) was another bad actor who attempted to screw their shareholders. I followed this case very carefully because while it was an unfair price for the buyout, there was also money to be made (I’m not proud!) I only owned a token position in BWP but got much bigger in the 2 weeks prior to the deal closing because there was an additional 5% to be made when things became much clearer. But when the trading price was the same as the takeout price, I sold a day before the deal closed. If I had remained a shareholder for one more day, I would have done much better because Bandera instituted a class action suit and the Chancery Court sided with him.

Judge Laster found that Boardwalk was not entitled to exercise their call right, and that the legal opinion it got from its lawyers “did not satisfy the Opinion Condition because outside counsel did not render it in good faith.” He found that the present value of Boardwalk’s shares — based on management’s own projections of future revenue and distributions — was $17.60, awarding shareholders damages of $5.54 per share.

So I will not be surprised to see a CA lawsuit in the Wheeler situation. Maybe nothing comes of it, but this deal strikes me as coercive and wrong, so I’m holding and willing to see how it all plays out.

any news today?

at $10 aren’t you getting a 23% IRR assuming 6% semi-annual coupon and 10% mandatory annual paydown? seems compelling here or am i missing something?

I think the issue with the paydown is that they can also buy on the open market.

Fair point, but still 18% IRR with no paydowns

While I don’t think the 10% paydown accrues to you directly, I’m with you, I bought around 10.2.

I think the risk at those prices is the tender failing, taking the Ds into an eventual conversion death spiral that you can maybe hedge with the Ls, if your position is small enough in absolute terms.

The only way the price action makes any sense to me is that folks think the tender will fail, and are not excited for what follows.

wouldn’t it be in Stillwell’s interest to just raise the tender offer price if it failed? he doesn’t want a death spiral either…

Given his L’s, maybe he does want the death spiral.