Blueknight Energy Partners (BKEP) – Expected Offer Increase – 60% Upside

Current Price: $3.25

Offer Price: TBD (current at $3.32)

Upside: 60%+

Expiration Date: March 2022

Blueknight Energy Partners is an MLP operating the largest independently owned network of asphalt terminals in the U.S. Its general partner and the largest unitholder (31% of economic interest), Ergon, is trying to steal the company with a non-binding takeover offer at $3.32 per common unit. The offer needs to be approved by the conflicts committee (3 independent directors) and by the majority of unitholders. A materially higher offer is expected and downside risk is minimal.

The offer is opportunistic and provoked outrage from common unitholders. Event-driven PE activist DG Capital acquired a 9.2% stake (making it the second-largest common unitholder) at or above the current prices and wrote two letters to the conflict committee rejecting the acquisition proposal. DG Capital argues the adequate price should be at $6/unit. Another owner, Nat Stewart, is also vocally opposing the offer saying the current price “rips off” BKEP unitholders and suggesting a fairer price would be at $4.39. Even in the recent Q3 call, two analysts started lengthy arguments calling the proposal as “insulting and offensive”.

Ergon has already tried lowballing BKEP before – back in 2019 an offer of $1.35/unit (the company was in distress at the time) was rejected by the conflict’s committee (the members are still the same) and withdrawn one month later. The current offer, although almost 3x higher per unit, is actually almost the same on EV basis as the one rejected in 2019. Given current activism, the takeover at $3.32/unit is unlikely to go through.

There is a decent chance that Ergon will improve the offer to satisfy unitholders and activists. Ergon is a knowledgeable, strategic buyer. It has been BKEP’s GP since 2016, owns 6.6% common and 60% of preferred units. Ergon is also the largest client accounting for 40% revenues of the company.

There’s plenty of headroom for an improved offer. Ergon knows BKEP is cheap and is even ready to sacrifice lucrative GP fees to achieve full ownership. Blueknight Energy Partners has recently completed restructuring, cleaned up its balance sheet, and is now generating high-quality cash flows. The improved performance hasn’t been reflected in the unit price yet due to artificially suppressed distributions (which is at least partially in Ergon’s control). Even a conservative distribution increase – management has already said they’re thinking about it – would lift the stock price to $5.23/unit at the current yield.

The current offer was priced at just a 5% premium to 20-day BKEP WVAP, the pre-announcement price stands at $3.02/unit. Since the announcement, BKEP has released very strong Q3 results, and hinted at even better Q4 results. Also the infrastructure bill has been passed lifting the whole infrastructure sector upwards. Asphalt product manufacturers like MLM and VMC are up to 15%-17% since early October’21. Of course, their businesses are very different compared to BKEP but the directional impact should be similar.

Given these developments, the downside should be minimal in the unlikely scenario that the acquisition breaks. I actually think BKEP price will shoot up once the uncertainty/ceiling from the current offer is removed.

Buying BKEP at current levels is basically a free option on offer increase/withdrawal with substantial 60%+ potential return based on reasonable unit distributions uplift and targets.

Timewise the situation should get resolved shortly, potentially over the next 2-3 months – during the last Q3 conf. call CEO had said that he expected the answer from the conflicts committee in late 2021 or by the Q4 conf. call (early March’22) at the latest.

Background on BKEP and asphalt terminal business

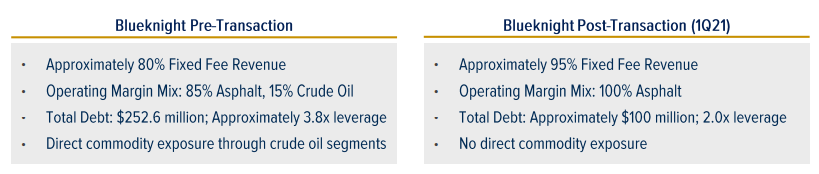

The company used to operate 4 businesses – asphalt terminal/storage, oil terminal/storage, oil trucking, and pipelines. Ergon has taken over a general partner in 2016 unloading a few asphalt terminal assets into BKEP and acquiring a substantial stake in preferred units. A bit more details on Ergon’s performance as a GP are provided in activist/analyst comments below, but the main point is that Ergon tried to save the struggling oil business and failed. Common unit owners paid the price as distributions were bombed out from $0.58/unit annually to $0.32 in 2018 and then reduced again in 2019 to the current $0.16 per unit. Eventually, in Dec’20 BKEP decided to fully divest the oil business assets. The restructuring was completed in March’21 and now the company remains a pure asphalt terminalling and storage business. The difference pre/post-transaction can be seen in the table below:

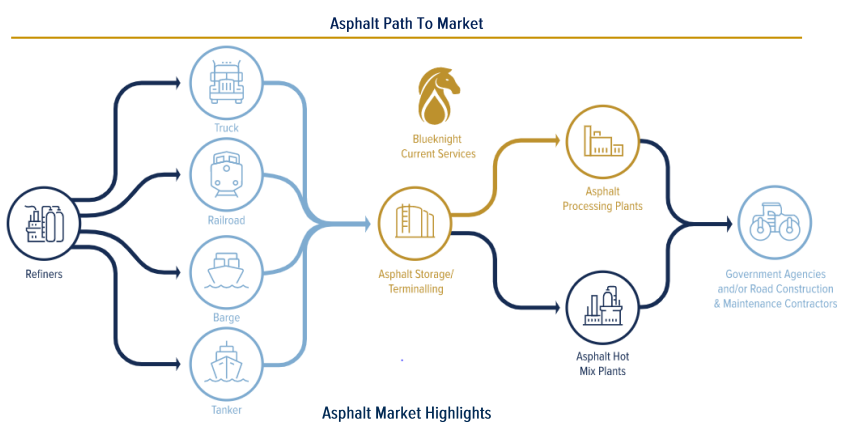

Currently, BKEP has the largest asphalt storage facility footprint in the US. It owns 53 terminals in 26 states with capacity of 8.7m barrels. Aside from storage tanks, BKEP’s assets include logistic assets – docks, rail spurs, and piping/pumping equipment to unload the liquid asphalt into storage facilities, as well as equipment for processing/manufacturing various asphalt products. After initial unloading, the liquid asphalt is moved via a heat-traced pipe into storage tanks. Those tanks are insulated and contain heating elements that allow the liquid asphalt to be stored in a heated state. The liquid asphalt can then be directly sold to marketers or end customers.

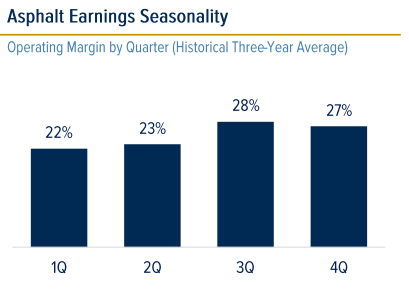

Essentially, BKEP is a much-needed intermediary between oil refineries and asphalt marketers/road construction companies providing customers the ability to effectively manage their liquid asphalt inventories while allowing significant flexibility in their processing and marketing activities. During the oil refinement process, the refineries end up with residuum that can be easily processed into liquid asphalt cement. This makes the supply of the product pretty much continuous whereas the demand is lumpier driven mainly by road constructions and varies by geography. Demand reaches the peak during the warmer summer/autumn (road works) when most of the road construction activity in the United States takes place. As a result, liquid asphalt cement prices can vary dramatically from the winter to summer months. Liquid asphalt cement marketers and finished asphalt product producers with access to extensive storage capacity possess the inherent advantage of being able to purchase supply from refineries at low prices in the low demand winter months and then sell finished asphalt products at higher prices in the peak summer demand season.

Liquid asphalt storage facilities are expensive to build but have low maintenance capex. BKEP has somewhat of a moat as larger clients require a wide (i.e. national) facility network.

BKEP operations are very stable with 100% contract renewal rates, 40% gross profit margins, low maintenance capex requirements, and no direct commodity exposure. The business itself is definitely sticky – in 2021 20% of the contracts were due to expire, however, the company renewed all of them at the same or better terms.

BKEP is run on long-term inflation-indexed contracts. Terms range from 5-7 years, weighted average remaining contracts term is 6 years. The contract structure is comprised primarily of fixed fees and cost reimbursements, which make up approximately 95% of our revenues. The remaining 5% of revenue is variable, primarily consisting of volume based throughput fees. As a result, BKEP revenues are very stable and with low volatility, except for the small variable part.

Ergon accounts for 40% of total BKEP business and the agreement expires in 2023. There are two other third-party customers accounting for 15% and 12% of total revenues.

As of Q3’21, the company had $96m in debt + it has recently announced certain terminal facility acquisitions, which should cost around $15m. Credit availability under debt covenants stood at $157m.

BKEP has 41.5m common units and 34.4m preferred units outstanding. Preferred units have par value of $6.50 and are convertible to common units at par. Annual distribution to common currently stands $0.16/unit (5% yield) and to prefs – $0.715 (8% yield).

Under MLP partnership agreement all of the available distributable cash is distributed to unitholders, first covering the preferred owners at $0.715/unit annually and the rest is split between the common units and general partner fees+IDRs. After common unitholders receive a minimum distribution of $0.1265/quarter the surplus is split in between the common and IDRs at 85.4%/14.6% till common receives $0.1375/unit, then at 75.4%/24.6% till $0.1825 and then 50.4%/49.6% thereafter. IDRs are way underwater with common dividend currently at only $0.04/share vs. the first threshold at $0.1265.

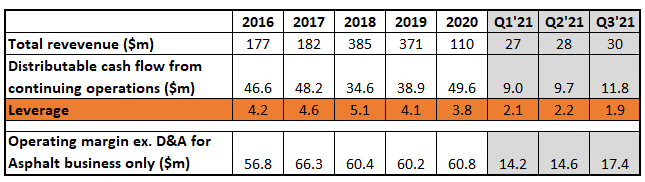

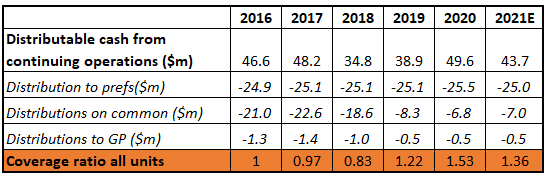

The table below illustrates BKEP’s historical financials. Prior to the reorganization, the company did not provide separate segment data for asphalt business except for the operating margin ex. depreciation and amortization. Asphalt assets have remained largely the same since Ergon’s transaction in 2016 – current 8.6m barrels capacity with 53 terminals vs 9.6m and 54 terminals then. The operating margin from the asphalt business has also remained largely unchanged.

* Note – Q3 2021 results are adjusted for $2.1m one-off insurance income.

Infrastructure bill

The infrastructure bill includes $110bn funding for roads, bridges, and other major projects. This is a 134% increase over the previous funding under FAST Act ($47bn annually). BKEP is definitely a beneficiary of this upcoming windfall spending. Company’s CEO had estimated a positive 6%-8% EBITDA impact from the new federal funding plan (Q2 conf. call):

It’s right around $45 billion spent on road construction and highway work. And we think what’s being considered there could be an increase to that annual number on an incremental basis of close to 30%. And so the benefits to us, we see in probably 3 different areas. The first is in the form of excess throughput or volume in a given year.

[…]

But, we think from a volume standpoint and from an EBITDA standpoint, it could translate into anything from 5% to 8% higher EBITDA or operating margin for asphalt business.

[…]

The second category is we think it also helps us with our contract renewals. And our renewals on an annual basis, we’ve typically had any anywhere between 20% of our capacity up for renewal to 30%. And so, we think that this supports more favorable renewal environments.

[…]

And then the third category is new projects. And we feel that with this type of incremental spending at the federal level, it could translate into new organic growth projects for us with customers. So that’s all to say we do think it’s going to be a positive outcome for our business, it will be positive for our customers. But I do want to remind my new and others that this is highly, highly fixed-fee type business. So how it shows up in our business will be much more muted than other places in the industry.

BKEP has already started growing the network through acquisitions and recently acquired a 200-acre industrial park in Colorado for $15m. Low leverage will allow to fund further growth with debt.

Distributions

Management is limiting common unit distributions based on the distribution coverage ratio in order to leave some of the generated funds for investments and growth. Historically, BKEP’s coverage ratio for all units (distributable cash flow/total distributions made) was around 1x-1.2x. Since 2019 the company started limiting it to 1.2x or above (meaning that less than 83% or less of the generated cash would be distributed to unitholders/IDRs). The historical distribution chart is provided below. 2016-2020 distributable cashflow figures also include results from the oil business (2020 – only partially). 2021 full year figures are estimated based on actual 9M results + a slight QoQ improvement for Q4’21 (as per management’s commentary).

* Note – 2020 distributable cash flow includes certain oil operations. The adjusted figure is $40.7m.

Despite the materially reduced leverage (from historical 4x to current 1.9x) as well as increased quality and stability of cash flows, in 2021 the limit was further raised to 1.3x. This meant that common unit distributions remained unchanged from the last year – activists argue that this was done on purpose to suppress common unit price before the takeover proposal.

It is quite evident (and one of the key points presented by the activists), that the current distributable cashflow generation levels easily support far larger common unit distributions. During the lastest conf. call CEO has finally hinted at the potential increase but still noted the 1.3x coverage ratio limit.

I think that if Ergon’s offer is withdrawn, given the current activism and sector tailwinds, the company will eventually move or be pressured to move towards the previous 1.2x coverage ratio and substantially increase the distributions for common units.

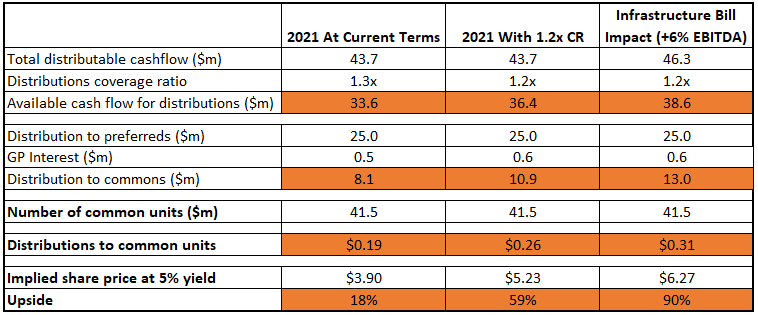

The table below illustrates two scenarios of how common unit distributions would look like if the coverage ratio gets adjusted to 1.2x and assuming 6% EBITDA increase (infrastructure bill impact as per management’s comments).

To illustrate that downside is completely protected at the current levels – even if the coverage ratio limit remains at 1.3x, 2021E cash flow generation levels will still allow a 16% distribution increase to $0.19 annually, which at the current yield should lift the unit price towards $3.71/unit (12% upside).

Activist – DG Capital

DG Capital acquired a 6.6% stake in Oct’21, raised it to 8.2% in Nov, and then to 9.2% in Dec buying at or above the current price levels. Currently, it is the second-largest unitholder. The activist has also issued two letters to the conflict committee (October and November).

DG Capital comments:

- DG Capital states Ergon’s offer materially undervalues BKEP and “improperly seeks to shift value to the Company’s preferred unitholders” at the expense of common unitholders (due to Ergon’s 60% ownership of preferreds and offer price on preferreds being way above par).

- There are significant conflicts of interest and self-dealing with Ergon controlling the board, serving as GP, and owning the majority of pref. units.

- Common unit distributions have been artificially depressed.

- The timing was opportunistic due to the proposed infrastructure bill, which had not been passed at the time yet.

- CEO was openly admitting of significant expected benefits from the infrastructure bill and Ergon’s offer doesn’t reflect that at all.

Several quotes are below:

The Company has successfully engaged over the past several years in a restructuring effort, that has resulted in a material deleveraging of the Company. The Company’s capital needs are modest, at best. The Company has substantial liquidity and balance sheet capacity, which should have resulted in larger distributions being issued to the Company’s common unit holders.

We also note that Ergon, which controls the Company as noted above, appears to be orchestrating the proposed transaction to have the Company otherwise fail to comply with best corporate governance practices under Delaware law. For example, the proposed offer does not indicate that the transaction will be conditioned on the approval of a majority of the disinterested common unit holders. This further brings into focus the degree to which the proposed offer reeks of self-dealing and constitutes nothing more than an attempt by Ergon to unjustly enrich itself at the expense of the common unit holders.

Based upon the foregoing, it is DG Capital’s position that the fair market value of the common units exceeds $6.00 per unit and that is without accounting for the additional potential upside to the value of the Company’s common units resulting from the passage of the proposed infrastructure bill, which the Company expects to be significant.

The board/committee has so far refused to meet with DG Capital.

Activist – Nat Stewart

Letter to conflict’s committee as of October 19, 2021.

On value shifting from common to pref. unitholders:

The conjunction of these two issues mean that Ergon’s proposal, as presently configured, “rips off” Blueknight Energy’s common unitholders. Shockingly, this attempt to rip value from the common unitholders comes just after a time period over which Blueknight’s management team has promoted the refocused business to the investing public – a plan that on its merits justifies a substantially higher common unit price.

[…]

As Ergon owns over 60% of BKEPP’s units and only ~7% of BKEP’s units, this manufactured value discrepancy benefited Ergon. By my estimates (holding the enterprise value of the deal constant) Ergon saves approximately $36M in cash outflows by shifting value from BKEP to BKEPP. I would be happy to share my calculations if the conflict committee is interested.

On artificially depressed distributions:

An easily affordable increased distribution would have supported BKEP’s unit price. Given Blueknight’s low leverage, stable cash flows and limited capex needs, a 1.2x coverage ratio is more than adequate. Using full-year 2021 estimates for DCF, this would have allowed for a common unit distribution of ~$.06/quarter or $.24/year. This distribution level would have left substantial dry powder for growth opportunities while maintaining a large margin of safety given the low leverage.

[…]

At a 5.1% yield (approximately equal to BKEP’s yield at the $3.16 reference price sited by Ergon) BKEP would trade at $4.74/unit. This higher unit price would have prevented Ergon’s absurd, low ball-offer for the common units.

Activist – Sebi Garden Capital

Sebi Garden Capital analyst put a long and detailed critique of Ergon as a GP and the takeover proposal during the latest Q3 conf. call. Some quotes are provided below:

But I would say simply put, that the offer as it stands today is insulting and it is offensive. It is offensive to the management of Blueknight, it is insulting to the common unit holders, and it is deficient for the preferred unit holders and undervalues Blueknight.

[…]

And by way of background, Ergon invested first invested in Blueknight in 2016 and became general partner then. And thereafter and for the ensuing three years, Blueknight deployed capital towards low returning crude oil businesses and trends deteriorated. And Blueknight was forced to cut the dividend the common dividend twice. Once significantly in 2018 and then significantly again in 2019. And of course, apps that Ergon put in a bid to acquire Blueknight, not unlike today, but at lower levels two years ago.

The stock since they first made that investment became channeled partner is down 40%, despite the bronze had year-to-date now it is still down 40% from their initial investment. The distribution on common is down over 70% since they became general partner. I’m going to say that again, because I think it is pretty important. The distribution per common unit when Ergon first became general partner of Blueknight was $0.58 per unit. It is $0.16 per unit today. So there has obviously been a bit of value destruction since they have been a general partner.

[…]

And right now at 1.8 times leverage you have got the cleanest balance sheet in the history of the company. And this company is in the best financial position it is ever been in. And now of course, you have got the infrastructure bill on the comp, as CG capital pointed out in the letter. And Ergon’s take takeout offer, as it stands now, doesn’t account for any of this.

Following the divesture crude oil, you have an under levered balance sheet at 1.8 times. Your target leverage ratio, as you say, is 3.5 times, when you pencil out the sources and uses of this offer, with a 3.5 times leverage. It isn’t a takeout, it is a take under. Ergon couldn’t would use book Blueknight’s balance sheet to lower its cash outlay with this bid. In other words, the implied cash costs Ergon is really the equivalent of what the bid was two years ago to acquire this company, which by the way was withdrawn within five weeks.

[…]

And as for the preferred shareholders, the bid would be highly taxable for the sellers, not for Ergon. But importantly, it also sidesteps the likely better alternative of a recapitalization of sorts, or a negotiated conversion of the preferred to common. At an exchange ratio that would benefit all shareholders, common unit holders, preferred unit holders and Ergon. Ergon has 60% of the preferred units, they could execute this easily.

The reason why the common units are depressed is because this Company’s capital structure is massively inefficient. Two-thirds of your fully diluted equity value is in a preferred security that is illiquid, and it has a high cost of capital. It looks like you have $130 million market cap and yet you have a $400 million fully diluted value.

Probably did not state this clearly enough in the write-up – my understanding is that shareholder approval would be based on the majority of all unitholders, including the preferred ones. Ergon already has 31% interest in all units and the remaining preferred units would probably also be in favor of the offer as they are getting cash out materially above par. If that’s the case, then Ergon already has almost 50% of the vote.

Having said that, I do not expect the offer to reach shareholder vote without price adjustment. The first threshold for Ergon to pass is the conflicts committee, which has rejected the previous offer.

It seems like preferred unit holders are eating up all the upside here? Overal EV/EBITDA is 9x. Say they buyback those preferred units at par (which seems quite difficult with them trading above par) and refinance at 8% overall. Then interest would be $25 million. EBITA is $40m. So that would mean distributions to common could be $10-15m. With debt at 6x EBITDA a 10% yield would not be a bargain.

Or am I missing something here?

I think your assumptions on debt costs are too high. Judging where preferreds are trading and stability of cashflow over the years, company/Ergon should be able to find much cheaper debt financing.

Had another look at this and I misread the financials and got debt figures all wrong, so my bad. That is what i was missing Ha!

So another attempt. Assume 4.5% interest on $325m debt, $50m EBITDA and $10m average capex, to get $25m of FCF. Value at 12-15x and equity value would be $300-375m.

But Ergon would lose $2 x 20.8m preferred units = ~$42m. And they would lose their GP interest and IDR’s, which can be valued at say, $50m? So that would imply they would at most pay ~$5-6.8 per unit.

Then they would probably want at least some discount, otherwise why bother doing the transaction? So an agreement between $4-6 can be expected?

But Ergon has quite a bit of negotiating leverage here, given that those preferred units cannot realistically be called without their permission. Their voting interest is about 50%. So then the question is, how stubborn will each party be here? Looking at where the preferred is trading, the market seems to think quite stubborn.

This is Nat Stewart, one of the Investors who sent a letter to the board’s conflict committee related to the proposed acquisition of all Blueknight’s public units by Ergon.

Thank you to this site’s proprietor for inviting me to make a comment here and for writing this excellent writeup. I agree that the risk/reward is highly favorable at this time.

I am writing to urge anyone who has recently taken a position in this security to *write your own letter to the conflicts committee as soon as possible* (investor@bkep.com). You are fighting not just for your own upside, but for the many long-suffering BKEP unitholders who have been thrown under the bus during Ergon’s watch (See Sebi Garden’s excellent comments in this writeup above).

I have been told the conflict committee is taking investor feedback seriously. The more unified and informed the shareholder base is and appears, the more likely it will be they will not bring a crummy offer to shareholder vote.

DG Capital’s letters as well as my own letter might provide some useful ideas to work with, however make sure to add your own insights, etc.

It does not need to be fancy – just let them know you will not support a proposal that acquires BKEP common units *anywhere near* the $3.32 ripoff price.

Duke R. Ligon (lead independent director) owns a decent amount of stock – I doubt he wants to be ripped off. Management is likely on our side as they are compensated in stock. I believe that management wants to see their strategy work in public markets and do not want this ripoff to occur.

An additional note on how I am thinking about it:

As this is a take-private proposal, I am mostly considering it in terms of enterprise value.

Blueknight’s asset base is in my view somewhat like a hybrid between industrial real estate and an operating business. Economics are very strong, limited capex, strong margins, cash flows are contracted, very stable, and inflation protected. If you go back to the correct earnings call, I actually proposed the cushing asset sale/asphalt terminal-focused strategy to the prior management just before he (Hurley, prior CEO) was fired – I have followed this for a long time.

I believe a business like Blueknight’s is worth a premium in today’s market. Using my 2021 estimates I think the EV on an acquisition *should* be at least $650M, which in my view is still relatively conservative. For Ergon, it will be even moreso as they will be able to create substantial overhead savings and rapidly boost EBITDA – they could pay us fair value or close to it and it would still be a no-brainer for them.

The key is that all incremental upside (assuming the BKEPP price stays the same at $8.46) goes to BKEP unitholders who are a small relative part of the capital structure. As such, a $650M EV would translate to a BKEP price of ~$6.40/unit, in line with DG’s statement of value being over $6/share. I mentioned the lower figure in my letter only as a price that would potentially have deterrred this extreme low-ball offer – not as my view of fair value. (Perhaps I should send my own letter clarifying this!)

So once again, I urge all shareholders who might have taken a position as a result o this very fine writeup to write the conflicts committee. Let them know you do not support this crummy “rip off” offer. Send an email to investor@bkep.com and make it clear that the letter is intended for the board of directors conflicts committee.

Just sent an email.

I have sent an email

Nat, if there’s no deal here, why wouldn’t Ergon push their incentives – with an extremely favorable Limited Partnership Agreement working in their favor? Why wouldn’t they (i) keep the distribution coverage ratio artificially high, (ii) push excess BKEP capital into growth capex and extract margin/value from their revenue contracts, (iii) keep the value in their preferreds.

As a common unitholder, incentives aren’t aligned with the GP. Ergon’s not paying much of a premium b/c they don’t have to (risk is Delaware court really…). How does the Ergon discount ever go away?

@rd128, I think you and @ijw have the central question nailed. What is the right sale price allocation for the capitalized value of the GP’s IDR? The EV can’t be allocated only to the common unitholders. Cannot picture a GP walking from their IDR on a sale without sale value being attributed to it, esp with a 50/50 split. I’m not as well versed in the numbers, but with a 50/50 split, I’m not sure $50M is the right number.

I kind of roughly ball parked that $50m estimate, what do you think the right number is? I figured a reasonable range of income from their IDR’s is between $1-6 million and kind of took the middle of that.

The problem is, those IDR’s are less valuable because of the abusive preferred units. So they do kind of partially cancel each other out.

I think this is still the crux of the problem, even with the IDRs being basically worthless. It seems like Ergon knows that their IDRs are all but gone forever so this was an attempt to buy them back on the cheap. But are they really incentivized to raise their offer? If they can fleece the common unitholders into taking a bad offer great, if not they just retain earnings to grow their self-dealing operation, keep collecting their prefs, and the common unitholders continue down the same path of getting enough distributions to cover their tax liabilities each year until they either give up and sell or accept a below market offer.

Ergon may just have too much leverage.

Edit: disregard the comment and table below. IDRs are worthless at current common dividend levels.

I think the IDRs are probably worth not more than $10-$15m. See Ergon’s waterfall benefit table below, calculated at different annual common dividend levels. At the current $0.16/share common dividend Ergon is actually pocketing only $0.9m from the IDR’s.

Of course, IDR’s value increases substantially as distribution to common shares rises, but in that case, common shares will naturally be worth more as well. At $0.25/share distribution and 5% yield, it would trade at $4.92/share.

Also, I think the IDR payouts that are coming from Ergon’s ownership should be deducted from the above figures. This would make the figures in orange column c. $0.3m lower (mostly due to IDRs on 60% ownership of preferred). So at current dividend rates, the $0.6m Enron receives from the IDR is probably worth below $10m (if at 15x multiple).

In other words, a rather negligible impact in value consideration compared to buying out common shareholders $50-$100m below fair price.

The 1.6% is not part of the IDR it is the GP interest. To maintain that interest they have to invest, I don’t think it is like an AUM fee:

“Our partnership agreement provides that our General Partner will be entitled to approximately 1.6% of all distributions that we make prior to our liquidation. Our General Partner has the right, but not the obligation, to contribute a proportionate amount of capital to us to maintain its approximate 1.6% general partner interest if we issue additional units. ”

The IDRs are way out of the money and as such not worth much. The first tier hits at $.1265/quarter, vs. $.04/quarter currently paid.

“First, 98.4% to all unitholders holding common units or Class B units, pro rata, and 1.6% to our General Partner, until each unitholder receives a total of $0.1265 per unit for that quarter (the “first target distribution”)”

There is a huge runway where BKEP takes all the growth upside, which is of course a major reason why Ergon wants to steal it.

Nat, thanks for the correction.

The tables in the write-up calculated IDRs incorrectly using $0.1265 as the annual dividend threshold. This was a mistake on our side. Thresholds are on a quarterly basis. This only makes BKEP more undervalued as IDRs are underwater and larger cashflows will accrue to common with increasing EBITDA.

Will adjust the tables and figures in the write-up.

In projecting/valuing the IDRs, I would look at not just the actual/projected distribs but the distributable CF, which is $11.2M higher. For valuation in the private market I believe there would not be a deduction for keeping a coverage ratio. The EV would be based on the CF (albeit at a lower multiple than with coverage). $43.7M distributable CF – $32.5M distribs to pref, IDR and common. (I’m using dt’s updated historical CF allocation table and assuming other tables have not been updated yet. Please let me know if I’m wrong.)

Since the distrib’s are past the first breakpoint, that excess CF (and all the upside from the infrastructure bill) is mostly (from 50.4% to 85.4%) theirs. Am I wrong in thinking that at 1.0 coverage (ie full distribution), the IDR’s would get $6+MM? Maybe the $50M isn’t far off.

I’d be looking at the entire EV less the entire IDR valuation (not just the 40% Ergon doesn’t own).

Sorry I don’t have time at the moment to fill this in more thoroughly.

mkasson, did not have a chance to update the tables yet. Distributions are way below the first breakpoint ($0.04 vs 0.1265), so IDRs have close to zero value. GP is only getting distributions from the GP interest, which is 1.6% of all funds payed out to common and preferred.

Sorry, @dt. Yes, @nat cleared that up and I didn’t read closely enough. Even at full distributable CF the IDR’s are still out of the money. Solid thesis: per unit price should reflect modest deduct for the IDR’s (perhaps on a higher val due to infra bill) and clean up the preferreds’ price.

BKEP valuation table has been updated to correct for IDR payouts. With all incremental payouts going fully to common till dividends reach $0.5/share annually (vs current payout of $0.16), the base case target price is now at least $5.2/share.

IDRs are basically worthless.

Previously, incorrectly assumed IDR thresholds to be on annual rather than quarterly basis – an oversight on my side, but at least with the correction, the case strengthened even more and not the other way round.

BKEP has increased its cash distribution from $0.16 to $0.17/common unit annually. Not sure what was the point of this given the current situation and takeover offer. The press release still talks about 1.3x coverage target.

https://investor.bkep.com/press-releases/press-release-details/2022/Blueknight-Increases-Quarterly-Distribution/default.aspx

Sorry if a dumb question, are there any accrued outstanding distributions owed the pref at current?

The company is current on its preferred distributions, so no liabilities there.

Please let me know if I’m missing something here. More or less it sounds like if they buy out the common you can probably throw the coverage ratios out the window since they’ll be in control, so they are more or less getting their hands on $0.35 – $0.45 per share of discretionary earnings and paying 7-10x for them when clearly the the market values those earnings at 20x+?

In a sense yes, if it is a private company with no public distribution obligations (neither to common nor to preferreds), then coverage ratios could be thrown into the bin. And yes, market seems to value these cashflows far higher than Ergon is currently bidding.

BKEP is scheduled to announce Q4 and full-year results on the 8th of March with a conference call the next day.

any recent news or is this just an opportunity to buy?

BKEP announced strong Q4 results. No updates on the special committee review yet. The thesis remains intact and I think this is one of the safest/most attractive special situation plays in the market at the moment. The two recent quarters clearly showed significantly improved financial performance and earnings quality post-restructuring. The company has the ability to pay much larger common dividends than it does now. Hard to imagine Ergon will push through the $3.30/share offer without facing substantial backlash and legal consequences from common shareholders.

Just a speculation on my side, but I view it as a positive that special committee has already spent $0.7m on ‘in non-recurring legal and professional fees related to the conflicts committee’s ongoing review of the Ergon buyout offer’.

Q4 Results:

– Revenue $30.2m – in line with the last quarter, despite Q4 usually being somewhat lower due to seasonality effects.

– adj. EBITDA of $13.9m or $14.6m if adjusted for the $0.7m SG&A expense for the special committee.

– Distributable cash flow from continuing operations at $11.8m or $12.5m if adjusted for the same expense.

– Q4 coverage ratio for all units was 1.46x (or 1.54x if adjusted).

– Q4 coverage for common unit distributions was 3.0x (or 3.7x if adjusted)

A few thoughts on 2022 guidance:

– 2% EBITDA growth guidance for 2022 seems to be a sandbagged. The Q4 run-rate would result in $58.4m EBITDA vs $53m guided by management.

– New growth projects after $15m initial capex in 2022 are expected to contribute incremental run-rate EBITDA of $2m/year. So that’s now $60m in normalized forward EBITDA.

– with interest expense at $3.5m/year and maintenance capex at $6.5m, normalized distributable cashflow should stand at $50m. Using management’s 1.3x coverage (which almost fully covers the anticipated growth capex) and deducting $25m for preferred holders, still leaves $13.5m for the common unitholders. That is $0.32/share in annual dividends or $6.4/share at 5% yield.

I may scoop some up here. Am a little worried that Ergon may be able to keep the price suppressed but downside feels really good. Thanks for the follow up.

I am getting fills at 3.33…….risk reward to great for me to ignore

Happy ending, coulda been happier but no complaints. Great trade.

https://investor.bkep.com/press-releases/press-release-details/2022/Blueknight-to-be-Acquired-by-its-General-Partner-Ergon/default.aspx

Agreed, a great outcome which could have been even better. Revised offer at $4.65/share.

Seems like a done deal now and I would expect BKEP shares to trade very close to the offer price.

Is anyone staying in this? The increased bid is $4.65 all cash, but BKEP is currently trading at $4.57 as of 4/22/2022@10amET (yet pre-market BKEP was $4.64, which is one cent less than the bid price). If you plan to stay in BKEP for several more weeks or months…

i. What is your best guess as to the probability that a competing bidder will come in? Or that the current bidder, Ergon, will increase its bid price?

ii. Probability the deal falls apart? My hunch is it’s a very low probability (i.e., less than 1%) given the bidder already has a large stake, strategic, and has been pursuing the acquisition for several years. My assumption is the bidder will have no issues coming up with the cash; however, Ergon is a private company, and I’m uncertain as to whether there is bank/external financing involved. Thanks!

Only selling if I have something else to buy

If it really closes in June/July that’s another 5-6 percent annualized plus the mid-May divvy of an annualized 3 percent. Not bad.

Thank you for the great idea!

DT, thanks again for the awesome idea! Do you know of any other situations (as was the case with BKEP) where a GP/major shareholder has made a takeover offer that is currently outstanding?

For context, the only situation like this that I’m aware of presently is Shell with its takeover bid outstanding for Shell Midstream Partners (SHLX). However, I am waiting/hoping for SHLX’s share price ($14.17/share) to decline because the offer ($12.89/share) is below where SHLX is trading.

Does anyone have a good sense of how long it will take for this deal to complete? In addition to the proxy statement, looks like there will also be 13E-3 filings – will the SEC review of these documents take a while?

Shareholder vote scheduled for Aug 16……this is still offering a 2.5-3.0% yield for about a month……any following aware of any risks to this closing? thanks