Taiga Building Products (TBL.TO) – Expected Large Dividend – Upside TBD

Current Price: C$2.82

Target Price: TBD

Upside: TBD

Expiration Date: February 2022

This idea was hinted by HomeSpunoff.

We think this is an interesting idea and the announcement of a large special dividend at the end of February is very likely. However, trading liquidity is low with a daily average of C$20k – C$40k.

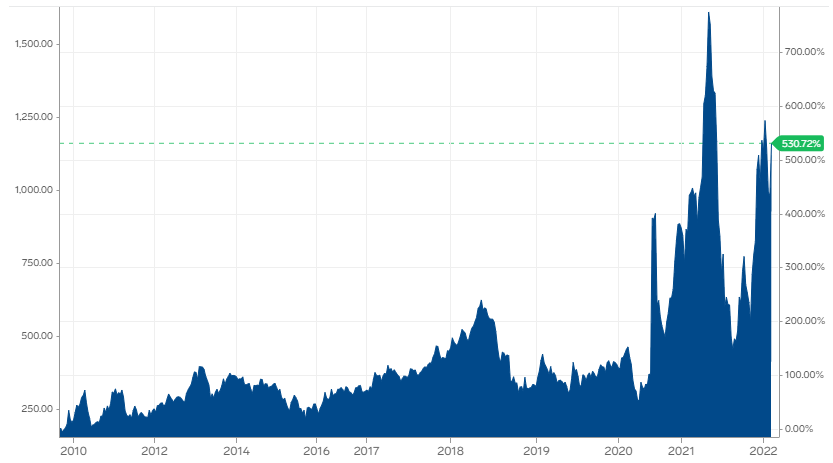

Taiga Building Products is Canada’s largest independent building materials wholesaler with significant exposure to lumber products. Due to housebuilding sector tailwinds during 2020 and 2021, the company has started generating lots of cash, has cleaned up its balance sheet eliminated expensive debt, and is now in a position to return funds to shareholders. A C$30m special dividend has already been paid out in Q1’21 and an even larger dividend is expected this quarter with the announcement of annual results. During Q4’21 Taiga has likely generated a lot of incremental cash due to steeply rising lumber prices and continuing housing boom in North America. I estimate the company might have ended the year with C$100m+ of cash on the balance sheet (vs C$300m market cap).

There are several parts to the thesis here:

- Expected large capital return. In Feb’21 due to strong financial performance over 2020, Taiga paid out C$30m in a one-time special dividend. The announcement of annual results and dividends resulted in an instant 20%+ share price jump. At the time, however, the company had a much weaker balance sheet – C$30m of net debt – and had generated only C$50m FCF during 2020. As already noted above, at the end of 2021 Taiga is expected to be in a net cash position of about C$100m+ with C$170m of FCF generated during the year. I expect an even larger special dividend this time, to be announced by the end of February.

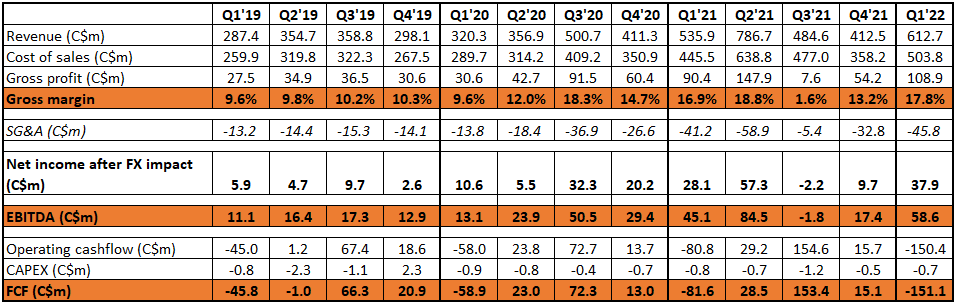

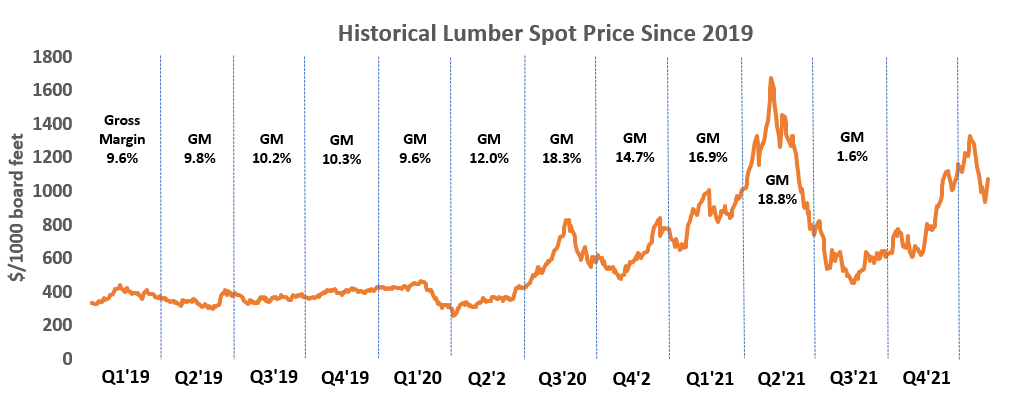

- Q4’21 results are likely to surprise to the upside. During the quarter lumber price has been steadily increasing, eventually doubling by the year-end. Due to the lag between lumber inventory purchases and sales to customers, Taiga is able to capture incremental gross margin in a rising lumber price environment. Historical performance correlation with commodity prices supports this notion. Q4’21 gross margins and cash generation will be at record levels.

- Q4 will also have a positive seasonality impact on the FCF due to the release of receivables (historically that happens in Q3 and Q4 quarters). In Q3’21 alone the company generated C$153m from working capital release and I expect another positive (although much milder) impact from the last quarter.

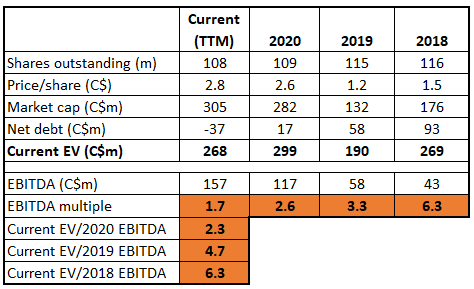

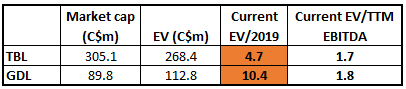

- Taiga is currently trading at 1.6x TTM EBITDA and is also inexpensive on normalized earnings trading at 2019 EBITDA – 4.7x multiple, below its closest peer valuation of 1.8x on TTM basis and 10.4x on 2019 EBITDA. Many building products distributors are currently cheap, but Taiga is especially attractive due to its large expected special dividend.

The company is 72% controlled by Singaporean holding company Avarga (listed on Singapore stock exchange). Taiga is the main cash-generating business of Avarga, so the incentives for large capital return are aligned here. Both Avarga and Taiga are controlled by the same Tong family (father and son). Avarga took ownership in 2017 and so far has made several positive steps in restructuring the company – eliminated very expensive 14% notes, started buybacks (7.4% acquired since 2018) and paid out C$30m dividend last year. So the track record seems decent and aside from excessive compensation for Tong family, the interests of minority shareholders seem to be well aligned.

There are several reasons why this situation exists and several important caveats to note:

- First of all, this is a completely underfollowed Canadian micro-cap with low free float/liquidity, that is controlled by an Asian Holdco.

- Financial reports provide rather low visibility into the business. Very limited disclosures on operations might be a thesis killer for most as it’s pretty much impossible to tell what’s going on with certain accounting items of TBL, e.g. extremely volatile SG&A expenses, or close to zero gross margins in Q3’21. Having said that, TBL’s operating margins are quite stable and in line with peers offsetting some of the worries here.

- Tong family, the son is TBL’s Chairman and the father is also on the board, receives egregious annual compensation, which includes $1.5m in director fees for each.

- Finally, the business is exposed to lumber price fluctuations and Taiga’s gross margins are expected to be negatively impacted in a falling lumber price environment. However, the dividend thesis is not overly dependent on lumber price fluctuations as it will only take a couple of weeks till the announcement and Q4 is already in the pocket. Given a short timeframe and continuing housing demand in NA, the commodity exposure risk is low.

Taiga Building background

Founded in 1973, Taiga is Canada’s largest independent wholesale distributor of building materials and also has a growing presence in the US (20% of sales).

Taiga distributes:

- Structural lumber – lumber cut to standard sizes and used as building material;

- Panel products – plywood, particleboard, strand-board, etc.;

- Allied/treated products – roofing materials, moldings, treated wood, etc. Treated wood is lumber that has been chemically treated to increase its ability to withstand variable weather conditions. It is used for fencing, decking, foundations, landscaping, and for other external applications.

Structural lumber and panels generate 59% of sales.

The nature of the business requires Taiga to maintain a substantial inventory, which is kept at 15 distribution centers in Canada and 3 centers in the US. Taiga also operates 4 wood preservation plants (3 in CA and 1 in US), which produce treated wood products. Nearly all properties (distribution centers/preservation plants) are leased.

Taiga acquired Exterior Wood for C$55m (1 preservation plant and 1 distribution center in the US) expanding its presence in the US. The acquisition was done at 6x EBITDA, in line with TBL’s 2018 EBITDA valuation.

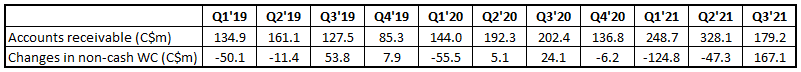

Taiga’s business is seasonal with higher revenues during spring-summer months when most of the building activity occurs. Q1 and Q4 are usually a bit weaker and during that time the company accumulates inventory in preparation for the high season. Due to order/payment lag the company accumulates large accounts receivable balance during the high season which is then released in Q3 and Q4. Overall, Q3 is the strongest quarter in terms of FCF generation from operations as well as working capital release. Q4 also tends to be the second-best seasonal quarter in terms of FCF generation.

The company is also exposed to lumber price fluctuation and usually doesn’t hedge it. The inventory turnaround is fast – about 2 weeks for structural lumber and about 4-6 weeks for total inventory – and gradual changes in lumber prices are transferred to the end customer. However, in times of high commodity price volatility Taiga’s gross margins may get impacted accordingly (expand or contract) due to inventory realization lag.

Due to low lumber price volatility during the 2010-2019 period Taiga’s performance was pretty much stable with 8%-10% gross margins and C$30m-C$40m in annual EBITDA. The company was slowly reducing its large and expensive debt (14% notes + credit facility, net debt/EBITDA at 7x+) and paid no dividends.

However, lumber prices exploded in 2020 due to the increased demand following the rapid rise of new housing starts/house renovation projects, etc. during the COVID outbreak. 2020 was a record year for the company with revenues of C$1.6bn, gross margins at 14.2%, and EBITDA of C$116m vs $58m in 2019. FCF (adjusted for working capital changes as Q4’20 saw a large investment in inventory due to high demand) also doubled to C$80m vs C$40m in 2019.

Historical lumber spot price:

The trend has rolled over strongly into 2021 as the housing boom only accelerated causing high volatility in lumber prices. In Q2’21 lumber prices reached $1600+ per thousand board feet (4-5x historical levels), later dropping to $500 in mid-Q3 and then rebounding back strongly during the last quarter.

Taiga reported 17%-19% gross margins and generated C$126m EBITDA (adj. for IFRS) during the first half of the year. Q3’21 was much weaker as commodity price was mostly falling throughout the quarter. Despite that, due to the release of non-cash working capital (accumulated receivables from Q1-Q2’21 and inventory), FCF generation still turned out extremely strong at C$153m.

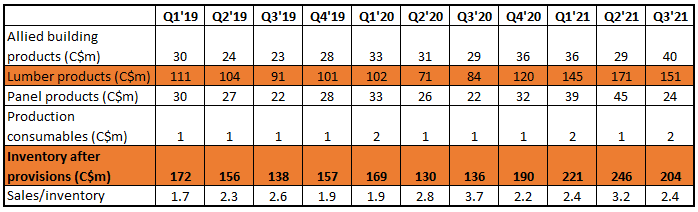

All of this can be seen in the historical quarterly performance table below (note – updated to reflect Q4’21 and Q1’22 results as well):

Note – due to limited disclosures in financial reports, the reasons behind this SG&A volatility are unclear. The company explains that the changes are due to variable compensation expenses, however, the volatility seems a bit too high to be accounted for only by the differences in variable compensation. Q3’21 SG&A drop is a complete headscratcher.

Exposure to lumber prices

Here’s a more recent chart of historical lumber prices:

Comparing lumber price movement during the quarters with Taiga’s historical performance chart above and keeping in mind 2 weeks inventory turnover for lumber and 4-6 weeks for total, one can see the correlation between sharp changes in lumber prices and Taiga’s gross margins. In quarters where lumber price is stable or increasing very slowly (e.g. 2019 year), the company reports table 9-10% gross margins. However, when upward lumber price movement gets sharper (e.g. from Q3’20 to Q2’21), gross margins and profitability explode as the company is able to capture incremental spread on previously acquired inventory at cheaper price. The same works in reverse in a falling lumber price environment, as happened during Q3’21, when a large part of inventory sold during the quarter was acquired during the second half of Q2’21 at much higher prices.

This lag in inventory realization (2 weeks for lumber, 4-6 weeks for total) is key. Moving the vertical quarter start/end lines a bit to the left to account for this lag results in the best correlation between volatilities in lumber prices and gross margins.

Potential Q4 FCF generation

This brings us to Q4’21:

- Firstly, this was the only quarter over the last two years that saw consistent increase in lumber prices – the price steadily doubled without any major corrections. Early quarters were exposed to both sharp rises and sharp falls in lumber prices.

- Inventory at the end of Q3’21 is not far away from an all-time high (materially above historical levels). A large part of this inventory was likely acquired around the end of Q3 or even during the mid-Q3 dip, at lower/much lower prices.

- Moreover, in Q3 Taiga has made an inventory provision for C$13.5 due to “due to the impact falling commodity prices had on its treated inventory values”. Thus an already low-priced inventory (looking from the end-of-Q4 perspective) was discounted even further. This provision of legacy inventory might add a couple more basis points to Q4 margins.

- There should be some incremental FCF generation in Q4 due to further release of receivables. Historically the company always had a release of receivables in Q3 and Q4. Q3’21 ended with both receivables and inventories still at historically high levels. So I wouldn’t be surprised to see another C$30m-C$40m in incremental FCF in Q4’21 from working capital release alone.

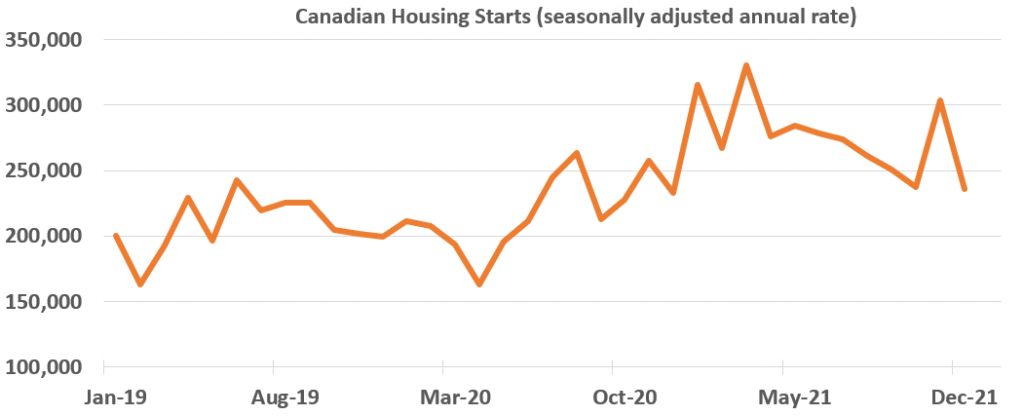

I am not a housing expert and you can find plenty of macro opinions by simply googling, but a couple of stats might be worth noting with respect to Taiga’s exposure to housing markets in Canada and US, both of which continued along the covid started boom during Q4’21 (source).

Average Q4 housing starts in Canada were at historical highs, which has now resulted in supply shortages and a very tight housing market.

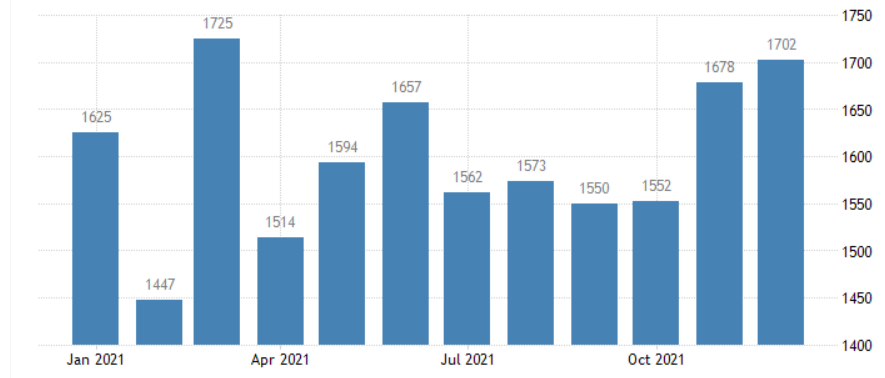

Meanwhile, in the US, the housing boom was even stronger in Q4’21 with housing starts going straight up during the quarter. US housing starts (in thousands):

One caveat regarding the US market is that at the end of November, US regulators doubled softwood lumber duty on Canadian lumber producers to 17.9%. The rates are going to stay until another review in Aug’22. However, US is only 20% of total Taiga sales and duty became effective only in December, so negative effect should be minimal/non-existant in Q4’21.

Keeping the above noted dynamics in mind, I expect Q4’21 quarter to be very strong. Looking at historical results and lumber price movements, I am estimating Q4’21 FCF at C$70m as a base case (including C$30m from the potential release of receivables and maybe even some release of inventory). That would sum up to C$120m cash (or C$100 net cash) that the company could use to return to shareholders.

Some thoughts on valuation

Taiga doesn’t have many comparable peers, but the best one is probably a bit smaller Canadian building materials wholesaler Goodfellow (73% of sales generated by lumber and panels). Gross margins of both firms are very different – 19%-20% for GDL vs 9%-10% for TBL due to different accounting. However, operating margins are very similar. Both firms historically had 2-3% operating margins, which peaked at 10% in Q2’21, however, for some reason TBL margins dropped to 2% in Q3’21, whereas GDL operating margins stayed at 8.8%. Despite that, it’s worth noting that Taiga has a much stronger balance sheet than its peer.

Assuming 2019 EBITDA as normalized earnings power, TBL seems cheap compared to GDL:

Avarga’s background and Taiga’s restructuring

Avarga is a Singapore-listed holding company, which apart from Taiga also owns a paper business in Malaysia and an electricity business in Myanmar. The two latter ones are relatively small compared to Taiga.

31% of Avarga is held by Tong family. The father Dr. Tong is the exec chairman of Avarga, while the son is the CEO. The son is also a chairman of Taiga, while the father is Taiga’s board member. Another 19% of Avarga is held by Singapore billionaire Peter Lim.

Avarga acquired its stake in Taiga in 2017 and subsequently started a restructuration of the company:

- January 2017 – Avarga acquired a 58.4% share of TBL from its previous two largest shareholders + C$46m principal amount of unsecured notes (14% interest) of Taiga. Total consideration was C$71.8m. Avarga states that share acquisitions were done at 4x EBITDA price.

- November 2017 – Taiga announced an exchange offer to get rid of its extremely expensive C$100m+ 14% interest notes. Noteholders were given the option to exchange it into either new 7% notes (5 year term) or Taiga’s shares at 16% discount to the market price (C$1.20/share face value vs C$1.42/share market price). Avarga chose to receive shares, yet due to dilution after the exchange, its ownership in TBL dropped to 49%. Most other debtholders also chose shares as previous $128m 14% notes turned only into C$12.5m new 7% notes and the sharecount increased over 3.5x after the exchange. Clearly, Avarga profited here at the expense of the minority shareholders, however, it also managed to get rid of 14% rate notes reducing the total net debt from C$215m to C$91m.

- In 2018 Taiga has finally started doing share buybacks. And has so far repurchased 7.4% shares through Q3’21. During the last quarter Taiga repurchased around 330k shares at C$2.50+/share average price (around current share price level).

- Late 2018 – Avarga acquired another 18.5m TBL shares from a major shareholder for C$27m increasing the ownership in Taiga to 65%. In time, due to small incremental purchases and buybacks, the stake increased to the current 72%.

- February 2021 – Taiga announced C$30m one-time special dividend due to strong performance in 2020.

The track record of Tong family in terms of caring for minority shareholders is not so bad (aside from excessive compensation). Given that Taiga is Avarga’s main cash-generating business, it makes sense to think that this year, another, potentially much bigger, special dividend will be announced.

This seems like a good short-term risk/reward scenario, thanks for the thorough write-up! One question: did they hint at making a special dividend last year before doing it, or was it just kind of out of the blue when they reported earnings? If they did give any clues last year, have they done the same this year?

The company only issues very limited info in press releases and earnings disclosures.

Looking back a year ago, Q3 earnings were announced on the 12th Nov 2020 and the next press release came out on 25th of Feb 2021 with the dividend announcement (one day before Q4 earnings release). There was not a word about any capital return in Q3’20.

The same story this year. Actually, the press releases and MD&As are almost identical every single year – almost the same text, just the figures different.

The company seems to be doing the absolute minimum of what is mandatory on public disclosures. Almost barebone numbers with hardly any real explanations.

Has anyone received any useful information from (or been able to talk to) this Company’s investor relations, a board member, or anyone in management?

For context, I emailed the CFO and investor relations (also spoke on the phone to two Company salesmen whose information I got online) but very short replies with no pertinent information.

As the write-up mentioned, this company is barebone as it pertains to communication & explaining its numbers in the footnotes. I would appreciate to get some insight/explanation into the huge variation in SG&A quarter to quarter, but perhaps the only way is if someone who knows the company very well communicates.

Quick update as it pertains to the Company’s one comparable peer mentioned in the write-up: Goodfellow (GDL.TO).

Today (2/18/2022), GDL.TO’s share price jumped +8% upon its earnings release. GDL.TO’s quarterly revenue is $143M (increase from PY) and quarterly net income is $10.1M (increase from PY, slight increase from PQ). This is on a $105M market cap stock with under 3X P/E TTM. Also in the press release was an eligible dividend increase to $0.40 per share from the prior payout of $0.30 per share.

This may bode well for Taiga Building Products when it reports earnings later this month (expected timeframe for the report date is similar to last year, which was February 25th). It may be indicative of strong underlying fundamentals in the sector as it pertains to revenue & earnings strength.

Just to add a point to the thesis…historic EV before this recent lumber price spike averaged around $280m.

Current EV (based on Sep21 net debt) is $282m.

>$100m CF generation to hopefully be announced for Q4, thus bringing the EV down to $182m.

Clearly, both TIKR and YahooFinance display the current EV including the capital leases ($100m), thus distorting the EV significantly as they show the EV as $382m.

Disclosure: I hold.

Seems like this article itself cause a 10%+ runup, which has held firm (somewhat) despite the larger market declines of the last week.

If you look at commodities in general, e.g. the DBC commodity index, commodities themselves have been moving up since the start of the year. I have a decent allocation to commodity stocks, and they are up YTD also, despite the market decline.

Agree with you that this article may have driven the increase from close of 2.82 to the price of around 2.90-3.00.

Does anyone know why the spread between TSX and OTC? It looks like after factoring in the exchange rate, TGAFF consistently trades at a few percentage points discount to TBL.TO. I suspect it has to do with low liquidity on OTC but still a little surprised that spread never seems to get closed out as I assume there is no difference in the shares.

TGAFF low liquidity skews the figures oftentimes, but let’s take Feb 23 trading since TGAFF traded 21500sh, unusually more than TBL.to. TBL.to range 2.98-2.72 canadian. Exchange rate fluctuates also 78c to 80c, let’s use 79c. So TBL.to range 2.35-2.15 US. TGAFF range 2.31-2.20 US (well within TBL range).

Do you own? Would love to know of those who own on this forum, is it mostly TSX or OTC shares?

I went in big on this one, TSX shares because I’m Canadian.

I bought TSX shares via Interactive Brokers. I will probably avoid buying via OTC, because I want as much liquidity as possible given unlikely to to hold long-term.

Do you think the parent will try to buy out the minority stake it does not own?

It’s possible that the parent wants to buy out the minority stake. However, the Company provides no communication on the matter.

One reason that I think the Company may be trying to intentionally depress its share price is it recorded an inventory writedown in 3Q2021, and this was the sole reason the Company had a net loss; without the inventory writedown, the Company would have had a quarterly net income. However, no similar company (that I’m aware of) recorded an inventory writedown in 3Q2021.

Perhaps the Company’s estimate amount that it chose for the writedown was intentional to swing to a quarterly net loss (despite awesome quarterly FCF, which the Company may have been trying to get investors to not focus on) so as to push down its shares price?

Yes, Brettrush1. I bought TGAFF at 2.20-2.26 in the past few days, after placing buy orders below bid and waiting for dips.

Hey dt…any thoughts on divi announcement, over and above the thesis?

LY the divi announcement came before the financials…this time we’ve had the financials but no divi announcement (yet)!

I appreciate the management are pretty opaque here…just wondering if your research suggested anything.

Taiga released Q4 results – as always very limited disclosures and hard to tell what exactly is happening with the business. The bottom line, the results were good, but not as good as I was expecting or as indicated in the write-up above. No dividends were announced despite cash pilling up on the balance sheet.

HomeSpunoff – interested in hearing your thoughts as well.

More detailed takeaways from my side:

– The largest disappointment was gross margin, which stood at 13.2% compared to 17%-19% margins reported in Q1-Q2 of the last year. Hard to believe the company was not able to achieve higher margins in an environment where lumber prices were only spiking up. US peer BXC reported record gross margin of 20% for the quarter (and 16.3% for the lumber segment) and this figure was above the ones reported back in Q1 and Q2 of 2021. Canadian peer GDL also reported (quarter ended Nov 30th) record gross margins of 23%, which was inline with the figures reported for the fiscal Q1 and Q2. GDL gross margin calculations differ from TBL, so direct comparison to TBL is not possible, however, the changes relative to previous quarters should be directionally similar. In other words, no idea as to way gross margin as at only 13% and below figures reported in earlier quarters. Remember, that GM stood at a non-sensical 1.6% for Q3, so management might be again playing something wi inventory adjustments.

– SG&A expenses continued to fluctuate and are probably at more reasonable levels this quarter accounting for 9.5% of sales.

– Company generated only C$16m of cash during the quarter, which is way below the $70m estimated outlined in the write-up. Shortfall was mostly driven lower than expected gross margins as well as smaller working capital release.

– Company now sits on C$70m in cash (or C$50m net cash) that could be easily distributed to shareholders. This compares to C$300m market cap.

As for what’s next, I have no idea if the company will distribute these excess funds to shareholders – as noted by Spider above, last year this announcement came before the release of annual financials. Also in yesterday’s announcement on the appointment of new COO there was this “will support CEO Russ Permann in executing the company’s strategy and vision of being North America’s most reliable and efficient distributor of building products” – maybe just buzzwords or maybe the company has intentions to pursue growth through acquisitions.

In any case, I think it is a relatively safe bet to wait another quarter to see if the company (i.e. the controlling shareholder) returns excess capital to shareholders. A few things in support of that:

– Taiga generated C$118m, C$51m and C$42m in FCF during 2021, 2020 and 2019 respectively. Company is cheap at the current EV of C$250m even if earnings fall back to 2019 levels, which so far seems to be unlikely.

– Lumber prices remain significantly elevated.

– BXC (US peer) reported a very favorable trading environment so far in Q1, with even higher gross margins for structural lumber products. From Q3 earnings conference call:

https://www.sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=00022285&issuerType=03&projectNo=03343273&docId=5142210

FWIW I agree with you here…they should in theory do something with that cash…divis and/or buybacks seem the logical option. But yeah…acquisitions could be an option.

They made a $50m acquisition in 2018, bought back around $2m a year for the past few years, and did the $30m divi last year.

They’ve never sat on a cash position so let’s see!

Downside seems protected given the EV is below the historic average of the past few years.

Also an interesting announcement from Avarga, the controlling Taiga shareholder.

Avarga did not declare the final dividend for the year and canceled its dividend policy. The absence of dividends for Q4 seems understandable keeping in mind all the cash company generates comes from Taiga distributions and Taiga has not announced any distributions yet. However, the cancellation of dividend policy altogether might be an indication that no Taiga distributions are coming Avarga’s way in the short term.

Avarga noted:

http://www.avarga.com.sg/investor-relations/sgx-announcements/

DT, I agree with what you wrote. To reiterate, the Company provided no indication of what it will do with its cash and the absence of a dividend announcement as well as its relatively low quarterly margin (compared to what others in the sector have reported for 4Q2021) was disappointing.

To add to what DT wrote about BlueLinx (BXC), the building products distributor—Builders FirstSource (BLDR)—just reported today (3/1/2022) and had awesome 4Q2021 numbers (alongside its buyback announced last month in Feb2022). Given the peer Goodfellow (GDL.TO) increased its dividend upon its 4Q2021 earnings announcement (and GDL.TO’s share price has continued to rise since then), this Company is lacking…

I’d love for someone to go “activist” on this Company. Does anyone have the skills/experience of a Jeremy Raper who went activist on Hunter Douglas last year (or even the GROW activism pushing against Frank Holmes’s minimal return of capital to shareholders)? Perhaps a letter to the Company’s Board asking to increase disclosures and return capital to shareholders?

To me, based on the below from the pitch, it feels like our interests are already aligned.

Obviously I have no crystal ball as to what happens next but I’m hoping they wont just burn the money here!

“The company is 72% controlled by Singaporean holding company Avarga (listed on Singapore stock exchange). Taiga is the main cash-generating business of Avarga, so the incentives for large capital return are aligned here. Both Avarga and Taiga are controlled by the same Tong family (father and son).”

Does the Avarga dividend policy cancellation annoucement signal that the cash won’t be returned to Avarga through a dividend, but rather might hint at Taiga doing a tender offer instead to manage its own capital allocation strategy? Feels like Taiga might be providing limited guidance to suppress price in an effort to increase tender participation.

Taiga reported very solid Q1 results. It is now a bit more clear why the company did not dividend out any of its large cash balance – all of it and more got invested into working capital with accounts receivables increasing by $150m, and inventory up by $30m. A similar seasonal spike in working capital was observed in Q1’21 (also earlier years), but this quarter the increase was even larger, especially into accounts receivables. When this working capital gets released in the coming quarters, by my rough estimates the company will have more than half of its market cap in net cash by the year-end. Assuming all pans out as I expect, the operating business now trades below EV=C$140m and pre-Covid this business was generating approx. C$40m in annual FCF. So this trades at only 3.5xFCF if earnings drop down all the way to pre-covid levels.

So although the investment thesis has somewhat shifted (never a good sign) away from a large dividend payout this year and the company still remains a bit of a black box (limited disclosures and unexplained moves in gross margins and SG&A), I think Taiga is really cheap. The large capital return might still be on the table, but maybe has been pushed out to next year.

Declining lumber prices add the risk of inventory losses and lower gross margins in the upcoming quarters, however, Avarga (parent) management did not seem concerned about it at all (more details below).

Now onto Q1’22 results.

– Sales up 15% from already record braking Q1’21.

– Gross margins improved significantly to 17.8% and now is much more in line with peers – BXC and GDL (both showed 22% gross margin in Q1’22).

– SG&A stood at 8% (in line with previous quarters).

– EBITDA was reported at C$58.6m vs C$45.1m Q1’21.

– Net income C$39.5m vs C$28.1m same quarter last year.

FCF was at a negative C$150m, however, that’s nothing unusual as seasonally Q1 is the quarter when accounts receivables spike up due to increased sales as well as some additions to inventories.

Taiga’s parent Avarga did an investor Q&A in April – most questions about Taiga’s business, industry and capital return were answered extremely vaguely. But management seemed optimistic that declining lumber prices will not materially affect the financial performance of the distribution business:

http://www.avarga.com.sg/responses-to-substantial-and-relevant-questions-received-from-shareholders/

Taiga released Q2 results. While gross margins were suppressed by declining lumber prices during the quarter, the company remains well-positioned for a large capital return early next year. Taiga released some of its working capital (C$58m) in Q2, leading to record-high second quarter FCF ($86.6m). However, historically Q3 is when the company releases the most working capital. Current receivables/inventories are at C$488m versus C$574m same quarter last year. Notably, Q3’21 was a weak quarter as commodity price fell (only 1.6% gross margin) yet the company still generated C$153 in FCF. This suggests that by the end of Q3’22 Taiga might very well have half of its market cap in net cash.

The company remains cheap and now trades at only 2.7x TTM EBITDA and 5.0x if earnings drop to pre-Covid 2019 levels.

Highlights for the quarter:

– Sales were at C$646m – up 5% sequentially and down from C$787m in Q2’21.

– Gross margin of 11%. Peers BXC and GDL reported 16% and 23% gross margins for the quarter.

– SG&A shrank to 5% of sales versus ~8% reported previously.

– EBITDA at C$33.7m versus C$84.5m in the same quarter last year.

– Net income of C$24.2m compared to C$57.3m in Q2’21.

I don’t quite get the cheapness. You need elevated earnings to continue for this to work.

Before Covid net working capital was about $150-170m.

Current net working capital is about $280m.

So that is a $1.15/share working capital release. 2017-2019 the stock traded between $1-1.7, so say $1.5.

Add that up and you get a $2.65 fair value, if earnings mean revert quickly. Vs a $2.55 share price.

Then there is the (not so insignificant) risk that a significant portion of cash will be hoarded. Since it is controlled by a Singapore holding company. SP exchange is full of cash hoarding value traps.

TBL Q3 results were pretty good, yet less of receivables were converted into cash, which is most likely a timing issue only. It is good to see that the company managed to grow revenues by 10% YoY despite the sharp drop in lumber prices during the current quarter.

TBL now sits on C$98m net cash – 34% of the market cap. Meanwhile, accounts receivable (C$200m) and inventories (C$198m) are still elevated setting up for a fairly strong Q4 in terms of further working capital releases (probably c. C$70-80m of additional cash generation). This would bring company’s net cash position to about half of the market cap by the end of the year.

My initial thesis (i.e. large dividend in Q1 or Q2 of 2022) is clearly not working out as expected and at the very least has been significantly delayed. However, the company is simply too cheap, and with lumber prices already close to pre-covid levels, I do not see much downside from continuing to hold. Pre-COVID the business rather consistently generated around $40m FCF a year, so the company trades below 5x 2019 FCF on normalized earnings.

More on Q3 results below, but keep in mind that QoQ TBL has some strange moves in gross margins and SG&A expenses which seem to even out over longer periods to provide a more meaningful picture of business performance (e.g. have a look at 9m comparison in the income statement).

– Sales were at C$533m, up 10% YoY, but down 17.5% sequentially.

– Gross margin was 12% vs 11% last quarter.

– SG&A was at 5.6% of sales.

– EBITDA was $29.8m vs negative ($1.8m) same period last year.

– Net income at C$18.6.m vs loss of $5.2m in Q3’21.

– FCF was C$102.5m vs C$153m same period last year due to non-cash working capital release.

Some comments on the industry from BXC:

“I think it’s important to level set the context around what’s happening in the market. The rate of change in rates is unprecedented, right? So more than doubling of mortgage rates and less than — roughly around 6 months. So the market isn’t accustomed to that level of change at that rate in such a short period of time. And so there’s going to be some settling out that happens and the demand impact, I think, is going to be meaningful, coupled with, at the very same time, supply constraints really easing. I think our ability to maintain the margins we did in Q3 and even to this point is a meaningful accomplishment.”

TBL Q3 financials – https://sedar.com/GetFile.do?lang=EN&docClass=5&issuerNo=00022285&issuerType=03&projectNo=03452906&docId=5304200

Regarding the Q4 strong cash generation, I think one also needs to adjust for the paydown of accounts payable – not sure if you’ve included that. Which looks like it might be $100m.

Update:

On Nov-21st-2022, VIC had a write-up on the Company, which is worth reading (https://valueinvestorsclub.com/idea/TAIGA_BUILDING_PRODUCTS_LTD/4597125230/messages/198423#messages

). The share price reacted positively to the VIC write-up over the next few weeks increasing from $2.61 to $3.00/share, where it still stands today.

I agree with the contents of the VIC write-up, which described it as an asymmetric play with limited downside and upside particularly if a special dividend were to be announced as a potential near-term catalyst in Q1’23 (similar to Feb’21, which was the most recent $30M special dividend announcement). The Company’s cash balance will likely peak for the calendar year around this time due to seasonality. Moreover, this year’s quarterly net income (including most recently for Q3’22) has exceeded my expectations.

Taiga released solid Q4 results showing very consistent year-over-year performance. Quite reassuring to see relatively stable revenues and earnings despite volatility/decline in lumber prices during the quarter.

However, my expectation of a material working capital release in Q4 did not pan out. Net working capital stayed basically unchanged, while inventories saw a slight bump to $226m (vs $198m in Q3). Although this is a completely normal seasonal effect for Q4 (and Q1), I was expecting inventories to normalize to the previous lower levels. It is a bit surprising that management wants to keep inventories elevated, given the ongoing cooldown in the housing markets. Remains to be seen how this plays out but so far I am inclined to take it as a sign of confidence from the management.

Other than that – a pretty standard quarter. At the end of Q4’22, cash remained at $95m and due to the share price run-up now stands at 29% of the market cap. Excluding cash, the company is still cheap and trades at 6x normalized FCF levels (pre-COVID earnings).

Management noted that the housing markets in Canada and US are expected to worsen during 2023. The company cited third-party agencies which are forecasting Canadian housing starts to drop by 5% YoY in 2023, while the housing starts in the US are expected to decline by 26% YoY. Taiga generates 82% of revenues in Canada and 18% in the US.

Q4 results:

– Sales at C$401m vs $413m last year, as explained by management, mainly due to lower selling prices on commodity products;

– Gross margins at 12.3% vs 13.1% last year;

– Net profit margins at 2.4% vs 2.5% last year;

– EBITDA nearly identical at C$17.2m vs C$17.4m for last year.

– FCF was $12m vs $15m last year.

Annual results:

– Sales at C$2.2bn, just 1% lower than last year;

– Gross margin nearly identical at 13.2% vs 13.5% in 2021;

– EBITDA at C$139m vs C$145m for 2021;

– EPS at C$0.82 vs $0.85 for 2021;

– FCF at C$50m vs around C$115m for 2021. Note that Taiga used to consistently generate around C$40m of FCF/year pre-COVID.

A few comments on the industry’s outlook from BXC. As mentioned above, the impact on Taiga should be much softer due larger exposure to the Canadian market, instead of the US.

“As we look at 2023, we believe single family housing starts will continue to be in double digit decline as compared to 2022, as the macroeconomic environment continues to impact the industry and until there is more certainty around mortgage rates. We are more optimistic regarding repair and remodel and believe recent housing turnover, aged housing stock and high levels of homeowners’ equity will support better performance for the repair and remodel market during 2023. Many homeowners are also locked in with a mortgage rate below 5% and may not have the desire to move and trade up for a house with a higher rate. Instead, they will likely seek to customize, update and upgrade their existing homes. We expect repair and remodel activity to remain relatively flat for 2023. Despite these market dynamics, we believe that the fundamental undersupply of homes and supportive demographic shifts along with aged housing stock, necessary repair activity and high levels of home equity continue to be positive indicators for the housing industry over the medium and longer term.

[…]

We still expect it to be a challenging market on the new home construction side in 2023. I think the mood is a bit better but it’s still expected to be double digits down year-over-year, and we think that’s appropriate just given the activity levels. We’re hearing from the builders in their communities, the conversations as a part of that at the Builders’ Show earlier this year and what we’re seeing in our business and what we’re hearing from our customers. So we still think it’ll be a down year on the new home construction side and our guidance or expectation is kind of in the double digit level mid teens or so.”

Taiga Q4 report – https://www.taigabuilding.com/sites/default/files/2022_quarterly_report_-_q4.pdf

Last week Taiga released Q1 results. It was a rather uneventful and expected quarter. However, I believe the initial thesis of large dividend payout following the Covid boom years is now fully broken. There is no longer any catalyst in sight.

The company remains cheap, trading at just 6x-7x normalized FCF with no leverage and the whole market cap covered by net working capital. But now TBL is just an undervalued Canadian microcap in a cyclical sector with controlling shareholder/management and limited financial disclosures.

With the special situation angle gone out of the window, I am closing TBL position for the SSI Tracking Portfolio purposes.

After better-than-expected Q4 revenues, sales are starting to normalize as exit covid-driven construction boom. Revenues are down 33% YoY – this was expected and compares very favorably to a 75% reduction in lumber prices. A seasonal increase in accounts receivables and other smaller working capital changes have reduced the cash balance close to zero from the previous C$95m. Inventory remains at elevated levels, but at least there was no incremental seasonal spike in inventory during the quarter.

With no cash on the balance sheet and working capital release now likely only in Q4, the initial expectations of a large dividend payout will clearly not materialize in the short term. CEO of Avarga, the parent of TBL, had the following comment on Taiga in its 2022 annual report:

“A wholesale distributor of our size, with sales of over C$2 billion annually, requires a lot of financing for inventories, receivables, stocks in preparation, stocks for treated wood, etc. Therefore, rising interest rates is a concern, given that our net margin on sales is very small. In the worst-case, if the economy is faced with a liquidity crunch and shocks to the financial markets, it can be disastrous. Even a trading company with great management and prospects will go bust without liquidity to run its day-to-day business and meet obligations as they come due. That is the reality.

Furthermore, we do not believe Taiga’s business is at a matured stage, even though the wholesale building materials industry has been around for a long time. As with all business models, we must change and adapt to stay relevant. To do so, Taiga must take advantage of our strong market positioning by investing and spearheading the necessary changes in the industry. Therefore, Taiga’s board and management have decided to retain capital to facilitate our plans and strategies. We believe this is necessary to ensure the Company’s sustainability and become even more successful in the years ahead.”

HomeSpunoff – thanks for sharing this and let me know if you have a different take.

TBL Q1 results: https://www.sedar.com/GetFile.do?lang=EN&docClass=7&issuerNo=00022285&issuerType=03&projectNo=03531312&docId=5416542

Avarga Annual Report: https://www.avarga.com.sg//wp-content/uploads/2023/04/5.-Annual-Report-2022-13Apr23.pdf#viewer.action=download