Advanced Emissions Solutions (ADES) – Large Capital Return/Company Sale – Upside TBD

Current Price: $6.2

Target Price: TBD

Upside: TBD

Expiration Date: Mid-2022

This situation is not particularly new or undiscovered (see previous write-ups on VIC and Clarkstreetvalue from a year ago). However, we believe the idea is still interesting and the timing looks attractive now given that the stock trades at the lowest point since May’21 announcement of a strategic review. Annual results will be released on the 8th of March’21 (tomorrow).

Advanced Emissions Solutions has 80% of its market cap in net cash of $91m ($4.81/share). The operating activated carbon business is currently valued at only $25m. This seems too cheap given the segment used to generate $12m-$20m in EBITDA and recently started growing again. Although I am unable to pinpoint specific valuation, in a sale scenario the segment is likely worth multiples of the current $25m stub value. In May’21, the company has started a strategic review to maximize shareholder value. Not many details have been given about the review so far, except that management is pleased with how discussions are ongoing. There is a decent chance that the outcome here will be a large capital return program + sale of the activated carbon business.

Management owns 12% of the company and has a track record of caring for minority shareholders. Between 2017 and Q1 2020 ADES distributed $106m in dividends and share buybacks and by Q3’21 has repaid nearly all of its $70m debt. Since Apr’20 the company is operating with an interim CEO, the main cash generative business (RC) is gone. Just after the strategic review announcement management signed $2.4m retainers (expire in Aug’22). Management’s comments during conf. calls pretty much point towards an opportunistic APT business sale:

And as I mentioned, we initiated a strategic alternatives process to evaluate the opportunities available to us to maximize shareholder value. As we have discussed on our past several calls, we have made great progress drilling our Red River plants capacity utilization, diversifying our product mix, and bolstering our financial position through our focus on repaying our term loan and growing our cash balances. And we possess the premier asset in this industry. We believe this leaves us with a unique opportunity to evaluate the options available to us from a position of strength Overall, we have been pleased with the nature of the discussions up to this point, and we will provide updates as appropriate as the process unfolds. At present, there is no timetable for the completion of that process..

APT segment business

Advanced Emissions Solutions used to have two businesses – Refined Coal (RC) and Advanced Purification Solutions (APT) involving the production of activated carbon. The RC segment was wound up at the end of last year with the expiration of RC tax credits. APT segment produces activated carbon for mercury capture for coal-fired power plants market as well as other air/water/food markets. APT owns Red River activated carbon facility and mostly sources coal from its Five Forks mine. As of Q3’21 ADES had $68m of net cash and estimated further $8.5m after-tax cash proceeds from RC business in Q4’21 + another $3.5-$5m from the final wound-up distribution in H1 2022.

Excluding cash already on the balance sheet as well as to be received RC distributions, the remaining APT business is currently valued at only $25m. We also need to deduct the reserved $10m obligation for shuttering of Cabot’s mine (more info in ‘further points’ section), resulting in $35m stub value for the APT stub. This still seems too cheap.

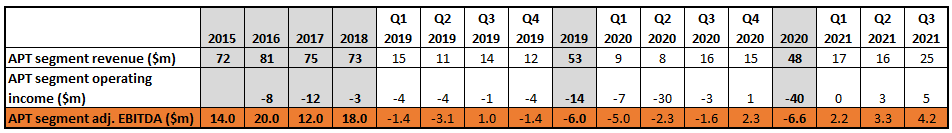

APT segment was generating $12-$20m annual adj. EBITDA before the demand for activated carbon fell off the cliff due to reduced coal power generation. During the last two reported quarters (Q2 and Q3’21) APT segment seems to be operating close to historical profitability levels having generated $7.5m in adj. EBITDA (or $15m annual run-rate). Given the points mentioned below, APT is only likely to grow going forward. APT is a high fixed costs business with high incremental contribution margins of 60%+. Further revenue growth will result in a disproportionate increase in EBITDA.

Note (1): The above financials are for APT segment only and exclude c. $12m of annual overeads;

Note (2): In Q2’21 ADES had an incident/fire at the plant, and had to be closed for 1 week. Total impact on cashflows was estimated at $3m. The figures in the table above are adjusted for this incident impact.

APT business is at a major inflection point. ADES acquired (also, presentation) APT in 2018 in a fire sale from ECP (PE firm), which had invested $380m to build APT’s Red River facility. ECP’s investment turned sour as coal power generation shrunk faster than expected, in part due to low natural gas prices and rise of renewable energy. ADES got a bargain and bought the business for $75m or 4.2x 2018 adj. EBITDA. However, due to the continued decline in gas prices, coal power generation started falling even faster depressing the demand for APT’s activated carbon. This dynamic has now reversed with spiking natural gas prices since mid-2021. Last year was the first time since 2014 when coal power generation increased YoY in US. Naturally, the demand for APT services went up to the point where the company even started experiencing inventory shortages and had to add supply of materials from third-party sources (this might have negative margin implications, see section ‘further points’ below). Gas prices are still elevated and have been spiking up again since the Ukraine invasion.

One of the key bullish arguments at the time of APT purchase was the possibility to serve RC segment’s clients with new solutions to tackle pollution after the expiration of RC tax credits. Given ADES experience in the industry and APT’s cheapest activated carbon products for mercury removal, the combined company was expected to be ideally positioned for the industry switch (quote below). Management estimated $35-$45m revenue opportunity there (only mentioned in Q4’18 call, so not sure if this is still valid):

Many RC users will need a solution to comply with mercury regulations and through our ownership in Tinuum and Carbon Solutions, as well as our existing product suite, we will be well positioned to capture incremental mercury control demand as these units retire.

[…]

We believe that the market opportunity related to these utilities is approximately $35 million to $45 million annually. This incremental volume will go to the bottom-line given our significant contribution margins. In other words, this market will grow when refined coal units lose their tax credit eligibility, and there is nobody better positioned to capture this incremental volume than us.

Aside from the general industry-wide positive dynamics, ADES announced two large contracts with its ex-peer Cabot. The first one was 15 year supply agreement to source activated carbon for Cabot’s air/water/food purification markets, etc. signed in September’20. The contract was due to ramp-up during 2021 and management estimated $10-$15m incremental annual EBITDA from the deal. In Feb’21, ADES signed another contract with Cabot, this time to supply mercury removal product for Cabot’s European subsidiary. Management was unable to quantify the financial impact of the second contract saying that certain new mercury/pollution laws were due to kick in in Europe in late 2021 and it was too early to say anything. More details might be unveiled in the upcoming conf. call.

In March’21 ADES announced that it will implement 10%-15% price increase for its activated carbon products. Given that most contracts are with 1-3 year terms, it will take a bit of time until the price raise is fully reflected on the financials.

Couple more data points:

- A few months ago ADES peer Cabot has sold its activated carbon plant for 10x EBIT. The business was focused mostly on non-coal markets (higher margins/growth). In Q2+Q3’21 APT generated $8m segment EBIT.

- In mid-20, another major peer Kuraray announced the expansion of its activated carbon plant for an additional 50m lbs capacity. The capex was estimated at $185m. APT’s Red River plant has 200m annual capacity.

Further optionality from RC segment close-outs

After RC business wind-up ADES should have about 26 remaining coal refining facilities that were previously leased to RC tax credit investors (who processed the coal with ADES services and later sold it to coal power companies, by the way Goldman Sachs leased 9 such facilities). Management commented that some of the facilities might get utilized by coal power plants for the front-end chemical processing of coal. Management previously mentioned that some of the facilities, which closed prior to Q3’21 are already beeing eyed by some clients, but incremental revenues are likely to stay small yet stable:

These facilities or other application facilities can be utilized to apply the front end chemistry of feedstock coal as utilities currently leveraging the production tax credits will need to pivot to another method of meeting requisite emissions control standards. Some of these utilities will likely purchase our frontend technology or activated carbon instead, which will help replace a portion of the RC cash flows from Tinuum distributions that are going away.

[…]

As I mentioned some of the expired facilities will likely remain in place utility customers to apply our front end technologies to assist them in meeting emissions control requirements. As such, we expect there to be a small but stable revenue opportunity from these customers after the wind down of Tinuum.

Further points/risks

- Overheads stand around $12m/year and management said that there won’t be any significant overhead reduction post RC wind-up as the RC-related expenses have already been eliminated over the last few years. Taking these overheads into account, the company operates at breakeven. Therefore, the investment thesis here is strongly dependent either on a successful sale of APT or continued ramp-up of active carbon business. The good thing is, even if all of this doesn’t work out, the downside is fully protected by a large cash balance (80% of market cap) and expected capital return to shareholders.

- The company provides very limited visibility into its operations (e.g. volumes, utilization, contracts, etc.). My understanding of the industry is limited and I am not sure how to take management’s comment in Q3 conf. call that due to increased demand and inventory shortages, ADES now has to get an additional supply of materials from third-party sources, which impacts the margins. I have no clue what the impact on margins might be and how much of the input price volatility can be passed to clients through increased prices. After the Ukraine invasion, coal prices spiked up 2x and this might fully eliminate any profits from activated carbon sales. Management provides no details on its Five Forks’ mine capacity and how much exactly has to be sourced from elsewhere, but the recent sharp coal price spike definitely doesn’t look positive for the margins.

- Management might decide not to pursue capital return and use the cash for something else (e.g. acqusitions). Seems unlikely given their track record so far.

- In the calculations above I also included $10m of restricted cash. The restricted cash is collateral for the reclamation works of Marshall coal mine. Marshall was Cabot’s mine, which ADES took over for shutterring. The works were estimated to take 24 months (should be over this fall). ADES is also paying for most of the reclamation works – remaining obligation has already been reduced from $20m+ to $9.4 as of Q3’21 (included in net cash calculation). Worth noting, that Cabot will reimburse part of reclamation expenses ($10m), but these funds will be paid out semi-annually over the next 13 years.

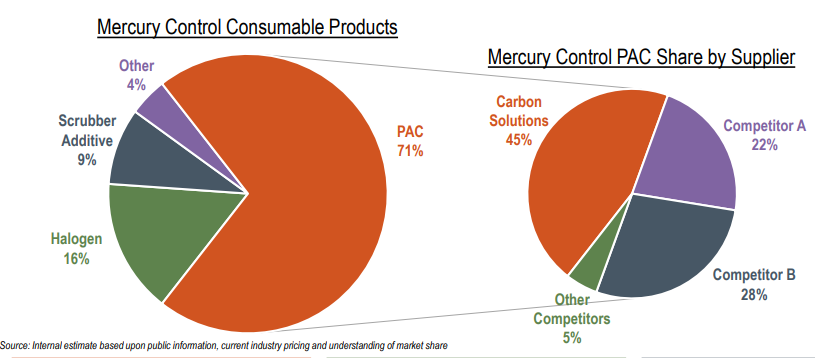

- A bit more information on the activated carbon market was provided in APT acquisition presentation (Nov’18, see below). APT used to be mostly focused on coal power market, however, the recent 15 supply agreement with Cabot diversified the mix. In the recent calls management said that coal market exposure should be <50% going forwards.

Note: PAC is powdered activated carbon.

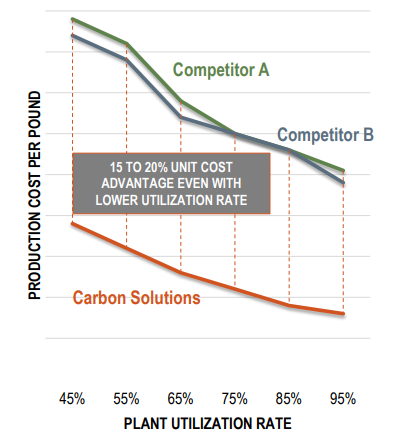

Note: Carbon solutions is APT. Apparently, APT is the lowest cost activated carbon producer in the US, in part due to being vertical integration and efficient distribution (located near rail spur)

I prefer XL Fleet.

From the earnings release today: In May 2021, the Company initiated a strategic review to assess a range of strategic alternatives to maximize shareholder value. There is no assurance that the review process will result in pursuing or completing any action or transaction, and no timetable has been set for completion of this process. The Company has been encouraged by continued progress and will provide an update as appropriate.

ADES reported Q4 results yesterday after market close. No change to the investment thesis – outcome of the strategic review still pending.

Key takeaways:

– Q4 RC distributions stood at $7.3m with further $4-$5m are expected from the final wind-up in H1 2022. This is c. $1m below the numbers in the write-up.

– Total net cash (including restricted cash, expected RC distributions, and deducting debt) is at $89m.

– The remaining obligation for Marchal mine retirement was reduced to $7.4m.

– APT performance with $23m revenues was inline with the previous quarter, however, margins were suppressed resulting in operating income at $0.8m and adj. EBITDA at $1.9m. The company says it experiences the same margin pressure due to inventory tightness and having to supply extra materials from third parties.

– The same dynamics are expected to continue through 2022, although ADES says it will offset some of the effects by passing increased costs onto customers as contracts become eligible for repricing.

https://www.bamsec.com/filing/151515622000007?cik=1515156

Stock down 8% to 5.80+. Right or wrong, market views earnings release negatively.

If they sell for 4x LTM EBITDA, plus net cash and less ~$15mm in overhead, sales costs etc, I’m getting somewhere in the mid 5s. Maybe that multiple is too low but that’s about what they paid before.

@nuggy when you say “that’s about what they paid before”, who is “they”?

@brett from this sentence in the write up. Essentially if 4.2x was the multiple in 2018, is there a reason it should be higher today? : “ADES acquired (also, presentation) APT in 2018 in a fire sale from ECP (PE firm), which had invested $380m to build APT’s Red River facility. ECP’s investment turned sour as coal power generation shrunk faster than expected, in part due to low natural gas prices and rise of renewable energy. ADES got a bargain and bought the business for $75m or 4.2x 2018 adj. EBITDA.”

Ah. Got it. No idea if it should be higher today haha, was just wondering what the 4x comp was.

Answer to question about strategic review process on today’s earnings call below. They are still playing this very close to the vest. There’s got to be some folks frustrated…maybe that contributed to the selling pressure today.

Ryan Coleman:

And our third question, it’s now been one year since the strategic review announcement with no public updates. Is there anything that you can offer investors on the direction of the strategic review process?

Greg Marken:

It’s a great question. While we are certainly sympathetic to investor’s desire for more detail regarding the status of our strategic review. We are also very appreciative of their patience. It has always been our desire and intention to provide updates as appropriate and required by public company regulations. That being said, we have no timeline for the process’s ultimate conclusion. It is very difficult to predict the timing or the evolution of a process like this, given the sensitivity of the discussions involved, as well as the need to preserve certain confidentialities. While the process has drawn out, the fact remains that we are pleased with where things stand within the process and are hopeful that we can provide an update soon. Despite the duration of the process, it has not detracted from our ability to run the business, as demonstrated by the results and operational improvements achieved within the business during this past year.

Q1 update – the same performance trend is continuing and we are still waiting for the results of the strategic review. See CEO’s comments on the strategic review in Brett’s comment above.

Revenues jumped up to $26.4m and adj. EBITDA was strong as well – reported at $0.9m. Back in Q4’21 APT segment EBITDA stood at $1.9m, but that was before corporate overheads of c. $4m. The current quarterly result already includes overheads (as APT is the only segment left after Tinuum’s run-off). Thus a strong result this quarter and favorable sequential development.

The margins are dropping due to elevated coal prices as the company has to source the raw material from third parties as well. As before, the CEO still says that they will be able to neutralize this with price increases and contract renegotiations:

However, in the conference call, the CEO said that the runover of the contractual portfolio will take 3-4 years. So overall it seems that the real change here will be slow.

Nothing was said on the optionality of closed RC facilities yet.

Regarding the potential capital return, that seems way less likely now. So far, management only said they will prioritize investments into the manufacturing capabilities.

Great Q2 update as the company continues to benefit from strong customer demand driven by macroeconomic tailwinds, primarily elevated gas prices. Most importantly, the language around strategic review has changed completely – management gave some very positive comments and it seems like we should see the result of it shortly:

“Lastly, we continue to be pleased with the progress of our strategic review process and will hopefully be in a position to provide additional updates in the very near term. We are encouraged with both the current status of negotiations as well as with the option available to us. Our focus remains on seeking a resolution that maximizes value for our shareholders.”

On the financial front – solid performance and slightly improved margins. At current levels, the operating APT business is valued at only ~$27m or 4.4x H1’22 run-rate EBITDA. The stock was up 20% on the announcement.

the thesis is still very much intact and the catalyst is waiting just around the corner. Meanwhile, the stock is still below our write-up prices, while net cash position is pretty much unchanged.

Highlights for the quarter:

– Final Q2 RC distributions stood at $3.1m. Total distributions since Q4’21 are now at $12.9m – in line with previous management’s estimates.

– The remaining obligation for Marshall mine retirement increased slightly to $5.2m from $4.8m in Q1’22.

– Net cash is at $86m (76% of the market cap) which is close to write-up levels of $91m.

– APT segment revenues continue to be elevated and fluctuate around the same levels as in previous quarters – $24.7m in Q2’22 vs $26.4m in Q1’22 and $23m in Q4’21. Notably, the second quarter is traditionally seasonally slower as the company builds up inventory for Q3.

– Adjusted EBITDA was quite strong at $2.2m compared to $0.9m in Q1’22.

– Management has finally reaffirmed the optionality of closed RC facilities. Incremental annualized revenues this year are estimated at $5m.

– The company expects tight inventory conditions to continue pressuring margins for the rest of the year. However, the company continues to raise prices and renegotiate commercial contract terms to offset the negative impact.

The stock was up 20% on the announcement.

Earnings release: https://www.bamsec.com/filing/151515622000063?cik=1515156

Call transcript: https://seekingalpha.com/article/4534923-advanced-emissions-solutions-inc-ades-ceo-greg-marken-on-q2-2022-results-earnings-call

Merger news: stock down 20% to $5.

https://finance.yahoo.com/news/advanced-emissions-solutions-announces-merger-203900701.html

any thoughts on the announced transaction? any chance s/holders can vote it down, turf the board, and wind this up? cynic in me would say this is the path they chose because there’s simply no bidder for Red River, at any reasonable price…

I’m holding and will vote against the present transaction, but I think you’re right that there is just no bid.

There’s a poison pill to a 5% acquirer, unfortunately, nominally in place to prevent the destruction of a NOL through a change of ownership.

That makes successful activism unlikely, in my mind.

That would be an

I contacted their outsourced IR who confirmed that the Arq transaction would be a change of control that would nullify the tax protection plan and cause ADES to lose their tax credits. So I don’t know why an activist couldn’t come in here and tender for the shares? The company shouldn’t get the entrenchment benefit of the poison pill while also destroying the value the poison pill is intended to protect via this transaction.

The announced merger looks terrible (at least for me). ADES is basically giving more than 50%+ of the company for a coal waste startup, which is only expected to start generating revenues in 2024. Arq (the startup) has a technology of producing coal mining waste into carbon powder that could be used as a feedstock for ADES’ activated carbon or other carbon products. However, Arq’s plant is expected to come online only in 2024, there’s very little visibility into how attractive the technology is. The whole merger is built around SPAC-like growth projections into 2026. The only small positive is that apparently, Arq has succeeded in creating partnerships with a few large names in the industry – Mitsubishi (early investor) or Peabody and Vitol (both will participate in a small PIPE of the combined company).

Other aspects of how this transaction was presented are also strange:

– announcement on Friday night;

– small and seemingly unnecessary PIPE for the combined company;

– This was announced only a couple of days after the ADES reported strong Q2’22 results with an overall positive tone for the outlook. However, the H2’22 guidance released with the merger announcement is super weak. The merger presentation showed 2022 revenue guidance at $87m, which implies 30% revenue decline in the second half of the year. Quite unexpected I would say.

As puppyeh suggested above, the main question is whether management really hasn’t found any other buyers for the activated carbon business or whether they simply want to continue keeping their jobs instead of liquidating the business.

Given management’s previous track record of caring for shareholder value (large dividends and tenders), the length of the strategic review process as well as support for this transaction by the largest shareholder Alta Fundamental Advisers (11%) supports the current deal, I am tempted to think that this was the best option on the table. Couple that with weak H2’22 guidance, and probably transaction will receive sufficient shareholder support.

So unfortunately I’m closing this idea at a 25% loss based on pre-market prices.