Opera (OPRA) – Share Buybacks/Hidden Assets – Upside TBD

Current Price: $5.72

Target Price: TBD

Upside: TBD

Expiration Date: TBD

I have been meaning to take a deeper look at Opera for a while now (mostly as a result of articles by Andrew Walker and Jim Roumell in mid-2021), but always put it aside for various reasons. Recently, the company has grabbed my attention once again as Opera’s share price has been testing new lows almost on a daily basis. Yesterday, after the write-up was ready and needed only the final review, after-hours news came out that Opera has sold one of its private investments. The sale price is in line with my estimates and I think it is a positive for the thesis, significantly strengthening Opera’s balance sheet and cash profile (almost 50% of the market cap now) as well as indicating management’s willingness to monetize minority investments. However, the referenced share price is as of yesterday’s close – after hours the shares traded up +5% on very light volume.

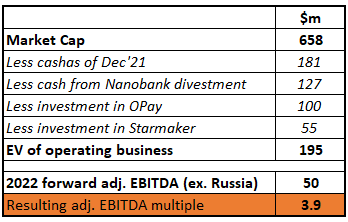

At a quick glance, Opera looks very cheap – at the current price of $5.72/share you’re getting $2.68/share in cash + $1.35/share in private investments + a profitable/fast-growing operating business at around 4x 2022 adj. EBITDA. On the operations side, the company owns Opera web browsers, news aggregating app Opera News, plus a number of other yet-to-be-monetized business initiatives. The business is profitable and has been growing pretty wildly recently – revenues expanded +50% YoY in 2021 and further 22% growth is projected for 2022. Over the recent years, adj. EBITDA margins have been suppressed due to prolonged spending on marketing and growth initiatives. However, this is likely to change in the near term – management has recently started hinting about margin normalization and has already guided higher margins for 2022.

Opera has recently announced a $50m share buyback. The amount is quite material as the company is 84% owned by the management, and the buyback actually stands at nearly 50% of the free float and accounts for 60 days of the trading volume. Management has made pretty straightforward comments saying they consider the company undervalued (buyback announcement PR):

We believe that the share price and market value of Opera are currently significantly undervalued in light of our solid trajectory and outlook. In addition, Opera holds three minority investments in private companies that represent additional unrealized value to our shareholders. Given our strong cash position, we believe repurchasing Opera stock offers a compelling ROI opportunity, and an opportunity for us to create value for our shareholders.

And from more recent Q4’21 conf. call (talking about the buyback):

For management and the Board, this was an easy decision to make as our business is firing on all cylinders with multiple long-term growth opportunities ahead of us.

Also worth noting that the company’s CEO/Chair and the largest shareholder acquired 1.9m shares in November’21 at an average price of $8.5/shares.

The risks are quite substantial and involve limited visibility into the private investments and also some parts of the operating business, questionable sustainability of the recent marketing-expenditure-driven-growth, various related party transactions, control by Chinese investors (although the company is incorporated in Norway), limited float, etc. Further considerations are provided in the ‘Risk’ section below.

Operating businesses – background

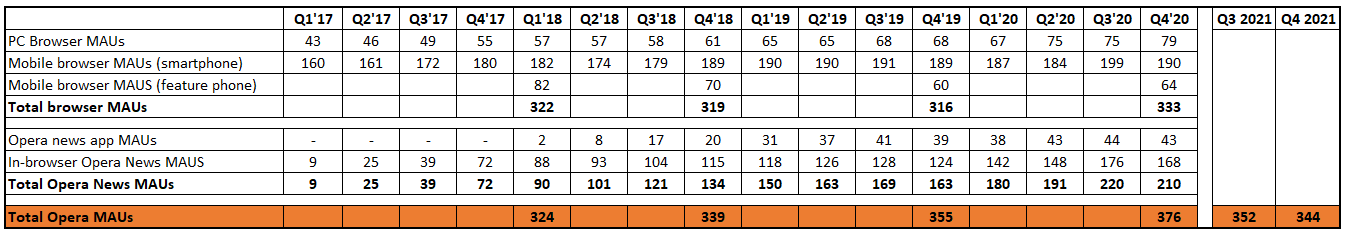

The key product is Opera web browser for mobile phones and PCs. The company is also leveraging the browser and its 344m active users to build new products and services, the most successful of which is Opera News (browser-built-in news aggregation service as well as a separate app) now accounting for 25% of total revenue. As per management – browser is a strategic asset that the company uses to launch various additional services onto.

The browser itself competes with the likes of Chrome, Safari, Edge and Firefox to be the default browser on any particular device. The company is obviously disadvantaged against the main players, which usually have their browsers pre-installed on PCs/phones/tablets. Firefox has a separate following as being a crowd-developed and independent browser. Opera is trying to position itself as being an innovator in the sector and has actually pioneered tab browsing, adblock, free VPN integrations, etc. Its browsers are well regarded due to their functionality and optimization towards internet data usage and power/battery consumption (e.g. Opera mini reportedly saves 90% of internet data). Due to this Opera products are most popular in emerging markets where the internet data is limited and expensive (Africa accounting for 40% of monthly active users).

The browser was created by Norwegian engineers in 1995 and the company is still incorporated in Norway. In 2016 a consortium of Chinese investors – Beijing Kunlun (controlled by Chinese billionaire entrepreneur Zhou Yahui) and Quihoo (controlled by another Chinese billionaire Hongyi Zhou) acquired browser business and some other operations for $575m – around 60x 2016 adj. EBITDA ($10.2m). The new management has significantly ramped up the profitability and added new fast-growing business segments, e.g. Opera News, fintech – later became Nanobank (read below in private investments) and retail – African venture selling mobile handsets and airtime (terminated in 2020). In July’18 Opera IPO’ed at $12/share raising $175m (initial range was $10-$12/share). IPO valuation stood at around 17x 2018 adj. EBITDA ($66m).

Yahui Zhou is a successful entrepreneur who founded Beijing Kunlun (Chinese gaming company), which now trades US$3bn market cap. In 2020, he resigned as a chair and CEO to focus on Nanobank. In 2016, he acquired 60% in Grindr (homosexual dating app) for $93m and later raised the stake to 98%. In 2019, he was forced to sell it by CFIUS as a national security threat due to sensitive personal info that could be accessed by engineers in Beijing. Grindr was sold a year later for $608m, with Mr. Yahui pocketing a nice return.

Despite growth in MAUs, Opera browser has actually been losing market share over the last few years – currently at 2% globally vs. 4% back in 2017. In Africa the share is higher at 10% but has also decreased from 20%+ back in 2017. You can play with the historical browser market share data here – unable to vouch for the accuracy of it, but I think directionally should be correct – Opera is able to grow MAUs only because the smartphone/PC penetration growth exceeds Opera’s market share losses. And while that might sound like a thesis killer, investors are actually paying very little for the browser business that generates strong cashflows (before corp overheads) and has a substantial and growing userbase.

Note: MAU information is usually disclosed in form 20-F (to be released in April) with almost no disclosures in quarterly press releases or conference calls. It is hard to tell why 2021 Total Opera MAUs are lower compared to 2021 levels and whether these figures are actually comparable to my calculations for the Total Opera MAUs for the previous years, as disclosures are different.

The company does not split its revenue by products/services clearly, but from a high-level perspective:

- 50% of total revenues is from browser search;

- 25% is from browser advertising;

- 25% is from Opera News advertising.

Browser search revenue comes from long-term partnerships with search engines – Google and Yandex. OPRA basically receives money for keeping Google or Yandex as a default for search. OPRA has been in partnership with Google since 2001. The agreement has been recently renewed again (multi-year terms). Yandex partnership started in 2007 and the contract is due to expire in April 2023. 2020 revenues from Russia stood at $17.2m – 10.7% of total revenues. Advertising revenue comprises various additional ads in the browser, speed dial, shortcuts to landing pages, etc.

Opera News is a proprietary AI-powered personalized news aggregator that is integrated into Opera browsers (visible by default after installing the browser, but not intrusive) and also comes as a separate app. The service was launched in 2017 as part of the browser and the standalone app was released in early 2018. The product has been very successful so far, especially in Africa, where it is currently the top news app. Since 2021, Opera News has been scaling into EU and the US as well. Google Play shows it to be 6th most popular app in the News & Magazines category in the US. The segment generates revenues (25% of total) from advertisements, usually based on revenue sharing, cost per click, or subscription revenues collected by third parties on the company’s behalf.

Other products/services which are yet to see any material monetization are:

- Opera’s gaming segment – this is actually pretty much the same browser business just targeting a different audience. The company started highlighting gaming operations only recently. The gaming segment is based on the Opera GX browser, which is customized for gamers. The product was launched in June’19 and OPRA says it has been so far their highest engagement product (quite successful too). Opera has even done a promotional partnership with Pewdiepie. In Dec’20 the browser had 7m users, which doubled to 14m by the end of 2021. In Jan’21, OPRA acquired a video game development engine for $10m (YoYo games) and has integrated it into Opera GX – now browser users can directly create and publish/play games in the browser for free. GX is apparently the highest ARPU product of the whole Opera lineup – Q4’20 ARPU stood at $2.5, Q3’21 at $2.7 and Q4’21 at $3. This compares to average Opera ARPU of $0.83. The large difference is likely attributed to a more targeted – and potentially richer – audience, i.e. gamers vs Africa’s browser users. According to management Opera GX monetization is still at early stages.

- In Jan’22, the company launched Opera Crypto (beta version), which features built-in crypto wallet, easy access to cryptocurrencies/NFTs, support for decentralized apps, etc.

- In early 2021 the company released Dify – fintech product for EU markets (apparently ORPA has 50m+ users in EU). The initial offering is a cashback feature integrated into the browser. The company is planning to include a number of other e-wallet services such as savings management, credit and investment opportunities, instant cashback, etc. The launch in Spain. During Q3 conf. call management noted that Dify has already 100k users, a 105% sequential increase vs. Q2’21. In Nov’21, Dify was also launched in Poland, Russia, and Ukraine. No more updates have been provided on this venture.

- Hype – in-browser messaging app for Opera mini browser. Launched also in early 2021 and targeting for African users (150m MAU). Pilot launch was done in Kenya (40% of the Kenyan population has smartphones, most of them younger people). In June’21 Hype service was expanded to South Africa, Zambia and Ghana. To drive usage, Opera partnered with the leading carriers in Africa to provide free internet data for the Hype app. The only updates provided so far were 1m sign-ups as of Q2’21 and that the figure has tripled to 3m by Q3’21.

Operating businesses – performance & guidance

Historical financials:

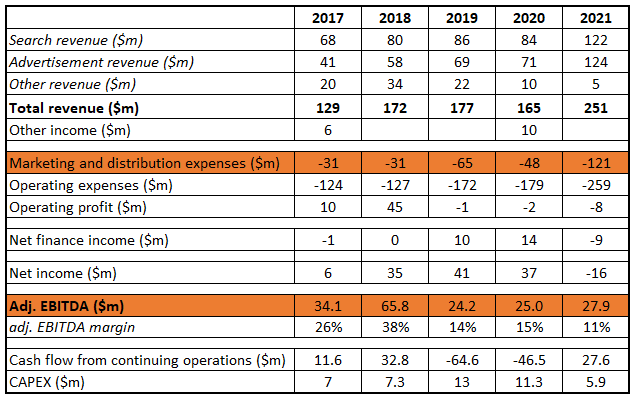

Note: the other revenue item relates to legacy and smaller business segments – some of these were sold or wound down. Net finance income reflects the results of speculative trading in equities using cash on the balance sheet by the CEO (more details in the “Risk” section below). Other income reflects certain IP sales in 2017 and divestment of sports betting JV in 2020.

The recent sharp growth in revenues was mainly driven by significantly increased marketing efforts and spending. This growth initiative was announced in Q1’19 and then was somewhat halted during 2020 due to covid. Marketing expenses reached $121m during 2021 (a double from 2018 levels) and this, in turn, has suppressed adj. EBITDA/operating margins in 2019-2021.

During Q3’21 conf. call management has hinted about adj. EBITDA normalization going forward.

Profits are expected to benefit from the combination of the additional scale we built during the year and the continuation towards a normalization of marketing and distribution spend.

And similarly during Q4 conf.call (Q4 adj. EBITDA margin was 22%, although its the seasonally strongest quarter):

Our core margins are very high. And when our marketing spend comes in below plan and as the scale of our business continues to grow, our trajectory towards a more normalized profitability level becomes very visible.

Before the Ukraine war, management guided 2022 revenues to reach at $300m-$310m (22% growth) and adj. EBITDA at $50-$60m (18% margin). For Q1’22 revenues were estimated at $67-$70m and adj. EBITDA at $4-$7m (8% margin at midpoint) – Q1 is the weakest quarter seasonally. This will likely get impacted by the Ukraine war and businesses moving away from Russia. In 2020 OPRA’s revenue from Russia (Yandex) stood at $17.2m – 20% of the browser search revenues. Assuming Yandex revenue proportion remained similar in management’s guidance, eliminating it fully still leaves 2022 expected revenues at $275m and adj. EBITDA at $50m (18% margin). While this guidance is more heavily loaded towards H2, profitability margins seem to be achievable if marketing spending can indeed be reduced without much of a negative effect on the existing user base and revenues. In other words, if the drastic ramp-up of marketing efforts during 2019-2021 has delivered a sticky user base then Opera will easily beat its guidance.

The current market cap stands at $660m with $180m cash on the balance sheet. Thus the operating businesses are trading at 9.6x forward EBITDA – arguably too cheap given the revenue growth and all the embedded optionality to launch/grow new products/services on top of the Opera browser. However, only using earnings from the operating businesses does not attribute any value to private investments. These private investments can be conservatively valued at $280m, and potentially materially more in upside scenarios (more detailed arguments for valuation of each of these assets are provided below). Taking these private investments into account reduces forward EBITDA multiple for the operating business to 4x.

Private investments

OPay – 6.44% stake – $100m valuation

Payment services (something like PayPal) provider in Nigeria and Egypt. The business was initially incubated by Opera and OPay’s chair/CEO is the same Zhou Yahui (OPRA’s chair/CEO). It was launched in 2018 in Nigeria and became a top payment services provider in the country with 22% market share in e-wallet market. In early 2021 it expanded, apparently successfully, into Egypt. As of Dec’20 the company had $2bn monthly transaction volume. By Feb’22 the monthly transaction volume has risen to $3bn already.

Opera’s initial stake of 20% was diluted to 13.1% in 2019 and then reduced to the current 6.4% in 2021. In Jun’21 Opera sold a third of its OPay stake at around $1.3bn valuation (3.8% outs. shares sold for $50m gross proceeds). At the time, the company said the sale was at 9-bagger vs the initial investment. A couple of months late, in Aug’21, OPay raised $400m at $2bn valuation. This financing round was joined by Softbank, Sequoia Capital China, SVB Capital, etc.

Since then, very few updates were provided – this year OPay plans to expand into UAE and North Africa.

At $2bn valuation, OPay’s stake should be worth around $128m. I’m gonna mark it at $100m to somewhat reflect the crash in the valuation of fintech companies since Aug’21.

Nanobank – 42% interest – $133m valuation (already sold for $127m, proud to have estimated it so accurately!)

The below description is probably no longer relevant as Opera has just announced the sale of Nanobank‘s stake at $127m, with payments to be made in eight quarterly installments. Such a quick sale was a bit of a surprise, given that half of Nanobank’s operations have recently been halted (potentially temporarily) since Q4’21.

Microlending business in Indonesia, India, Kenya and Mexico. Opera acquired the business from OPay for $9.5m back in Dec’18 and then formed its own fintech segment. In Aug’20, Opera merged the business with an Indonesian peer (Opera’s microlending business was mostly based in India back then) to form Nanobank. Opera retained 42% stake in the combined company. At the time of the merger, Nanobank’s pro-forma 2019 annual revenues stood at $209m and pre-tax profit at $68m. As of Dec’20, Nanobank’s 42% stake fair value was estimated at $266m. (i.e. balance sheet book entry based on a combination of income and market approaches).

The business was strongly impacted by COVID and hasn’t grown much since the merger. Disclosures are limited, but Q2’21 quarterly revenues were $57m with adj. EBITDA of $1.6m and Q’1’21 revenues at $50m with adj. EBITDA of $6m.

Moreover, by the end of last year, Nanobank’s India operations received an in-depth review from India’s regulators due to licensing fees paid by India’s subsidiary to the parent Nanobank (Q4 call):

So at least seen from our perspective, there were some minister of finance process to look into what seemed to be most focused on platform fees. So Nano develops their platform centrally and uses it across its markets. It’s a key component of the value offering. It’s what enables them to scale quickly while at the same time, keeping loan losses under control. That product has been licensed from its central operations to the various operating countries, and it was that fee payable from the subsidiary in India that I think triggered the review. As of now, I don’t think any formal accusations have been made, but their funds are frozen, so they cannot operate.

As a result, Indian subsidiary’s assets were seized and operations halted. In Q4’21 Opera has written off all of its Nanobank’s stake exposure to India ($82.6m). The company still says they will continue to fight to resume operations but comments from the recent conf. call are not exactly inspiring. In 2019, Indian operations generated $98m revenue, nearly half of the combined pro-forma 2019 revenues. Since then India’s portion of revenues has likely dropped due to a strong COVID impact on India, whereas according to management comments, Mexico has recently shown very strong growth.

Assuming back in Aug’20 Nanobank’s stake was correctly valued on Opera’s balance sheet at $266m, I think it is prudent to cut valuation down by 50% to account for the write-off of Indian operations, reduced scale as a result of that, as well as lack of revenue growth over the last 1.5+ years (even before the impact on India)

StarMaker – 19.4% interest – $55m

Social media/music/karaoke app for the Middle East, Indian and Indonesian markets. Opera invested $30m in the business back in Nov’18. As of Dec’20 the carrying value has been estimated at $55m.

The app has 100m+ downloads on Google Play. It generates revenue and has been growing pretty fast – 2019 revenues stood at $21m, 2020 and $90m, then Q4’20 annualized run-rate revenue was $127m and finally Q1’21 run-rate was at $180m. After that, the company has provided no updates on this business yet. Google trends indicate that the interest in the app has been rather stable over the last 2 years, but not sure if that is a good indicator.

I keep the value of this investment at an unchanged Dec’20 balance sheet valuation of $55m.

Risks

- The recent revenue growth has been largely fueled by the sharp ramp-up in marketing spending to nearly 50% of revenues in 2021. It is not exactly clear whether these expenses were really buying growth (i.e. delivering sticky user base) or simply buying revenues – i.e. once the marketing spend is normalized revenues might tumble down again. In 2019, the company said that most of the marketing spend will go towards Opera News, and not clear how much was spent to grow the browser user base. Both businesses are in extremely competitive industries, which are dominated by giants (Opera’s actual market share in the browser market is just 2.2%) that have significant distribution advantages (browser pre-packaged in new devices). Might turn out, that the only way for the company to stay relevant is to constantly spend huge sums on promotions.

- Operate provides quite limited disclosures on the operating businesses and new initiatives as well as its private investments.

- Exposure to emerging markets for both operating businesses as well as minority investments (e.g. risk of force majeur events such as with Nanobank’s Indian subsidiary).

- Uncertainty around exposure to revenues from Russia – in the write-up above I’ve assumed that Russian revenue margins are in line with the total company margins (18%), however, given that this is essentially Yandex search tab business, which requires no promotions, etc. and receives fees for just being placed on Opera’s browsers, the actual profitability margins might be way higher. If that is the case then the impact from Russian exposure might be more material than I estimated in case ties with Yandex are cut. On the other hand, the impact might also turn out to be negligible.

- Q1’22 results should come out at the end of April’22. Q1 is usually a seasonally weaker quarter (only $4-$7m adj. EBITDA guidance vs $50-$60m for the whole 2022). This might put further pressure on the stock price while investors wait for the margins to recover.

- In Jan’20, Hindeburg released a short report on OPRA. The core part of the report concerned the fintech segment (current Nanobank) getting crashed due to Google app policy changes. This was quickly debunked, however, the report also unveiled many more details about various related party transactions and Opera’s management’s history. E.g. Yahui Zhou used to sit on Qudian’s board – the Chinese lending firm that IPO’ed on NYSE in late 2017 and shortly thereafter was accused of illegal and deceptive lending practices (shares now trade at $1/share vs $24/share IPO price). Hongyi Zhou is the founder of “controversial” Chinese antivirus company Quihoo 360. Various related party transactions were highlighted – e.g. all OPRA’s private investments are actually affiliated/influenced by Yahui Zhou. You can also find a few pages on these in the 20F (search F-59). So far, these related party deals have mostly only created value for Opera, but their presence adds risk and combined with the (1) appearance of being “controlled by Chinese” and (2) low visibility/limited disclosures in the reports definitely creates a major overhang to the stock price.

- Furthermore, Yahui Zhou seems to be using Opera’s cash pile to speculate in the stock market (e.g. writing options) with questionable success so far (almost no details on these speculations are provided).

Broad question: when and why does it make sense to measure a business using EBITDA, without subtracting maintenance capex?

It doesn’t make sense to back out ITDA. It’s better to look at those expenses and make normalized estimates when they fluctuate or when depreciation is more than maintenance capex. I wish everyone would stop using EBITDA, or just use pretax income.

Opera sold its investment in Starmaker for a total of $83.5m, which is above the carrying value of $55m used in the write-up above. However not all the funds are received upfront – $28.4m will be paid promptly and the remaining consideration will come in two equal installments by Dec’23 and Dec’24. OPRA will collect 3.5% simple annual interest on the deferred installments. Taxes might consume a portion of sale proceeds.

Calculating $79m total net proceeds for Starmaker, the operating browser business now trades at 4.7x 2021 adj. EBITDA and 2.6x 2022 adj. EBITDA.

With the recent exits of Nanobank and Starmaker the thesis has been derisked, even if the sale prices of the assets have not been super great. It seems like the company is refocusing on its main business and I wouldn’t be surprised to see the sale of OPay stake soon as well. OPRA has more than half of the market cap in cash now, which would come closer to 80% if the OPay is sold.

Q1 earnings should come around 20th of May. The company has guided for 33% YoY revenue growth, but a rather modest adj. EBITDA in the range of $4-$7m (vs. 2022 at $50-$60m) due to seasonality and marketing expenses.

Starmaker sale – https://www.bamsec.com/filing/143774922009380?cik=1737450

Up 23% to $6.39 today, probably due to the earnings report.

https://finance.yahoo.com/news/opera-reports-first-quarter-2022-110000213.html

OPRA released Q1 results beating guidance both in revenue and adj. EBITDA, and affirmed 2022 guidance. Importantly, the company has also signaled intentions to sell the remaining stake in OPay – the asset has been classified as held for sale on the balance sheet. The share price jumped up +22% yesterday. The remaining business still seems cheap trading at 4.8x low range 2022 adj. EBITDA guidance.

Positives:

– Revenues of $71.6m (+39% YoY) vs the guidance of $67-$70m;

– Adj. EBITDA of $7.3m (+58% YoY) vs $4-$7m guidance. Adj. EBITDA margin increased to 10.3% vs 8% midpoint guidance;

– Opera GX reported 16m monthly active users in Q1’22 (14% growth vs the last quarter).

– The company has reiterated 2022 revenue guidance at $300m-$310m (22% increase YoY) and adj. EBITDA guidance at $50-$60m (18% margin at midpoint vs 12% margin in 2021).

– Q2 revenue is expected at $71-$74m, while adj. EBITDA at $8m-$12m (14% margin at midpoint).

Some negatives:

– The marketing expenses skyrocketed as well to $34.1m vs $23.4m same quarter last year; The risk/main question of how sustainable the current revenue growth (or even current revenue levels) with more normalized marketing expenses.

– Total Opera’s MAUs continued to slow decline (to 339m in Q1’22), although the company states that it is drifting towards higher ARPU markets. The strongest user growth was in Americas with North America up 15%, South America up 10%;

– The company has also repurchased 569k ADSs at an average price of $5.33, for a total spend of $3 million, leaving $47 million remaining under our existing buyback authorization. This speed of repurchases seems quite low given company’s cash position, trading levels during the quarter, and the fact that they sold two major assets.

– As expected, revenue from Russia, Belarus, and Ukraine was only 10% and the company expects revenues in the region to decline during the year.

OPRA reported pretty good Q2 earnings delivering record revenue despite a harsh macro climate. Guidance was raised as the company now expects 2022 revenue growth of 26% (vs 22% growth guidance the previous quarter). The now trades at 3.4x 2022 adj. EBITDA guidance (taking into account the $173m receivables from Nanobank and Star X). The Opay asset is still classified as “for sale”.

– OPRA recorded $78m of revenue in Q2 (beating guidance by around $6m) and expects Q3 revenue to be at around $82m;

– Adj. EBITDA was $17m, beating guidance by around $7m. Management expects to generate a similar amount of adj. EBITDA next quarter;

– Net profit was negative due to $15.3m in finance expenses (associated with value fluctuations on their marketable securities);

– Opera GX users increased by 1m QoQ to 17m;

– Marketing expenses have decreased 28% YoY to $25.3m;

Average MAU base this quarter was 327m, clearly a continuation of this negative trend (average MAU was 339m last quarter). The company continues to say they are shifting to higher ARPU markets. On an annualized basis, each user on average generated $0.94 of revenue, up 46% from Q2 2021.

OPRA repurchased $6.7m worth of shares at an average price of $5.3/share (vs current $4.84/share stock price) and has another $39m remaining in existing buyback authorizations. Though the total repurchase has nearly doubled from last quarter, it is still puzzling why management is reluctant to buy back even more shares if they believe OPRA is really undervalued.

I am waiting for the decision on Opay sale, which will hopefully help re-rate OPRA’s stock.

Unexpected development at OPRA. On September 23, Opera agreed to repurchase an entire 20.6% stake from its second-largest shareholder Hongyi Zhou for $129m in cash. Zhou was one of the two Chinese billionaires who took control of OPRA in 2016. His shares will be repurchased at $5.5 per ADS – 35% premium to pre-announcement prices. The transaction is subject to shareholder approval expected on October 10. After the shareholder approval, Hongyi Zhou will resign from his board seat at OPRA.

The announcement seems really positive in a sense that the company is using cash to repurchase shares instead of doing some questionable acquisitions. The chair/CEO will increase his personal stake from 64% to 80% with this transaction, so it could be a vote of confidence from his as well. The market has reacted positively and shares are up +16% since the announcement.

However, I guess you could also turn it upside down into a negative just as easily. OPRA is using cash to buyout the insider at a considerable premium (which puts a ceiling on the stock price too), while completely leaving out minority shareholders.

https://www.bamsec.com/filing/143774922022938?cik=1737450

OPRA shareholders approved the share repurchase of an entire stake from its second-largest shareholder Hongyi Zhou for $129m in cash. The transaction is expected to close within the next 10 days.

After the initial jump the stock has been trading sideways over the last 2 weeks. After the transaction (accounting for Nanobank and Star X receivables) OPRA will have $2.5/share in cash. Assuming they will be able to sell Opay for $80m (20% discount to value estimated in write-up), the cash would then stand at $3.36/share or 77% of the current market cap. The company now trades at 3.3x adj. EBITDA guidance (would drop to 1.9x if Opay gets sold).

https://www.bamsec.com/filing/143774922023867?cik=1737450

Opera has just released very strong Q3 results and lifted 2022 guidance. Taking into account the receivables from Nanobank and Star X, OPRA now trades at an adj. E2022 EBITDA of 2x. OPay stake is still held for sale and might act as a further catalyst for re-rate here. A concerning negative here is that so far management’s promises to tackle undervaluation through buybacks have only applied to insiders and not minority shareholders. The company has barely touched its open market buyback program during the quarter, but bought out former insider at a material premium instead.

Q3 performance:

– $85m in Revenue, a 27% increase YoY (Q3 exceeded guidance of $82m);

– $21m in Adj. EBITDA, a 160% increase YoY (Q3 exceeded guidance of around $17m);

– $12m in Adj. Net Income, a 60% decrease YoY (current results are not positively impacted by fair value gain on investments).

OPRA has updated its 2022 guidance and now expects:

– Revenue of $323 – $326m (up from $313 – $319m);

– Adj. EBITDA of $62 – $64m (up from $53 – $60m).

Other notes:

– Opera GX users increased by 1m QoQ to 18m (same increase as in Q2);

– Marketing expenses were at $26m (a 20% decrease YoY but a 3% increase QoQ);

– Average MAU base was 321m. A continuation of this negative trend (average MAU was 327m last Q and 339m the quarter before that);

– OPRA continues to hold its OPay stake as an asset for sale;

– During the quarter OPRA repurchased only 0.9m of ADSs at an average price of $4.84/ADS, This still leaves around around $35m of its existing buyback authorization to be used;

– OPRA also bought out ex-board member’s full 20.6% stake.

https://www.bamsec.com/filing/143774922024862?cik=1737450

Opera (OPRA) shares are up 15% upon the announcement of a $0.8/share special dividend (12% of market cap). The $71m capital return likely accounts for the majority of cash that was available for distribution, so it is really a big positive. I would expect further dividends/buybacks after the proceeds from the remaining $170m from the previous asset sales hit the balance sheet mostly over the next year. The company remains cheap at a low single-digit EBITDA multiple.

However, one aspect surrounding this special dividend is quite peculiar. The press release explained that this special dividend will be partially ($59m) financed by selling the OPRA’s portfolio of listed marketable securities to entities controlled by its Chairman/CEO. It’s not clear why these securities could not have been liquidated in the open market. Either OPRA had a portfolio of concentrated illiquid investments that could not have been sold in the open market or the CEO is benefitting in some way at the expense of shareholders.

https://investor.opera.com/news-releases/news-release-details/opera-limited-declares-special-dividend-080-ads

Regarding selling of the portfolio there is written:

The sale price was determined based on the average market closing price of these securities over the fifteen trading days prior to this announcement, and enabled Opera to fulfill its dividend while maintaining an adequate cash position.

I think it’s not bad, as if they would have sold the securities on the open market during the last fifeteen trading days, the price would also not be higher. Togehter with the buybacks, I think it’s a good reward for the shareholders.

It is right that there will be no withholding tax as cayman island holding company, or will the 25% for norway apply?

I am closing out OPRA idea.

Yesterday Opera reported great Q4 results. Both revenue/EBITDA exceeded the guidance and the stock is up substantially.

The company also provided a forecast for 2023 which at the midpoint would result in 15% revenue growth and 12% EBITDA growth.

Also company converted the Nanobank receivable into an increased OPay stake (still classified as held for sale), but had to take $35m impairment to the fair value of it.

My quick take the current valuation:

$835m Market cap

$60m Cash

$220m Star X sale receivable and stake in OPay

EV=$555m

This compares to 2023 mid-point EBITDA guidance of $76m. Thus the operating business is trading at 7x forward EBITDA.

I think the special situation part of the setup has pretty much played out. The upside in the remaining Opera investment depends on the continued traction of Opera browser businesses. I have much less confidence in that area, especially with the valuation already at 7x EBITDA and tech multiples having contracted significantly over the last year.

Counting in the dividend the stock is up +77% from the write-up levels in less than a year.