Paramount Group (PGRE) – Merger Arbitrage – 15% Upside

Current Price: $10.43

Offer Price: $12.00

Upside: 15%

Expiration Date: Q2 2022

This idea was shared by Dan.

A short note on a seemingly asymmetric merger arb situation.

On the 24th of February, New York/San Francisco office REIT Paramount Group has received a non-binding proposal from its 5.5% shareholder PE firm Monarch Alternative Capital. PGRE is still reviewing the offer. A large 15% spread likely reflects the risk of management rejecting the buyout outright – the founding family with 14% ownership and entrenched CEO/chair with 3.5%. At the same time, the offer is opportunistic and somewhat low. However, given limited downside, there is a play on the current spread as well as a tiny chance that the parties will negotiate a higher buyout price.

I find this situation interesting for a number of reasons outlined below. Having said that, this is a $2.5bn market cap REIT, and most likely the market is pricing the risks correctly (albeit market turned out to be very wrong on a similarly sized CNR buyout case recently also posted on SSI).

- Monarch is a credible suitor with $9.5bn AUM. The buyer has experience in real estate (owns 15m sq.ft. of properties) and office real estate in particular (6m+ sq. ft. owned). Over the last year Monarch has been on a buying spree acquiring $3bn worth of real estate assets (couple examples here and here – much smaller transactions compared to PGRE). The buyer itself states that it has a deep understanding of PGRE’s portfolio and would need only limited due diligence for a binding offer.

- Monarch is currently in discussions for arranging the financing and states that a definitive agreement will not contain financing conditions. The buyer also states that it has “never failed to meet obligations to close a transaction” before.

- Back in Nov’20, PGRE had another takeover proposal from an activist Bow Street at a price range of $9.50-$10/share. Management has rejected the offer within less than two weeks, calling it opportunistic and undervaluing the company. Now, 3 weeks have already passed without any update – might signal that management is considering Monarch’s offer more seriously.

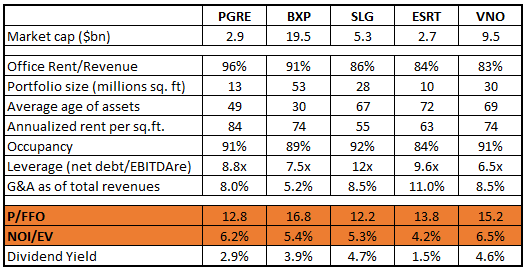

- The current offer comes at 6.2% cap rate and 12.8x forward FFO. The offer looks rather low based on the average NY/SF office market cap rates of 4.6%-5% (here and here) and relative to where PGRE’s peers are trading. In the table below PGRE market cap and valuation are indicated at the offer price and the company still seems to be the cheapest REIT out of the peer group – SLG is the only one trading at a lower P/FFO multiple, but it also has much higher leverage. Seems like there is plenty of room for an improved offer.

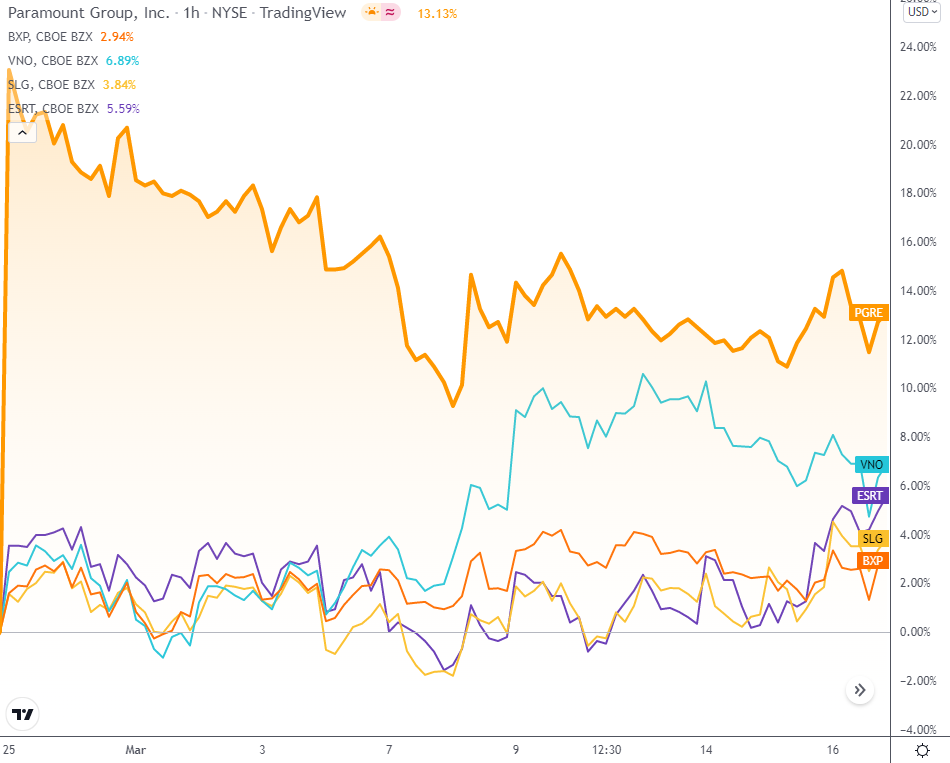

- Pre-announcement price of $9.3/share stands 11% below the current levels, however, the actual downside is likely to be lower than that. On the 15th of March PGRE raised its dividend by 10.7%. Office REIT peers have also traded up in the meantime (graph below). Monarch has acquired its 5.5% stake at prices ranging from $8.40 to $9.70/share (mostly during Jan/Feb 2022) – with plenty of shares purchased above $9.30/share.

Risks

Founding billionaire Otto family owns 14% of shares, while a further 3.5% is owned by CEO/Chair who has been at the wheel since 1991. It is not clear if they will be willing to part with the company and the associated prestige/perks of owning prime Manhattan real estate assets. The office RE market also is at an inflection point – management might be willing to see what waits ahead before selling.

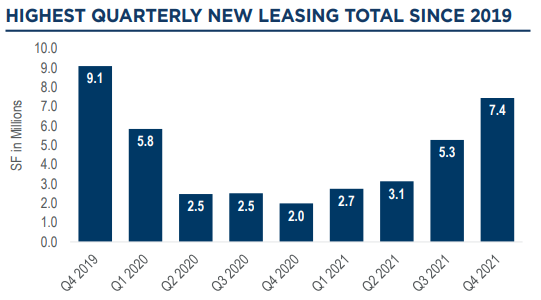

The offer comes at a time when the NY/SF premium office market has finally started rebounding post-COVID. The last two quarters of 2021 have seen an acceleration in new leasing activity (chart below), while the absorption has finally turned positive as well.

PGRE and peers have all made positive comments regarding the 2022. From BXP latest conf. call:

Now turning to 2022, we believe the market and economic factors which impact BXP are on balance very favorable. Though the Omicron variant has been a setback in the course of the pandemic has proven hard to forecast, most experts believe conditions will improve in 2022, resulting in more workers returning to the office and further improved space demand.

The fact that management has just increased the dividend and the way they have worded the offer response (adding several paragraphs on how strong they think the business is) suggests a decent chance that the offer will get rejected outright without any negotiations on the appropriateness of the valuation.

PGRE

Paramount Group is an internally controlled office REIT with exposure split between midtown Manhattan (70%) and San Francisco (30%). The company also manages 6 other properties in Washington.

The company has low near-term debt maturities and low near-term rent expirations.

For more background on the PGRE business please refer to this VIC article.

Great idea

Thanks for the idea Dan!

What is your (or the Company’s / others’) estimate of the “run rate” cap rate on their portfolio of properties? Or is there another metric superior to “cap rate” (i’ve never done commercial RE investing) that is indicative of the value of their properties?…the reason being is i’m trying to assess how much my downside is protected on this idea.

I re-read and think the idea has the answer here: “6.2% cap rate and 12.8x forward FFO”…sorry about that.

Can probably close this one. Offer was rejected a few days ago.

We are closing PGRE case as management has rejected Monarch’s $12/share offer. I like these types of bets – even if the chances of transaction closing were low, the downside was well protected from the valuation perspective and the upside stood in double digits. Not surprisingly, PGRE shares have traded up after the rejection of the offer (+3% over the last week and +6% since this idea was published).

Dan thanks for the idea, and please share your views if you are expecting a higher rebid from Monarch or someone else.

Any thoughts on if this is a good buy here? With multiple offers above this level I’d like to think there should be a decent floor valuation somewhere near here.