StarTek (SRT) – Merger Arbitrage – 30% Upside

Current Price: $4.13

Offer Price: $5.40

Upside: 31%

Expiration Date: mid-2022

This idea was shared by Ilja.

In Dec’21, call centre services provider StarTek received a non-binding offer from its 55% shareholder PE firm Capital Square Partners (later CSP) at $5.40/share. The offer is being reviewed by the special committee of independent directors and, during the Q4’21 results call (11th of March), management mentioned that the review is still ongoing. The spread to the offer stands at a staggering 30% and I struggle to find an explanation for that. SRT is cheap, trades below peers, below industry transactions and at the offer price is valued under 5xEBITDA. Upon the offer announcement, SRT shares popped to $5.30+ and for a few weeks the company was trading at <5% spread. The gap started to widen at the time when the war in Ukraine started, although the company has no business neither in Ukraine nor in Russia.

The buyer – Capital Square Partners – fully controls the game here – has 4 out of 7 board seats, including the Chairman and the CEO. The business Process Outsourcing (BPO) industry is in a consolidation mode and given how opportunistic and cheap this offer is, CSP is unlikely to walk away from this deal easily. Shareholder approval for CSP’s low-ball offer might be an issue, but there is plenty of headroom to raise the price to secure minority shareholder consent. A competing bid might be in the cards as well – ex-CEO with some other shareholders is rumoured to be contemplating an offer at a much higher price ($10.5/share).

I might be missing something – 30% spreads for $170m market cap companies on cash offers from controlling shareholders are usually seen only for Chinese going private transactions

A few points worth highlighting for this merger arbitrage situation:

- The offer is very opportunistic. Since 2018 (with the exception of two covid quarters) SRT has been trading within a $6-$9/share range. The shares slid down in Nov’21 after the company reported a security breach. The cyberattack happened in Jul’21 and put some pressure on Q3’21 margins – all of this resulted in a material sell-off. Since then, SRT has announced that the problem is fixed and that the company has eliminated any remnants of the attack and has significantly ramped up its cyber defence mechanisms. This take-private attempt seems to exploit the recent share price weakness to snatch SRT on the cheap.

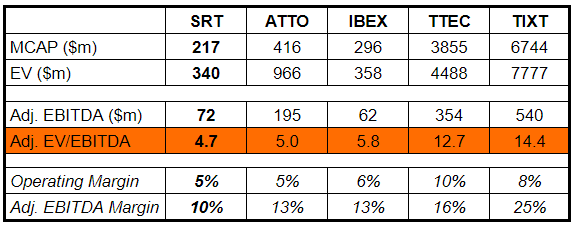

- The offer values SRT at 4.7x adj. EBITDA 2021, whereas similar peers trade at 5x-6x (see more details below). The industry is consolidating and plenty of recent transactions happened at around 10x adj. EBITDA multiple (more details below). A few weeks ago, rumours appeared that StarTek’s peer Atento is exploring a sale – at post-rumour price, ATTO is now trading at 5x adj. EBITDA even before any offer announcement or confirmation of the rumours. Atento’s case has also been posted on SSI.

- CSP is a Singapore based PE firm, which has experience in the BPO/outsourcing industry (more details below). CSP received its stake in SRT as a result of SRT’s merger with CSP’s owned Aegis back in 2018. During the merger, the combined company was being valued at $390m vs $220m at the current offer price – almost 50% cheaper. Meanwhile, SRT’s financial performance has only improved since the merger.

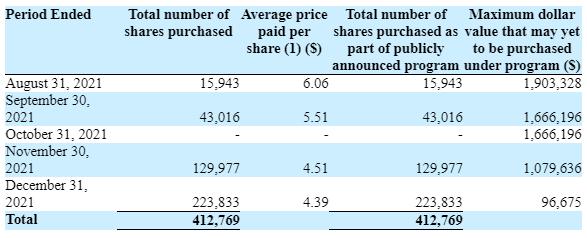

- SRT had authorized $25m share buyback in 2004 and did not touch it till 2021, when for some reason the company has suddenly started repurchasing shares. During 2021 412k shares were re-purchsed at an average price of $4.61/share, with plenty of shares also repurchased at $5.51-$6.06/share. The only explanation for these sudden open market buybacks is CSP willingness to increase its ownership in SRT, even above the prices of the current offer.

- To spice the story, another interesting twist. Just recently The Deal reported that SRT’s ex-CEO is considering making a competing bid. Basically, the ex-CEO alongside a few other shareholders think CSP’s offer is too low and are considering their options. Reportedly, ex-CEO has spoken with the current CEO (CSP’s affiliate) about launching a counteroffer at $10.50/share (almost a double compared to the current one) and also is saying that in a competitive sale process SRT could fetch 8-10x adj. EBITDA – SRT is an attractive target for strategic bidders even at far higher valuations than the CSP’s bid. However, in the offer announcement CSP clearly stated that they do not want to sell to any third party. Nonetheless, all of the additional noise created by the rumours of a competing bid at the very least should be a positive in pushing CSP to raise their current offer to appease the shareholders.

- Approval by a majority of minority shareholders will be required. Non-CSP management owns 3.7%, SRT co-founder owns a further 7.1% and another private investor holds 6.4%. Not clear if CSP offer would pass without the consent of these shareholders or if CSP has already consulted with them.

- Estimating the downside is trickly. Pre-announcement price stands at $3.94/share (-5%), however, since then SRT has released somewhat soft Q4 earnings – revenue +2% YoY, gross margins -2% YoY, adj. EBITDA $18.9m vs $23.3m last year. However, it’s worth noting again that before the security breach SRT traded at much higher prices and fundamentals have not changed much since.

- There have been some strange management reshuffles post the offer announcement. One of the CSP managing partners became CSP’s president in Oct’21. Then in Feb’22 – he has taken the SRT’s CEO role as well. A few weeks later, SRT announced CFO and CIO changes. Interestingly, the contract for the new CEO included an inducement grant of 100k options to purchase SRT common stock at $5.75/share. This seems quite weird in light of a $5.40/share offer that was already on the table at the time. The market did not react to these announcements.

- Regarding the previous security breach, in Jan’22 a couple of articles appeared that SRT’s employees are preparing a class action suit due to the leaked private information – apparently both customer and employee info might’ve been leaked (here and here). Neither the company nor The Deal article has addressed this.

Valuation

The table below details how SRT valuation at the offer price compares to other publically listed peers.

And here is the of several recent industry transactions – a number of them were shared in The Deal article referenced above. As evidenced by industry transactions (expansion efforts by industry giants + acquisitions by PE firms) and industry commentaries (here and here) the business processes outsourcing/call centre industry has been in consolidation mode for a few years now. SRT itself also mentions industry consolidation multiple times in its reports.

- Teleperformance/Senture in 2021 at a $400m EV or 13x EV/EBITDA ;

- ChrysCapital Management/ResultCX in 2021. Deal terms were undisclosed, but sources say valuation came in at between 9.5 times and 10 times the target’s $47m in 2021 EBITDA. ResultsCX had EBITDA margins around 11.7%;

- Sitel Group/Sykes Enterprises for $2.2bn or just over 7x EBITDA in 2021;

- Brookfield Asset Management/Everise Holdings in 2020. According to The Deal’s sources, reportedly paid between $425m and $450m for Everise. Everise had reportedly generated revenue of $300m and EBITDA of $40m in its fiscal 2020, which would put Brookfield’s deal multiple at 11x EBITDA. Everise’s EBITDA margins stood at 13%.

- Concentrix/Convergys for around $2.4bn or at an estimated 10x EBITDA in 2018.

Some of SRT’s cheapness relative to peers and industry transactions can be attributed to smaller scale, closely-held shares, and lower margins. The Deal article also argues that SRT is cheap partially due to management avoiding the conferences (being non-promotional) and not providing earnings guidance. All of these seem to be fixable in sale scenario, especially for a strategic buyer and margins have been improving recently and reached 10% in 2021 not far from the previously guided 12% post-synergies adj. EBITDA margins (guided at the time of the merger with Aegis).

Capital Square Partners

CSP is a Singapore-based PE firm that invests across telecommunications, media & technology, healthcare and other sectors with footprints across SE Asia and India. CSP says that co-investors of its funds include Hermes GPE, Partners Group, AlpInvest Partners, Aberdeen Private Equity, etc.

CSP has already made a couple of successful deals in the call centre/BPO industries and can be judged to know the dynamics of the industry pretty well.

- In 2014 CSP acquired MINACS – multi-country BPO business for $260m, grew its EBITDA by 50% in 2 years and sold it for $420m in 2016.

- In 2016 CSP acquired 55% stake in Indecomm for $90m. In 2019 it was reported that Warburg Pincus invested $200m in Indecomm and “bought out former investors that were led by CSP”.

Background on SRT merger with Aegis

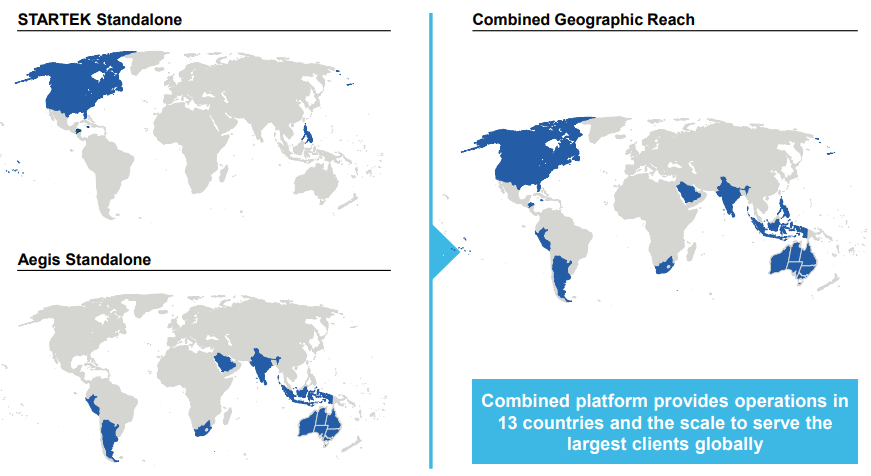

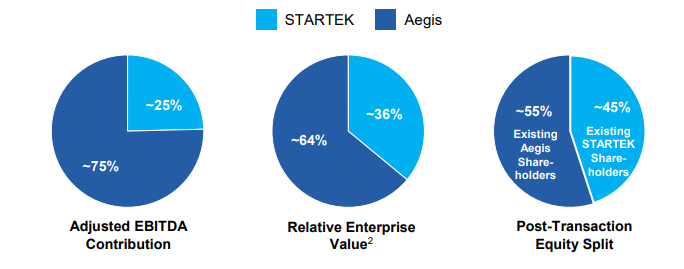

In Nov’17 for $300m CSP acquired Aegis – a multinational BPO/call centre business in India, Indonesia, Australia and South America. In Mar’18 CSP reverse merged Aegis with SRT and was issued 20.6m shares of SRT stock. Ownership of the combined company was split at 55% for CSP and 45% for previous SRT shareholders. CSP part was valued at around $216m at the time, i.e. materially below what CSP paid for Aegis just few months ago.

Back in 2017, the pro-forma combined revenues stood at $681m ($388m by Aegis and $293m by SRT) and adj. EBITDA at $51m ($38m Aegis and $13m SRT).

Given that Aegis was a larger company generating the majority of combined adj. EBITDA, it is somewhat strange that CSP has agreed to this combination at a discount to their cost basis. Moreover, upon the reverse merger, CSP also invested a further $2m at $12/share price (premium to $10.5/share price then). According to SRT management (pre-merger), this showed how much CSP believed in the synergies of the combined entity.

Both firms had no client overlap and guided significant synergies ($30m adj. EBITDA) from revenue opportunities (e.g. cross-selling) and operational efficiency.

Until the merger with Aegis in 2018, SRT used to be a call centre business focused mostly on North American clients. The merger has significantly diversified the revenue base (see graph below) and client concentration – before the merger SRT top 3 clients represented 53% of revenues vs <30% post-merger.

Current StarTek

SRT is a call centre business with over 200 clients – mostly in telecom, media/cable and e-commerce sectors. Also has some exposure to the government sector (in the US).

The company focuses on medium-sized businesses and operates on multi-year contracts. Relationships with the 5 largest clients have averaged around nine years. Top 5 clients accounted for 40% of 2021 revenues (the largest client is at 18%).

Geographical revenue segmentation:

-

Americas – 37%

-

India & Sri Lanka 15%

-

Malaysia – 8%

-

Middle East – 29%

-

Argentina & Peru 5%

-

Rest of the world 7%

The company has 45k employees, 95% outside the US (mostly in India, the Philippines and Honduras).

Financial performance:

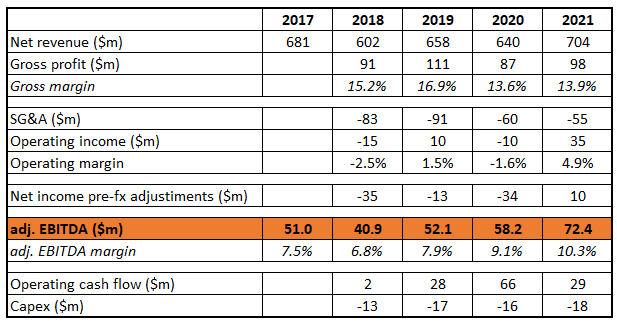

It seems that since the merger in 2018, SRT’s financial performance and profitability have been steadily improving. In 2021 the company has almost reached the post-synergy adj. EBITDA estimates of $80m (as communicated during the merger with Aegis). 2021 results were also slightly affected by the above-mentioned security breach and leaked information.

Any thoughts on why the SRT spread is so large, at 20% at the moment? I am truly puzzled by this one and probably miss an important part of the equation.

Is CSP going to talk away or will the special committee reject the proposal?

DT – The reason I passed is employee data breaches, in the U.S. particularly, can cost huge lawsuit payouts and multi-year contingent liabilities that I don’t want to wait around for. I think the share price downside if the deal breaks could be significantly below the pre-announcement share price. This trade doesn’t seem asymmetrically positive (or have a floored downside)….for instance, perhaps a 70% probability of a better than 20% share price upside, whereas the remaining 30% share price downside probability (assuming the deal breaks) is a -40% or so….very rough estimate.

Thanks, did not expect this to be such a big concern. I am guessing then this materially increases the chances of CSP walking away (as the employee suit was filed at the end of Jan, i.e. after the offer from CSP). I tried to find any further developments for this case on Colorado Judicial Branch site (https://www.courts.state.co.us/dockets/index.cfm), but no case can not be found here – maybe I am looking in the wrong place or maybe too little time has passed since filling.

On the other hand, CSP must have known that employee data breaches might end up in court and still made the offer for the company.

Stock is back to write-up price after recent weakness. Is there new news?

No update on CSP offer. From 10Q:

On January 17, 2022, the Company announced that the board of directors has formed a special committee of independent directors that is authorized, among other things, to evaluate the non-binding proposal, dated December 20, 2021, by CSP Management Limited (“CSP”) to acquire all outstanding shares of common stock of Startek that it does not already beneficially own for $5.40 in cash per share. The special committee has engaged legal and financial advisors to assist in its consideration of the proposal. CSP is currently the beneficial owner of approximately 56% of the outstanding common stock of Startek. The special committee has appointed Foros Securities LLC as a financial advisor in connection with private offer and the Company incurred total expenses of $500 during the quarter ended March 31, 2022 which is included in selling, general and administrative expenses.

From the call:

“At this stage, all we can tell you is that the special committee was constituted and their advisers, Freshfields and Forus, are still evaluating the situation. They are looking at the business given the dynamics that Ron and I talked about. So obviously, they are fine-tuning their numbers, assessing the situation. And they haven’t formed a view as yet. But as soon as that does or they are able to form their view, I think we will provide a lot more information. But at this point, fair to say that they’re still evaluating the situation given everything that’s happening in the industry and the environment around us.”

With no mention in the press release, and the last sentence above, it sounds like they’re trying to lower go-private expectations. Investment in sales personnel pressuring the bottom line (short term). Financing also likely getting more expensive.

Is there a chance they are depressing margins to pressure the board to say yes to their supposedly lowball offer?

Def. Possible.

Yesterday, SRT announced that CSP has reported $20m in cash and/or unfunded capital commitments to use in the transaction. Updates on debt financing availability are expected to be provided in 5-7 weeks. CSP’s total consideration is at ~$96m. Meanwhile, the spread has widened from 31% to 71% since June 13th. Obviously market does not believe this acquisition will close.

“In response to ongoing requests from the Special Committee, CSP has notified the Special Committee that it has an aggregate of US$20 million of available cash and/or unfunded capital commitments, all of which is available to be applied as equity financing of its proposed transaction. In addition, CSP has informed the Special Committee that CSP believes that the proposed transaction and all related costs and expenses will be funded by such US$20 million of equity financing, with the balance to be funded by debt financing. CSP has further informed the Special Committee that the prospective sources of its debt financing have preliminarily indicated that, in approximately five to seven weeks’ time and subject to market conditions, they will know whether they are in a position to commit to providing such necessary debt financing. Each of these notifications to the Special Committee have been confirmed by CSP in a public filing in an amendment to the CSP Schedule 13D.”

https://www.bamsec.com/filing/143774922015365?cik=1031029

The special committee took 6 months to find out they have $20mm and financing will take 5 weeks to confirm?

Non-binding proposal for $4.65. Old $5.40 offer withdrawn. So, market was correct to push price to around $3 over the months. Premarket now $3.70, implying a low chance the new proposal will succeed.

https://finance.yahoo.com/news/special-committee-startek-updates-stockholders-110000889.html

So apparently CSP was unable to raise debt at satisfactory terms, withdrew the previous bid and made a new one at $4.65/share. The new bid is financed by equity and seems to have been secured already. CSP controls 55% of SRT shares and has 4 out of 7 seats on the board. Kind of suggests that the offer should go through, so with 26% spread outstanding, the situation does seem interesting.

I’m inclined to think that special committee will not reject this deal. So far, in the past 8 months they haven’t made any negative comments about CSP’s intentions and were only interested about the buyer’s financing ability. That has been settled. The new price comes at a decent discount to the previous offer, however, it simply reflects the overall sell-off in the call center sector impacted by inflationary pressures.

The current bid comes at 5x TTM adj. EBITDA and 6x H1’22 run-rate adj. EBITDA – slightly below ATTO’s 5.8x TTM and 5.7x run-rate adj. EBITDA and IBEX 6.8x TTM adj. EBITDA valuation. The buyer is clearly interested in SRT and is getting an even better deal now.

However, the market clearly sees an elevated level of risk here, so maybe I’m missing something. Would be interested in hearing other opinions.

Press release – https://www.bamsec.com/filing/143774922019472?cik=1031029

Any opinion if a higher bid will likely come after the rejection of the proposal?

https://www.businesswire.com/news/home/20220909005362/en/Special-Committee-of-Startek-Updates-Stockholders-on-Status-of-Preliminary-Non-Binding-Proposal-by-CSP

With the forecasts of the committee’s report and the statement of the board on the future financial viability of the company based on said report, things do not seem to look very good, but I do not see the door closed either.

Unfortunately, CSP has decided that it won’t raise the price and will withdraw the proposal instead. Market reaction was muted as clearly this turn of events had already been anticipated. While it can be argued that SRT is cheap at these prices, the original merger thesis has failed and we are closing this idea with a 19% loss in 6 months.

https://www.bamsec.com/filing/94787122001001/2?cik=1031029

11/22 – MCI $4.2 tender for up to 4mm shares (10% outstanding, closer to 40% of float). Expires 12/20

https://investor.startek.com/sec-filings/sec-filing/sc-t/0000930413-22-001975

Tender done. Unusual sequence: trading under tender price throughout the tender period since tender news, on initial deadline zero shares tendered, extension announced, after which nearly 3m shares tendered (out of 4m shares to be purchased).

Anyone played this? Could have easily bought at about $3.60 and tendered for $4.20, all the shares you want (no proration).

I guess the risk is the tender getting cancelled if the minimum of 2m shares were not tendered, and the price tanks to the level before the tender news, about $3.

I was in smallish but I tendered it all thinking it would be prorated after reading a Dec 4 VIC writeup. VIC writeup still isn’t public but should be soon….since 30 days have passed, I thought.

Anyone, Ilja, thoughts?

Interesting outcome. I passed the tender mainly thinking that the offer was going to get oversubscribed and the price would tank after that.

Anyone interested in this after 16% repo authorization last wk? Is there any other news or catalyst?