Turquoise Hill Resources (TRQ) – Expected Better Offer – Upside TBD

Current Price: $30.00

Offer Price: $27.24 (increase expected)

Upside: TBD

Expiration Date: TBD

This idea was shared by Povilas.

This is a bet on activists succeeding in their attempts to force Rio Tinto to make a better offer in the buyout of Turquoise Hill’s minority shareholders. TRQ trades 10% above the current offer. Given $6bn capitalization of the target, the market is likely pricing the situation efficiently, and ‘the edge’ factor from my research below is clearly limited. TRQ is listed both in Canada and the US (NYSE), but as financial statements and other technical reports are provided in USD, all the numbers in the write-up below are in USD as well (unless stated otherwise).

On March 14th, copper/gold miner Turquoise Hill Resources received a non-binding proposal from its largest shareholder mining giant Rio Tinto (owns 51% of TRQ) to acquire the remaining TRQ shares at C$34/share (around US$27.24/share). The offer will need consent from the special (independent) committee and a majority of minority shareholders. TRQ background and minority shareholder letters suggest that Rio Tinto might have a strong influence over the independent directors as well, so approval by a special committee is likely. However, the offer has raised a fierce backlash from the minority shareholders, including the largest minority holder Pentwater Capital Management (10%), who claim the offer to be opportunistic, low-ball, and is unlikely to go through. Overall, it’s quite likely that the offer will be voted down by the minority shareholders.

TRQ’s Oyu Tolgoi copper/gold mine is a premier copper/gold project and it seems that Rio Tinto has a strong intent to gain full control of it. Rio Tinto has already tried to increase its ownership in TRQ by unsuccessfully pushing a dilutive self-underwritten equity raise (back in 2020), but received backlash from the minority investors. Rio Tinto acquired its stake in TRQ before 2013 at a cost basis of US$63.7/share. Given how cheap the current offer is at today’s gold/copper strip pricing, there is a chance that Rio will improve the bid.

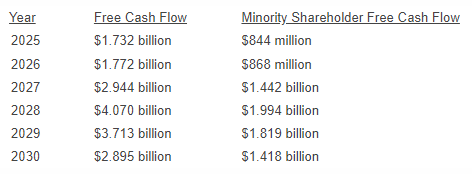

To cash out TRQ 49% minority shareholders Rio is paying only $2.6bn (equity value). The activist Pentwater Capital estimates that at current commodity price levels during the 2025-2030 years alone TRQ will generate $17bn after-tax FCF out of which $8bn would be attributable to minority shareholders. Meanwhile, the TRQ’s mine has 70 years of estimated mine life (letter):

So it’s not surprising that both activists (Pentwater Capital and Sailing Stone) expressed willingness to acquire Rio Tinto’s TRQ stake themselves at the offer price.

We would be more than happy to participate in a proposal to purchase Rio Tinto’s stake in TRQ for C$34/share.

Pentwater Capital summarized its thoughts on Rio Tino bid in this way:

Would you agree to sell your house to your corrupt banker for less than the equivalent of one and a half years of rental income? That is what Rio Tinto is asking you to do.

Other analysts/shareholders are also pushing for the raise in the bid price – Macquarie has sent a letter to its clients saying control premium has to be higher and set a price target of c. $35/share (calculated assuming much lower long term copper prices of $3.40/lb vs today’s longer terms strip prices at $4.77/lb). Top 20th largest TRQ shareholder Argo Investments also “noted that the first bid was not always the last”.

The gap to pre-announcement levels is pretty steep (30%), however, the largest minority shareholder Pentwater Capital believes that the downside in case the deal breaks will be smaller (letter):

In Pentwater’s opinion, it is highly improbable that Rio will be successful at its current bid price and equally improbable that Turquoise Hill shares will ever fall back to the levels they traded at prior to Rio’s offer now that Rio’s true intentions are known.

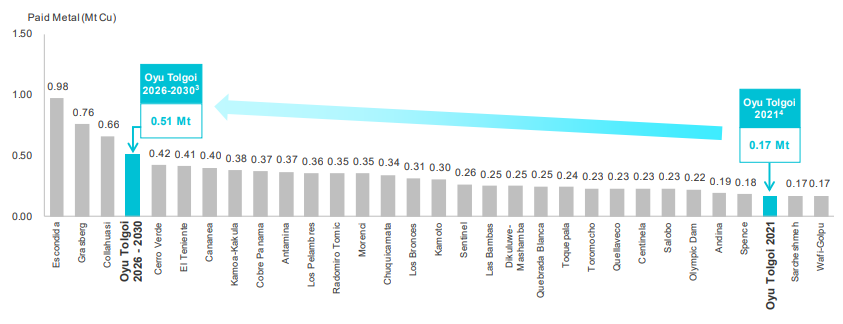

Rio’s offer for TRQ is not surprising given that TRQ’s flagship asset – Oyu Tolgoi copper/gold mine in Mongolia is one of the world’s largest Tier 1 copper/gold deposits, expected to become the world’s 4th largest copper producer (1% of world’s copper production) once the underground expansion project is completed. The offer also comes at an opportunistic timing given that TRQ has just settled with the Mongolian government over a 2-year long dispute, which was a significant threat to the project timeline (minority shareholders argue that the offer came just after the project got “de-risked”, but benefits of tat are not yet reflected in the share price). Moreover, the bid was announced shortly before the long-awaited project development process updates and minority shareholders are speculating that Rio might be acting on inside information. Sailing Stone’s letter:

On a related note, it is obvious that as the entity responsible for developing and operating the mine, Rio Tinto has access to a significant amount of material information which has yet to be released to the public. Specifically, TRQ management has indicated that updates to both the underground mine development plan and an open pit optimization are due in the next few months. Presumably neither the independent directors nor management has access to this information since it would have to be disclosed. And, presumably, the news can’t be all that negative or Rio would not be making a cash bid

Turquoise Hill

Turquoise Hill owns a 66% stake in Oyu Tolgoi copper-gold mine in Mongolia (80 km from the border of China). The remaining stake is held by the Mongolian government. Oyu Tolgoi has 1 open pit and 3 underground deposits. Most of the mine resources are located underground – open pit contains only 4% of copper and 11% of total mine’s measured and indicated resources.

Open-pit deposit has been in production since 2012. 2021 revenue mix was 61% copper, 38% gold and 1% silver. 2022 production guidance stands at 150kt copper and 165koz gold.

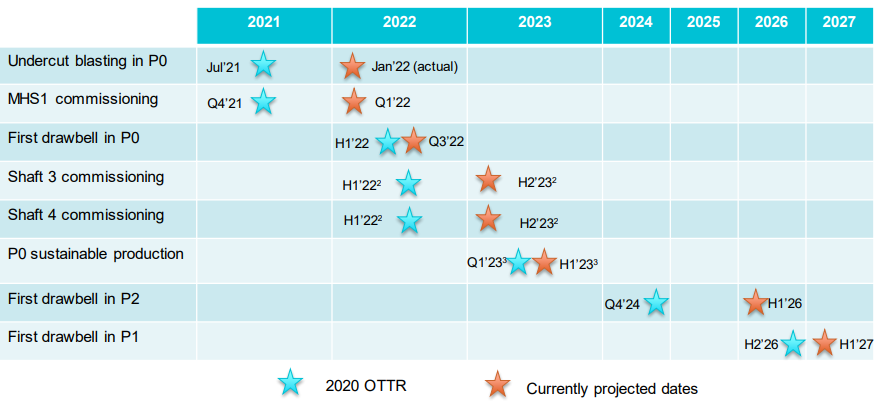

The underground mine expansion project is ongoing. The first underground deposit is expected to come online in H1 2023 and the other two in H1 2026 and H1 2027.

Expected mine development timeline:

After that, the Oyu Tolgoi mine is expected to become the world’s 4th largest copper producer:

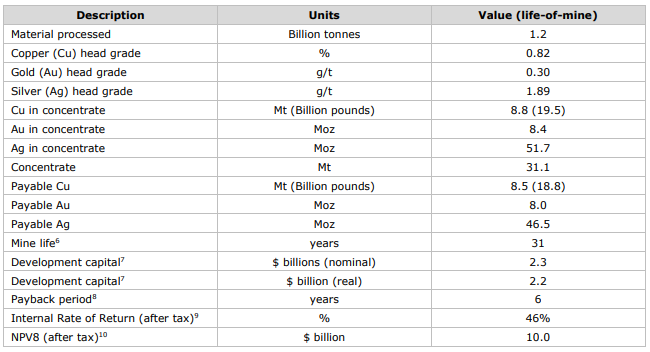

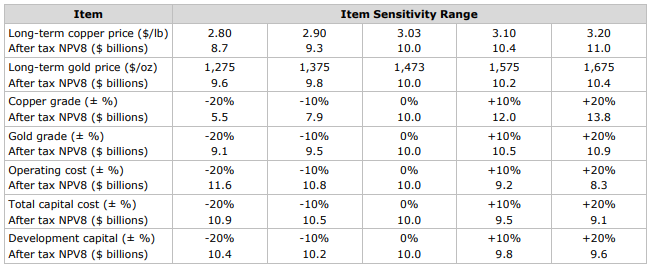

2020 feasibility study estimated total Oyu Tolgoi mine NPV at $10bn using an 8% discount rate and long term copper price of $3.03/lb + gold price of $1474/oz vs current copper future prices 2025-2027 at $4.70-$4.77/lb and gold 2025-2027 future quotes at $2000+/oz:

NPV sensitivity to commodity prices

Using sensitivities in the table above as well as futures quotes for copper at $4.77/lb and gold at $2000/oz, the Oyu Tolgoi mine’s NPV would stand at around $21bn. At this NPV level, TRQ’s equity would be worth north of $51/share vs the current offer price of $27/share.

Rio Tinto’s mismanagement background

In mid-2016 TRQ has started construction for underground mine expansion. Rio Tinto was signed as a contractor for the project. TRQ made a deal with Mongolia that it will cover government’s costs, which will later be repaid through dividends that the underground mine will generate. Initial CAPEX was estimated at $5.3bn and the first production was expected in Q1 2021.

In mid-2019 Rio Tinto reported, that due to unexpectedly difficult geology the project has faced some issues and estimated $1.2bn-$1.9bn CAPEX overruns + 16-30 months of delays. Rio Tinto was reviewing different scenarios on how to proceed further with the mine redesign.

Rio Tinto’s provided only limited reports on the construction process – this raised concerns from both TRQ minority shareholders and the Mongolian government. This resulted in a joint launch of an independent review into the construction process suspecting mismanagement from Rio Tinto side.

In Dec’20, more than a year later after the initial announcement of delays, Rio Tinto gave the final verdict on the ‘scenario’ review saying that the expansion project capex was now estimated at $6.75bn (i.e. $1.45bn overruns), and production was estimated to start in October 2022 (vs previous Q1 2021). The contractor noted that new financing will be needed, estimated at $1.7bn-$3.6bn (vs TRQ market cap at the time of $1.75bn. Additionally, Rio Tinto said that it will accept only a limited amount of debt in the new financing (up to $0.5bn) and was ready to underwrite equity financing itself. This raised a swift backlash from TRQ minority shareholders, who claimed that Rio Tinto wants to cheaply increase its stake in the project at the expense of the minority holder, and Mongolia, who expressed concerns over significant delays, failed promises, and diminished economics of the project. Rio Tinto’s relationship with Mongolia’s government started to turn for the worse and in May 2020, Mongolia blocked Rio Tinto’s plan to build a $1bn coal-fired plant to supply electricity to the Oyu Tolgoi mine saying it will build a state-owned plant instead. There were also some concerns that Mongolia will terminate the partnership altogether.

In 2021 the independent review concluded that the delays and cost overruns were not a result of geology, but rather Rio Tinto’s mismanagement of the process. Pentwater Capital filed a class action against Rio Tinto for concealing the real reasons for the delays. No further updates on this litigation yet.

The process got stalled and Rio Tinto/TRQ/Mongolia continued negotiations till Dec’21, when it was announced that Rio Tinto has reached a settlement with Mongolia’s government, which reset the relationship and will allow the proceeding of the Oyu Tolgoi expansion project. However, the settlement included that TRQ will write off the Mongolian government’s $2.4bn debt, which was another large blow to TRQ’s minority investors. In Jan’22 Rio Tinto and TRQ also announced a new financing plan, which was expected to potentially reduce the remaining capex to $1.8bn from the previous $3.4bn estimate, but the focus on equity raise instead of debt still remained.

By the way, Rio Tinto was also suspected of bribing Mongolia’s finance minister in relation to the Oyu Tolgoi mine restart.

Comment from one of SSI members:

While I admit TRQ is interesting, there’s serious risk. RIO is indeed getting a steal on TRQ, even if they raise their bid by 10-20%. But keep this in mind, if there’s no deal TRQ must do a massive, very dilutive equity raise (see article pasted below) and then still have to work with RIO and fight for dividend cash flow for years. All in Mongolia, which happens to be sandwiched between two countries arguably allied against the West and with little love for Rio Tinto (see all the RIO execs arrested over the years by Chinese authorities etc). Turquoise Hill is an incredible mine and would be valued much higher if in a better jursidiction and without such a difficult corporate governance structure. I loved the stock in the low teen’s, but I took the bird in the hand myself, even though I agree the company is worth much more. But getting all that value out of the ground and cash out between Russia/China is another thing entirely. So anyway, might be worth pointing out to SSI subscribers the rights offering risk if no deal, and also that all the bombastic negotiating comments by activists like Pentwater aside, nobody will ever pay full price for the mine. It will ALWAYS be subject to a substantial geopolitical and geological risk discount in either the share price or the final takeover price.

Povilas or anyone have any comments given recent earnings and price action? Risk/reward seems even better at these levels….but that all changes with a Rio bid rejection.

I agree and I don’t think the thesis has materially changed since the write-up. Management continues to be very vague about the strategic review process.

However, I like that they’ve suddenly added a slide to the TRQ presentation saying that the company is undervalued compared to peers (12th slide).

https://static.seekingalpha.com/uploads/sa_presentations/230/83230/original.pdf

CEO of Erdenes Oyu Tolgoi (34% Mongolian owner of the mine) recently came out and said what can be interpreted as an indirect support for RIO’s acquisition of TRQ:

“As a shareholder of Oyu Tolgoi, we are asking Rio Tinto that this project be transparent and have a proper management structure and without that it doesn’t matter who owns the shares. If Rio succeeds in its bid to buy Turquoise Hill it is good for us because the decision making will be shortened, this is the good side (of the deal).”

https://www.reuters.com/business/mongolia-urges-transparency-rio-tinto-seeks-control-giant-oyu-tolgoi-project-2022-06-08/

On a side-note, TRQ also announced that the first drawbell of the underground mine will be fired on June 17th. The company described it as “ahead of expectations” as the mine nears the production stage.

https://turquoisehill.com/investors/news/news-details/2022/Turquoise-Hill-Announces-First-Drawbell-Firing/default.aspx

TRQ now trades just slightly above the offer price.

Does copper’s nosedive put this deal at risk? Never mind reduce the possible upside…?

I have exited my position in TRQ. Rio Tinto was unwilling to raise the price at much better market conditions and now that copper price dropped 30% I think the chance of a price bump no longer exists. Only 2% spread exists to Rio’s offer. Activist shareholders have also stayed quiet and will likely support the offer at this point.

Thanks for the update, Povilas. The idea is closed with 14% loss in 4 months.

Timely exit. Company rejects $27 offer (advice of special committee), and stock falls to $23. Afterwards, activist Sailing Stone applauds this decision, while at the same time lamenting that majority owner Rio Tino is not willing to sell at any price.

https://finance.yahoo.com/news/rio-tinto-offer-over-giant-092844148.html

https://finance.yahoo.com/news/sailingstone-applauds-turquoise-hill-response-070000040.html

Rio raised offer to C$40 ($30.75), 18% higher than its previous bid of C$34 that was rejected. Trading at $28.28 now, an 8% spread.

https://finance.yahoo.com/news/rio-tinto-raises-bid-turquoise-131935501.html