Cumulus Media (CMLS) – Merger Arbitrage – Upside TBD

Current Price: $14.70

Offer Price: $15-$17 (with potential to be increased)

Upside: TBD

Expiration Date: Q2 2022

This idea was shared by Jarred.

A quick overview of a rumored acquisition offer that has the potential to turn into a competitive sale process or at least an improved offer from the currently rumored bidder.

4th largest radio group in the US, Cumulus Media, has been approached by a consortium led by the industry veteran Jeff Warshaw, who previously sold his radio station business to Cumulus Media in 2000. Reuters reported that company’s spokesman had confirmed the offer and the board is currently reviewing it. However, no official statements have been released by CMLS yet. The offer price is rumored to be in the $15-$17/share range. Subsequent to the announcement, CMLS shares jumped from $10/share to $14.7/share. Despite a large premium, the offer looks opportunistic and lowball, so it’s hard to imagine management accepting anywhere close to $15/share. However, there seems to be plenty of headroom for an improved offer and the buyer has reportedly expressed willingness to increase the offer after the due diligence. At the same time, this acquisition offer has put the company in play and there’s a chance that the board will consider running a full-scale competitive sale process to identify any other potential buyers.

CMLS is a somewhat left-for-dead microcap stock with a messy background – M&A streak leading to high leverage and then bankruptcy in 2017/2018. The business was also negatively affected by covid. However, management has been successfully progressing with the turnaround for several years now and the business is quickly rebounding from the pandemic impact. The year 2022 is expected to be an inflection point that should finally put Cumulus Media’s balance sheet in a proper shape and carry its FCFE into positive territory.

Downside to pre-announcement is steep (30%), however, given the turnaround/received offer/and hints of potential capital return in later 2022, the actual downside in case the acquisition fails could be much lower.

Offer

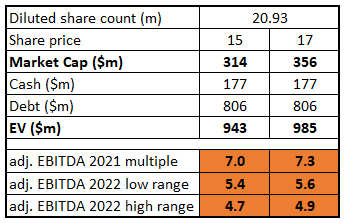

The current offer comes at 7-7.3x 2021 adj. EBITDA multiple and at 4.7x-5.6x forward EBITDA guidance.

It’s quite unlikely that management will accept the offer at this level given that in Feb’22 presentation they’ve dedicated a whole slide to highlight analysts’ consensus price target of $20/share (the stock was at c. $10 at the time):

Moreover, in the latest conf. call management has also mentioned a potential capital return later in 2022:

With the strongest balance sheet among our peers and significant liquidity, we expect to delever to below 3x by year-end, which positions us to return capital to shareholders in the second half without compromising our flexibility to execute accretive acquisitions to accelerate growth. So that’s the punch line. Revenue and EBITDA growth, high free cash flow conversion and growth, lower leverage, potential return of capital with investment flexibility and audio-first strategic repositioning.

[…]

With this positioning, our strong financial results and outlook, our rock solid balance sheet and potential to return capital to shareholders in the back half, we continue to believe that there is tremendous upside for our shareholders.

The closest peer, the largest US radio group IHRT is currently trading at 10.1x 2021 adj. EBITDA. Of course, it is several times larger, has an even faster growing digital business, and has better EBITDA margins (23% vs CMLS’s 15%). However, IHRT is levered by a couple of turns more at 6.8xEBITDA vs CMLS’s at 4.7x. IHRT also went through the bankruptcy process 3 years ago. Other peers include: AUD – 12.8x 2021 adj. EBITDA (10.6x net leverage), BBGI – 11.3x adj. EBITDA (9.3x net leverage), TSQ – 7.2x adj. EBITDA (4.6x leverage) and SALM – 6.8x adj. EBITDA (4.6x net leverage).

So some kind of discount is definitely warranted here, but the most important point is that due to CMLS leverage each turn of 2021 adj. EBITDA acquisition multiple results in $7/share change in the valuation of the equity stub. So at $20/share offer, the company would still be valued at only 7.7x 2021 adj. EBITDA. In other words, a 33% improvement in the acquisition offer (from $15 to $20/share) would result only in 11% change of the total acquisition price (EV).

It’s not yet clear who the other members of the consortium are, but Jeff Warshaw is a well-known industry veteran, who founded Connoisseur Communication Partners, a 39 radio station group, and sold it to Cumulus Broadcasting (CMLS subsidiary) back in 2000 for $258m. A few years later he started Connoisseur Media and now still operates 13 radio stations in 5 markets. Thus, there seems to be a strategic rationale for the acquisition of CMLS, and given the current valuation+leverage dynamics described above, it’s not hard to see Jeff raising the offer price substantially if negotiations are successful.

Worth mentioning that Jeff apparently has a somewhat dirty sport on his recent track record – he launched a $250m SPAC in 2021 that has merged with some Chinese “smart mobility firm” and now trades at $3/share (70% discount to trust value). The ticker is WEJO.

CMLS

Cumulus is the 4th largest radio group in the US with 406 stations, the Westwood One radio network (9500 affiliated stations), and a growing digital platform (streaming/podcasts and digital marketing services).

The company was founded in 1998 and after 15 years of M&A ($5bn worth of acquisitions) found itself struggling to integrate the acquired businesses, while some previous projections on the acquisitions turned out to be overly optimistic. The company had amassed $2.5bn in debt and it became clear that its cash flow from operations will not be sufficient to cover the upcoming debt maturities. In 2015 new CEO Mary Berner took over the wheel and started the turnaround, however, after the failed refinancing attempt in 2016 the company was forced to file for chapter 11 in Nov’17. $1bn of debt was exchanged for pretty much all the new equity (debt dropped from $2.3bn to $1.3bn).

Since then, the company has successfully continued the turnaround by focusing on the new digital segment (streaming/podcasting). This segment grew 48% in 2021 and now generates 14% of total revenues. CMLS podcast network is now the 8th largest in the US. Moreover, CMLS has been selling the non-core assets ($480m since mid-2018) and successfully cutting costs – in 2021 management permanently cut $50m of fixed costs vs 2019 level and is expected to cut another $25m in 2022.

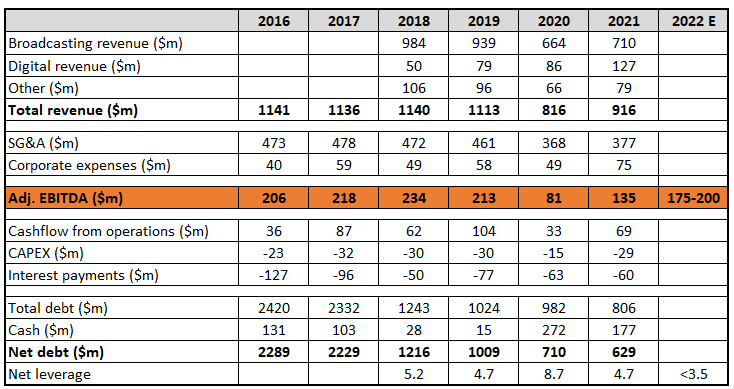

High leverage has historically been the main issue for CMLS. Nearly half of the debt was eliminated during the 2017-2018 bankruptcy. Since mid-2018, the net debt was reduced by another 50%. Interest payments on debt have consumed most of the cash from operations over the last few years, however, with the reduced leverage (the company guided for <3.5x net leverage in 2022), it seems that this year CMLS will finally generate positive cash flow.

Historical performance:

Note: The company has guided for $175-$200m adj. EBITDA in 2022.

CMLS adj. EBITDA has a bit of seasonality due to exposure to political advertising (generates around $5m in non-election years and $20m in election years). The upcoming elections in 2022 suggest the opportunistic timing of Jeff’s offer.

Major shareholders:

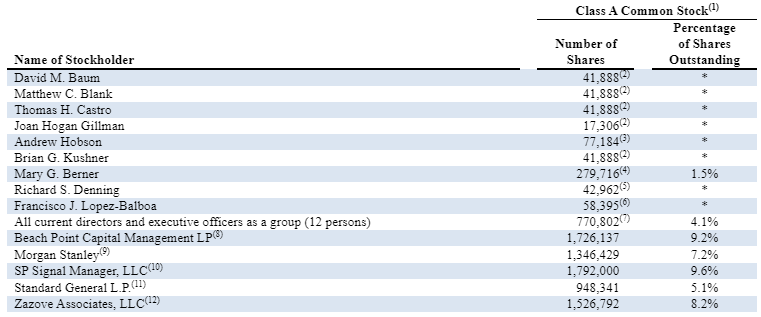

Management owns only 4.1%. As I understand, most of the previous debtholders who received the stock in 2018 are already out (except SP Signal). Other major shareholders seem to be sitting on decent gains here – Breach Point Capital filed the first 13G in Feb’22 at $10.50/share, Zazove Associates in Jan’21 at $9/share+, Standard General – Aug’21 at around $12/share. After the recent share price jump, they might be incentivized to push management to start the sale process.

Management rejects offer, says remaining independent will produce more value. Cites strong recent results, and initiates $50m buyback (vs $272m mkt cap) with a “plan to commence … in the near future”. And says this buyback is “a first step” to a “meaningful return of capital”.

https://finance.yahoo.com/news/cumulus-media-sends-letter-shareholders-120200894.html

Time to close idea?

Tender offer at $14.50-16.50 for $25m (out of the $50m buyback announced yesterday, and about 8% of mkt cap), with odd lot, ends June 3 end of day.

https://finance.yahoo.com/news/cumulus-media-announces-modified-dutch-110000912.html

Yesterday’s price action after the news of offer rejection, was wild as expected. Opened high, with one outlier high trade at 14.82, quickly dropped to 12.70 in minutes, then steadily rose to end the day at 14.24. Premarket now with the tender news, up $1+ to $15.40 (near midpoint of tender range).

I think it’s a great development overall and I’m still holding my shares. Q1 results were very strong – revenue up +15% YoY, digital +18% YoY. adj. EBITDA increased +250% YoY. Current adj. EBITDA stands at $157m on TTM basis and the company has reiterated a 2022 guidance for $175-$200m. Capex is expected at $30m, so the company generates lots of FCF now.

CEO has provided many comments saying CMLS is undervalued and I think the second batch of the repurchase program will not take long to materialize after the expiration of this tender. Wouldn’t be surprised if the current tender ended up at the high price range as well:

No response has been made from Jeff Warshaw yet, but given the strong Q1 there is a chance that the consortium will return with an improved bid.

Im holding Spanish Broadcasting myself. I think Iheart CEO made case well that Radio ads are actually quite cheap vs Cable ads, and this could start evening out in the near future:

“Bob Pittman

…

When you talk about TV, the biggest TV network is NBC, reaches about 50% of Americans every month, slightly more than half of what we do. The biggest cable network, which I think right now is USA Network, I think, reaches 28% is the number. The next largest broadcast radio company is Odyssey, I think they reached 36% of Americans. So when you reach 91% of Americans and that’s our — with our broadcast radio, you just say, what on earth would — why wouldn’t you use that? What’s derailing?

If you look at every medium that’s had a decline, whether it’s newspapers or TV, et cetera, it’s because their usage dropped off and advertising followed. And I think when you look at the second trend, which is every advertiser today is looking for new efficiencies. And when you look at efficiency, the beneficiaries should be the people who have the lowest price for the same impact. And radio and TV have historically, and I think same true today, delivered about the same impact at the same weight level, in terms of sales for advertisers.

And yet, today TV is 4x the price. So to get the same thing you’re going to spend 4x as much for TV. As we begin to develop unified buying systems where advertising agencies can now plan all media together instead of in silos, we’re going to benefit from that. And I think as you see pressure on advertisers to get more efficient and to find efficiencies and costs, we’re going to benefit from that.

So I think radio is in a pretty good spot. And it’s sort of hard for me to think of the reasons why it wouldn’t continue to grow. Easier for me to think about all the reasons why it is continuing to grow and why there’s real help in that growth number for Multiplatform Group.”

From March call this year.

CMLS is now trading ~10% below the bottom of the tender range ($13.28 v $14.50).

Could be a good 99 share buy, though at $13.28 the stock is ~14% below its 5/5 close price which is a possible termination event (company can terminate the offer if the stock or general market falls more than 10% from its 5/5 level).

Any thoughts on the likelihood of the company terminating / amending the tender offer?

It’s rare though I do remember getting burned by MGM a couple years ago…

The whole set-up for this tender is quite interesting – the recently rejected takeover offer makes it quite difficult for the management to cancel the tender or lower the tender price without losing face (even if lowering the tender price would actually be very beneficial for those no intending to tender). So my view is that the tender proceeds at current terms. The tender size is only 8%. So probably will be over-subscribed, but participating with an odd-lot position should work out.

MGM was ~7-9% of shares outstanding as well and came simultaneously with a big cash infusion from selling portions of the Vegas properties.

Given market volatility I held off from buying but have been monitoring closely. I believe since the price dropped below $13.84, they can cancel the tender at any time so I didn’t think this was a “sure thing” by any means. Does anyone else have any other thoughts?

Any thoughts on why CMLS dropped so much recently, particularly on Friday, which was an up day for general market?

A reminder that CMLS has a tender with odd lot 14.50-16.50 expiring on Friday after close (midnight June 3).

Plenty of people shied away from this one because the company had the option to cancel the tender (due to market price reducing >10%). However, the company hasn’t canceled the tender (yet). Given the passage of time, I think it’s a fair assumption that this tender will proceed as planned and isn’t going to be canceled.

Last traded price is $11.86, leaving a >$260 / 22% return (assuming tender goes at the bottom of the range). Tender terms include Notice of Guaranteed Delivery, so it’s not too late to buy 99 shares and tender them.

https://www.sec.gov/Archives/edgar/data/1058623/000119312522143656/d356398dsctoi.htm

Thanks Kiwi. It looks like Guaranteed Delivery just a mechanism to make sure those who buy close to the expiration date have time (2 business days after expiration) for shares to settle before delivering them, am I thinking about that correctly?

yes Brett, with guaranteed delivery you can still on the last day before expiration and tender. Your broker might have a different deadline. With IB it is usually noon of the expiration day.

Thanks again for the reminder on this Kiwi!

Didn’t MGM cancel theirs on the day of expiry?

Yep. But in fairness it was March 2020 and they are a resort company that was looking down the barrel of a massive amount of room night cancellations at the time.

As I posted earlier, PCHM canceled tender on expiry date after trading hours. Reported in Marketwatch (may 31, 5:02pm), yahoo finance does not show the news. Reason was financing not obtained, which I guess company should have known earlier.

PCHM was conditioned on financing. CMLS is not. Cancelling a Dutch-tender on a 10% market (though always a condition in all these offers) w/no financing contingency is rare, but possible, at the discretion of the board. It’s not cheap to launch a tender…Investment banking fees etc., if pulled, conditions are normally extreme (i.e. MGM).

Tender has gone ahead and cleared at the bottom of the range – $14.50 – https://www.bloomberg.com/press-releases/2022-06-06/cumulus-media-announces-preliminary-results-of-tender-offer

10% market decline condition waived as expected.

https://www.sec.gov/Archives/edgar/data/1058623/000105862322000101/cmlsscheduleto-preliminary.htm

I am really quite surprised by the results of this tender, by my calculations only c. 450k odd lot shares were tendered, which is equivalent to 4500 odd lot accounts. Keeping in mind the large spread size right till expiration and the background of the whole offer (with management rejecting the buyout at higher prices), i expected the number of odd-lot accounts to be much higher.

Risk of tender cancellation – the apparent reason. Many did not have your good judgment, DT!

4500 odd lots is low: what’s the normal range? I think there’s a list of # of odd lots for past deals, posted here years ago.

Some observations:

10% down condition: while CMLS price was way below 10% down, none of the market indices (except nasdaq briefly) got close to 10%. Maybe a factor.

After the tender news, stock up briefly to 15.50, the middle of the range, before sliding down, way down. Seems to imply that some big players were in only for the merger and had no belief in management’s capital return program/other value creation.

After expiration, price down from near $12 to $11 briefly, back up to nearer $12 again. No bigger drop occurred – 8% tender is not a big enough factor.

my numbers for odd-lot account calculation was off and seems like the company has actually not differentiated odd-lots in the preliminary proration factor calculation. Final results of the tender should be announced shortly.

Final results are out, and proration factor went from 30.94% to 16.68%. Very significant change obviously, and with these kind of numbers also a real risk that companies will cancel or adjust tender offers with odd lot clause. Big holders that tendered can’t be happy.

Wish I would have bought more than 99…

Captain Hindsight always helps:

https://www.youtube.com/watch?v=gdbjw27QPJQ

Yes, best on hindsight is buy many many shares close to the expiration, tender, and get 31% proration to earn 22%, and sell returned shares at only a 3% loss. Two favorable factors: (1) even though, stock was trading 20%+ below the minimum tender price, only 1/3 of total shares tendered (what were the rest thinking??), resulting in a better proration. (2) price after expiration is down only minimally.

I’m also surprised by the fact that two-thirds chose not to tender. I’m wondering if this is a signal that these holders expect another offer or see significant additional equity value in this (very) leveraged capital structure. Given that radio advertising is quite cyclical, it’s interesting that this stock appears closely held.

“these holders expect another offer … ” == if they’re bullish on the stock, they still could have tendered and buy back at $12 now. (Unless really big holders afraid they have to buy back at much higher prices due to not enough liquidity?)

I didn’t expect 100% to tender, since in every tender, somehow there are always holders who don’t no matter what. But I’d expect >2/3 to tender, not 1/3.

And the stock price is down very little after the tender.

Thanks, AV. DT, you’re right, the preliminary proration ignores odd lots despite the press release stating otherwise. Seems odd lots are close to 1 million shares. If this is correct, I wonder how it compares with past tenders.

Captain Hindsight is no longer smiling; my numbers above are now way off. With the proration halved, buying >99 shares just before expiration ekes out only a minimal gain if the $12 price continues to hold.

If my numbers are correct, only 24% of non-odd lot players tendered, which is even more strange!

The initial merger arbitrage thesis has failed. The subsequent bet on the upper limit pricing of the tender offer did not workout either so, unfortunately, we are closing this idea with a 46% loss in 7 months. Other than that, the company seems quite interesting at these levels, trading at 4-4.5x the reiterated adj. EBITDA guidance for 2022. Aside from the rejected buyout, management’s track record seems solid. The debt issue is getting sorted out. And CMLS still trades at 1-3x turns discount to more levered peers. Significant buyback is still in the cards and shouldn’t take a long time to materialize if the company continues to trade at these levels.

Thanks for sharing this idea Jarred. Would love to hear your thoughts on the current situation.