Regional Health Properties (RHE-PA) – Preferred Stock Exchange – 100%+ Upside

Current Price: $4.3

Redemption Price: $10.0 (incremental increases through 2025)

Upside: 100%+

Expiration Date: 2025

This idea was shared by Brett.

Summary

- Before digging deeper, keep in mind that the situation relates to the company with capitalization of only $5m for common shares and under $10m for preferred shares.

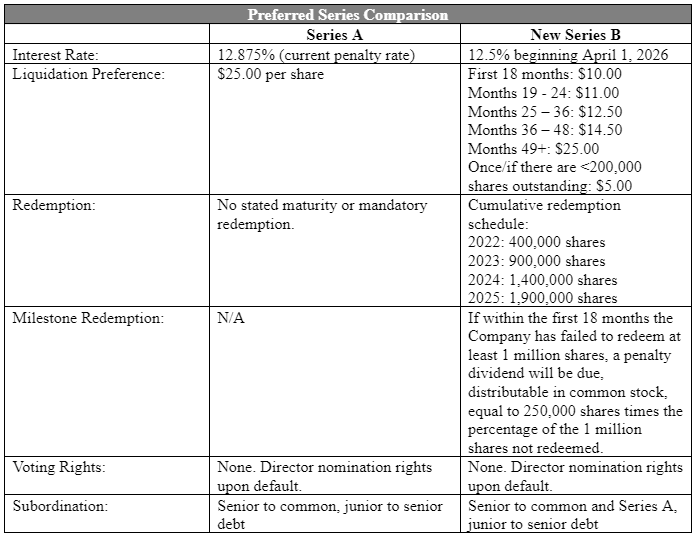

- Regional Health Properties (RHE) is offering to exchange its current Series A preferred shares for new Series B preferred shares and amend the Series A charter. This will lower the current liquidation preference (and accrued interest) on the Series A from approximately $38/share to $10/share for the new Series B.

- The Company has put forth a redemption schedule to redeem approximately 2/3rds of the Series B shares by 2025.

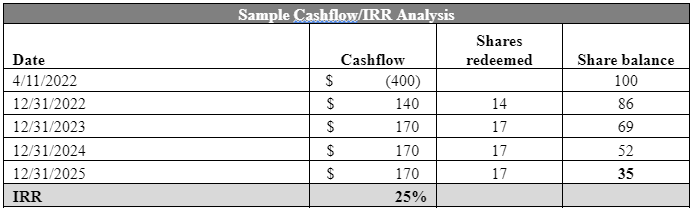

- At today’s price of $4.00 the redemption schedule (if abided by) should conservatively yield a 25%+ IRR and leave a stub of remaining shares (approximately 1/3rd) that could be sold or used to create a future income stream.

- If the exchange offer and charter amendments are approved, RHE will be able to buy back the new B shares on the open market, which should increase price and liquidity and may provide for a quicker, more accretive exit.

- The exchange and charter amendments will require approval by 2/3rds of Series A shareholders and a majority of common shareholders. The initial vote on March 28 was adjourned to May 4 to gather more votes. Upon communication with the Company’s management, the required number of preferred votes have been received and they are working to get the necessary common votes.

- This may also provide an interesting play on the common, as it will reduce the massive overhang of the current preferred, and such a reduced amount should accrue to the common, providing multi-bagger potential.

Overview

This is an idea about an exchange offer in which Regional Health Properties is offering to exchange, on a one-for-one basis, shares of its Series A Preferred Stock for newly issued shares of Series B Preferred Stock. The exchange will effectively relieve the Company of its obligations under the Series A shares and create new, less stringent obligations under the Series B shares. The offer is contingent upon the approval of 2/3rds of Series A shareholders and a majority of Common shareholders.

As a background on this offer, the Company originally put forth an exchange offer in June 2021 that offered to exchange one share of Series A for half a share of common. After the offer came out, the largest Series A shareholder, Charles Frischer, expressed his dissatisfaction with the offer and requested a special meeting to nominate two board members on behalf of the Series A shareholders, per their rights. At that point the board began meeting and negotiating with Frischer and other larger Series A shareholders to go through the necessary steps to get to the current offer. It is encouraging that the Company more or less pre-negotiated this deal with the larger preferred shareholders, and, per management, have received the necessary votes from preferred shareholders to enact the exchange.

To start, RHE has been delinquent on its dividend obligations for its Series A Preferred Stock since Q4 2017 and has since accumulated an accrued dividend balance of $13 per share. When combined with the liquidation preference of $25 per share, Series A obligations represent nearly $110 million, for a company with a $10 million book value. This has created a burden that has hampered the Company’s liquidity for operations and growth and put common shareholders under water.

As such, the Company is currently offering to exchange its Series A preferred shares that carry an effective payout obligation of $38 per share for newly created Series B shares that would carry a liquidation preference of $10.00 per share that would gradually increase over the next four years to $25.00 per share. Additionally, the dividend obligations for the Series B would not begin until April 1, 2026. As part of the deal, the Company has set forth a redemption schedule in which they would redeem approximately 2/3rds for the Series B shares (on a pro rata basis) by 2025 and include a penalty dividend payable in common shares after 18 months if they are falling behind on the redemption schedule.

Note: the table above conservatively assumes $10/share value for all repurchases, whereas repurchases in 2024 and 2025 are actually expected to be done at higher liquidation preference prices.

A simple cash flow analysis, based on the redemption schedule, yields over a 25% IRR on today’s price and leaves the owner with a stub of approximately 1/3rd of their original shares that will produce an extraordinary yield (>75%) on today’s pricing when they begin paying dividends and could be sold upon the expiration of the redemption schedule or kept as an income stream.

Possibly the most important item to note in all of this is that if the vote/exchange passes, RHE will then be able to buy shares of the new Series B in the open market, which they have not been able to do with the Series A since it went delinquent. This should provide an immediate boost to liquidity and price, as it should provide RHE the opportunity to purchase shares at a discount to the new liquidation value which they would be behooved to take advantage of in a big way.

Company Overview and Valuation

RHE is a real estate investment company that owns, leases and manages 24 facilities purposed for long-term care and senior living. The Company owns 12 properties and leases 9 properties which they then lease to third party operators. Additionally, they self-operate one property and act as the manager of three facilities. The Company leases (or subleases) its properties to third-party operators of the facilities on a triple-net basis. Because of the NNN lease set up, RHE produces significant positive cash flow consistently, which is important for fulfilling its Series B redemption obligations.

One encouraging factor is that less than 20% of the Company’s senior debt is due to mature this decade, with the majority of that in 2026 and 2027, and the rest matures well past 2030. This eliminates some near-term liquidity/refinancing risk and should allow them to focus on using cash to redeem the Series B shares, per their obligations.

In terms of valuation, and more importantly, liquidation value, I think the easiest and most conservative thing to do is to throw out management fee and other revenue and simply look at the triple-net rental income of owned properties to see what they might be worth in a sale scenario. With owned property NNN income of $8 million (which will have rent escalations going forward), a liquidation of the properties would need to be inside of a 10% cap rate to be in the money at today’s $4.00 price (this assumes approximately $64mm of senior debt and other liabilities and 5% liquidation costs). Based on conversations with healthcare real estate insiders I believe a market cap rate for these properties today would be between 7% and 8%, implying a ~$100 million value and approximately $13 per preferred share of equity value, which provides considerable downside protection.

Additionally, the Company consistently generates positive free cash flow, which, when combined with their existing cash balance of $6.8 million, provides some comfort that the Company should be able to follow through on the redemption schedule.

Potential Common Play

As of today, RHE’s common shares are significantly under water from a market value standpoint, although you wouldn’t know that by looking at the price over the last year as it had some wild upward fluctuations in 2021 (along with however many other worthless stocks).

However, should the exchange go through, the Company’s capitalization would be dramatically improved and would accrue much of the current balance of the preferred stock to the common, creating the potential for a significant price increase from today’s ~$3.50 per share price.

At current, the Company has a balance of approximately $53 million in senior secured debt and $108 million in preferred obligations, representing ~$90 per common share in obligations senior to the common. At a market value of ~$100 million or ~$60 per common share, the common realistically has no value at the moment. Upon this exchange, the preferred obligations would be reduced immediately to $28 million and the obligations senior to the common would reset to ~$45 per share, leaving about ~$15 per share in equity value for the common, or potentially 4x upside from current pricing.

I think this could be the most compelling play in this whole situation, however, if the exchange doesn’t go through we’re still talking about common stock with no value and a company potentially headed for a reorganization in which that lack of value would be realized, so I am holding off until there is more certainty around the outcome of the exchange deal.

RHE insiders own 12.8% of the common shares. Common shareholder approval shouldn’t be an issue, as suggested by Frischer: “I believe that the common shareholders will vote in favor given that this appears to be a very fair and potentially very profitable transaction for common holders.”

Conclusion

It seems clear that the Company is aware of how obstructive this Series A will continue to be to common shareholders until it is dealt with, and that they are actively seeking ways to improve their capitalization. They mention in the prospectus that they will exhaust other alternatives to restructure their capitalization if the exchange is not approved, including liquidating well-performing assets or even chapter 11. Bottom line is that this situation provides some interesting plays in which one potentially good opportunity may parlay into an even better one.

Hey, Brett, thanks for a great write-up. Just posting a few questions/thoughts below.

– Is it not concerning that management apparently did not have enough common share votes by the initial shareholder meeting date and had to adjourn it? It kind of seems that this exchange should be a no-brainer for the common shareholders.

– The play on preferreds is a rather long-term bet on management keeping their word/following the repurchase plan and not screwing the pref holders sometime later. The way they basically tried to scam pref holders in 2021 with the previous exchange offer is not very inspiring. Management owns like 12.8% of common stock, but its worth like $0.75m only at the current prices. Kind of insignificant compared to CEO/CFO’s combined salary of over $1m in 2021. So it seems that they are mostly incentivized in just keeping their jobs and pushing this pref exchange deal in order to avoid chapter 11/open the window for RHE to raise cash. Can we really expect them to perform and create value afterward (maybe you could shed a bit more light on their track record)?

– Aside from this long-term bet, the start of redemptions seems like a major catalyst here. Once the market starts believing that management will follow the redemptions plan, the discount to par should narrow down. Or am I missing something?

– Their liquidity position is tight and the company hardly generates cash after the interest payments. So basically they will have to raise a lot of cash even just for the pref buybacks ($22m until 2026). Is there a risk of a large common share dilution incoming?

Thanks Ilja. I’ll try to answer these in order here.

1. It is, however the real reason behind it is that quite a few shares have traded hands since the record date so tracking down the folks that don’t own shares now and asking them to vote has been a bit of a pain. They chose not to move the record date though at the adjournment as they were confident that they could get the votes needed and did not want to start over calling people with a new record date. Who knows though, maybe they end up having to move it. I’m not worried about them ultimately getting the common votes needed, this was just a bit of a timing issue (and lack of shareholder knowledge).

2. Yes that is the main risk here. I think the way the deal was structured was smart and has good incentives for both sides (increasing liquidation preference back to $25 and goes to $5 once 200k ‘B’ shares remaining) and that it is in common shareholders’ best interest to get this completed if they have the resources (fiduciary duty). I am hopeful that they would not want to throw the common right back under the bus in 4 years after they’ve negotiated a pretty darn good deal for themselves that should be manageable. Also, because it is manageable, I think it reduces the chance of them falling way behind and just saying “screw it” and throwing in the towel.

In terms of long term value creation for the common (outside of this event), that is a little tougher. I haven’t been all that impressed with their ability to execute in the past, although I guess they have been hampered by this preferred for a long time. I don’t think I’d want to make a play on long term value creation for the common, I’m more so just interested in a potentially good event driven outcome here because it will certainly be worth more than it is today if this exchange goes through.

3. Yes I think redemptions beginning shortly is a catalyst, but I think the most important thing here is that they will be allowed to buy shares in the open market again, and are incentivized to do so at basically any price below the new liquidation preference. So I would suspect they’ll add immediate liquidity to the market.

4. That is definitely a risk to the common although I don’t know when. I suspect they can generate maybe $10-$12 million of free cash over the next four years so they will need to come up with $10+ million to completely the redemption schedule. Given that their secured debt is reasonably low leverage against the value of the assets maybe they can come up with the cash through increasing the debt on some assets but dilution is a possibility, and maybe even near term. Although they haven’t mentioned anything about it.

“Regional Health Properties, Inc has offered to exchange any and all of its outstanding 10.875% Series A Cumulative Redeemable Preferred Shares for new shares.”

Do we submit shares for stock or take no action?

You will need to tender them for exchange before the next meeting (or your broker’s deadline before the meeting). Any shares that don’t get tendered will not be converted and will become subordinate to the new series and have their liquidation preference reset to $5 and all of the accrued dividends stripped. They’ll also have no right to dividends going forward. Definitely make sure to tender.

thanks brett

At what price do you think the Series B preferred shares will trade at?

Hard to say, especially immediately after the exchange. In theory you have a natural buyer at anything under $10. I doubt they will flood the market immediately but I would expect the price to move that direction over time. I wouldn’t be surprised to see a decent pop though if the exchange goes through.

I’d like to see it get to $8 or $9 before selling so I’ll take my time to see if it can get there.

Spoke to management today. I can confirm that their goal is to buy as many ‘B’ shares back on the open market under $10 as possible. They also said that they are confident they will get the common votes needed and have 180 days after the first record date to close the exchange before having to reset it, so if they need to adjourn again they will, even if it has to be a couple more times.

They basically said they’ve worked too hard and too long (a few years) to get this deal done with the preferreds to let the easiest part (the common vote) stop it from happening. The CEO is personally calling people every day along with the proxy solicitor and he said they will be relentless until they get it done. They also said that the proxy solicitor (Morrow Sodali) told them that although this is a tough one it’s nowhere near the toughest deal they’ve had to get done so they’re not worried.

I may start dabbling in the common as we get closer to May 2. I’m hoping it keeps going down.

Brett, do you still have a position in RHE? With RHEPB trading below $3 today, it doesn’t seem management is repurchasing in the open market yet. Curious if you had any recent discussions with management around their strategy for purchasing/redeeming the B series. Thanks.

Meeting reconvened to May 31, not enough votes, tender deadline extended also. Did not disclose # of positive votes so far. 2.275m sh of preferred tendered so far, what’s the total shares?

https://finance.yahoo.com/news/regional-health-properties-inc-announces-120000408.html

The total amount of preferred shares is 2.8m. So they have enough of them tendered (but also had enough during the last adjournment as well), yet for some reason, the press release said the current adjournment was made to “allow additional time for the holders of Series A Preferred Stock to tender their shares of Series A Preferred Stock in the Exchange Offer”.

Quite a puzzling situation. Kind of doesn’t really make sense that common shareholders would be blocking it. What is the management waiting for then?

The common shareholder base is super fragmented and the majority of shares have changed hands since the record date, so they are running into the problem of having to get people that don’t own the stock anymore to vote. I personally think they did a really poor job of telegraphing the potential value of the exchange to the common shareholders before announcing it and setting the record date. They just kind of threw a slide deck out there the day that the exchange was originally announced.

I think there is a chance that the record date will need to be reset, although management does seem confident in being able to get the needed common votes without have to reset the date and incur the expenses to do so.

I flat out asked management if it would make sense for me to buy a really large chunk of common to have a sizable vote with a new record date and they said they were confident that it wasn’t necessary because they didn’t think the record date would need to be changed.

I guess we will see though.

Meeting reconvened again! to July 25, 10am, not enough votes, tender deadline extended also. Try and try until you succeed! 2.308m sh of preferred tendered so far.

http://newsfile.refinitiv.com/getnewsfile/v1/story?guid=urn:newsml:reuters.com:20220601:nBw2wRpZya&default-theme=true

RHE up 50% today….RHE PRA nothing yet…..anybody know what is going on?

18 million shares traded today lol. 10x the total share count and a lot more than the daily average of like 10k. Very strange.

REH now doubled….up 100% for the day

Exchange offer terminated. One condition voted down.

https://finance.yahoo.com/news/regional-health-properties-inc-announces-212200322.html

Quite surprised that common shareholders did not approve the transaction – it seemed common shares had the most to gain from rebasing the preferreds to $10 vs the current $38.

What am I missing?

frustrating…..can only imaging as Brett has been saying they just can’t herd all the shareholders of record who have subsequently sold and don’t care, to vote.

Hopefully they can set a new record date and get this done