River & Mercantile Group (RIV.L) – Merger Arbitrage – 21% Upside

Current Price: £2.64

Offer Price: £3.20 (£2.20 will be returned shortly)

Upside: 21% (or +125% for the stub)

Expected Closing Date: Q2 2022

This idea was shared by Curtis.

This is an interesting merger arbitrage case UK asset management industry. Borrow for hedging is unavailable, however, the substantial upside might make this worthwhile playing even unhedged. The risks of buyers walking a-way seem low and the chance of losing money here looks limited. The stock is listed on the London AIM market.

UK-based asset manager River & Mercantile Group sold its UK fund administration and advisory business and now will return the proceeds to shareholders. The capital return will amount to £2.20/share, so the remaining asset management business currently trades at pro-forma £0.44/share. In January’22, the remaining stub has agreed to be acquired by peer AssetCo for 0.07392 AssetCo shares per RIV share – currently worth £0.99/share. The merger has a very low risk of falling apart and is expected to close in Q2’22. The £2.20/share capital return will be made shortly before the merger closes. So basically, at current prices, 83% of your investment gets covered by the capital return leaving a 125% potential upside on the stub price.

RIV’s shareholder approval for both the capital return and the merger has already been received. AssetCo shareholders vote will take place on the 13th of April, however, it’s basically guaranteed given the irrevocables from 52% of shareholders. Regulatory approvals (FCA) will not be an issue. The merger with AssetCo is also conditioned on a successful sale of RIV’s tiny US fund administration and advisory business, which is getting acquired by senior managers for £8.6m. This US business buyout has no financing risk and it should close soon without any hurdles. The capital return is conditioned only on FCA approval and from then the company expects it will take about a week for the cash to reach RIV shareholders.

The merger is orchestrated by a prominent UK fund manager Martin Gilbert, who controls AssetCo (the buyer) and is also a deputy chair at RIV (his affiliate is a CEO). Martin is best known for founding and growing Aberdeen Standard Investments from £70m AUM in 1983 to over £670bn in 2017 when it merged with Standard Life (Martin continued as a co-CEO and then Chair). He is also the chairman of Revolut (one of the largest fintechs in Europe valued at $33bn last July). Martin resigned from Standard Life Aberdeen in 2020 and in Jan’21 took control of AssetCo, which used to be a tiny fire engine selling business, as his “second act” – to transform it into another asset management giant. AssetCo wound up the legacy business, went on an acquisition spree, and during last year grew to £600m AUM + 30% ownership in Parmenion (fund investment/advisory platform, £9.3bn AUM), whereas the share price has tripled since Martin took the wheel. RIV will be AssetCo’s largest acquisition so far, will add £3.3bn AUM, and is expected to become the foundation of AssetCo’s active equities business.

A few days ago, on the 7th of April, RIV’s CEO (Martin’s affiliate) bought £0.5m shares at £2.65/share – clearly a positive sign.

A really pretty picture so far, however, AssetCo is an illiquid AIM-listed stock with tightly held shares (top 8 shareholders own 68%, mostly Martin and his affiliates/friends) and there is no borrow available for hedging, at least on IB. This will likely be a dealbreaker for most, however, I believe the situation is attractive enough to be played unhedged:

- AssetCo currently trades at £13.50/share. The breakeven price for RIV arbitrage play is around £5.50/share – the stock hasn’t traded anywhere close to this level since early 2021 when Martin took control.

- Last July, AssetCo raised £25m, 26% of its equity at the time at £14.50/share valuation, which gives a bit of support for the current pricing as well.

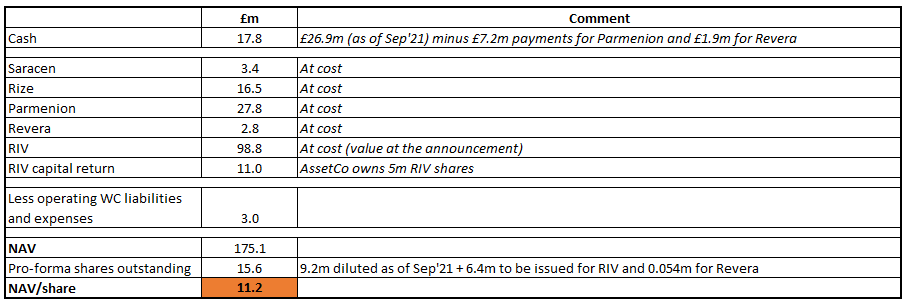

- Looking at AssetCo from a perspective of a holding company and valuing its boutique asset manager acquisitions (including the RIV stub) at cost, I arrive at £11.2/share valuation (see the table below). So AssetCo currently trades at a 20% premium to this cost-basis valuation estimate, which I guess, is reasonable for a quickly growing asset-manager-roll-up with superstar management.

So I think it’s virtually impossible that shares would fall anywhere close to £6/share and under this scenario going unhedged still seems like a rather safe bet. Even if AssetCo’s share price fell to £11.2/share – the consideration would still be over 2x of what the market is currently pricing the RIV stub at. As for low liquidity – it might present difficulties while exiting the trade, however, given the materially increased float and scale post-merger, the liquidity situation might improve materially. Moreover, as the scale increases, I don’t think it will take long before AssetCo gets uplisted from the AIM market.

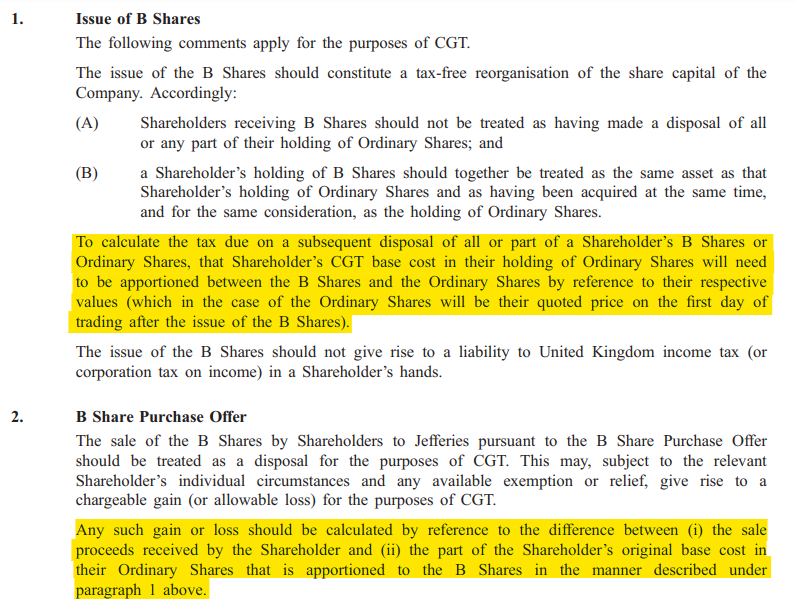

From my perspective, the main risk in this situation (and maybe the reason for the spread) is related to the taxation of the announced £2.20/share capital return. To avoid taxes on this shareholder distribtion RIV management has decided to return the cash in an unusual way – through preferred shares scheme. Basically, RIV will issue each shareholder pro-rata B series preferred stock. The broker (Jefferies) will then purchase each preferred share from shareholders for a total of £190m (the intended capital return amount, equals £2.20/share). RIV will pay the broker a dividend of a total of £190m and the B prefs will turn into another type of security that will get canceled. According to the Capital Return circular, doing it this way will ensure that shareholders won’t get taxed.

Admittedly, I am unable to judge if there are any risks with this type of capital return scheme and whether regulators can still put a stop to it (to me seems like tax avoidance, but I might not be understanding it fully). Given the experience of management here, I am tempted to think they know their stuff well. There is also a risk (an ‘unlikely scenario’ as per circular) that for some reason the broker Jefferies will decline to purchase the preferred shares in which case the company will have to pay the dividends straight to the shareholders.

In case 15% dividend tax is applied to the £2.20/share distribution, it would cut the capital return proceeds to £1.87/share, which would significantly reduce the potential upside. In this scenario, the AssetCo breakeven price for the RIV stub arbitrage would move to £10/share. This still looks fairly safe, and most, importantly the chance of this happening is very low – RIV constantly states that it is an ‘unlikely scenario’ and has entered into a Purchase Offer Deed agreement with Jefferies, which puts the broker under a legal obligation as well (p. 16 of the Capital Return circular). So, although I see this kind of scheme for the first time, it seems that the risk of it not working out is low.

AssetCo Background

Martin Gilbert resigned from the Standard Life Aberdeen in mid-2020. In late 2020 AssetCo has won its decade-long suit with a former auditor, which put £30m on its bank account. This attracted Martin to use AssetCo as its new vehicle. Reportedly AssetCo was recommended to him by his friend, manager of Harwood Capital, who held 46% stake in it at the time. In Jan’21 Martin acquired a 30% stake in AssetCo (partly from Harwood, which decreased the ownership to 26%) paying £4.75/share. He became chair two months later.

Subsequently, in Jan’21, AssetCo acquired a 2.9% stake in RIV (around £2/share price) and later raised it to 5.9%. Martin also joined RIV as a deputy chair. RIV quickly decided that the market is undervaluing the sum of its individual businesses and in Oct’21 announced divestment of its largest business – UK Solutions (fund administration and advisory) for £230m. After the sale was completed, Martin’s affiliate became CEO of RIV (used to be a senior manager at Aberdeen). In November’21, AssetCo expressed interest to acquire the remaining RIV stub (there was another interested party – small fund manager Premier Miton, which withdrew from the talks) and a definitive agreement was signed in Jan’22.

Apart from RIV, AssetCo also acquired:

- May’21 – Saracen Fund Managers for £3.44m (Edinburgh-based three funds with a total AUM of £113m). Due to its low scale, Saracen was/is slightly unprofitable – £15k net loss in 2020.

- Jul’21 – Rize (provider of thematic ETFs) for £16.5m. At the start of 2021 Rize had AUM of $100m, which increased to $514m as of Feb’22.

- Jul’21 – 30% stake in Parmenion Capital Partners (B2B fund investment and advisory platform) for £27.8m. The initial consideration paid was £20.6m + two deferred payments of £3.6m in Mar’22 and Mar’23. Parmenion was previously owned by Aberdeen. Aberdeen acquired it in 2016, when Martin was still CEO. At the time Parmenion had £1.9bn AUM, which increased to £8.1bn AUM as of Mar’21 and $9.3bn by Feb’22. So the company seems to be growing rather rapidly.

- After RIV’s merger announcement, in Feb’22 AssetCo also announced the acquisition of Revera (Edinburgh-based fund manager with £120m AUM). The merger is expected to close in May. Consideration stands at £2.8m: £1.9m in cash + 54.6k AssetCo shares. Revera generated £63k profit in 2020.

NAV table below looks at AssetCo post-RIV and Revera acquisitions and assumes all of the investment at cost basis – could be conservative as the main investments seem to be fast-growing businesses – Rize and Parmenion.

A couple further notes

- In Feb’22, RIV’s asset management business suffered a big client loss. The client accounted for £927m AUM (vs £4.4bn AUM at the time) and £2.8m annual revenues (vs £20.8m total revenues at the time). I think this is a negligible risk as AssetCo did not make any comments on this event and the sale has just been proceeding as usual. RIV is their biggest acquisition so far, so it makes sense they want to play it smoothly, plus the recent £0.5m share purchases from RIV’s CEO (Martin’s affiliate) give confidence in the successful completion as well. However, not clear if there’s a risk of any further big withdrawals that could threaten the merger.

- According to media, some critics are concerned that “the businesses Gilbert has assembled so far are disjointed, subscale and the synergies unclear”. Not sure how to address this, but it seems that the whole growth game has just started and material synergies will bloom further into the process when the scale increases.

Given the relative uncertainty with the capital return, does it make sense to wait for the return before initiating this trade? Obv the risk is the stub rerates beforehand but at this point can one believe they have a pretty good shot at buying the remainco at a decent level post cap return?

As expected, Assetco’s shareholder approval has been received. The spread remains at 21%.

Anyone have thoughts on buying RIV now for ~20% gain? Doesn’t seem like it’s worth it to me given ASTO’s weakness/illiquidity. Somehow I was able to locate/short a hefty 29 shares from the start….and IB’s binoculars have been searching for many more since.

Several updates:

– FCA clearance was received on the 19th of May.

– Cash distribution amounts to £2.2138/share and RIV shares are already trading ex-dividend.

– AssetCo’s (the buyer of the stub) shares declined by 30% over the last couple of weeks materially reducing merger consideration for the RIV stub. There was/is no borrow for hedging.

At current prices, RIV stub trades at 18% spread to AssetCo merger consideration – most likely due to no available hedging. Only customary conditions remain outstanding for the merger is set to close on the 14th of June.

AssetCo’s 30% share price fall over the last week without any related news seems concerning. The volumes are elevated as well. Given the risk of further AssetCo share price decline, playing this without hedging seems quite risky.

So we are removing this idea from active cases with a 7% gain in 1.5 months.

Curtis, thanks for sharing this idea and let us know if you have different views on the remaining stub arb.