Big River Gold (BRV.AX) – Merger Arbitrage – 9% Upside

Current Price: A$0.33

Offer Price: A$0.36

Upside: 9%

Expected Closing: 1st of August’22

A short note on a mining merger in Australia. The deal seems likely to close, but it might be prudent to wait until the 9th of June before more information is revealed in the Scheme Document (proxy).

Advanced stage gold exploration company Big River Gold is getting acquired by a consortium of its largest shareholder Dundee Resources (19.3%) and mid-tier gold/copper miner Aura Minerals. Dundee will roll over its stake and will own 20% of the combined company. Consideration stands at A$0.36/share in cash (A$92m in total). Given the size of the merger, regulatory risk is pretty much zero. As usual, approval from 75% of BRV shareholder votes cast will be required. Dundee Resource’s shares will not count towards this. However, the second-largest shareholder Copulos Group (18.8%) has agreed to support the deal. Apparently, given Dundee Resource’s comments (see below) Aura Minerals must’ve approached other large shareholders before making the offer. The other two major shareholders own 12.5%. So with around 31% of total outstanding shares in favor (42% disinterested), shareholder approval is likely. Shareholder meeting is scheduled for the 11th of July and the deal is expected to close on the 1st of August. Transaction will be financed from Aura Mineral’s cash on hand (US$193m). Given how cheaply the buyers are acquiring BRV (70% discount to NPV), the risk of deal termination seems low. The downside to the pre-announcement price is 18%.

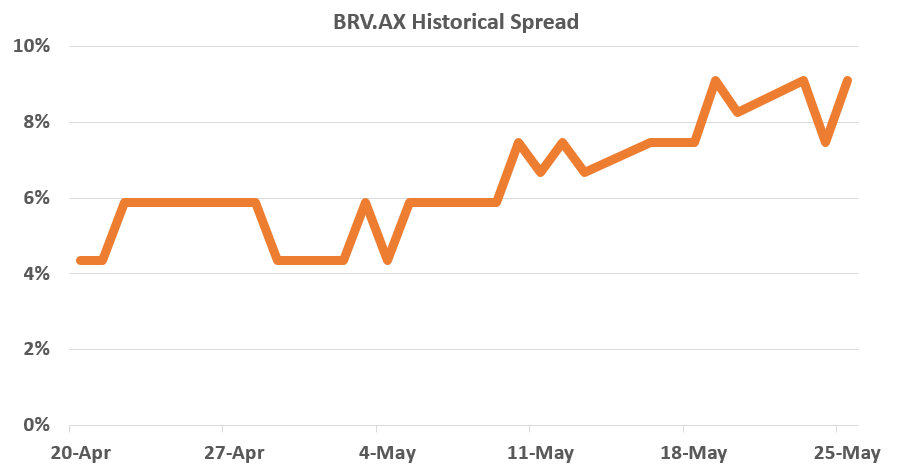

Since the announcement date (April 19), the spread used to stand at 4% indicating that the market saw limited risk in the transaction failure. The spread increased to the current levels only recently:

Part of this might be related to the overall market volatility, nano cap size and limited liquidity of the stock. However, there is also a chance that the market grows more cautious about the buyer’s intentions in the currently deteriorating market environment. There were 3 other conditions mentioned in the press release:

- No occurrence of material adverse effect or prescribed event;

- Big River unlisted option holders agreeing to the cancellation of their options; and

- Big River maintains a certain minimum cash balance.

Further details are currently limited and will be available on the 9th of June in the Scheme Document. I’m assuming the last two conditions are more of a formality and are not going to be an issue. However, as the markets are in free-fall now, material adverse effect conditions, if conditioned on the market volatility, could potentially free the buyer’s hands to terminate the deal. We’ll have a better view on this once more info becomes available.

So far this seems to be a kind of well-timed and opportunistic acquisition at a bargain price (70% discount to NPV), so there is a strong chance that general market movements will not sway the long-term attractiveness of BRV’s gold project.

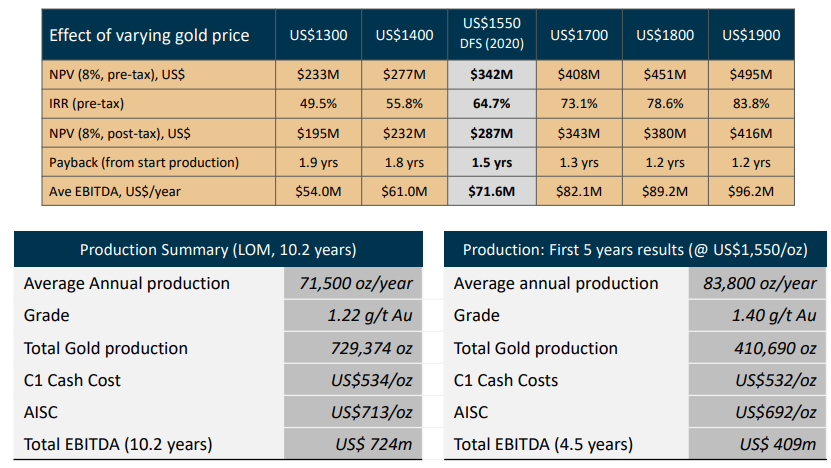

BRV is developing Borborema project in north-eastern Brazil. A definitive feasibility study was conducted in 2019 and updated in 2020. The mine is estimated to have a total of 2.43 Moz of gold. Here’s a summary of the feasibility study as of 2020:

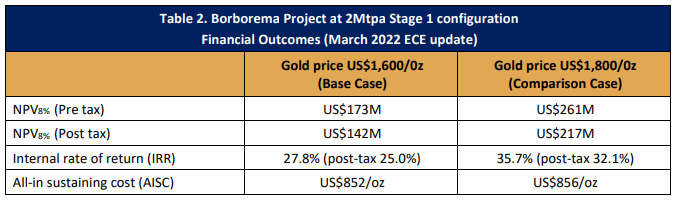

After the study, BRV management announced that they are going to produce only 730koz (less than third) of resources as a stage 1 with the potential to expand the mine. Investors were waiting for updates on the production timeline, however, despite a number of various funding options management started to stall the project. First, it went for an operational update in 2020, then announced the commencement of another operational update in mid-2021. When the results of an update came out in April’22, suddenly the project’s costs, and estimated CAPEX went up considerably, while the post-tax NPV of the stage 1 project dropped by nearly 50%. AISC increased from US$713/oz to US$856/oz, CAPEX nearly doubled from US$98m to US$170m+, while post-tax NPV (at 8% discount rate and US$1800 gold price) dropped from US$380m to US$217m (April’22 update):

Management blamed supply chain issues, the addition of previously unpriced capital items, upscaling capacity, etc., and instead of providing a clear timeline for finally starting the production, commenced another pre-feasibility study for project expansion.

So Aura Minerals and Dundee Resources’ play here is to take over the project from the hands of this clearly incompetent management team, re-run the numbers and start the production as fast as possible. A bit more details from Dundee Resource’s parent Dundee Corporation’s most recent conf. call:

I want to share with you some of the thinking or thought processes and the Big River Gold story and how that’s evolved. When we did our work on Big River, I think several years ago, the first thing we noted was that they had planned to mine about one-third of their 2.4 million ounce stated resource, which, obviously, we thought that was quite low, and we thought there was a potential opportunity to — at some point [Technical Difficulty] I apologize for the background noise, that Mr. [indiscernible] can delivered as non-impacted routine those [indiscernible]

So we recognize that there’s opportunity down the road, hopefully, to potentially expand this mine. But we did feel that originally looking at a 2 million tons of your operation, was a very conservative, compared to the size of the resource. We also thought that the capital cost that they use — that they’re estimated to build the mine was too low. That said, we did like the ore body and we wanted them, we made the investment, and we asked Adrian Goldstone, one of our very valued team members, to go on the Big River board. And our goal there was to Adrian to be able to introduce the company to some of the independent engineering groups that we’ve worked with over the years and that we had — we know where their A-teams are so that the company can go out and get more reliable estimates and eventually put out what we hope would be a better study.

On April 1st of this year, Big River put us a press release updating the cost of their feasibility study. And these are their numbers, of course, from their press release, but their projects that they stated had an internal rate of return of 29% at $1,700 gold and an NPV — an after-tax NPV of $217 million.

As we moved on over the course of time, we were approached by Aura Minerals, who is a company that has Brazilian assets. The senior management of the company are Brazilian and they thought the company would be a good fit. And we noted that with them that we really did like the project, and we were 20% shareholder, I guess, about 19 [indiscernible], where we own and that we would like to remain around the 20% level, but we were happy for them to buy the other 80% of the project.

We spent a lot of time with the management and also met with the Chair of Aura Board. And as we got to know them, we realized that they were an excellent company, and we thought they would make an excellent partner in the project. And we noted that not only do we feel that our interest would potentially align, we also felt that the shared set of value there. And so we are very much looking forward to partnering with Aura on this deal.

More importantly, as this mine gets built, and I think the first step we’re going to do once Aura buy this is work with Aura to redo a study to get numbers that we all buy into and hopefully then work with them to build a mine. And that will provide a very excellent stream of cash flows for Dundee Corporation. More importantly, we think that this model is replicable and we intend to pursue more deals like this. And as investors, we know that you need the research. Junior mining stocks tend to trade at somewhere between 10% and 30% of the ultimate NPV. And often, we all know that those NPVs turned out to be wrong. But our strategy is that if we can do our homework and really do the work, there are several ways to get NPV out of the project.

Aura Minerals is a proven mid-tier operator with 3 projects currently in production (one of them is also in Brazil). It is listed on TSX with a C$750m market cap. Dundee Corporation also has substantial experience in the sector. Obviously, given BRV management’s track record, there is a risk that the buyers will find unexpected problems after taking over the company. However, the buyers are taking over the project at 30% of the most recently updated NPV, which seems like a good margin of safety for them.

The deal is still on track, but the whole timeline has been moved (not explained why) – scheme booklet despatch is now expected on the 28th of July, shareholder meeting moved to the 29th of August and the merger is expected to close on the 13th of September.

https://www.investi.com.au/api/announcements/brv/65aeaf00-2b4.pdf

As the spread on BRV.AX acquisition has been almost eliminated, we are removing this idea from active cases. Albeit it took a bit longer tan initially expected, still a solid 9% gain in 3 months.