Genesis Metals (GIS.V) – Merger Arbitrage – 26% Upside

Current Price: C$0.145

Offer Price: C$0.18

Upside: 26%

Expected Closing Date: July 2022

*NOTE – the idea has already been closed as the spread narrowed down without any news or updates. Recently, it widened again and the idea has been returned to the active cases. Please refer to this comment below.

This is a merger between two Canadian exploration-stage gold mining companies.

Northern Superior Resources is acquiring Genesis Metals at an exchange ratio of 0.2304. The spread is quite large at 26%, which seems to be mostly a result of expensive hedging. The expected closing date is in July (likely early part of it) – so the timeline is quite short. Northern Superior Resources trades on TSXV (SUP.V), however, borrow for is available only for its OTC ticker NSUPF with 380k shortable shares on IB at 15.5% annual cost. The borrow fee has been stable since the merger announcement (27th April) and given the limited liquidity of the target any spikes in borrow demand for arbitrage play seem unlikely.

The transaction is conditional on approval from two-thirds of GIS common shares votes cast + two-thirds of votes cast from GIS common shares and GIS option holders + majority of votes cast by GIS minority shareholders. GIS management supports the merger with a combined 5.6% stake. Shareholder meeting should take place in June and more information will be included in the proxy (which will become available shortly before the meeting).

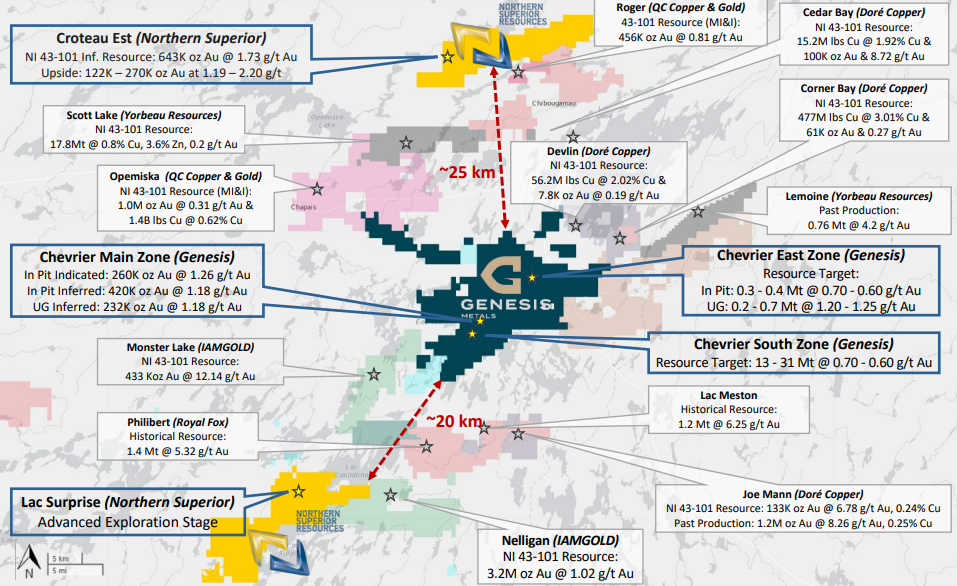

The merger makes sense based on the geographical proximity of the mining properties – the main projects of NSUPF and GIS are located just 25km away apart from each other and are all near key logistical infrastructure. Management expects significant operational synergies. With this acquisition, the buyer will diversify its portfolio by adding one slightly more advanced exploration asset (Chevrier) to its current Croteau project. It will also more than double the inferred resource base from the current 643koz to 1555koz combined. The combined company will become one of the largest junior miners in the region and will benefit from the increased scale, liquidity, and the ability to raise funds, which is especially important in the current market environment.

NSUPF owns Croteau Est and Lac Suprise. GIS owns Chevrier.

One thing that comes to attention is that NSUPF will more than double its resources by diluting its share count by only 17%. However, the first thing is that GIS’ Chevrier project has a substantially lower gold grade (1.2-1.3g/t) vs Croteau’s 1.62g/t. Another thing is that NSUPF has a significantly stronger cash position of C$12m vs GIS’ C$1.8m. If not for this merger, GIS would soon have to think about raising fresh funds. GIS management started a strategic review in Dec’21 and apparently were the first ones to approach NSUPF.

A few more positive points toward likely shareholder approval:

- GIS provides only the names of its largest shareholders, but not the exact ownership. You can find it here. The largest shareholder Delbrook Capital is a PE firm that acquired a large part of its stake in 2017 through financing at C$0.14/share. Assuming the ownership hasn’t changed, the firm owns 12% of diluted GIS shares. I don’t see why would they oppose the merger given the price premium and ownership transfer to a bigger gold miner.

- GIS is a part of Discovery Group – an alliance of exploration stage miners, with a goal to raise funds, advance the project to a certain point and sell it to a bigger peer. So far miners in this group have successfully completed two transactions since 2016.

- Approval from GIS option holders shouldn’t be an issue given that all options will be exchanged for NSUPF options at the same exchange rate.

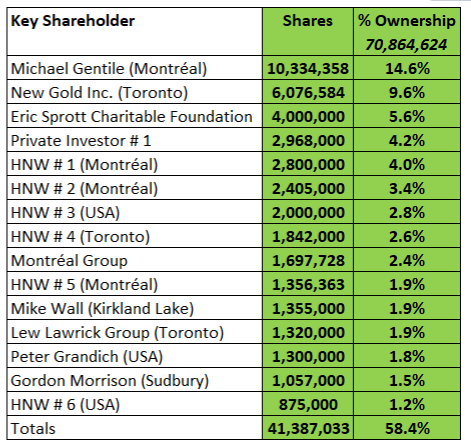

- Looking at NSUPF’s major shareholders (table below), it seems that the company has received more recognition from the industry. E.g. New Gold (C$1.2bn market cap) – owns 9.6% and Eric Sprott owns 5.6%. This is also a point in favor of GIS shareholder approval.

SUP.V down 20% this week. GIS.V has held in there…but spread now 4%.

Interesting volatility indeed. Yesterday’s volume was unusually high and no news was released. As the spread has narrowed down to only 4%, the idea is now closed with around 20% gain in 2 weeks. I guess there’s a good chance the spread will widen again sometime until the merger closes, so might be worth tracking.

As expected, the spread has widened again to 18%. Still no news or updates from either party. 408k shortable shares are available and the fee is still stable at 13%. We are bringing this back to active ideas at C$0.115/share. SUP.V price – C$0

59/share.

The meeting date is set for July 7. Proxy firms ISS and Glass Lewis recommend voting in favor. 18% spread remains.

https://sedar.com/GetFile.do?lang=EN&docClass=8&issuerNo=00030789&issuerType=03&projectNo=03404920&docId=5236329

Merger has been completed. GIS shares will be delisted from TSXV on or about July 15. Yesterday this still traded at 10%+ spread albeit liquidity was limited.

https://genesismetalscorp.com/news-media/news/index.php?content_id=247