Large-cap M&A basket

Given the recent widening of the arbitrage spreads we have reassessed all of the U.S. listed large-cap arbitrages with 10%+ spreads and selected 6 of those situations for our large-cap M&A basket.

Comments on all the names are provided below, including the ones not in the basket.

We do not have any specific edge in any of the below-listed situations and the market is most probably efficient in pricing the risks – there is plenty of much smarter money than us betting for or against these mergers. However, we think our basket approach might work for two reasons: (1) some spreads have widened recently amid an overall market sell-off without any news directly relating to the mergers, (2) our expectation is that on average these cases will work out, that’s why the basket approach. The intention is to wait for the spread to narrow by 5%-10% rather than for the successful closure of some of these transactions.

Keep in mind that SSI track record on large-cap merger arbitrage is very spotty, and usually we avoid these outright.

We are allocating 10% of SSI tracing portfolio for this M&A basket, split in the following way:

- 3% on ATVI ($76.92) – larger allocation due to BRK involvement;

- 2% on SAVE ($17.37) and TGNA ($21.26);

- 1% on FHN ($21.76), VG ($18.34) and TWTR ($46.9) – smaller allocations mostly due to large downsides in case M&A fails.

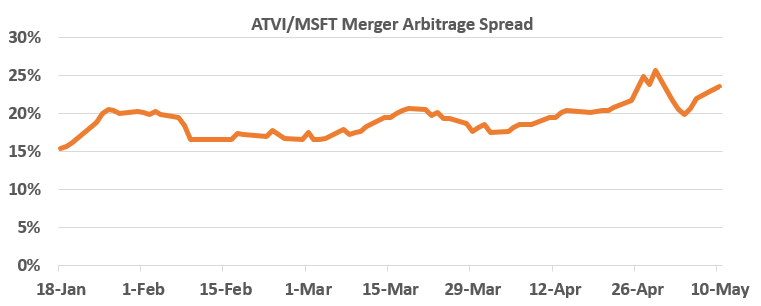

Activision Blizzard (ATVI) – 24% Spread

Video games developer ATVI is getting acquired by Microsoft at $95/share in cash. Shareholder approval has already been received. The main thing that got us interested is Warren Buffet’s participation. Berkshire has been increasing its stake in ATVI and now owns around 9.5%. Buffett doesn’t play merger arbitrage that often anymore and he is also very close friends with Bill Gates. So overall, Berkshire’s involvement here is quite reassuring.

- Expected closing: H1 2023.

- Reasons for the spread: Regulatory risk and the extended timeline. Antitrust clearance might be a problem. Apparently, some senators have even written a letter to FTC expressing concerns over the merger. This is the largest big tech acquisition of a game developer so far and the largest MSFT acquisition so far as well. Although MSFT’s footprint in the video game development industry is limited right now, ATVI deal will turn it into the world’s third-largest game developer. There are fears the merger will hurt the competition in the console gaming industry as Microsoft might start offering Activision Blizzard gaming franchises only to Xbox console owners – similarly to what it did after acquiring Bethesda in 2021 (here and here). Recent VIC write-up outlines the arb case well and argues that even if the merger with Microsoft breaks, Activision Blizzard might be worth more than the current offer price due to dominant video game franchises, lead in e-sports, and expected earnings ramp from delayed games. Maybe that was a part of what attracted Buffet to this play as well.

- Downside if the merger fails: pre-announcement price is at $65/share, but could be larger due to overall market decline since. Peers EA and TTWO declined 14% and 33% respectively since the ATVI deal announcement.

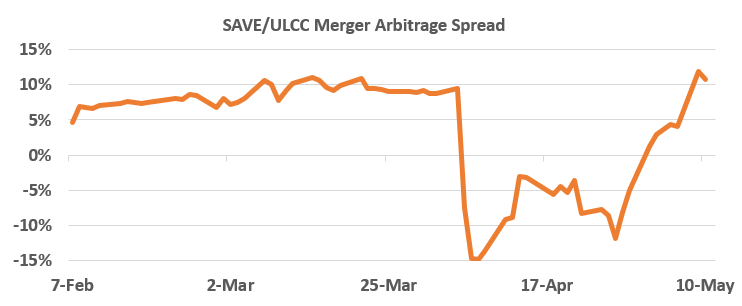

Spirit Airlines (SAVE) – 11% Spread

US low-cost carrier Spirit Airlines is getting acquired by its peer ULCC at 1.9126 in stock + $2.13 in cash (currently worth $19.3/share). Additionally, there are rumors that JBLU will come back to the acquisition of SAVE with an improved bid after its previous offer (at $33/share) was just rejected last week by SAVE’s board. The board said there was an “unacceptable level of risk” due to potential regulatory interference, despite JBLU operating in a slightly different segment, being ready to make substantial divestitures, and committing to a very large break fee of 11% current market cap. Given the optionality of JBLU’s return, the current spread to ULCC’s offer seems a bit overblown.

- Expected closing H2 2022, shareholder meeting is set for June.

- Reasons for the spread: transaction still needs to receive shareholder and regulatory approvals. Antitrust approval is the key issue here as both SAVE and ULCC are the two largest players in the ultra-low-cost carrier segment. Several senators wrote a letter to the Biden administration with concerns that the merger will further monopolize the ultra-low-cost segment instead of creating a new competitor to the “Big Four”.

- Downside if the merger fails: Assuming share prices revert to pre-announcement levels, the downside on hedged trade would be around 8%. SAVE and ULCC trade at 20% and 28% respectively below the pre-announcement prices whereas larger, higher-cost carriers like LUV, AAL, and DAL are in the range of -4%/+4% in the same period.

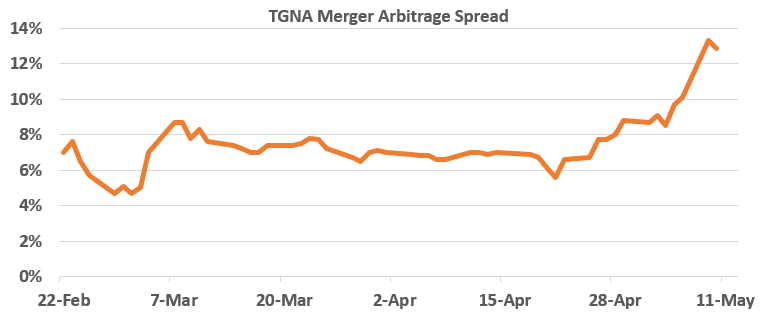

Tegna (TGNA) – 13% Spread

Broadcast media company Tegna is getting acquired by PE firm Standard General at $24/share in cash. There is a small ticking fee included as well – up to $0.125/share if the deal completion is extended. Standard General used to be TGNA’s major shareholder and had unsuccessfully tried to overhaul the board in the past. The buyer also has some competence in the broadcasting industry – in 2010 acquired post-bankruptcy Young Broadcasting, merged it with Media General in 2013, and sold the combined entity to Nextar in 2016 for $4.6bn (with profits of $300m). The spread has recently increased from 8% to 13% without any merger-related news.

- Expected closing: H2 2022, shareholder meeting is set for the 17th of May.

- Reason for the spread: Regulatory consent – antitrust and FCC approvals will be required (see concerns here and here). Apollo and Cox Media are also involved in the consortium (alongside the primary buyer – Standard General), but will only own non-voting shares. There are concerns that TGNA/Cox Media combined will control too much of the market share (39% of U.S. TV households). So there will likely be a prolonged regulatory review here, however, the competence of the buyers and the addition of a small ticking fee on top of the consideration amount indicates confidence in the ultimate success of the merger.

- Downside if the merger fails: The company has recently posted solid Q1 results and now trades at pre-announcement prices, however, most broadcasting peers are down 15-20% since the merger announcement.

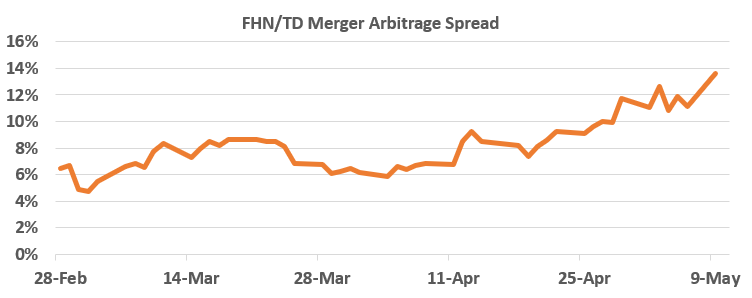

First Horizon Corporation (FHN) – 15% Upside

The largest Canadian bank TD Bank Group ($130bn market cap) is buying FHN at $25/share in cash. The deal is valuing FHN at 2.4x TBV, which doesn’t look cheap for a 10-13% ROE generating bank. Thus, shareholder approval shouldn’t be an issue. If the offer doesn’t close till the 27th of Nov’22, FHN shareholders will receive an additional $0.65/share per annum (pro-rata for delayed period).

- Expected closing: Q4 2022, the meeting is set for the 31st of May.

- Reasons for the spread: Regulatory consent, FINRA and antitrust. The merger will make TD’s US bank franchise the 6th largest US bank (US$600bn+ in assets). Analysts’ consensus seems to be that the transaction is likely to get approved under the current merger guideline standards. However, the merger is ongoing in parallel with the US government’s general bank merger guideline review and the outcome is difficult to forecast. Another currently ongoing large bank merge between U.S. Bancorp and MUFG is also facing higher than expected scrutiny and will likely have to adjourn the previously expected H1 2022 closing deadline.

- Downside if the merger fails: up to 40%, comprised of 20% to pre-announcement prices and another 20% due to banking peer stocks declining since the merger announcement.

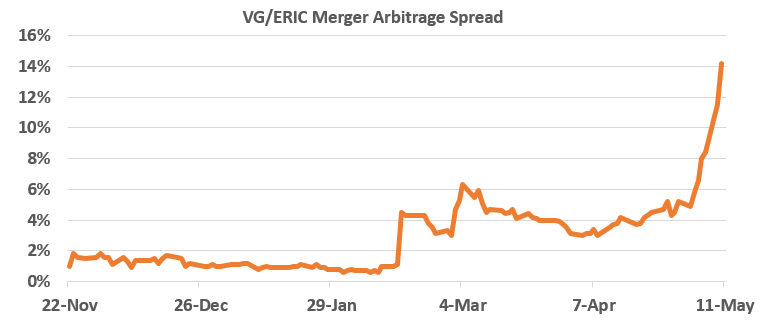

Vonage Holdings (VG) – 14% Upside

Cloud communications provider VG is getting acquired by Ericsson at $21/share in cash. Shareholder approval is in the pocket already.

- Expected closing: H1 2022.

- Reasons for the spread: the buyer is having problems with DoJ and is facing turmoil in management due to allegations of its secret dealing with ISIS (these allegations appeared after the merger announcement). The company might also be facing a material fine (the size is still unknown), which creates some uncertainty regarding the merger and the timeline – CFIUS review is getting delayed until the matters with the DoJ are settled. Other countries are starting to investigate this matter as well. However, ERIC’s CEO is still optimistic and reiterated the expected merger closing in H1 2022 (Q1 conference call). Till the recent general market sell-off (without any news related to the merger that I am aware of), the spread used to be around 5% only.

- Downside if the merger fails: 11% to pre-announcement levels, however, the merger was announced in mid-Nov’21, at NASDAQ’s peak, so the actual downside here could be materially larger.

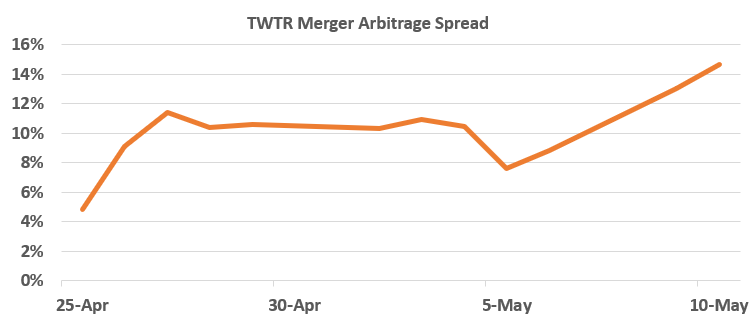

Twitter (TWTR) – 15% Upside

Twitter is getting acquired by Elon Musk at $54.2/share in cash. A nice summary of the situation can be found in YAVB post. No material news has been announced since then, except for Elon saying he will lift the Trump ban and Hindenburg Research publishing a short report on this arb. Musk is proceeding in securing the financing for the transaction with a number of prominent ventures and PE names already liked up to share Musk’s equity part. Regulators are not likely to block the acquisition.

- Expected closing: Not clear, but situations should get resolved in the coming months.

- Reasons for the spread: several risks including the possibility of Musk changing his mind and withdrawing/renegotiating the bid, especially keeping in mind further tech sell-off over the last couple of weeks as well as lackluster Twitter Q1’22 results. Hindenburg Research summarized bearish arguments well in their recent report.

- Downside if the offer fails: around 30%, could be hedged with options.

Other Large Cap M&A with 10%+ spreads

- Tenneco (TEN) – 29% Spread – OEM and aftermarket auto parts designer/manufacturer is getting acquired by Apollo for $20/share. Spread used to stand at 13% until recently. Reasons for not including in the basket: very large downside – 32% to pre-announcement but will likely be larger. Tenneco is extremely levered (mostly debt with variable interest rate) and has recently posted weak recent Q1 results. The merger was announced just before the Ukraine war and given the overall market/economy outlook changes since then, it’s difficult to argue that Apollo will want to pursue the transaction at that price/at all.

- Change Healthcare (CHNG) – 20% Spread – United Health is buying Change Healthcare at $27.75/share in cash. Reasons for not including in the basket: (1) in Feb’22, DoJ filed litigation to block the merger, (2) the timeline is uncertain, (3) with the increased scrutiny on healthcare mergers, there is a real risk this deal won’t go through.

- Shaw Communications (SJR) – 19% Spread – The merger of Canada’s biggest cable and telecom giants. Rogers Communications is buying SJR at C$40.5/share in cash. Reasons for not including in the basket: the spread has widened mostly due to the recent statement from the competition watchdog that the concessions made were insufficient and will seek to block the merger.

- MoneyGram International – 12% Spread – Global money transfer services provider MGI is getting acquired by a PE firm Madison Dearborn Partners at $11/share. Reasons for not including in the basket: (1) the spread has widened mostly due to NY Attorney General filing a lawsuit against MGI due to multiple violations and there were rumors that other states might be looking to start investigations as well, but MGI said they hadn’t been aware of that. The magnitude of the litigation is not clear and it is difficult to say how much the buyer had anticipated it before making the offer.

- Tower Semiconductor (TSEM) – 12% Spread – Israelian semiconductor manufacturer TSEM is getting acquired by Intel at $53/share in cash. Reasons for not including in the basket: (1) uncertainty regarding Israeli’s government approval, (2) withholding taxes – to avoid these foreign investors have to file a load of paperwork (personal info, etc.), which is a burden and might delay the consideration by a few months.

- PNM Resources (PNM) – 11% Spread – A merger between two energy utility companies, Avangrid will acquire PNM at $50.3/share in cash. Reasons for not including in the basket: (1) the merger has been ongoing for 1.5 years now, (2) in Dec’21 New Mexico regulators said they will oppose the acquisition and the companies filed a suit, but the recent updates say the court has no statutory deadline to act.

- Sanderson Farms (SAFM) – 8% Spread – SAFM is getting acquired by its peer Cargill and Continental Gran Company for $203/share in cash. Reasons for not including in the basket: (1) antitrust concerns due to reduced competition and increased pricing power concerns in the poultry processing market (2) DOJ’s second stage review has been continuing since Dec’21 with no new updates yet.

Thanks for these ideas! Do you have any opinion on Shell Midstream Partners (SHLX) that received an offer from Shell to buy it out at $12.89/share. I am uncertain of the likelihood that Shell may have to increase its bid price to get the deal done…wondering if you think the risk-reward is worth taking a position.

There is a good write-up on VIC regarding the SHLX situation, I do not have much to add to it. Reminds a bit of BKEP and CNR, but upside in base case is small, under 5-10%.

https://valueinvestorsclub.com/idea/SHELL_MIDSTREAM_PARTNERS_LP/0108938811

Hi, thanks for the ideas.

Any opinion on DOUG? In my research I see upside for a double, did you take a look into it?

Thanks for highlighting it. We had a look at DOUG 3 months ago and came to a conclusion that although it looks cheap on recent earnings, its too difficult to forecast what the normalized earnings will look like. 2021 adj. EBITDA was 10-20 times above pre-COVID levels -clearly that is not sustainable. If it falls back to 2018-2019 levels, the company is not cheap. However, we can’t say whether or how fast that is likely to happen.

Is there a good service out there that gives you a list of all the current merger arbitrage spreads?

Does the tracking portfolio leverage positions? What happens if at least 5% (or 10% in this case) of the portfolio isn’t cash when a new idea is posted?

We try to avoid leverage and usually have less than 20 portfolio ideas active at one time. But small deviations from this might happen. The table below shows levels of cash relative to total SSI tracking portfoflio value (cash + open positions) at each month-end.

As you can see most of the time tracking portfolio carries a large cash balance rather than leverage.

Hindenburg already made a ton of money on their short call and looks like they might be proven right eventually in that Elon will renegotiate the price.

An optimistic take on today’s TWTR situation from YAVB:

https://yetanothervalueblog.substack.com/p/quick-twtr-thoughts-and-the-tif-lvmh?s=r

Jet Blue returned to make another bid for Spirit Airlines (SAVE) – this time with hostile tender offer at $30/share. The tender is conditioned on acceptance from 50% of SAVE shareholders and shareholder rejection/overall termination of a merger deal with ULCC. The offer also outlined a path towards returning to a $33/share bid price if SAVE board engages with JBLU. SAVE shares jumped up +13% yesterday but still trade at a vast discount to JBLU’s offer.

Twitter’s board intends to enforce agreement with Musk.

https://edition.cnn.com/2022/05/17/tech/twitter-board-elon-musk-reliable-sources/index.html

Also an interesting article yesterday:

https://www.bloomberg.com/opinion/articles/2022-05-17/elon-musk-does-not-care-about-spam-bots

Beware of the media’s love affair with their new faviorite phrase “specifc performance”. The remdey itself is dubious on constitutional grounds given its highly coercive nature and the DE court is going to be leary of ordering against the Musk entities (Musk is not buying Twitter personally, he has two vehicles that court can sanction, but sanctioning Musk personally is very different) who can appeal and/or refuse to close and just pay damages, rather than establish once and for all the SP has no teeth against parties who refuse to abide by it. The fundamental flaw in the merger agreement is that only Twitter the corporation has the right to seek damages and proving damages directly to Twitter’s earnings or operations will be an uphill battle. Twitter’s sharheholders do not have any rights to damages, and that would have made it fare more costly. Even then, Musk could just file Ch 11 for those entities, it would be extreemely difficult to gain recourse here to his personal fortune. See recent WSJ op-ed for what a toothless tiger SP likely is in reality despite what the left wing media would like us to believe in the all powerful DE Court of Chancery.

What is the consensus for the price TWTR will trade to in the case of a total break? I have heard a few people say $25 but curious what everyone thinks is most likely case & worst case?

For background, I have a long position in TWTR…at least until the 5/25/2022 proxy vote, because it could be a near-term catalyst for the share price to jump, at minimum, a few dollars from where it sits today.

It seems that there could be a few different break scenarios…each of which would have a different share price point (here is the worst-to-best for TWTR shareholders):

1. $0 breakup fee;

2. With breakup fee (at least $1B);

3. Going to court;

4. TWTR agreeing to a haircut of the deal price (likely by no more than 15%).

I think there is so much downside baked in by the retail crowd (and professional PMs not wanting to put career risk on this) that there is a possibility that the share price could rise on at least some of the above scenarios, such as the latter three scenarios.

ISS considers SAVE/JBLU offer to be superior and put out a recommendation against SAVE/ULCC merger. I am guessing Spirit management will finally be forced to start talking to JetBlue.

https://www.bamsec.com/filing/119312522163573?cik=1498710

Old news but, Tegna’s shareholders approved the merger with Standard General. The transaction is still subject to regulatory approval. Closing is expected in the 2H’22.

https://deadline.com/2022/05/tegna-broadcaster-shareholders-sale-standard-general-apollo-cox-1235025877/

How confident are we in JBLU’s financing for the all-cash offer to buy SAVE? Hefty check.

As of Q1’22, JBLU had $2.9B of liquidity ($1.8B in cash and cash equivalents + $1.1B in investment securities) compared to $3.3B-$3.6B in transaction equity value + $0.35B reverse break-up fees. In investor presentation done on May 16th, JBLU confirmed secured financing “with commitments from Goldman Sachs and Bank of America”, so financing appears to be in place.

On June 15th, Senator Elizabeth Warren sent a letter to regulators (the OCC) asking to block FHN-TD merger, citing TD Bank consumer abuses. The acquisition still appears to be on track but the timeline may get extended. Spread stands at 16%.

“As TD Bank seeks approval from your agency to increase their market share and become the sixth-largest bank in the U.S., the OCC should closely examine any ongoing wrongdoing and block any merger until TD Bank is held responsible for its abusive practices.”

https://www.cnbc.com/2022/06/15/warren-asks-bank-regulator-to-reject-td-deal-after-customer-abuse-report.html

A new development ahead of the June 30th SAVE shareholder meeting. JBLU has raised its offer by $2 to $33.5 per share and reiterated guarantees on regulatory divestitures. Reverse break-up fees remain unchanged at $350m. Spread to the latest offer stands at 43%.

ULCC also bumps its offer for SAVE by $2, now valued at $24.29 as of Friday’s close.

New ULCC offer at 4.13 in cash (out of which $2.22 would be paid upfront upon approval) + 1.9126 ULCC shares. The termination fee has been increased by $100m to $350m.

https://www.reuters.com/markets/deals/frontier-raises-offer-buy-spirit-airlines-by-2-per-share-2022-06-24/

JBLU is trying to save the transaction at the last minute with another improvement in its offer after ISS sides with ULCC:

– Upfront payment increased to $2.5/share (from $1.5 before).

– Reverse termination fee increased to $400m (or $4.3/share).

– Monthly $0.1/share pre-payment tickling fee added, with $1.8/share max. Up to $1.15/share of these tickling fee prepayments will offset either termination fee or merger consideration. So in total $0.65/share on top + pre-payment benefit on the remaining $1.15.

– Total deal value now at $34.15/share assuming merger takes 18+ months to close.

https://finance.yahoo.com/news/jetblue-modifies-superior-offer-consultation-214100953.html

Shareholder meeting in two days and vote is said to be very close as passive index funds will simply follow ISS recommendation:

– If ULCC offer prevails, SAVE shares will trade down, my guess to something like $21/share as the spread will remain wide given regulatory concerns. Trading yesterday at $2.55/share with still chances of ULCC offer rejection, is indicative of potential downside here.

– If ULCC offer is vote down, SAVE will probably be at something like $27-$28.

Voting on ULCC merger now deferred to 8th of July. Seems like the company did not feel there is sufficient shareholder support for the ULCC merger and wanted to take an extra week to try push it through.

Also SAVE seems to be desperately trying to convince shareholders to vote for ULCC merger:

– started quoting Jim Cramer in its press releases: https://www.bamsec.com/filing/149871022000278?cik=1498710

– is publishing ULCC merger adds in New York Times: https://www.bamsec.com/filing/149871022000282?cik=1498710

Apparently, ULCC still lacks votes and is again postponing the shareholder vote to July 27th. Spread to JBLU offer remains very wide.

https://www.bamsec.com/filing/149871022000304?cik=1498710

https://www.washingtonpost.com/business/frontier-airlines-lacks-the-votes-for-spirit-merger/2022/07/11/075b1680-012b-11ed-8beb-2b4e481b1500_story.html

Ericsson has reiterated that it continues to work with CFIUS on regulatory approval – the last hurdle in the VG merger. Expected closing date has been moved from H1’22 to the end of July’22. Meanwhile, share price jumped 5% on the news. The spread stands at 13%.

https://www.prnewswire.com/news-releases/update-on-ericssons-proposed-acquisition-of-vonage-301576471.html

Elon has terminated the acquisition of Twitter. Spread now at 58%.

Matt Levine summarized really well on what can be expected next: https://www.bloomberg.com/opinion/articles/2022-07-09/elon-s-out

A long article, but well worth a read. Quick summary for the lazy ones:

Musk’s lawyers outlined 3 pretexts for why he wants out of the deal:

(a) TWTR has been lying about bots – unlikely to stick in court as Musk has no way to prove TWTR representations on bots (‘estimated under 5% DAUs’) are wrong. Additionally, the representation proven false wouldn’t be enough. It also needs to have a “material adverse effect” on the business.

(b) TWTR is not giving Musk enough info about the bot problem – unlikely to stick either, as TWTR has clearly done a lot to accommodate Musk’s information needs, but he continues to ask for unreasonable requests. Also the aim of information requests must be for the purpose related to the business combination and not to avoid the merger.

(c) TWTR violated ‘ordinary course of business’ covenant by firing two employees. Seems to be a minor thing that could have been easily avoided by TWTR over-communicating with Musk on small business decisions.

All pretexts in Musk’s termination letter seem “pretty laughable”. TWTR board plans to enforce the merger agreement and is confident in prevailing (if the case actually comes to court).

Two potential outcomes from the court:

(a) $1bn reverse termination fee – likely what Musk is aiming for.

(b) Order of “specific performance” forcing Musk to fund the entire $33.5bn equity commitments

For the court to order specific performance:

(a) Court has to want to do it – a big question as there is a risk of Musk not obeying the court’s order and in turn managing Delaware court’s reputation.

(b) Debt financing needs to be funded.

Debt financing might be the best card in Musk’s hand, but it is also weak:

(a) Banks have signed commitment letters limiting the outs.

(b) TWTR could ask the court to order Musk not to blow up his financing (precedents available).

Nevertheless, the financing clause is hard to handicap.

Don’t let Matt Levine and Andrew Ross Sorkin get your hopes up that specifc performance” is the be all end all most powerful corporate weapon of all time. The remdey itself is dubious on constitutional grounds given its highly coercive nature and the DE court is going to be leary of ordering against the Musk entities (Musk is not buying Twitter personally, he has two vehicles that court can sanction, but sanctioning Musk personally is very different) who can appeal and/or refuse to close and just pay damages, rather than establish once and for all the SP has no teeth against parties who refuse to abide by it. The fundamental flaw in the merger agreement is that only Twitter the corporation has the right to seek damages and proving damages directly to Twitter’s earnings or operations will be an uphill battle. Twitter’s sharheholders do not have any rights to damages, and that would have made it fare more costly. Even then, Musk could just file Ch 11 for those entities, it would be extreemely difficult to gain recourse here to his personal fortune. See recent WSJ op-ed for what a toothless tiger SP likely is in reality despite what the left wing media would like us to believe in the all powerful DE Court of Chancery.

Section 8.2 in the merger agreement specifically allows damages based on lost shareholder consideration:

Quote: no such termination shall relieve any party hereto of any liability or damages (which the parties acknowledge and agree shall not be limited to reimbursement of Expenses or out-of-pocket costs, and, in the case of liabilities or damages payable by Parent and Acquisition Sub, would include the benefits of the transactions contemplated by this Agreement lost by the Company’s stockholders)

Good cath AV. I missed that in Merger Agreement. Shareholders would have damages. I do not see TWTR the corporation itself having damages beyond the break fee. However,the question remains is Musk persoanlly liable for them, since he is not a signatory to the merger agreement in his personal capacity, but as CEO of the two vehicles. The compalint’s assertion of personal jurisdiction over Musk as the Equity Investor was very weak. If all shareholdres have are claims against the aquisition cos, then Musk can just put those into BK and drag it out for a few years in bankrutpcy court since those vehciles have no assets. All you would have is whatever D&O insurance is there.

Thanks for the warning Joshua.

Every day there is a new article/podcast/blog entry or long tweet (including mine) explaining what a strong legal case Twitter has. But 50% spread in the market clearly tells a different story. Consensus is very far from ‘Twitter will win this easily and $54.2 is almost in the pocket’. As you suggest it might be difficult (or impossible) for Twitter to extract funds from Musk even if Twitter wins the legal case in a full extent (which also still remains a big IF).

Good news – Ericsson-VG merger has received CFIUS clearance and is expected to close on or before July 21. We are closing the idea with a 14% gain in 2 months.

https://www.prnewswire.com/news-releases/ericsson-receives-regulatory-approval-to-complete-acquisition-of-vonage-301587286.html

Fairfax financial and Prem Watsa hold 75.4 M shares of ATVI which is more than BRK(64.3M). Gives me added confidence in this merger with MSFT.

TWTR’s wish to expedite the lawsuit was granted and a five-day trial is now set for Oct’22. Seems like a decent win for TWTR, especially keeping in mind how fast the decision was made and how easily all the arguments from Musk’s team were rebutted (who asked for an early 2023 date).

Full take and commentary on the hearing here:

https://twitter.com/compound248/status/1549434354664980481

FHN/TD merger update: In light of the recent senator’s letter to the regulator OCC, the expected TD Bank merger closing date has been pushed to Q1’23. The management remains confident and regulatory approval applications are “progressing”. A meeting with the regulator OCC is scheduled for August 18. The spread stands at 14%.

https://www.bamsec.com/filing/3696622000045?cik=36966

Frontier cancelled their bid. 12 hours later JetBlue and spirit reach a deal.

Spread still seems pretty wide here. Jet blue offering 33.5, stock is 25.1. 33% spread for the regulatory risk?

MSFT/ATVI merger update: Recent reports suggest MSFT has responded to FTC’s second request. It’s not clear, however, if ATVI has done the same. FTC will have 30 days to respond once both companies provide the data. FTC’s concerns were rumored to center on worker issues but apparently in June Microsoft reached an agreement with a major labor union CWA. The union later sent a letter to the FTC supporting the merger.

Meanwhile, both UK and European antitrust watchdogs started their inquiries earlier this month. Spread stands at 19%.

https://seekingalpha.com/news/3857237-microsoft-said-to-have-responded-to-ftcs-second-request-in-activision-deal

https://www.nytimes.com/2022/06/13/business/economy/microsoft-activision-union.html

Despite current UK regulatory hurdles, Activision Blizzard’s CEO has reiterated he expects the merger to be completed before June 2023.

https://investor.activision.com/news-releases/news-release-details/letter-ceo-bobby-kotick-regarding-activision-blizzards-merger

Does MSFT/ATVI require approval in all countries/regions for the merger to proceed?

How many countries/regions are involved in the regulatory approval process? UK, EU, US, China..?

Assuming China is a necessary part of the approval process, can the rejection by their regulators prevent the deal from closing even if MSFT/ATVI have approval from all other regulators?

As you can tell, I have no idea how the global regulatory process works so if you have a link to any relevant resources that would be appreciated.

I think they need approvals from about 20 jurisdictions. Some approvals have already been received, e.g. Brazil, Saudi Arabia, etc, however, the main hurdles here will be the UK, EU and US regulators. And yes, Chinese approval will be needed as well. Any of those could derail the deal.

On September 13, Twitter shareholders’ officially voted in favor of the proposed acquisition by Musk. The turmoil around the acquisition continues. Trial is set to start on the 17th of October.

https://www.bamsec.com/filing/119312522244289?cik=1418091

Tenneco (TEN): Stock sink 5% to 17,68 USD at Friday –> 13% spread to 20 USD for a deal which likely this year, I picked up some shares. Any idea why the discounts widened so much and what the concerns of the market are (but afterhours good reboot):

https://finance.yahoo.com/quote/TEN/community?p=TEN

I think the reason behind this widening is the same as before. As the market environment sours, investors get more anxious that Apollo will pull the plug. Very large downside doesn’t help either.

A couple of updates on Spirit Airlines merger. As a reminder, in late July, JetBlue announced it would acquire Spirit Airlines for $33.5/share cash, which included a $2.5/share special dividend that will be paid after SAVE’s shareholders approve the deal. NYSE has recently clarified that only shareholders of record (September 12) will be entitled to receive the $2.5/share prepayment. SAVE shares now trade ex-dividend.

https://www.bamsec.com/filing/149871022000334?cik=1498710

Also, proxy firms ISS and Glass Lewis both recommend to vote for JetBlue’s offer.

https://www.bamsec.com/filing/119312522258593?cik=1498710

The special shareholders’ meeting is due October 19. For holders of record, 76% upside remains. Without the special dividend, upside is 63%.

As the price has fallen from approx. 23 USD to 18,3 USD, the upside is 70% quite high. But as also mergers like TEN or TWTR which are expected to close withhin a few weeks deal with approx. 10% spread, one can think that is ok as closing is expected in 2024. Where do you see the downside in case the deal will not go through, and is there a high risk that JetBlue is not able to get the financing?

TGNA merger continues to face regulatory pressure. FCC asked for more information to be sent no later than October 13. While, recent media rumors suggested that the review is going rather smoothly, house speaker Nancy Pelosi has expressed concerns about the takeover and urged FCC to closely scrutinize the merger. The spread has slightly increased to 18%.

https://www.fcc.gov/document/tegna-inc-standard-general-lp

It seems that the Twitter saga just can’t find its way to the finish line. Even after Elon Musk finally agreed to proceed with the transaction at the original terms there are still doubts of his actual intentions and whether the acquisition will close. Musk just wants the trial shelved (as he already agreed to buy TWTR), whereas Twitter wants to be fully 100% certain that Musk has no outs (from financing clauses or anything else Musk might think of) – so far the parties were not able to reach an agreement. The trial has been postponed and both parties now have until October 28 to close the deal or the trial will be rescheduled to November. Spread to $54.2 stands at 12%.

A small positive in the Twitter acquisition saga. Bloomberg reported that Twitter has locked staff’s stock accounts in anticipation of merger completion. The spread narrowed to just under 5%

https://www.reuters.com/technology/twitter-locks-staff-stock-accounts-anticipation-deal-bloomberg-news-2022-10-18/

FHN/TD merger was delayed to H1’23. The buyer stated that some progress toward securing regulatory approvals has been made but limited details were provided. From Nov 27, a $0.65/share annualised ticking fee (pro-rata for the delayed period) kicked in.

As the remaining spread has now narrowed to 1.6% (+ 1.5% from the ticking fee assuming the merger closes at the end of H1’23), we are closing this case in the large-cap basket. 13% return over half a year, but it was only a tiny 1% position in the SSI Tracking Portfolio.

https://www.bizjournals.com/philadelphia/news/2022/12/01/tds-134b-acquisition-faces-a-delayed-closing.html?utm_source=sy&utm_medium=nsyp&utm_campaign=yh

FTC has officially filed a lawsuit to block MSFT/ATVI merger, citing concerns that Microsoft would limit Activision’s games to only Xbox consoles. The lawsuit was anticipated by the market and had no effect on ATVI’s share price. The executives of both companies remain confident that the deal will close. The spread remains at 26%.

https://www.ft.com/content/c5a15ebc-4e4f-41b2-bcbe-9b8705cf8c37

Update on TGNA:

In mid-December SG agreed to waive certain contractual rights to alter TGNA’s current retransmission consent fees, giving cable companies the ability to choose legacy contracts. This is expected to alleviate the regulator’s concerns on the transaction’s negative impact on cable and satellite TV consumers amid heightened inflation. The FCC is set to provide its comments on the concessions by January 20.

Last week, however, senator Elizabeth Warren sent a letter to the FCC, pushing the regulator should still block the transaction. The senator has argued that the proposed remedies are “historically ineffective” and would not be sufficient to prevent potential anticompetitive practices. In response, SG sent a letter to Warren, pushing back on the lawmaker’s claims and requesting a meeting with the senator.

Spread to the buyout offer stands at 21%.

https://www.businesswire.com/news/home/20221216005478/en/Standard-General-Issues-Statement-on-Acquisition-of-TEGNA-Inc.

https://www.fcc.gov/document/mb-seeks-comment-letters-relating-proposed-tegna-transaction

https://www.warren.senate.gov/imo/media/doc/2023.01.11%20Letter%20to%20FCC%20re%20Standard%20General%20-%20Tegna.pdf

https://www.sgandtegna.com/wp-content/uploads/2023/01/SG-Warren-Response.pdf

I think at the very least the Warren letter will cause another delay. Especially since NCTA is not yet satisfied:

https://www.cablefax.com/distribution/more-wanted-from-standard-general-tegna

Approving it right after someone as high profile as Warren has just pushed back against the merger is probably not a good look politically.

Update on JBLU/SAVE:

During the most recent conference call, Spirit Airlines noted it expects DOJ’s decision over the next month.

“We announced in December 2022 that Spirit and JetBlue had certified substantial compliance with the DOJ’s second request and are now waiting to see whether the DOJ filed suit to block the deal or allows us to proceed. We anticipate hearing from the DOJ in the next 30 days or so, and that’s really all we have to say on that topic for now.”

https://www.bamsec.com/transcripts/15444758

Update on MSFT/ATVI:

Microsoft’s attempt to acquire Activision Blizzard (ATVI) continues to face regulatory hurdles. This week, UK’s CMA has issued a provisional ruling that the acquisition would harm competition in the gaming console and cloud gaming services markets in the UK. The antitrust regulator noted it will accept comments from interested parties until Mar’23 before making a final decision. In turn, Microsoft reiterated its commitment to the proposed concessions to main console competitors, including Sony and Intendo, as well as potentially other solutions required by the CMA. Meanwhile, the transaction is also under regulatory scrutiny in the US and Europe. Spread to MSFT’s offer stands at 30%.

Update on JBLU/SAVE:

Recently, Politico.com reported that the DoJ is likely to block the pending merger between JBLU/SAVE. It is rumored lawsuit could be filed as soon as March.

“Among the staff reviewing the JetBlue-Spirit merger, some are at least a bit sympathetic toward the airlines’ argument that the deal is needed to stay competitive with the four largest carriers, some of the people with knowledge of the matter said. The companies are arguing in part that in a highly concentrated market that exists due to past DOJ antitrust decisions, the only way to move forward is to be bigger. That argument is not expected to persuade DOJ lawyers, despite acknowledging that past federal decisions contributed to the current merger plans.”

https://www.politico.com/news/2023/02/10/blocked-jetblue-spirit-merger-00082327

Update on MSFT/ATVI:

EU hearing with Microsoft over its ATVI deal is set for February 21. MSFT is expected to offer concessions after the hearing.

https://finance.yahoo.com/news/microsoft-defend-activision-deal-eu-160619035.html

Apparently, Buffet trimmed his position in ATVI by 12% in Q4. He still owns a 6.7% stake. The decision might’ve been prompted by the increased regulatory scrutiny.

https://www.ft.com/content/751342cf-3753-44e3-9a22-8bd2ebbac990?ftcamp=traffic/partner/feed_headline/us_yahoo/auddev

re: JBLU, JETS Index materially higher post deal announcement.

Is there any deal premium baked into the stock?

Update on MSFT/ATVI:

Microsoft continues its attempts to ease regulatory concerns by pre-emptively entering into licensing deals with other gaming platforms. In its latest move, MSFT has signed a 10-year agreement with the Boosteroid cloud gaming platform. The company has already made similar deals with other major players in the gaming industry, including Nvidia, Nintendo, and Steam. However, its main competitor Sony continues to refuse the deal unless Call of Duty gets fully divested.

https://www.reuters.com/technology/microsoft-tells-uk-it-will-license-call-duty-sony-10-years-2023-03-08/

https://www.reuters.com/markets/deals/microsoft-signs-licensing-deal-with-cloud-gaming-provider-boosteroid-2023-03-14/

Update on MSFT/ATVI:

Some good news on the ATVI merger. On March 24, the CMA (UK’s regulatory authority) released provisional findings on the merger. The regulator stated that MSFT/ATVI deal will not result in “a substantial lessening of competition in relation to console gaming in the UK”. Previously, competition in console space was one of the main concerns for CMA. However, it did not mention anything yet with regard to the merger’s effect on cloud gaming which is also part of the investigation. CMA is expected to provide a full report on April 26.

Quote from the report:

“Our revised model now suggests that making Call of Duty (CoD) exclusive to Xbox would result in a significant financial loss for Microsoft post-Merger”

ATVI stock was up on the news with the remaining spread currently at 12.5%.

https://assets.publishing.service.gov.uk/media/641d6b7e32a8e0000cfa9381/Updated_version_-_Microsoft_Activision_Addendum_PFs__For_Publication_230324_.pdf

Update on MSFT/ATVI:

Yet another positive update on the merger. Japanese regulators have given a green light to the deal stating that they do not expect the merger to stifle the competition. Spread is 12%.

https://www.reuters.com/markets/deals/microsofts-activision-deal-will-not-harm-competition-japan-watchdog-2023-03-28/

Update on JBLU/SAVE:

Trial hearing date on the DoJ case against the JBLU/SAVE merger has been scheduled for October 16. The judge stated that he expects to conduct the trial expeditiously and will try to rule by 2023’s end. This should leave enough time to pursue an appeal before the end of July 2024 deadline to close the merger. Currently, the market assigns very low chance that the merger closes with the spread at an eye-watering 100%+. Meanwhile, the shareholders continue to collect 10 cents per share ticking fee on monthly basis.

https://www.reuters.com/legal/judge-sets-october-trial-us-challenge-jetblues-spirit-deal-2023-03-21/

Update on TGNA/SG:

Standard general sued FCC alleging that Media Bureau’s decision to halt the merger was unprecedented and illegal. Especially, considering that they have raised no concerns during a year-long review.

Standard General states the following:

– This deal should never have become controversial in the first place.

– It conforms to all FCC rules and precedents, requiring no waivers or divestitures.

– The takeover does not constitute consolidation—in fact, it is making TEGNA’s existing group of stations, smaller.

– Standard General has a proven track record, with more than a decade of experience owning television stations—and doing so in a way that has grown, not shrunk, newsrooms across the country.

– The DOJ waiting period to close the deal expired without any judicial challenge—in a time where many deals were being challenged.

– The FCC has a standing policy in favor of acquisitions that would help diversify the media industry—and this deal would triple the number of minority-owned commercial TV stations nationwide.

The spread is close to 50% now.

https://www.businesswire.com/news/home/20230327005768/en/Standard-General-Seeks-Judicial-Review-of-FCC-Media-Bureau%E2%80%99s-Pocket-Veto-of-TEGNA-Deal

Update on JBLU/SAVE:

Quick update on the merger. The parties continue to face increased regulatory scrutiny. Last Friday, multiple states led by California joined the DOJ lawsuit against the JBLU/SAVE merger. On the other hand, Florida’s Attorney General resolved a state probe into the merger after parties agreed to increase seat capacity by at least 50% in Fort Lauderdale and Orlando airports in case of a merger close. Spread is at 94%.

https://www.reuters.com/business/aerospace-defense/california-three-other-states-join-us-fight-stop-jetblue-buying-spirit-2023-03-31/

I’d add one — not precisely merger arb but merger arbish: Spectrum Brands (SPB). Getting sued by the DoJ on dubious antitrust grounds. Weak case. The transaction isn’t M&A but a transformative asset sale. Reasonable analysts will differ but I’ve been using $50 down / $80 up / 80% chance of the upside. Trial this month. Decision next. Quirky judge. I’ve listened to all of the pre-trial hearings and nothing is going the government’s way. Their lawyers appear ill prepared and so incapable of thinking on their feet that they seem almost narcoleptic. As an SPB shareholder it makes me feel great; as a US taxpayer not so much. This will probably be a litigation focused on the (near complete, signed sealed and delivered with a credible divestiture buyer) fix. The government doesn’t sound like they want to settle. But they should.

ATVI fell -11% yesterday as the merger with MSFT was blocked by Britain’s antitrust watchdog. The spread has widened to 24%.

“The Competition and Markets Authority said its concerns couldn’t be solved by remedies such as the sale of blockbuster title Call of Duty or other solutions involving promises to permit rivals to offer the game on their platforms, according to a statement Wednesday.”

Microsoft will appeal the decision and has stated it remains fully committed to this acquisition.

https://finance.yahoo.com/news/uk-blocks-microsoft-69-billion-123153776.html

FHN / TD merger was terminated citing uncertain timeline on obtaining regulatory approvals. Shares are down 40% pre-market. The news comes amid concerns of another bank, PACW, failing.

FHN now trades at 0.8x TBV having generated 15%+ ROTCE over the last few years.

ATVI/MSFT – recent media reports suggest the European Commission is expected to approve the deal transaction week. The regulator’s deadline for a ruling is set for May 22. The market remains skeptical of the transaction overcoming regulatory hurdles in the UK and the US and the spread remains wide at 25%.

https://www.reuters.com/markets/deals/eu-decision-clearing-69-bln-microsoft-activision-deal-expected-may-15-sources-2023-05-10/

EU regulators have approved MSFT’s ATVI acquisition, conditioned on Microsoft entering long-term licensing agreements to allow gaming consumers continued access to Activision’s games, including “Call of Duty,” even on rival cloud streaming services.

Both companies plan to appeal against the UK’s decision and apparently have hired a top lawyer for that. Activision is also threatening to reassess its growth plans for the UK, claiming the UK is “closed for business.”

https://finance.yahoo.com/news/microsoft-scores-big-win-stock-012301737.html

My opportunistic foray into large-cap merger arbitrage ended up exactly as could have been expected – the basket of 6 arb bets has lost 1.8% altogether. Back in May’22 I was tempted by the widened spreads “amid an overall market sell-off without any news directly relating to the mergers” and, as a result of this, 6 merger arbs were added to this basket.

My disclaimer at the beginning of this pitch was spot on: “Keep in mind that SSI track record on large-cap merger arbitrage is very spotty, and usually we avoid these outright”.

I am closing all the remaining positions in the basket and moving on.

Out of the initial 6 arbitrage cases in the basket:

ATVI – still pending, blocked by UK regulators, 1% gain;

TGNA – regulatory turmoil continues, 23% loss;

SAVE – blocked by regulators, 9% loss

FHN – the position was closed in Dec when the spread was eliminated, 13% gain;

VG – merger closed, 14% gain;

TWTR – merger closed, 16% gain.