PharmChem (PCHM) – Turnaround – Upside 100%+

Current Price: $3.68

Target Price: $7+

Upside: 100%+

Expiration Date: TBD

PharmChem is an illiquid nanocap and this idea is suitable for small PAs only. Liquidity has been somewhat increased by the current tender offer. The thesis is mostly based on the actions of insiders, who are actively cashing out minority shareholders and growing their own ownership in the company. Despite apparent cheapness, there are a number of uncertainties/unknowns regarding business prospects as well as competitive dynamics in the industry.

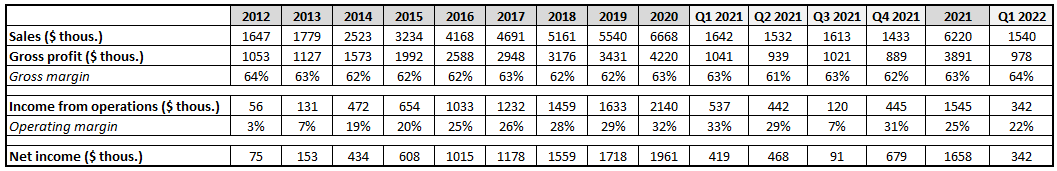

PCHM markets and sells its branded sweat patches for drug abuse detection. Laboratory operations are fully outsourced leaving an asset-light, steadily growing (16% revenue CAGR over the last 9 years), high margin, high FCF generating, debt-free business that trades at 11x 2021 PE. Last year, two activists, with 25% combined stake at the time, overthrew the entrenched board and implemented governance turnaround:

- reduced the board to only three seats;

- fully aligned themselves with the shareholders by refusing to take any salary (will be compensated only through stock ownership and dividends);

- materially increased financial disclosures, which allowed PCHM to uplist from ‘dark’ into a more liquid ‘pink’ exchange in Q1’22;

- announced intention to register with the SEC (yet to be implemented).

On top of the governance changes, activists have also invested into increased salesforce, which apparently is paying off already – the company announced that’s it’s close to signing a new major customer (>10% sales).

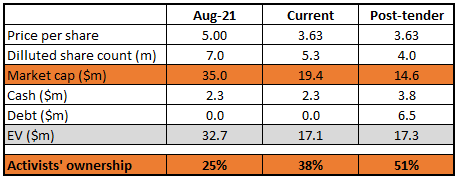

Finally, and this is probably the key part of the thesis, new management has also refused to waste cash on speculative capital investments (e.g. buying a manufacturing facility or a laboratory) and instead, returned nearly all of the previously accumulated cash to shareholders, reducing the diluted share count by 24% and in turn increasing insider ownership in the PCHM to 38% over the last 8 months:

That leaves us with the question of what to do with cash generated by this business. We have analyzed vertical integration through purchase or construction of either a screening laboratory or patch manufacturing. These two possibilities appear to be too capital intensive to justify a speculative buildout. We had an active open-market buyback program, but found little volume in the stock at acceptable prices. Instead, we completed a Dutch Tender Offer in November. Between all share buybacks through the year, we reduced fully diluted shares outstanding by ~24% to approximately 5.3mm.

One part of the capital return was ex-management’s stock option repurchase, another was a tender offer for 11% of shares at $4.5-$5. The offer ended up oversubscribed (around 17% of all outstanding were tendered) and the final price was set at $4.6/share. The stock was extremely illiquid at the time and ex-management had not done any buybacks for over 15 years, so the fact that only a relatively small amount of shareholders rushed to cash out (at higher prices than today) is very positive. The activists did not participate in the tender and apparently bought even more shares pushing the current combined insider/activist stake to 38%.

A few days ago, following a post-Q1-result share price slump, PCHM announced another large tender (at $3.25-$3.75 range) for around 25% of outstanding shares or 40% of the free float (if calculated at the upper limit). The tender is conditioned on financing, but the important thing is that activists/management once again will not be participating in the offer. If the tender is fully subscribed, insider ownership of PCHM will increase to 51%. Not sure in the resulting majority ownership by insiders creates any additional risks here, but so far their actions have been minority shareholder friendly.

The cap table below depicts the reduction in the PCHM diluted share count as well as an increase in the ownership by current insiders. The last column indicates changes assuming the current tender is fully subscribed at the upper limit.

So basically what we have here is a cheap company with a steadily growing, highly profitable business + new management that owns nearly 40% of stock, has already taken shareholder-friendly actions, and wants to increase the ownership in the company even further. Below are a couple of quotes from the activist campaign and recent letter to shareholders:

The business is an exceptional one: cashflow generative, capital light, and growing. Operational management of PharmChem appears to be outstanding. We do not wish to interfere with the underlying operating business. It is the absentee senior management and board that are the problem.

We believe this to be secularly growing business over time, although it’s our job to prove that.

None of the above-mentioned very positive changes have been reflected in the share price yet. Meanwhile, following the Q1’22 results (April 22) the stock dropped from $4.5-$5 levels to $3.3 Shortly thereafter, the company announced the currently ongoing tender offer. The interesting part is that Q1 results weren’t even that weak and just reflected the previously observed post-COVID normalization of the business. Instead, in the Q1’22 press release, the management also hinted that they are very close to signing a new major customer that might be a catalyst for further growth.

A quick and opportunistic tender for 50% of the free float and willingness buy insiders to lever up the business in order to cash out minority shareholders is a very clear sign of confidence in business prospects as well as its low valuation today.

The main reason why this situation exists is that PCHM has virtually been a forgotten ghost stock for nearly two decades – at least I haven’t been able to find any coverage on it anywhere so far. No reports with the SEC, limited disclosures, and limited visibility on the business performance. On the catalyst front – tender results, the announcement of a new major customer contract, or registering with the SEC could all easily push the share price significantly above the current levels. I think the sale of the company or management’s buyout might be in the cards as well. While this might sound too speculative, given the management’s action so far, it really looks like something is brewing there behind the scenes.

Activists

PharmChem outsourced all of its manufacturing and screening laboratory operations in 2004 and subsequently deregistered from the SEC/went dark. This has basically turned the company into a ghost stock – very dry liquidity and no coverage anywhere – despite its profitable business growing at 16% CAGR in the last 9 years. In August 2021, two activists Tice Brown and Tim Eriksen (manager of well-performing micro-cap focused fund Cedar Creek Partners) amassed 23.3% and 1.6% stakes accordingly and started a campaign against the entrenched board. The activists claimed that the business had been significantly undervalued due to severe mismanagement. They also alleged the board abused PCHM’s “dark” status and in 2015 issued themselves 16% of the company’s share capital via options (at $0.15/share exercise price – below 1x PE and 30% below PCHM cash position). Shareholders apparently did not even know what was going on as management refused to report its compensation. Ex-management was also stockpiling cash ($8m) and the average age of the board members stood at 80 years. The activists won the campaign in August 2021, receiving all the board seats and ousting the previous management.

Tice Brown (LinkedIn, Twitter) is currently PCHM’s chairman and owns 31.6% of the stock. He is a fresh private investor activist, who also manages/owns Woodmont Property Partners, likely a tiny real estate fund (no info except for the registry, see here and here). Tice has recently started another activist campaign – in casino table game developer Galaxy Gaming. He filed a first 13D on the 1st of April with a 5.9% stake (around current prices). The plan was to get a board seat and then declassify the board. On the 25th of April, GLXZ announced the resignation of one of the directors and a cooperation agreement with Tice Brown. The agreement foresees that the company will form a hiring committee, which will identify a new candidate to fill the vacancy. The activist will withdraw the nomination and will be limited by a standstill provision. Not sure what was the point of the campaign here, unless the hiring committee themselves will now announce that they elect Tice as a new nominee.

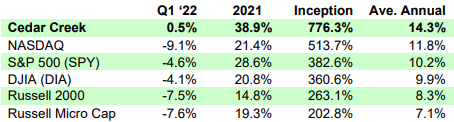

Tim Eriksen (director, owns 3.8% of PCHM at the moment) is a managing partner of Cedar Creek Partners – a micro-cap/OTC stock-focused fund, which has been printing very solid returns over the last 15 years. The fund was launched in Jan’06:

Most of PCHM shares beneficially owned by Tim are actually held through the fund. Tim is also CEO of Solitron Devices – received the board seat in 2016 through a proxy fight as well. The stock is now +130%. He also sits on the board of TSR Inc since 2019 (proxy fight led by another activist). Since then the stock has appreciated +160%.

PharmChem business

The disclosures on business operations and overall visibility into the business/industry are quite limited. As already noted above, my conviction on this stock is mostly based on insiders’ actions as well as PCHMs steady historical financial performance. Below are some snippets on the business that I managed to compile from various sources.

PharmChem sells its branded PharmChek sweat patches, which use the technology the company patented in 2000. The patches are worn on the skin for up to 14 days. It absorbs sweat, which is then screened in laboratories for drug use. The patches are slightly less accurate than the urine tests, but are cheaper, more hygienic, and have several other advantages like being difficult to dilute, substitute or adulterate without detection. The patches have a clear film that will become cloudy if removed (tampering is not possible). The customers are private and public employers, criminal justice agencies, and drug treatment programs in the United States who all seek to detect and deter the use of illegal drugs and alcohol.

The company seems to be splitting its customers into three categories – distribution (wholesale), retail, and federal probation (government clients). Revenue splits between these 3 groups are not provided.

From the ex-management’s response to proxy challenge in Aug’21, it seems that PCHM has a contract with only one lab that screens the specimens and one or two reagent suppliers. The company manufactures the patches by itself, but the manufacturing process is very basic and this is still an asset-light business.

Here’s a bit more color on the industry and thoughts on PCHM product from the new management (Q4’21 letter):

Based on industry reports, drugs of abuse screening generates approximately $2.6B of revenue in North America, and is growing >$150mm per year. PharmChem’s revenue is approximately 0.25% of this market. The vast majority of revenue nationally is collected by a urine testing duopoly, Quest Diagnostics and LabCorp. Their operations are tucked into other segments that make their margins difficult to parse; but we do know contribution FCF margin for additional PharmChek patches sold is attractive. We have no idea whether we can be 0.3% or 3% of the total revenue of this large market. But we are confident our product is superior in many ways (convenience of multi-week use, absence of unsanitary urine handling, higher fidelity) and we are excited to compete for a larger piece of the pie.

More information about the technology and effectiveness of the sweat patches can be found in Pharcheck’s patent filing as well as here, here, and here.

Pharmchek’s patents have expired in Sep 2020 – but I am not really sure if these patents had any real effect on deterring the competition. The sweat patch technology itself seems really basic – three layers of easily sourceable materials – and the patent filing itself already notes (back in 2000) other available sweat patches for frug abuse testing. Also Pharmcheck the patent seems to be on incremental sweat patch improvements rather than the patch itself:

Contamination may also come from the sweat of prior use. Because the individual being tested may still reside in the same location, wear clothing, or contact other drug users, this contact may put that individual in proximity to metabolites generated from other people or at a prior time. Contact with metabolites may be ruled out based on the circumstances of the subject’s environment but contact with the parent drug could still be a possibility. Thus, the studies show that the potential for external contamination of skin (CFWI) as well as contamination of the patch membrane (CFWO) can occur and generate false positive results.

The current sweat patches do not adequately prevent CFWO. Additionally, the current methods for using the sweat patch do not adequately indicate the possibility of CFWI. Further, the current sweat patches and methods for their use do not adequately detect tampering. Therefore, there is a strong need for sweat patch devices and methods of using sweat patch devices that reduce CFWO and detect and reduce CFWI thus producing more accurate and reliable results, and also allowing for easier detection of tampering.

SUMMARY OF THE INVENTION

Accordingly, it is an object of the present invention to provide devices and methods for collecting chemicals and biochemicals in perspiration for analysis whereby CFWO is reduced.

It is an object of the present invention to provide devices and methods for collecting chemicals and biochemicals in perspiration whereby CFWI is reduced and/or detected.

It is a further object of the present invention to provide devices and methods for collecting chemicals and biochemicals in perspiration for analysis in which tampering is more easily detected.

However, after a quick search, I was actually not able to find any other branded sweat patch name and all references seem to be to Pharmcheck (including some relatively widely cited scientific papers). The sweat patch market might be too small for any bigger pharma companies to be interested in – that might explain the lack of other branded competing products.

So the overall picture that I’m getting here is that the previous management developed this technology and through outsourcing the lab operations/minimizing the employee count basically turned PCHM into a self-driving cashflow machine. According to the activists before the board overhaul, PCHM sales “were handled by three individuals, while simultaneously performing other duties within PharmChem—a lot to ask of anyone”, meanwhile the previous semi-retired management put as little effort as possible into running the business.

Their average age is 80 years old. The CEO lives semi-retired in Southern California, 1,300 miles from headquarters. Board meetings were held solely telephonically in each of 2020 and 2019.

Seems like the full potential of the business might not have been properly explored yet.

That’s why one of the first things the new management/activists did was to promptly hire five new sales people (three are still with the company). The comments so far have been quite cautious, but (Q4 letter):

Our customer base of municipal and government buyers has a long sales cycle. We don’t expect to have enough data for 9-12 months to determine whether the increased SG&A investment of around $400,000 per year from this salesforce exceeds the gross margin dollars (and incremental FCF) it generates. We are heartened by several larger possible customers circling orders, but it is the salesforce’s job to convert these.

The recent Q1 report has hinted at a new major potential client, suggesting increased salesforce might ramp up the business/FCF growth:

While we are continuing to onboard many smaller new customers, we believe we have come to an agreement with a material new distribution customer (>10% of sales) resulting from our salesforce’s efforts. This relationship has not yet yielded an order, and we have no certainty if or when it will.

Historical financial performance

2020 was an unusually strong year driven by two factors – 1) due to restrictions pretty much all other methods of drug testing were not allowed and sweat patches remained pretty much the only viable method, 2) customers may also have been pulling forward their patch purchases into 2020, increasing their inventory levels during uncertain times.

Tender offer’s financing condition

The tender is conditioned on PCHM raising $6.5m in fresh debt. Private placement press release came out on the 3rd of May – senior secured notes with an expected 9%-9.5% interest rate and maturing in 2030. PCHM will have a right to redeem all or part of the notes from Sep’22. The placement agent also provides $3m backstop commitment. Negotiations with initial purchasers seem to be ongoing. Given the backstop and stable earnings profile of the business, raising these funds for the tender should not be a problem.

Levering up the balance sheet was another major goal of the activists. It was discussed in the Q3’21 letter, however, the issuance of debt proved to be much harder than initially expected (from Jan’22 letter):

One genuine failure of the Chairman has been the complete inability to obtain reasonable debt financing for PharmChem, although this hasn’t been for lack of effort. This company does not have real estate, manufacturing works, substantial receivables or inventory to borrow against: it is a gem of a business generating cash flow with little capital required. Lenders want hard assets as collateral; and without it request large equity grants, personal guarantees, nosebleed interest rates, or all three.

EV of the post-tender should be 16.5 m ?? 14.6 +6.5 -3.8

Or something wrong with my calculation?

Thanks, typo on our side. Now corrected (EV=$17.3m).

How did you arrive at your PT of 7$+? Guess a 15x FCF (2,07m steady state FCF) multiple?

Thanks

Nothing really scientific behind it, as you suggest a 15xPE or a double from here. If it becomes clear that his business can continue generating $1.5-$2m in annual earnings and management keeps on returning cash to shareholders, PCHM should be an easy double, but might take a couple of years to reach that.

Any recent updates from the company re: financing? Is the private placement complete / financing condition satisfied?

Tender terminated as they cancelled the financing. “The Company elected to terminate the Note Offering due to recent developments with respect to the Company’s business and results of operations, which the Company intends to review and address before evaluating any potential financial transactions.”

https://s3.amazonaws.com/com-pharmcheck-cdn/document-uploads/Notice-of-Termination-of-Tender-Offer-and-Private-Offering-May-31-2022.pdf?mtime=20220531153224

Tender deadline soon on May 31. Price now is $3.55, with tender range 3.25-3.75.

But the thesis here is not to tender, but to hold long term due to undervaluation. As DT said, aiming for a double in years.

Down about 18% today after cancelling the tender. Release said something vague about new developments, wonder if this is about the new big customer not materializing.

Failure of the tender due to financing conditions was one of the risks. But I am not really concerned about the tender failing as by the vague language in the statement:

It doesn’t sound pretty. I think of 3 possible scenarios:

– They really failed with the financing. Kind of hard to believe that they went into this without being very close to sure the funds will be secured.

– Management is blatantly putting their own interests above the shareholders. The offer traded close to the upper range for most of the time and I highly doubt that many shares were tendered. Management might’ve decided not to proceed with a failed tender (which would probably cause the stock to jump) or raise the price. Why do that when they can now come back with something else at a cheaper price.

– Something material happened with the business outlook.

Honestly, neither scenario looks good and I think the third one is the most likely. But given positive changes with PCHM till now, I’m inclined to give management a benefit of the doubt and to wait for further updates.

A new letter from PCHM chairman on failed tender offer as well as the appointment of new CEO who happens to be chairman’s brother-in-law:

https://www.otcmarkets.com/otcapi/company/financial-report/336929/content

The new CEO is here https://www.linkedin.com/in/matthewlkatz/

– A young guy with Wharton MBA;

– From past roles seems like quite limited leadership experience – definitely nothing similar to running a company;

– But at least he will be compensated mostly by well-out-of-the-money option grants.

– This is what is being expected of him going forward:

And a final word from the chairman:

While on the surface a stream of quite bad news – canceled tender, unable to raise debt financing, weakness in sales, termination of distributor contract and new CEO with limited experience – the company is very cheap with a unique product that had a long history of stable profitability and with the interests of management and minority shareholders well aligned.

However, as I noted in the write-up “there are a number of uncertainties/unknowns regarding business prospects as well as competitive dynamics in the industry.” This remains the key concern/unknown, but I am tempted to wait and see if new management is able to revitalize sales.

Following Q2 results, I am closing the PCHM idea as the capital return thesis failed and the prospect of the ongoing turnaround continues to be highly uncertain. There simply seems to be better opportunities on the market to put the cash in. Exiting at a loss of 25% in 2.5 months.

PCHM has released Q2 results together with a letter to shareholders:

– Revenue $1.5m, -1.6% YoY – continues to normalize vs COVID peak;

– EBIT $0.2m, -65% YoY;

– Net income $0.15m, -69% YoY.

The profitability was impacted by around $0.4m increase in opex. Most of that was one-off expenses related to the failed capital return. The remaining was ‘growth opex’ and higher salary of the new CEO. Overall, the company now expects SG&A expenses to permanently go up by 25% on an annual basis.

Management has clearly said that although they consider shares to be cheap, no debt issuance or buyback are in the cards for now:

“While we would take advantage of low-priced shares or low-cost debt if we had the opportunity, current plans do not include further debt issuance or buyback.”

Instead, the new company is going to focus on its salesforce efforts, while the new CEO is exploring some new potential verticals to grow the business, e.g. employer/employee private use, DTC or international market.

The most alarming update was regarding the company’s largest customer (federal) that generates around 10% sales. The customer has notified that its funding won’t permit any purchases in Q3’22 and the company is not aware whether sales will resume in October.

Overall, the situation doesn’t look very promising right now. No catalysts in the near term and the whole thesis now leans on this turnaround/sales growth story, so success of which remains very questionable.

https://s3.amazonaws.com/com-pharmcheck-cdn/document-uploads/PharmChem-Q2-2022-Letter-to-Shareholders-7.27.22.pdf?mtime=20220727100952