Oklo Resources (OKU.AX) – Merger Arbitrage – 14% Upside

Current Price: A$0.145

Offer Price: A$0.166

Upside: 14%

Expected Closing: Q3 2022

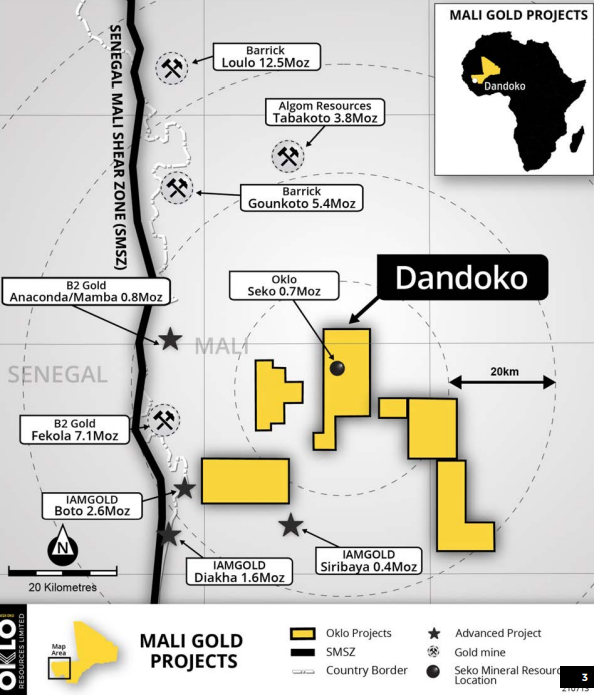

Australia-listed junior gold miner Oklo Resources has agreed to be acquired by a much larger peer B2Gold. The consideration is 0.0206 BTO.TO shares + A$0.0525/share in cash, which at current prices equals A$0.166/share or A$86m in total. Daily liquidity has increased after the merger announcement (May 26) and now averages around A$400k/day. The buyer-related risks are minimal. B2Gold is a C$5bn market cap gold miner loaded with cash. For the buyer, this is a tiny purchase and it seems to make sense at least from geographical proximity as OKU’s Dandoko project is located just 25km from BTO’s mines (see image below). B2Gold also believes that 65% of Dandoko’s resource is contained in soft oxidized material, which would be viable for the processing at B2Gold’s Fekola mill. Plenty of shortable shares for hedging are available on IB at a 1% annual fee. As usual, approval from 75% of OKU votes cast + 50% of shareholders being present and voting (headcount) will be required. The meeting is planned for August. Directors own 3% and support the merger.

The spread seems to be explained by two factors – steep downside (around 50%) and worries about shareholder approval. Major OKU’s shareholders are Blackrock index funds (11%), local peer Resolute Mining (11%), London’s hedge fund Ruffer (10%), and African-based PE firm Capricorn Group (5%). Not sure about others, but Resolute Mining has a cost basis of around A$0.3/share. Moreover, OKU has raised A$10m of equity just 2 years ago (July’20) at A$0.32/share. This poses some risks of shareholder approval. However, there are several arguments suggesting shareholders will vote in favour of the transaction:

- Shareholders are likely dissatisfied with OKU management’s underperformance. The company started focusing on the Dandoko project back in 2016 and IPO’ed at A$0.2/share in 2017. The project has advanced very little so far. 6 years have passed and aside from some initial resource estimates provided in March’21 and the project has remained at a very early stages. Even the indicative timeline for the PEA (preliminary economic assessment) has not been announced yet. With no changes on the horizon, shareholder might just opt in for the sale of the company.

- OKU’s mines are located in Mali, which has been undergoing major political turbulence for the last 2 years. In Aug’20, Mali had a military coup and junta is still in control. As a result, the Economic Community of West African States (ECOWAS) has closed land and air borders with Mali and in Jan’22 started an embargo + put various economic sanctions in place. ECOWAS is demanding Mali to provide a date for presidential elections and gave 12-16 months for the transition. However, the junta says it will take another 2 years for that. This turbulence has destroyed the share price of Mali’s junior gold miners – OKU fell from A$0.3/share to A$0.07/share (pre-merger), while Resolute Mining dropped from A$1.1/share to A$0.25/share. Larger players have apparently been less affected, although as stated by BTO’s CEO “the international attitude is basically don’t buy shares in companies that are invested in Mali”. Nonetheless, B2Gold remains optimistic about the longer-term outlook and is actually ramping up gold production in its mines. For OKU, staying optimistic is much more difficult as it is still an early-stage miner and will have to somehow raise a substantial amount of cash for the project development.

- As of the latest report, OKU’s cash position was at A$3.8m, enough for around 2 additional quarters. Without the merger, the company will have to raise cash, potentially at very depressed share price levels. In comparison, as of March’31, BTO had A$940m in cash.

- Peer/major shareholder Resolute Mining might support the merger, despite its larger cost basis. Resolute’s shares are now at all-time lows, while the company burns cash and has a significant debt load. It might welcome a little bit of extra cash and much higher liquidity/lower risk of owning BTO’s shares instead.

- OKU’s trading volumes are still very much elevated, despite 2.5 weeks passing since the merger announcement. It seems like some larger shareholders don’t want to play the arb and are exiting at slightly elevated prices due to pending merger. This selling pressure might also be one of the reasons for the current spread.

Note that the Dandoko project has 2 other large players next to its mines (Barrick, IAMGOLD), so there is a tiny speculative chance of a competing bid here. Although, the current merger contains no talk and no shop provisions.

The Dandoko project location:

Scheme booklet has been dispatched. Shareholder meeting is set for September 1 and the merger is expected to close on September 19. Remaining upside is 5%.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02548081-6A1102441?access_token=83ff96335c2d45a094df02a206a39ff4

The merger is set to be completed on the 19th of September and OKU.AX shares have been suspended from trading as of today. The idea is closed with a 14% gain in 3 months.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02565859-6A1108670?access_token=83ff96335c2d45a094df02a206a39ff4