Seritage Growth Properties (SRG) – Strategic Alternatives/Asset Sales – 100%+ Upside

Current Price: $8.08

Target Price: $17.06

Upside: 100%+

Expiration Date: TBD

This idea was shared by David.

Note from SSI: Seritage Growth Properties is a real estate holdco spin-off from Sears. After Sears’s bankruptcy in 2018, SRG became probably one of the most controversial and polarizing real estate plays on the market. Many high-profile investors (e.g. Buffet/Berkshire, Olshan family, Mohnish Pabrai, Berkowitz) are or were involved. Below, you will find a bullish take presented by David. There is also a recent short pitch on VIC. We definitely recommend reading it as well as it contains additional color on the SRG background and has a comment section with intense back and forth between bulls and bears. Below the write-up, you can find our attempt at a quicker summary of both long and short SRG theses.

Intro

Seritage Growth Properties (SRG) owns interests in 161 former Sears and Kmart properties throughout the U.S., comprised of ~19 million square feet of gross leasable area (GLA). SRG had planned to convert these retail locations, many of which are well located in major cities, into more valuable real estate such as office or multi-family apartments. Poor execution and Covid disrupted their plans.

SRG is a heavily shorted stock. As of 5/26/22, Bloomberg data showed SRG’s short interest is 7.9mm shares, or ~18% of SRG’s ~44mm Class A shares (SRG also has ~12mm OP units held by ESL which can be converted 1:1 into Class A shares).

SRG is not followed by any sell-side analysts and management does not hold quarterly calls. They do provide a wealth of information about their assets on their website and in their filings.

In 3/22, SRG announced that it had hired Barclays to explore strategic alternatives. The bank is marketing pieces of the portfolio to large real estate buyers. Separately, SRG is trying to sell numerous individual properties, mostly in their Non-Core segment. They are motivated sellers, as they need to repay $640 million on a $1.44 billion term loan from Berkshire Hathaway by the end of July 2023 to get a two-year maturity extension.

My investment thesis is simple: SRG and its assets are up for sale via multiple processes, and a conservative liquidation value of the real estate is at least 100% above the current market cap of ~$460mm. The results of the sale processes, debt paydown, and unwinding of short positions should serve as a catalyst for the stock

Non-core properties

I begin my valuation with what are SRG’s least valuable assets: 60 non-core properties with ~8.8 million square feet of GLA on 740 acres. In their latest 10-Q, they state these properties are “to be disposed of.”

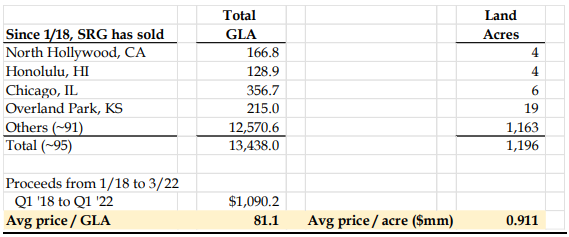

To estimate value, I first reviewed the property sales that SRG has completed over the last few years. From 1/18 to 3/22, SRG generated ~$1.1 billion of proceeds from the sale of ~95 properties with ~13.4 million square feet of GLA, or approximately ~$80 per GLA or ~$900,000 per acre. On average, the properties sold were 74% leased. Looking at the list, some markets were highly desirable (e.g. Honolulu, North Hollywood) but most were in less populated areas (e.g. York, PA and West Jordan, UT).

By comparison, the 60 Non-Core properties remaining were ~18% leased at 3/22. So perhaps $60 per GLA (~$713,000 per acre) would be a conservative estimate for a starting point, to reflect the higher vacancy rates vs the already sold properties (though real estate values have increased meaningfully over the past few years; more on this later). Note that $60 per GLA is likely below replacement cost. Using this metric, we would estimate that the 8.8 million Non-Core GLA are worth $528 million.

There are a few properties included in Non-Core that should push the simple $528 million estimate up considerably. For example, in 11/21 SRG sold a single vacant property at 1178 El Camino Real in San Bruno, CA (near San Francisco Airport) for $128 million, or $11 million per acre / $462 per square foot, to Alexandria Real Estate Equities (see here). Alexandria plans to redevelop the land and noted that it can support 620,000 square feet of development, or 2.2x the size of the former Sears building. Per Zillow, the average single-family home in San Bruno is now worth $1.5 million while the average condo is ~$580k, both up 150% in the past 9 years. This is an important theme that the market is overlooking: many SRG properties sit on land that is very valuable if and when converted to non-retail uses. The land and real estate in most if not all of SRG’s locations have increased considerably in value over the last few years. Even though management’s execution has been mediocre, SRG can still capitalize on the value and the densification potential of these sites, most likely by selling the properties to others who have capital (like San Bruno) or contributing their sites to joint ventures with partners who bring capital (like Riverside and West Covina).

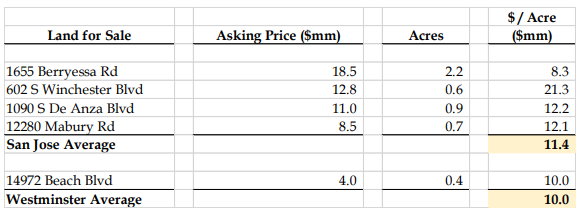

SRG’s Non-Core segment includes a 22-acre property in San Jose, CA and a 14-acre property in Westminster, CA. Housing in these two locations is priced even higher than in San Bruno: condos in San Jose now fetch $866k on average (source) while condos in Westminster trade at $701k on average. Additionally, on Loopnet one can find multiple land parcels available for sale in San Jose, mostly in the $5-10 million per acre range. Similarly, in Westminster there is a 0.4-acre piece of commercial land two miles away from SRG’s site offered at $4 million, or ~$10 million per acre.

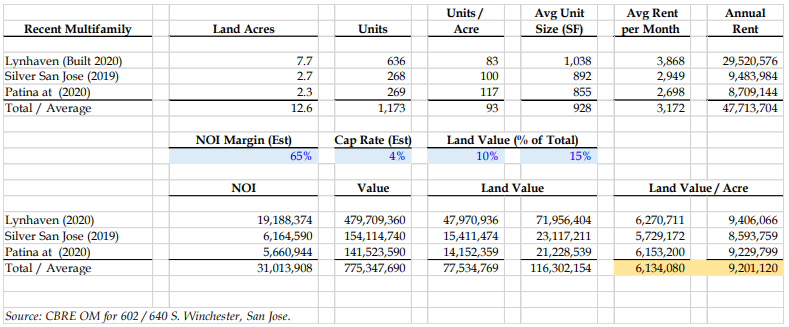

As another data point, I reviewed a few recent multifamily rental developments in San Jose. Based on the average rental rates and using a 65% NOI margin assumption, 4% cap rate, and assuming the land is worth 10-15% of the total development, I estimate the land value per acre to be in the $6-9 million range.

Additionally, the Village Oaks shopping center in South San Jose was sold on 3/22 for $115 million, or $6.5 million per acre. This was part of a larger portfolio sale of 8 properties (source).

If we use the initial $60 per GLA ($713,000 per acre) metric for Non-Core overall, San Jose and Westminster’s values would be estimated at a combined $28 million. However, if these two locations were sold for $5-10 million per acre (less than San Bruno at $11 million per acre), they would be worth a combined $180-360 million. At these levels, these 2 vacant and non-cash flowing Non-Core sites could account for 9-19% of SRG’s $1.9 billion enterprise value, or 39-79% of SRG’s entire ~$460 million equity value. I don’t believe the market, particularly short sellers, are aware of this.

Adjusting the valuation assumptions for San Jose and Westminster could push the value for the 60 Noncore assets up to $680 million to $860 million. At these levels, the Non-Core segment would represent 36% to 45% of SRG’s total $1.9 billion enterprise value. The Non-Core assets represent SRG’s least valuable properties.

In their Q1 ’22 results release, SRG stated that they are “currently marketing over $700 million of properties for sale at estimated fair value (before considering the Barclays strategic review process)…” I suspect they are guiding to the market that a subset of the Non-Core assets (and possibly part of their joint venture assets) could be sold for over $700 million.

The San Jose property is on the market via a broker (source). Bids were requested in April, so we may have price discovery shortly.

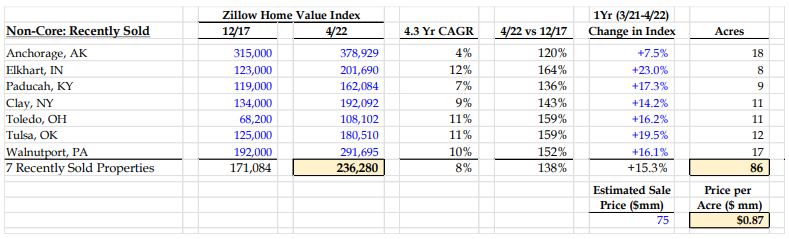

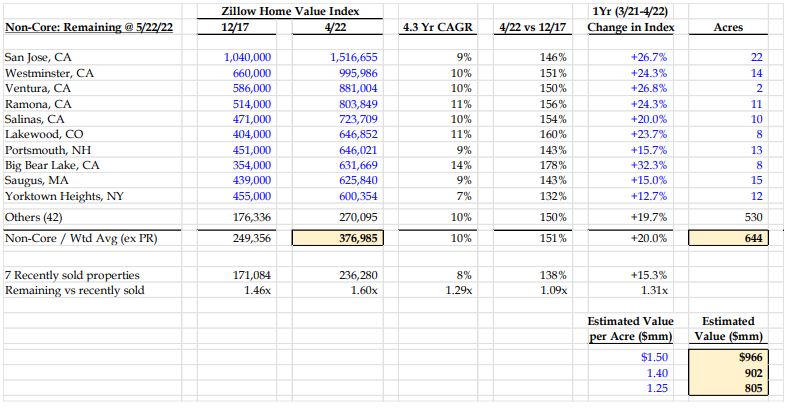

As an additional sanity check, I reviewed the Zillow home price index for all 60 of SRG’s Non-Core locations. First, below is a summary of the Non-Core assets that were recently sold; I compared the assets on SRG’s website at 5/22/22 to the ones listed in their 3/31/22 filings. I believe they sold 7 assets for a combined $75 million, driven by their $44 million sale of their Anchorage, AK property.

On a weighted average basis (weighted by acre), these properties increased in value by 15% according to the Zillow home price index in the past year. Since 12/17, home prices increased by ~38% or +8% per year, from $171,000 per average home to over $236,000 per home.

By comparison, the remaining ~52 properties in Non-Core are in even stronger housing markets. The Zillow Home Value index for the remaining properties is ~60% higher than the 7 recently sold (~$377k weighted average house value vs ~$236k) and the 1-year change is higher as well (+20% vs +15%). Adjusting the $872k per acre estimate for the 7 recently sold would suggest land associated with the remaining 52 are worth ~$1.4 million per acre. At these levels, the remaining 52 Non-Core properties would be worth ~$900 million, even higher than my estimates above.

Residential

SRG’s Residential portfolio consists of 31 sites with a combined 423 acres. These are sites where SRG hoped to convert the former Sears retail building into a residential building. Conversions require a lengthy entitlement process where they need the blessing of the local governments, which can sometimes take 3-5 years or more given all the parties involved and red tape. The length of these processes and concerns about the capital required for the development have weighed on SRG’s stock price.

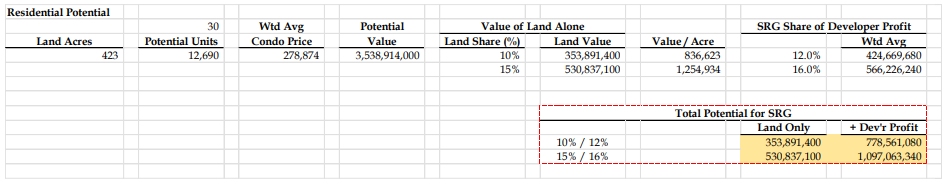

A recently announced deal with joint venture partners suggests SRG has multiple levers to monetize these assets, some of which may not require any capital investment. In their Q3 ’21 results, SRG announced that they finalized joint venture agreements to convert 66% of their sites in West Covina, CA and Riverside, CA to residential. They guided to 745 new condo units to be constructed on 22 acres (~34 units per acre) across the two sites. SRG “contributed only the residential portion” of the land to joint ventures and “retained an 80% interest in each entity”. I believe this means that SRG will earn 80% of the developer’s profits, which is typically ~15-20% of the completed project value, without having to put up additional capital to develop the residential properties. All they had to contribute was the land, suggesting that the development partner viewed SRG’s site as well located and valuable.

Per Zillow, the average condo in Riverside sold for $428k in 4/22 while the average condo in West Covina was worth $566k. Using the average of $497k would suggest these two locations could create condos worth ~$370 million (new condos should fetch a premium but we’ll stick to averages for illustrative purposes). If SRG receives 80% of the developers’ 15-20% estimated profit (as a percent of total value), it would result in value of $44 million to $59 million excluding any value attributable to the land ($2 to $2.7 million per year). Assuming the land is worth 10% of the potential value, SRG’s share of the value for these parcels could reach $81 million to $96 million ($3.7 to $4.4 million per acre).

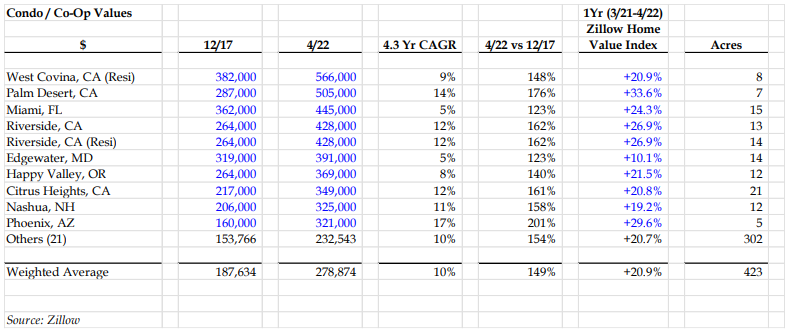

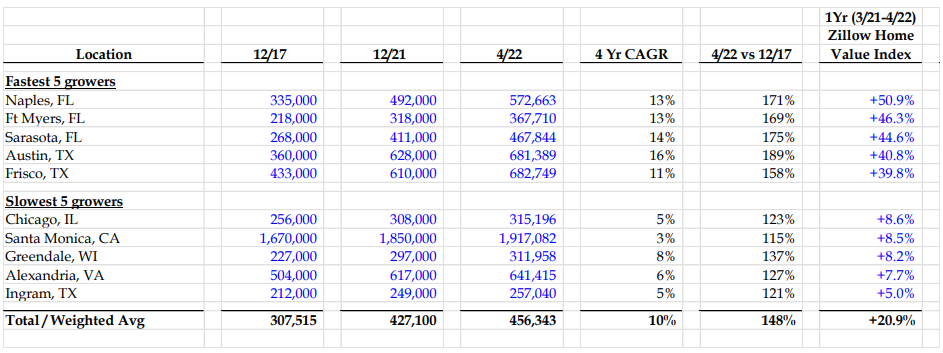

To estimate the potential for the overall Residential portfolio, I reviewed condo prices from Zillow for the 31 locations. The weighted average condo price in these 31 locations is nearly $280k at 4/22, up almost +50% vs the 12/17 average of $188k. These locations are in hot markets: the average home value in these markets is up +20% over the past year. Assuming SRG or its development partners can construct ~30 condos per acre suggests potential for about ~12,700 condos (note: they may reserve some of the land for non-residential purposes). If these condos sold for the ~$278k average, the value of the ~12.7k condos would total $3.5 billion.

A real estate developer told me that the land cost in most development projects can account for 10-15% of the total value and still be profitable for the developer. This would suggest that the land alone for these 31 sites is worth $350 million to $530 million, or $836k to $1.25 million per acre, a premium compared to our $713k estimate for the Non-Core properties.

Per the West Covina and Riverside announcement, it seems SRG is not just selling the land. They appear to be earning a portion of the developer profits from developments without having to put up additional capital. For the entire Residential portfolio, assuming SRG earns 12-16% profits on these developments (80% of 15-20%), that could add another $425 million to $565 million of value. Combined, the land plus SRG’s share of the developer profits from these 31 sites could deliver another $780 million to $1.1 billion ($1.8 million to $2.6 million per acre) to shareholders. At these levels, the Residential segment would account for 41% to 57% of SRG’s total enterprise value of $1.9 billion

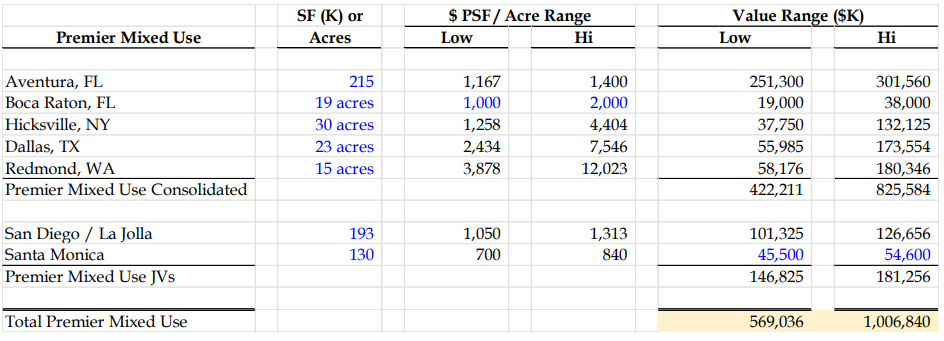

Premier mixed-use

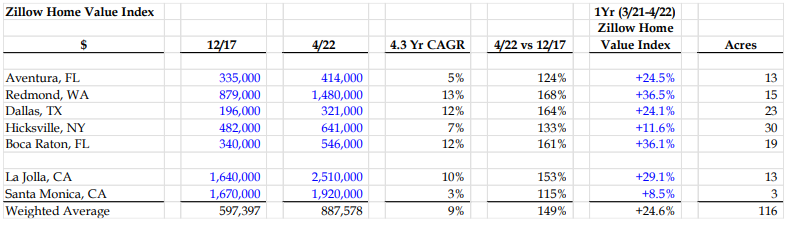

SRG has 5 wholly-owned Premier Mixed-Use properties and 2 joint venture Premier Mixed-Use properties. These properties are the ones with the highest value potential. These markets have also experienced meaningful increases in real estate values recently. For example, per Zillow, the weighted average home values for the group are +49% since 12/17 and +25% in the past year:

a. SRG is developing a 215k square foot retail property (in Phase 1) on a 13-acre former Sears site in Aventura, FL, near Miami. In their Q1 ’22 release, they noted that the development is 90% done and on track to open in Q4 ‘22. This property is well located in an affluent area next to Apple, Louis Vuitton and Tesla stores. As of 3/22, this property was ~63% leased. In a 6/21 presentation at NAREIT, SRG noted that base signed lease rates for Aventura ranged from $56 per square foot to $125 per square foot per year, with a median of $100 per square foot. Assuming SRG leases the full 215k square feet in Phase 1 at an average of $100 per square foot and applying a 70% NOI margin (note: they may be signing triple net leases so NOI may be higher), implies the Aventura property will deliver ~$15 million of NOI per year. Applying a 5% to 6% cap rate results in an estimated value of $250 million to $300 million. By comparison, REIT Realty Income acquired 415 properties in the U.S. in 2021 at an average cap rate of 5.5% and 139 in Q1 ’22 at a 5.7% cap rate (Realty Income’s dividend yield is 4.4%). Given the quality of the location, it is possible that SRG could sell Aventura at a lower cap rate, especially considering the quality of the location, the fact that it is a new construction and that they have a second phase that could add another 100k square feet of space

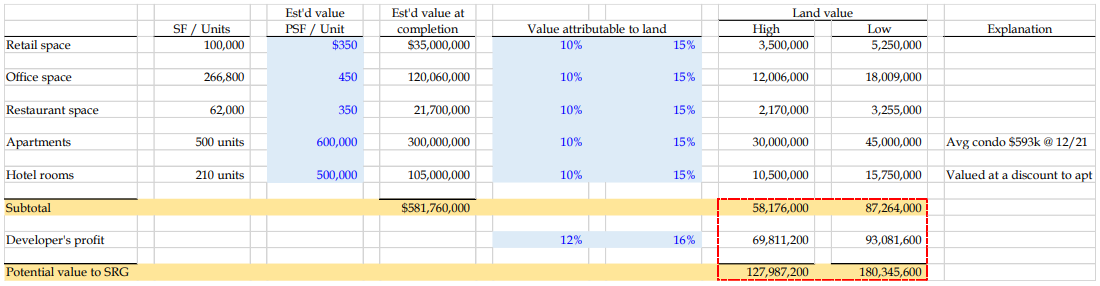

b. SRG owns a 15-acre site in Redmond, WA, about one mile from Microsoft’s headquarters. In Q1 ’18, SRG announced an agreement with a residential developer to pursue a multi-family development on 2.5 acres valued at $16 million ($6.4 million per acre). That deal suggests the remaining 12.5 acres of land would be worth at least $80 million (Redmond’s Zillow home index is up +68% in the past 4.3 years, with the average home worth $1.5 million).

SRG has plans to develop 100k square feet of retail, 266k square feet of office, 62k square feet of restaurants, 500 apartments and a 210-room hotel on this land. Using the estimates below and assuming 10-15% of the value goes for the land would suggest the land alone is worth $58-87 million. Additionally, assuming SRG earns another 12-16% of the value as developer profits, SRG could earn $128-180 million total ($8.5 to $12 million per acre) from the Redmond site.

Even if SRG can’t realize this value alone, this site should be highly valuable to others in the strategic review process given real estate values in Redmond and its proximity to Microsoft headquarters.

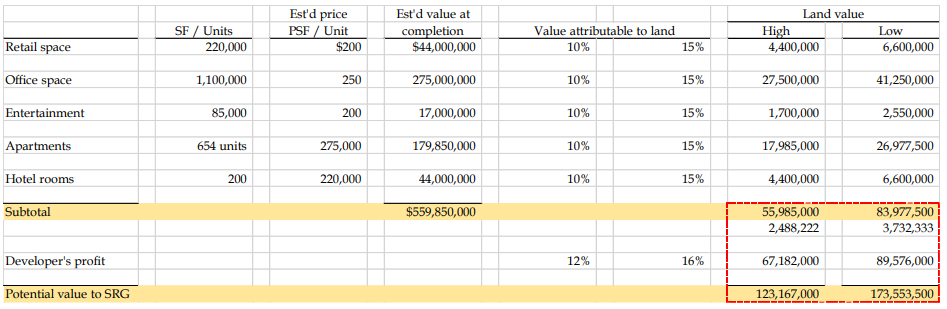

c. SRG hopes to redevelop its Park Heritage Dallas location, a 22.5-acre site. SRG wants to develop 220k square feet of retail space, 1.1 million square feet of office space, 650 apartment units and a 200-room hotel. Using the estimates below and assuming 10-15% of the value goes for the land would suggest the land alone is worth $56-84 million, or $2.5-3.7mm per acre. By comparison, a few smaller, less convenient locations nearby are offered for ~$2 million per acre.

Additionally, assuming SRG earns another 12-16% of the value as developer profits, SRG could earn a total of $123-173 million ($5.5 to $7.7 million per acre) from the Park Heritage Dallas site.

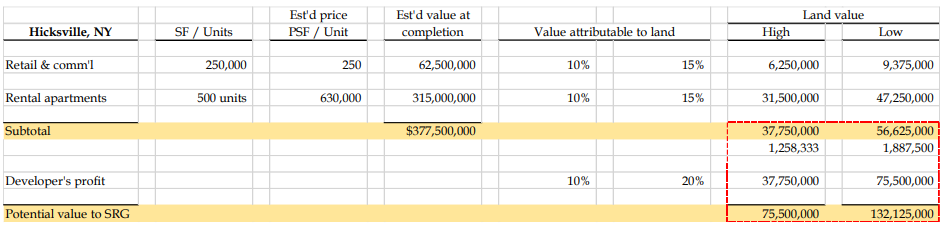

d. SRG owns a 30-acre site in Hicksville, NY, a Long Island suburb of NYC. On this site, SRG is planning 250k square feet of retail and commercial space and 500 rental apartments. Per Zillow, the price of the average single family home in Hicksville is up to $644,000 in 4/22, +33% vs $485,000 average in 12/17, aided by the suburban shift post-Covid. Using this metric to estimate the potential value of the apartments and $250 per square foot for the retail space, the total value at completion could be $378

million. SRG’s potential land value would be worth $38-57 million ($1.3 to $1.9 million per acre), and together with its share of the developer’s profit, SRG could earn between $75-132 million ($2.5 to $4.4 million per acre).

e. SRG has a development in Boca Raton, FL. They had proposed a 244,000 square foot retail project on their 19-acre site, but this appears to have stalled given the pandemic and a lawsuit from Simon Property Group. Simon, which owns the mall next door, claims that it had a right of first refusal to purchase the location if it no longer served as a retail space. I assume this site is worth $1-2 million per acre, or $19-38 million (discount to land offered on Loopnet at $2-4 million per acre), though it is possible Simon would pay more for it.

f. SRG has a joint venture in a life sciences/office, retail and residential property in La Jolla, CA near San Diego. SRG sold a 50% interest to Invesco Real Estate in 5/18 and received $44 million in proceeds. The 193,700 square foot location was remodeled and re-opened in 10/21. In 5/22, SRG announced that Amazon had signed a lease for 123,000 square feet in the property at an annual rent of $68.40 per square foot, or ~$8.4 million per year of gross rent. They didn’t state how long the lease was for, but with an

estimated ~800 Amazon workers moving into the office space early next year, I assume it was for 5-10 years. On a pro forma basis, the property is now ~84-91% occupied.

Assuming the full 193,700 square feet is leased at $75 per square foot with a NOI margin of 70%, would suggest this site can deliver $10.2 million of annual NOI. Applying a 4% to 5% cap rate (given the quality of Amazon as primary tenant) would suggest this site is worth $200 million to $250 million. SRG’s 50% stake would be worth $100 million to $125 million. Notably, SRG and Invesco are “advancing entitlements to activate +/- 8.5 acres of parking lots for potentially millions of additional square feet of life science, office and residential uses”. The joint venture has 12.9 acres in La Jolla, which suggests the buildings that were constructed are on approximately one-third of the land. In other words, there is meaningful future upside potential at the site (Zillow home value index in La Jolla is now at $2.5 million, up +53% in the past 4.3 years).

g. SRG has a joint venture to develop a residential, retail and office property in Santa Monica, CA. SRG sold a 50% interest to Invesco Real Estate in 3/18 for $50 million in proceeds (Santa Monica real estate +15% in the past 4.3 years). The location is near an Apple store and half a mile from the Santa Monica Pier and the Pacific Ocean. This location has been converted to 130,000 square feet of retail and office space. While office space is tough to lease now, I assume they can rent it for $60 per square feet (some older facilities nearby asking between $40-75 per square feet). Assuming an NOI margin of 70% and a 5% to 6% cap rate implies the property is worth $90-110 million. SRG’s 50% stake would therefore be worth $45-55 million. When they announced the JV in 3/18, SRG called the conversion the “first phase of redevelopment” and hinted at a future development on the parking lot, so there could be additional value here as well. Hopefully, they’ll get approval to add multi-family, as the average condo in Santa Monica is worth $1.3 million.

As an additional sanity check, I reviewed six office properties for sale now in Santa Monica on Loopnet. They were smaller sites (5k to 19k square feet) but the asking prices range from $780 / square foot to $1,400 per square foot. This range suggests SRG’s 50% interest could be worth $50 million to $90 million before considering additional development opportunities

To sum, for the Premier Mixed Use properties:

At these levels, the Premier Mixed Use segment would account for 30% to 53% of SRG’s $1.9 billion enterprise value.

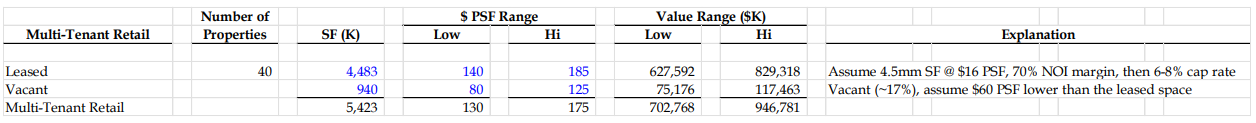

Multi-tenant retail

Next, I valued SRG’s Multi-Tenant Retail assets. SRG has 40 properties with ~5.4 million GLA on 532 acres. Approximately ~83% of the GLA is either leased or about to be leased to a variety of tenants including Dick’s Sporting Goods, Dave & Busters, Round One Entertainment, Amazon, Nordstrom Rack, Burlington Stores and At Home.

To value these properties, I separated the vacant portion from the leased or about to be leased portion. I assumed that the leased portion of ~4.5 million square feet earns $16 PSF of annual rent, at a 70% NOI margin and then applied a 6-8% cap rate (vs Realty Income’s 5.5% purchase rate in 2021). Under these assumptions, the value per square foot (PSF) range would be $140 to $185. For the vacant portion of ~0.9 million square feet, I assumed a value of $80 to $125 PSF ($60 discount to the leased portion).

Under these assumptions, SRG’s Multi-Tenant Retail segment would be worth $703-947 million. At these levels, the segment would account for 37% to 49% of SRG’s $1.9 billion enterprise value.

Joint ventures

Finally, I valued SRG’s joint venture interests. SRG owns stakes in 22 properties, most of which are retail-related. I attempted to value these interests based on nearby land using Loopnet, effectively giving no value to the building or rental income. Land in most of these locations are in the $200-500k per acre range, though there are some more valuable areas including Cerritos, CA (near Los Angeles) and Austin, TX. I then applied a 30% discount and arrived at a total value of $119 million, or about ~$700k per acre (similar to the estimate for the Non-Core properties). The joint ventures would account for ~6% of SRG’s enterprise value.

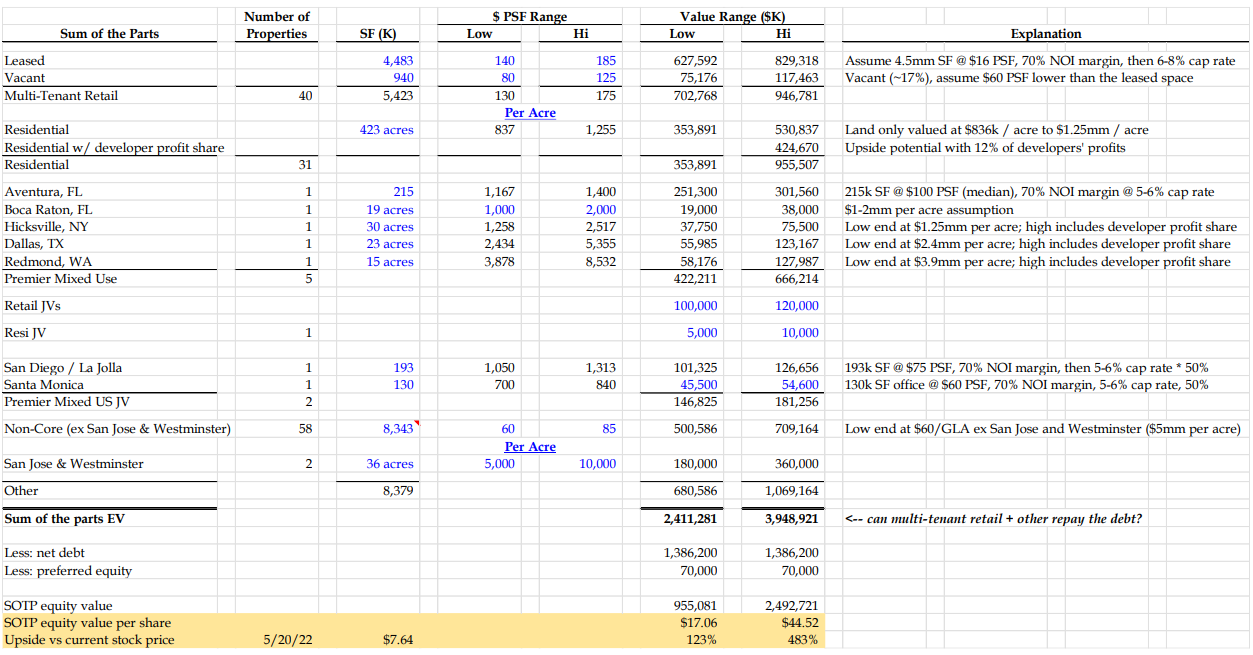

Sum of the parts

In total, my sum of the parts for SRG’s properties:

Even the low end of the sum of the parts analysis suggests more than 100% upside from the current stock price of $8.17 per share. Given the current market for real estate and the inflationary environment, I suspect Barclays and SRG’s other brokers will find multiple bidders for many of SRG’s properties, which should push the outcome towards the middle of the range.

The situation reminds me of something Steve Schwarzman wrote in his book “What It Takes”. Schwarzman said Jon Gray, the head of Blackstone real estate, developed two major insights that accelerated the growth of their real estate business. One of them was that public companies containing lots of properties are frequently valued at less than the sum of their parts. I think the gap between street value and screen value is exacerbated at SRG by the facts: no sell-side analyst coverage, no quarterly calls, spotty management track record, Sears/retail history, ~160 properties (many of which are vacant), etc.

Risks

SRG’s primary risks include:

1. Leverage: SRG has a $1.44 billion term loan held by Berkshire Hathaway. SRG earnings do not currently cover the ~$100 million of annual interest on the loan and opex, driven by the high vacancy rate. The term loan has a 7% fixed coupon and matures in 7/23, or ~14 months from now. If the term loan is repaid down to $800 million (SRG repaid $160 million in 1/23), there is an automatic 2-year maturity extension to 7/25. SRG has not been in compliance with the maintenance covenants on the term loan for a while, so Berkshire has approval rights over all property transactions (they’ve approved all sales to date). In addition, in the latest 10-Q, SRG highlighted potential going concern risk. They also noted that “starting in July 2022… the full amount of the Company’s term loan will be factored in as a… current obligation.”

Although the covenant breach is concerning, I view Berkshire’s involvement as a positive. It is unusual to have a lender with a long-term mindset who will give a borrower time if needed. I’ve yet to find an example where Buffett or Munger took control of a company via the debt in bankruptcy or forced a company into bankruptcy. Not to say that it can’t happen, but I think that would be inconsistent with Buffett’s reputation, which they care deeply about.

In addition, Buffett has made long-term investments in real estate in the past with similar theses to SRG. For example, in his 2014 annual letter to Berkshire shareholders, Buffett recounts a story of a personal real estate investment he made with Larry Silverstein in a retail property near NYU back in 1993 (in 2014, Buffett had held the property for 20 years and seemed to be in no rush to sell it). Part of the thesis was that the property was mismanaged and that the largest tenant was also on a bargain lease, similar to SRG’s history with Sears.

Buffett has specifically called out the real estate as an asset class that performs well during periods of inflation. For example, watch Buffett’s reply in the following clip, 2 hours and 38 minutes in, when asked about investing during periods of inflation (source). In addition, below is a summary of Zillow residential home price indices for all of SRG’s markets (I know commercial and residential real estate are different, but I wanted to gauge how local real estate markets are doing in SRG’s locations). The average market is up +21% in the past year and almost +50% since 12/17.

2. Sales process is unsuccessful: There are no guarantees that SRG will be able to sell its real estate, of course. For example, if a recession begins before they can finalize large real estate sales or their strategic review, that could push back their processes and increase the risk that they can’t repay the term loan by next July.

That said, in their recent 10Q, they cited several specifics that give me confidence. Between 3/31 and 5/10/22, SRG generated $75 million of gross proceeds via completed dispositions of 7 properties. Comparing the properties listed on their website vs their 10-Q as of 3/31/22, I believe they sold the following 7 properties: Anchorage, AK; Elkhart, IN; Paducah, KY; Clay, NY; Toledo, OH; Walnutport, PA; Tulsa, OK. Per this news article, the Anchorage property seems to be the most significant sale at $44 million, or $2.4 million per acre (source). I wouldn’t call these markets the cream of their Non-Core crop.

SRG also stated that they have 9 additional assets under contract for anticipated gross proceeds of $85 million, subject to buyer diligence and closing conditions. Combined with the completed post-Q1 dispositions, they are guiding to $160 million of gross proceeds from 16 properties sold between 3/31/22 and 5/10/22, or $10 million per property.

Beyond the $160 million of completed or pending sales, SRG said they are “currently marketing or about to bring to market for sale, assets with an estimated fair value of $636.3 million, which would, if sold, allow the Company to meet the $640 million principal pay down required to extend the facility.” Assuming all of these sales come from the Non-Core segment, would imply a valuation for Non-Core of ~$796 million (versus the range in my Sum of the Parts of $680 million to $1.069 billion).

Even assuming the $796 million represents the entire Non-Core segment, it would still take the Sum of the Parts equity value to just of $19 per share, or +130% greater than the current market price.

Interestingly, Eddie Lampert resigned from the board the day SRG announced they are exploring strategic alternatives. Lampert noted that SRG’s stock is “currently significantly undervalued” and said he wanted the “flexibility to explore alternatives for [his] investment in Seritage, which could include participating with other parties” in the process. Given the strength of the real estate market, real estate’s performance in inflationary times, the sheer number of properties and processes, I think the low end of the valuation range should be more than doable.

To facilitate a quicker discussion below is my attempt to summarize the key points of the bullish and bearish takes on SRG. On both sides, the main arguments rest on the eventual realizable value of the properties and require various assumptions to be made. Feel free to correct me if any of the emphasis is wrong or if I have misunderstood the story, I am far from an expert in this.

SUMMARY OF THE BULL THESIS

From David (and also VIC commentary bulls):

SRG has announced a strategic review and is looking to liquidate part of its real estate assets in order to pay down its debt (owned by Berkshire) to a $800m level. The market is undervaluing the owned land and redevelopment potential of SRG’s properties. Conservative SOTP equity value stands at $17.06/share with a more optimistic estimate of $44.52/share. The asset sale has already begun – in 5 weeks since March 31, the company sold 7 assets with 9 more under contract with total anticipated proceeds of $160m (25% of what they need for the debt pay down). Together with the strategic review announcement, SRG’s chairman, former Sears chair, and billionaire hedge fund manager Eddie Lampert (who owns 29% of SRG) resigned saying the stock is undervalued and he wants the flexibility to potentially join the bidding for SRG assets. The debt is owned by Berkshire, who is a non-predatory creditor and will likely give SRG enough wiggle-room to sell down the assets without pushing for fire sales at distressed prices. Buffet used to own 8% in his personal account but got diluted, so it’s not clear whether he still owns any shares. The management team is solid with a well-regarded CEO Andrea Olshan (from the Olshan family). Any positive developments including results of the sale process and debt paydown are expected to drive SRG re-rate, which will be further catalyzed by the unwinding of short positions.

SUMMARY OF THE BEAR THESIS

From VIC short report – https://www.valueinvestorsclub.com/idea/SERITAGE_GROWTH_PROPERTIES/1598112691#description

SRG is a melting ice cube with significant cash burn – $30m in NOI vs $100m+ interest payments annually and is “selling furniture to pay debts”. SRG’s portfolio mix is 60% freestanding properties and 40% mall anchor boxes (part of the mall). Historically, most of SRG’s asset sales were freestanding properties, whereas most of the mall boxes are B/C level properties, which are difficult to lease and are generally considered to be toxic assets with significant cash flow risk. Many of these mall boxes won’t find a buyer at any price. The only possible bidders are the actual owners of the adjacent malls – however, they either don’t want those properties or are waiting for SRG to go into distress and then acquire the assets at the lowest prices possible. Given the mall downturn, there is a substantial risk of B/C mall occupancy crumbling down. Premier mixed-use development projects are a failed concept and will have a hard time getting leased out. Non-core assets are bottom of the barrel in terms of location quality – won’t stabilize as retail, can’t be redeveloped as residential, and haven’t found any buyers over the last two years. Overall, the non-core assets sales won’t be enough to cover the debt paydown, while the prompt sale of other assets is also unlikely. The risk of bankruptcy and full equity wipe-out is very high. Berkshire has previously repeatedly refused to increase the loan by an additional $400m that SRG wanted and eventually might be not as friendly as bulls are expecting.

CONTRASTING THE TWO SIDES

The table summarizes the valuation of SRG from both sides. Please note that SRG currently trades below the target levels indicated in the VIC short thesis for a “very optimistic” scenario with all positive assumptions already being priced in. The report was written at $12.2/share price levels.

David, would really love your thoughts on the risks/bear points outlined above and in the VIC article. If the figures in my table above are directionally correct, then the key difference between bullish/bearish takes is the valuation of the non-core assets.

Also how likely do you think the bankruptcy/equity wipeout scenario is?

Without understanding zoning, I think per acre estimates are tough to rely on for vacant/redevelopment assets. What really matters for valuation is current right-of-use or likely potential re-zoning options which can then provide an idea of potential FAR to get to a price per square foot valuation. I would guess that in a lot of the nicer residential areas it may be tough to get zoning to allow a bunch of new FAR (NIMBY).

From my understanding, the company’s assets are not in high demand real estate (i.e. single family homes) and therefore interest rates going up will probably be a significant headwind

I would second this and it is the primary reason I have passed. I’ll preface with saying my background is heavy skewed to CRE investments, including several use changes and property conversions, and I am struggling to get many of these asset to pass the napkin math stage. Zoning changes are a double edge sword. Easier in the less valuable markets, and painfully slow in the markets where the use change or new construction would produce the most value. I think a prudent approach would be to look at this as dirt value pricing and if it ever gets close to that level then it’s a no brainer.

I called a broker who was selling their vacant San Jose property. He told me he got 7 bids and winner put down a hard cash deposit.

We shall see what the price was soon, but I’d say that many of their assets are very much in demand.

We shall see but Im sure management, CBRE and Barclays considered the specifics of zoning and other considerations before publishing the $18.50 to $29 per share estimate.

A positive update for SRG. The debt agreement with Berkshire was amended to allow for the sale of properties without Berkshire’s consent. Some conditions remain, such as that proceeds can only be received into a controlled account and used for agreed purposes only, namely loan repayment.

https://www.bamsec.com/filing/89534522000495?cik=1628063

Seemingly positive update – Green Street report came out saying SRG has put its multi-tenant retail portfolio (38 properties) on sale. This portfolio generates $63m in NOI. At 9% cap rate, it implies $700m valuation (vs $640m outstanding debt).

https://twitter.com/GreenStreet_CRE/status/1539358268606259200

https://www.sec.gov/Archives/edgar/data/0001628063/000119312522189568/d384540dprem14a.htm

They are voting to dissolve company. Eddie Lampert has voted for it. From the proxy:

“After selling all of our assets and paying off all of our known liabilities and expenses, and making reasonable provisions for any unknown or contingent liabilities, we expect to distribute the net proceeds of our plan of sale to our shareholders. Based upon management’s review and evaluation with its advisors, including CBRE, and with input from the Special Committee’s financial advisor, Barclays, if the plan of sale is approved by our shareholders and we are able to successfully implement the plan of sale, we have estimated, based on data and information reviewed by management of the Company as of or prior to early June 2022 (without taking into account macroeconomic, market or other factors after June 7, 2022), that the Estimated Total Shareholder Distributions Range will be between $18.50 and $29.00 per share. “

As a Canadian, do I have to worry about the liquidation distributions being subject to withholding tax? Hinges on paid-up capital or something?

David, does this actually change anything from the thesis before?

The biggest question was always the value SRG can achieve for these assets rather than management’s willingness to monetize them.

Thanks.

I’d say so.

Before last week’s news, it wasn’t clear that management would pursue a sale of all the assets. I view this as bullish news. After all, the thesis is that the public markets are not valuing these assets any where near where the private markets will.

The fact that management wants to pursue a liquidation and with that, effectively terminate their jobs is noble on their part. They are putting the interests of the shareholders ahead of their own.

They also put in the proxy the $18.50 to $29 per share estimate. This figure was in consultation with CBRE and Barclays. I would assume they’d wouldn’t have put in a figure like this unless they were confident it is achievable.

Is there any indication of potential timeline for liquidation of these assets/RE? If their $18.5-29 estimate has some truth to it, calls barely indicate $17 upside out to Jan 2023. Lottery ticket could be worth it….but that would be well worth it only if mgmt indicated a timeline.

Here is their quote from the proxy: “If our shareholders approve the plan of sale, we will seek to sell all of our assets and make shareholder distributions as soon as practicable in order to maximize shareholder value, and we estimate, based on the information available as of the date of this proxy statement, such sales will be completed within 18 to 30 months after the plan of sale is approved. ”

I suspect the vote may happen next month, so timeline is within 19 to 31 months from now. Most likely, the proceeds will be distributed piecemeal and the final dollars to come in month 19 or month 31.

Having been a shareholder for a while, I must say this idea was timed well. Although I’m a little disappointed with the prospect of full liquidation. I would rather they get rid of the debt overhang and keep at least one of the prime properties whose square footage could be densified.

We should know more after Q2 earnings are released, possibly next week, but a check of their website shows that there are currently 140 properties listed vs 161 properties at 3/31/22 (https://www.seritage.com/properties ). So they have closed 21 property sales in the past 4 months, with more pending (e.g. San Jose is in contract but still on the list).

I view this positively. It shows the management is serious about selling and that there are buyers for the assets. Notably, many of the properties that were sold are not SRG’s most desirable. Furthermore, management and their advisors clearly knew these sales were on the way when they posted their proxy in early July. As such, their $18.50 to $29 per share sales target seems more credible.

More to come after earnings are released.

The recent Q2 reported only 150 properties as of June, with most of the properties sold during the quarter being residential. Meanwhile, the website now shows 129 properties, suggesting that a further 21 properties were sold since the end of June and 11 since David’s comment a week ago. Property sales in Q2 were significantly above their book value at – $163m versus $95m in carrying amount. Total proceeds (including sales in July-August) were at $266m. Pending asset sales under contract are at $261m with another $1.2bn in property sales expected to be closed before Jul’23.

Recently, the company also made a voluntary prepayment of $100m on its debt to Berkshire. $1.34bn of the loan remains outstanding. The remaining paydown required to extend the loan now stands at $540m. SRG was up 10% after the earnings release and now trades 60% above write-up levels.

A minor update – shareholders’ meeting date to vote on the liquidation has been set for the 24th of October. The expected liquidation value range of $18.5 – $29/share is unchanged.

https://www.bamsec.com/diff/view/1628063/119312522244738/1/119312522235309/1?token=119312522244738-1-119312522235309-1.v6M12ogpgbJ6KWV1Zdur06HlzQQ

SRG is interesting again. I spoke to the CFO this week.

* Reading between the lines, they are pursuing the vote based on advice from their counsel. Since the Multi-Tenant Retail (MTR) assets drive all or substantially all of their revenues, counsel believes they need shareholder consent to sell the entire portfolio.

* They are currently marketing the MTR portfolio to potential buyers. He couldn’t give specifics, but said they have had multiple bidders for all of their properties so far, even the ones that aren’t in great locations (e.g. Toledo, OH, Clay, NY). I told him that I assume that Multi-Tenant Retail is worth $700-900 million. He said that seems about right. Hinted that they are trying to line up bids and purchase agreements before the vote next month.

* If the vote goes through, they will likely sell the entire Multi-Tenant Retail portfolio shortly thereafter, with a close in 1-2 months. Adding the $700-900mm of anticipated proceeds plus the proceeds of sales that have closed since 8/8, I estimate they will have $800mm to $1.1 billion that could prepay the term loan, likely by year end. At that point, they have ~$300mm to $600mm of term loan plus preferred in front of the equity, assuming no further asset sales. They’d also have ~80-90 properties left including the most valuable premier assets (Dallas, Redmond, Aventura, Hicksville, La Jolla, Santa Monica).

* If the vote does not go through, they sell a portion of Multi-Tenant Retail, but not all. They should still be able to pay down $540 million to get to the magic $800 million number by year end. At that point, they’d get the two-year extension on the term loan to 6/25.

* They are marketing the Dallas and Redmond properties. There is more demand for the portion that has been entitled for residential. He suggested that might sell a portion in short term and then try to get the entitlements so that they can unlock more value later.

* If all goes to plan, he guided to having the term loan and preferred repaid in full by Q3 of 2023. Then, they would start making payments on the equity periodically. The last dollars could come in over the next 18 months. So I assume some equity payments come 12-30 months from now.

* I asked why they haven’t used cash to repay debt. Believe they were waiting for the legal settlement to be finalized and also will likely carry more cash to fund any capital calls to JVs, UTC for Amazon, etc. That said, he left open the possibility that a paydown could come in next month.

This feels like good value again now. They narrowed the range of expected proceeds to $18.50 per share to $23.75 per share, suggesting +75% to +125% of upside over the next 2.5 years.

Most importantly, assuming the vote goes through and management can sell MTR in full, the priority debt balance falls dramatically. The possibility of a liquidity squeeze or Berkshire taking control and liquidating the company goes away. They would then have two years more of runway and a lot of valuable assets still remaining to be sold. Even the ones that aren’t in market officially are no doubt being evaluated. Plus, the comment about multiple bidders for all properties sticks out. If multiple parties bid on the properties in smaller markets, it is a good sign for the remaining ones.

If the vote passes, could they still keep some premier assets, continue densifying and persist as a going concern? Or would they be obligated to liquidate and shut down?

Not sure of the legality. Would not be consistent with the intent though. I can’t imagine it would be cost effective to have a public company to do that.

In my view, management is acknowledging what the market has been saying for years. Basically, no interest in this as a public company and stock price reflects that. But in private markets, these assets are worth more. Hence, liquidate and move on and everyone should be happy.

SRG has repaid a small amount of $70m on its BRK loan. $1.27b of the term loan facility remains outstanding.

https://www.bamsec.com/filing/95017022019149?cik=1628063

According to their website, SRG has 118 properties left (versus 129 in mid-August and 150 in late June).

https://seritage.com/properties

As a reminder, the shareholders’ meeting date to vote on liquidation is due October 24.

Over the last couple of weeks, Eddie Lampert sold about $4.5m worth of stock at $9.55-$11.82/share. Still, a tiny portion relative to his stake/net worth, so probably nothing much to read into here?

Seritage posted a sale process update today, one week before a shareholder meeting where the results of its liquidation vote will be announced. The highlights:

* From 3/30 to 10/13, SRG sold 45 properties and JV interests, generating $411mm of gross proceeds.

* More importantly, as of 10/13, the company has assets under contract for sale for anticipated gross proceeds of $400mm.

* Additionally, SRG has accepted offers and is negotiating definitive purchase and sale agreements on assets with offers of ~$670mm.

Assuming they close on the assets under contract and the accepted offers, the $1.07bn of gross proceeds could nearly repay the $1.27bn Berkshire term loan in full. Recall that SRG needs to reduce the loan by $470mm before next June to get an extension.

Separately, many properties have been removed from Seritage’s website. Currently, there are 115 properties listed, down from 150 as of 6/30.

Most recently, SRG’s North Miami, FL property was removed. This is one of SRG’s valuable Multi-Tenant Retail properties. The 129,300 square foot North Miami location was 100% leased to Aldi, Burlington, Ross and Michaels. The fact that it was removed individually is a good sign – I believe the best way to maximize proceeds is to sell these properties individually, where they will attract more buyers, rather than as a portfolio.

With this update, Seritage’s bankruptcy / liquidity risk is reduced dramatically. If all of these sales close and the pace continues at this pace, it possible that the loan could be repaid in full by early next year.

More broadly, this update suggests that management is delivering on its plan and is ahead of pace. Interestingly, they did not mention the $18.50 to $23.75 per share target sale price, which to me suggests it is still intact. Based on the current stock price of below $10, there is still an opportunity to double your money with Seritage.

As for catalysts, I see a few:

* Outcome of the 10/24 liquidation vote. If approved, I believe we will see asset sales, particularly for the Multi-Tenant Retail portfolio, accelerate.

* Additional sale closings and debt paydowns.

* Short sellers realizing that their thesis is refuted. If the term loan is materially repaid and there is no longer a bankruptcy or liquidity scare looming, I’d think many short sellers will cover. ~15% of the shares were sold short (and an even greater share excluding ESL’s shares).

Shareholders approved the liquidation plan on October 24.

https://www.bamsec.com/filing/119312522267589?cik=1628063

Last Monday 10/24, shareholders voted to approve liquidation. Now SRG free to sell any and all assets.

$110mm loan payment occurred on Friday, 10/28. Term loan down to $1.16bn now. They need to repay another $360mm by end of June ’23 to extend maturity to June ’25.

Now there are 109 properties listed on the Seritage website, down by 41 since 6/30. Suggests they have sold and closed ~30% of their properties in just 4 months.

If the pending assets and accepted offers that they stated on 10/17 close, they should be close to repaying the term loan in full. At that point, the equity risk diminishes considerably.

Just skimmed the old short case from VIC above. I think it has been largely refuted already and will be clearly refuted post Q3 results. They’ve sold down from 160 properties at 3/31 to just 109 properties now, so nearly 1/3 of properties sold in 7 months. The properties they have sold are in less valuable locations compared to what remains. Also, they’ve stated $400mm of pending sales and $600mm+ of accepted offers as of a few weeks ago, so another $1bn of potential asset sales in the coming 2-3 months. At that point, they can almost entirely repay the term loan in full. So the bankruptcy / liquidity / cash burn risk will be largely diminished.

108 properties left, now.

Seritage posted Q3 results yesterday. Most importantly, they provided an update on the asset liquidation process.

In terms of history to date, here is a summary of the properties they have disposed of:

Notice that the pace of the sales has increased meaningfully this year. In just over the last 4 months, they have closed on the sale of 44 properties, nearly 30% of the 150 properties they owned at 6/30/22.

More interestingly, they provided guidance on future asset sales:

I was pleasantly surprised that the pace appears to have continued or even improved. The gross proceeds for the pending sales and accepted offers is also 56% higher than all of the YTD sales through 11/4.

I’d expect these sales to be completed over the next 3-4 months. As the sales are completed, expect the company to repay the term loan. As such, assuming the 58 sales occur, Seritage will be able to reduce the $1.16 billion term loan balance to under $300 million. So, it is possible that in 4 months, the capital structure of Seritage could be:

At this point, the leverage / liquidity risk that Seritage faces will be dramatically diminished. The term loan maturity would be pushed out to June 2025 once the term loan balance falls below $800 million (pending asset sales of $546 million alone exceed the $360 million debt paydown requirement by over 1.5x). The company would still own 51 properties. Key to understand which properties are included in the 51. I’m checking with management, but believe they would still own most of the highly valuable properties (e.g. Dallas, San Diego, Redmond, etc).

Last month, management guided that the ultimate shareholder distribution proceeds are expected to be in the lower half of the $18.50 to $29 per share range in the proxy. They have not updated guidance since; I assume this means they still expect the proceeds to fall within this range. Comparing the PF capital structure suggests:

This suggests that management’s estimates for the value of the final 51 properties could be overstated by $424 to $718 million before a stockholder at these levels would lose money. I’ll post if I can confirm which properties are included in the 51.

As the tables n David’s comment did not upload correctly, please find the full update in this file:

http://ssi.wpdeveloper.lt/wp-content/uploads/2022/11/Update-for-SRG-1122.pdf

I have been asked to be more specific about timing. I believe it will play out as follows.

First, I noticed that the Columbus, MS property came off of Seritage’s website on 11/11. This was a property that was auctioned off on 10/12 (https://cdispatch.com/news/2022-09-24/kmart-building-slated-for-online-auction-in-october/ ), which suggests 30 days from sale to close. I suspect auction sales like this one have no diligence contingencies. As such, I believe SRG will receive $125 million from 10 property sales sometime in November and would expect a $125 million term loan paydown this month. The term loan balance will decrease to just over $1 billion.

Next, I believe that property sales subject to customary due diligence will take longer, perhaps another 30 days. I expect the 26 properties sold for $422 million to close sometime in December. I think we will see a similar amount of debt paid down, taking the term loan balance to about $620 million by year end.

For the accepted offers, my guess is that Seritage is currently negotiating these contracts, which could take a month. After that, the closing could occur 1-2 months later. So I assume the $299 million of proceeds from these 20 properties will occur by the end of January. A term loan paydown in this amount would take the balance down to ~$320 million by January 31.

Finally, the put options were exercised for $66 million or more. The timing is a bit more uncertain here but would likely still happen in Q1 2023 at the latest (since these are JV deals, the counterparty should not need diligence as they own half the property currently). A term loan paydown could take the balance down to ~$250 million.

The good news is that we can track the properties regularly on Seritage’s website. Se we will have a good sense of timing of closings. Also, we will know what the final ~50 properties are in Feb/Mar of 2023 (assuming they haven’t sold by then).

I had a helpful call with Seritage’s Interim CFO. My key takeaways.

* The biggest risk facing Seritage is its $1.16 billion term loan, which is due to mature in June 2023. To get a 2-year extension, Seritage must repay $360 million by June 2023. The company’s current projections have them repaying below the $800 million level “by the end of Q1 2023, possibly sooner”. There are several paths to repay the $360 million, and management is “very comfortable” that they’ll do so.

* Interestingly, there is a path to completely repaying the $1.16 billion in full by June 2023. They should get close and will have a better idea of precise timing in early Q1 2023, once they know more on a few multi-tenant retail assets that are pending / up for sale.

* In terms of the remaining ~50 assets that have not yet been sold or have accepted offers (note: as of 11/4; sounds like sales activity has continued), they still own most of their valuable premier mixed-use assets, including Dallas, Aventura, UTC/La Jolla, Redmond and Santa Monica. The only premier asset mentioned as having an accepted offer was Hicksville, though he said the press report was not entirely accurate on that one. They also still own a good chunk of multi-tenant retail assets, although several have accepted offers currently. They also have a decent number of residential properties; they are working on entitlements before putting them on the market.

* In terms of ultimate proceeds to shareholders, he said that as of late November, the sales and accepted offers are trending “above the low end” of the $18.50 to $23.75 per share guidance. He didn’t get more specific than that, but my sense is that they are probably tracking in the $20 to $22 per share range. I suspect this is one reason why they haven’t mentioned the range in recent news releases (no update means range still their current thinking).

* On the timing of asset sales, he said that the sales pace to date has been faster than they expected. Interestingly, increasing interest rates and the higher cost of debt financing seems to be weighing on the more valuable properties like Dallas, Santa Monica and Redmond, whereas the smaller properties in secondary and tertiary markets can “easily be financed via local banks”.

* He guided that ~75% of the proceeds from pending asset sales will be used to repay debt. Part of the holdback will be for capex and tenant improvements for Aventura and UTC / La Jolla, though they expect to recover these amounts when these properties are sold.

* Phase 1 of UTC / La Jolla is complete and 97% leased, mostly to Amazon. They are currently trying to obtain entitlements for Phase 2 and Phase 3 of UTC, with support from many in the community. While Seritage could sell Phase 1 as is, there should be more value selling the property together with Phases 2 and 3 and/or once the entitlements are known for Phase 2 and 3.

* In the current environment, he said that deals with no diligence contingencies and the put options Seritage exercised have close to 100% certainty of closing. It usually takes 45-90 days from signing of a purchase and sale agreement to close, while the exercised puts could take 90-180 days to close.

* Deals that are subject to diligence and accepted offers have a 70-80% chance of closing in the current market. Since it takes 1-3 weeks to sign a purchase and sale agreement after an accepted offer, these deals could take between 45-90 days to close for those with a purchase and sale agreement and 55-110 days from the time of an accepted offer.

* I prepared the above summary using his guidance. The probability weighted proceeds from the assets under contract + accepted offers is $730 million. Even assuming 25% is held back for capex and to cover operating cash burn, they should still have nearly $550 million to repay the term loan down to ~$600 million.

* He didn’t mention specifically, but I got the sense that Seritage continues to market and sell properties, with more accepted offers since the announcement on November 4. My guess is that they now have more than a $1 billion of assets under contract and accepted offers (ignoring any closings in the interim).

* In terms of the exercised puts, he noted that the $65.7 million minimum figure in the 10-Q for the 2 properties refers to the amount that Seritage’s joint venture partner is offering to buy out their interest. Seritage believes the value is higher, but it will depend on a negotiation and/or a third party appraiser. The delta is likely in the 5-20% range, so the $65 million could become $70-80 million for the 2 properties.

* I also asked about the risk of this liquidation. He said it is in the middle of the pack vs other liquidations he has been involved with, though it is easier than liquidating an operating company given all the hard assets.

Overall, the tone of the call was positive. The only negative takeaway is that the debt financing climate is hurting their ability to monetize the premier mixed-use assets.

On the other hand, the comment around the potential for repaying the debt in full by next June was interesting. This signals that the asset sales are tracking nicely and prices realized are solid. If they repay the debt in full, I estimate Seritage will still own ~30-40 properties in the middle of next year, many of which will be in valuable real estate markets e.g. Dallas, Redmond, San Diego, etc. At the current price of $11.39 per share, the market is valuing these properties at ~$640 million vs a $1.1-1.2 billion potential value if the ultimate proceeds are $20-22 per share. That 43-48% discount worth $480-595 million feels like a decent margin of safety to me.

I’ll continue to track the assets on their website to get a better sense of when closings are occurring (103 properties listed as of 11/28). The website should be a leading indicator of debt paydown notices. I’d expect to see periodic debt paydowns approximately at the end of every month.

Seritage announced this morning a $100 million loan prepayment on 11/30.

I expect $100 million per month of prepayments for next couple of months, then an increase for the following months. There is a chance they’ll fully repay the $1.06 billion on the term loan by next summer.

How do you think about the if the high interest rate will affect the sale of its assets?

For the ~$1 billion of pending asset sales, higher interest rates shouldn’t have much of any impact, as prices are already determined.

The CFO told me that financing for deals less than $10 million have seen no impact, as there are local banks willing to step up to finance with little or no change. I assume with equity, this probable means up to $20 million purchase price.

There is an impact on the large properties that require $50 million+ in financing. There are probably a dozen or so properties that are worth this much e.g. Redmond, Dallas, San Diego, Santa Monica, Aventura. Not sure how much of a hit in value they will see from higher interest rates, but I suspect it will be a couple dollars per share (e.g. if all of these properties worth $700mm to $1bn and values hit by 10-15%, that could be $100mm of lower value or ~$2 per share).

Also bear in mind that with higher interest rates and inflation, should mean higher rental rates. Real estate tends to hold value well in such times.

Finally, the impact should be low $20s proceeds to $19-20, since the pending asset sales should be able to cover the debt entirely. Then the debate is that the remaining properties are worth and how long to monetize. They are ahead of plan to date.

Thanks for your explain and hard work.

Another $30m term loan prepayment to Berkshire. $1.03bn is still outstanding.

https://www.bamsec.com/filing/95017023000015?cik=1628063

Seritage just posted an update on liquidation.

They repaid their term loan balance down to $800mm, so now have a maturity extension to 6/2025. Also have >$100mm of cash on balance sheet.

They have $489mm of pending asset sales, half of which have no contingencies. If/when these close, gross debt should decline to just over $300mm (ignoring cash).

They are negotiating $95mm of pipeline sales. If/when these close, gross debt could decline to just over $200mm.

It is feasible that company could retire debt in full by mid 2023.

On the other hand, environment worsening for sale of higher quality properties, which rely on financing. Higher interest rates are hurting.

That said, the last time I spoke to CFO at end of year, it sound like sales were mapping to a low $20’s price for shareholders.

I’m biased, but I think short thesis now refuted (with 2.5 years breathing room and pending sales taking priority capital to ~$200-300mm on net basis).

https://ir.seritage.com/news/news-details/2023/SRG-2022-Year-End-Business-Update/default.aspx

I thought this was an interesting way to play SRG with put options. A bit outside of my scope.

https://assets.empirefinancialresearch.com/uploads/2023/02/Seritage-Growth-Properties-Matthew-Peterson-2-2-23.pdf

Seritage has dropped about 10% so far today, to ~$10.8. I’m not seeing any news or filings, but perhaps I’ve missed something.

I can’t find anything either

I can’t find anything either, but I see big options volume, especially in the back months. Maybe someone stuck with a big delta position ? That would also explain the slow down since the up-tick rule kicked in (i.e. he has to sell short, it is not a long liquidation).

I haven’t seen anything. I’ve seen some chatter online like maybe Lampert is caught in a margin call or something. Who knows?

I view the most recent data points from management as a positive. They had about $580 million of pending sales as of early Feb. Perhaps some fell through but they could have also added some since early Feb. Assuming they use those proceeds to repay the loan, they’d have about $300 million of priority capital and $600 million equity value, so PF $900 million EV. Implies an EV discount of about 33% at least.

Feels like a safe cushion to me. Going to reach out to some people in the CRE business for some additional checks but nothing has changed my view on SRG so far.

SRG reported annual results and the stock is down 9% on the day. The market was likely disappointed by the contracted sales pipeline being significantly smaller today vs what was reported in the beginning of February. Only $6m of additional assets were sold, but ‘assets under contract for sale’ decreased from $489m to $366m. So it looks like some of the previously negotiated sales have fallen through. Obviously not a good sign, but I do not think this breaks the investment thesis.

In the annual report SRG also has a note on additional $90m proceeds from put options. These are mentioned under capital and liquidity sections and I am not sure if these are anyhow related to the decrease in the contracted asset sale figure.

“Additionally, we are currently negotiating the pricing on three put options that we have exercised. We anticipate proceeds from the exercise of the put options will be at least $90.0 million”.

Another point worth noting is that every subsequent SRG press release appears to have an increasingly longer note on challenging market conditions and its potential effect on shareholder distributions. Among other changes:

Feb market update – “All of these considerations may impact the amounts and timing of distributions to shareholders.”

The latest market update – “If these challenging market conditions persist, then we expect that they will impact the Plan of Sale proceeds from our assets and the amounts and timing of distributions to shareholders.”

David, any additional thoughts on Q4 results?

The way I see it, they don’t have a huge time pressure anymore, which makes me feel more comfortable that they can weather the storm and eventually sell at favorable prices. Granted, the timeline for a full sale is likely to extend. But I wonder if I’m missing something.

I think the time pressure is rising interest rates and the run on uninsured deposits of community banks, which have 67% of all commercial real estate loans and will be hard pressed to lend in this environment. This will continue to lower the market value of their properties. It would be better if they moved faster and lowered their estimate of return to shareholders (say to $15-20 per share).

It has been a slow month+ since the early Feb release. Not much headway made recently.

That said, I look at SRG this way.

– First, they repaid term loan down to $800 million. No maturities to deal w/ until 7/1/25.

– They have $327 million of assets under contract for sale w/ no due diligence continency.

– They have 3 puts they’ve exercised where they’ll receive at least $90 million in gross proceeds.

– They have accepted offers and are negotiating sale of an additional $98 million of properties. Also have 5 others sold w/ diligence outs for another $40 million gross.

– Adding up the sales proceeds, you get over $550 million. So they could continue to repay term loan down to $250 million.

– They have $97 million of cash at 3/6/23. So PF net debt assuming all these deals close is ~$150 million. Adding in the $70 million of preferred and you have net $220 million of priority capital.

Stock is currently trading at $9.70. That is about $545 million of equity value. So PF EV is ~$765 million currently.

Management did not lower the expected proceeds range. There is some legalese that if market conditions continue, proceeds could be lower and take longer to achieve. Last range is $18.50 to $23.75. Even at $18.50, there is a ~$500 million cushion between the low end of the range and the current equity value / enterprise value. So ~40% or so.

Granted, a lot of stocks have gotten cheaper recently, but this feels like decent value. As they continue to close sales, the remaining assets will be the ones in the best locations e.g. Redmond, La Jolla, Dallas, Santa Monica, etc. There are also some tax assets; I’ve seen some chatter that this could encourage a buyer for the whole business potentially.

Even without that, you have 50%+ upside with limited downside assuming the property sales close. Would need real estate to fall in value 40%+, which seems unlikely given inflationary environment.

Tbh, looking at how this name is ticking down (currently @ 7.55), very likely that range will be lowered down. Surely, there are some technical conditions (derivatives etc) and panic selling but I wonder where the new range would be ? Any estimates anyone ?

I’m more worried the time and cash burn. Now with banks tightening lending standards and worries about office and commercial RE, it might take a lot longer for SRG projects to be sold (especially the large premium development projects, if they cannot sell them in a period of time SRG will put into a trust and market will value this remaining properties at a large discount. I agree there might be a big value spread now with current share price and target price, but would it be worth it with uncertain waiting time? the longer you wait, the more cash burn and less value in terms of company equity… Its more about whether there are more opportunities other places… I was a shareholder and now I exited and deployed my capital elsewhere. If SRG continue to drop like crazy, I might re-enter. Best luck everyone!

FWIW, Matt Peterson, who was a large holder (apparently ~1%), appears to have reversed course and closed his position.

https://www.youtube.com/watch?v=dq9-Qip3Cew

Peterson Capital Management on exiting SRG. Thoughts?

https://youtu.be/dq9-Qip3Cew

Don’t follow him

For those who didn’t have a chance to listen to the Peterson Capital Management podcast, here’s a quick summary of my notes.

TLDR: Petersen sold his position and generally thinks we are very early in witnessing the cracks, the situation could get much worse.

– Peterson Capital Management was a 1% shareholder, now sold the position. Played it through common stock and options.

– Peterson has been valuing individual SRG’s properties since it had 200 of them and it seems the fund has been pretty accurate with the valuations thus far.

– Thinks management will not reach the disclosed price range target. Thinks closer to $12/share is more likely and $18/share seems too optimistic. However, the timeline has been greatly extended. He also says there is a decent chance shareholders will only receive $3-$8/share in the next 1-2 years and the rest of the properties will get moved into the trust and will then be liquidated most likely in 2026 or similar. In other words, the upside looks muted as SRG has a fixed amount of properties that are seeing price declines. The downside is becoming much greater. Thinks NPV is now negative.

– The main problem is that the macro environment has changed mostly due to rising interest rates. This has a massive impact on property values through cap rates. Borrowing is also becoming more difficult which is decreasing demand for the remaining properties.

– Peterson thinks we will not see any distributions by at least Q2 2024. If so, the share price will be kept suppressed and SRG will likely trade at 30% NAV due to uncertainty and the time value of money if shares go into liquidation trust.

On the positive side, Petersen doesn’t see any liquidity issues and says the remaining portfolio is very much manageable, just that the upside has been greatly reduced.

Interested to hear other thoughts.

I wonder if he is assuming rents stay constant. If rent goes up with inflation, it offsets the effect of rising cap rates on property values.

I did not catch Petersen saying anything about rent increases. He only talked about the negative effect of rising cap rates on property values. The potentially offseting inflationary impact on rents was not discussed.

Q1 release today:

https://www.sec.gov/Archives/edgar/data/1628063/000095017023011686/srg-ex99_1.htm

Any thoughts ?

I think this update is quite positive. Overall, SRG seems to have accelerated the pace of property sales over the last couple of weeks:

– YTD SRG sold 27 properties for total proceeds of $290m vs $239m in mid-March. Basically, SRG sold 9 more properties in a couple of weeks for an incremental value of $51m.

– The cash balance increased from $97m at the beginning of March to $130m today.

– $456m worth of assets are under contract or with accepted offers versus $366m at the beginning of March.

– Further $65m of asset sales are in the negotiation stage.

– Currently, 78 properties are remaining with 34 properties already in the sales pipeline and further a 18 expected to be sold during 2023.

The CEO of Seritage recently participated in a panel on Real Estate hosted by the Milken Institute, during which she made some interesting comments about SRG (albeit she might not have had an option to speak otherwise) .

At the 15-minute and 40-second mark, she expressed confidence that the sale of the non-core, small-dollar, and less attractive properties will continue without any issues, mainly because these sales are done within local communities with close ties to local banks. However, she noted that there are basically no bids for larger, premium assets given the current financing environment.

At the 60-minute mark, she made another noteworthy comment regarding the potential sale of the company. She stated that soon enough, they will have their “best properties in a debt-free vehicle with a lot of NOLs, and it might get really interesting not this year, but not far off.”

Here is the link to the panel video:

https://milkeninstitute.org/panel/14617/funding-real-estate-win-lose-or-draw

Reading between the lines, is that a suggestion that the best properties might be held and produce income for a while, rather than be liquidated for unfavorable prices? I’m kind of hoping that the liquidation gets called off after the debt is fully repaid, but I don’t know whether that’s a possible outcome (perhaps another shareholder vote?).

SRG released Q1’23 results with a few small updates since the last trading update in April. While the pace of asset sales has moderated since early April, the contracted as well as negotiation-stage sales pipeline has remained robust. The company seems to be on track to substantially repay its $800m term loan this year.

More details from the Q1 report:

– Since the end of March, SRG sold 4 additional properties for incremental proceeds of $21m. Total YTD proceeds from asset sales are now at $312m (vs $291m as of March 31).

– Cash balance has increased from $132m (end of March) to $144m (May 8).

– 19 properties are under contract for sale, with estimated proceeds of $334m. This compares to $456m worth of assets under contract at of the end of March. However, the difference seems to have come primarily from SRG’s exercise of its put rights that are expected to deliver $106.5m in proceeds.

– Assets under sale negotiations went to $103m vs $65m as of late March.

– 74 properties are remaining, with 34 in the sales pipeline and another 17 anticipated to be sold in 2023. SRG’s website now lists 68 properties.

If the listings on SRG’s website are in any way indicative of property disposal progress, then the pace of asset sales has picked up again. In three weeks since the release of Q1’23, the company removed 14 properties from its website, leaving a total of 54 properties listed.

Additionally, the company just announced a $200m pre-payment towards the Berkshire loan, reducing the remaining balance to $600m.

https://www.bamsec.com/filing/95017023024627?cik=1628063

See here for a recent write up on SeekingAlpha.

In the comments they note that the premier property at Hicksville has been taken down from the site which was under contract for over 50m.

https://seekingalpha.com/article/4608718-seritage-stock-time-to-get-greedy

SRG continues to paydown the debt. Company is down to $550m after making an another prepayment worth $50m today.

https://finance.yahoo.com/news/seritage-growth-properties-makes-50-105500059.html

Looks like SRG just sold one of it’s JVs to its partner, 819,000 SF.

https://finance.yahoo.com/news/macerich-acquires-remaining-50-interest-100000054.html

I’ve been trying to model their quarterly burn and if my assumptions are right it should be declining significantly starting this quarter. My model is based on forecasting operating costs, property taxes and G&A as a conservative percentage of remaining real estate holding values and it has burn declining from -$20M in Q1 to -$14M in Q2, then -$12M, -$6M, and breakeven following three quarters. We’ll see how accurate that is next quarterly but if it and my sales forecast is anywhere close we end up paying off Berkshire in Q1 next year with an approximately $10/share book value.

That’s modeling sales at carrying value, though they’ve been consistently selling well above it. My math on 2023 sales with reported sale prices on works out to $79M in proceeds for properties carried at $62M. But there is a reasonable presumption is the worst quality properties are left, so the risk is we get less than carrying values going forward.

“But there is a reasonable presumption is the worst quality properties are left” – I agree, that sounds reasonable assumption to make, but management continues to communicate the opposite, saying that they will soon be left with “the best properties in a debt-free vehicle” (see Giorgi’s comment above).

Do you think they are misleading investors in their communications?

Nope, I typically don’t think much about management claims (even when they match my model) and am just trying to figure out how we could lose here.

@Crandyhill So you dont buy the guidance of $18-20/share?

Not really. It would require selling remaining properties at least 30% above carrying values, which seems extremely difficult in present climate. The counter is that they have been selling at roughly 30% over carrying value this year, and they claim their best properties are yet to come.

Be aware that I bought this at $12 in a moment of weakness last year without doing my normal research, thinking it was so far below mgmt range how could I be wrong? So maybe I’m just bitter over my unforced error.

NT 10-Q filed after hours today:

Seritage Growth Properties (the “Company”) is unable to file, without unreasonable effort and expense, its Quarterly Report on Form 10-Q for the three months ended June 30, 2023 (the “Q2 Form 10-Q”) by the prescribed due date. The Company experienced an unexpected delay in finalizing the financial statements in the Q2 Form 10-Q relating to the assessment of one impairment with respect to one real estate asset. Specifically, the Company expects to recognize a material non-cash impairment charge with respect to such real estate asset. The Company is continuing to evaluate its portfolio, including its development plans and holding periods, which may result in additional impairments in future periods. The Company is working to complete the impairment analysis.

Dropped 9% to $8.08.

I’m glad I dumped my position in the low 9s. I just could never confidently model their liquidation proceeds, and book value keeps declining (in the mid $9 range in todays report I believe).

DT, David, do you have any input from your side regarding latest report and impairment?

It seems like now book value stays at $9-9.5/share down from $12+ from previous report. Do you know how much tax assets costs if any? I couldn’t find in report what tax asset company carry in case someone would want to acquire SRG stub for tax optimization goal

Book value is now $8.74, I had forgotten to deduct the $70M owed preferred.