Sisecam Resources (SIRE) – Expected Higher Bid – 40% Upside

Current Price: $18.14

Offer Price: $17.90 (expected to be increased to $26)

Upside: expected +40%

Expiration Date: TBD (probably 6+ months)

Yet another MLP buyout by its general partner. A number of other MLP buyouts have been recently covered on SSI – PBFX, SHLX (both still active), and BKEP. The situation below offers a similar set-up of skewed risk/reward – the downside appears to be well protected and if the idea works out and the offer is adjusted upwards, the upside could be quite significant. SIRE situation looks a lot like BKEP that concluded with 40% price bump – depressed dividends, earning/distributable cash on a verge of spiking upwards, and clear strategic benefits from the transaction. But as this is the third MLP buyout we post in a row, maybe what I consider to be a pattern recognition is actually just a confirmation bias. Look forward to any pushback.

Sisecam Resources is an MLP operating one of the world’s largest natural soda ash mining and production facilities. Two weeks ago, the company received a non-binding offer from its parent/GP (owns 75% of SIRE’s LP units) to acquire the remaining LP units at $17.90/unit. Shareholder approval won’t be required, but the offer needs to receive the blessing of the conflicts committee. SIRE now trades 1% above the offer price. The current bid has definitely been lowballed and came at zero premium to pre-announcement levels. I see a decent chance of a price bump (to $26/unit) following the conflicts committee review.

First things first – the buyout makes sense. MLP structure is outdated and no longer has any reason to exist. That’s why many MLPs have already disappeared over the last 4-5 years. GPs usually have strong incentives to acquire the LPs – fund the acquisition with low-cost debt and get a high-yielding stock + realize some operational synergies (see below for more recent precedent of MLP buyouts). SIRE’s parent/GP is owned by two international conglomerates headquartered in Turkey – Sisecam Group (owns 60% of the parent and GP) and Ciner Group (owns 40%) – the companies SIRE names as sponsors. Both sponsors are major players in the soda ash industry. Ciner Group is one of the largest/lowest-cost natural soda ash producers in the world. Sisecam Group is primarily a glass/glassware manufacturer (2nd largest in glassware worldwide, 5th largest in flat glass), where soda ash comes as one of the most important inputs. Sisecam Group produces some soda ash proprietary, but not sufficient quantities for its glass operations. Naturally, Sisecam Group has been a long-term client of Ciner Group. The buyout of SIRE comes shortly after both sponsors have agreed to extend their partnership and together invest $4bn to build one of the largest soda ash production facilities in the US (2x larger than SIRE now). The agreement was signed at the end of last year. A few months later, Bloomberg reported that Ciner Group (WE Soda is the operating vehicle) is working with Goldman to IPO in London. Sisecam Group is already listed in Turkey. So overall, SIRE buyout comes as a natural corporate structure clean-up and elimination of no longer needed micro-cap listing/MLP structure.

Why the bid is likely to be raised:

- The offer comes at around 40% discount to where Sisecam Group purchased its 44% interest in SIRE just 8 months ago. Initially, SIRE used to be controlled by the Ciner Group alone. As part of the last year’s partnership extension between the sponsors, Sisecam Group purchased 60% interest in the parent/GP for $300m. I estimate, the GP part to be around $36m (for 60% Sisecam’s stake), which leaves the acquisition of SIRE’s LP units at c. $30/unit. Sisecam Group even positioned the transaction as a cheap buy vs comparable peers in the acquisition presentation (albeit that was based on long-term projections assuming all new facilities are built and online, etc).

- The bid also comes at zero premium to the last-close or 30-day VWAP prices. Such a move now seems to be common in MLP buyouts, where similar scenarios have already played out very positively. In all recent MLP buyouts, the initial bids also came at zero/very small premiums and were later bumped after the review by the conflicts committees.

- SIRE buyout also looks opportunistic given the tailwinds in the soda ash industry. Since 2021, soda ash price has been soaring and now trades at a 50-80% premium to its historical range. This has been a result of the two-way squeeze from both the demand and supply sides. The demand surged as the end markets recovered from COVID, while the supply side has been pressured by depleted inventories, plant closures in China, and other issues in the supply of synthetic soda ash (which works favorably for SIRE’s natural soda ash – more on this in the section below). These tailwinds are expected to be sustained into the mid-term.

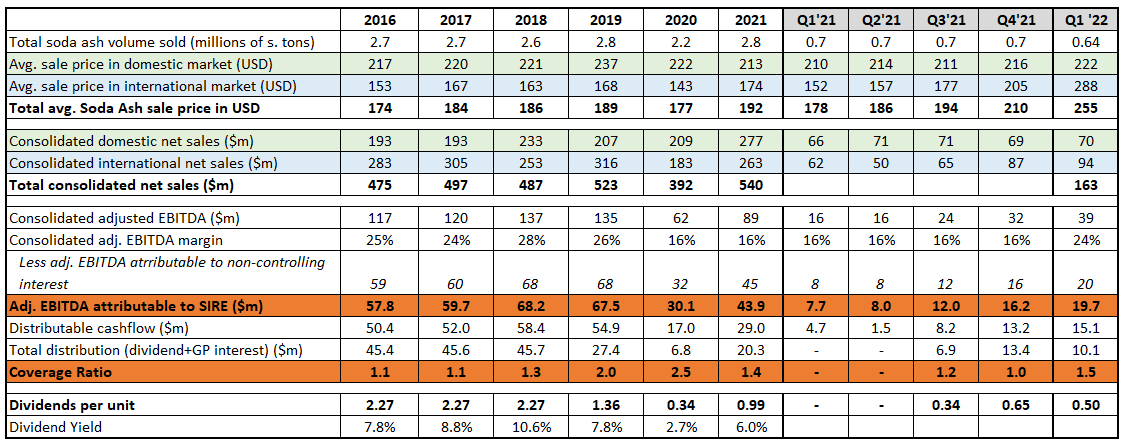

- Due to a time lag in the rollover of contracts, the favorable pricing impact has begun to show on SIRE’s income statement only from Q4’21. The positive impact should get amplified even more in the upcoming quarters. Q1’22 results showed record revenues and earnings (revenues up 20%+ vs pre-COVID, adj. EBITDA +17%). Despite that, the company has been artificially suppressing its dividend below the pre-COVID levels, when soda ash prices were 50% lower. At the current $2/year dividend level, the offer comes at 11% dividend yield – below SIRE’s pre-COVID trading levels of 7.8%-10.6% yield. At the Q1’22 earning levels, which still do not reflect the benefits of elevated soda ash prices and expected further increase in earnings, SIRE could easily raise its annual dividend to $2.3/unit and still remain comfortably at 1.3x dividend coverage ratio (vs 1.1-1.3x pre-COVID). At this $2.3/unit dividend, the buyout proposal values SIRE at only 13% yield – a lowball offer from a historical perspective as well as vs its larger US peer GEL, which trades at 7.3% yield (albeit GEL is diversified into O&G too). A much more reasonable 9% yield on $2.3/unit dividends, SIRE would be $26 stock – much closer to what Sisecam Group has paid for its stake 8 months ago. And again, even this price does not account for the expected windfall from higher soda ash prices. There’s clearly plenty of room to raise the bid. More details on the valuation/industry background are provided in other sections below.

- An interesting twist – apparently, one minority shareholder, Blackwood Capital Management (owns <1%), has already written a letter to SIRE’s conflicts committee saying the offer should be raised to at least $34/unit. The PE firm has even threatened to go to court mentioning a recent case of Boardwalk Pipeline Partners as an example. Boardwalk Pipeline Partners was an MLP that has been snatched from the minority shareholders by the GP in 2018. Minority shareholders of Boardwalk Pipeline went to court and in late 2021 the court awarded $690m damages vs $1.6bn transaction size. I am sharing a couple of quotes from Blackwood Capital Management below. Worth mentioning, though, that the letter was published among Seeking Alpha comments only and not released publicly officially, which is quite strange. There’s not much information available neither on the hedge fund nor its managing director, however, I was able to find an old SEC filing, which at least confirms this company actually exists. From the letter:

I recall your group just recently acquired your own units from Mr. Ciner at roughly $34 each. Our fabulous little soda ash business is booming and has a very bright future, especially given its ultra-low position on the global industry cost curve. With historical cash flow at a very stable and reliable $2.50-$3 per unit, we think the units are worth at least the $34 each that your group just paid.

[…]

I remind you and your Board of your fiduciary duty of good faith and fair dealing to my family and I and other minority unitholders. We pay your team quite handsomely for managing our business, and now you want to steal from us? We will aggressively defend our rights if you and your affiliates take us down a path similar to the forced-take-under that Lowes Corp. attempted with Boardwalk Pipeline Partners LP. Your recent action of cutting back the distribution despite the business earning record revenues and profits, is now clear and transparent. We strongly caution you against any further attempt to drive down the price of your thinly traded and easily manipulated units. If that happens, the next letter you’ll receive is a litigation hold notice from our attorneys.

- Finally, the conflicts committee consists of three independent directors – Alec G. Dreyer, Michael E. Ducey, and Thomas W. Jasper. At least two of them come from pretty reputable backgrounds: M.E. Ducey has been sitting on the board of Apollo Global Management since 2011, T.W. Jasper – sits on the board of multiple Blackstone funds. Seems unlikely they will be willing to tarnish their reputation here. This increases the odds that the conflicts committee will fight for a higher offer.

Other recent MLP buyouts

- NBLX – an initial bid from Chevron at $12.47/share in Feb’21. Two months later, the price was raised to $14.27/share. 14% increase.

- PSXP – first bid at $32.57/share in Apr’21 followed by two raises and a final offer at $43.85/share. 35% premium in 10 months.

- BPMP – initial proposal in Aug’21 was at $13.01/share. The price was raised in 4 months to $14.75. 13% premium.

- BKEP – the initial proposal came at $3.32/share in Oct’21. In 6 months, it was adjusted to $4.65/share. 40% premium.

- HMLP – first bid at $4.25/share in Dec’21. At the end of May’22, the deal was revised to $9.25/share. A slam dunk of +117%. This was mostly driven by the gas price explosion (also around 2x since the offer announcement until the definitive agreement).

Industry background

Soda ash is a commodity, which is primarily used in the production of glass, e.g. flat glass (which is then used in solar panels, automobiles, etc.), glass containers (glass bottles), etc. It is also used as an essential composite in the production of soaps, detergents, various chemical compounds, air/water purification, etc. The global production capacity of soda ash is estimated to be 65m tons per year. It is expected to grow at a 3% rate until at least 2026.

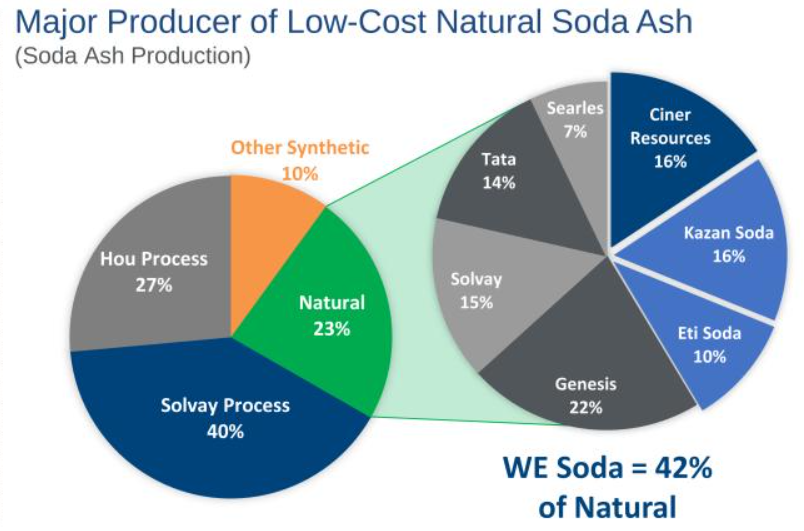

Soda ash can be produced in two ways: natural (30% of total production worldwide) and synthetic (70%). Natural soda ash is processed from trona minerals via a simple/lower-cost process of filtering, concentration, crystallization, and drying. 90% of the world’s trona resources are located in the Green River Basin (Wyoming, US). The remaining resources are located mostly in Turkey (EU).

Synthetic production involves a chemical process, which requires more inputs (coal, ammonia, limestone, etc), is overall much more expensive, energy consuming, and creates additional waste products. The waste is usually discharged into waterways and pollutes the environment. Most of the synthetic soda ash is produced in China. Apparently, ESG concerns worldwide resulted in certain environmental protection policies in China which have put some limits on synthetic soda ash production hikes and also blocked new big projects. Moreover, some large Chinese producers have been forced to close – e.g. last year Lianyungang plant in Jiangsu was shut down (1.3mt annual production or 2% of global). This year – an even larger player Tangshan Sanyou Chemical (3.4m annual capacity – 5% global market share) had to temporarily suspend operations (from Apr to Sep). Inflationary pressures and rising energy costs are pushing soda ash prices even further (the cost impact on natural producers is lower but some of that is offset by higher freight costs to international markets). SIRE doesn’t do conf. calls since 2021, however, its larger US peer Genesis Energy (GEL) thinks that current tailwinds for the natural soda ash will be sustained into the medium term. From GEL’s Q1’22 call:

Turning to our Sodium Minerals and Sulfur Services segment, we continue to see robust demand for soda ash across the globe and specifically in our export markets. The market for soda ash worldwide remains very tight, and is leading to strong soda ash pricing in all of our markets.

[…]

We’re starting to see the real effects of strong demand and soda ash supply being impacted by a net decrease in global supply we mentioned last quarter, 1.3 million tons synthetic production facility in China close at the end of 2021.

[…]

According to our analyses, as well as third-party reports, for the global supply and demand of soda ash to balance, the market requires China’s installed synthetic production capacity to operate at a roughly 95 to 96% rate. Historically, China has only operated around a 90% rate. In January and February of 2022, Chinese operating rates dropped to some 83% and 84% respectively. As a result, the worldwide market is even tighter than what we would have otherwise expected. These fundamentally driven market conditions coupled with the rise in energy input cost and increase in awareness of the environmental footprint of synthetic production provide, we believe, a very constructive backdrop for soda ash pricing for the remainder of this year. We expect these conditions to continue over the near to intermediate term and importantly, still be in place, as we discussed redeterminations for 2023 prices towards the end of this year.

[…]

And as we said, even with a slight reduction or a reduction in economic activity in the back half of the year, we think that it’s really primarily a supply story that is extremely tight, inventories have been depleted, there’s been a couple of force majeure events by some of the domestic producers in the first half of the first four or five months of the year, that have, again, reduced available inventories. And so we think it’s really primarily driven on a supply basis that things are extremely, extremely tight.

According to Echemi (top e-distributor of chemicals), in mid-July’22, China’s production has declined even further to 80% of capacity.

SIRE business and valuation

Initially, SIRE was set up as Ciner Group’s soda ash production subsidiary in the U.S, and Ciner Group used to be the sole owner of the parent/GP. In 2019, Sisecam Group decided to expand into natural soda ash production and formed a JV with Ciner Group to build a greenfield soda ash facility in the US. In late 2021, the partnership has been significantly expanded, which resulted in Sisecam buying a controlling stake in the parent/GP.

SIRE owns a 51% stake in the soda ash project in Green River Belt, Wyoming, which is one of the largest and lowest-cost producers of natural soda ash in the world (only Ciner Group operates with lower costs). The remaining 49% is owned by Natural Resources Partners (listed on NYSE with ticker: NRP). The Wyoming project produces around 2.8m short tons/2.5m metric tons of soda ash annually and has an estimated mine life of over 50 years.

Natural soda ash industry players and market shares are provided below. SIRE = Ciner Resources (the old name before Sisecam took a controlling stake), Kazan Soda & Eti Soda = Ciner Group. Hou Process and Solvay Process are two main processes used in synthetic production:

Natural trona processing is a low input process and the main variable of the company is gas prices. The company hedges its gas exposure to some extent. The company also claims to be the most energy-efficient soda ash producer in NA.

Around 43% of revenues come from domestic clients, and the remaining 57% – from international customers. The majority of end clients are glass manufacturers. Domestic contracts are for 1-3 years timeframe, while international – up to one year. Most domestic clients have been working with SIRE for around 10 years now.

SIRE’s revenues and earnings have been quite stable historically, which translated into a stable dividend at a 1.1x-1.3x coverage rate:

The dividend was cut in 2019 due to temporary CAPEX investments into a gas-fired turbine, which was finished in early 2020. Subsequently, COVID-19 hit and dividends were suspended till Q3’21.

The average soda ash sale prices went up significantly in Q4’21-Q1’22 due to rolling contracts and elevated soda ash prices in the market. However, this pricing still significantly lags the spot market, where soda ash has been trading at $400+ per ton (both short and metric). As contracts continue to roll, the gap between market prices and SIRE’s sale prices should narrow down, especially in the international segment, where the contracts are signed for less than a 1-year timeframe. This should result in a substantial earnings increase and potentially higher dividends. Hence, the $26/share price target based on Q1’22 earnings with a 1.3x coverage ratio and 9% yield might be too conservative here.

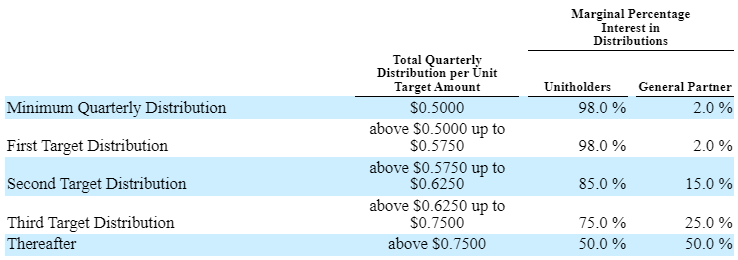

GP interest and IDRs

The exercise below is done mainly to split the GP and LP parts in Sisecam’s 60% acquisition of SIRE’s parent from Ciner for $300m – attempting to determine how much was paid for LP units only. GP has a 2% interest in LPs + incentive distribution rights (IDRs), which scale the interest as the distribution increases. The structure can be seen below:

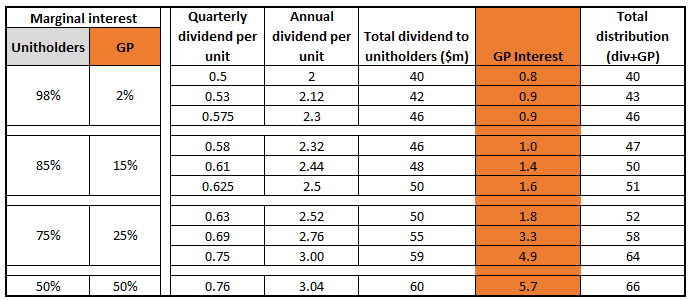

And here’s a table of how it translates into payments to unitholders/GP:

At current dividend levels, the GP interest is not worth much. Even with $3/unit annual dividends, the IDRs would deliver only $5.7m/year. To reach this level, distributable cashflow has to increase by an incremental 40%+ from the Q1’22 levels. My quick back-on-the-envelope calculations show that this could be achieved if SIRE’s avg. soda ash sale price increases to around $330/ton, while adj. EBITDA margins stay stable. So kind of seems possible. At these earnings levels and assuming a 5x multiple (quite low to account that SIRE is still far from these levels of IDR payouts and that the favorite market conditions are not expected to last in perpetuity) the IDRs are worth under $30m.

The GP also gets annual management fees. The exact amount is not indicated, however, the total SG&A charged by the partnership amounted to $17m in 2021 and $16m in 2020, and $15m in 2019. Profits from these management fees (as this clearly does not go straight to GP’s bottom line) are probably only a fraction of that. To put a number on the value of these fees, $30m is probably somewhere in the ballpark (just a guess, but I am more likely to be overestimating it)

Taken all together, the value of GP’s IDRs and management fees is around $60m.

In Dec’21, Sisecam paid around $300m to acquire 60% in SIRE’s parent, which owns 100% of the GP and 74% interest in SIRE. Excluding the 60% of GP value, Sisecam paid around $30/unit for SIRE (19.8m units are outstanding).

Risks

Aside from the two obvious risks of the offer getting withdrawn, or going through at the current bid of $17.9/unit, there’s one more little nuance worth mentioning – limited call right. It basically says that if the parent or its affiliates own 80% or more common units, it can squeeze out the minority. Parent/sponsors now own 75%:

I don’t think this is a big risk. Limited call right is a standard thing in all MLPs, including the recent buyout cases mentioned above. The only thing here, which visually increases the risk is that the parent would need only 5% incremental stake to exercise this right. However, given SIRE liquidity, it would take the sponsors a long time to acquire shares in the open market, which would push up the unit price anyways. Moreover, this right doesn’t protect from potential lawsuits as illustrated by the Boardwalk Pipeline Partners case (the MLP buyout where shareholders received $690m in damages). There, the GP did this exact thing – artificially depressed the unit price and exercised the limited call right. As we know that did not work out in the end and should keep SIRE’s sponsors from following the same path. Finally, I think the pure fact that they’ve made a non-binding offer shows that they are willing to buy out the remaining shares properly and limited call right is not even being considered here.

Blackwood letter with link to SA in tweet below:

https://twitter.com/natstewart5/status/1548728814871744512

Can anyone shed some light anecdotally on the tax consequences/headache of MLP’s for US residents?

Is it generally worth the trouble? I know you have to file taxes in multiple states but unsure how CPA’s handle that.

Similarly there is a liquidating trust CPPTL that owns JC Penny stores & distribution centers that looks attractive depending on the tax implications. ““because the trust owns properties in 37 states, this could result in certificate holders being required to file tax returns and paying taxes in a large number of jurisdictions”

Any insight is greatly appreciated.

My accountant has told me that multiple state taxes aren’t a big deal for her. “The software handles all of that”

What about buying it in an IRA account? I read there are issues due to distributions being an unrelated business taxable income, but does anyone have any first-hand experience?

Even in an IRA that wouldn’t solve the issue of having to file in multiple state, which I think will be the biggest factor impacting returns.

I read a Forbes article that said “if you have your tax preparer file returns for faraway places, expect a bill for $250 per state” so 37x$250= $9250

Multiple states shouldn’t be a big deal for most….aside from the supposed “forbes” article.

fwiw – I couldn’t even buy in Interactive IRAs but schwab worked. Think it has to do with interactive providing K1s and their mandatory terrible customer support.

Articles on IRA buying LPs. Per first article: If UBTI >$1k, the IRA pays tax, and IRA custodian has to file return. Most LPs have minimal UBTI.

https://finance.zacks.com/buy-lp-shares-ira-9625.html

https://www.investopedia.com/ask/answers/102714/can-i-own-master-limited-partnerships-mlp-my-roth-ira.asp

Does anyone here know if there are tax consequences for NON-US investors?

Thank you

37% WHT on Div’s for Non US Investors & cap gains dependant on your own jurisdiction, as far a I’m aware. Obviously not tax advise 🙂

I think it’s 15% on divs and 0% on capital gains for non-US, you just have to pay the taxes in your country

This is what I found a couple weeks ago because the question also applies to US persons/citizens that live in PR.

https://www.nasdaq.com/articles/tax-implications-foreign-mlp-investors-2010-12-27

Any news

SIRE reported strong Q2 results. The thesis is working out as expected with revenues and earnings getting pulled up by soda ash industry tailwinds. This effect should continue into the following quarters. At this rate I don’t think that management will be able to keep distributions suppressed for long.

SIRE now trades at an unusually high 29% premium to the offer price. An improved bid seems to be very likely and I think a further upside is still available here. Even at these elevated levels, the downside should be rather protected by improving earnings and a likely increase in dividends if the transaction fails (see SIRE peer GEL commentary on the industry below).

Highlights from SIRE Q2’22 report:

– Net sales of $189m up +57% YoY and +16% QoQ. Volumes sold were up 8% YoY and 9% QoQ.

– Average soda ash sale price during the quarter was $271 per short ton compared to $186 same quarter last year and $255 in Q1’22. Avg. sale price for the international market jumped to $311, while for domestic it is still at $229. So overall, there is still a significant lag to the spot market, where tight supply keeps prices elevated at $400+.

– Adjusted EBITDA attributable to SIRE was $20.2m or +153% YoY and +3% QoQ.

– Distributable cash flow jumped to $16.1m (vs $1.5m Q2’21 and $15m Q1’22). Distributions remained depressed at $0.5/unit, resulting in an even higher coverage ratio of 1.6x vs 1.5x in Q1’22. Nonetheless, management said they maintain a focus on conservative cash flow management to tackle inflationary pressures, increasing interest rates, etc.

A few comments on soda ash industry tailwinds from the Q2 conf call of Genesis Metals (larger US peer, July 28):

And here’s a question about how quickly this tightness could be alleviated:

SIRE Q2 results – https://www.bamsec.com/filing/162828022019858?cik=1575051

GEL’s call – https://seekingalpha.com/article/4527218-genesis-energy-l-p-gel-ceo-grant-sims-on-q2-2022-results-earnings-call-transcript

Isn’t the conflicts committee just a board committee? Sure they’re supposed to do the right thing but wouldn’t it be expected that they stick with the lowball since they’re probably in the parent company’s pocket?

For all previous recent MLP buyouts, similar conflict committees managed to squeeze out additional premiums. So the same is expected here. The conflicts committee is supposed to be comprised on independent board members and therefore should not serve buyers’ (which are also the largest shareholder) interests.

What percentage of SIRE premium compared to offer is based on recent performance, and what is based on the spec of a higher offer?

If the business has materially improved, what is the desire to buy the remaining business?

Not sure I understand the question. Buyers want to have full control of the business in order to simplify the corporate structure and because now they can still buy out minority shareholders relatively cheaply. Might be a very different situation one year or couple years down the line if recent trends in the soda ash industry continue.

Two Questions:

1) Is it possible to diligence natural soda ash demand? – I understand that supply may be structurally short, but isn’t demand for glass reasonably elastic and will slow as the economy slows? Are there spot prices that give you a sense of supply / demand?

2) With financing rates going up – the 10yr has gone up 100 bps from 2.8% to 3.8% since the offer was announced, how sensitive are Sisecam and Ciner (hq’d in Turkey where things are crazier still) going to be to more expensive financing?

Demand for glass in Europe is pretty ridiculous now. With these energy prices, replacing old windows with new isolation glass has a very high return. Quoted prices have doubled where I live.

For those interested in a refresher on SIRE situation – I have just been featured as a guest author on Lone Wolves substack and you can find a pitch of the case here:

https://lonewolves.substack.com/p/sisecam-resource-lp-nysesire

Shall we interpret this as high conviction on your part? 🙂

I continue to hold and it is a pretty sizeable personal position. Maybe my perception is too biased after success with BKEP, but we will see that shortly.

SIRE will report Q3 earnings tomorrow after the market closes. Shares currently trade 26% above the $17.90/share offer, but significant upside remains.

https://www.businesswire.com/news/home/20221021005368/en/Sisecam-Resources-LP-to-Release-Third-Quarter-2022-Results

They seem determined not to provide an update on the transaction review in the press releases or filings…

As expected, SIRE’s Q3 results were great as rolling contracts continued to lift the average price of sold soda ash closer to the spot prices. Spot prices remain elevated and stable, while the market tightness is expected to continue. As earnings continue to grow, the Inadequacy of SIRE’s current dividend becomes more and more visible – the coverage ratio was 1.67x in Q3 (vs historical range of 1.1-1.3x). Nonetheless, management has provided no updates on either the strategic committee review or the dividend reassessment. I expect more details to be unveiled by the end of the year or at the very least – early next year together with the annual results. I expect the privatization offer to be raised to at least $26-$28/share (+23% upside). Meanwhile. the downside is protected by fundamentals and a potential dividend increase. I think SIRE continues to be one of the most attractive setups in the market right now.

Q3 results:

– Net sales in Q3 were $190.5m (up 40.5% YoY) mostly due to a 43% increase in average sale price. YTD net sales were $543m (up 41.4% YoY);

– Q3 soda ash volume production and volumes sold decreased slightly, however, it was more than offset by the increased sale prices;

– Q3 adj. EBITDA of $40.6m (a nearly 69% increase YoY). YTD adj. EBITDA of $120m (a 114% increase YoY);

– Q3 distributable cash flow of $16.8m (a nearly 105% increase YoY). YTD distributable cash flow of $48.1m (a 204% increase YoY). Distributions remain suppressed at $0.5/unit.

– The coverage ratio jumped up to 1.67x this quarter versus 1.6x in Q2 and 1.5x in Q1.

SIRE does not have any conference call, but a few comments on soda ash industry tailwinds from Q3 results of Genesis Metals (SIRE’s larger US peer):

“The macro story for soda ash remains intact as worldwide demand ex China is continuing to outpace supply despite any concerns of a slowdown of the broader economy. According to third-party reports, estimated demand growth for soda ash in the ex-China market alone is expected to be in excess of approximately 1 million tons per year through the end of the decade. The outlook moving forward is driven by a combination of industrial production growth and increasing demand associated with the green transition, specifically from solar panel and lithium battery manufacturers at the same time as there is limited new supply available to the market outside of significantly higher cost synthetic soda ash production. As a result of the structural tightness and the cost structure of synthetic producers, our noncontracted export soda ash prices have steadily increased throughout 2022 and this again held true as our fourth quarter soda ash prices are expected to be higher than our third quarter prices.

[…]

Furthermore, we believe the structural tightness in the soda ash market will continue to support soda ash prices in 2023, even if all or parts of the world start to see any slowdown in economic activity. “

SIRE’s earnings https://www.bamsec.com/filing/162828022027325?cik=1575051

Genesis Metals Q3 confernce call https://seekingalpha.com/article/4550108-genesis-energy-l-p-gel-q3-2022-earnings-call-transcript

DT, are your surprised that there was *no* information on the strategic committee review? They didn’t even lay out the costs of the ongoing review or the bankers and lawyers advising – which ideally should be an add-back to EBITDA. Do you know anyone who has recently talked to any members of the strategic committee to get a sense of whether the review is progressing? / and how it is progressing? Surely those are materially relevant disclosures.

Special committees love to keep you in the dark….longer than your wildest dreams.

Input from key shareholders – especially minorities – is often a part of their process, as it should be. If they recommend a proposal, certainty of completion is important to them.

On that note, Tom Jasper is the head of the Conflicts Committee and here is his email address – twjasp@gmail.com.

It wouldn’t hurt to speak out as a minority shareholder. Here’s a link to the article with the original email from Blackwood. I just picked the main points and wrote a much shorter email.

https://seekingalpha.com/news/3854625-sisecam-chemicals-resources-offers-to-acquire-remaining-stake-of-sisecam-resources-lp#comment-92876835

vko007 – thank you for his contact information….I emailed twjasp@gmail.com eight days ago (i.e., on Nov-7th-2022) and haven’t received a response. In the email, I mentioned that I’m a minority shareholder. Has anyone else emailed twjasp@gmail.com and received a response? Thanks!

I’m sure he’s receiving many emails at this point so not worth replying now. I did get a response from him a couple months ago, here it is:

Thank you for your interest in SIRE and your perspective. The Conflicts Committee and it’s advisors are working through a process to determine an appropriate response.

I have sent him an e-mail as well and didn’t get a response. When going through a process, not particularly surprising.

I received email from IBRK “Withholding on Publicly Traded Partnerships starts January 1, 2023”. As a result of recent US legislation under Internal Revenue Code Section 1446(f), gross proceeds from sales of and certain distributions from Publicly Traded Partnerships (“PTPs”) held by non-US tax residents (both individuals and entities) will be subject to 10% withholding starting on January 1, 2023.

It might seem that for non-US residents it makes sense to close position until the end of the year

Not as familiar w/tax code.

Does “gross proceeds from sales…” mean capital gains? or does it mean a withholding from total value of sale?

Is there a withholding exemption available for SIRE?

10% from total value of sale, there is no any exemption for SIRE as fas as I know

Wow that’s punitive…

You are also taxed if you just sell the MLP units in your brokerage account to someone else? Or just sales from proceeds paid out to holders after a buyout?

I’m going to have to sell before Dec 28th to avoid the new tax rule. Any idea the odds of a positive move before then? Or should I bail now with a nominal loss?

Any update on the committee?

There will be an EDGAR update when one is released

What exactly is the exit plan at this point since Special Committee is showing how special they are?

At resistance/triple top.

I plan to stay in SIRE until we receive word (i.e., an SEC filing and/or press release) from the Special Committee. It isn’t that long of a time as far as Special Committees for MLPs have historically gone…I’d get more concerned if there is absolutely no mention in the Dec2022 quarterly earnings date.

Also, I’m not a big “resistance” (or technical analysis) type of trader; accordingly, it isn’t something I’d factor into my decision to sell.

The price target of $26/share that DT mentioned in his original writeup still seems reasonable to me. SIRE’s earnings have beta to the price of oil–which isn’t down enough to reduce the target price. Demand from window glass segment seems likely to decline in 2023, but I’d expect the upcoming Dec2022 quarterly earnings to still be good. Also, you get paid a distribution to hold SIRE.

I’d be disappointed if the final px is $26/sh.

Take a look at Sisecam stock (inflation adjusted) in Turkey – best indicator of end-market expectations.

Hi rd128, what are the input numbers you’re using for your calculation of end-market expectation?

Hi HomeSpunoff, what #’s are you using for end-market expectations?

I’m always curious about where others are at…and sources etc…

Do you mind sharing the ticker for Sisecam’s stock in Turkey?

My estimate ex-China for 2023 is ~ 36mm tons. In the US, I expect SAAR will rise from 12-13mm units to ~ 15-16mm.

But flat glass is just one of the end markets. It’s a wide end-market (Flat and Container Glass ~ 55%,).

Structurally short supply continues. The current spot px has been ticking slightly higher.

OPIS (IHS Markit) – if you have a subscription – provides a reasonably detailed breakdown of expectations (country, product).

https://finance.yahoo.com/quote/SISE.IS/

Thank you, sir.

Q4 earnings will be out on February 1. Hopefully, it will include an update on the buyout review.

https://www.businesswire.com/news/home/20230126006025/en/Sisecam-Resources-LP-to-Release-Fourth-Quarter-and-Year-Ended-2022-Results

$25 new buyout price, closing by 7-30-23. After hours price up 3+% to $25.04 bid. Dividends in Feb of 50c (per news), 50c in May (expected), or 8% per year.

Sell now at $25, or hold half a year for the $1 dividend or 8% annualized. Price seems just right. https://www.businesswire.com/news/home/20230201005990/en/Sisecam-Resources-LP-to-be-Acquired-by-Sisecam-Chemicals-Wyoming-LLC

Agree. Sold today at $25.50. Thanks all

Definitive Agreement at $25. At least one $0.50 dividend, probably another $0.50 in May, if the close is actually 7/30/23.

https://finance.yahoo.com/news/sisecam-resources-lp-acquired-sisecam-213100656.html

The $25/share improved offer is definitely lower than I expected given the continued favorable industry developments – the company is easily worth another +10-20% and the buyers are getting a bargain. But still, the thesis worked out as predicted with 46% gain in half a year (including two quarterly dividends).

Also, the new offer appears to be spot on with my initial target in the write-up (“I see a decent chance of a price bump to $26/unit”) if the remaining 2x$0.5/share dividends are counted in. So very proud of my accuracy 😉

The buyout will close by the end of July. Till then investors have the option to wait and receive the two additional $0.5 dividends, or an incremental total of 3.9% That’s pretty much a guaranteed 8% yield. The buyout is very likely to go through with no surprises.

Nicely done!

(Shame that bizarre change is US tax law saw, presumably, most non US investors dump their holdings last year).

Is this SIRE deal closing going to be a catalyst for NRP? Excluding the 49% stake, from what I’ve read, NRP’s remaining operation trades sub 1 p/e.

Would love to hear thoughts on this as well. Not sure if this will serve as a catalyst for a re-rate but it seems clear from any angle you look at it that NRP trades well below its private market value.

The ideal re-rate catalyst may be a dividend raise. Anyone have a hunch when it may occur? Based on my reading of NRP’s most recent (3rd-Nov-2022) CC & press release, no mention of a common dividend increase due to debt paydown intention: “We expect our leverage ratio to continue to decline as we continue to pay down our debt.”

MLP buyouts seem to all work, even in periods when few other pre-arbs worked. Any left (besides GLOP)?

Oh and to my LPs’ accountants: sorry about the paperwork but I hope/expect it is well worth it.

Yes, MLP buyouts have been a very nice ride so far and I hope we will get much more of these situations in the future. However, at the moment, besides GLOP, I’m not aware of any other MLP pre-arbs.

Chris DeMuth, I’ve bought most of these MLP deals in my Roth accounts and I’ve been swamped with K-1’s this year. I’m being hit again with UBTI this year in some of these IRA accounts., but at least this year, I knew it ahead of time and it’s manageable. Last year, one of my Roth IRA’s paid a large tax bill ($70K+), which was a complete shock.

If some of your LP’s are invested with their IRA’s, they may also be a bit surprised if it generated any taxable UBTI. I believe they are still worth doing in an IRA, but the tax bill was easier to accept when I knew it was coming.

Thanks for the wise advice.