Tyme Technologies (TYME) – Merger Arbitrage – 33% Upside

Current Price: $0.265

Offer Price: $0.353 (in stock)

Upside: 33%

Expected Closing Date: H2 2022

A very positive update to TYME – a situation was previously highlighted in our 1st Weekly newsletter. The assumption of the upcoming company sale turned out to be correct and TYME has just announced a merger with its peer. The current 33% spread seems overblown and I get a feeling that I might be missing an important piece of the puzzle here. Sharing my research below – any pushback is welcome.

Tyme Technologies is getting acquired by cancer-focused clinical-stage biopharma Syros Pharmaceuticals (SYRS). The transaction is basically an equity raise for the buyer – SYRS is getting TYME’s net cash (estimated to be $60m at closing) by issuing around 74m new shares (also worth $60m at current prices). Even the press release is clear about this: “to TYME stockholders to acquire TYME’s expected net cash”. The existing TYME drug development program will be put on hold and all exec positions in the combined company will be retained by the existing SYRS leadership. Together with the merger, SYRS has announced an oversubscribed $130m PIPE financing (vs $55m market cap), mostly from the existing major shareholders. After both transactions, SYRS share count will multiply by a factor of four, all of it being backed by cash injections at higher than the current price levels.

The exchange ratio is 0.4312, implying a 33% upside on TYME’s current price. The ratio is subject to certain adjustments but these are unlikely to be material. Plenty of shortable shares for hedging are available at a 2% fee.

Given the extent of the upcoming dilution, there’s a risk that the availability of borrow will get depleted and fees might spike up. However, even without hedging, there seems to be a sufficient margin of safety:

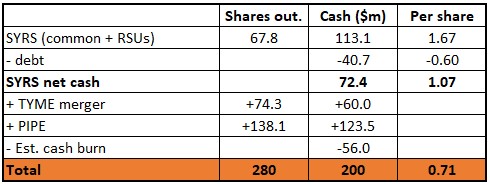

- Both the PIPE and equity raise through the TYME merger are getting done at $0.94/share SYRS valuation vs the current price of $0.865/share. PIPE participants are mostly SYRS current major shareholders, who also happen to be reputable PE firms: Bain Capital Life Sciences (owns 10% of SYRS), Invus Public Equities (5.6%), Ally Bridge MedAlpha (6%). Aside from several other PE firms, another participant is Flagship Pioneering – US life sciences-focused VC fund, which is also SYRS’ co-founder and founding investor. These firms have significantly more information about the SYRS treatment development projects and have just made a high confidence vote on it at $0.94/share (+warrants exercisable at $1.034). In contrast, by buying TYME now, one is setting up SYRS shares at just $0.63.

- Pro forma SYRS will have $0.71/share of net cash. Before the PIPE/merger announcement, SYRS traded at an 8%-10% discount to net cash. Assuming the same discount, results in $0.64/share post-merger/PIPE, in line with the look-through price from TYME stock position. Looking even earlier (2019-2021) SYRS used to trade at 2x – 4.5x premium to net cash.

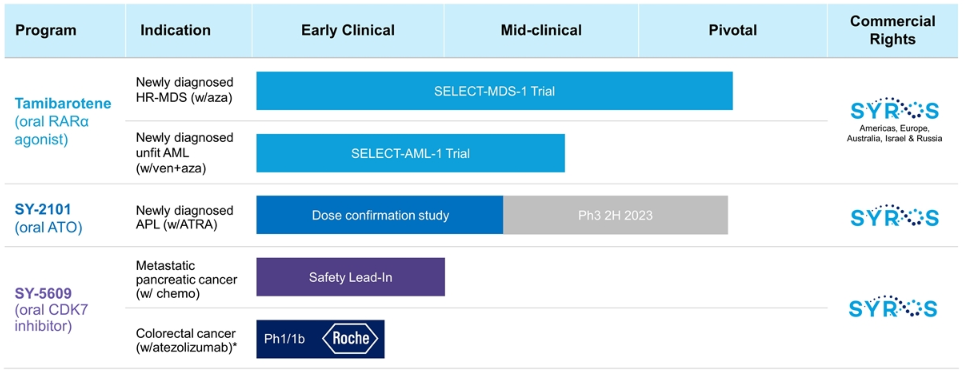

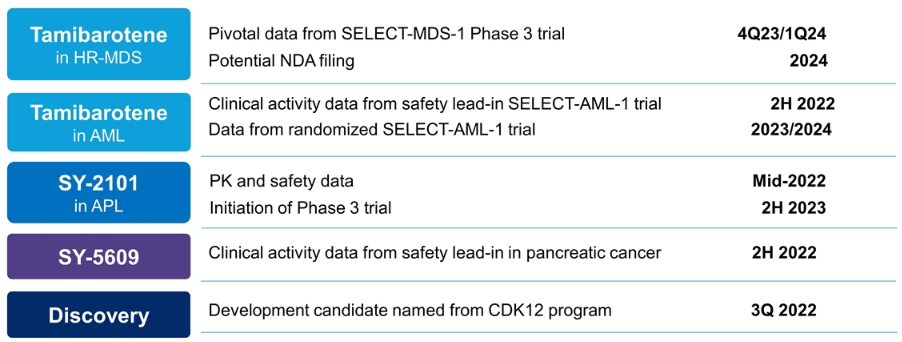

- There are also reasons to believe the discount will not be as wide as before the merger announcement. After the transactions, the company will now be in much better shape with enough cash to fund operations till 2025-2026, enabling it to significantly advance its current late-stage gene-based cancer treatments towards commercialization. One candidate, Temibarotene, is currently in Phase 3 with potential NDA filing expected in 2024. Another, SY-2101, is expected to enter Phase 3 in H2 2023. SYRS has also just recently amended the terms of its debt facility, postponing the maturity from Feb’25 to Feb’26. So overall, given the eliminated financing risk and vote of confidence from major shareholders, it’s possible that SYRS shares will trade higher than historical levels relative to net cash.

Closing is expected in H2 2022 and all conditions are likely to be satisfied easily:

- SYRS shareholder approval – 28% are already in support. SYRS management together with the 5 largest shareholders owns 56% of the shares outstanding. 3 of these 5 shareholders are participating in SYRS PIPE financing, which is happening concurrently with the merger, and are likely to support the merger as well. Adding PIPE shareholders’ stakes + management’s shares I arrive close to 35% combined ownership. Getting over the 50% threshold for shareholder approval is unlikely to be a problem.

- TYME shareholder approval – 30% are already in support. TYME’s main development compound is SM-88, for which the company was running trials for metastatic cancer and breast cancer treatment. The metastatic cancer treatment trials were canceled this January due to unsatisfactory results. Ever since then, TYME has been trading at a wide 40% discount to net cash. The merger will allow the shareholders to eliminate the discount and avoid future uncertainty regarding the development of breast cancer treatment (still in Phase 2).

- Another condition – the completion of SYRS PIPE with gross proceeds of at least $100m (expected to be at $130m). I don’t think there’s any substantial risk here as PIPE is indicated as being oversubscribed and participants are mostly SYRS current major shareholders, who know the company quite well and have already agreed with this financing, despite the current market turmoil.

Both TYME and SYRS are trading at pre-announcements levels and at discounts to net cash. If merger/PIPE fails, capital losses for both hedged and unhedged positions should be minimal.

Syros Pharmaceuticals

Syros develops treatments for cancer and monogenic diseases. After the merger TYME’s SM-88 development will be put on hold and the company will focus solely on its own pipeline. SYRT seems to be literally interested only in TYME’s cash position.

I do not have much insight into SYRS drug program and, with no near-term pending trial or FDA application results, I do not think this is important for the merger arb play. The willingness by the existing shareholders to put an additional $130m at risk here, tells me the company is not likely to blow over the next half a year while the merger is proceeding.

SYRS projects/timeline:

The sell-off in SYRS over the last 1.5 years (from $10/shr to $1/shr) does not seem to be driven by any specific news on the drug development programs, but rather correlates with:

- Very well-timed $165m equity issues in Dec’20 and Jan’21 at $8/share and $14/share respectively. The Jan’21 dump on the markets at peak prices was quite likely unexpected as just a few days earlier the company issued the ‘Strategic Priorities and Expected Milestones‘ press release, where it clarified that: “Syros ended the year with approximately $174 million in cash, cash equivalents and marketable securities1, which the company believes is sufficient to fund its anticipated operating expenses and capital expenditure requirements into the second half of 2022.”

- H1’21 full sell-down of SYRS position by ARK Investment Management. It was at 25% shareholder back in Oct’20.

- 50% sell-off in biotechnology stocks over the last year (see IBB and XBI ETFs).

Pro-forma for the transactions, SYRS expects outstanding shares at 280m and total cash at $240m. Net cash will be $200m or $0.71 per SYRS share. The $56m cash-burn figure is a plug to get the cash figure to balance with management’s expectations, but seems to be directionally correct given c. $25m quarterly cash burn over the last 1.5 years. From $130m PIPE gross proceeds I have deducted 5% transaction expenses.

No material changes are expected for the exchange ratio

The merger stock exchange ratio will be calculated by dividing ‘Tyme Per Share Value’ by $0.94 – in line with the pricing of SYRS shares to be issued in PIPE financing, except with no additional warrants attached.

TYME Per Share Value = (TYME net cash (cash + marketable securities less total liabilities) + $7.5m) divided by TYME shares outstanding.

Merger announcement documents indicate the expected net cash position at closing to be “around $60m”. As of Mar’22, the net cash stood at $75.5m. I think estimating $60m at close might even be slightly too conservative as the average cash burn per quarter last year was $5.3m, whereas in Jan’22 TYME canceled one of the main development projects (metastatic cancer). Moreover, as TYME’s SM-88 development will likely be put away after the merger and SYRS’ priority is raising as much cash as possible, it’s quite unlikely that the current trials will be going on at full power during the merger process. The merger is tiny and has chances of getting closed early (a fair guess would be October-November), further limiting any ongoing cash burn till closing.

As of May, TYME shares outstanding were 172m and are unlikely to change much till the merger closes. Options and warrants are way out of money and will be converted automatically into Syros’ options/warrants on the same terms and conditions as common stock.

Even assuming some deviations from the $60m cash balance, the margin of safety at 33% spread more than compensates for it.

At yesterday’s trading/closing prices (when I started looking into the name) the spread was actually 41%, so it is quite volatile. The indicated write-up prices are for a narrower spread at which TYME and SYRS stocks seem to be trading today.

Retail majority ownership is untrustworthy for vote…..rational buyers soaking up shares can make the deal go through….but that will close the spread from here…..

Large owner of SYRS. Agree with reports findings and the arb may not be best way to skin this cat. Own TYME as discount to SYRS and hold.

now a negative return on this deal? intrinsic value .285 cents? why?

how do you mean?

If you buy tyme at .29 you get .353 shares of syrs which was 80 cents when I posted. .353 of .80 equals .2824……..is there a piece I am missing, syrs has dropped from $1.00 to .80 and tyme has not moved……..great trade if hedged…….wash if unhedged

The exchange ratio according to the write-up is 0.4312.

ah my mistake I was looking at the $.353 extrapolated price

SYRS traded at high as $1.50 last night on news of positive drug ruling……Now settled back to around $1.10 still up 25% from yesterday’s close. TYME not fully participating in the move.

TYME upped to 0.3556. Does it mean it makes sense to close the position instead of waiting till the merge completes?

Both shareholder meetings have been set for September 15. Remaining spread is 25%. SYRS borrow fee is at 7.5%/year.

https://www.bamsec.com/filing/119312522215131?cik=1537917

Proxy firms ISS and Glass Lewis recommend voting in favor of the merger. The meeting is set for the 15th of September. https://www.globenewswire.com/news-release/2022/09/07/2511446/0/en/TYME-Technologies-Inc-Announces-Proxy-Advisory-Firms-Glass-Lewis-and-ISS-Recommend-Stockholders-Vote-FOR-Proposed-Merger-of-Syros-and-Tyme.html

5% divergence between TYME and SYRS……wonder if their is a brewing issue with the vote?

Just think it is illiquid spread and too small to be on any real arbs radars. MILE/LMND and MBII/BIOX both closed with few cents to make as well. Both $1 tgts. Anyone have any view on this SYRS orphan news here?

anybody have insight into todays syrs/tyme vote? seems still a 10% opportunity with syrs borrow available?

Closing tomorrow. SYRS trades split-adjusted on Monday, 9/19. Assume TYME shares convert then?

Does anyone know if they confirmed the Exchange Ratio at 0.4312?

interesting to see the spread widen a bit on press release that it is closing tomorrow. Would have expected the opposite, unless exchange ratio is not 0.4312. No commentary on ratio in 8-k

just market inefficiency. Compressed to 1.5% now. Who would have thought best time to put on the trade was after the deal risk went away!

Closing TYME / SYRS arbitrage case. +33% return in a couple of months.

After these types of arbs close successfully I struggle to understand why there was such a widespread in the first place. Obviously, that is partially Captain Hindsight speaking, but were there really risks in this merger that could have deserved a double digit spread let alone 33% one?

Exchange ratio pickup.

0.4382

Even better – an additional 1.5% return.

SYRS is down 25% post-merger closing. I could not find an explanation for that – could it be that previous TYME shareholders are dumping newly received SYRS shares in the market indiscriminately? Or am I missing something?

The company should have c. $7.2 shares in net cash, so it is trading at 25% to net cash and 40% discount to where the largest shareholders (and prominent pharma investors) have made an additional $130m PIPE investment. The breakeven point for them is $9.4/share.

Historically SYRS traded at 10% discount to net cash. But now all funding/dilution risk has been removed at least till 2025/2026, the largest owners expressed a strong vote of confidence – kind of suggests the discount should at the very least be smaller today vs historical.

The development pipeline and management’s profiles look pretty solid, but I am very far from pharma investor and maybe the same can be said about every single clinical stage pharma company.

Is this a buying opportunity caused by indiscriminate selling?

I find the drop puzzling also, but I’m incapable of answering your question. I can add that it seems after big reverse splits, prices sometimes move up or down significantly, with no apparent reason.

SYRS trading volume during the last week was also excessive (10x-30x normal levels) – which might be related shareholder vote last Thursday and more people getting involved either in merger arb or simply expecting a post-merger SYRS price surge. Now the same traders who piled on SYRS or TYME last week, are dumping shares when there was no post-merger spike. Just speculating on potential reasons here.

I believe its matter ofworking thru the traders who are just exiting the arb trade. Already seeing a bounce off the bottom. I am a buyer here

Back to ~$7 today, quick rebound!