ThinkSmart (TSL.L) – Merger Arbitrage – 12% Upside

Current Price: £0.35

Offer Price: £0.39

Upside: 12%

Expected Closing Date: Nov’22

This situation is only for those with access to London AIM market (trading available through IB). Liquidity has increased significantly over the last few days.

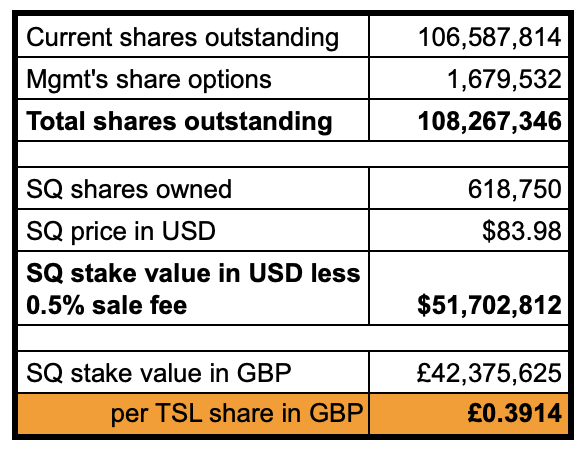

London AIM-listed holdco ThinkSmart has agreed to be acquired by its chair/CEO/founder Ned Montarello (owns 29%). TSL shareholders will receive net proceeds from company’s stake in Block that is about to be sold. At current SQ prices, the consideration amounts to £0.39/share and offers a 12% upside (was 17% when I started working on this post, but SQ shares are down pre-market following Q2 results, so spread narrowed). Till SQ shares are sold, the exposure will have to be hedged (ratio of 0.00571x). SQ very liquid and hedging should remain cheap and easy. The offer will have to be approved by a simple majority of independent TSL shareholders (in number) + 75% of total votes cast. Aside from Montarello, the remaining insiders own 12% shares and support this transaction. It’s not yet clear whether they will be considered as an ‘interested party’, however, I expect the shareholder approval to pass easily. Consideration is expected to reach accounts in Nov’22, so the timeline is quite short.

ThinkSmart is basically a holding company for 618,750 SQ shares, currently worth around £40m. On top of that, it also has a very tiny cash flow positive legacy business that is currently in wind-down. TSL received its SQ shares earlier this year after it sold a 6.5% stake in buy-now-pay-later operator Clearpay to Afterpay in exchange for Afterpay’s stock . Shortly after, Afterpay got acquired by SQ. TSL management vaguely promised return of capital a few times but offered no clear details and did not elaborate on future plans for the company. Due to this uncertainty TSL used to trade at an average 30% discount to its SQ stake. More background details can be found in our previous TSL write-up.

Eventually, management decided the market is putting too big of a discount on the SQ stake, and in May’22 announced a strategic review, that culminated in the current take-private transaction. Montarello has set up a good deal for himself – he is essentially getting TSL’s balance sheet (around £1m net cash) + the remaining operating business for free.

The remaining operations have been cash flow positive so far and management expects it to stay that way after the company is delisted. These consist of:

- a legacy leasing business that is currently in wind-down – had £0.7m remaining gross receivables as of June’22 with a maximum term outstanding of 2 years.

- Very tiny call center customer support operations provided to Clearpay. Call center operations generate around £0.9m annual revenues and can be terminated on a 3 months notice.

The chances of Montarello walking away from this transaction seem slim.

Likewise, I expect TSL shareholders to be supportive as there is very limited further upside in trying to push for a better offer:

- Previously TSL traded at a large 30% discount to SQ stake.

- Current consideration comes only at a minor discount to TSL NAV.

- Shareholders who want to continue having exposure to SQ, can easily do so by acquiring shares directly after the transaction proceeds are received.

The puzzling part of this transaction is the timeline for the monetization of SQ stake. Scheme booklet dispatch and shareholder meeting are expected in October. The scheme record/implementation date is expected shortly after that (October/November) at which point TSL shares will get delisted. Only after that TSL intends to dispose of SQ shares with distribution of the proceeds expected in November. It is not clear why would management sell SQ shares only after the implementation date and not before. The stake could also get easily liquidated today. Naturally, this raises the question of whether management can somehow screw up shareholders once the shares are delisted. Their recent track record is a bit spotty- Clearpay was sold at a lower valuation than expected, and communication after the sale was quite vague causing very wide discount to NAV. Having said that, management still owns over 40% stake and has a history of large capital returns (£25m in 2019-2021 + £2.5m last month). Most importantly, of course, the bidco will be under a contractual obligation to sell and distribute SQ shares following scheme implementation. Any unexpected issues will likely be followed by shareholder lawsuits and that should prevent any value destruction.

I am also not 100% certain whether the distribution will be classed as the return of capital or dividends and in turn the tax treatment for the receiving shareholders. The last distribution in Jul’22, mostly classed as the return of capital.

“I am also not 100% certain whether the distribution will be classed as the return of capital or dividends and in turn the tax treatment for the receiving shareholders.”

Hi dt, since Bidco would be acquiring ThinkSmart, wouldn’t it be the case that the payment is neither a return of capital nor a dividend? And since it is a sale, presumably not subject to withholding taxes?

Thanks

You are probably correct. TSL shares will be acquired, instead of distribution being made before the liquidation:

“Under the Scheme, Bidco will acquire 100% of ThinkSmart’s issued shares, including the shares owned and/or controlled by Mr Montarello. In exchange, ThinkSmart shareholders, other than Mr Montarello and entities he controls (“ThinkSmart Independent Shareholders”), will be entitled to receive cash consideration equal to the proceeds realised from the post-Scheme implementation sale on the New York Stock Exchange (“NYSE”) of the proportion of the 618,750 shares in Block Inc (“Block”) held by ThinkSmart attributable to their shareholding in ThinkSmart “

The write-up deducts a 5% sales fee instead of 0.5%. SQ share price has declined since so spread has closed a bit.

There is an extra zero in the ratio above, ratio of 0.00571x should be .0571x

My mistake, original was correct upon double check

A small update, but TSL has released its annual report. The company continues to be cash flow positive and is proceeding with the wind down as expected. Management reiterated that the intention behind delisting is to keep cash flows positive.

“From an operational perspective, we will continue to service our existing customer base during the orderly wind-down of our legacy leasing business. However, the Board believes that the costs of maintaining ThinkSmart as a listed entity until completion of the wind down would likely exceed the cash generated from the wind down of its business operations”

Shareholder meeting to approve privatisation will be held in October (no exact date yet). Remaining spread is 7%.

https://www.londonstockexchange.com/news-article/TSL/final-results-for-the-year-ended-30-june-2022/15630078

TSL provided an update on the ongoing merger/liquidation – the company has hired Canaccord Genuity as a broker responsible for selling Block shares once the merger is completed. Canaccord seems to be a reputable Canada-based investment bank with C$91bn in AUM as of Jun’22, somewhat minimizing the risk that the management can somehow screw up shareholders once TSL shares are delisted.

Remaining spread to the TSL’s stake in Block is now at 4%.

Further timetable, including the date of shareholder meeting, will be provided in “due course”.

https://www.londonstockexchange.com/news-article/TSL/broker-agreement/15679132

Recently, TSL released a scheme booklet laying out the dates for the final innings of the merger:

– Shareholder meeting is set for November 16.

– Record date is set for November 25.

– The sale of Block shares expected between the 5th and 7th of December. The fact that they’ve specified the exact dates for SQ sale is a positive.

– Finally, all proceeds from the sale of the shares would be fully distributed (net of 0.5% sales fee + forex conversion fees) to the shareholders 8 business days after the stake liquidation. The final proceeds will be taxed as a regular sale of shares.

https://www.londonstockexchange.com/news-article/TSL/scheme-booklet-and-notice-of-meetings/15683827

TSL shareholders have approved the ongoing merger/liquidation. As previously stated, the sale Block shares is expected between 5th and 7th of December, with sale proceeds distributed to the shareholders 8 business days after stake liquidation. The last date to hold TSL shares and be entitled to sale proceeds is November 25.

Remaining spread to TSL’s stake in Block is 7%.

https://www.londonstockexchange.com/news-article/TSL/results-of-scheme-meetings-and-agm/15718733

TSL’s ongoing merger/liquidation seems to be progressing on schedule:

– Earlier this week, Federal Court of Australia approved the transaction.

– Two days ago, TSL’s shares were delisted from LSE.

– As initially anticipated, the sale of TSL’s stake in SQ will be completed between 5th and 7th of December, with proceeds expected to be distributed approximately 8 business days thereafter.

https://www.londonstockexchange.com/news-article/TSL/scheme-of-arrangement-approved-by-court/15725297

Latest updates after the delisting can be found here:

https://www.thinksmartworld.com/investors/announcements/

They sold their Block shares for $64.046 per share.

That’s fantastic. I have luckily timed my exit for the 6th of Dec (in the middle of the indicated timeframe) and closed the short SQ position at $61/share. So this will be an incremental 5% bonus on this arb.

Trading ranges for SQ:

– Dec 5 – $62.4-$67.4

– Dec 6 – $60.2-$63.9

– Dec 7 – $59.6-$61.8

So it seems that TSL.L liquidated all/majority of its SQ stake on the very first day of the indicated window.

TSL/SQ liquidation proceeds have just hit my account – £0.2986 per TSL share. I am marking 15% in 5 months on this liquidation/arbitrage. The incremental 3% return relative to the write-up levels came from the closing of the short leg of the trade (SQ part) at more favorable prices vs where the company exited the stake.