Hollysys Automation Technologies (HOLI) – Expected Management Privatization – 53% Upside

Current Price: $19.00

Offer Price: $29.00

Upside: 53%

Expiration Date: TBD

The two-year-long saga of Hollysys Automation Technologies privatization might finally be coming to an end. Reuters has recently reported that the founder/CEO Changli Wang received a blessing from Beijing regulators and has partnered with a certain state-owned firm to take HOLI private at $29/share. The report said the consortium has nearly secured financing from some major Chinese lenders (ICBC) and aims to get a number of large PE firms on board, including Warburg Pincus. HOLI share price jumped up almost 20% on the news, however, a very wide 53% spread still remains. There’s a decent chance that investor skepticism towards anything China-related as well as failed previous take-private attempts have created an intriguing set-up here. The market might be underestimating the chances of this transaction closing successfully.

Pre-announcement price stands at around $17/share (11% downside). Even if you assume the price was elevated due to certain other recent takeover rumors and consider the unaffected price to be at $15/share, that’s still a risk reward of 1 to 2.35.

The catalyst is straightforward – as soon as the offer becomes official, the spread should narrow to teen levels.

Why does the spread exist?

Part of the spread might be explained by investor fatigue due to the prolonged privatization/bidding war saga that went from mid-2020 to early 2022. Changli Wang was also one of the bidders with the 3rd largest offer price, yet he was not the CEO at the time yet. The whole process ended up abruptly when Wang became the CEO in Jan’22 and said the bids won’t even be considered anymore, with the company focusing on improving operational efficiency instead. A quick timeline of events is presented below:

- Dec 2020 – $15.47/share offer from the ex-CEO Baiqing Shao.

- Jan 2021 – the ex-CEO raised the bid to $17.10/share. Both proposals were quickly rejected as undervaluing.

- Aug 2021 – $23/share from a consortium led by the company’s founder Changli Wang. Shortly after the proposal, HOLI reported that certain senior managers have joined the consortium.

- Sep 2021 – a consortium led by Zhejiang Longsheng Group offered $24/share.

- Dec 2021 – a consortium led by Recco Control Technology placed a competing bid at $25/share.

- Jan 2022 – the company’s founder and one of the bidders (with offer at $23/share) Changli Wang became the company’s CEO and decided to put an end on the bidding war. HOLI announced that it will no longer evaluate any proposals and will instead aim to improve operational efficiency.

- Mar 2022 – Recco consortium was joined by PE firm TFI Asset Management.

- Mar 2022 – Bloomberg reported that Chinese state-owned operator of Beijing’s railway and subway is considering a bid for HOLI and had already had preliminary discussions. The price was mentioned at $1.9bn or around $31/share.

- Apr 2022 – founder/CEO Wang acquired nearly 2% of HOLI stock (1.055m shares) at around $16/share levels.

- Jul 2022 – Recco consortium was joined by one more PE firm – Great Wall Capital – and the offer price was reaffirmed at $25/share.

- Sep 2022 – Reuters reported that CEO Wang received a blessing from Beijing and is partnering with a certain state-owned firm to take HOLI private at $29/share.

Another potential reason for the wide spread is HOLI being an out-of-favor U.S.-listed Chinese stock. The US-China tensions, the Chinese stock market crackdown, as well as overall turbulence in the markets, have created a strong negative sentiment around the US-listed China companies. Most investors wouldn’t touch these companies with a ten-foot pole now. Aside from depressed valuations, this has also created many arbitrage opportunities in the US-listed Chinese privatization set-ups, which, at least historically, have had one of the highest success rates. Even the privatization deals with signed definitive agreements have been recently trading at very wide spreads – e.g. BLCT (20%+), HLG (peaked at 20%), ZXAIY (20%+), MITO (20%+) or GSMG (peaked at 35%). HOLI situation is still only in the rumor stages, so an even larger spread is not that surprising. However, this negative sentiment suggests the market might be underestimating the chances of this transaction closing successfully.

What is different this time?

The main risk here is that the rumors might prove to be false and it turns out Changli Wang is not really interested in taking the company private (which is exactly what happened in the previous bidding cycle). There are some reasonable counterarguments to that.

First of all, compared to when Wang’s first bid was made, he is not an outsider anymore. Now he is in the position of the CEO and has recently acquired large bulk of HOLI shares. That should’ve cost him around $16m. When the CEO invests that amount of personal cash into the company, it doesn’t really speak “not interested” to me.

Moreover, at the time of his previous bid, he was pressured by two other consortiums with higher offers, so the suspension of a bidding war might’ve been nothing more than a move to give himself more time to find partnerships and raise cash for a more competitive higher offer. A partnership with a state-owned firm (potentially a client) seems like a smart move.

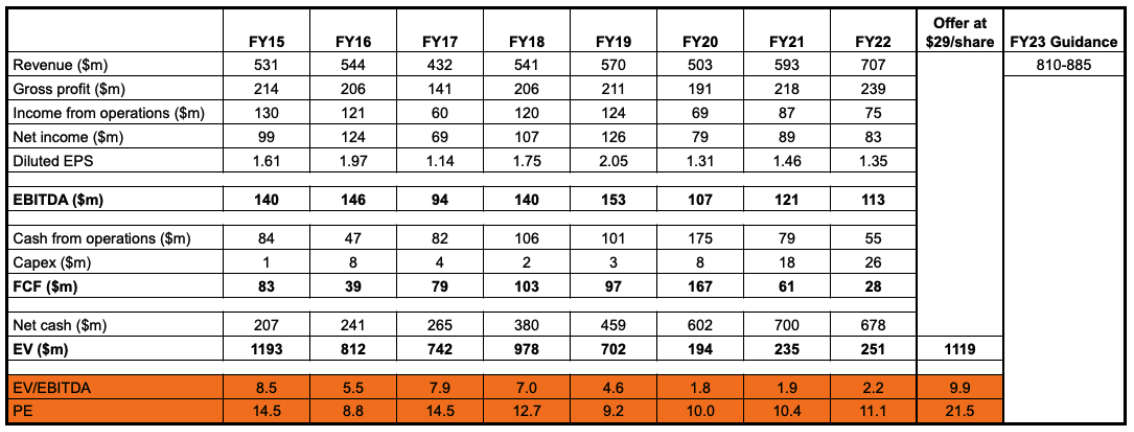

The offer also makes sense from a financial standpoint. Reuters reported that the current bidders’ consortium wants to delist from the US and potentially relist the company in Chinese markets a few years later. HOLI’s strong net cash position ($678m, or more than half of the market cap), profitable business ($60-$100m annual FCF), and the overall negative sentiment for U.S. listed Chinese stocks leave little reasons for the company to remain listed in the US. The offer at $29/share would value the company at 10x TTM EBITDA and 21.5x PE. Not screaming cheap on paper, but a very close China-listed competitor – Zhejiang Supcon Technology – trades at 64x TTM PE. Financial reports from this peer are not available (at least not in English), so the visibility into its business is quite low. However, HOLI says Zhejiang Supcon is its closest domestic competitor. Also based on the available information (annual report summary) both companies definitely appear comparable and are almost identical in size. Zhejiang Supcon’s 2021 revenue was $709m vs HOLI’s $707m, and net profit stood at $91m vs $83m for HOLI. Notably, Zhejiang’s recent financial performance has been improving (10% higher sales growth in the recent quarters). One could probably say Zhejiang Supcon is overvalued, however, I feel quite strongly that at least directionally the gap between the peers here is way too large, and having HOLI relisted in the domestic markets would result in a materially higher valuation than the company currently receives with its US listings.

The two recent media reports/rumors from Bloomberg and Reuters are also quite interesting. Their stories seem to be well-aligned despite getting published 6 months apart. Bloomberg says that a state-owned railway and subway operator wants to make a bid at $31/share. Reuters mentions that an unnamed state-owned firm has pretty much already formed a consortium with the management at $29/share. I think it is quite possible that both reports talk about the same state owned company suggesting the buyout negotiations are already underway for a few months. The price cut from $31/share (March) to $29/share (September) makes sense given the market downturn during this time.

The idea that a state-owned railway/subway operator is interested in HOLI is not surprising given that a large part of HOLI revenues (26%) come from signaling control and automation products sales to rail/subway sector. So this would be a strategic deal/vertical integration, which also explains the ability to pay a price premium above the other two closest bids (at $25/share and $24/share). Chinese government interest in HOLI also makes sense as HOLI’s automation systems are also used in sensitive industries, e.g. nuclear power, petrochemical, etc. Takeovers with state-owned Chinese bidders usually get done smoothly, so if an official deal is announced, the remaining regulatory risks would likely be lower than usual in Chinese privatization transactions.

A few thoughts on other risks

- This is a Chinese company and financial reports provide very limited visibility into the business and its prospects.

- It is also not clear if numbers HOLI can be fully trusted as their auditors are not inspected by the Public Company Accounting Oversight Board (no auditor oversight). However, this risk is countered by the notion that the previous CEO, current CEO as well as a number of various PE firms have been/were trying to take the company private. Recent share purchases by CEO Wang are also quite reassuring in this regard.

- The recent rumors could prove to be false. In this case, the share price should gradually drift to pre-announcement levels. However, certain other PE consortiums have been quite persistent with their offers and if that continues, it might provide a bit of support for the share price.

What is also a bit strange is that here we potentially have a CEO of Chinese company who seems to be playing by the rules. This is a Chinese ADR and there are probably a number of different other ways he could have siphoned away shareholder value without cashing out shareholders a pretty large premium.

Unlike other recent US-listed Chinese privatizations, the management owns relatively little amount of shares (around 6% vs the usual 60%-80%). Privatization would require a shareholder vote and most major shareholders are large US PE firms – Davis Selected Advisors (11%), Fidelity (7.2%) and M&G Investment Management (5%). One other large holder – Ace Lead Profit (6.7%) is currently controlled by the ex-CEO Baiqing Shao. HOLI is currently in litigation with Shao as apparently the control of Ace Lead Profit was temporarily granted to him by the current CEO Changli Wang while Shao was CEO at the time. Shao was removed from the CEO in Jun’20, however refused to return the shares. The litigation is still ongoing.

Given the presence of several other bidders, the premium offered to appease shareholders (including Shao) is kind of self-explanatory here. Of course, it still assumes that Changli Wang is willing to be a good guy and not do anything shady instead.

Business

Hollysys, founded in 1993, is an automation control system solutions provider in China with additional overseas operations in 8 countries throughout Asia. The company operates in three business segments:

- Industrial automation (62% revenues) – hardware, software, control systems for industries involving continuous flow of material handling (power generation, petro-chemical, metallurgy, etc.).

- Rail transportation (26% revenues) provides control and automation systems to the high-speed rail sector. The products include automation train protection mechanisms, train control centers – equipment stations that monitor route conditions, schedules, the distance between trains, etc.

- Mechanical and electrical solutions (12%) provide solutions in design, engineering, project management, construction and other industries, mostly in international markets around Asia.

Historical financials (fiscal year ends in June):

Revenue growth has ramped up as the company has taken a number of new projects for the industrial automation segment. FY22 revenue grew +19% YoY and another 15-25% growth is expected in FY23. However, the margins and profitability have been pressured during the last year due to higher input costs (labor) and R&D expenses ($69.6m vs $13.6m in FY21) – HOLI says it intends to upgrade its mainstream products and develop new ones to meet the needs of the digital infrastructure market. Further visibility into the results is limited as the 20-F for FY22 is not out yet.

Excellent succinct write up, any commentary/news on Weibo/We Chat ?

Is it possible that the deal is on hold until after the 20th National Congress of the Chinese Communist Party on 16 October 2022 ?

HOLI was added to the SEC’s Holding Foreign Companies Accountable Act (“HFCAA”) list this week.

https://www.sec.gov/hfcaa

May provide further impetus to go private and delist.

$29 looks a little too good after the last week – any reason to be worried about $29 disappearing or revised down?

Definitely. That’s why the spread is so large.

A few weeks ago, Hollysys released its FYQ1 results (ending in September). No updates regarding the potential buyout so far.

From the operations perspective, things continue as usual and there is nothing to suggest the going-private transaction might brake. The company delivered +11% YoY revenue growth including the effect of depreciating RMB against the dollar as well as a 12% growth in EBIT. The company continues to onboard customers across all of its operating segments. Most notably, they have signed a contract to provide Industrial Automation infrastructure to China National Offshore Corporation, a large state-owned energy business, this quarter. The company’s operating cash flow was barely positive in Q1 with most of the cash tied up in working capital. Management has not provided any color on these dynamics. HOLI continues to hold large cash reserves equal to 64% of Mcap with minimal debt.

https://www.bamsec.com/filing/119312522285830?cik=1357450

I bailed out of half with a small profit because I sized this too big for some reason. Is this still a good play with obvious Chinese uncertainty etc?

https://www.reuters.com/business/us-pcaob-says-is-able-inspect-firms-china-first-time-2022-12-15/

With the recent agreement between PCAOB and the Chinese govt, incentives for Chinese companies to delist from the US market have come down. We already saw consortium of Fanhua(FANH) calling off the go-private offer for the exact reason. https://www.sec.gov/Archives/edgar/data/1413855/000121390022082628/ea170816ex99-1_fanhua.htm

Bright Scholar Education Holdings(BEDU) is another one, although consortium to BEDU didn’t specify reasons for calling off the deal. Admittedly the set up with HOLI is a little more favourable with the new(founder) CEO and rumours of acquisition, but the recent development in other companies in similar situation is certainly noteworthy

How big of an impact do you think this will make on Chinese privatizations in general? The spreads of most ongoing transactions barely budged on this announcement. Some other Chinese privatizations have been announced or went from non-binding to definitive (e.g. CIH, ICLK) since then. I guess the delisting threat has been more of a minor/secondary aspect in most cases, while opportunistic/cheap prices and/or potential to relist in China have been the primary and won’t be affected much.

HOLI released FYQ2 (ending Dec’22) results to mark another solid, business-as-usual quarter. The company continues to onboard new clients and steadily grows its top line. This recent quarter also saw some meaningful cut in expenses, which elevated margins across the board. HOLI now trades at 11x TTM earnings and has 55% of its MCAP in net cash with minimal debt. Other than that, there have been no updates on a potential privatization for several months already, which is obviously concerning. However, given the stable financial performance, I am inclined to wait for a few more months before reassessing the situation.

Quick overview of FYQ2 results (worth noting that YoY comparison might be a bit skewed due to COVID lockdowns last year):

– Revenue up 13% YoY;

– Gross margins at nearly 40% vs 36% same quarter last year;

– Operating margin at 19.5% vs 11% the same quarter last year;

– Net income up 60% YoY;

https://www.bamsec.com/filing/119312523040301?cik=1357450

Any updates on the bid here?

I believe it’s time to close HOLI case as the expected privatization thesis seems to have failed and the previous rumors did not pan out. Since I posted this write-up, I have not seen any further news/chatter on the buyout. This is kind of strange given the high number of parties that were reportedly interested in acquiring the company. Although HOLI remains cheap (and has 65% of mcap in cash), as a Chinese ADR with very limited visibility into the business it can remain cheap indefinitely. Moving on and marking a 14% loss in 9 months.

https://seekingalpha.com/news/3977901-hollysys-automation-gains-amid-report-of-management-led-buyout-talks

HOLI went up 10% yesterday as rumors appeared on Dealreporter that the company’s management has now teamed up with CITIC Group for a potential privatization valued at $1.6bn (vs $1.8bn rumored in September). HOLI trades at a 50% spread to the $25.8/share buyout price implied in the rumors. The market remains highly skeptical that after all of the previously failed buyout sagas/rumors, something will finally materialize this time.

Seems to be ramping back up – DT, worth opening back up?

Bueller, anyone?

8/24 – Buyer Consortium Led by Recco Control Technology and Dazheng Group Affirms US$25 Per Share Offer to Acquire Hollysys

https://seekingalpha.com/news/4006141-buyer-group-renews-bid-for-chinas-hollysys-automation-report?hasComeFromMpArticle=false

8/30 – Shareholders ask China’s Hollysys to set special meeting amid takeover frustration

https://www.reuters.com/markets/deals/shareholders-ask-chinas-hollysys-set-special-meeting-amid-takeover-frustration-2023-08-30/

And a rumor that CEO led buyers consortium is planning to make their bid in September.

https://seekingalpha.com/news/4005175-hollysys-automation-gains-on-report-management-buyout-consortium-finalized

This looks like a very interesting situation here. Downside is limited, and seems like some sort of resolution is likely to happen within the next month or two.

Formal sale process launched:

https://seekingalpha.com/news/4017000-hollysys-forms-special-committee-to-conduct-a-formal-sale-process

Let’s continue HOLI discussions on this post http://ssi.wpdeveloper.lt/2023/09/quick-pitch-hollysys-automation-technologies-holi