Pitches For SWKH, APE and IMRA

APE – Share Class Arbitrage – 69% Upside

IMRA – Strategic Review – 58% Upside

SWKH – Potential Takeover – 24% Upside

NEW QUICK PITCHES

SWK Holdings (SWKH) – Potential Takeover – 24% Upside

We’ve been following this company from the sidelines for a while now, certain recent developments have sparked our interest again. SWK Holdings owns a portfolio of pharma royalties and structured loans. Its largest shareholder for at least the lat 12 years has been Carlson Capital with 71% stake. Carlson has been dissatisfied with the company’s performance and in Nov’21 lobbed a non-binding offer for $19/share (vs $16 currently). The price was later increased to $20.20/share (24% upside to the current price). In Jan’22 special committee rejected the bid. Shortly after the rejected take-over, the company went through some kind of board clean-up – out of 5 directors and 3 were changed during Feb-Mar, basically all except for Chair/CEO and Carlson Capital’s nominee. Then on the 1st of September, SWKH announced that its Chair/CEO Winston Black has also resigned – an unexpected move given his 10 year tenure in the company and 6 years as CEO.

It looks like something is brewing behind the scenes here. Its quite possible that Carlson Capital is still interested in taking SWKH private and has fully cleaned up the board to push through another offer. The timing would be opportunistic as well. SWKH currently trades at a much wider 19% discount to BV (ex. Enteris, more on it below) vs Nov’21 when the discount to BV stood at only at 2.5%. Moreover, current economic backdrop likely provides tailwinds for SWKH’s financing business as many pre-revenue pharma companies will find it more difficult to raise cash from traditional sources and will have to go to lenders such as SWKH. The risk is of course that the offer doesn’t materialize and chairman’s resignation was due to some other reasons/issues, e.g. failed milestone for Enteris or other.

SWKH stock is cheap. The BV currently stands at $21.25/share, comprised of $18.5/share in finance business TBV+ $1.17/share from Enteris + $1.5/share in BV value of SWKH NOLs. Assuming Enteris is a zero, SWKH currently trades at 19% discount to BV. In comparison the average discount for debt-focused BDCs is 8% (also BDCs are usually quite levered and SWKH has basically no debt). A way larger pharma royalty peer RPRX ($29bn market cap) trades at nearly 3x BV.

A bit of background. SKWH specialty finance operations have historically performed pretty decently – compounding TBV at 6.5% since 2015. During the last 10 years the company has realized 30 investments with an average IRR of 20% and MOIC of 1.4x. Current portfolio composition – 75% first lien debt (16 investments), 24% royalties (11 investments) and 1% warrants. Aside from the financing segment and pharma royalties, the company also owns Enteris, a biotech platform/technology, that is supposed to help re-make injectable drugs/molecules for oral delivery. SWKH acquired Enteris in 2019 for $30m ($2.34/share), but due to a certain accounting-related write-off Enteris BV now sits at $1.17/share. The main license agreement is with Cara Therapeutics, which uses Enteris to develop a certain drug, that is currently moving to phase 3 (should be this year). The success of Enteris will largely depend on the success of this particular drug. In 2021 several milestones have already been secured for which Enteris received $15m payment from Cara Therapeutics. A bit more color on the company’s history can be found in this VIC write-up and in the company’s presentation.

AMC Entertainment Holdings (APE) – Share Class Arbitrage – 69% Upside

A fresh share class arbitrage situation with a very wide spread. At the moment, we find it too risky, but definitely worth following for further developments.

On the 22nd of August, retail crowd beloved AMC Entertainment issued a special dividend to its common shareholders in a form of listed preferred shares (ticker: APE). These preferred shares have equal economic rights to the common shares and are an almost ‘ídentical’ security. Management has noted that it would make sense for both APE and AMC to trade at the same level:

Because the AMC Preferred Equity unit is designed to have the same economic value and voting rights as a share of common stock, in theory, the common stock and AMC Preferred Equity unit should have similar market values and the impact of the AMC Preferred Equity unit dividend should be similar to a 2/1 stock split.

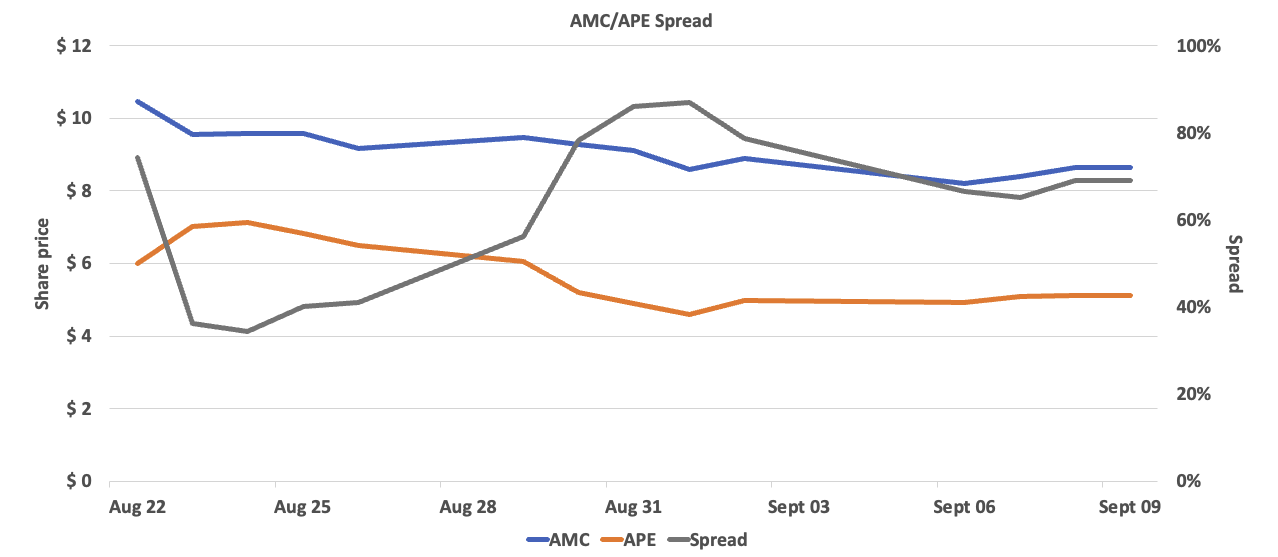

However, right from the first day of listing, APE shares have been trading at a wide discount to AMC. Currently, the spread between the two classes of shares currently stands at 69%. If the prices would converge in short term, then long APE and short AMC would be an obvious bet with a 69% upside. And apparently, some prominent investors are playing this arb, e.g. short-seller Jim Chanos and a large event-driven/arbitrage-focused hedge fund Millenium Management ($50bn+ AUM), which seems to have jumped onto this arbitrage trade right from the first day of listing and breached 5% ownership on the 24th of August.

Despite the appeal of extremely wide spread and some prominent funds/people participating in the trade, there are some very serious issues/risks with this case:

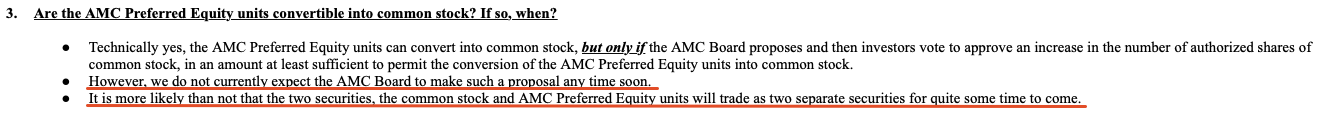

- There is no catalyst for the AMC / APE share prices to converge in the short term. APE is economically equivalent to AMC and theoretically might become exchangeable into common stock in the future. However, management clearly stated that it does not expect this to happen in the near future (see quote below). The key reason is that AMC simply can’t issue any more common shares to make the conversion – the company used up all of the available common share issuance authorization. Apparently common shareholders want to limit any further dilution and the proposal to authorize more common shares was firmly rejected last year. This is also the key reason why management created the currency of APE preferreds. This effectively blocks a path for APE convertibility.

- APE has been created pretty much for the sole purpose of going around the AMC share authorization restriction to continue equity issuance. The company is extremely levered and is close to breaching its debt covenants. It needs to continue raising cash in order to avoid bankruptcy. The CEO has been pretty open about the whole set-up as well. 483m APE shares are still available under the current authorization, which would mean nearly 2x further dilution for APE. The dynamic where AMC amount stays fixed and the company continues to pump APE into the market might only make the spread wider.

- AMC borrow fee is very expensive – currently at 20%. Moreover, AMC is reddit/WSB crowd’s darling and is still quite volatile. The risk of further short squeezes is real. If that happens and borrow rate spikes you might be left holding a pretty heavy bag with no catalyst in sight.

With all of this in mind, it’s pretty difficult to answer what is the appropriate spread size here. However, APE has just started trading and we still need to see where the whole thing will settle. Given how volatile AMC is, the set-up could provide interesting entry points in the future.

Imara (IMRA) – Strategic Review – 58% Upside

The idea has previously been covered on this SSI Weekly. Below is more of an extended update of the current situation. IMRA was a failed biopharma company, that traded at 50% discount to net cash. The company discontinued all treatment developments and started a strategic review. Subsequently, small-cap/biopharma-focused fund BML Investment Partners increased its stake in IMRA from 6.2% to 12%.

Just recently, IMRA announced an unexpected sale of its main treatment tovinontrine, which had been previously discontinued, to Cardurion Pharma. The consideration is $35m in cash + two potential earnout payments of $10m and $50m. Cardurion Pharma is a privately held clinical-stage biotech focused on cardiovascular diseases. The buyer is apparently backed by some large names including PE firm Bain Capital and industry giant Takeda Pharmaceuticals ($42bn market cap). IMRA had already been trading at wide discount to net cash, so investors were clearly not expecting to receive any material incremental proceeds from the disposals of discontinued drug development programs. As a result of this sale announcement, IMRA’s share price jumped up +86%. Strategic review is still ongoing. The only other remaining asset to be sold is IMR-261 – a much earlier stage, on the brink of entering Phase 1 only – I would be surprised if it delivers any material proceeds.

The details around the earnout payments are limited. The $10m is subject to Cardurion reaching ‘proof of concept milestone or other specified clinical milestones’. $50m is conditioned on certain regulatory/commercial events. IMRA was developing tovinontrine for two separate treatments – sickle cell disease and β-thalassemia (inheritable blood disorder). Both of these treatments were in phase 2b stage. On top of that, IMRA was planning to start clinical development for tovinontrine in heart failure with preserved ejection fraction this year. Since Cardiurion Pharma (the buyer) is focused specifically on ‘treatment of heart failure and other cardiovascular diseases’, I expect the future payments are based not on the first two treatments that are in phase 2, but on this new potential development for heart failure, for which the trials haven’t probably yet started. This also makes sense given that one of the conditions is the proof of concept milestone, which is typically done in phase 1 or phase 2a (irrelevant for the first two treatments). The point here is that both of those $10m and $50m future payments are very uncertain and likely quite far away in the future.

Taking into account only $35m cash proceeds from the sale IMRA’s pro-forma net cash position (cash – total liabilities) as of Jun’22 would be $95m or $3.62/share. Q2 cash burn was still elevated ($12m) as the company had large lay-off-related expenses and some R&D spend was still there as well. Assuming, 3 more quarters with cash burn at $2m (seems conservative given only 6 employees left), the net cash position at the end of a strategic review could be $3.39/share. So despite the massive recent share price jump, the discount to net cash here is still substantial at 37%.

However, I am not sure if shareholders should be expecting the liquidation of the company and the distribution of a large cash balance. The risk of management taking the M&A route remains – despite 40% stock ownership, management is used to getting very high compensation and the company has massive $250m NOLs, which could utilize through acquisition. Given the risk of some value-destroying transaction, the discount to cash appears justified. Also worth noting that, following the tovinontrine sale, IMRA entered into retention agreements with the CEO and CFO. The retention payments (albeit relatively small – $275k for CEO and $110k for CFO) are conditioned on execution/closing of either the (1) Asset Purchase Agreement (or any other definitive agreement for the sale, lease, exclusive license or other disposition of all or substantially all of the assets of the Company) or (2) definitive agreement for the merger or consolidation of the Company with a non-affiliate third-party. This kind of makes it unlikely straightforward liquidation is currently in the cards.

PREVIOUS QUICK PITCHES PLAYING OUT

Hemisphere Media Group (HMTV) – Merger Arbitrage.

The initial pitch is here. The 1st update is here. Another update on the opportunistic management’s attempt to buy out Hemisphere Media at $7/share. Management owns 43%. Since the takeover announcement, multiple activists have clearly communicated dissatisfaction with the price saying that the offer significantly undervalues the business. Management has initially refused to review two superior offers at $8/share and $9/share. This caused further investor outrage and in July management granted due diligence to one of the outside bidders. This has recently culminated in the submission of a non-binding revised proposal at $9/share comprised of $7.25/share cash and $1.75/share in stock. HMTV now trades at $7.05/share, just above management’s offer.

I think it is really positive that management granted due diligence for a third-party bidder – a sign that the overall pressure from activists/competing bids is working. The chances of management raising its offer to appease shareholders are now higher. The risk-reward setup seems favorable – a small downside to the current management’s bid and optionality from any third-party bids or an improved offer from the management. As before, the main risk is that management is totally in control as their unofficial affiliates apparently own enough of the minority stake to push through the current offer.

ResApp Health (RAP.AX) – Merger Arbitrage. Fully played out.

We have highlighted this merger multiple times – initially in June. Pfizer was buying ResApp Health for A$0.146/share. Due to unsatisfactory efficacy test results announced after the merger, the spread widened to 17%. Pfizer seemed very interested in the merger and eventually re-confirmed its intentions. Retail shareholders of RAP were very dissatisfied with the price and raised a lot of noise on Australian investor forums. This has forced Pfizer to raise the offer price to A$0.205/share. Finally, on the 7th of Sep, shareholders approved the merger ending the RAP.AX acquisition saga. Since our initial highlight, the transaction has generated a generous 62% return in a little less than 3 months, with the last 10% return generated since our latest update on the 5th of Aug after the improved bid from Pfizer.

Cynergistek (CTEK) – Merger Arbitrage. Fully played out.

This was a timely arb trade on a successful merger of two cybersecurity companies, which seemed to have minimal risks and eventually worked out as expected. The idea was highlighted a month ago. Cynergistek was buying its peer Clearwater Compliance at $1.25/share in cash. There was a 6% spread to the offer price. Shareholder approval was likely given high ownership by management as well as the participation of a certain event-driven fund that acquired 10% stake after the merger announcement. The downside was well-protected by the presence of another bidder and overall M&A activity in the industry. Shareholders approved the transaction at the end of August and the merger promptly closed generating 6% in one month.

PLTK: there is no odd-lot.

“Upon the terms and subject to the conditions of the Offer, if more than 51,813,472 Shares, or such greater number of Shares as we may elect to purchase, subject to applicable law, have been properly tendered and not properly withdrawn prior to the Expiration Date, we will purchase properly tendered and not properly withdrawn Shares on a pro rata basis with appropriate adjustments to avoid purchases of fractional Shares, as described below. Such proration will apply to all stockholders without priority, including “odd lot” holders (e.g., stockholders who own, beneficially or of record, less than 100 Shares and who properly tender all of those Shares)”

Thank you for the correction. Have removed it now. Also resent the newsletter with the correction. Rushed through the filling and somehow skipped that ‘odd-lot’ is mentioned in a different context here.

With IMRA, Clark Street seems more expectant of a liquidation based on the language in the 8K. (A commentator on his blog suggests that the phrase “and the plan of liquidation” which, in part, led Clark Street to believe liquidation is likely may be boiler-plate language used in error.) With the amendment to the retention agreement my interpretation was the same as yours; i.e., it doesn’t appear to favor liquidation in particular, although I have no experience with such matters.

The one thing that struck me was that with 40% ownership, potentially $3.39/share in liquidation distributions and ~26.3m shares outstanding would result in ~35.66m (26.3m * 40% * $3.39) for insiders in a liquidation scenario. I can’t recall their compensation off the top of my head, but presumably ~35.66m ought to provide a meaningful incentive to liquidate and return capital to shareholders wouldn’t it?

http://clarkstreetvalue.blogspot.com/2022/09/imara-asset-sale-below-ncav-potential.html

Your guess is as good as mine on how the final outcome for IMRA will look like. Almost 50% of the company is owned by several VC funds. They might be looking for where to reinvest. Doing that through IMRA as a vehicle (M&A or reverse merger) is a simpler and faster way than liquidation. VC representatives are also on the board and will continue to extract salaries this way as well.

So I guess I’m leaning towards more of a pessimistic side. But obviously, all options are possible.

G98 and DT:

Both of you mentioned that IMRA has 40% stock ownership by management. Where did you get that figure from? I couldn’t find it in IMRA’s SEC filings, but likely I’m looking in the wrong place. Thanks!

See the proxy statement from April

SWKH – anything worth updating since last week’s earnings and yest buyback announcement (4.6% of outstanding until May 2024).

https://www.sec.gov/ix?doc=/Archives/edgar/data/1089907/000155278123000281/e23266_swkh-8k.htm

Re SWKH: my pitch was mostly regarding strange management reshuffling in the company in light of the previously rejected buyout offer from the largest shareholder. Since then SWKH traded up close to the previous offer price of $20. This happened back in Nov-Dec’22 and I have not followed SWKH since.

It looks like the company is not moving in the privatization direction and just continues operations as usual.

The announced 4.6% buyback is actually quite large given the limited float. Carlson Capital owns 70.9% and two other funds own a further 13.7%. So the buyback would be 1/3 of the float if these largest shareholders are excluded. Open market liquidity is minimal so no idea how this buyback plan can be implemented through Rule 10b5-1 and Rule 10b-18.

Any thoughts on this?

My thought is that nothing much is happening. I don’t expect any near-term events. Nothing wrong with it but I don’t see another privatization attempt anytime soon.