111 (YI) – Management Privatization – 30% Upside

Current Price: $2.77

Offer Price: $3.61

Upside: 30%

Expected Closing Date: TBD

IMPORTANT: The following write-up has been originally posted on Oct’22. The case was then closed in December’22 with +30% gain when YI stock popped after China relaxed Covid restrictions and the spread to the buyout price was eliminated. However, in the following month, YI shares have retraced all the way back to the initial write-up levels, whereas the thesis has remained virtually unchanged or maybe even slightly improved given the expected positive impact on YI’s business from the lifted lockdown. Therefore, the idea has been reopened on January 20, 2023 at a price of $2.85/share (27% potential upside).

Non-binding Chinese privatization deals are inherently very risky. Although YI’s situation seems particularly interesting, with multiple aspects pointing towards a definitive proposal materializing within a short timeframe, the risks related to these types of transactions should not be ignored.

YI is a pharmaceutical distributor in China, with a primary focus on the wholesale segment. In early Sep’22, the company received a non-binding acquisition proposal from a consortium led by the company’s two co-founders/co-chairmen (92% of the voting power and 44% economic interest) at $3.66/ADS or $3.61 after ADS fees. Two weeks later, YI established a special committee to evaluate the proposal. Given controlling ownership shareholder vote would be just a formality. The spread sat at 10% right after the announcement but over the last week widened quite materially alongside other Chinese privatization transactions (e.g. VNET or HOLI). The spread now stands at 30% with YI shares trading significantly below pre-announcement (Sep 9) levels. The market seems to be highly skeptical of the proposal being serious, despite multiple arguments suggesting otherwise. Similarly to the recently highlighted OIIM privatization, this could be one of those cases where the situation has been temporarily mispriced due to investors’ skepticism towards anything China-related. I expect the timeline till definitive agreement to be short – for reasons outlined below management can’t afford long reviews and delays, which are quite common in Chinese privatizations at the non-binding stage.

Several factors make this setup particularly interesting:

- YI has unusually reputable management for a micro-cap Chinese ADS – founders’ profiles and track records add to credibility of the offer. One of the co-founders Gang Yu previously held executive roles at Dell and Amazon. He also launched two other businesses, which were later acquired by US giants. Yihaodian (online grocery business) was founded in 2008 and acquired by Walmart in 2015. A year later Walmart sold the business to JD.com (but remained a retailer inside the platform). Gang Yu also founded CALEB Technologies (aviation management systems) which was acquired by Accenture in 2004. YI co-founder Junling Liu was Dell’s China/HK president and VP before co-founding Yihaodian together with Gang Yu. Open market share repurchases even if small (around 4% in total since 2019) also speak quite a bit towards management’s credibility – a US-listed Chinese micro-cap that’s buying back shares is a rather unusual sight.

- There’s a very clear reason behind the privatization proposal. As a US-listed Chinese company, YI has been struggling with raising new capital, and since 2020 YI’s management has been emphasizing the goal to tap into the domestic Chinese capital markets and get listed on the domestic STAR (Sci-Tech Innovation Board) market of Shanghai Stock Exchange. This situation forced the company into a pretty bad deal two years ago. As part of two post-IPO capital injections into YI’s onshore principal operating subsidiary in Aug’20 and Dec’20 (~$130m in total), YI has agreed with these investors to redeem their equity interests at cost + pay 6% annual interest if STAR listing of YI’s subsidiary is not completed before Jun’23. The redemption would be exercised upon investors’ request. YI has recorded the liability for these redeemable interests – mostly held by Chinese private equity/venture capital firms – at $154m as of Q2’22. The company has explicitly noted it may not have the needed liquidity if such redemptions are triggered – net cash was $130m as of Q2’22 and run-rate annual cash burn stands at $30m+. Without Shanghai’s listing, YI would have to carry out a dilutive equity raise, the success of which would be very questionable given current market conditions, low sentiment towards Chinese companies, and YI’s HFCAA classification (the company could get delisted by SEC if it doesn’t change the auditor till 2024). Elimination of the US listing seems like a necessary step toward this relisting process. Unlike Hong Kong, the Shanghai stock market is particularly secretive and prohibits foreign investors from participating. Getting Shanghai’s approval could be problematic without removing the US listing first. Management should be incentivized to move swiftly with this privatization as it is running out of time (and cash) to avoid substantial paydown to equity investors and resolve funding issues. Interestingly, YI has even eliminated VIE structure (shifted into full equity ownership) of its operating subsidiaries, which is a rather unusual step for US-listed Chinese companies. This was likely done as part of organizational structure simplification in preparation Shanghai’s relisting.

- YI is cheap and buyers are getting a very good deal. The US-listed entity owns 86% of the onshore principal operating subsidiary. The remaining 14% are owned by the above-mentioned equity investors from the Aug’20 and Dec’20 financings. At the time of Dec’20 equity raise, the operating subsidiary was valued at $1.6bn post-money. YI’s management also participated in the financings and invested $3.5m into the operating subsidiary. At this valuation, the fair value of YI would be $1.45bn. This compares to $230m current market cap. At the current offer price, the buyers’ consortium would be cashing out 56% YI’s minority shareholders for only $170m – two years ago this stake was valued at $810m. Similarly, minority shareholders are getting cashed out at cents on a dollar of the IPO price ($14/ADS in 2018). And although valuation multiples have come down over the last two years, YI is not a technology business where the valuation could have contracted by a factor of 4. The current market price has likely been suppressed by negative sentiment towards Chinese companies as well as temporary pandemic-related issues, which should eventually subside and be replaced by favorable tailwinds driven by the government’s initiatives to improve and digitize China’s healthcare and drug distribution industries.

- Additional credibility of the offer comes from the transaction being financed by a government-controlled entity. The buyer consortium is sponsored by Shanghai Guosheng Capital Management, a PE firm, which manages a state-owned investment fund/platform. It was created back in 2007 to innovate and improve the operating mechanisms of state-owned assets in strategic industries. The involvement of such a financier confirms that the co-founders’ privatization intentions are serious, and increases the chance of a successful outcome. Another government-owned fund (Shanghai Science & Technology Venture Capital) had already participated in the Aug’20 and Dec’20 financings mentioned above.

- YI is not your usual shady US-listed Chinese company, but rather a strong business with ties to international partners and close cooperation with the Chinese government. YI is partnering with major international healthcare players, e.g. a recent deeper collaboration announcement with German healthcare titan Bayer Healthcare (€47bn market cap). YI is also the first e-commerce company in China that secured a direct sourcing partnership with Bayer. Due to its technological capabilities the company has been certified as a ‘national high-tech enterprise’ by the Chinese Ministry of Science and Technology and also designated as a ‘ppecialized, high-end and new technology enterprise of Shanghai’ by Shanghai’s municipal government. During COVID lockdowns, many pharma companies were struggling with supply chains and YI was appointed by the Shanghai government as a ‘supply guarantee enterprise’ (special permit to move through the city) and also received a special green channel (logistics passage) from one of its fulfillment centers to Shanghai (see quote below).

And those companies are classified as supply guarantee companies. They’ve given special permits on to the road. Initially, they were only companies which can deliver food and water, which is the most essential for survival. And our DR team proves its value. They approached relevant authorities repeatedly. As you can imagine how chaotic it can be when the city just got locked down initially. And the system was literally in shock. And eventually make sense to the authorities that in addition to food and water, many chronic patients who need drugs to survive. So they granted us the permit. But unfortunately, our fulfillment center is in Qianshan, which is a neighboring province. And we have to go through a similar process in Qianshan which was governed by different decision-makers. To put the long story short, we got it sorted and eventually made it work. And both governments give us the green light.

- The special committee consists of three independent directors – all of who come from reputable although pharma-unrelated backgrounds. Nee Chuan Teo is the CFO of H World Group Limit – a large Chinese hotel group listed on the Nasdaq (HTH) with a market cap of US$10bn. Jian Sun is the executive director and general manager of BTG Hotels – another hotel group listed on the Shanghai exchange with a market cap of US$3.4bn. Previously he was the CEO of Homeinns Hotel Group – an economy hotel chain, which was also listed on NASDAQ and got acquired by BTG for US$1.2bn in 2016. Given YI’s financial position (threat of $154m paydown), I don’t think that the special committee would reject the offer outright and force dilution on shareholders a few months down the line.

111 background and financial performance

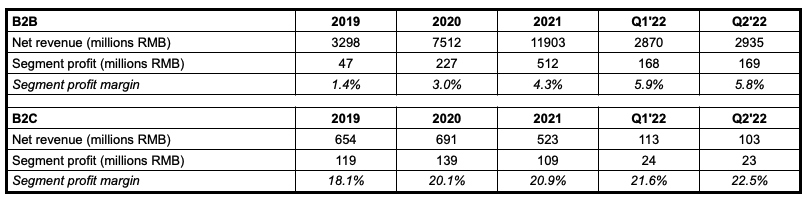

YI has online retail pharmacy (B2C) + telehealth (online hospital) operations, but the main business of the company is B2B wholesale drug distribution. The company started expanding into wholesale back in 2016 and B2B quickly became the largest segment of YI. Revenues skyrocketed as the increased scale added to the attractiveness of YI as a commercial partner. As per the CEO, ‘With that infrastructure, we were able to scale – as one can understand and one can appreciate in the Chinese market, scale matters a lot. And without scale, nobody takes you seriously.’

YI partners with 500+ global and domestic pharma suppliers and provides services to 410,000+ Chinese pharmacies, covering 70% of China. The company itself operates 8 regional fulfillment centers, double from the 4 in 2018. YI has recently started a new initiative called ‘the franchise fulfillment center program’, where it onboards third-party fulfillment center operators to allow YI’s clients to use their facilities. So far, 11 third-party centers have been signed up, putting the total count fulfillment center count at 19. The company is able to deliver to 270 Chinese cities. Clients in major cities get their orders within 24 hours, and others within 72 hours.

YI also leverages its supply chain, big data, and cloud platform tech to offer software services to its clients, e.g. CRM, supply chain management, digital contract sales organization, etc., however, revenues from this venture are still minuscule. This year, YI also launched its private-label products (only 3 brands so far). Management claims that its CRM, big data and healthcare database gives it the ability to pick and target specific high-margin segments/products.

Putting it all together, YI management asserts it has created the largest pharmacy/distribution network in China, where all participants of the value chain are interconnected in YI’s omnichannel platform. Management calls this business model S2B2C meaning leveraging the supply chain platform to help business to better serve customers.

There are no direct publicly listed peers, and the main competitors operating in this space are owned by giant Chinese conglomerates – JD Health, Alibaba Health, Baidu, Tencent, etc.

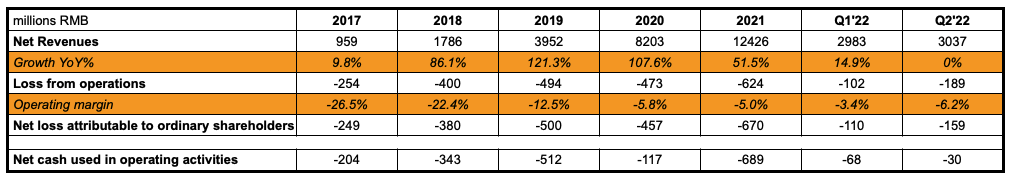

Historical financials are indicated below (for consistency’s sake numbers are provided in Chinese RMB):

Also B2B and B2C segment information:

2021 and 2022 proved to be difficult years for YI due to repeated COVID lockdowns. Some of YI’s fulfillment centers and offices were shut down, many orders got stuck in transit, and inventory replenishment became a big hurdle. This significantly pressured the online retail segment and effectively eliminated top-line growth in the B2B segment. However, this negative impact was partially offset by YI’s focus on operational efficiency (renegotiating with suppliers, restructuring inventory to focus more on high-margin products, etc.) and cost-cutting efforts. The second half of 2022 is expected to remain challenging.

While these external negative factors might last for last a couple more quarters, the business should return back to normal and back on its growth trajectory in short term. Meanwhile, the Chinese healthcare sector, and especially digital healthcare, is poised to ride major tailwinds due to regulatory support. The current 14th 5-year plan (2021-2025) and Healthy China 2030 initiatives have put a strong focus on healthcare digitalization in China. YI’s management is confident this digitization effort will boost business expansion even further (see the quote by YI co-founder below):

Under China’s 14th 5-year plan for national economic and social development, digital economy has been elevated to a vital position and expected to enter a period of rapid expansion through 2025. Digitizing the health care industry has been our goal since our inception. We see this as a tremendous opportunity to leverage digital technology and reconstruct the value chain in the health care industry.

[…]

So first of all, if you look at the Healthy China 2030 and the 14th 5-year plan, where the government has elevated the health of the country, of its citizens to a level of the national strategy, and there are lots of tailwind for us, and we feel very excited about. We spoke about this in the previous few quarters, and I didn’t elaborate in so much of the detail on today’s call, but we see digitization and the investment in the health care industry will provide a lot of tailwinds for us.

Thanks for a typically insightful and thoroughly researched writeup.

Do you know the base rates for Chinese privatization deals that go from non-binding to consummated (without material drop in offer price)?

“I expect the timeline till definitive agreement to be short” – did you have a date by which you expect this to close?

The fact that YI is trading below ($2.80, 18-Oct-22) the pre announcement price ($3.05, 8-Sep-22) implies that market thinks there is no possibility that the deal will go through which makes this particularly intriguing.

That YI has to list in Shanghai until June’23, I’d expect a definitive agreement to be in place by the end of this year or early 2023. The spread should narrow considerably on the definitive agreement announcement.

Regarding the success rate of non-binding deals, you can find more information in our quick study of US listed Chinese privatizations here http://ssi.wpdeveloper.lt/2020/07/analysis-of-us-listed-chinese-going-private-transactions/

A good chunk of non-binding situations fail, so these are definitely risky. However, I think each situation must be assessed individually and the setup at YI seems particularly solid compared to other Chinese privatizations that we’ve seen so far.

I also don’t know the real base rates, but quite a lot goes through, see appendix in this https://www.whitecase.com/insight-our-thinking/hfcaa-and-consequences-us-listed-china-based-companies

IMO YI has a high probablity, as also the consortium agreement seem very solid, but still there is a risk.

YI tanked (down ~14%) on 24-Oct-22 on no news I saw – anyone come across news which would justify such a drop?

News is China.

China.

Google Hu Jintao.

I’m also not optimistic about development of market economy in China. However for the investment case of YI, as this case should close the next 6 month, I’m still optimistic and take the opportunity to buy more shares for low price, as I do not see new hurdles for YI based on the latest developments.

The future premier Li Qiang from Shanghai oversaws the establishment of the STAR Market, where YI will probably relisted,

https://twitter.com/keithzhai/status/1584218949700681729

And the initial sponsor seems to be a state-owned chinese company, those privatization of YI should not be against the CCP.

https://www.sec.gov/Archives/edgar/data/1738906/000110465922098712/tm2225527d1_ex99-1.htm

There are also rumors that some ADR funds has been liqudiated, a lot of ADRs have fallen more than 20% yesterday much more than the although poor performing HangSeng, hope YI just fall due to this poor market sentiment without any real concern regarding the non-binding offer.

https://twitter.com/acpandy/status/1584465755394842624

Anyone know if the consortium could withdraw their offer/ have offer rejected by special committee and instead have a new (lower) price be offered?

Yes, it’s possible for the non-binding proposal to get revised down in case of significant changes in the business outlook since the initial bid. For example, in the recently highlighted OIIM case the initial non-binding bid was revised downwards by by 11% (after 4 months of silence) and then a few weeks later a definitive offer has been signed.

But these revisions happen quite rarely. I think in YI’s case, the chance of this happening is low given the presence of reputable actors, the goal to relist in Shanghai (they probably don’t want to screw minority shareholders just before relisting) and urgency with which the transaction needs to be carried out.

Having said that, anything is possible and the offer could also get withdrawn. That’s the risk one takes with non-binding proposals.

As J.P. Morgan Trust Company of Delaware (https://privatebank.jpmorgan.com/gl/en/services/trusts-and-estates/delaware-trust-services) and other companies with well reputations joint the consortium and the updated non-binding proposal letter confirms the original price of 3,66 USD/ADS and the huge spread is really irrational. Even if the spread is decreased to 30% I consider the chance/risk ratio here really good.

I’m confident that a defintive agreement will come out this year and that the deal will closed at least by the non-binding offer price in Q1 2023, more background see filing from yesterday:

The Reporting Persons’ response to Item 3 is incorporated by reference into this Item 4.

On October 29, 2022, Gang Yu, Junling Liu, and Shanghai Guosheng Capital Management Co., Ltd. jointly submitted an updated non-binding proposal (the “Updated Proposal”) on behalf of the new Consortium to the Issuer’s special committee of the board related to the proposed acquisition of all of the Class A ordinary shares (including the Class A ordinary shares represented by the ADSs) not beneficially owned by the Consortium members in a going-private transaction at a purchase price of US$1.83 per Class A ordinary share or US$3.66 per ADS.

In the Updated Proposal, the Issuer’s special committee of the board was formally informed that the new Consortium has additional members including (A) (i) 6 Dimensions Capital, L.P., (ii) 6 Dimensions Affiliates Fund, L.P., (iii) ClearVue YW Holdings, Ltd., (iv) ClearVue Partners, L.P., (v) Zall Capital Limited, (vi) Tongyi Investment Holdings Limited, (vii) First Pharmacia International and (viii) J.P. Morgan Trust Company of Delaware, as trustee of Hodge Mountain 2020 Irrevocable Trust, each as a rollover shareholder; and (B) (i) Morning Star Resources Limited, (ii) Shanghai Changfeng Huixin Equity Investment Fund Management Co., Ltd., and (iii) Ningbo Youkai Venture Capital Partnership (Limited Partnership), each as a sponsor. The other key terms of the Proposed Transaction remain the same as those set forth in the Proposal included as Exhibit 99.2 of the Original Schedule 13D.

Reference to the Updated Proposal is qualified in its entirety by reference to the proposal letter, which is attached hereto as Exhibit 99.15 and is incorporated herein by reference in its entirety.

https://www.sec.gov/Archives/edgar/data/1738906/000110465922112691/tm2228785d1_sc13da.htm

Any chance there’s a possibility of an increased bid offer, either by another interested party or by the existing consortium? Has anything similar of the sort happened in the past for deals like this?

YI Q3 results are out. Pressures from COVID-19 lockdowns are continuing and revenues overall were flat YoY. However, the company has substantially improved its margin profile due to cost-cutting, reduction of procurement costs, optimized product assortment, and working capital efficiency. YI continues to inch towards profitability and has reached a major milestone this quarter – reported positive operating cashflows. The trend is expected to continue following further focus on operational efficiency and economic recovery after the COVID impact subsides. Other than that, management has again stressed digital healthcare as an important focus for the Chinese Communist Party saying it will provide multiple tailwinds for the company in the future.

An update on the ongoing privatization was limited and the company simply reiterated that the special committee is continuing the review. 28% upside remains.

Conf. call https://www.bamsec.com/transcripts/15388524

Press release https://www.bamsec.com/filing/95010322020542?cik=1738906

YI jumped up +18% in the last two days without any news or updates from the company. The remaining spread is at 9%.

I think there are good reasons that the share price has go up:

China relax the strict Covid19 Zero-covid policy, and to be prepared for potential new corona-wave, a lot of people buy medicine to be prepared if they get Covid.

Therefore, the fourth-quarter result will likely exceed the expectation, and overall, the management is serious, the conference-call transcripts also give me strong confidence.

Given all the positive developments specific to the company and also in general as the market sentiment regarding Chinese companies improved significantly the last six weeks, there is a probability well above zero that the independent financial advisors consider the price of 3,66 USD/ADS as too low and definitive agreement might be at higher price, and in case that – in my opinion very unlikely outcome – they will not proceed with the privatizations, the stock can also go up significantly even if there will be no privatization at all given the good prospects.

So crazy……The price is over 3.9…..Unfortunely, I sold it before the opening.

Good Luck! Happy hunting~~~~

Yi Yi Yi, back down to 3.35. 2.3m shares traded so far at noon, vs <100k normal. Apparently, a play stock.

Not sure what is driving wild price swings in YI stock, but closing the case here as the shares are trading above the offer level. Maybe there are rumors of a binding agreement at an even higher price. But at the moment I think it makes sense to take the chips off the table.

30% gain in 3 months.

I think the price increase is mainly driven by Chinese investors, huge volume in the morning, and now the Chinese go to sleep and price comes down, and not so much related to the non-binding offer.

It’s amazing how fast China change its zero covid policy, it seems it’s not just relaxing the rules, but almost 180° U-Turn, and it is expected that 850 Mio. people will get infected in the wave:

https://www.theglobeandmail.com/world/article-chinas-covid-19-cases-spread-rapidly-days-after-relaxing-isolation/

This should increase the sale and 111 Inc. pharmacies.

They also starts with the sale of Paxlovid:

https://www.reuters.com/business/healthcare-pharmaceuticals/chinas-111inc-app-starts-retail-sales-pfizers-paxlovid-covid-treatment-2022-12-13/

Yet another buying opp for YI today, no news correct?

yes YI is dropping a lot from $3. Any news caused this drop? @dt?

I have not seen any news on YI. The stock is volatile and swings with market moods.

Thanks DT 🙂

Regarding this point of the investment case:

As part of two post-IPO capital injections into YI’s onshore principal operating subsidiary in Aug’20 and Dec’20 (~$130m in total), YI has agreed with these investors to redeem their equity interests at cost + pay 6% annual interest if STAR listing of YI’s subsidiary is not completed before Jun’23.

I’m a little confused why they don’t come out with a definitive agreement. Even if it would be executed as LAIX last year as a “short-form” merger in accordance with section 233(7) of the Companies Act (does not require a shareholder vote or approval by special resolution) I would expect the closing take some month. But do you think a delisting of YI would be required for listing of YI’s subsidiary?

Also other Chinese offshore companies have listed there Chinese subsidiary without delisting is US (e.g. Daqo New Energy DQ has listed Xinjiang Daqo New Energy Co.,Ltd. (688303.SS) which has approx. 4 times higher market cap than DQ).

YI reported Q4 results and will hold a conf. call a bit later today. As expected, business performance has finally picked up driven by the positive impact of China lifting COVID lockdowns. Although Q4 was still heavily impacted by lockdowns (lifted in early December), revenues saw a material growth of +20% both on YoY and QoQ basis. The margin profile has also improved on the segment level and management said YI has finally managed to reach non-GAAP operating income profitability in December. This likely signals a strong upcoming Q1, which will be fully free from COVID restrictions. Will be interesting to hear more details in the conf. call today.

The concerning thing is that management still remains silent on the status of the ongoing privatization, despite the fact that the Jun’23 deadline for achieving the Shanghai STAR market listing approaches. YI currently trades at a 30% spread to the non-binding acquisition bid. Hopefully, they will update investors in the call.

Below, you can see a refreshed historical performance table of YI:

https://www.prnewswire.com/news-releases/111-inc-announces-fourth-quarter-and-fiscal-year-2022-financial-results-301779564.html

On YI’s conference call management confirmed the privatization discussions are still ongoing.

“And the second question is, what’s the current progress of the company’s privatization?”

“Yes. On the privatization, we understand that the process of the privatization is still ongoing. And the independent committee is working with the [indiscernible] Group on the privatization proposal. The company should make all necessary public announcement according to SEC rules. So I would suggest that you stay tuned on the announcement if there’s any to be made by the company. Thank you.”

https://app.tikr.com/stock/transcript?cid=577608285&tid=579504287&e=1828068703&ts=2771919&ref=3no6ed

Interesting tidbit in the 20-F:

“The Group has evaluated subsequent events through April 28, 2023, which is the date when the financial statements were issued.Since January 1, 2023 till April 28, 2023, the Company negotiated with investors of 1 Pharmacy Technology in the contingently redeemable non-controlling interest in 1 Pharmacy Technology, and has obtained commitments from certain investors, who agreed to not exercise their redemption rights before June 30,2024 in connection with redeemable shares amounted to RMB584 million as of December 31, 2022, and one investor holding redeemable shares of RMB114 million has made the same undertaking , subject to certain customary conditions.”

This is about 70% of the liability. This seems like a positive indicator the buyout will go through.

Thanks for the update. Is this also and indicator that the buyout is not imminent, or is that maybe reading too much into the tea leaves?

It’s difficult to understand what’s actually going on behind the scenes and why is management taking so long with the privatization/re-listing. While the redemption adjournment reduced the need to rush the privatization, those large redemption liabilities haven’t vanished and June’24 is not that far away. Also note that the remaining 30% of redeemable equity interest holders haven’t agreed to the deadline extension so far (if I am reading the announcment correctly). This alone would pose a very large payment for YI (around 40% of the current cash balance) this year. Overall, I believe management must feel a strong pressure to advance the re-listing process, and sooner or later that will happen. I think privatization will be a necessary step along the way. Hence, the thesis still stands, although limited communication from management and the shift in the timeline are worrying.

YI has just reported a solid quarter. But unfortunately, the press release again did not mention anything regarding the ongoing privatization. The quarterly conference call is scheduled for later today and might shed some more light on the review of the privatization offer as well as the situation with redeemable equity. The company seems to have sufficient liquidity to cover the redemption liabilities from the investors that have not signed the extension agreements. At the end of Q1, YI had around $123m cash and $39m in debt, whereas the redeemable portion due this month amounts to c. $50m.

With regard to the quarterly results, revenue growth accelerated to 24% YoY and the company finished the quarter almost at breakeven – a marked improvement compared to the previous periods. Management expects this positive trend to continue with the focus on higher margin products as well as fulfillment cost optimization and other cost savings.

Just listened to YI’s Q1’23 conference call. No real updates re the pending buyout – upon question by one of the callers, management noted that the offer review is still ongoing and the special committee is working with the buyer consortium. YI is also working with preferred equity investors who have not yet agreed to adjourn the redemption date, however, the company hinted that current liquidity would be sufficient even if all current redemptions are triggered.

Beyond this, the management expressed optimism about the company’s robust operational performance, propelled by China’s post-COVID recovery and a growing number of partnerships with pharmaceutical companies, coupled with the introduction of new drugs on YI’s platform. They emphasized that, for the first time, the company achieved a break-even point at the non-GAAP operating level. They also expect significant top-line growth to continue in the future, spurred by new partnerships with domestic and international pharmaceutical companies. In addition, YI revealed a strategic alliance with Tencent, with the plan for both companies to jointly offer services such as pharmaceutical sales support. Concurrently, the management projects continued margin improvement due to the business’s high operating leverage and substantial potential for cost savings, encompassing supply chain efficiencies. The management at YI predicts that if the sales reach RMB 30bn (up from RMB 14bn in 2022), the company’s operating expenses could decrease to 4% of sales (down from 9% in 2022). At this level, they anticipate the business will yield a net margin of approximately 5%.

A positive update on pending YI privatization at $3.61 per ADS.

The consortium has just filed amended 13D saying:

“On July 17, 2023, the Consortium informed the Issuer’s special committee of the board of the expansion of the Consortium and reaffirmed their interests in the Proposed Transaction. The other key terms of the Proposed Transaction remain the same as those set forth in the Proposal included as Exhibit 99.2 of the Original Schedule 13D.”

This update comes after 8 months of silence from the consortium – the previous 13D was filed at the end of Oct’22. No clarification was provided for such a long delay and not clear why the special committee has not responded to the offer yet.

The consortium ownership was somewhat expanded with an additional 2m of class A shares (+5% vs previous 13D) and the consortium now has 70% economic interest and 95% voting control in the company. (counting Class A + Class B shares).

My guess is that it took this long to get remaining minority investors of their operating subsidiary on board.

YSB recently IPOed in Hong Kong and has nearly doubled since late June. It is a near identical business as YI. So this probably gave them confidence to go along with an IPO instead of cashing out early?

It is kind of comical how badly US shareholders are getting ripped off here even at $3.61. Which gives me some hopes for a price increase to $4+.

YI shares have appreciated by +40% over the last few weeks, likely driven by the reaffirmed interest from the buyout consortium. The remaining spread to the privatization offer is now only 7.5%. Keeping in mind how volatile this trade has been and how long it has taken so far, this spread is too low to keep the position open. I am closing YI at $3.35/share, a 17.5% gain in half a year.

There is also a chance that the special committee will successfully negotiate a better take-out price. By exiting today, I am skipping not only on the remaining 7.5% spread but also the optionality of the higher offer.

At the same, there might also be further opportunities to reopen the trade. This has been the second successful iteration of YI privatization.

– Oct’22-Dec’22 for 30% return.

– Jan’23-Jul-23 for 17.5% return.

Well played on this one!

reinitiating the trade that keeps giving…..i hope

(Once again) approaching interesting levels?

The recent earnings call confirmed that the privatization still is ongoing, but other than that no real news.

Financials kind of soft

I think the spread widened due to softer earnings. Upside definitely looks attractive now, but my main concern is not being able to understand why is it taking almost a year for them to proceed with this privatization. The offer is still in the non-binding stage.

Sure, and I agree, but that concern is hardly new the last 2 months. If this was a good idea in e.g. June, I can’t see how its not a good idea now – positive news mid July, confirmation that the privatization is still ongoing in this call, and one soft quarter putting pressure on the price (compare to e.g. HOLI where we had no updates on the priv. for ages, but it still was kept open). But maybe I am missing something, and maybe the last successful run was more luck than anything else – hard to know in markets! 🙂 I started a small position again – will see how it pans out

Doesn’t this pretty much has to be taken private to be relisted in China? Otherwise co is on the hook for a 700m+ RMB liability. Plus insiders will likely earn a nice buck on this as well. I have no idea why they would not go through with this asap, especially given where YSB is now trading.

And from call:

“So the execution of the government strategy of separation definitely is very favorable to us as the separation of the drug sales from hospital, meaning it will go to the retail market. And the drug sales in hospital is, we are talking about RMB 1.2 trillion. So the overall pharmaceutical retail will get benefits, including us.”

And:

“Last year, the volume of China pharmacy retail has exceeded RMB 600 billion. And as I mentioned just now, more and more are moving out from hospitals. So it’s a very, very big market and we believe we have enough room to further expand our business volume with a healthy margin.”

So looks like their TAM is about to signficantly expand.

On the Q2 2023 earnings call they mention that the privatization offer is expanded with Bayer’s group, I cannot find it in the SEC filling, which corporation is Bayer in that filing?

I think this is a typo in transcripts and should have been ‘Buyer Group’ instead of ‘Bayer Group’. The SEC filling management refers to is 13D/A on the 17th of July. I commented on it already above (see my July 18 comment).

DT – are you buying again? Nice upside from here if the story is still intact.

$2.10, even lower now. What happened to the privatization? Any comments, DT? Thanks!

I continue to monitor the situation but only from the sidelines for now. With YI shares at all-time lows and the non-binding offer at $3.6/share supposedly still in consideration by the buyers, the setup is intriguing. July’s announcement on consortium expansion suggest wheels are still in motion. Redeemable equity investors not only adjourned the redemption deadline to 2024, but also joined the buyers.

However, what gives me a bit of a pause is the ongoing changes in China’s healthcare system. A massive overhaul of the industry seems to be taking place. This might also have a material impact on the drug distributor businesses and in turn affect buyer’s willingness to proceed with YI’s privatization. I am not yet sure how to handicap this risk, but this healthcare reform seems to be a new wildcard on the table.

Thanks for the update. Do you have any links/sources to get an intro to the mentioned changes?

Thanks, DT!

Olve, you can review the Q2 earnings call to get the management’s perspective on the new developments and the actual reform.

This part specifically:

“So obviously, you noticed and we noticed there is suddenly a pretty big change in our general population’s medical insurance. So for those people who do not understand the Chinese Medicare system. So anybody’s Medicare system is divided into 2 accounts. One account is called the personal account and the other account is called the unified account. And the recent change in the policies that used to be majority of the money is deposited into the personal account. And now it’s reversed. Majority of the money in the account has been distributed to the unified account, which means customers are not able to spend at their own discretion as before. Our understanding of the implications is such that, first of all, more and more pharmacies will be included in the group of pharmacies that can provide reimbursement services to customers. And those numbers will grow. We anticipate that a majority of the pharmacies will be entitled to provide the reimbursement services to their customers.And #2, the consumers’ personal account is reduced. So their ticket size will be somewhat reduced. This will also impact the pharmacy. Those are the negative impacts to pharmacies and to a certain degree to us. But we actually take this as a tremendous opportunity because what this will do is to drive a lot of traffic to pharmacies. And because more and more pharmacies will be joining the group that can do the reimbursement services. And therefore, they need to purchase more drugs, they need to purchase more medicines. Furthermore, they have the opportunity to upsell their products and services. So this clearly is going to drive those pharmacies to enrich their offerings. They will have to introduce more categories and more services. So our understanding from the government is that there is a clear trend that the government is intending to separate the consultation from drug sales, which was the fundamental problem of the Chinese healthcare system.And it is not an easy reform as we understand but we are very encouraged to see the government’s determination to head towards this direction, which will be great news for the pharmacy sector and not necessarily the best news for the hospitals. I hope that answers your question.”

And here are some relevant reads on the current crackdown in China:

https://www.reuters.com/world/china/china-drugmakers-axe-ipo-plans-they-face-scrutiny-anti-graft-drive-2023-08-11/

https://edition.cnn.com/2023/08/24/china/china-healthcare-corruption-crackdown-intl-hnk/index.html

https://www.scmp.com/news/china/politics/article/3234638/will-chinas-healthcare-crackdown-be-magic-pill-medical-systems-woes

Yeah I was under the impression reforms would actually benefit YI and YSB is now trading at 20x the valuation of YI.

The pharma anti corruption campaign seems to mainly focus on hospitals, and actually aims to move hospital sales to pharmacies. Latest conference call, YI’s management mentions that hospital drug market is twice the size of pharmacy drug market. So whatever other reforms hit the pharmacy market will likely be cancelled out by this.

From YSB’s interim report:

“In February 2023, the National Healthcare Security Administration issued the Circular on Making Further Progress on the Inclusion of Designated Retail Pharmacies in the Outpatient Clinics Coordinated Management Regime (《關於進一步做好定點零售藥店納入門診統籌管理的通知》). It called for an accelerated outflow of prescription drugs to the outside-of-hospital market to make them available for sale, thereby securing more stable customer flow and sales for pharmacies.”

And:

“The introduction of such policies and administrative measures accelerated the outflow of prescriptions and directed quality medical resources to primary healthcare. This drove a steady growth in the market size of out-of-hospital pharmaceutical services, shaping a promising outlook for the development of out-of-hospital pharmaceutical and medical services.”

After a bit of reading, I agree with Giorgi’s comment above. It seems that on a net basis the ongoing changes in the healthcare market might have a negative effect on YI business. The key reason is increasing competition in the sector.

The ongoing changes seem to be attracting new big players to the pharmacy distribution business. As one analyst on the call mentioned on the Q2 call: “because of the recent regulatory changes, we have seen a more emphasis on the out-of-hospital channel, including the pharmacies. But at the same time, we do see a lot of the players mentioned they want to enter into this specific sector.” And the only defense from YI was that they are “more efficient”, which doesn’t inspire much confidence.

YI and YSB has previously focused on small/medium/rural pharma market, which seems to have been ignored by large traditional distributors and big online pharmacy players. That’s changing now. Here’s a few excerpts from several bearish reports on YSB with regard to YSB’s lack of moat (I think the same also applies to YI) from Smartkarma:

“It is often the case that (terminal) consumers go to the pharmacy for the specific medicine they need. However, the regular SKU of pharmacies in grassroots regions may not be able to meet all consumers’ demand. How to supplement this part of unconventional and necessary SKU demand is the pain point of daily operation of pharmacies. This is actually the market that YSB Inc (YSB HK) is targeting. Pharmacies in grassroots regions can regard YSB as their own “drug cloud warehouse”. If the pharmacies do not have certain drugs, they can place orders on the YSB platform on behalf of terminal customers and then set a time with them to pick up drugs.

Based on the above logic, we could see that the key participants on YSB platform are the downstream pharmacies and primary healthcare institutions who serve the terminal customers with different drug demand, because they are the main reason for attracting and keeping the upstream pharmaceutical companies and distributors to cooperate with YSB. However, with the favorable policies on the prescription outflow, the cross-border competition of pharmaceutical e-commerce is intensifying. The rapid development of B2C online pharmacies such as Alibaba Health Information Technology (241 HK) and JD Health (6618 HK) has affected the offline pharmacy market. For example, if terminal customers could buy the drugs they need through those online pharmacies with lower price, they do not need to go to offline pharmacies. For an intermediary platform such as YSB, the reduced demand from terminal customers is bound to affect its own performance, facing the risks of losing upstream pharmaceutical companies and distributors.”

‘’The market is highly competitive. YSB’s key competitors include B2B platforms and traditional pharmaceutical distributors (e.g. Sinopharm Group Co Ltd H (1099 HK), China Resources Pharmaceutical (3320 HK) and Jointown Pharmaceutical A (600998 CH), etc.), who have substantially greater financial position, bargaining power, customer base, wider market coverage and resources than YSB, leading to price pressures. Meanwhile, if these pharmaceutical distributors also establish their own B2B platforms, YSB’s business would face risks. Besides, downstream pharmacies and clinics may still prefer off-line face-to-face transactions and not be willing to procure products online for various reasons. So, YSB may face uncertain performance if it cannot compete effectively, especially for its self-operation business.”

“At present, China’s pharmaceutical e-commerce platforms can be roughly divided into three types of models. One is the O2O platform, such as Dingdang Health Technology Group (9886 HK). The second is B2C platform, such as Alibaba Health Information Technology (241 HK) and JD Health (6618 HK). The third is B2B platform, such as YSB. So, essentially, YSB’s business model is closer to that of traditional pharmaceutical distribution enterprises such as Sinopharm Group Co Ltd H (1099 HK), Shanghai Pharmaceuticals Holding (2607 HK) and China Resources Pharmaceutical (3320 HK), and these SOEs can also carry out businesses similar to YSB based on their huge market share, resource advantages, and financial strength (e.g. cash flow). In other words, YSB’s moat is not high.”

“We think YSB’s revenue scale could encounter bottlenecks after reaching a certain stage of growth, because the main market it covers is the small B-end market that has not been reached by traditional large pharmaceutical distribution enterprises (Those above-mentioned SOEs have much more advantages than private enterprises in terms of pharmaceutical distribution, so their market position is hard to shake). YSB’s profit margin is also difficult to improve significantly because operational cost/expenses are hard to reduce if there is no scale effect or well-established logistic/distribution system, etc.”

“The business structure of “Self-operation Business + Online Marketplace” could involve certain policy risks. The State released an exposure draft stipulating that third-party digital healthcare platforms shall not directly participate in online drug sales activities. The NMPA has further clarified the boundary between the self-run and third-party business of the pharmaceutical e-commerce platforms, which means that platforms may have to decide either to offer a purely self-run drug sales business, or to become purely third-party platforms if this policy is strictly implemented. By 2022, 40.2% GMV of YSB was from self-operation, so if implemented, this policy would still have an impact on the Company.”

YSB is 9885 HK? How does its valuation compare to YI now? Sorry I don’t have reliable info on HK stocks.

anything on the conference call?

No major updates, management received the question below and issued their standard response that the offer is still under consideration.

Anyone with any thoughts on the recent price action?

Great question, until we get a response from someone more knowledgeable here’s a special sit holding trader’s response: it’s a bloodbath after another disappointing broader based Chinese healthcare backdrop news. YSB – comp trading in HK (9885) – got destroyed similarly since Oct but still valued at multiples of YI.

My guess is that special sitters are tired of waiting and just puking, esp on today’s increased volume/huge decline. All this while YSB is up 25% today (maybe for ETF inclusion though, not sure).

How do you see the down risk in case they announced not to proceed with the merger? The YSB Inc. (9885.HK) price has fallen sharply from almost 30 HKD last monday (11th December) to just 8,3 HKD in about one week, are you aware of any regulatory changes in China which might also reduce the fair value of YI? mean as YI is a non dividend paying and loss making company, I have no clue about the fair value.

Bernd, have a look at the discussion/comments by Giorgi / ijw / value9 above. These cover the regulatory landscape topic – it is not year clear how and if YI’s business will be affected by this but there are structural changes ongoing within the China healthcare and in turn pharmaceutical distribution industries.

At the current prices, I think that the market has fully given up on the privatization setup, so most likely we are already seeing the downside scenario (i.e. privatization fails to materialize) prices.

Not to provide false hope but YSB (9885 HK) is up 40% since early feb lows – if anyone is able to comment on the sector/China-related news?

Also, Nov 2023 VIC writeup:

https://valueinvestorsclub.com/idea/111_INC_-ADR/2917263954?

Going private canceled, as expected. Price – no change today. So DT was correct, cancellation already priced in in Dec 2023.

https://finance.yahoo.com/news/111-announces-receipt-withdrawal-going-135800155.html

Anyone following this one?

30% down since q4. results.. In the fourth quarter, they made $578.7 million in revenue, a 1.0% decrease from the previous year. The gross segment profit was $30.2 million, down by 15.5% year-over-year. For the whole year, their revenue increased by 10.6%, reaching $2.1 billion. They also improved operational efficiency, with total operating expenses decreasing as a percentage of net revenues. Despite some challenges, they remain focused on providing top-tier services to their customers and patients. The company is investing in operational efficiency, product diversification, and enhanced partner ecosystems to achieve long-term success and innovation in the healthcare industry.

I dont understand why the market has price this company so low at 0.1 x EV/Sales. When comps like JD health or Alibaba Health are at 1x EV/Sales.

Any thoughts?

Anyone follow the dumpster fire known as YI 111? Earnings this morn disappointed, of course. Bagholders unite! Is there any hope at all?

https://seekingalpha.com/pr/19831613-111-inc-announces-second-quarter-2024-unaudited-financial-results?feed_item_type=news&utm_medium=referral&utm_source=interactivebrokers.com

https://www.turtlesresearch.com/p/chinese-animal-spirits

To go with above link – optimistic update from IJW – thinks biz could be sold, founders buying shares, but need to act by Dec 2024

Also said they’re paying an analyst firm to write reports on the stock:

https://ir.111.com.cn/Analyst-Coverage

On that note, this is no longer a special sit but bags holding bags.

Bag is very cheap though. It feels a bit heavy, smells like there is a turd inside, but my optimism tells me there is a rock of gold inside that turd.

the old gold in turd play

Call me crazy but this is starting to look like a real company now, from last ER:

$71mm cash a/o 12/31/2024, 2024 CFFO = $36mm

https://ir.111.com.cn/2025-03-20-111,-Inc-Announces-Fourth-Quarter-and-Fiscal-Year-2024-Financial-Results

@ $10 gives you $86mm mkt cap. Just for reference, the $3.61 broken deal (from 2022/23, different world now so take a grain of salt) would equate to $36 post-RS price. Chinese discount is def a factor so I’m gonna put my (slight BS) PT closer to $20. I’m Interested to hear other opinions, esp on prev consortium returning, reputation of mgmt, etc?

Screaming @ $5.5 – either in a good way or chinese scam