Cornerstone Capital Resources (CGP.V) – Merger Arb and Company Sale – Upside TBD

Current Price: C$3.30

Offer Price: C$3.66

Current Spread: 11%

Expiration Date: Q4 2022

A merger of two junior miners, which comes as a consolidation of interest in one of the largest and high-potential copper-gold projects. Unusually for such small cap transaction, multiple global mining/royalty giants such as BHP Group and Newcrest Mining and Franco Nevada are involved. There are two ways to play this situation. First, a straightforward merger arbitrage with 11% spread that’s very likely to close in a few months. The second more speculative, yet also much more lucrative, bet is that the combined company will get acquired by BHP in short term, i.e. CGP.V is a cheaper way to create a position in SOLG.L before the latter gets acquired. I am positioned for the second option, unhedged long in CGP.

Cascabel is the only available Tier 1 copper-gold project that is not yet in the hands of any major global mining giant. The asset is located in Ecuador and is currently about to enter a definitive feasibility stage. Cascabel is owned by two junior miners – SolGold (listed in LSE and TSX) and Cornerstone Capital Resources (listed on TSXV), which including cross-ownership have around 79% and 21% interest in the mine. After 5 years of unsuccessful attempts, both parties have finally agreed to consolidate their ownership in Cascabel – SolGold will acquire CGP with an exchange ratio of 15 SOLG shares per each CGP. At current prices, 11% spread remains with plenty of cheap borrow for hedging. CGP shareholder meeting is expected in Q4 and the merger should close soon after that. Proxy will be released in Q4 as well. Shareholder approval should pass easily – all CGP directors (own 44%) have entered into support agreements while the remaining CGP shareholders are also finally getting a fair deal.

The whole ownership consolidation saga has been ongoing since 2017, which probably explains part of the spread. This is the 5th time SOLG is trying to takeover CGP. All previous offers were lowballed and would have diluted CGP’s total interest in Cascabel – e.g. the exchange ratio of the previous offer (2019) would’ve lowered CGP’s interest in the project from 23% to 18%. All the previous offers were rejected immediately and CGP raised impossible conditions for further negotiations, such as requesting half of the board seats of the combined company, etc. In 2020 SOLG even tried to go hostile, but the offer expired without any acceptance. More background on the previous takeover attempt can be found here. Finally, both companies have reached mutually acceptable terms and the current offer comes with no dilution to CGP’s 21% interest in Cascabel and proportional allocation of 2 out of 10 board seats. I expect that CGP shareholders will have no issue in transferring their interest into the combined company at these fair terms.

The risk of SolGold walking away from this transaction is very low. The strategic rationale is straightforward – SOLG will consolidate the interest and become a sole owner of an attractive Tier 1 copper project. This ownership consolidation is likely preparation for the sale of the combined company (more thoughts on this below). NPV of Cascabel is in multiple times higher compared to EV of the combined company. Together with the merger, SOLG has also announced the appointment of Citigroup and Maxit Capital (which interestingly is also the largest shareholder of CGP) to explore value-creating alternatives for the combined group including a spin-off of the remaining exploration assets, other than Cascabel, to shareholders of the combined group. Both companies have several such projects, but they are at very early stages.

SOLG’s share price is now at absolute lows since 2016 when Cascabel excavation started. The 40% YTD selloff in SOLG shares might have been partially driven by artificially created financing uncertainty creating an opportunity for BHP to scoop it up opportunistically. Assuming the merger closes, then CGP is a cheaper way to bet on SOLG eventual sale.

BHP Group (US$179bn market cap) and Newcrest Mining (US$10bn) have shown substantial interest in Cascabel and currently own around 27% of SOLG. BHP has amassed a large influence on SOLG management and has long been rumored to eventually acquire SOLG (more on this below). Royalty giant Franco-Nevada (US$22bn) is also involved as a major debtholder of SOLG.

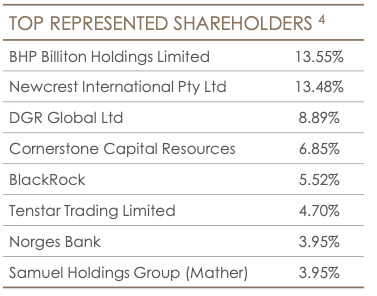

Major shareholders of CGP (presentation):

Major shareholders of SOLG:

Cascabel project and its valuation

Cascabel is directly owned by Exploraciones Novomining (ENSA), 85% of which is controlled by SOLG and 15% by CGP. Additionally, there’s some cross-ownership between the two companies with CGP holding 6.85% in SOLG, while SOLG has a 5.6% stake in CGP.

Until feasibility studies are completed SOLG will finance the project alone, which CGP will have to cover by paying 90% of its cashflows (from 15% interest) once production starts. As of June, the amount owed by CGP to SOLG was US$48m.

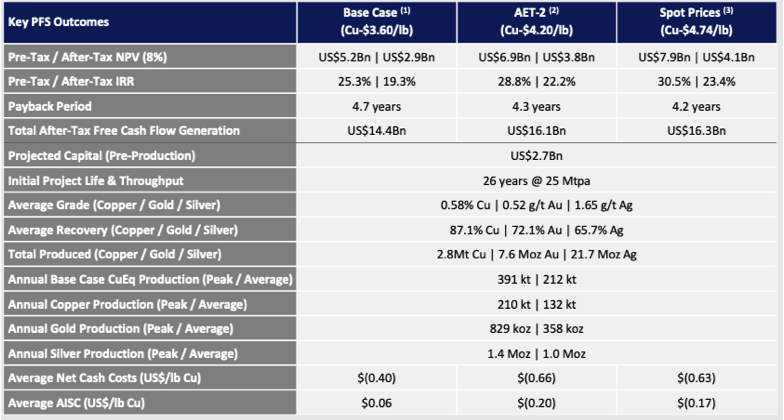

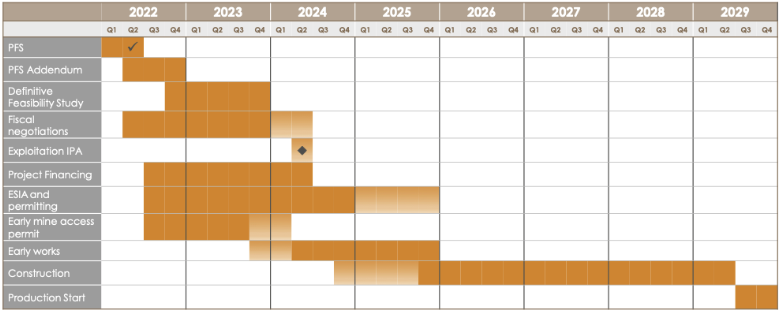

Cascabel is a large Tier 1 copper-gold project, which is expected to become one of the top 20 largest mines in South America. Pre-feasibility study has been completed this April showing measured and indicated resources of 12.6Mt of copper, 26.7Moz of gold and 92.2Moz of silver. At peak production, the mine is expected to produce 391kt CuEq, 210kt copper, 82kt gold and. 1.4Moz silver annually. The mine also has 26-year mine life and is expected to have very low production cost with an average copper AISC of US$0.06/lb. A definitive feasibility study is expected to start in Q4 this year and finish in 2026. Production start is estimated in 2029.

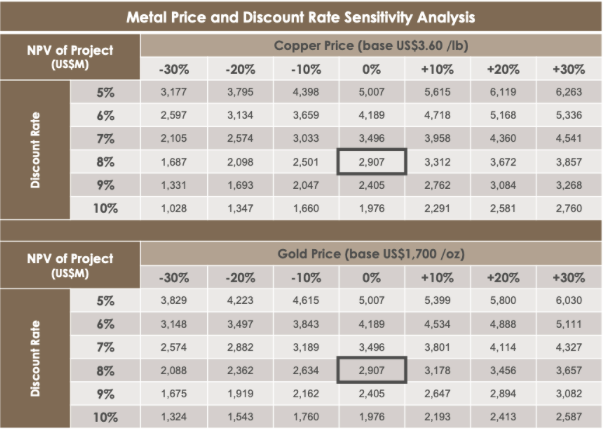

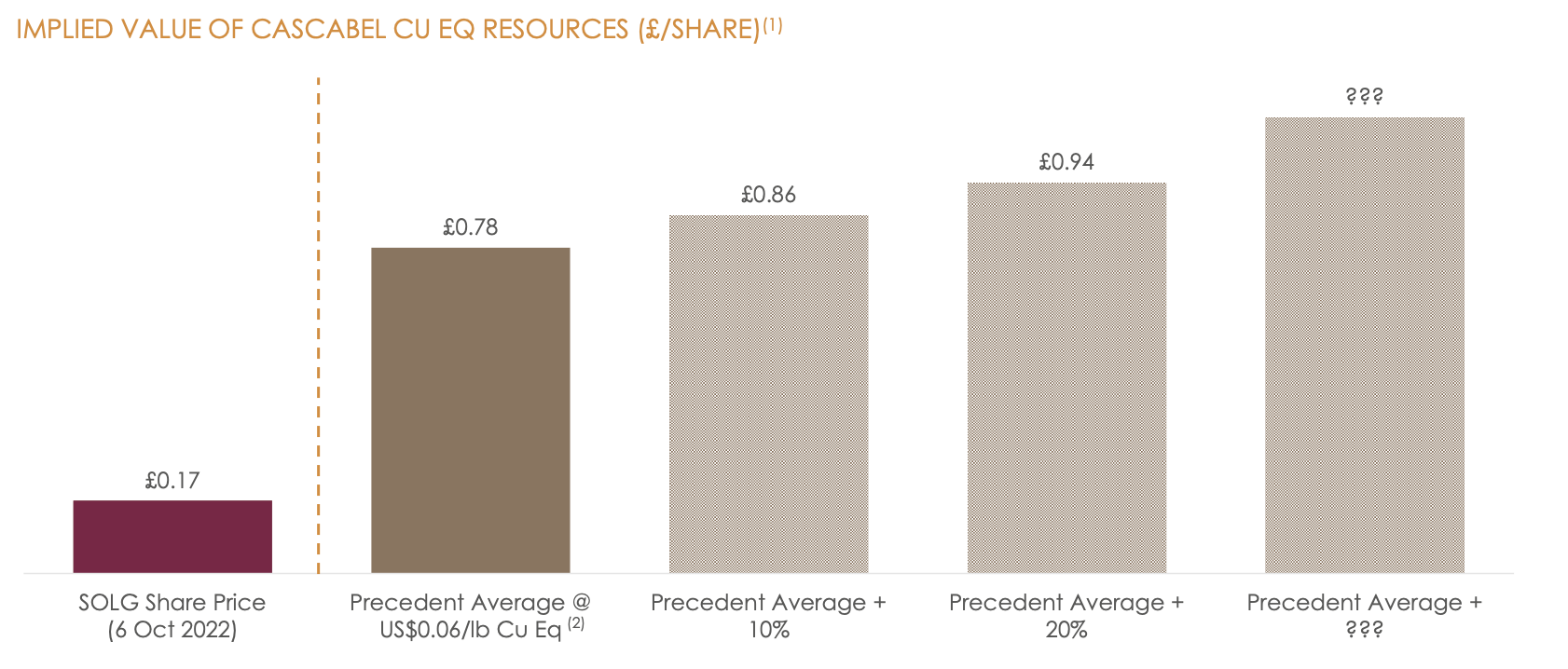

My experience with pre-production mine valuations is limited, however, at a quick glance it seems that Cascabel is rather inexpensive right now, especially considering its top-tier status and backing by top names in the industry. At a base case of $3.6/share copper and $1700 gold prices (in-line with current spot prices) and 8% discount rate, Cacabel’s after-tax NPV is stands at US$2.9bn – see tables below (presentation). In comparison, the combined EV of CGP and SOLG is just US$600m. A very big discount, part of which accounts for various uncertainties related to many years remaining until the start of production as well as substantial CAPEX requirements to put the mine online – US$2.7bn pre-production and US$2.1bn additional post-production.

Pre-feasibility financial data:

NPV sensitivity:

Expected timeline:

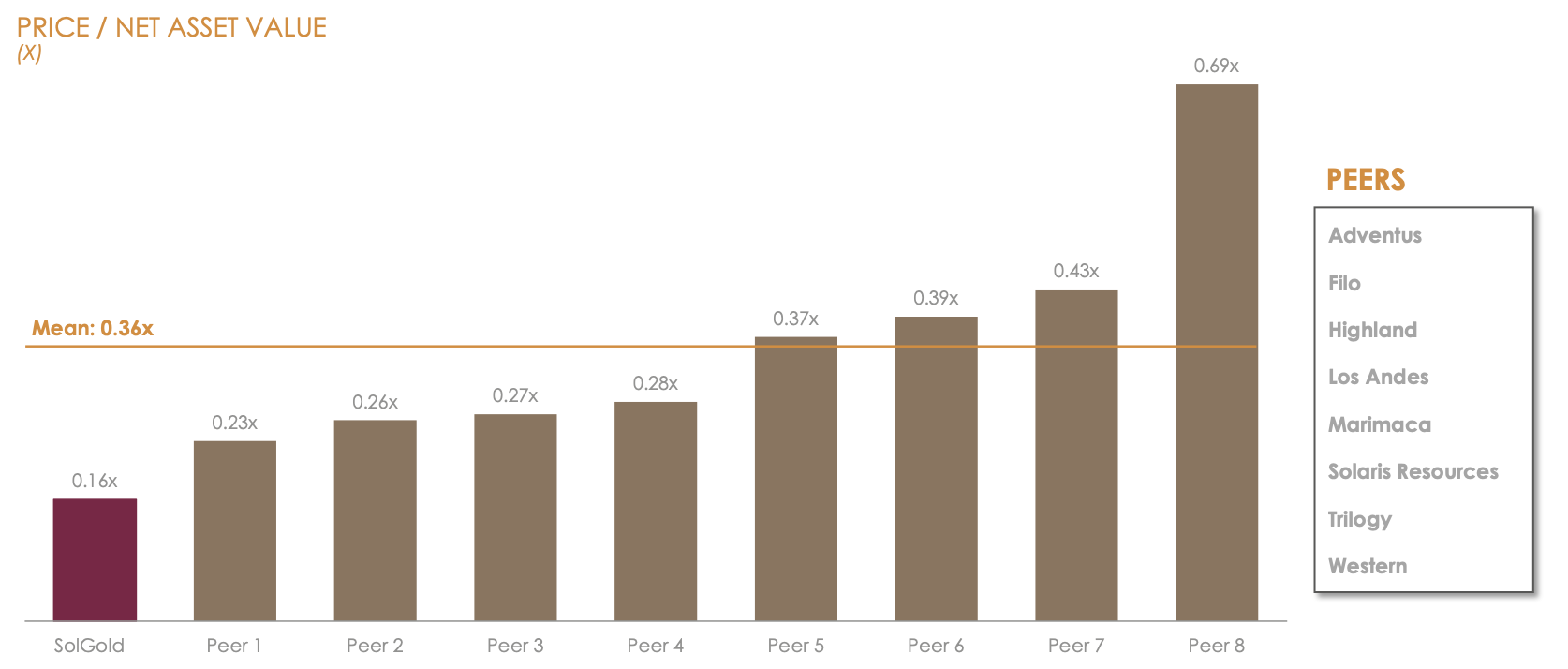

SOLG management also highlighted company undervaluation in the recent merger presentation:

Interest in Cascabel from the mining giants

Since 2016 both BHP and Newcrest have been going over each other’s heads in order to acquire a larger stake in Cascabel:

- In 2016 both mining giants competed to fund SOLG. BHP has even offered to acquire 85% of SOLG’s interest in Cascabel for US$275m in 2016, but got rejected and Newcrest’s proposal to take 10% stake was chosen instead.

- In Sep’18 BHP acquired a 6.1% stake and increased the stake to 11.2% at a premium to market price. Newcrest also increased its ownership in 2018 at premium prices.

- BHP then subscribed for even more shares in 2019 amassing a 13.6% catching up to Newcrest’s 13.5% stake (adjusted for current share count). Both mining giants then entered into lock-up agreements, which prevented them from further increasing their stake SOLG and even acquiring shares in CGP. Newcrest’s lock-up agreement expired in 2019 and BHP’s – in October 2020.

Given the large ownership, speculations around a full Cascabel takeover by its major shareholders have been circulating in the media for years (for example). Even CGP management used the potential takeover argument while defending from the previous lowball offer from SOLG:

There may be a number of other companies interested in Cascabel, such as BHP Billiton and Newcrest Mining, both of whom have acquired substantial shareholdings in SolGold.

At the end of 2020, both BHP and Newcrest were looking toward increasing their stakes through another equity raise in SOLG, however, for some reason, the previous management of SolGold has decided to go for very expensive debt issuance with a royalty giant Franco Nevada (US$22bn market cap) instead. This angered shareholders and resulted in prompt CEO resignation a few months later. Subsequently, in 2021 almost all of SOLG’s board has been reshuffled. It seems that BHP might’ve had a hand in this as in Nov’21 SOLG’s non-exec chairman wrote a letter to shareholders saying he received information that BHP was in some way meddling in the reappointment of SOLG’s board members. Instead of working behind the scenes, the chair invited BHP to put forward a takeover offer.

‘It has come to my attention in recent weeks that one of SolGold’s significant shareholders, BHP Group Ltd., has been actively canvassing certain shareholders and members of the board’. ‘‘if a party wants control or to significantly influence the development of your Company, the party should put forward an offer that results in all Shareholders benefitting from a premium’.

Just a few days after this letter, SOLG announced a new CEO/managing director – not surprisingly, a veteran from BHP, who previously worked as a senior executive in BHP’s Australian copper and gold project. Aside from the CEO/managing director, there is also another BHP-alumni on SOLG’s board. BHP seems to have amassed a very strong influence on SOLG management.

The sale of the combined company might be in the cards

The timing and situation of the current CGP takeover are definitely strange and suggest that something is happening on behind the scenes. SOLG is likely getting dressed up as a pure play on Cascabel with an endgame being an opportunistic sale to BHP at depressed prices (but still at a premium where the company is currently trading).

- SOLG is short on cash – as of the latest report (June) it had US$21m, which will run out by the end of this year. SOLG had been looking at the financing options already for a few months. In July, rumours appeared that the company has unsuccessfully tested equity markets and the attempt to raise equity failed. This seemed just outright weird, as how could Cascabel fail to find interested parties, when it’s backed by BHP and Newcrest, and both major shareholders previously indicated willingness to provide euity financing themselves? Apparently, BHP might’ve had a hand in this again. Shortly after the failed funding rumors, an activist/minority shareholder Berry Street Capital published a letter saying that SOLG’s major shareholders might’ve intentionally interrupted the equity raise and again urged a full company sale:

‘We believe the Board should represent the entire shareholder base and not only a select group who might be exercising control. Hence, we urge the Board to act fully independently and begin a strategic review imminently to initiate a sale process of the Company.’

- Several key SOLG executives have resigned recently – in May CFO and head of exploration left the company. In August, another director and the new CFO (which had been working for 6 weeks only) resigned as well.

- Without any response or announcement from SOLG, the financing issue has been dragged uncomfortably close to the year-end, when the company is due to run out of cash. As a result of this uncertainty, the SOLG share price has tumbled by 40% YTD.

- Then suddenly a few weeks ago, SOLG announced the merger with CGP saying it will also explore spin-off of all non-Cascabel assets after the merger.

As suggested by AFR below, the current setup comes down to only two remaining scenarios – either major shareholders will provide financing themselves or buyout SOLG/combined company:

There’s bound to be a time in the next few months when its two big Australian shareholders will have to decide how much they want Cascabel. If it’s a bit, then the two shareholders will have to tip into an equity raising and try to maintain the status quo. But if it is a lot, like some analysts suspect, then we could see a pair of Australian heavyweights in a ding-dong battle.

The way the situation has been handled so far suggests that the latter scenario is more likely. There was plenty of time to do an equity raise earlier, especially when the latest merger presentation highlighted that ‘Strong interest in SolGold assets remains despite challenging short-term market dynamics’. Instead, the financing question was getting postponed till SOLG is almost out of cash. Consolidation of Cascabel’s ownership by merging the two companies is a hint that the sale is coming.

A few more bits and pieces pointing towards the likely sale of SOLG/combined company:

- BHP is now transforming itself into green-energy metals-focused miner and has been on the hunt for copper assets. BHP recently tried to acquire Australian copper miner OZ Minerals for A$8.4bn but got rejected. Although Cascabel still has many years until full-scale production comes online, the project would clearly fit as a long-term strategic asset. Newcrest seems less likely as a potential acquirer here – its hands are full with the recently completed US$2.8bn takeover of gold miner Pretium Resources.

- Warren Irwin of Rosseau Asset Management (PE fund which owns 8.1% in CGP) has been vocal about SOLG/CGP merger on Twitter. One of the commentators suggested that BHP is now in control and will buy out SOLG cheaply. Warren rebuked his argument saying, ‘Don’t worry, you will be proven wrong. We will not be rolling over to BHP’. This might imply that Rosseau Asset Management wants a cash exit at a material premium.

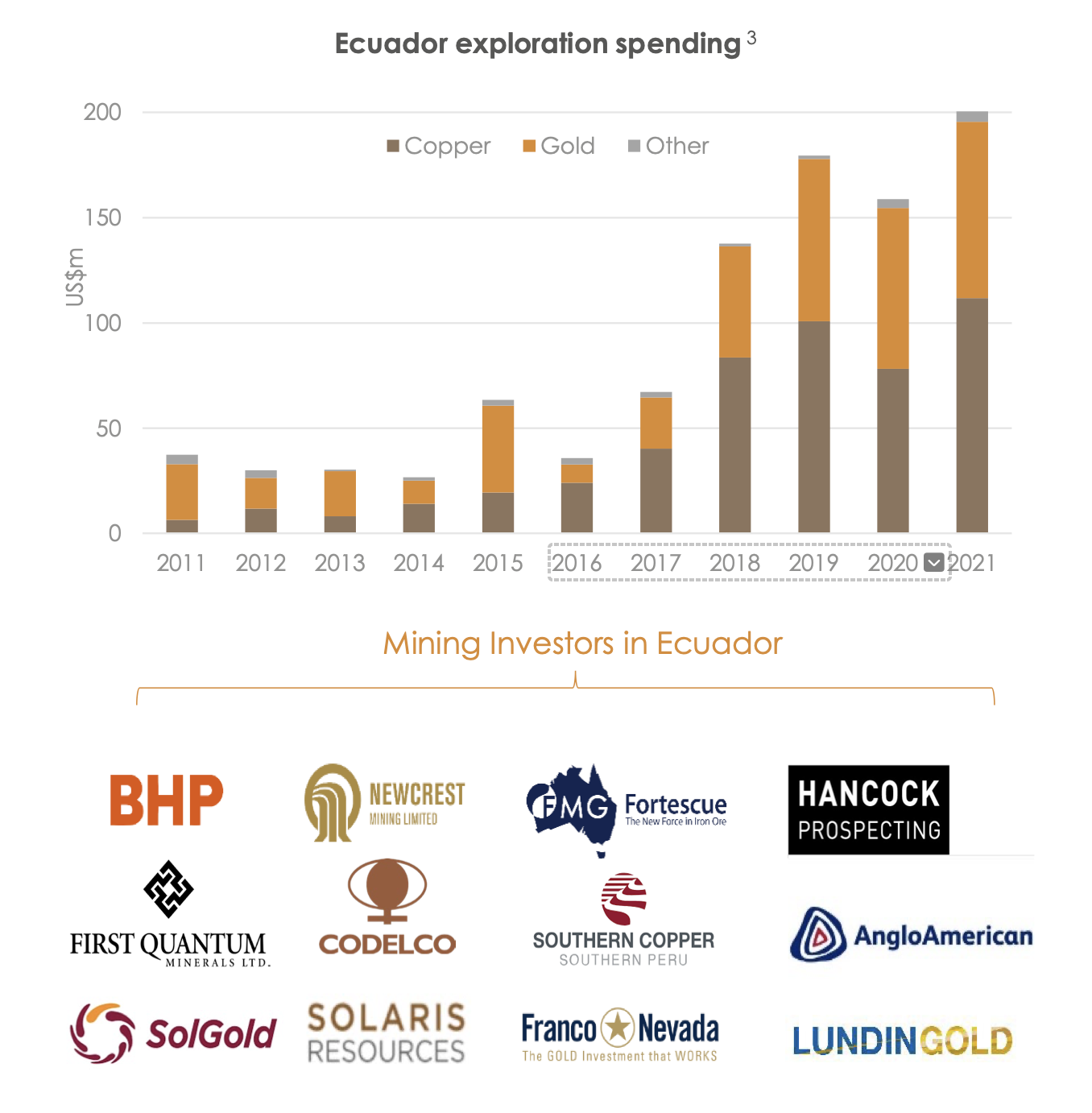

- Ecuador is the most underexplored region in the Andean copper belt, which accounts for 40% of global copper production. Till recently, the country wasn’t a particularly friendly mining location. However, several years ago the government changed its tone, made multiple law reforms and began inviting mining investors to scale-up mining production in the country. As a result, many global names entered the country and total exploration spending jumped up 4x since 2016-2017. Nonetheless, this month the government has temporarily suspended new mining licenses for 1 year due to pressure from local groups until a new consultation law is adopted. Arguably this has increased the value of current, already ongoing projects for those willing to enter this mining destination.

Nice writeup! Didn’t see addressed that SOLG can pay up to 20% in cash. Have you seen any discussion of what amount that would be (i.e. what SOLG price that would be based on?)

I did not manage to find any additional info about this 20% potential cash consideration or any clear specification what would be cash-out amount per share (nothing additional in the merger agreement either). However, I do not think it is material for this case.

1) SolGold should be quite short on cash already by the time the merger closes, so I doubt it will elect the cash option.

2) Given it took a number of years for the companies to reach a mutually acceptable merger agreement and with major CGP shareholders being in support, there is close to zero chance minorities will get screwed over.

Having said that, here are my rough calcs of how 20% cash consideration will be assessed.

– Termination fee amount from the merger agreement = C$5.2m;

– Termination fee as % of transaction value (from presentation) = 4%;

– Implied total value of CGP acquisition C$130m;

– Implied value per CGP share C$3.52.

I am guessing clarification on this point will be coming before the shareholder vote.

Looks interesting, but some risks:

-Copper has traded at an average price of about $3/lb in the past decade. So this would be a bet on a coming copper shortage.

-China represents >50% of global copper demand. They are significantly overbuilding real estate, if that normalizes (which now seems to start happening) that could put a major dent in copper demand.

-Using average past decade gold and copper prices, I get a NPV closer to $2bn.

-Capex requirements are larger than NPV, so if this goes, say, $1bn over budget, that puts a large dent into NPV? Not leaving room for much of a premium. A counter point against this is that BHP bought in at much higher prices.

-What is stopping BHP/Newcrest from waiting this out until SOLG gets more capital starved/macro gets worse, to then do a lowball tender offer to accumulate cheaply? Or wait until share price has cratered, and then issue a lot of shares cheaply when company is on the ropes. Commodity stocks that do not generate any revenue tend to not do that well in downcycles.

And then a question for the mining experts, at what discount to NPV do these non producing buyouts usually happen?

This is a wonderfully sophisticated and well researched idea – thank you!

I too wonder what stops a potential acquirer (e.g., BHP) from letting SOLG’s financial condition worsen to then make a lowball offer.

Beyond the tweet by Warren Irwin of Rosseau Asset Management, ‘Don’t worry, you will be proven wrong. We will not be rolling over to BHP’ are there any more formal indications that an activist could prevent BHP from lowballing SOLG shareholders?

Would you please expand a little more on this, “there is close to zero chance minorities will get screwed over”. I note that CPG shareholders finally agreed to a deal which they deem acceptable, but once they become SOLG shareholders what circumstances make you believe they won’t get screwed over?

Finally, with regard to the discount rates used to quantify the NPV, they appear pretty aggressive topping out at 10%. If 10% becomes 12% or 15% presumably the NPV would become materially lower such that the margin of safety may become quite slim. These higher discount/opportunity cost of capital rates seem more appropriate to me given the various risks involved, and the multitude of alternate ideas currently covered on SSI.

Any answers and feedback to my (potentially simplistic) thoughts and concerns would be very much appreciated.

Thanks,

G

Any news today with CGP.V fall?

Or opportunity to get in cheaper with spread closer to 20%?

SolGold has signed a US$50m funding from Osisko Gold Royalties (US$2bn market cap) in exchange for 0.6% NSR interest. This alleviates any short-term liquidity problems and both CGP and SOLG were up +8% yesterday. However, that also reduces the likelihood of the acquisition of the combined SOLG/CGP by BHP.

So far the long CGP position has returned 11.5% since write-up levels. Given the somewhat reduced likelihood of BHP acquisition as well as widened spread (now at 15%), I am switching from the pure long on CGP.V, into the hedged trade for the merger arb, i.e. adding short SOLG.L position at £0.182 share. The same applies to SSI Tracking Portfolio.

Unexpected development at SolGold. Both BHP and Newcrest bashed SOLG’s financing agreement with Osisko as too expensive. Shortly after that, SOLG’s CEO resigned. So the history rhymed as the previous CEO had also resigned almost two years ago after the Franco Nevada funding deal and subsequent pressure from BHP/Newcrest. However, the current CEO was allegedly supposed to be BHP’s guy (previous employee, etc). Hence, this recent reaction from major shareholders changes my thesis that BHP has a strong influence on SOLG management and is dressing up for a combined SOLG/CGP acquisition. Clearly, I was wrong on this part.

Nonetheless, I don’t think these developments have any impact on the merger thesis. SOLG/CGP merger makes sense and there’s no reason for both entities to stay separate when both management teams already agreed on fair consideration terms. My switch (see comment above) from the long CGP into the merger arb bet seems to have been quite well-timed.

https://www.afr.com/companies/mining/solgold-boss-walks-as-bhp-newcrest-blast-finance-deal-20221110-p5bxc0

Learned a lot by just reading the analysis and comments. Thanks.

Closing out CGP idea as the spread has now narrowed to 2%. This arbitrage resulted in a juicy 33% return in 1.5 months. The gain was split into two parts, the initial 11.5% from the unhedged CGP position and the rest from the later hedged part (albeit keeping the trade unhedged would have delivered a very similar result).

The merger is still set to close by the end of the year.

Some other recent updates on SOLG below – not directly related to the merger with CGP.

– Recently, SolGold announced that they are delaying the definitive feasibility study (DFS) on the Cascabel project mainly due to the increasingly expensive cost of capital. Initially, DFS was planned to start in the second half of 2022. The study will be delayed up until the company completes its review of opportunities to derisk the project and reduce costs.

– A few days later SOLG announced a strategic investment from Jiangxi Copper, the largest copper producer in China. Jiangxi will acquire 155m shares or about 6.3% of the current share count at US$0.2/share (10% discount to current prices). Investment from Jiangxi Copper is expected to provide about $36m in gross proceeds. The transaction is subject to the completion of due diligence on part of Jiangxi. Assuming the DD review is satisfied, the investment will close on December 9.

– The royalty financing agreement with Osisko Gold has been completed on November 30.

https://www.mining.com/solgold-delays-cascabel-dfs-porvenir-pea-as-it-looks-to-cost-reduction/

https://resourceworld.com/solgold-issues-shares-to-jiangxi-copper-hong-kong/

http://ir.q4europe.com/Tools/newsArticleHTML.aspx?solutionID=3676&customerKey=Solgold&storyID=15628257