Quick Pitches For ZVO, CANO and XX.V

ZVO – Liquidation – 200% Upside

CANO – Potential Takeover – 58% Upside

XX.V – Potential Takeover – 60%+ Upside

NEW QUICK PITCHES

Zovio (ZVO) – Liquidation – 200% Upside

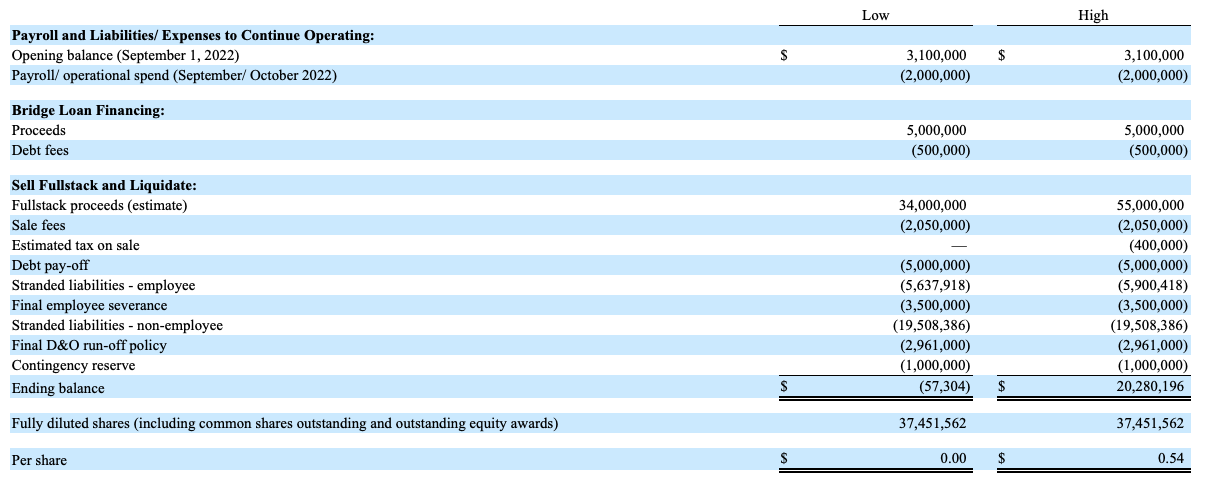

This is liquidation with a potential multi-bagger upside as well as 100% downside. Liquidity is surprisingly decent ($200k-$1m+ per day recently) despite a super small market cap. Zovio has announced that it will sell its last remaining asset – coding bootcamp business Fullstack Academy – and then liquidate. Shareholder meeting to approve liquidation is set for the 25th of Oct. Management says it has already received indications of interest from potential strategic and PE buyers and expects to sell Fullstack at a price range of $34m – $55m. Accordingly, liquidation proceeds would range from $0 to $0.54/share vs the current share price of $0.17/share. Management owns only 2.3% of shares, however, 27% of ZVO is controlled by 4 different PE firms so shareholder interests should be looked after. Ex-CEO has a further 5%. ZVO liquidation process seems to be running quite smoothly so far – management has already sold two other businesses earlier this year.

Zovio used to be an online education company, operating two online universities. However, as the regulatory environment for online education changed in 2018, the company merged and sold its universities, while keeping the online program management (OPM) contracts. OPM business provided recruiting, admissions, marketing, student finance, support services, etc., and generated revenue based on a percentage of tuition revenue. In 2019 the company also acquired two online businesses – Fullstack Academy and TutorMe. Fullstack Academy offers live online coding bootcamps – mostly as a white-label product through university partnerships. TutorMe is an online tutoring business. Despite strong growth in Fullstack Academy and TutorMe, the main OPM business turned out to be loss-making as student enrolments were lower than expected. In 2022 ZVO started reviewing strategic alternatives and in May sold TutorMe business for $55m or 7x 2021 sales (vs acquisition price around $7.5m). In August, the company divested its OPM business and a few weeks later announced that it will sell Fullstack Academy and then liquidate. Definitive proxy to vote on the plan was filed on the 3rd of October.

Management’s liquidation value estimates are provided below.

Notably, the company is rapidly burning cash and had to take a bridge loan (14.5% interest for the used portion and 5% for the unused) to get more time to finish the sale and dissolve the company. ZVO now has 6+ months of runway, which seems to be enough given that the process has Fullstack sale process should already be in mid/late stages. The company has enough NOLs to cover all/most of the potential capital gain taxes from the Fullstack sale.

Fullstack valuation is a guessing game as the business has no comparable public peers. However, a couple of soft references point towards management’s estimates being conservative:

- Fullstack was acquired for $38m in 2019. Since then the IT bootcamp business has grown significantly – increased its revenue over 3x (combined segment revenue together with TutorMe was $10m in 2019 vs current H1’22 run-rate of $27m for Fullstack), while university partnerships multiplied from 4 to 19. Latest Q2 top line expanded by 35% YoY. While the software/education M&A environment is different now compared to what it was 3.5 years ago, estimating the potential sale at the cost basis seems overly conservative here. TutorMe was sold at a much higher relative price, although admittedly, it’s a different business that was much closer to profitability breakeven than Fullstack. To break even at the current $0.17/share ZVO price Fullstack would have to be sold for at least $41m, which is just slightly above the price paid for the business 3.5 years ago.

- Management estimates indicate 1.3x and 2x run-rate sales multiples for the Fullstack sale. A somewhat comparable company would be TWOU. 67% of TWOU revenues are generated from providing technology and platform for universities to launch their degree programs online. The remaining 37% are somewhat similar to ZVO – TWOU provides open courses, education programs, and boot camps through relationships with colleges and universities. TWOU trades at 1.2x run-rate sales. It also burns cash, is incomparably more levered than ZVO (net debt $700m), and grows much slower – sales increased by 72% since 2019 mostly through acquisitions. The recent in H1’22 results have shown growth of only 5% YoY. Clearly, a case could be made here for Fullstack Academy to receive a higher revenue multiple, especially if gets acquired by a strategic buyer. Interestingly, in June, Bloomberg reported that Indian education giant Byju was looking to buy TWOU for $15/share, which would value the company 1.9x sales. In a recent interview, Byju’s founder confirmed that it was indeed interested in TWOU. However, the Indian buyer stumbled into problems with raising funds, so the deal did not materialize eventually. Importantly, the fundraising problems were not related to ZVO itself, but to general concerns over the Indian consumer tech industry amidst worsening macroeconomic conditions and the credit market.

Also, the fact that ZVO was able to receive bridge financing to finalize asset sale/liquidation is also a small positive and vote of confidence towards prompt resolution of the situation.

Cano Health (CANO) – Potential Takeover – 58% Upside

A potential takeover of $4bn mcap primary care company amidst a consolidating industry and two activist shareholder campaigns. Given the size of the transaction, there’s probably a high number of eyes following the case whereas the business and its valuation are rather tricky. The market is likely to be pricing the risks correctly here. Cano Health owns and operates senior primary care health centers in nine US states, with a primary focus on Florida. Recently, Bloomberg, Reuters, and WSJ reported that the company has received acquisition interests, with health industry giants Humana (HUM), UnitedHealth (UNH), and CVS Health (CVS) mentioned as the front-runners to buy out CANO. Reportedly, CANO has hired financial advisors and the second round of discussions is currently ongoing, with the deal possibly getting finalized in the upcoming weeks. One of the activists, Owl creek, suggests a $14/share (58% upside) target and a quick glance of peer valuations seems to justify it as rather reasonable.

The potential acquisition would make strategic sense for all of the rumored buyers given CANO’s extensive presence in Florida’s primary care market, where CANO is the largest independent value-based primary care provider. Meanwhile, three potential suitors currently rank as the three largest primary care insurers in Florida. Humana and Cano have seemingly deep ties – HUM has been invested in Cano Health prior to CANO’s IPO and still owns an undisclosed stake. CANO is currently HUM’s biggest independent primary care provider in Florida. Interestingly, as part of their earlier agreement, HUM has a right of first refusal, meaning that HUM can match any acquisition offer made for CANO.

Buyout rumors come amid broader healthcare industry consolidation trends as large healthcare insurers are scooping up healthcare providers in an effort to combine insurance and healthcare provider activities. The industry is currently in a shift towards value-based-care model where providers are paid based on patient health outcomes (as opposed to the traditional fee-for-service model where patients pay for each service rather than outcome). Naturally, the value-based care model closely aligns the interests of both health insurance firms and healthcare providers. Not surprisingly, these dynamics have spurred a number of acquisitions of healthcare providers by major insurers. CVS is currently buying healthcare platform provider Signify Health (Sep’22), UNH is scooping up home care provider LHC Group (announced in Mar’22) and HUM has already acquired home healthcare provider Kindred at Home (Aug’21). HUM has significantly expanded its investment in primary senior care over the last five years, recently stating that the TAM is very large at $700bn. CVS also indicates its priority is to expand into this sector. The industry has also seen increasing M&A activity from non-insurers entering the space, including Amazon acquiring primary care company One Medical (announced in Jul’22, with CVS being one of the bidders) and Walgreens Boots Alliance purchasing a majority stake in primary care provider VillageMD (Oct’21). These dynamics and the fact that CANO might be an attractive target have also been recently reiterated by CANO’s CEO.

Recently, the company has been subject to activist pressure. In March, Daniel Loeb’s Third Point (2.2% of voting power) started to push the company towards strategic alternatives, arguing that CANO should address the valuation gap by initiating company sale. Then, in August, Owl Creek Asset Management (owns 1%) delivered a letter, also saying that the company was undervalued versus peers and industry transactions. Both activists have argued that the undervaluation has been due to the company’s SPAC heritage, dual share class structure, and heavy concentration in the South Florida market. Owl Creek suggests that the company might be worth 3x 2022E revenues or $14/share. Currently, CANO trades at only 1.8x 2022E sales. Peers OSH (also owns and operates primary care centers) and AGL (runs primary care physician networks so not as comparable) fetch multiples of 3.0x and 3.4x. Moreover, the recently announced ONEM acquisition was done at 3.9x TTM revenues (compared to 2.2x for CANO).

Avante Logixx (XX.V) – Potential Takeover – 60%+ Upside

A pitch on a potential takeover by a founder/CEO and major shareholder has been recently made public on VIC. Avante Logixx is a C$21m market cap security services provider to ultra-high-net-worth individuals/households in Canada. They operate exclusively in the high-end neighbourhoods of Toronto offering real-time monitoring and rapid response services (6 minutes resp. time). It is a low-churn business with no competition and only 20% penetration so far. XX stock has been orphaned since the founder Manny Mounochos (owns 10%) and major shareholder Fairfax Financial Holdings (owns 20%) blocked a sale of the whole company at C$1.6/share earlier this year. To reach 20% ownership and blocking power, FFH even converted its debentures at C$1.56/share – a 10% premium to the market price at the time and multiples above the current C$0.83. So the key shareholders were unwilling to sell at prices that are double the current levels.

Along with the terminated acquisition agreement, XX replaced the entire Board of Directors and reinstated the founder Manny Mounochos as the new CEO. The new management team started restructuring/cost-cutting processes, recently sold the company’s lower-margin Logixx Security business, and secured a C$10m credit facility from Fairfax. XX has a solid liquidity position with 69% of the market cap in net cash and financial support from FFH suggests there are few reasons for XX to remain public.

There’s a chance that the founder/CEO and FFH will move to take XX private. The timing seems opportunistic – the stock hovers at the 10-year lows, 50% below the recently blocked takeover offer. The market continues to ignore the company’s turnaround, which seems successful so far with XX having already returned to positive adj. EBITDA. The remaining operations now trade at just 3.6x EBITDA (and 1x revenues) taking run-rate of the last two quarters. While not a directly comparable peer, AlarmForce, was acquired by BCE in 2017 at 3x revenues. Just using the cash + credit facilities on XX balance sheet, FFH/Manny Mounochos could cash out minority shareholders at C$1.30/share (66% premium to current prices).

Fairfax and Manny seem to have a fairly tight relationship as Fairfax CEO Prem Watsa has been a long-time client of Avante. The risk is that FFH acquired the stake/blocked full company sale as a personal favor from Prem Watsa to Manny. The intended buyer at C$1.6/share was SSC Security Services – a company with a rather questionable background. It was previously called Input Capital and was purely a canola streaming business. In late 2020 Input Capital tried to sell the whole business to some very shady buyers and after the sale (unsurprisingly) failed, it turned into a security business. It’s quite possible that Prem Watsa simply did not want to give away his own security firm to some questionable buyers. Instead, he and Manny, got rid of the previous CEO along with his unsuccessfully built Logixx Security segment and returned to the core business. The fact that FFH lent XX $10m might also not speak towards the cashout of minority holders, but might rather be funds to be used for some acquisitions. Just a few weeks ago, the company has finally hired a permanent CFO, who among other things is tasked with assessing acquisition opportunities and integrating the acquired businesses.

However, even if the minority shareholder cashout scenario doesn’t materialize, Avante Logixx is a stable, fairly high-quality, recession-resistant business at 3.6x EBITDA. The downside seems well protected by existing cash on the balance sheet. The continuation of positive earnings should make Avante Logixx screen much better and catalyze re-rating eventually.

PREVIOUS QUICK PITCHES PLAYING OUT

Pasithea Therapeutics (KTTA) – Net-Net/Activist Pressure – 27% spread to net cash remains

Pasithea Therapeutics was originally covered in June and last month updated here. KTTA is a net-net biopharma under activist pressure trading at a 27% discount to net cash. The activist campaign led by Camac Partners (12% stake) has been progressing well over the last couple of weeks. Recently, KTTA chairman resigned from his position, a decision encouraged by the activist since the beginning of the campaign. Moreover, on Monday, the board finally caved in and approved the special shareholder meeting. The activist has a pretty good chance of winning seats with at least 25% of votes already in support. So far, Camac Partners hasn’t provided many details on their plans following the board overhaul, except ‘improved capital allocation and unlock significant value for shareholders’. Since our initial highlight, the shares are up by 8%.

Biohaven Pharmaceutical (BHVN) – Merger Arbitrage + SpinCo

Biohaven Pharmaceuticals was originally highlighted in July. As a quick recap, BHVN, a maker of migraine tablets, signed a definitive agreement to be acquired by Pfizer for $148.5/share in cash + 0.5 shares of a publicly tradable new-co. The merger seemed like a done deal as Pfizer showed significant interest in the company’s portfolio, there seemed to be no shareholder opposition, and regulatory hurdles were unlikely. At the time of the write-up, BHVN traded at $145/share, which provided a symbolic 2% upside on the cash consideration + a free upside from the new-co shares. The takeover has recently closed. The new-co kept the original BHVN ticker, was capitalized with cash, and retained all non-migraine-related products. Currently, BHVN trades at $13.2/share (or $6.6 per the half-received share) versus its net cash position of $7.7 another $2.8 at cost value of the recently purchased KV7 platform. As a bonus, BHVN’s shareholders will also receive potential royalties from Pfizer (mostly a free option). The idea resulted in a pretty safe 7% return in 3 months (in-line with our expected estimates).

Glory Star New Media Group (GSMG) – Chinese Take-Private

Glory Star New Media’s take-private idea was originally highlighted on the 14th of July. GSMG received and accepted a sweetened $1.55/share offer (the initial $1.27/share bid was rejected by the special committee – quite unusual for a Chinese-controlled buyout). While the business is a black box, it is backed by Shah Capital (a US hedge fund that runs a concentrated $380m AUM portfolio), which will roll its 11% stake. The spread has now been eliminated after GSMG announced that the shareholder meeting will be held on October 27. The meeting is a formality (as the buyer holds a 73% stake). GSMG’s shares will be delisted soon after the meeting.

CVS backed out of CANO deal. Down 35% intraday. Could still get a deal with HUMA, who had ROF on a deal with CVS, but I would not hold my breath for anything close to $10.

Moody’s also downgraded CANO last week to Caa1 from B3: https://www.moodys.com/research/Moodys-downgrades-Cano-Health-LLCs-CFR-to-Caa1-outlook-stable–PR_470308

Anyone following ZVO? Up 35% on 147M share volume.

Seems like a pump & dump. No shorting availability though. No updates from ZVO.

With the ZVO pump behind us, any sense of the probability of a FullStack sale?

Estimating the potential FullStack sale price is largely a guessing game. However, as as stated in the quick pitch above, there are some indications that it could end up in the upper half of the estimated range.

By the way, ZVO shareholders approved the liquidation plan on October 25.

Did the company announce a definitive date when it will delist?

Not yet, they still have to find a buyer for FullStack first. However, the time they have is limited due to the ongoing cash burn.

ZVO will get de-listed this Thursday, Nov 10.

I don’t think you’re going to be able to trade after that.

Risk reward worth it at this price?

It’s very risky and not far away from a Casino bet right now. Shares are down to 9ct due to delisting today, while the market previously valued the odds at 14-17ct, before it became clear the stock will get delisted. So I guess you could get in cheaper now and wait for what can end up as a 4x multibagger or 100% loss. Meanwhile, you’ll be stuck with a delisted stock, which is not fun.

The company has announced that “Pursuant to the Notice, the Company’s common stock will therefore cease to trade on The Nasdaq Capital Market following the close of business on November 10, 2022. At that time, the Company has further instructed its transfer agent to close the Company’s stock transfer records and discontinue recording transfers of the Company’s securities.”

https://www.sec.gov/ix?doc=/Archives/edgar/data/1305323/000130532322000070/zvo-20221101.htm

The second sentence seems inconsistent with the stock continuing to trade OTC. Does anyone know how this works? Is there risk that if one buys now, one does not obtain ownership? Seems odd.

I am wondering this myself. Have you tried calling the company?

Anyone with an opinion about CANO? May it be worth a shot for a potential rebound? Risk/Reward good or not so? Thanks!

Any update/thoughts on XX.V? 1.25 target from VIC writeup but how about SSI target?

Quick update on Avante Logixx:

The company became a target of a couple of activist investors. Last week, a private investor George Christopoulos (owns 12%) released a filing, urging the company to return all of its C$11m (vs. C$25m market cap) in cash to shareholders as well as initiate the sale process. On the same day, another private investor Jason Senensky published an open letter, pushing management to return excess cash and pursue management-led privatization. The activist has reiterated that the company has little rationale to remain public given its limited scale and low float. The investor suggested that the company might fetch a 10x EBITDA valuation in a privatization scenario, implying a 100%+ premium to current levels. Avante Logixx share price has run-up significantly since late 2022, likely partially driven by Mr. Christopoulos’ aggressive purchases of stock in the public market.

Filling by George Christopous: https://www.sedar.com/GetFile.do?lang=EN&docClass=4&issuerNo=00024271&issuerType=03&projectNo=03510411&docId=5385727

Open Letter by Jason Senensky: https://chaptertwelve.substack.com/p/an-open-letter-to-the-board-of-avante

Seems like somethings going down with XX?

XX.V – do disappointing earnings change the activist route/goal at all?

Seems like XX.V mgmt has proven unreliable with recent acquisition – https://www.avantecorp.ca/avante-corp.-announces-acquisition-of-55-of-north-star-support-group.

Could you please clarify what you mean by “unreliable”? Is it the fact that they are doing M&A in general, or is this acquisition sub-par?

I believe that management has been talking for quite some time about doing M&A, they even have a section on their website titled “being acquired”.

Management has been saying that they want to expand beyond the key Toronto area, and the acquisition gives the exposure to the US, Europe, and the Middle East by leveraging NSSG’s existing corporate client base and expertise in international markets.

Also, the acquisition isn’t that large – €1.3m or around C$1.8m compared to ~C$10m cash on the balance sheet. It seems likely that management will continue to grow the company both organically and inorganically.

You can just reread the writeup above. I’m not sure I can explain it any better, esp if you believe mgmt is doing what’s best for shareholders. Also things like this:

https://twitter.com/ChapTwelveCap/status/1706767860092084383?t=15sn8Lg9ZEeeNpnf7qyVnA&s=19

I am quite familiar with the situation. As far as I understand the current management never hinted at selling the company, it was just an educated guess based on a few assumptions. Management has clearly chosen the part of continuing existing operations/building the business. Is it worse than an outright sale? time will tell.