First Eagle Alternative Capital BDC (FCRD) – Merger Arbitrage – 14% Upside

Current Price: $4.21

Offer Price: $4.80

Upside: 14%

Expected Closing: early Q1 2023

Proxy and presentation

This is a merger arb involving two BDCs. We had a fairly similar situation covered on SSI last year. The transaction is likely close over the next 2-3 months and provides an attractive IRR. Liquidity is decent with an average trading volume of $0.5m/day.

Crescent Capital BDC (CCAP) is acquiring its peer First Eagle Alternative Capital BDC. The consideration stands at 0.2063 CCAP shares + $1.89 in cash. This amounts to a total of $4.80/share or 14% upside to current prices. Plenty of cheap borrow is available for hedging. FCRD shareholder approval is very likely as the merger is getting done at a minimal discount to NAV. FDRC’s external manager with 17% ownership and the second largest shareholder (with 7%) are supporting the transaction. CCAP is a motivated strategic buyer and is unlikely to walk away. The merger was initially planned to close late this year, however, in the recent conference call management said the closing will probably slip into Q1 2023.

This situation is similar to HCAP‘s takeover covered on SSI last year. The spread seems to be partially explained by a combination of small capitalization, somewhat confusing consideration calculations, and unknown, but predictable transaction expenses. There is also NAV volatility risk that might affect merger consideration, however, given the positive high-yield bond market dynamics since the end Q3’22, the margin of safety seems more than sufficient.

The downside to pre-announcement prices stands at 30%, however, the chances of this transaction failing seem fairly slim. Moreover, during the sale process (initiated by FCRD external manager), there were 2 other seemingly serious buyers which made non-binding offers and then revised them higher. Although the details are limited, the second most attractive proposal after CCAP’s offer was similarly structured (26% cash, 74% stock) proposal with a total value just 3-5% below CCAP’s offer at the time. Even if the current deal failed, there’s a non-zero chance that other interested parties would return to the table.

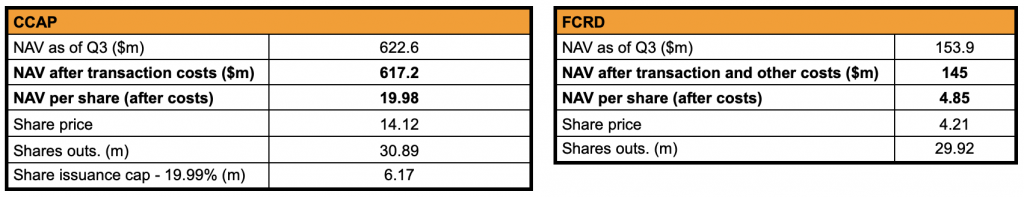

Merger consideration

Essentially this is a NAV for NAV merger with the additional $35m payment from the buyer’s external manager in order to convince FCRD shareholders to vote for this transaction.

The merger consideration per share is split into:

- $2.91 in stock from 0.2063 CCAP shares. This exchange ratio is not fixed and will be determined upon closing based on NAVs of FCRD and CCAP, but it is very likely to stay at the current 0.2063 rate. Not more than 20% of the total CCAP outstanding share are to be issued for this merger – this share issuance cap results in a fixed exchange ratio of 0.2063 around current NAVs. NAVs of the companies would need to deviate from the Q3’22 values by more than 15% for the exchange ratio to change. This is unlikely to happen.

- $0.72 in cash from CCAP – this cash part of the consideration is also the result of the above-mentioned share issuance cap. Due to the cap FCRD shareholders are not getting the 100% NAV equivalent from the 0.2063 CCAP shares and the difference is compensated by cash payment. This cash portion of the consideration will be affected by the eventual NAVs of both companies as well as any unlikely changes in the stock exchange ratio,

- $1.17 in cash from CCAP external manager which is adding $35m out of its own pocket.

The total sums up to $4.8 per FCRD share or 14% upside to current prices.

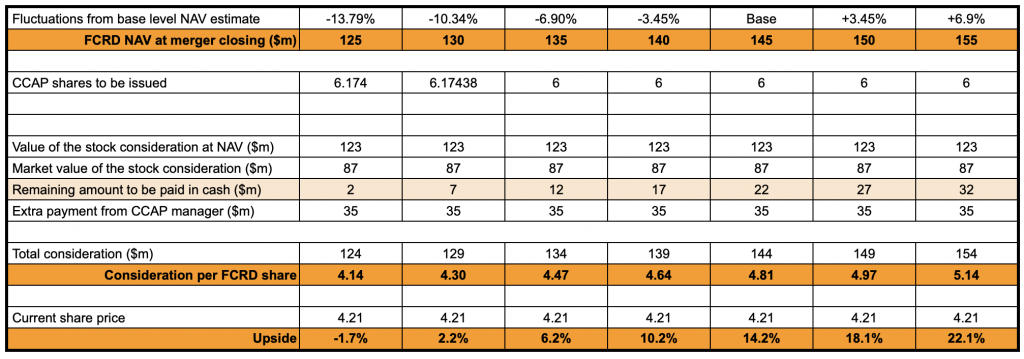

The key determinant for merger consideration will be NAVs of both companies upon closing of the transaction. At the moment we have values as of Q3’22. NAVs will be determined by two factors: (1) changes in asset values on the balance sheets and (2) merger transaction costs that will be deducted from NAVs before closing. On the former point, I do not expect material changes as the portfolios of both companies are comprised of first-lien senior secured floating rate loans, which are expected to be of relatively stable value. I have covered the risk of NAV fluctuations in a bit more detail in the very last section of this write-up. As for the second point, there is sufficient visibility into the likely transaction costs and resulting effects on NAV:

- Both firms will cover their own transaction costs, which will accordingly reduce the NAVs at the closing of the merger.

- The financial advisor in the proxy (page 63) estimates FCRD NAV upon closing at $145m vs $154m as of Q3’22. This would mean $9m of transaction-related expenses on FCRD side alone. This seems a bit extensive given that 2 years ago Alcentra Capital (another BDC acquired by CCAP) paid transaction costs of $4.5m (see page 10), whereas during FCRD’s sale process the same financial advisor was estimating only $4m of ‘standard costs’ (page 54) for FCRD. Even including a $2.1m NAV reduction due to repayment of deferred financing costs (as of Q3) still leaves sufficient headroom for any other unforeseen costs. If actual transaction costs turn out to be below $9m, this will result in higher FCRD NAV and in turn higher merger consideration.

- For CCAP, I’ve estimated the transaction costs at $5.4m – the same as the company spent during Alcentra Capital’s buyout two years ago.

- Quarterly dividends will be paid on the 30th of Dec for FCRD and on the 17th of Jan for CCAP. The yields for both BDCs are very similar and these payments for the hedged trade will pretty much cancel each other, maybe resulting in a tiny consideration boost as the short leg of the trade will be smaller.

My calculations are shown in the tables below.

FCRD shareholder approval is likely

The meeting date hasn’t been set yet. FCRD external manager owns 16.7% and supports the transaction. Additionally, on the conference call CCAP CEO mentioned that the second largest FCRD shareholder Leon Cooperman (with 7.3% stake) is also supportive of the merger.

Cooperman is a US billionaire and retired hedge fund manager, who turned his fund Omerga Advisors into a family office a few years ago. His portfolio now consists of around 40-50 positions and FCRD is definitely on the smaller side in terms of allocation. Nonetheless, Cooperman seems quite interested in FCRD and frequently participates in the company’s conference calls. Rather unusual for a micro-cap BDC.

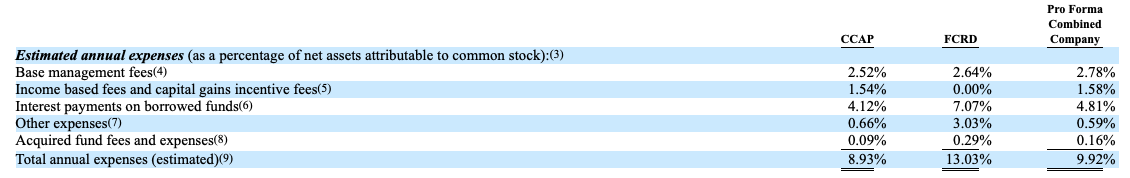

With support from 24% of shares and the current external manager willing to exit, I would expect the remaining shareholders to also vote in favor. This merger offers shareholders an exit at just 7% discount to Sep’22 NAV. In comparison, FCRD’s historical discount to NAV used to stand at 20% pre-COVID and after COVID ranged between 30%-40%.

From cefdata.com:

The buyer is unlikely to walk away from this acquisition

CCAP is a motivated strategic buyer. The chance it would suddenly break the merger is negligible.

The portfolios of FCRD and CCAP are highly complementary. Both BDCs focus on senior first lien (84% and 89% respectively), sponsor-backed ( 93% and 98% respectively), and mostly floating rate loans (97% and 99% respectively). The companies also mostly target borrowers in the same industries – healthcare and pharma, business and consumer services, financials, etc.

CCAP management has emphasized a few times they’ve already done extensive work going through FCRD portfolio and checking each loan on the company by company basis. CCAP also said they’ve analyzed FCRD’s more risky legacy portfolio (16% of total assets) and came out satisfied with what they found. From the vice president of CCAP:

I’ll comment a bit more on — or provide some additional color on just the work that we did on the portfolio here. Our valuation opportunity started with royal (inaudible) and doing the credit work on a portfolio company by portfolio company basis. That was critical in terms of our process when evaluating Alcentra and that’s where we started our due diligence with this process as well. I think for those that are familiar with the overall First Eagle BDC story, the portfolio historically was, I’ve been more focused on subordinated debt investments in a much more concentrated portfolio.

We’ve seen that migrate over time to a portfolio that in many ways, looks much more similar to ours today where it’s majority first lien sponsor-backed floating rate investments. And our — the key focus of our diligence was ensuring that, that portfolio was a fit with ours on a combined basis in terms of the overall complexion of the investment type, the types of companies that we’re bringing to the portfolio and the industry focus. And that’s where the bulk of our diligence was focused here.

CCAP external manager seems to be very interested in getting this deal done. It is putting $35m of its own cash to get approval from FCRD shareholders. Then, the parent company of CCAP’s external manager (Crescent Capital Group $39bn AUM) intends to purchase $20m of the combined company stock via a share purchase program following the closing of the merger. Finally, CCAP’s external manager has agreed to waive its income fee incentive if the combined company won’t be able to cover its dividend through 2023 (although management is confident that won’t be necessary).

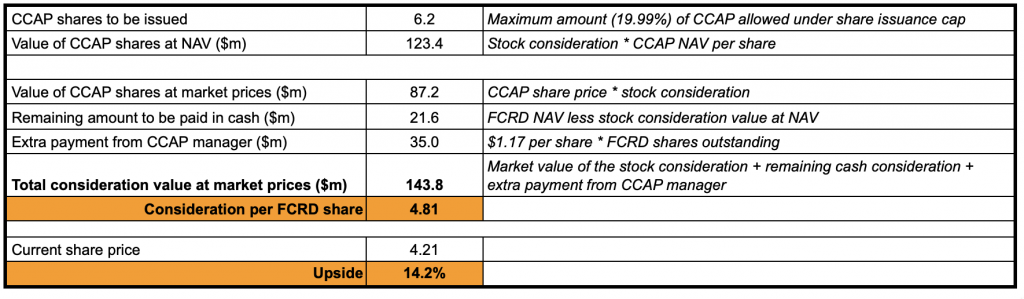

From the perspective of financial incentives, as a result of this merger, not only will the AUM (and the resulting management fees) increase by c. 28%, but the whole fee structure will be lifted slightly upwards relative to NAV base. From the pro-forma estimated expenses table below (proxy) can be seen that the incremental fees will amount to $8m/year, so it will take just 4.5 years (assuming minimal incremental costs to manage these additional assets) to get back the $35m cash invested to get this merger done.

CCAP expects substantial synergies and cost-savings through the G&A expense reduction. The buyer calculates mid to high single-digit net interest income accretion. The merger will also add scale and liquidity. CCAP management said the added size should eventually open the door for more institutional ownership and will also allow the combined company to begin issuing index-eligible bonds.

The main goal for the buyer seems to be short-medium term monetization of FCRD portfolio with prioritizing the legacy assets first (second lien, unsecured, equity loans, etc – around 16% of the FCRD portfolio). CCAP has already done one acquisition before (Alcentra Capital, closed Jan’20) and it was very similarly sized – the target shareholders got around 20% of the combined company. Management said all of Alcentra Capital’s portfolio has already been monetized at 30% gain on cost basis (worth noting that this merger was completed just before the pandemic and a following bull run in the credit markets). Something similar is now planned with FCRD’s portfolio (M&A call):

Since formally acquiring Alcentra in January of 2020, our team has successfully realized 130% of our cost basis from the acquired portfolio with approximately $35 million of remaining fair value yet to be realized. We view the key success factors of the Alcentra transaction as a combination of acquiring a portfolio that was similar to ours in terms of asset composition, active management, and rotation out of legacy Alcentra investments into Crescent directly originated private credit investments. We have established a successful playbook to onboard, monitor and appropriately monetize an acquired BDC portfolio which we kicked off several months ago with both a top-down and bottoms-up analysis of First Eagle BDC’s portfolio assets.

[…]

Over the longer term, we expect that the majority of the First Eagle BDC investments will be fully realized within the next 2 to 3 years as sponsor activity pursuing refinancings and portfolio company realizations drives a natural matriculation of the investments. With respect to legacy watch list investments, we expect to take an active role in generating near and immediate term monetization activity.

FCRD background and legacy assets

The company used to be called THL Credit and was rebranded to First Eagle Alternative BDC in mid-2020 after $100bn+ asset manager First Eagle Investment acquired THL’s external manager.

FCRD started trading in 2010 through a small $250m IPO and initially focused on junior capital investments – mezzanine, subordinated debt, etc. – with equity components. The company grew its asset base mainly by issuing equity. NAV per share was rather stable at $13/share till 2015. The company overextended itself and built a more concentrated portfolio (the largest investment was 10% of NAV) with substantial exposure in more risky second-lien debt and equity investments. In 2015 credit markets soured and markdowns started piling up, which hit the company’s NAV.

Eventually, the external manager decided to refocus on a more conservative first-lien secured senior loans and started slowly exiting non-core assets. Here’s how management described the situation in 2018:

The only way I can fix NAV stability is to, a, run diversified and run more senior secured. And if all of our portfolio construction — our portfolio out of the box was built wrong. I said this in the call last year. We went public very small. No one could go public again today at $250 million, nor should they, in my opinion. But we did it and that created this concentrated portfolio where we were stretching for yield and now we’re paying the price for it.

To this date, FCRD has disposed nearly all of its legacy assets. The portfolio mix shifted from 50% first lien secured back in 2014, to 84% as of today. The portfolio size has also been considerably reduced with net assets going down from $443m in 2014 to $154m in Q3’22.

The key legacy exposure on FCRD’s books (12% of total assets) is an investment into Logan JV, in which FCRD holds an 80% equity stake. Logan JV was formed in 2013 and invests primarily in broadly syndicated first lien loans (BSL) in addition to directly originated loans. Logan JV’s BSL loans are liquid and frequently traded, therefore this joint venture investment is marked to market on FCRD’s books every quarter, driving material NAV fluctuations.

Logan JV’s loans are all floating rates and have a rather high yield (LIBOR + around 5%). The JV is also quite levered. This year the company has refinanced the JV’s credit facility into a middle-market CLO structure, which management said will provide more capital flexibility. More information on its loans and financials can be found here.

Here’s what CCAP management said about their due diligence on Logan JV’s portfolio and refinancing into CLO.

In the case of Logan, today, we certainly have done our work on that JV and that CLO. And we like the characteristics — the yield characteristics of that JV today. We like the structure of that CLO. We think that was set up in a thoughtful way, and we think it can drive attractive returns for the shareholders for the intermediate term, the near intermediate term.

So I think we would seek to maintain that vehicle likely through the end of the reinvestment period, which is a few years from now. And so that would be the plan or at least the current thinking at this point. There will be runoff, just like there is in our JV portfolio when assets start to realize and the reinvestment period winds off. And we would certainly seek to redeploy those assets when the runoff takes place into directly originated Crescent private credit assets.

Sensitivity of merger consideration to NAV fluctuations

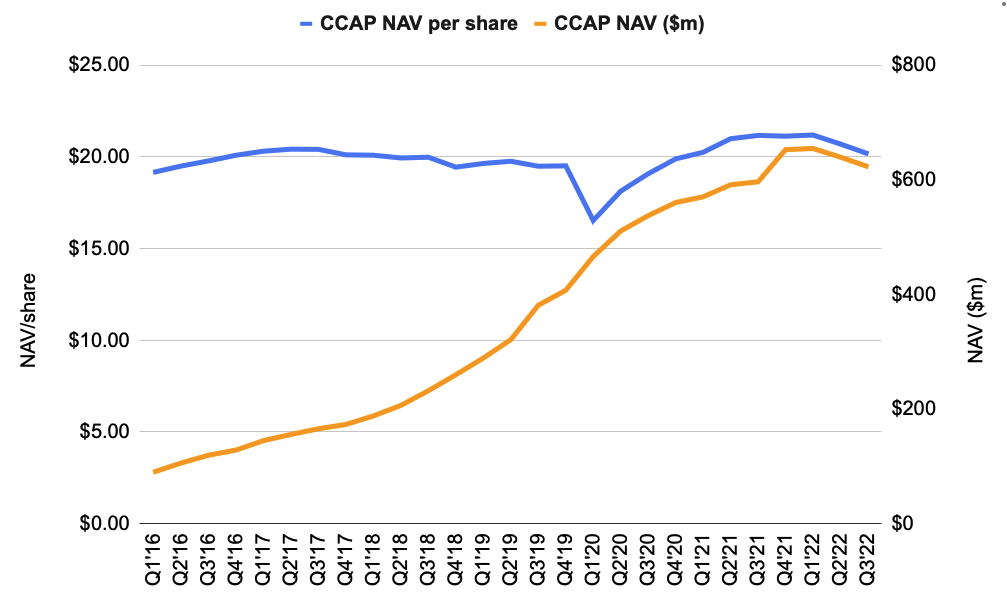

The main risk for this merger arb trade is exposure to NAV fluctuations of both companies. CCAP portfolio is conservative and the NAV/share has been very stable for many years. There should be no major fluctuations until the merger closes. CCAP has grown mostly through equity issuance and acquisitions.

However, the FCRD portfolio poses a higher volatility risk, mainly due to the remaining 16% portfolio allocation to its legacy assets. This might be one of the reasons why market is skeptical and leaves a large apparent spread on this transaction.

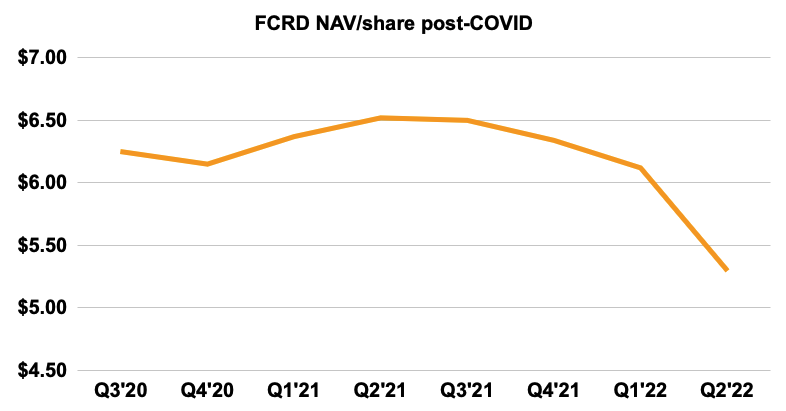

While being relatively stable post-COVID, FCRD NAV dropped by 13% from $6.12/share to $5.3/share in Q2’22. Nearly half of this decline was driven by mark-to-market Logan JV investment revaluation, the rest came from the other legacy loans. From Q2’22 call:

This drop in NAV can be broken down as follows: $0.36 of the decline is related to the Logan JV, which generally follows the drop off in the Credit Suisse Leveraged Loan Index during Q2. The balance of the NAV decline was primarily related to 3 specific investment’s: Matilda Jane, $0.21; Loadmaster, $0.14 and OEM $0.06.

As management noted Logan JV’s markdown during Q2’22 was driven by the general sell-off in debt instruments as interest rates shot up alongside investor sentiment/expectations for rapid further raises. From Q2’22 call:

As a reminder, the Logan JV is primarily composed of broadly syndicated loans and the NAV impacted was driven by market volatility as opposed to any credit-specific issues.

In Q3’22, as the debt markets stabilized, FCRD NAV fell only 3%. In the current quarter, high-yield bond markets (e.g. HYS and HYG high-yield bond ETFs) are up over 3% as the recent inflation data gave hope that FED will slow down rate increases sooner than previously expected. Hence, any further downward Logan JV mark-to-market portfolio revaluations are unlikely at the moment. Quite the opposite – upward MtM revaluation might give a little boost to FCRD NAV and in turn to merger consideration.

The other legacy assets are a tiny part of FCRD portfolio (3.5% of the total) and material markdowns have been rare.

The table below shows the sensitivity of merger consideration to changes in FCRD NAV. The calculations assume CCAP NAV remains stable at Q3’22, less the estimated transaction costs. This shows that the risk of NAV fluctuations breaking the trade is low – FCRD NAV would need to drop by another 12% till closing for the hedge trade to result in losses. Such a move in NAV appears unlikely given where high-yield bonds have traded so far this quarter.

@dt could you please elaborate on the hedging part?

Not entirely sure if I understand your question correctly, but assume you are asking about the hedging ratio. If the merger closes FCRD shareholders will receive 0.2063 CCAP shares + $1.89 in cash – this assumes NAVs of both companies do not deviate materially from the figures outlined in the write-up. To hedge exposure to CCAP shares and just bet on the merger arb spread of 14% one would need to short 0.2063 CCAP shares for every long share in FCRD. If NAVs deviate materially (unlikely, in my opinion), then the cash portion might be smaller. At even larger relative NAV changes the exchange ratio might also move.

Received a couple of questions via email regarding NAV stability of both companies.

I probably did not articulate it well enough in the write-up, but the reason I expect NAVs for these BDCs to remain rather unchanged till closing (except for transaction expenses) is that the portfolios of both companies are comprised of senior secured first-lien loans at floating rates. The values of these loans tend to be stable and not fluctuate QoQ. The only risky part is FCRD’s legacy portfolio, which I have addressed in more detail.

Just looking at CCAP briefly – I’m thinking this might be a good candidate for an unhedged arb.

1) NAV expected to be stable.

2) it has traded down sharply the past two months leaving valuation attractive at .69x P/TBV.

3) by not hedging you get CCAP’s fat yield of 11.8%.

Any thoughts on doing this unhedged? Thanks.

That might also work out. However, even if NAV is stable, you will never know how the discount to NAV might move and where will it settle.

As you say, with unhedged positions, you get:

– 12% yield from dividends;

– Additional upside from CCAP discount to NAV narrowing.

Lots of things short of a fully hedged bet. Given that there’s a CCAP options chain, you can maybe do a half assed job of hedging here, by buying FCRD and selling calls on CCAP to leave you with what you figure to be an attractive entry price. Or, if the yield has pushed down the price of options enough, you could buy a put spread to build a similar payout map…

Don’t know that I’d put this on with no hedge personally, but that’s an option if you like the underlying.

Spread down to about 9%, maybe due to people buying based on this writeup?

It’s 3% move in FCRD and 2% move in CCAP – these days when indexes easily move +-5% in a day, such 2-3% can also be purely random. Volume on both days since the posting was below average, so do not think there was a lot of incremental buying.

CCAP merger event: CCAP and FCRD had previously announced a merger agreement. The acquisition of FCRD is a NAV-for-NAV swap, subject to limits of amount of stock (and anything in excess of the limit, paid in cash). Based on the new NAV/share for FCRD, we believe the cash portion of the offer would be reduced (since the exchange ratio already hits the max stock amount). On a preliminary basis (since it is based on CCAP 6/30 NAV/share) we believe the current offer is closer to ~$0.47/share in cash plus 0.2063 shares of CCAP stock for each share of FCRD.

Note the manager is also offering $1.17/share in cash – so the total consideration to FCRD is in excess of the cost to CCAP. We currently estimate FCRD shareholders would receive $1.64/share in cash and $4.29/share in NAV value of CCAP stock (current trading value at $2.95/share based on the CCAP price/NAV of 0.69x). This is subject to change, depending on the relative changes in FCRD and CCAP NAV/share.

From RayJay note. They assuming .47 for $1.64 total. Not sure if you addressed their point above.

What is RayJay note?

re: above. Raymond Jones, a broker, put out a note on the deal bit ago with slightly different ratio.

The meeting date is set for March 7. Q4 results with updated NAVs should be out shortly before that. At current prices and September-end NAVs remaining upside stands at 5%.

https://www.bamsec.com/filing/119312523012102?cik=1464963

Merger election for cash/stock consideration, due Feb 23.

Merger election for cash or stock ist out. Should I select 100% stock or cash?

Good question. I would be inclined to choose cash, but I see that in the previous BDC merger HCAP, share election resulted in a slightly higher (1.5%) total return.

http://ssi.wpdeveloper.lt/2021/05/harvest-capital-credit-hcap-merger-arbitrage-14-upside/#comment-11487

Anyone knows how much is cash, how much is stock??

See illustrative calculations in the proxy (pages 78-80).

The latest info shows $0.58 in cash and 0.2065 in CCAP shares in merger consideration. And then an additional $1.17/share in cash from CCAP advisor.

The amounts in merger consideration might still change and will depend on NAVs upon closing.

https://www.bamsec.com/filing/119312523012102?cik=1464963

So, again, what’s better to elect? (Sorry, I don’t understand the election at all!)

I’m confused. In the CA Election I have two options, “Submit shares for cash” and “Submit shares for stock”. So it sounds like it is all cash or all stock. But originally I was supposed to get 0.2063 CCAP shares + $1.89 in cash. Has it been changed? If not, which option should I select to get the mix of shares and cash?

This is how the choice is described in the proxy. Perhaps it is too late to make a choice. Anyway, there probably is no way to know in advance which will be the best choice. I don’t own any so haven’t tried to figure it out. As @dt noted, pages 78-80 show some calculations.

https://www.bamsec.com/filing/119312523012102?cik=1464963

—-

“Each person who as of the Effective Time is a record holder of shares of FCRD Common Stock will be entitled, with respect to all or any portion of such shares, to make an election (an “Election”) to receive payment for their shares of FCRD Common Stock in cash, subject to the conditions and limitations set forth in the Merger Agreement. Any record holder of shares of FCRD Common Stock at the record date who does not make an Election will be deemed to have elected to receive payment for their shares of FCRD Common Stock in the form of CCAP Common Stock. For the purpose of making Elections, a record holder of FCRD Common Stock that is a registered clearing agency and which holds legal title on behalf of multiple ultimate beneficial owners shall be entitled to submit elections as if each ultimate beneficial owner were a record holder of FCRD Common Stock.

Each share of FCRD Common Stock (other than a Cancelled Share) with respect to which an Election has been made will be converted into the right to receive an amount in cash equal to the Per Share NAV (as defined below), subject to those adjustments described in the accompanying proxy statement/prospectus under “Questions and Answers About the Special Meeting and the Mergers—Questions and Answers About the Mergers—What will FCRD Stockholders Receive in the Mergers?” and “Description of the Merger Agreement—Allocation of Merger Consideration and Illustrative Elections and Calculations,” as well as the right to receive an additional amount in cash equal to the applicable ratable portion of the CCAP Advisor Cash Consideration (as defined below).

Each share of FCRD Common Stock (other than a Cancelled Share) with respect to which an Election has not been made will be converted into the right to receive a number of validly issued, fully paid and non-assessable shares of CCAP Common Stock equal to the Exchange Ratio, subject to those adjustments described in the accompanying proxy statement/prospectus under “Questions and Answers About the Special Meeting and the Mergers—Questions and Answers About the Mergers—What will FCRD Stockholders Receive in the Mergers?” and “Description of the Merger Agreement—Allocation of Merger Consideration and Illustrative Elections and Calculations,” as well as the right to receive an amount in cash equal to the applicable ratable portion of the CCAP Advisor Cash Consideration.”

Responding to questions regarding electing cash vs stock. Choosing cash will deliver a better outcome if some of the other shareholders opt for stock or make no election. However, regardless of what one elects, part of the merger consideration will be received in cash and part in stock.

– With cash portion, you get that part of the merger consideration at full NAV value.

– With stock portion, FCRD NAV gets exchanged into CCAP NAV, but because CCAP is trading at a large discount to its NAV, the $$ consideration received is below FCRD’s NAV.

The same can be seen in the illustrative payout tables in the proxy by comparing 100% cash election table and 50% cash election table. The 100% cash election results in better outcome.

Thanks, DT! FRCD and CCAP should let you write the proxy, but they won’t because you write comprehensible English, ha-ha.

For future reference in case of similar situations, below is my understanding (probably not accurate):

Page 78-80 illustrates 3 scenarios. # of shares of FCRD ~30mil.

One is 100% elect cash (unlikely). Two is 100% elect stock (unlikely, this is the default for those who don’t elect). In both scenarios, 100% will receive the merger consideration of $0.58 + .2065 x CCAP stock at $15.27 today, and the advisor consideration of $1.17. Total = $4.90.

Scenario Three is 50% elect cash (more likely): Those electing stock will receive merger consideration of zero cash + .2356 X CCAP stock, and the advisor consideration of $1.17. Total = $4.77.

Those electing cash will receive less CCAP stock, .1769 x CCAP stock, but the difference of .2356 less .1769 = .0587 x CCAP NAV of $20 instead of stock; plus again the advisor consideration of 1.17. Total = $5.04.

Thus, those who got DT’s advice will receive 14c more, which comes out of the pocket of those who elected stock or did not elect.

Election deadline March 2. (I think “stockholders of record” means as of merger effective time.)

http://archive.fast-edgar.com/20230224/AN22PG2CZZ2R7ZZU229M2ZYOCB7IEZ22Z252/d416315dex991.htm

Merger completed.

https://finance.yahoo.com/news/crescent-capital-bdc-inc-completes-223100289.html

Closing out FCRD case. The merger closed yesterday. The consideration ended up at $1.46/share in cash + 0.20635 shares of CCAP.

The overall return of 6% on this situation (including dividends) is well below the 14% expected in the initial write-up. The difference is mainly due to a large decline in FCRD’s NAV (from $4.85 to $4.4) vs virtually unchanged CCAP’s NAV. NAV volatility was one of the risks, however, as expected, the margin of safety was sufficient.

The return might be slightly better for those that elected the cash option (info has not been disclosed yet).

FCRD merger proceeds have hit the account. As expected cash election turned out slightly better bringing the final return on this case to 7.8% (including dividends).

Cash election resulted in each FCRD share being exchanged into 0.195 CCAP shares + $1.68/share in cash.