Metacrine (MTCR) – Liquidation – 20% Upside

Current Price: $0.54

Target Price: $0.65

Upside: 20%

Expiration Date: Q2’23

Biopharma merger between Metacrine and Equilium was terminated in mid-December due to pushback from an activist shareholder, who argued that liquidation is a preferred option. The situation was covered on SSI and you can refer to the earlier write-up for any further background details. Subsequently, Metacrine announced the full dissolution of the company. The expected liquidating distributions for shareholders are in the $0.49-$0.65/share range vs the current share price of $0.54. I think there is a solid chance of the setup eventually ending up much closer to the upper limit. Shareholders are set to approve the dissolution plan on March 23 and I would expect the initial distributions already in Q2 or Q3 this year. Following the vote, MTCR will be promptly delisted to preserve cash. Two prominent biopharma investors, BML Investment Partners and Kevin Tang, own a combined 21.6% stake – this adds reassurance that the shareholder value will be preserved. The downside risk is limited to 10% if the liquidating distributions land at $0.49/share.

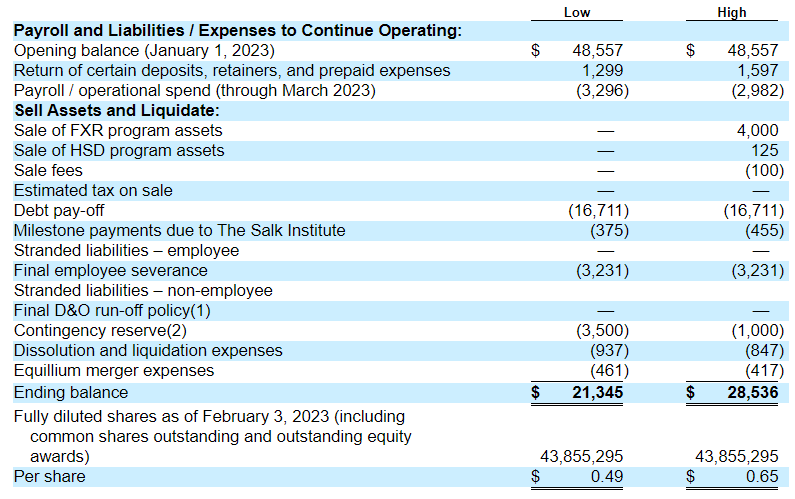

Management’s liquidation value estimates are detailed in the table below (from the proxy).

Note: My previous estimates (as per this comment) of MTCR liquidating distributions were too conservative. I based these on the available info before management released their estimates in the latest definitive proxy. I have mostly overstated the size of the final liquidating expenses. The activists seem to have pressured the company to run a really lean dissolution process. The stock is up 10%+ since the publication of the definitive proxy, but at the same time, the setup has been significantly derisked.

The company sits on $32m of net cash vs $25m in mid-range expected distributions after the deduction of various expenses. A number of outlays have already been pre-agreed, such as CEO severance or debt termination fees, so the accuracy of the estimates should be relatively high. The main difference between low ($0.49/share) and high ($0.65/share) liquidation scenarios are the net proceeds from the 2 remaining asset sales ($0 vs $4m) and the size of the contingency reserve ($3.5m vs $1m). Taken together these account for a $0.15/share difference in distributions.

As per the proxy, the asset sale process seems to be moving pretty fast. In Feb’23 the company signed a binding term sheet to sell the larger asset (FXR program) for proceeds of up to $4m and assumption of certain liabilities. Negotiations for the sale of the other asset ($0.125m) are ongoing with the program licensee. Management expects these sales to close promptly. In early February MTCR approved a new compensation package for the only remaining executive – he is set to receive a bonus of $100k if the FXR asset is sold. Given the above, the $4m net proceeds from the asset sale seem quite certain. That would be an incremental +$0.09/share on top the low-end scenario distributions.

In February 2023, we entered in a binding term sheet to sell the assets related to our FXR program, including any compound we have on hand, to a third party. Consideration for the sale is expected to include up to $4.0 million in cash and the assumptions of certain liabilities. We expect to close this transaction prior to the filing of the Certificate of Dissolution but this remains subject to satisfactory agreement on the terms of the asset purchase agreement.

<…>

We are currently negotiating an asset purchase agreement with Foresite, pursuant to which will we sell the HSD assets and terminate the HSD License Agreement. We expect that the consideration for the purchase will be $125,000. We expect to close this transaction prior to the filing of the Certificate of Dissolution but this remains subject to satisfactory agreement on the terms of the asset purchase agreement.

I do not have much to add regarding the contingency reserve range. However, it is worth mentioning that in the preliminary proxy, which had no other figures for the estimated liquidation proceeds, the contingency reserve was indicated at ‘approximately’ $1m. That’s in line with the high distribution scenario. This kind of hints that management might be too conservative in their $3.5m figure. But even if the contingency reserve ends up at the upper limit of $3.5m there is a chance that part of it will get released and distributed to shareholders at a later stage. However, this might take a year or two.

I like the risk/reward setup here and think that the chances of losing capital on this liquidation are rather slim.

As expected, MTCR sold its FXR asset for $4m, in line with the amount estimated in management’s high liquidation distribution scenario. With FXR proceeds, the low guidance range was now lifted to $0.58/share vs $0.57/share price as of yesterday’s close. Most of the remaining upside to reach the high-end estimate ($0.65/share) will come from the potential release of the contingency reserve.

https://www.bamsec.com/filing/119312523071470?cik=1634379

As expected, on March 23, the shareholders officially approved the plan of dissolution. Concurrently, 8 out of 9 directors resigned from the board. Meanwhile, Michael Hogan and Dave Maggio are the only two remaining company representatives charged with carrying out the liquidation. Michael Hogan would serve as the only remaining board member while Dave Maggio is the only remaining executive.

https://www.bamsec.com/filing/119312523079293?cik=1634379

Any idea when/how much is the distribution? Weird they didn’t communicate this after the approval.

After the FXR asset sale proceeds, the liquidation value should be in the range of $0.58-$0.65/share as guided by the management. The initial distribution will probably be a bit below $0.58/share as the company will keep some cash in reserve for any contingent liabilities, etc. After that, any further upside (up to $0.65/share) will come mostly from the release of the contingency reserve and subsequent distributions.

With liquidations, how often do you see the total distribution amount fall outside the stated range from the proxy (from your experience)?

I’m just surprised here to see MTCR trading slightly below the low-end distribution amount, after adjusting upward for the announced $4mm FXR sale. Seems like you’re getting a bunch of upside for free and will get back vast majority of your investment very shortly in the eventual first distribution.

I think it’s trading low-ish because it’s been almost two months since the last update and investors are getting a bit nervous. This liquidation should be relatively straightforward (in theory, at least) so the longer it takes the higher the chance that the company hit a road bump somewhere down the road.

I have a decent position in this and I don’t like the radio silence either. That said, I don’t see any lawsuit on pacer or anything else that indicates a problem.

The filing below is from Mid-March. It takes a little bit of time to get a program transferred, releasing the final $2m. I’ve been expecting everything (final payments and distribution) to be done in the June context.

On March 10, 2023, Organovo, Inc. (“Organovo”), a wholly-owned subsidiary of Organovo Holdings, Inc., entered into and closed an asset purchase agreement (the “Purchase Agreement”) with Metacrine, Inc. (“Metacrine”). Pursuant to the Purchase Agreement, Organovo acquired Metacrine’s FXR program from Metacrine in consideration of cash payments totaling $4 million, of which $2 million was paid at closing and the remaining $2 million will be due shortly after the completion of the transfer of the FXR program to Organovo. The parties to the Purchase Agreement have agreed to customary representations, warranties and closing conditions for transactions of this type.

Thanks for the color! On the other hand, I think the obscurity is probably one of the main reasons such opportunity exists.

Could this be due to a timing issue with relatively high t-bill/arb rates extending to end of Q3?

It’s a combination of things. Uncertainty and silence from management (as per writser’s comment above), lack of clarity why MTCR continues to trade when all approvals for the liquidations have already been received, and then high rates/opportunity costs add a bit to the spread as well.

Would they release a record date before a distribution?

The stock is deregistered from SEC, so I am unsure what the disclosure requirements are. Another similar case I can recall where the company continued trading through the liquidation is HRST, covered here: http://ssi.wpdeveloper.lt/2021/06/harvest-oil-gas-hrst-liquidation-39-upside/

HRST company seems to be announcing liquidating distributions in advance, but I am not sure if this is reg requirement or just a voluntary disclosure. The latest dividend distributions have been announced only on the company’s website, and not on otctmarket.com.

https://www.hvstog.com/post/december-28-2022

https://www.otcmarkets.com/stock/HRST/news

Thanks for the reply

When would you expect the contingency reserve to be released? What is typical time period for release in a liquidation?

I am really not able to advise on that. I believe first we need to wait for the initial distribution (which already takes surprisingly long) and only then we can start talking about the expected timing on the release of contingency reserve, if any. Generally, the full wind-down can take anywhere from a few months to a couple of years. The initial distribution should fully cover/release the invested capital and ten anything incremental from the contingency reserve release would be just pure upside, so I not mind waiting even a few years for that.

Trading in MTCR shares has been suspended and the company announced ‘Final Liquidation Distribution’ of $0.58/share with the payment date set for June 21.

Distribution info can be seen in the June 16 FINRA list https://otce.finra.org/otce/DailyList/archives (courtesy of Writser).

I was hoping for some additional upside from the partial release of the $3.5m contingency reserve, but apparently, that did not happen.

is there any idea or explanation what happened to contingency reserve?

Have not seen any announcement regarding this liquidating distribution. So no explanation for contingency reserves either. But it is quite common for this kind of contingency reserves to get fully drawn and this was also one of the scenarios expected by management.

Won’t the contingency reserve unlock 3 years from now?? Has the cash hit you account yet? Has not with mine

The proxy noted that “Any unexpended amounts remaining in a Contingency Reserve shall be distributed to the Company’s stockholders no later than the Final Distribution Date.” As FINRA indicates the upcoming distribution to be a ‘Final Liquidation Distribution’, I assume the contingency reserved has been fully used or anything that remained in it is getting distributed concurrently.

Hey I’m.with Schwab the $$ has not hit my account. Does anyone else have this issue? Last trade was 5/31 so I am definitely of record

I wouldn’t worry yet. My experience is it sometimes takes up to a week to get paid (though I’m at InteractiveBrokers).

I was with Ameritrade and they were usually next day. They told me to give it a week and I will. Not worried yet just interesting how it seems to work for different brokerages

Money hit today. It’s all good

Any non US residents in this positon? I just got the proceeds and it seems that I got wacked with the 30% withholding tax (I’m a UAE resident). I was under the impression that I would get taxed on the capital gain alone (capital return). Perhaps I am being hasty here but this is a headache.

….. That sucks! They just have treated it as a dividend and not a capital return?

Looks like it, unfortunately.

IB has refunded me a number of times withholding taxes on distributions that were incorrectly classed as dividends. So as suggested by G98, reach out to your broker.

DT – I understand that considering the international membership base and multiple brokers involved, it might be a challenging request, but it would greatly assist us if you could inform us about any unforeseen tax withholdings made by your broker or IB.

Of course.

For anyone having issues with withholding tax on MTCR distribution, you need to reach out to your broker and ask to revert these tax. The OCC document linked below clearly states that $0.58/share is a liquidating distribution and not a dividend.

https://infomemo.theocc.com/infomemos?number=52699

Maybe message your broker. And reference the 8k or whatever document details the tax treatment of the distribution.

(I didn’t realise UAE had no tax treaty and has dividends hit with 30% withholding (after it’s been taxed at the corporate level). )

(Also you probably know, but there is an egregious Estate Tax trap for non US persons who own securities listed on a US exchange…. also not relevant here but something to be aware of in general).

Just found this document on the OCC website:

https://infomemo.theocc.com/infomemos?number=52699

Surprisingly (at least for me), it reads:

This is in contrast to the word ‘Final Liquidating Distribution’ on FINRA document. So it seems that the distribution was not final and there might be a few pennies more down the road.

I think that is how these things always work. There is a contingency reserve to cover unforeseen or uncertain liabilities that arise during the next three years (at least in Delaware that period is three years) and some money in the bank to pay for dissolution and liquidation expenses. After three years all unused funds are distributed to stockholders. See page A-4 of the proxy:

“Any unexpended amounts remaining in a Contingency Reserve shall be distributed to the Company’s stockholders no later than the Final Distribution Date.”

Note that during these three years stockholders could be held liable for other amounts due to creditors. In other words, theoretically the whole distribution could be clawed back! See page 26 of the proxy:

“Under the DGCL, if the amount of the contingency reserve and other measures calculated to provide for the satisfaction of liabilities and claims are insufficient to satisfy the aggregate amount ultimately found payable in respect of our liabilities and claims against us, each stockholder could be held liable for amounts due to creditors up to the amounts distributed to such stockholder under the Plan of Dissolution.”

I have never seen that happening though.

In any case, the proxy indicated a contingency reserve of $1m – $3.5m. Unless something stupid happens I would expect shareholders to get back a decent chunk of that in three years, i.e. potentially up to $0.08 / share.

The big question is how large the contingency reserve ended up being. Things took a little longer than I expected, does that mean there were some cost overruns and is there only a $1m reserve or did everything go according to plan but there is a $3.5m reserve? The latter would obviously be much better because we could still get that money back.

I’ve reached out to the company about that but I haven’t heard back yet. Might pop up in some court filings but Delaware court filings are not available for free AFAIK.

Withheld Taxes problem has been fixed by IB. Thank you all!!!

HI, I am quiet new to this tread and have some shares of MTCR. Just wanted to know what are the next steps.

At this point, there is nothing you can do but wait for any potential distribution from the contingency reserve. For more details, take a look at @writser’s comment above outlining the typical post-liquidation steps and timeline.