Vertical Capital Income Fund (VCIF) – Manager/Strategy Change – Upside 20%+

Current Price: $9.6

Total Price: TBD

Upside: 20%+

Expiration Date: end of 2023

Changed Ticker: At the end of Ju’,23, the fund has been renamed Carlyle Credit Income Fund and is now trading under the new CCIF ticker.

I am borrowing this idea from Clark Street Value, who posted about this setup a couple of weeks ago. I will start with a quick summary and then delve into more detail on why I believe this setup offers a far higher upside (20%+) than might seem initially. Investors are getting this optionality for free.

Vertical Capital Income Fund, a closed-end fund, plans to appoint Carlyle Group, a private equity giant, as its new investment manager. The fund intends to shift its portfolio from whole residential mortgages to equity and debt tranches of Collateralized Loan Obligations (CLOs). Carlyle is one of the largest managers of CLOs and wants this transaction badly. Carlyle is set to invest $60m and reach 40% ownership of the fund. To incentivize VCIF shareholders to support this change Carlyle is rewarding them handsomely. Current shareholders are set to receive:

- $0.96/share in dividends from Carlyle ($10m total),

- $2.41/share from Carlyle’s tender offer at NAV ($25m total). Carlyle will also invest an additional $25m into buying VCIF’s new and existing shares.

- $6.67/share in value of the remaining 76% of their pre-tender VCIF share assuming these revert back to 15% discount to NAV (NAV at $10.26/share as of Dec’22)

This sums up to $10.04/share or a 4% upside from the current prices. This is likely the minimum return that investors can expect. The eventual gain could be significantly higher. The final result will depend on the NAV discount at which VCIF shares will trade after the transaction is completed. The current discount is 6%, but VCIF has historically traded at an average discount of 12%. Just before the transaction announcement, the discount was at 15%. Thus, the 15% used in the calculations above is likely the most pessimistic scenario. There are reasons to believe that VCIF will trade at a lower discount or even at a premium to NAV, with a potential upside in the teens or twenties. The downside is well protected with a guaranteed return of at least 4% in 5 months. I see three key factors driving this and will elaborate on each in detail.

Reason 1: The other closed-end funds investing in CLOs trade at a premium to NAV

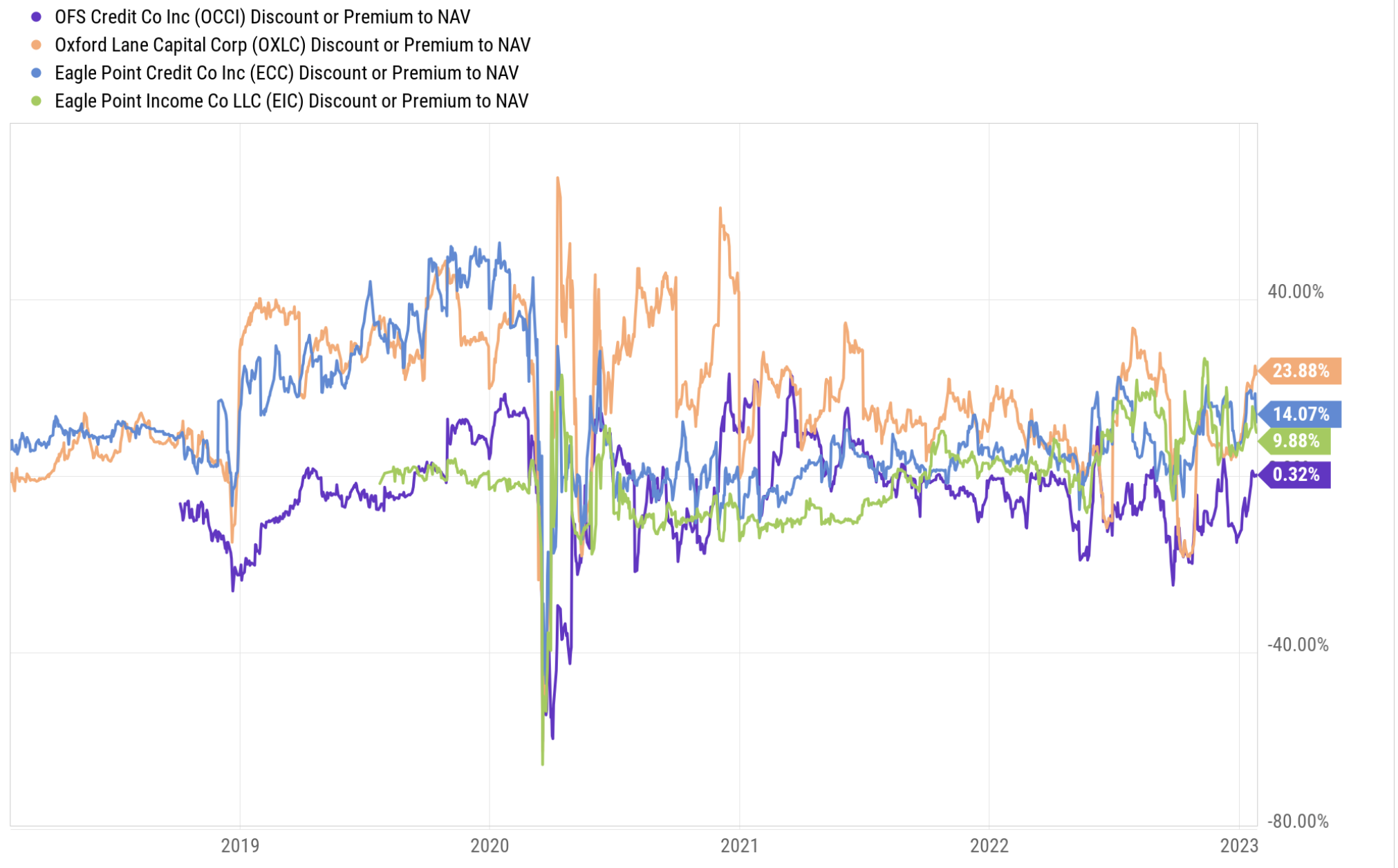

Carlyle plans to reallocate VCIF’s portfolio into Collateralized Loan Obligations (CLOs) – for a primer on CLOs, please see here or in a longer form here. The underlying assets of the CLOs, i.e. the actual loans that comprise the particular CLO pool, often have credit ratings of BB and lower, with interest rates ranging from 5-10%. However, when securitized, the riskiest CLO tranches often have the yields in high-teens or more. CLO-focused closed-end funds are income vehicles that invest in the riskiest tranches of a high number of CLOs, e.g. the largest closed-end fund OXLC has 200+ holdings and ten times as many unique underlying obligors. As shown in the chart, these closed-end funds have historically traded at premiums to NAV and currently do so as well, although there may be a timing lag as the NAVs are as of December 2022 and may have increased in the last month (high yield bond ETFs are up during the month).

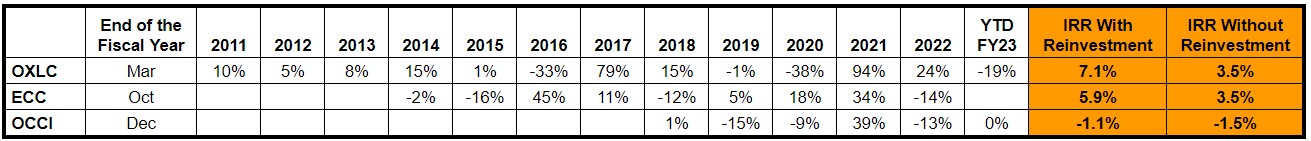

This premium to NAV appears to be primarily driven by retail investors who are attracted to the high perceived dividend yield (15% or higher annually) and bid up the market prices of these closed-end funds. However, many CEF retail investors may not realize that a significant portion of the distribution is actually a return of capital and the actual yield of these vehicles is much lower than the 15%+ headline figure. The table below lists the returns for three CLO closed-end funds, calculated as changes in NAV plus distributions relative to the initial NAV for the period. The last two columns show the realized IRR with reinvestment of distributions back into the CEF and without. As the data shows, the actual IRR is a fraction of the 15.5% dividend yield for OXLC, 15.9% for ECC, and 23% for OCCI.

The point I am trying to make is that the investors of these CEFs do not seem to be concerned with the performance of the underlying CLO portfolios and are predominantly interested in the monthly distribution stream. VCIF also pays out a monthly dividend, but at a lower yield of 9%, which most probably does not look juicy enough in the eyes of retail investors. Once Carlyle shifts VCIF’s portfolio into CLOs and announces an increase in regular distributions, the stock should re-rate quickly. As I will discuss in the next section, Carlyle is strongly motivated to bring the VCIF market price to or above NAV by increasing the distribution.

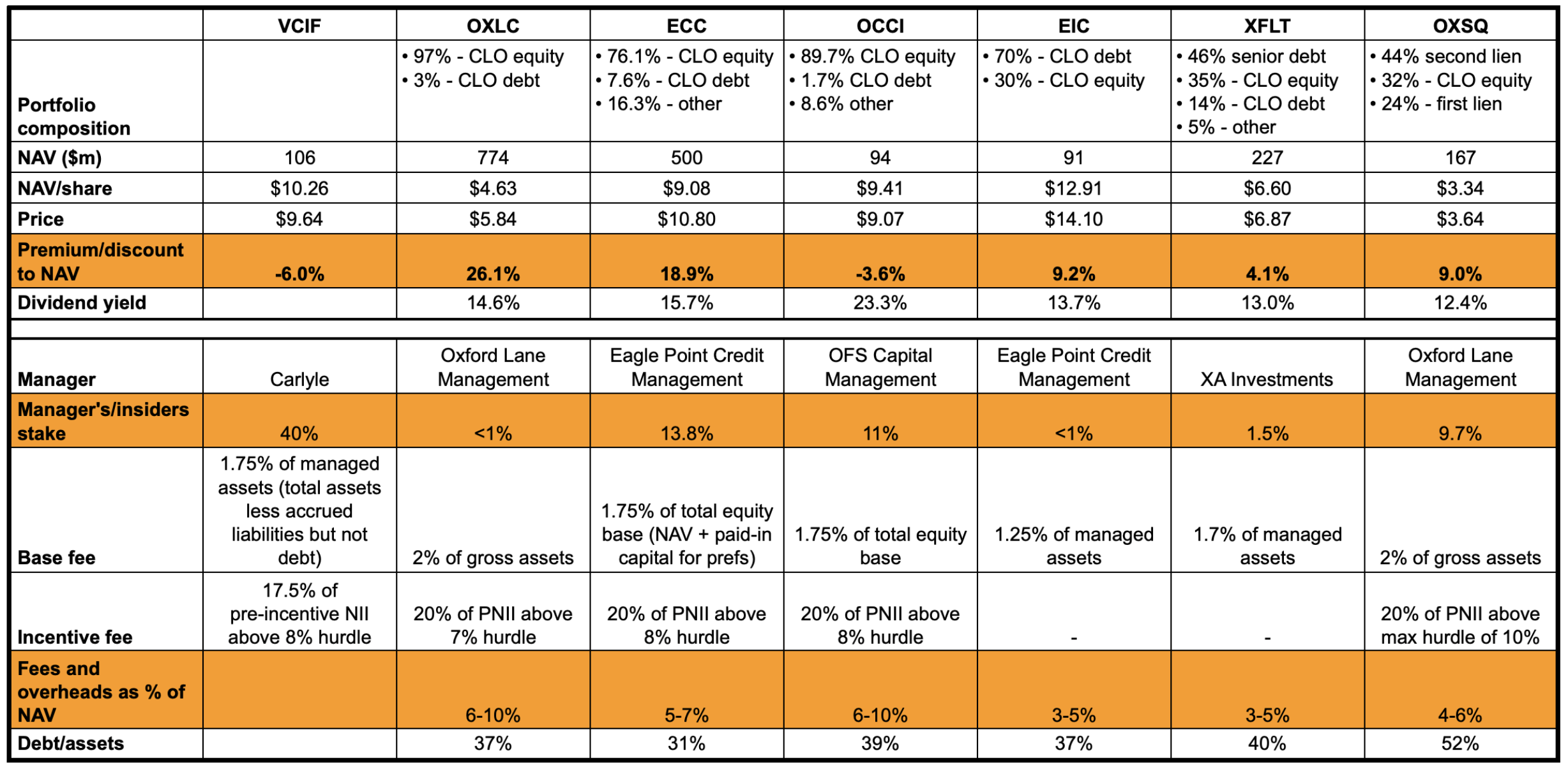

Reason 2: VCIF is a better CEF vs peers and deserves to trade at a premium

The table below compares VCIF to other closed-end funds that invest in risky collateralized loan obligation tranches. All of these CEFs are trading at or above their net asset value. The fee structure for VCIF is similar to that of its peers, but it has the advantage of having Carlyle as its manager and a 40% owner. Total expenses for these CEFs are usually far higher than the base management fees – additional expenses are mostly driven by incentive fees and pass-through administrative overheads. It is hard to tell, how the eventual total VCIF expenses will look after Carlyle takes over, however, with the 40% ownership, the incentives are much better aligned than for peers. On top of that, Carlyle is the largest CLO manager in the world, with unparalleled access to the widest range of CLOs that it could put in VCIFs portfolio. The supply of attractive investments will not be an issue. It is more of a question of Carlyle’s willingness to put them into VCIF rather than keeping them for itself.

Although retail investors might not care for these VCIF’s merits over its peers, at least there does not seem to be any structural reasons for VCIF to trade at a discount to peers post-conversion to CLO investments.

Reason 3: Carlyle is incentivized to have VCIF trading at or above NAV

Carlyle is putting $60m of its own funds into VCIF in exchange manager’s contract as well as 40% ownership in the fund. With the total post-transaction Assets/NAV of $130m, the earned fee stream will likely be under $10m annually (counting in base/incentive fees + overheads) most of which will go towards covering expenses. The net income from the manager’s contract for Carlyle is likely to be a few million dollars. The 40% ownership part will not bring fortunes either, as returns for shareholders of OXLC and ECC were only 6-7% annually. This is pocket change for Carlyle and I doubt they would have started this deal and poured $60m into it only for the sake of these ‘tiny’ fees. Carlyle’s real plan is likely to grow VCIF’s portfolio to the size of OXLC, which has 10 times the assets. This would drive the earned fees proportionally and eventually make it a sizeable business for Carlyle. As already noted above, the supply hose of the new CLO investments is wide-open as Carlyle is the largest CLO manager globally. All Carlyle will need to achieve this growth is incremental capital.

Part of the new capital will be in debt or preferred shares, but similar vehicles in the market only have debt/preferreds accounting for 30-40% of total assets. Hence, the majority of growth must come from new equity. Closed end funds like OXLC and ECC are utilizing ATM programs to continuously issue new shares – e.g. OXLC’s share count has increased 7-fold over the past 5 years. To issue new shares the funds need to trade above BV, as issuing new shares below NAV is dilutive, pushes investor sentiment lower, and can lead to a financing death spiral. Thus, VCIF must trade above NAV for Carlyle to be able to grow the vehicle and start generating decent returns from its investment.

To trade at or above NAV, VCIF needs to have distributions in the 15%-20% range as this seems to be the main reason for retail investors to jump on the stock and bid up the price. This can be achieved either by artificially inflating the distributions with the return of capital or by adding high-performing CLO tranches to VCIF’s portfolio. The former option would require even higher new share issuance to compensate for the returned capital and might not be a viable path while the fund is still small. Hence, at least initially Carlyle will have to load VCIF with the best-of-the-breed CLO investments to produce high-quality portfolio yields and attract new investors to the fund. I am assuming that, as manager of a high number of CLOs, Carlyle can select the best equity tranches to create a high-yielding portfolio.

Additionally, if the internal portfolio yield is high, then the returns on the 40% ownership stake would also be much more lucrative than the 6-7% delivered by OXLS and ECC. Thus a win-win for Carlyle. Incentives with the minority shareholders seem to be very well aligned here.

And a shorter version of my reasoning. Carlyle is putting $60m into VCIF >> Returns from manager’s fees and ownership stake would be tiny >> VCIF must increase in size to justify this investment >> Growth will require continuous issuance of new equity >> Equity can be issued only if VCIF trades at or above NAV >> Distribution yield must be 15%+ to achieve this >> To maintain high distributions Carlyle will need to load VCIFs portfolio with best of-the-breed CLO investments >> High returns on CLO portfolio >> VCIF trades above NAV and is able to grow >> Management and incentive fees grow proportionally >> The returns on Carlyle’s 40% investment also deliver superior returns.

With all of this taken together, I think there is a decent chance we will see VCIF trading at or above NAV once the portfolio/manager transition is complete. That might happen already in mid-2023 but might also take till the end of the year.

Some additional details, thoughts and risks

- The transaction is expected to close in H1’23 and is subject to shareholder approval. Four major shareholders with a combined stake of 36% have signed voting support agreements. Preliminary proxy has already been filed.

- The risk of getting burned by VCIF NAV fluctuations till the transaction closes is limited. VCIF currently invests in residential mortgage loans. The portfolio value is likely to remain stable in the absence of FED rate hikes – actually, January’s NAV is likely to be higher than the Dec one as mortgages are up during the month. Also one of the conditions for this manager/strategy change is that the current investment advisor liquidates 95% of VCIF’s gross assets before mid’23, which should reduce further NAV volatility.

- Costs and expense leakage from dissolving the current mortgage portfolio should be limited. The present manager has agreed to limit fund expenses to 2.5% of NAV, which would translate to around $0.67m/quarter (any fees waived or absorbed would be repaid at a later stage). This should get partially/fully covered by VCIF’s interest income of $2.2m/quarter – the income part will gradually get smaller with asset liquidations. The new manager, Carlyle, has agreed to waive a part of management/incentive fees for 6 months following the effectiveness of the new advisory agreement as the portfolio transitions to the new strategy and will also limit certain other operating expenses until at least 75% of the fund’s assets are employed in CLOs.

- Lower tranches of CLOs and especially CLO equity tranches are high-risk investments, essentially it is a levered bet on a large pool of junk bonds (rated BB and lower). Most of these loans have been issued over the recent years to pursue leveraged buyouts and various M&A deals. Cheap money was freely available to all and the default rates of the underlying obligors have been tiny/non-existent. It’s not clear how these securities will perform in a less economically favorable and higher interest-rate environment. Some are suggesting that CLO market feels bubbly and that the default rates are expected to increase going forward. The CLO fund diversification offers some protection from systemic risk – e.g. ECC has about 1.8k underlying obligors with the largest one just at 0.8% of the total investment portfolio. However, even a tiny increase in the default rates would hit the riskiest CLO tranches first and could potentially detonate NAVs and reverse investor sentiment for such CLO funds. Given the short expected timeline of my thesis (end of 2023) and an even shorter period with the actual CLO investments on VCIF’s portfolio, I do not think this risk is material.

- Carlyle’s position as a virtually controlling shareholder and investment manager of VCIF could lead to concerns regarding conflicts of interest. Carlyle will already be double or even triple dipping on some/all of the VCIF’s CLO investments – collecting fees as CLO manager, then collecting fees as a manager of the closed-end-fund, and in some cases, Carlyle might even be the underlying borrower. These double fees apply to all other CLO CEFs as well (just the fees are collected by different parties), so I do not think it should drive any additional discount. My bigger concern is that Carlyle will utilize VCIF as a vehicle to dump its least attractive CLO investments. This risk should be at least somewhat mitigated by the 40% ownership stake and incentives to grow the fund.

- I haven’t been able to find anything on the current investment manager’s termination fee. The previous agreement from 2019 only mentions the requirements of shareholder approval and 60 days notice. The same agreement was extended in Aug’22 for two more years. It’s hard to believe the current manager would simply walk away without any compensation. Any break-fee would reduce VCIF’s NAV.

- Nothing has been said about regular distributions during/after the manager’s change phase and until the portfolio transition is completed. I assume this means regular distributions will continue.

Is the one-time payment from Carlyle ($10mm / $0.96 per share) taxable?

Have not found anything in the proxy with regard to the tax treatment of this one-time special payment. I am assuming this will be treated as capital gains and taxed accordingly.

Interactive Brokers (IB) doesn’t allow the trading of VCIF for retail investors. When asked about this, IB indicated VCIF not having a KIID document as the reason, as that is a requirement for retail investors. They asked if I had access to the KIID document and if I could send it to IB for them to upload it in the platform. Could you confirm whether the KIID exist for VCIF? In case it doesn’t, could you suggest alternative brokers allowing to trade VCIF?

That applies only for the EU/UK residents.

Thank you for your reply. That is my case, hence my question above. I have searched VCIF in several online brokers and banks in the EU space, without success. Do you know of any brokers allowing EU residents to trade VCIF?

No you need to be classified as a MIFID2 Professional investor otherwise they won’t let you trade this vehicle (nor most US ETF). This is broker agnostic.

If you have at least EUR 500k in liquid assets you can try to get classified as a Professional (cash counts, so does margin positions)

Thank you alphahammer.

Looks like my broker categorized the distribution as a taxable event. Are there any supporting documents I can submit to recategorize this?

Thank you for the write-up.

QUESTION: In the table above – how are you defining/calculating fees and overhead as % NAV? Is that annual or NPV of all future fees?

COMMENT: I’m a bit skeptical that the VCIF will trade at par/premium to NAV. ECC and OXLC do seem to have traded at premium during their lifespan, but the lifespans are short (I only see data back to 2019). Closed-end funds generally trade at a discount to NAV, due to the fee load (hence question above). According to this BlackRock paper, a 9% discount is the recent average market-wide https://www.blackrock.com/us/individual/literature/investor-education/cef-market-update.pdf. At 9% discount, the trade would still yield a positive return, but not as exciting for the risks (misaligned incentives, recession etc.).

For expenses, I have simply summed up all expenses except for the interest expense. These vary year by year, therefore I have indicated the approximate range, mainly to show that a large part (close to half) of income from the underlying investments is eaten by various manager’s and admin fees.

As for CEF discounts – I do not think the average CEF discounts are applicable in this case. CEFs investing in CLOs have consistently traded above NAV and in the write-up I have explained why that is the case and why I expect the same to happen for VCIF (but we will see, might be you will be proven correct eventually).

Thanks for the idea.

It seems their website isn’t working, however several websites indicate 4% front-load fee as well, given that you expect roughly a year for this idea to work out, is it correct to assume overall we would pay about 7% fees ?

Not sure I understand your point – you can acquire VCIF stock directly in the market via your broker. Not sure what you mean by 7% fees.

VCIF website is working: https://www.vcif.us/

Sorry about the confusion.

I was just trying to get a clear expense(fee) ratio on the fund. I saw in some places about 4% front-load fee on this specific fund and I thought perhaps Carlyle taking over would cost that on the NAV. Otherwise, in a CEF structure that does not make sense, I guess (?). In addition, just assumed 3% annualized fees for the fund, thus thought 7% what it would cost in this trade.

Neither the press release or the preliminary proxy, state when the $0.96 distribution or tender offers will happen, will or will not be concurrent, etc.

It would seem VCIF market price would rise, perhaps just a guess ~ $0.50, around the date of the distribution, to capture the $0.96. If the distribution and tender offer are close together / concurrent – say, the ex-dividend date and the tender offer expiration date are the same day – that might also prevent shareholders from capturing both the distribution, and the tender offer?

Is Carlyle likely to own a large minority ~ 40% of VCIF long-term? Just curious what is the logic of Carlyle selling loans it owns, to a fund it controls? Is it transferring ownership from 100% to 40%, or something else?

The distribution and tender will happen only after Carlyle is appointed as a new manager. My guess is somewhere around mid-2023. The details around the exact dates will be provided at a later stage.

As for reasons benefits of this transaction for Carlyle, see the third section of the write-up. Carlyle would mostly benefit from the management fees on VCIF assets if it manages to grow the vehicle. I expect Carlyle’s 40% ownership to decline over time, but mostly due to the raise of new equity to grow VCIF rather than Carlyle selling down its stake. Also, I believe Carlyle does not usually own all of the CLOs it manages – most of these are securitized and sold to other investors. By transferring particular CLOs to VCIF, Carlyle can earn double fees on the same assets (as a manager of CLO and as a manager of VCIF) and also have 40% exposure to any after fees residual income.

VCIF NAV as of March end stands at $10.12 (vs $10.26 at the time of the write-up)

Two monthly distributions ($0.068/share each) were paid in February and March. These were partly a return of capital, and partly an investment income. Another similarly sized distribution was announced for April.

VCIF special shareholder meeting is set for June 15. Investors are asked to approve Carlyle as the new investment manager and related cash distributions. The transaction will include a special $0.96/share dividend from Carlyle as well as a $25m tender offer at NAV, which will commence promptly after the change of the investment manager is completed.

As of April 30, the updated NAV stands at $10.05/share. VCIF currently trades at a 2.5% discount to NAV. The remaining upside here will depend on what discount to NAV VCIF will trade after the completion of the distribution/tender. From the current trading levels ($9.8/share) investors will breakeven if post-tender VCIF share start trading at a 15% discount to NAV. I think this is overly conservative and at current prices, the downside is very well protected.

Also, VCIF has already paid out $0.27/share in dividends since the write-up.

Proxy: https://www.bamsec.com/filing/158064223002832?cik=1517767

Updated NAV: https://finance.yahoo.com/news/vertical-capital-income-fund-vcif-230700311.html

Yesterday, VCIF shareholders voted to approve Carlyle as the new investment manager. All of the proposals were easily passed. The transaction is expected to close shortly after the vote. The next catalysts will be a special one-time payment of $0.96/share from Carlyle as well as the tender offer. This is what was said about the timing of these events in the proxy:

Taking into account the $0.96/share pending payment from Carlyle, VCIF trades at a 10% discount to NAV at the end of May ($10.02/share).

https://www.bamsec.com/filing/138713123007595?cik=1517767

VCIF halted – news pending for special payment/tender? Or could this be something bigger?

VCIF sold a significant part of the portfolio and reported a new NAV of $8.27 (down from $9.96)

I really don’t get this. VCIF had a portfolio of residential mortgages which is supposed to be a pretty liquid market and easily calculatable values and the fund was recalculating its NAV on a monthly basis. The PR explains the difference from the previous NAV “due to the significant sale needed to facilitate the Transaction”. It’s a staggering 17% discount to the fair value. The external manager of the fund had almost half a year to find buyers for the portfolio. This does not make any sense. Either the NAV was significantly overstated previously, or this asset sale is just some backroom dealing and someone got a real bargain.

I’m traveling hence only limited visibility on mobile but there is another news headline:

… CGCIM will make $40 Million Equity Investment in Fund in multiple transactions.

@dt I think in your initial thesis assumption was $60M?

It’s $50m versus the initial $60m. The amount of the newly issued shares that Carlyle will buy was reduced from ‘at least $25m’ to ‘at least $15m’ with the definitive proxy published in May.

https://www.bamsec.com/filing/158064223002859?cik=1517767

Is the 96 cent payment from Carlye a payment from Carlye’s pocket or a distribution that reduces the fund NAV by 96 cents?

It’s payment from Carlyle’s pocket.

Buy now at 8.50, and get nav of 8.27 + .96 = 9.23?

No, I do not think it is going to work out this way.

1. Carlyle will pay out 0.96/share dividend, and the stock will trade at a discount to NAV ex-dividend.

2. Then Carlyle will launch tender for $25m worth of shares at NAV.

3. Any shares not accepted in the tender might eventually trade at an even large discount to NAV.

All three of the CLO closed end funds above are currently trading at premiums to NAV, so would it be a likely assumption that the same will occur for VCIF?

This possibility was part of the initial pitch. However, it might take some time before the market reprises the situation. Carlyle will initially need to invest cash on VCIF balance sheet and then the price relative to NAV will depend on the returns generated for shareholders and dividend payout. It is in Carlyle’s interest to bring VCIF share price above NAV, as then it can expand the vehicle by issuing new shares.

96c ex-dividend today per filing below, but no press release. Close yesterday at $8.44-.96=7.48 adjusted price today.

Premarket trading today around $8 or up 52c, 10k+shares. Opened at 7.93, 10k+ shares.

Now at 10am, price stabilized at a bid of 7.50, which is back at same price as yesterday. Discount to NAV of 8.27 of about 9%, as DT predicted.

Based on past dividends of 80c/year, yield is >10%. Attractive yield?

http://archive.fast-edgar.com/20230712/AR2VDQ2DZZ2RUZZK22ZW2ZYM6HNKZZ22Z25G/

You cannot base expected yield on past dividends. Past dividends were generated by the recently sold mortgage portfolio, so these are no longer relevant. Carlyle will probably initiate new regular dividend once the cash on the balance sheet is fully invested into the new CLO strategies and starts generating returns. Till then this stock will trade just as a discount/premium to cash.

Sooo is this situation a close then?

Not yet. I intend to participate in the tender (which will be done at a premium to today’s prices) and wait for the outcome of it. The tender will be launched today.

Also, Carlyle just announced today it is restarting monthly VCIF distributions at $0.0551/share. While currently, that is obviously just a return of capital, I think it shows Carlyle’s confidence in earning that much from the future CLO’s investments.

Tender, for $25m of VCIF launched and will expire on the 14th of August.

The tender price will be based on NAV at the time of tender expiration. On July 10 it was $8.27/share and is unlikely to change materially keeping in mind fund balance sheet is mostly in cash.

Concurrently, VCIF has also filed a shelf registration for $500m. If Carlyle intends to raise these funds through equity issuance, it will need to bring VCIF share price to or above NAV.

The ticker will change to CCIF on or about July 27.

https://www.bamsec.com/filing/119312523188435/2?cik=1517767

The fund has been renamed Carlyle Credit Income Fund and is now trading under the new CCIF ticker.

Any update on this one? Still atractive for entry?

Several updates on CCIF (previous VCIF):

– The tender has been extended by two weeks from August 14 to August 28. As of August 11, 4.8m shares were tendered compared to around 3m shares the company has intended to buy at NAV. The offer is already significantly oversubscribed, so it’s strange that they’ve decided to extend the expiration.

– July 31 NAV is estimated between $8.16-$8.26/share. Another slight reduction from the previous $8.27/share from a month ago, after a partial portfolio sale.

– A big positive is that CCIF has already deployed 77% of cash proceeds from the portfolio sale announced on July 11 into CLOs with an average yield of 18.7%. (vs current dividend yield of 8%, so there seems to be sufficient room for dividend growth, if/when the fund is scaled up).

– The company has also announced a monthly dividend of $0.0551/share to shareholders of record as of August 21 to be payable on August 31.

Whether this is attractive before the tender depends on where the stock will trade after the tender expiration (the market says it will drift lower, but other more levered CLO vehicles are trading above NAV). I am still holding and intend to participate in the tender.

Tender update – https://www.bamsec.com/filing/119312523212341?cik=1517767

NAV and dividend update – https://www.carlylecreditincomefund.com/2023-08-10-Carlyle-Credit-Income-Fund-CCIF-Declares-August-2023-Dividend-and-Announces-July-31,-2023-Net-Asset-Value

dt, is it CCIF fault to extend tender offer? from bamsec doc it says: “In response to certain comments raised by the Securities and Exchange Commission staff”. Was SEC really a stone on the road or just CCIF wants to extend offer to buy for lower NAV price tendered shares?

You’re correct. The tender extension seems to have occurred due to SEC’s request to amend the tender and specify a fixed number of shares to be acquired and a fixed tender price (previously it was just ‘we’ll buy $25m of shares at NAV’).

CCIF has now updated the terms – the fixed tender price has been set at $8.30/share, which was the company’s NAV on August 14. The company will buy up to 3,012,049 of shares.

Accordingly, there should be no further extensions and the tender will expire on August 28. CCIF share price closed at $7.97/share yesterday.

https://www.bamsec.com/filing/119312523213446?cik=1517767

I pulled my tender, any thoughts?

CCIF (previously VCIF) released preliminary tender results. As expected, the offer ended up oversubscribed with 7.5m shares tendered and 3m accepted at $8.3/share. Around 75% of all CCIF’s shares outstanding participated in this tender. Shares are now trading at a 2% discount to NAV.

https://www.bamsec.com/filing/119312523222932?cik=1517767

Looks like 40% proration

CCIF up 1% today and 2% after hours on dividend news –

Declaration of a monthly dividend for September, October, and November 2023 equating to a 14.0% annualized dividend, higher than the 12.0% target dividend yield previously disclosed to investors.

CCIF is declaring a monthly dividend on shares of the Fund’s common stock of $0.0994 per share for September, October, and November 2023. The dividends are payable on September 29, 2023, October 31, 2023, and November 30, 2023, respectively, to shareholders of record as of September 22, 2023, October 19, 2023, and November 17, 2023, respectively. The monthly dividend represents an annualized yield of 14.0% based on $8.52 net asset value as of August 31, 2023.

Net asset value has increased from $8.27 at closing of the transaction to $8.52 as of August 31, 2023. The increase is primarily driven by an appreciation of value of the CLOs held by the Fund and the exit of one of the two remaining legacy real estate positions at a price substantially higher than the Fund’s mark.

Full story here:

https://www.prnewswire.com/news-releases/carlyle-credit-income-fund-ccif-completes-initial-transition-plan-declares-monthly-dividends-and-announces-august-31-2023-net-asset-value-301925411.html

I’m closing CCIF/VCIF idea with a total return of +1% in 7.5 months, including the tender and dividends ($1.41/share in total).

This trade failed even though the stock now trading at only 3% discount to NAV vs the conservative 15% post-transaction-discount I have modelled in the write-up. This is mostly due to the unexpected value leak during the liquidation of the legacy VCIF portfolio in July – the legacy assets were sold at a surprisingly large discount to book value. The special situation angle for this case has now played out with Carlyle announcing a full portfolio transition into CLOs and increased dividends.

Further upside in CCIF could come if the vehicle starts trading at a premium to NAV. The gap to peer trading levels is still substantial, with OXLC at a 15% premium to NAV, ECC at 8.5%, and EIC at 6%. The new manager (Carlyle) is incentivized to make CCIF trade above NAV in order to issue new equity and scale up the vehicle. The recently announced dividends at a higher yield than communicated previously is a good sign that the new manager is serious about closing this gap.