Quick Pitch: Holly Energy Partners (HEP)

MLP Buyout – Upside TBD

TWO NEW MLP BUYOUTS

MLP buyouts with subsequently raised offers have been a successful theme for SSI lately – see SIRE, BKEP, PBFX and SHLX, (only GLOP has been an exception so far). This month, two fresh MLP buyouts by their GPs have been announced – Holly Energy Partners (HEP) and Green Plains Partners (GPP). Both are currently trading above the offer prices with the market expecting improved bids. Any higher offers will depend solely on the pushback by the conflict committees – both GPs own nearly 50% of respective MLPs making shareholder approvals just a formality. While the setups appear similar to the previous cases covered on SSI, I think that both of these are less attractive and offer only limited upside from the current trading levels. I am sharing a bit more detailed research on each of the names below.

Out of the two, HEP’s setup looks more promising given the rather visible undervaluation of the company and stronger arguments for the improved offer. However, previous pipeline MLP buyout precedents suggest that the revised offer is unlikely to come anywhere near the full fair value of the company. The potential upside is probably only around 10%. Meanwhile, the GPP’s setup presents little to no support for a higher bid from the valuation perspective.

Merger considerations in both cases are in GPs’ stock rather than cash. This not only adds additional hedging complexity but also suggests lower chances of improved bids or lower chances of potential pushback from shareholders. Out of the 6 all-stock MLP buyout examples from 2015-2018 (NGLS, WPZ, AM, OKS, DM, EEP/SEP) only Enbridge acquisition of its subsidiaries EEP and ESP saw improved bids, however, the increase from the initial bids was fairly limited, at +9% and +10% for EEP and ESP respectively. Most of the more recent MLP buyouts have been done in cash.

Holly Energy Partners (HEP) – MLP Buyout – Upside TBD

Midstream services provider Holly Energy Partners received a non-binding takeover interest from its general partner HF Sinclair (DINO) at an exchange ratio of 0.3714x DINO per each HEP share. The offer is clearly low-balled and was made at a 2% discount to the previous day closing prices. The GP owns 47% of HEP shares. The conflicts committee is currently reviewing the proposal. The market expects the bid to be improved and HEP trades at a 10% premium to the buyout price. In the Q1 call management noted the offer to be ‘under negotiation’:

We’re not going to comment on the specifics of the transaction as we’ve just made the offer and it’s under — obviously, under obviously on the negotiation.

This seems to be a rather standard, highly opportunistic MLP buyout scenario and is very similar to the cases previously covered on SSI. The dynamics have closely followed the usual playbook so far:

- HEP has cut its dividend by almost 50% during Covid despite hardly any change in operating performance. An excuse for that was increased uncertainty (these are the days when WTI price went negative) and intentions to reduce leverage. Interestingly, out of the whole peer group, only HEP and PBFX (another midstream MLP that got acquired by GP, covered by SSI here) reduced their dividends – all of the remaining peers were slowly increasing the distributions instead.

- HEP shares drifted from $23 to under $15 during the Covid sell-off and have remained at depressed levels due to reduced dividends. MLPs are mostly yield vehicles and the market usually values the units solely based on the dividend payout.

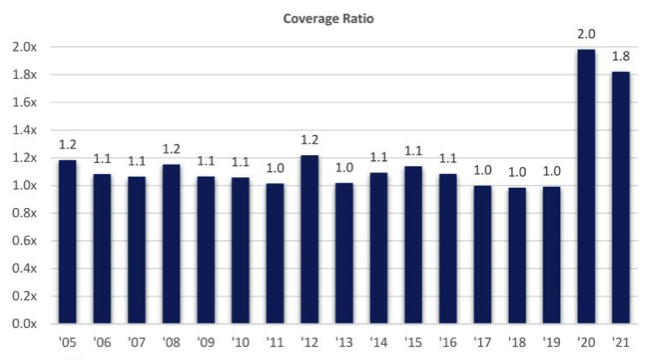

- As a result of unchanged operating performance and the reduction in dividend payouts, the dividend coverage ratio went up way above the historical norms. Dividends are now 2x covered by the distributable cash flow vs a very stable 1-1.1x coverage ratio in the pre-Covid years.

- While keeping the dividend payouts (and in turn HEP share price) intentionally depressed, GP now tries to capitalize on the situation by making a lowball offer to buy out the minority HEP shareholders.

- The situation is currently in the hands of the special committee, which is supposed to be independent, and which is expected to renegotiate the offer higher.

What I believe strengthens the case even further that during the recent Q4’22 call, management nearly outright stated that distributions will increase in the coming quarters, and set a 1.3x dividend coverage target. The same coverage target was also shown in their investor presentation. That was at the beginning of March, only two months before the announcement of the buyout offer.

Douglas Irwin: Just have one on the midstream side. Just wondering if you could just expand a bit on the capital allocation strategy at HEP. And I guess, specifically, around the potential distribution increase, kind of how you’re thinking about balancing the flexibility of being almost 2x covered versus also being able to kind of achieve your leverage target and maintain that going forward?

John Harrison: Sure. Thanks, Doug. This is John Harrison. Our capital allocation strategy really remains the same here. So we’ve kept the distribution flat, while we’ve reduced leverage. And we’re really pleased with the progress that we’ve made there. Happy to report we’re at 3.6x on a pro forma basis. We do have that short-term target of 3.5x leverage, and we expect to hit that in mid-2023. And then longer term, we plan to maintain leverage in that 3.0 to 3.5x, with a coverage ratio of at least 1.3x. So fair to say, incremental cash return is top of mind for us. And as we approach our leverage target over the next couple of quarters, we’ll communicate what we’re going to do in terms of incremental cash return to shareholders.

Funnily enough, during the Q1 earnings and HEP buyout call, management emphasized the attractiveness of ‘unlocking HEP cash’ and shifting it from the hands of HEP unit holders into DINO’s coffers:

It also provides an opportunity to unlock cash that is currently being held at the MLP level for LP distributions and debt reduction, and this cash will become available for DINO’s long-term capital allocation strategy.

Assuming 1.3x distributable cash coverage, HEP could pay out $1.85/units in annual dividends – this compares to today’s dividend of $1.4/unit and $2.66/unit pre-covid. Currently, the company trades at a yield of 8.5%, this is slightly higher than HEP’s historical range of 6%-8% and in line with peer yields of 7.5%-9%. For the yield to remain unchanged after the increase in dividends (quite likely, as MLPs tend to trade relative to their dividends), HEP units would have to rerate 32% higher or close to $22/unit.

However, I do not think the revised offer, if it materializes, would come anywhere close to this value. At best I think investors could expect a 10% upside from the current levels, i.e. the offer would be increased by c. 20%. A few arguments for that.

- HEP is a pipeline/storage asset owner created almost solely just to service its GP – HF Sinclair. The GP generates about 80-90% of revenues for HEP. There would hardly be any other bidders for these assets even if competitive auction was allowed.

- The current HEP setup is very similar to the last year’s PBFX case. PBFX operated rather similar midstream/pipeline assets and was also highly dependent on its GP, which owned a 48% stake and generated 85% of revenues for the partnership. PBFX dividend was cut by 50% during COVID despite the stable financial performance. In Jun’22, when the coverage ratio reached (2.5x vs 1.2x historical levels), the GP announced a non-binding takeover interest without indicating the price. As with HEP, shares traded at a 10% premium relative to the pre-announcement prices. A month later, a definitive agreement was signed at a 16% premium to pre-announcement prices. Importantly the takeover was done far below the theoretical levels PBFX shares could have traded if the dividend payout was returned to historical coverage levels.

- Another similar example is SHLX (covered here) – it was also a midstream MLP that got privatized last year while the dividends were depressed due to temporary issues in its subsidiary. The offer came at a 2% discount to pre-announcement levels and shares started trading 10% above it. The final offer came at a 23% premium vs the initial one and also did not reflect the true earnings power (judging by historical distributions) of the SHLX units.

- HF Sinclair is clearly aware of these buyouts and probably does not see any reason to bid a higher premium than what was offered to HEP’s pipeline peers relative to the pre-announcement prices. A year ago, at the time of PBFX and SHLX buyouts, the refining industry was booming, and crack spreads were wide. Currently, the refining industry is facing strong headwinds and is potentially entering downcycle (judging from the crack spread futures), limiting any further growth in HEP’s midstream asset base in the short term.

- The acquisition consideration is in stock (as opposed to all cash) and implies lower chances of a material increase in the offer price – arguments could be made that LP unitholders can still participate in the upside of the merged company, or that the acquirers stock is also undervalued and therefore the offer is fair enough.

That’s the gist of the thesis and I believe the upside, if any, from the current levels will not be that material, probably around 10% max.

Holly Energy Partners – Background

HEP is a midstream company that operates oil pipelines (4400 miles across the US), terminals, tankage, loading rack facilities, and refinery processing units. The business is mostly volume/throughput based and has minimal commodity risk. Most of the company’s revenues are generated from the GP – HF Sinclair – which is responsible for around 80% of HEP’s pipeline volumes and 93% of terminal throughput. All of HEP’s refinery units are also integrated into DINO’s refineries and are used to support their daily operations. Despite the significant dependence on the GP, HEP has very strong protections with 70% of contracts having minimum volume commitments. Substantially all MVC revenues have inflation escalators which are recalculated each year in July. The contracts are also very long – 5 to 15 years on average.

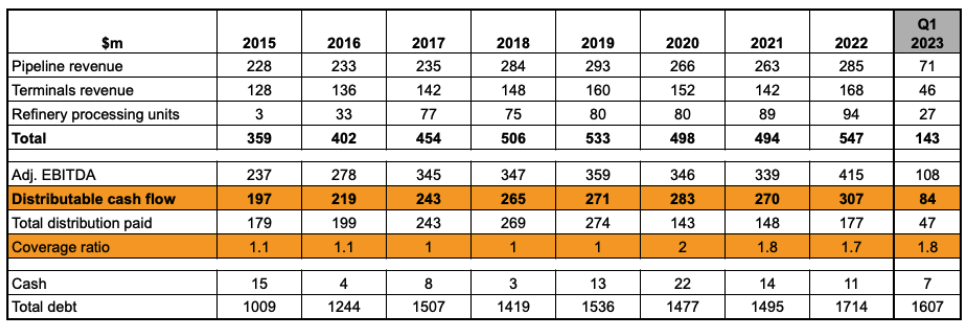

Overall, this is a very stable business and HEP has been a commendable, consistently growing performer with a distributable cash flow CAGR of +12% since 2005:

* Note – DCF/unit was at around $2.43/share in 2022, while the unit count was 126m.

Till the Covid outbreak, HEP was proudly emphasizing that its dividend had been growing each quarter without failure. The coverage ratio (distributable cashflow divided by the distributions paid) used to consistently hover at 1-1.2x. From Aug’22 presentation:

The buyer, HF Sinclair (DINO), operates seven oil refineries with a capacity of 678k barrels per day. The industry is highly cyclical. Crack spreads have soared from a mid-cycle $20/bbl level to $40-$60/bbl during 2022, which was a record year for refiners. The spreads have since come down from peak levels to around $30/bbl today. Crack spread futures show that the market will continue to normalize with spreads expected to drop to $17/share bbl, slightly below the mid-cycle levels. To translate that into DINO’s earnings – the company has generated $4.6bn EBITDA in 2022, whereas the mid-cycle EBITDA has been guided to $1.35bn.

Investors betting on higher bids on HEP and GPP should take a look at this recent Delaware Supreme Court ruling and the discussion on GLOP thread.

https://www.engage.hoganlovells.com/knowledgeservices/news/delaware-supreme-court-reverses-us690-million-judgment-in-boardwalk-pipeline-partners/

http://ssi.wpdeveloper.lt/2023/02/gaslog-partners-glop-expected-higher-bid-40-upside/#comment-16574

Any new thoughts on the HEP trade? Or does anyone else have a holding in this?

The premium has declined, so it looks more attractive. This past week, HEP traded at a <3% premium which is much better than the 10% premium back in May. However, there has been capital appreciation in the HEP increasing 20% since May, so the lower premium may be logical given it's factoring in a lower offer due to the share price appreciation.

It seems your skepticism wasn’t misplaced here, Dt. HEP and DINO entered into a definitive merger agreement. The consideration was adjusted from the previous 0.3714x DINO >> 0.315x DINO + $4/share in cash. So only 4% increase overall.