Performance – August 2023

SSI tracking portfolio was down 0.8% in August 2023. A detailed performance breakdown is provided below.

Summary of SSI activity during August:

- Portfolio Ideas – 2 new portfolio ideas were published, and 3 cases were closed.

- Quick Pitches – I have also published 8 Quick Pitches during the month.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

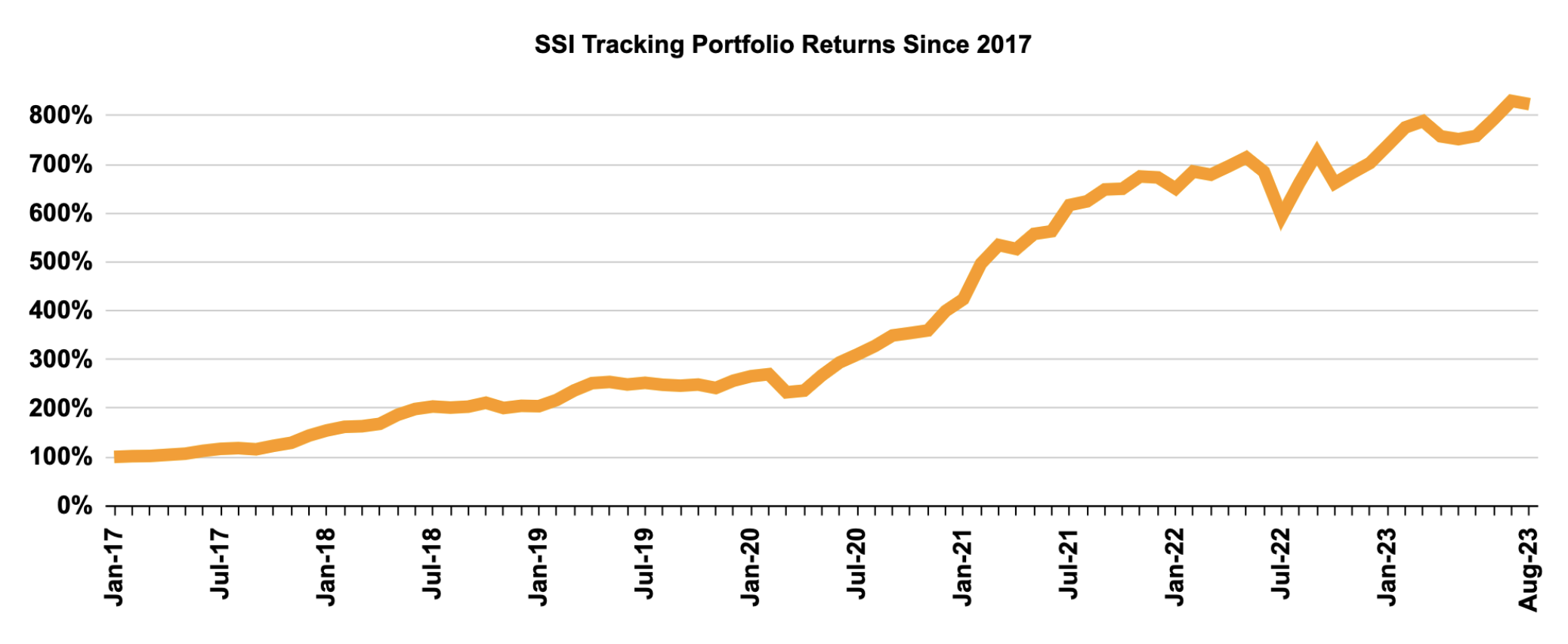

TRACKING PORTFOLIO -0.8% IN AUGUST AND +11.4% YTD

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

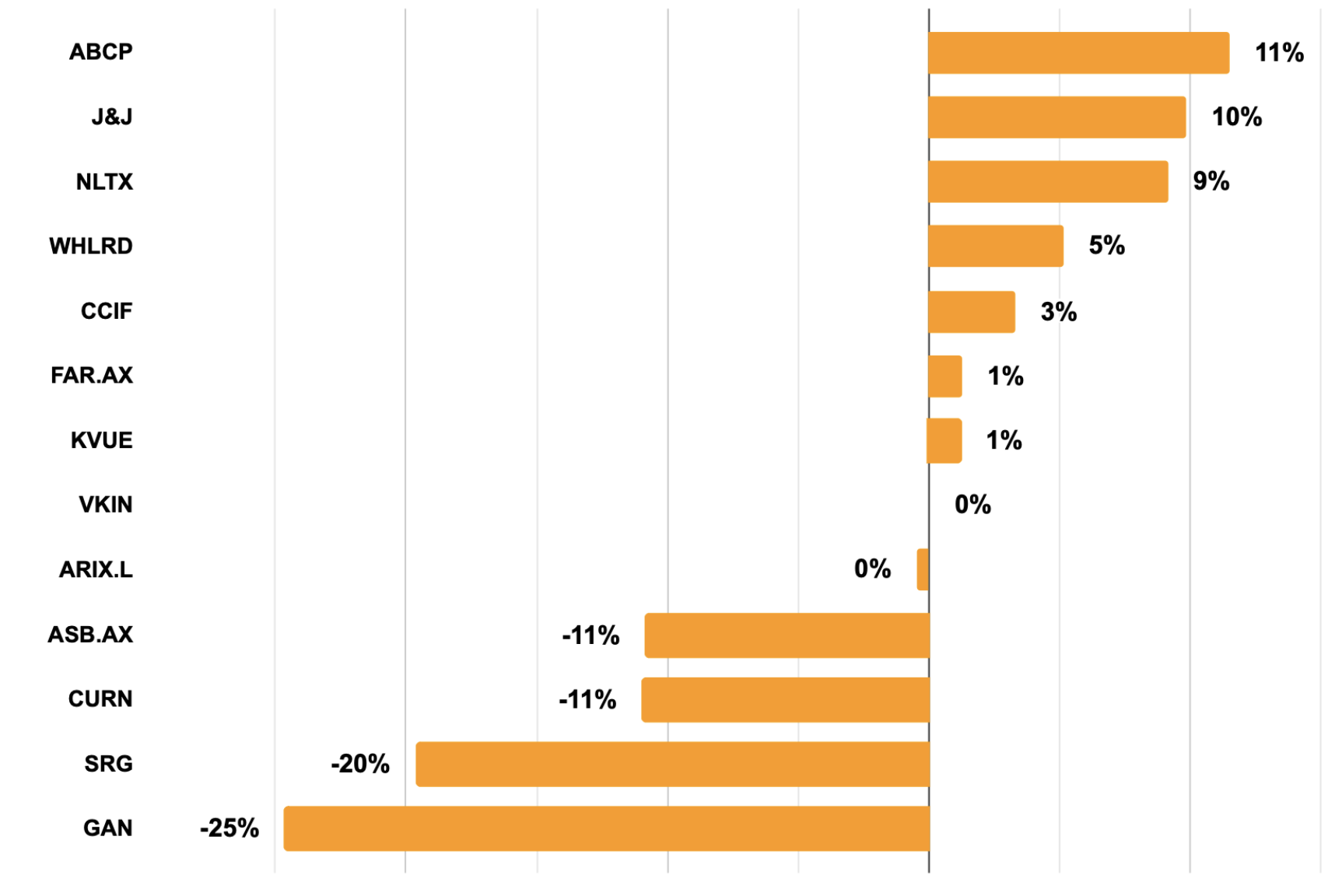

PERFORMANCE SPLIT AUGUST 2023

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of August 2023.

PORTFOLIO IDEAS CLOSED IN AUGUST 2023

Viking Energy (VKIN) +35% in 5 Days

Viking Energy (VKIN) and Camber Energy (CEI) merger closing was due in just a few days and yet the spread was extremely wide at 35%. CEI borrow was expensive but available. CEI owned 61% of VKIN and the same CEO was running both companies. Shareholders on both sides had already approved the transaction and the other key conditions for the merger were met. It seemed that the spread stood there for no apparent reason. As expected, the companies successfully completed the merger just 5 days later. This trade returned 35% after borrow fees which were de minimis 0.6%.

Johnson & Johnson (JNJ) +$2400 in 1 Month

Another standard split-off is now in the bag. Johnson & Johson was divesting its 80.1% stake in Kenvue, its recently IPOed consumer healthcare division. Shareholders of JNJ had the option to participate in the tender and exchange their JNJ shares for KVUE shares at a 7.53% premium. The tender seemed likely to get oversubscribed, but odd lot holders (<100 shares) were to be accepted on a priority basis. KVUE borrow for hedging stayed widely available pretty much throughout the whole tender period. Spread also stayed wide up until the last few days of the tender period. The offer expired on the 18th of August and the idea was successfully closed with a $2400 return in 1 month after hedging fees.

Austal (ASB.AX) -11% in 3 Weeks

Austal was a US defense shipbuilding business, masquerading as an Aussie company with an Aussie listing. Shortly after ASB announced a significant new contract from the US Navy, media reports started to pile up mentioning multiple suitors interested to buyout the company. ASB seemed like a relatively cheap strategic asset and there was a chance that a bidding war might’ve unfolded here. After enough time, no bids have eventually materialized. The idea was closed with an 11% loss in 3 weeks.

Archive Of Monthly Performance Reports

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020