Performance – September 2023

SSI tracking portfolio was down 1.2% in September 2023. A detailed performance breakdown is provided below.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO -1.2% IN SEPTEMBER AND +10.1% YTD

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

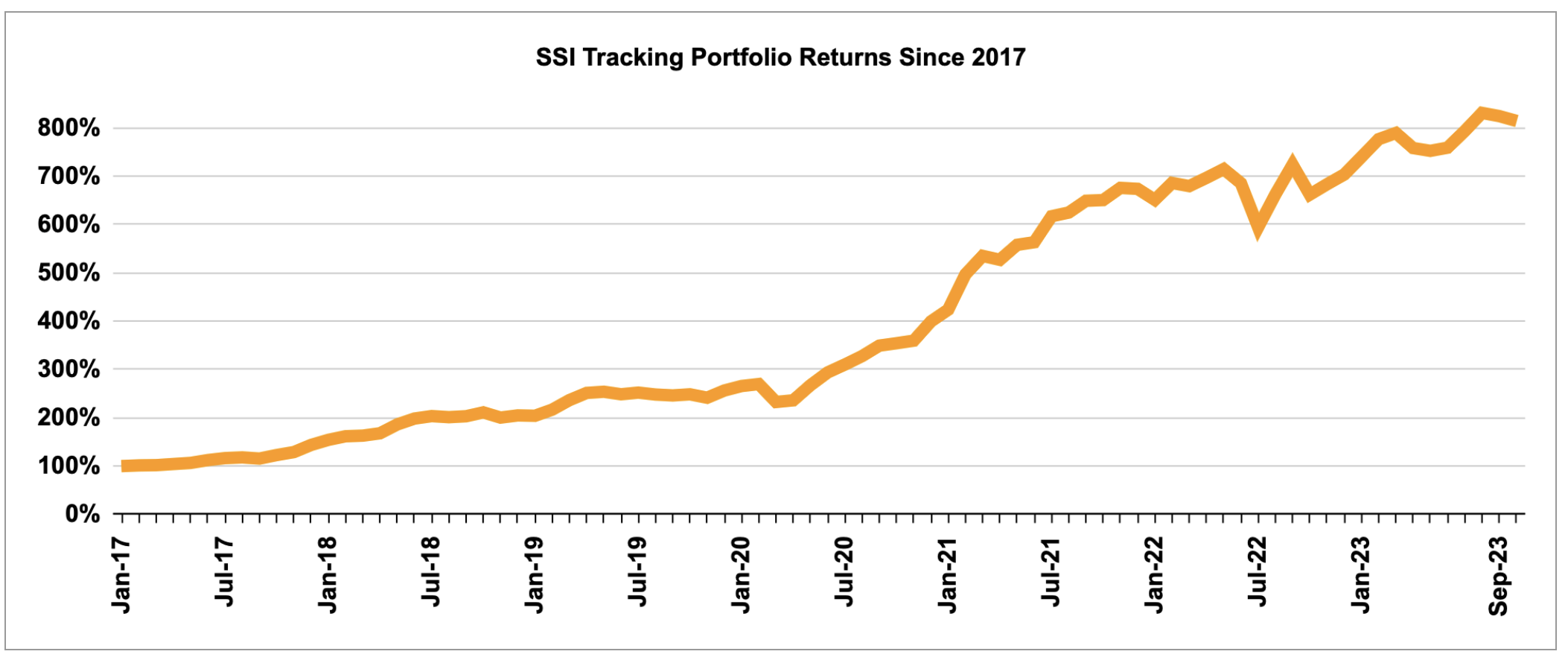

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

PERFORMANCE SPLIT SEPTEMBER 2023

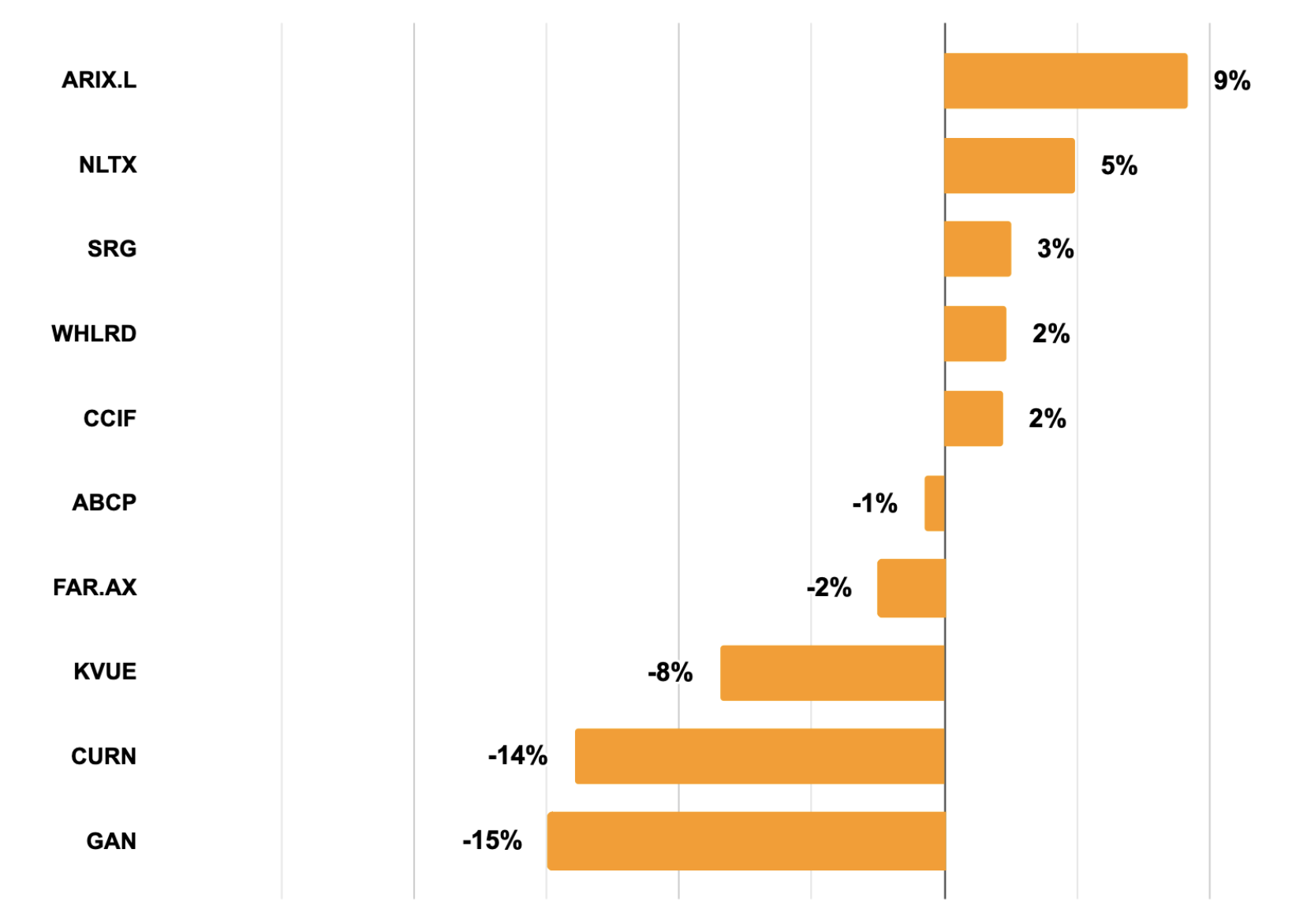

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of September 2023.

PORTFOLIO IDEAS CLOSED IN SEPTEMBER 2023

Carlyle Credit Income Fund (CCIF, previously VCIF) +1% in 7.5 months

Carlyle Credit Income fund (previously known as Vertical Capital Income) was a closed-end fund that appointed Carlyle Group as its new investment manager. The new manager intended to shift CCIF’s portfolio from whole residential mortgages into equity and debt tranches of Collateralized Loan Obligations (CLOs). Investors were about to get rewarded handsomely to approve the transition, with Carlyle paying a substantial special dividend and making a tender offer from its own pockets. CCIF was trading at a slight discount to NAV, whereas CLO peers were mostly trading at a premium. Even without any substantial discount narrowing, the special dividend and the tender offer was expected to result in double digit upside. Meanwhile, if CCIF valuation was to re-rate closer to peer levels after the portfolio transitioning, the potential upside might’ve been significantly higher. Nearly all developments progressed as expected with Carlyle fully transitioning the portfolio into CLOs and rewarding the shareholders as planned. However, there was a surprisingly large NAV leak during the portfolio sale process, with some assets getting sold substantially below previously reported book value. Therefore, even though the valuation gap narrowed somewhat to only 3% discount (still a way to go to reach peers levels), total result for this case turned out to be a modest 1% gain over 7.5 months.

Kenvue (KVUE) -6.5% in a month

Johnson & Johnson’s recent divestment of an 80% stake in Kenvue seemed to have put a significant share price pressure on KVUE due to the post split-off selling and KVUE’s free float increasing by 9x. I thought the effect will be temporary, and KVUE would eventually recover to the previous $25-$26.5 per share levels. KVUE’s stable and high-quality business, combined with its undervalued valuation relative to peers, suggested a well-protected downside for this timely bet. Unfortunately the price recovery did not happen as the stock was hit by increased volatility related to a recent lawsuit. Any remaining split-off related dynamics started to get mixed up with the lawsuit news. As the thesis shifted, I’ve closed the idea with 6.5% loss in a month.

GAN Limited (GAN) -10% in 2 months

GAN Limited was a fallen-from-grace backend software provider for the online casino and sports betting industries, with a depressed share price, an ongoing strategic review, and a recently announced financing agreement hinting that some kind of transaction was imminent. Multiple tidbits in the financing agreement suggested that the strategic review was progressing well and the company just needed some additional time to carry it through to the finish line. A sale scenario could have resulted in a multi-bagger from then existing levels. The remaining timeline was very short, and the sale announcement was expected to materialize in September. However, the sale announcement did not materialize within the expected timeline. While the strategic review is still ongoing, and a transaction could possibly be announced any day, I think the investment case has gotten far weaker. Therefore, I’ve removed the idea from the active cases with -10% in 2 months.

Wheeler Real Estate Investment Trust (WHLRD) -21% in 2 years

Grocery store REIT Wheeler Real Estate Investment Trust had a substantial overhang of Series D preferred stock, amounting to $115 million in par and accrued dividends versus $46 million of Wheeler’s book value. The redemption value per WHLRD pref. share stood at $36+ (vs. $15.95 share price at the time of the write-up), and the redemption date was set for September 21, 2023. The company did not have enough cash to redeem the pref. shares, whereas redemption in exchange for common stock was likely to result in a massive dilution spiral. Therefore, management seemed highly incentivized to remove WHLRD overhang until the redemption date by gradually reducing the pref. share count through tenders offers, which it had already unsuccessfully tried a few times (tenders failed due to lackluster offer price). It was expected that more tenders at better prices will be announced eventually. Unfortunately, besides yet another lowball failed tender management showed no further effort to remove WHLRD overhang. Once the redemption date came due, management said it will redeem WHLRD shares in exchange for common stock. Participating in the exchange is very risky and the upcoming dilution spiral for the common shares will be very hard to predict. Therefore, to minimize any further losses, the idea was closed with -21% in 2 years.

Archive Of Monthly Performance Reports

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020