Ocean Wilson (OCN.L) – Large Asset Sale/Discount to NAV – 40% Upside

Current Price: £9.70

Target Price: £13.80

Upside: 40%

Expiration Date: end of 2023 / early 2024

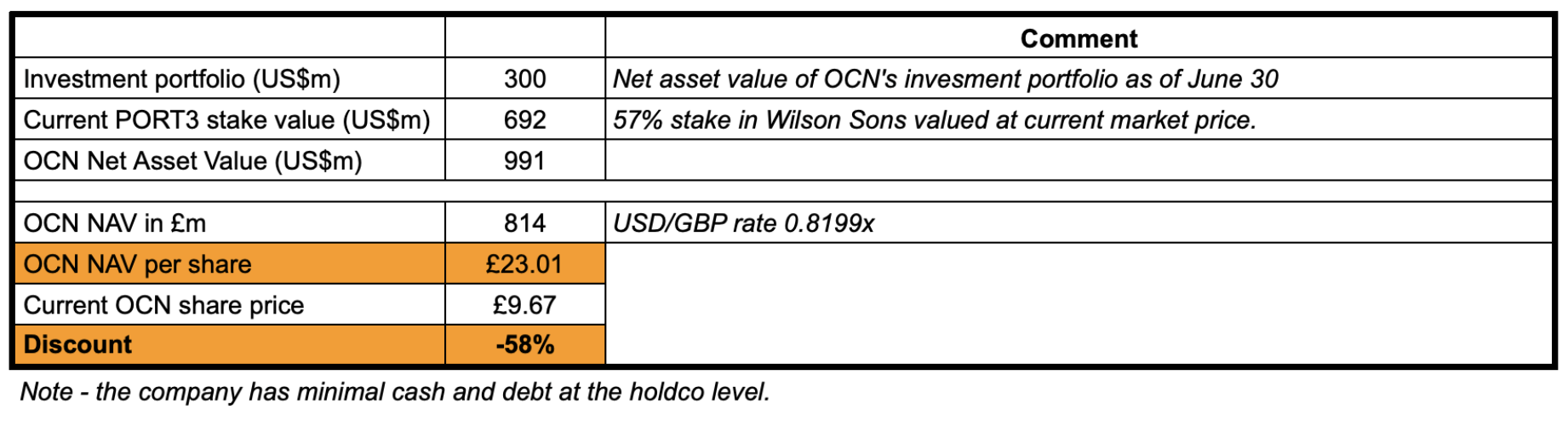

Ocean Wilson, a London-listed holding company, trades at a 58% discount to its NAV. The company has recently received a bid and launched a strategic review for its key asset. I believe the setup will deliver 40%+ upside with a clear path to value realization over the next few months. The downside risk is limited. Liquidity is limited with a daily trading volume of c. £100k.

Ocean Wilson owns two very distinct operating subsidiaries:

- A Brazil-listed maritime sector player Wilson Sons (ticker: PORT3.SA) in which OCN holds a 57% stake – this is the part currently under the strategic review. PORT3 is primarily engaged in towage services and container terminal operations.

- OWIL – a diversified portfolio of fund investments. This subsidiary is like a fund of funds.

OCN’s NAV calculations are indicated in the table below:

In June, it was reported that Swiss-based shipping giant MSC Group is in talks to acquire Wilson Sons (PORT3) for US$1bn. MSC Group is definitely a credible suitor with a number of recent acquisitions. Last year, MSC acquired a 67% stake in Brazilian maritime player Log-In Logistica Intermodal and also completed another $6.4bn buyout in Africa. In general, the last few years saw robust M&A activity in the maritime space and container terminal sectors.

OCN confirmed the rumors and launched strategic review for its 57% stake in PORT3 indicating that so far no ‘formal’ bids had been received. PORT3 currently trades 20% above the rumored bid price. OCN shares have also reacted to the news (c. +15% vs pre-announcement levels), but the discount to NAV remained virtually unchanged at 58%.

The sale of the stake in Brazilian subsidiary would simplify OCN’s holdco structure and might help narrow the valuation gap. Management is also well aware of this and seems to be focusing on this goal, as suggested by this quote from the interim results released in August:

The Board continues to recognise that there are divergent views among our shareholders regarding our non-correlated asset holdings. We announced on 12 June 2023 that the Board has instigated a strategic review of the Company’s investment in Wilson Sons. This review is intended to provide a platform for us to optimise our asset mix, enhance returns, and drive growth in the longer term.

The upside in this setup will depend on a number of uncertainties listed below and I will try to elaborate on each of them in the rest of the write-up.

- At what price will Wilson Sons (PORT3) be sold?

- How will OCN’s management use the sale proceeds?

- To what extent will the OCN’s discount narrow following the sale?

- Is a full liquidation or merger with another public vehicle also in the cards?

For my base case, I assume that PORT3 will get sold at the current trading levels, all sale proceeds will be reinvested, and OCN’s valuation gap will then narrow to 40% to align it with another public vehicle controlled by the same family. In this scenario, OCN shares would re-rate to £13.80 resulting in a 43% return.

The main risk is of course that the sale will not materialize. Back in 2018, PORT3 was running a strategic review for its terminals’ business (1/3rd of revenues) and received non-binding bids from several PE firms. The strategic review took 1 year and ended fruitless with the board deciding not to engage with any bidders. This time, however, in the cards we have a potential sale of the whole Brazilian subsidiary (or at least the stake owned by OCN). The communication from management is also different this time. Instead of just a dry and generic strategic review commentary that we had in 2018 (here and here), the strategic review commentary in the interim results (quoted above) seems much more specific, with a clear focus on streamlining the asset portfolio and reducing the valuation gap.

If the sale doesn’t materialize, I expect the downside to be limited. Return to pre-announcement levels would result in a 14% loss.

I first came across this OCN setup on Value Investing in Poundland blog. After digging some more, I am somewhat less optimistic, especially with regard to the multi-bagger upside potential. Nevertheless, I still think the case is quite attractive and asymmetric.

Wilson Sons (PORT3)

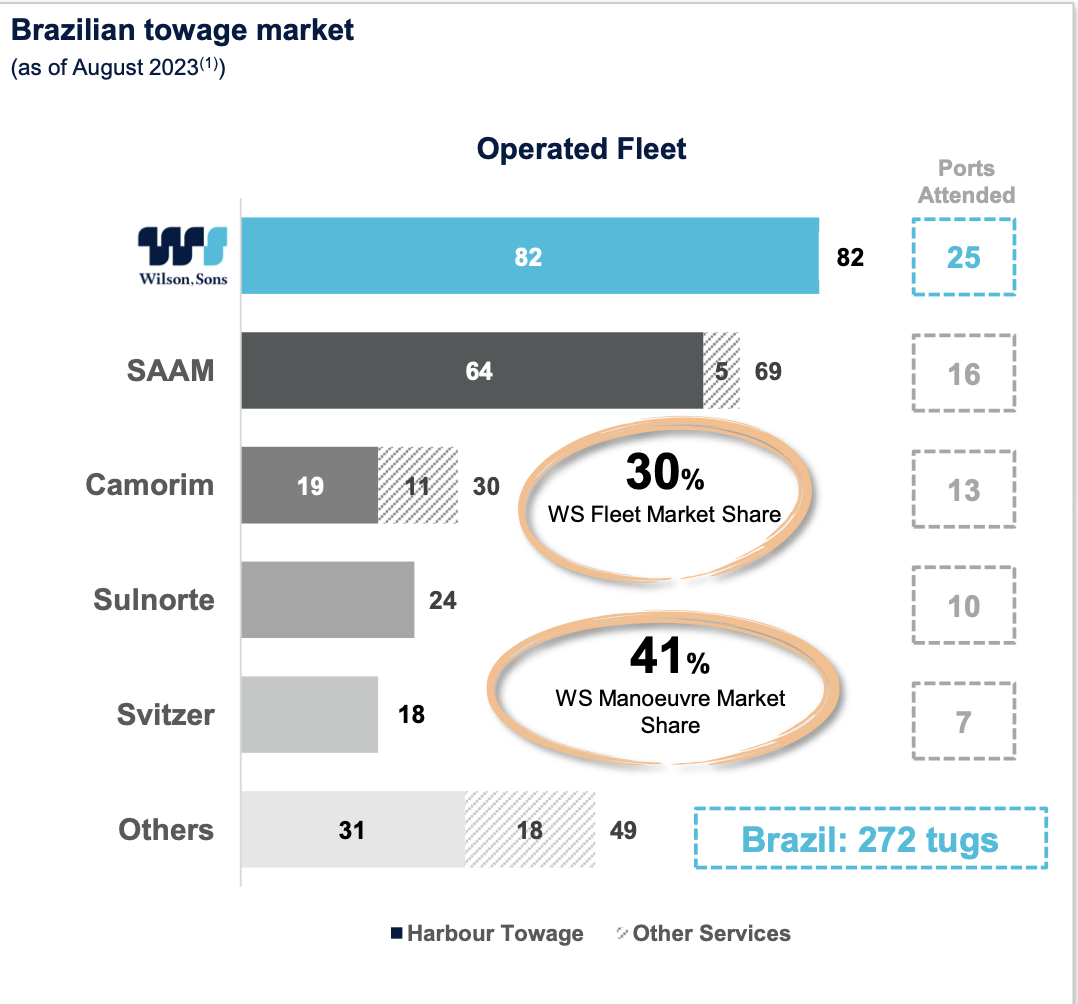

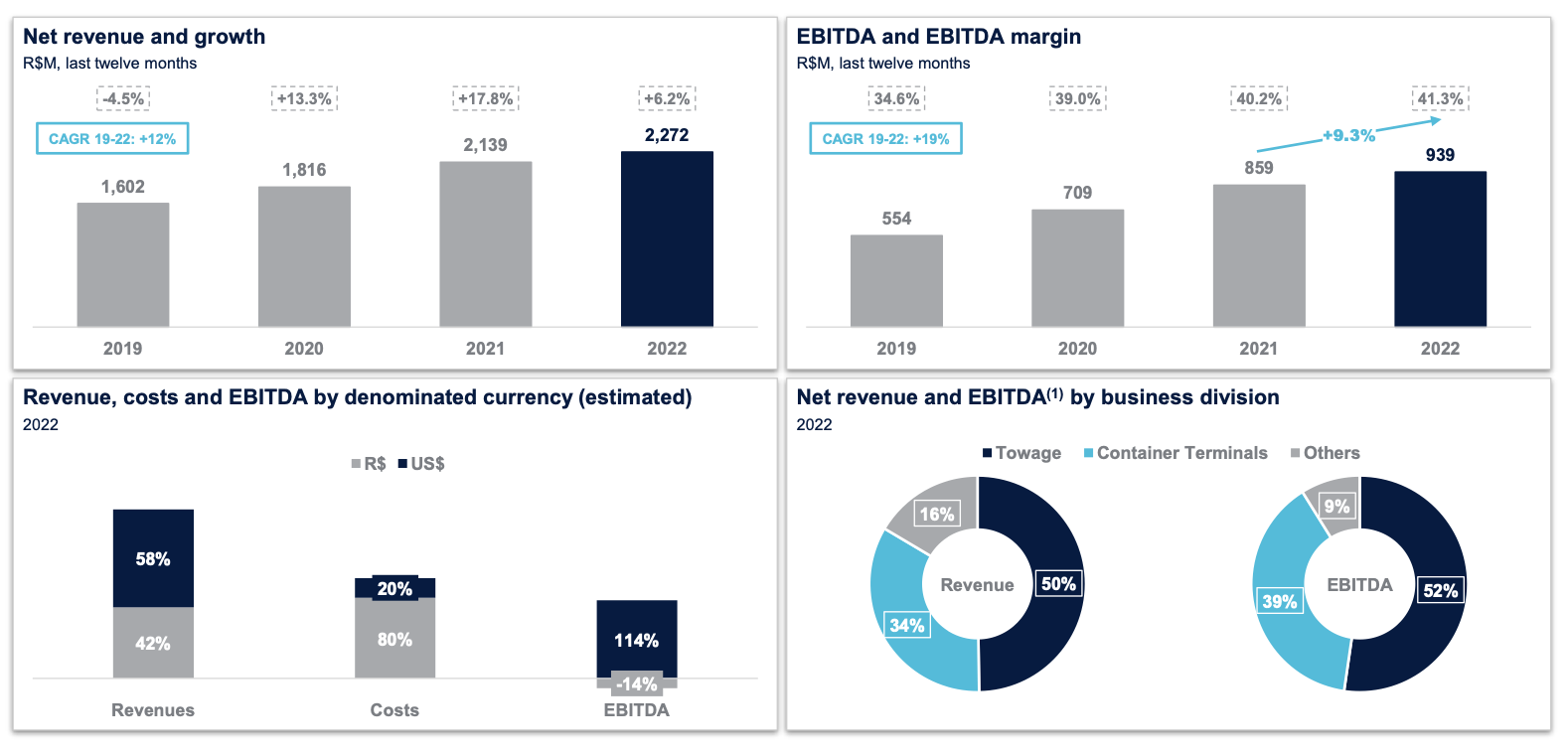

Wilson Sons is port towage operator in Brazil with a 30% fleet market share. The company has the largest and most modern fleet (82 tugboats and 35 fire-fighting vessels) in the country and covers 25 ports and terminals in Brazil. The towage segment generates around half of the company’s revenue and EBITDA.

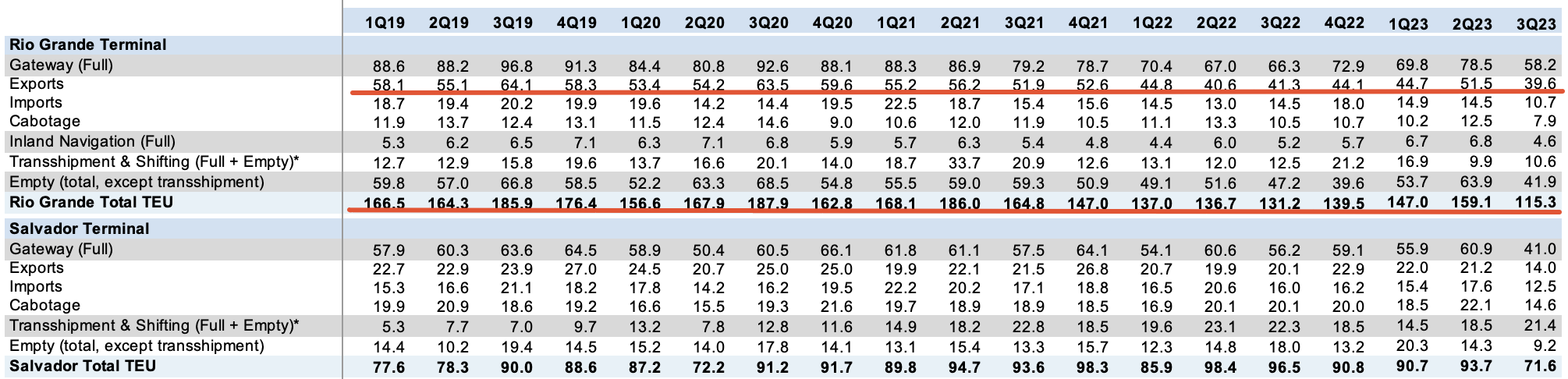

Wilson Sons’ second-largest business (generating over a third of revenue and 39% of EBITDA) is operating container terminals in the 6th and 10th largest ports in Brazil. OCN is the sole operator in both of these ports. Operating lease contract with the larger terminal, Rio Grande with a handling capacity of 1.4 million TEUs per year, expires in 2047. For the other terminal, Salvador with a handling capacity of 0.5 million TEUs per year, the contract lasts till 2050. Management explained that trade flows in Rio Grande are disproportionally skewed towards exports (31%/11% exports/imports), which makes the port very sensitive to the availability of free containers to fill the export demand. Since 2022, the terminal has been experiencing a drop in trade flow volumes due to container shortages. However, in the most recent call/presentation management has been hinting at trade flow normalization saying the upcoming prospects for Rio Grande are great.

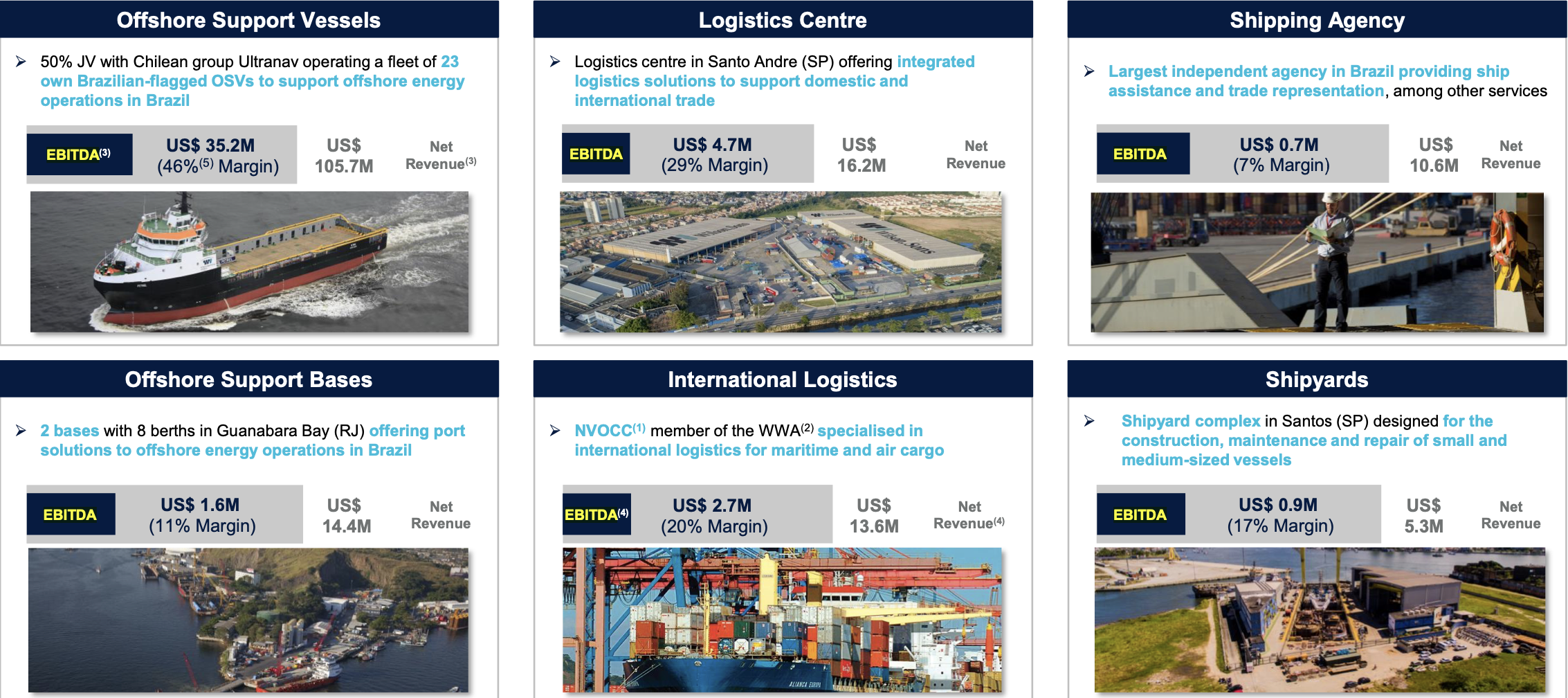

The remaining PORT3 operations include several more business units (see slide below).

OCN’s offshore support business has been showing particularly strong results recently due to the heightened activity in the O&G sector.

Overall, PORT has been growing revenues at 12% and EBITDA at 19% EBITDA CAGR since 2019. The exchange rate is 1 USD for 5 Brazilian Reals.

Potential sale price of PORT3

The rumored offer from MSC Group came at around BRL 11.7/share. PORT3 currently trades at BRL 14/share, with the market expecting a higher bid. OCN holds 249m shares of PORT3, which at current PORT3 prices would net them BRL 3.5bn or US$692m. Since OCN is incorporated in Bermuda, I understand there would be no capital gains tax leakage (at least there was no/minimal tax leakage when PORT3 shares were sold in 2007 IPO).

The company doesn’t have any close public peers. However, a couple of data points suggest that the eventual takeout valuation might be above the MSC’s rumored offer but not materially above the current trading prices.

- At the moment PORT3 trades at 8.8x TTM EBITDA (ex IFRS 16).

- The closest available peer Sociedad Matriz sold its terminals business (10 terminals in 6 countries) to Hapag-LLoyd for US$995m. This business was generating around US$110m EBITDA, so the sale was done at 9x EBITDA. The deal was closed last month. The remainco Sociedad Matriz is pretty much left with a pure-play towage business and operates 192 tugs in 13 countries. It is also the second-largest player in Brazil after OCN. The RemainCo trades at 5.2x EBITDA.

- Santos Brazil Participacoes (the biggest terminals operator in Brazil) trades at 11.8x LTM EBITDA (ex IFRS 16).

PORT3 seems to be priced a bit closer to terminal operators, despite the majority of the earnings being generated by the towage segment. However, PORT3 has the largest port towage market share in Brazil and is able to service its customers across the highest number of Brazilian ports. This scale seems to result in higher EBITDA margins: 40%+ for POTR3 towage operations vs. mid-30% for Sociedad Matriz. In turn, it could be argued that PORT3 towage business deserves a premium.

Overall, it seems reasonable to expect the sale price of PORT3 to land somewhere around the current market price.

OWIL subsidiary – fund of funds

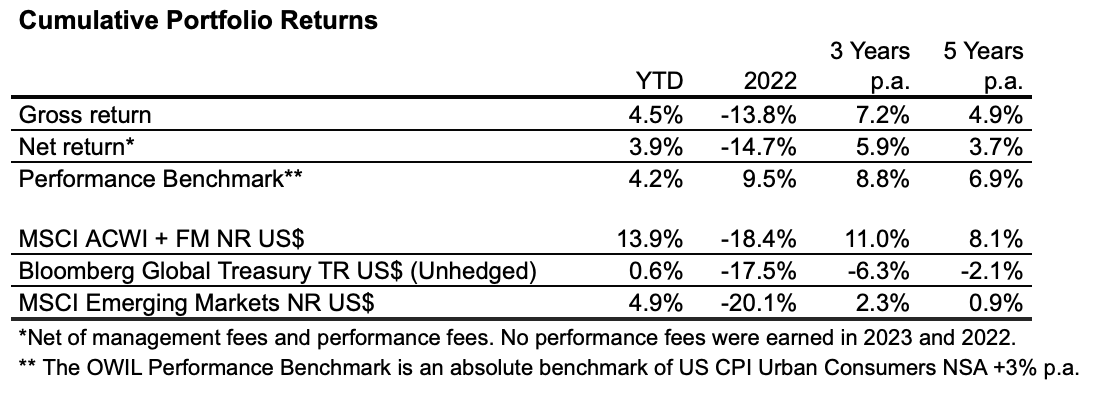

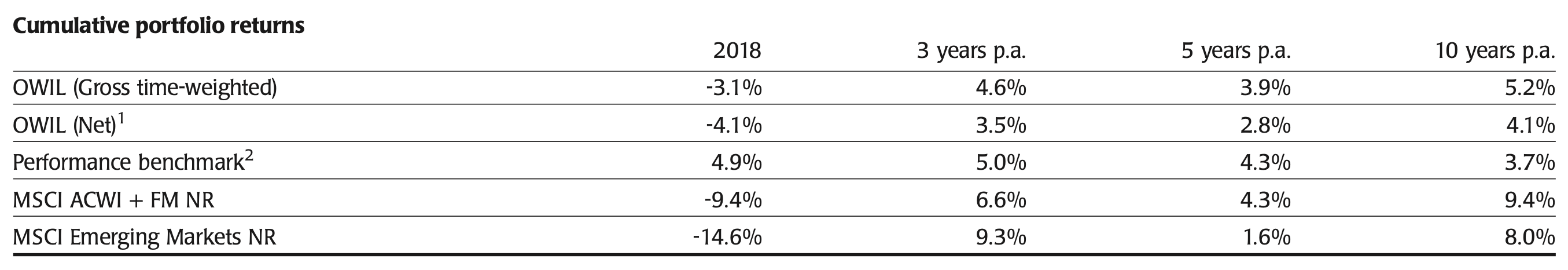

The investments portfolio held by OWIL subsidiary was valued at US$300m as of Jun’23. This is really just a fund of funds and one that has delivered mediocre/inferior results so far. Even though the fee structure appears to be fair (around 1% of FUM and performance fees only kicking in above a certain threshold with a high-water mark), as with all funds-of-funds investors are burdened with two layers of fees, which creates a drag on investment returns. The top 30 portfolio positions account for 64% of exposure and are listed in the latest interim statement.

Recent portfolio returns are not inspiring and lag Performance Benchmark. Returns during the 2009-2018 decade are hardly any better (see tables below). If management would’ve put the money into an index fund back in 2007 instead, the portfolio would be 2x larger today. In the meantime, the portfolio manager has been pocketing £3m-£4m in annual fees.

As of Dec’22, only US$94m of the portfolio was marked as highly liquid, and that number included US$20m of cash. This cash was reduced to almost zero as of June’23, so it seems that the highly liquid investments now comprise only about 20%-25% of the total portfolio at best. Management also marks US$120m of the portfolio assets as level 3 investments, which are not quoted in an active market. These level 3 investments also “include investments in limited partnerships and other private equity funds, which may be subject to restrictions on redemptions such as lock-up period, redemption gates and side pockets”.

OCN also has around US$55.3m of funding commitments to certain portfolio investments. US$9.3m of these commitments are set to expire within one year, US$4.4m from 2-5 years, and the remaining US$41.5m – after 5 years. These commitments might limit cash available for shareholder distributions after the sale of PORT3 and might prolong the liquidation (if management takes this direction).

Why is OCN trading at a wide discount?

OCN has always traded at a wide discount to NAV, fluctuating between 30% and 40% since 2015. Last year, when the discounts of UK investment trusts widened across the board (see here), OCN’s valuation gap went over 50%.

OCN is controlled by Solomon family, which runs The Hanseatic Group. This group is OCN’s largest shareholder (26.45%) and also OCN’s investment manager. On top of the ownership by Hanseatic Group, William Solomon also has a 13.2% personal stake in OCN, while Christopher Townsend (who seems to be Solomon’s relative according to comments on ADVFN forum), owns a further 11.4%. This results in a total 51% combined control over OCN. Solomon is also a director of both OCN and PORT3 and a chairman of OCN’s investment manager.

OCN has owned a controlling stake in PORT3 since the late 50s. Meanwhile, the OWIL subsidiary (the fund of funds) was created from the proceeds of PORT3 IPO in 2007. This structure of two unrelated subsidiaries has prevailed since then. Over the years Solomon family has shown zero interest in caring for shareholder value or reducing a large discount to NAV, while at the same time pocketing millions of pounds from managing OCN’s poorly performing and highly inefficient investment portfolio. A combination of the convoluted ownership structure and management’s indifference to prolonged poor investment performance is a major reason for the market’s dislike of OCN.

Discount to NAV would likely narrow after the sale

Based on management’s track record so far, I think PORT3 sale proceeds will simply be diverted to OWIL subsidiary and reinvested in various funds. This would allow management to collect even higher fees from the management of fund of funds. Nevertheless, in such a turn of events, OCN’s discount to NAV would still likely narrow – if not due to the simplified HoldCo structure, then at least due to an improved perception of OCN’s management in the markets.

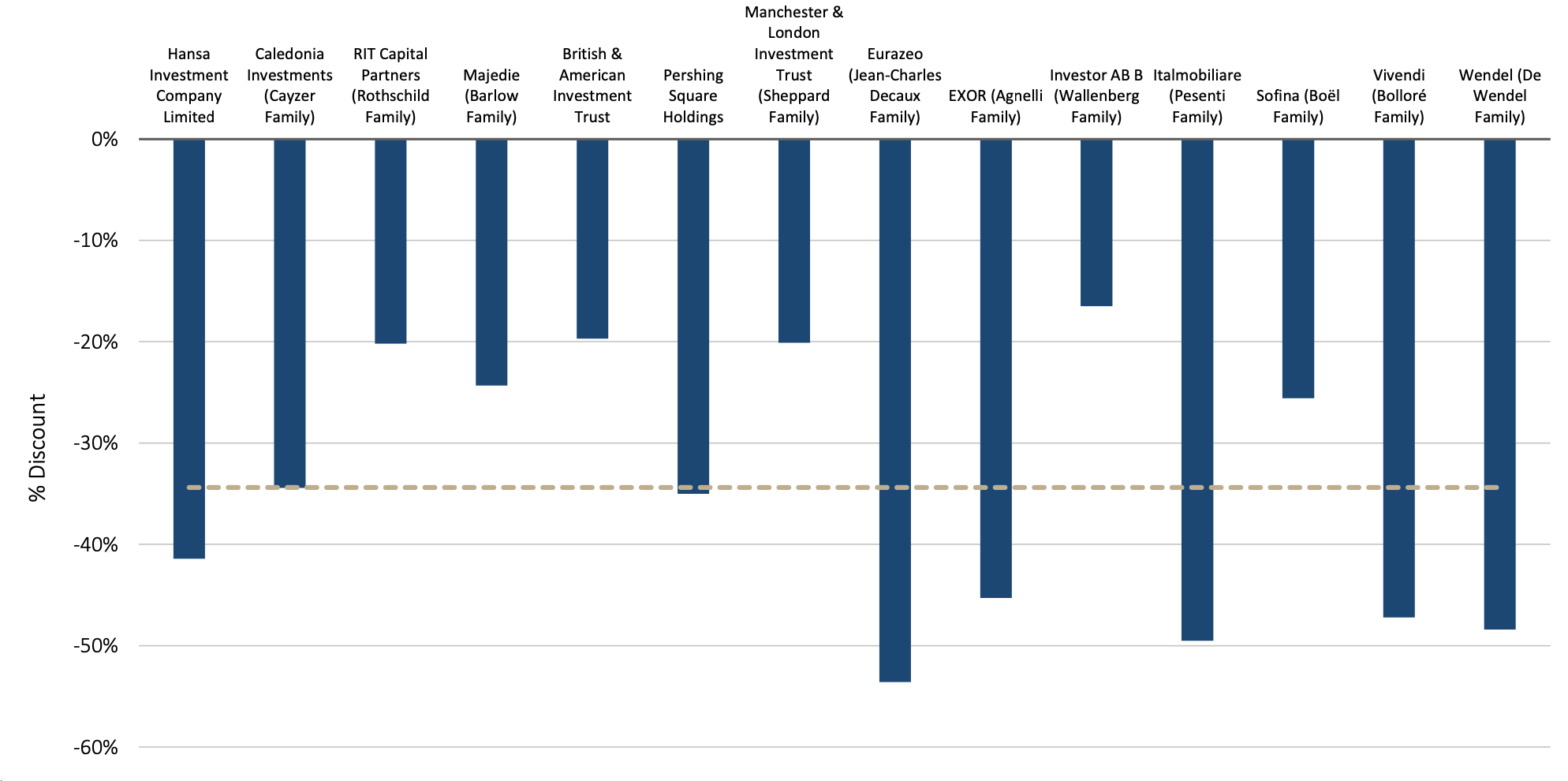

I think it’s reasonable to expect the valuation gap to narrow from the current 58% to 40%, which is the level Hansa Investment Company (OCN’s largest shareholder and investment manager) trades at. Hansa is also listed on LSE under a ticker “HAN.L” and runs a very similar portfolio/investment strategy, having invested in pretty much all of the same funds. In fact, not only do all of HAN’s top portfolio holdings coincide with OWIL’s portfolio, but the sizing is also pretty much identical. Once the PORT3 sale is out of the picture, I don’t see any reason why OCN’s discount shouldn’t at least get in line with that of HAN’s.

Based on HAN’s presentation from last month, the average family-controlled holdco discount is around 35%:

Thoughts on more optimistic scenarios

Now that PORT3 sale is on the table, there is also a chance that OCN’s management will decide to liquidate the remaining OCN (i.e. OWIL subsidiary) or merge it into HAN. This would kind of make sense as after the sale of PORT3, Solomon family would be left with two listed vehicles (or funds of funds) with very similar/identical investment portfolios. OCN’s liquidation at full NAV would also result in +25% gain for HAN’s NAV giving a material boost to it’s overall investment performance. Meanwhile, Solomon and Townsend would cash out nearly £100m each. Liquidation would definitely be the most optimistic turn of events with a potential 100% upside.

Although it might seem that liquidation of OCN would significantly lower the fees the Solomon family collects, the loss of fees would actually be not as high as it might seem initially. HAN currently does not earn any management fees on its 25% stake in OCN. If OCN is liquidated at full NAV, then HAN’s portfolio of fee earnings assets would increase by more than 50% of OCN’s NAV. Thus in the liquidation scenario, Solomon family would actually lose only half of the management fees it currently receives from OCN. Coupled with a strong boost to HAN’s paper performance and personal cash-outs for Solomon and Townsend, it might be enough to seriously consider this option.

I would love to be that optimistic, however, there are several reasons, that make me seriously doubt management will lean toward liquidation:

- The Solomon family clearly doesn’t care about shareholder value and loves being the asset managers, extracting millions in management fees with seemingly minimal effort involved.

- Their track record also suggests the family doesn’t care much about the reputation aspects or the investment performance results of either vehicle.

- Given their wealth, it is questionable whether they would have a strong desire to cash out their personal OCN investment either.

- Considering all this, I would expect their incentives to be mostly aligned with maximizing the management fee base. This is also consistent with their recent communication in the interim results, which stated that the review is “intended to provide a platform for us to optimize our asset mix, enhance returns, and drive growth in the longer term.

- Some of OCN’s portfolio assets are illiquid and might be difficult to sell. Divestments would likely entail a significant “illiquidity discount” on the less liquid assets, further eroding the potential management fee base for the management. The way to overcome this would be to transfer all of OWIL portfolio into HAN, then none of the portfolio investments need to be disposed of in order to liquidate OCN.

An all-stock merger of OCN and HAN is a different story and I am guessing the Solomon family will be leaning this way. Combining both vehicles would be much faster and easier to execute than a full liquidation of OCN, especially with the Solomon family already having controlling ownership of both companies. A merger would eliminate the extra public listing while retaining the OCN’s NAV in the pool of management fee-earning assets. In this scenario, OCN and HAN discounts to NAV would likely converge (e.g. if merger would be done on NAV for NAV basis). Even a fractional narrowing of OCN’s valuation gap following the sale of PORT3 would result in a very positive outcome in the short term.

Thank you for the wonderfully in depth research.

My first thought: while the discount to NAV is large on a relative basis, are you concerned that the less liquid investments are “marked to model” (I.e. materially inflated) which may result in an overstatement of the NAV?

FWIW, at least by my calculations, even if you haircut the investment portfolio to 200m usd, the discount to NAV is still >50%

Agree with Dylan, the current discount is so wide that even if some of the funds have inflated values, it will not have a material impact on the thesis. Besides the portfolio is well diversified.

I think the uncertainties I have indicated in the pitch will prove to be of higher importance than the accuracy of OWIL’s investment portfolio valuation:

– At what price will Wilson Sons (PORT3) be sold?

– How will OCN’s management use the sale proceeds?

– To what extent will the OCN’s discount narrow following the sale?

– Is a full liquidation or merger with another public vehicle also in the cards?

Do you anticipate the company encountering any regulatory issues in a deal scenario?

At this stage, we don’t even know what the outcome of the strategic review will be so I think it is a bit too early to talk about potential regulatory issues in case management decides to sell PORT3 to a competitor. It could decided to split off its stake rather than sell it to another party. Meanwhile, even in a sale scenario, one of the key aspects that management is most likely considering are any regulatory hurdles of the to-be-proposed transaction. Thus, any potential regulatory issues should be at least partially adressed in the outcome of the strategic review.

Positive Q3 update from Ocean Wilsons and the stock is up 11% on the news.

The main highlight is that the strategic review is still ongoing and the company noted it has already received a number of indicative non-binding offers for its stake in Wilson Sons. The announcement of multiple suitors adds confidence that the review will result in the sale of PORT3 stake at a higher valuation than the previously rumored MSC’s offer (around BRL 11.7/share). Wilson Sons currently trades at a 25% premium to the rumored price as the market expects higher bids.

Wilson Son’s quarterly results were solid, showing 8.3% revenue growth 14.2% EBITDA increase YoY, with strong performance across all business segments – towage, container terminals, and offshore energy-linked services.

The valuation of OCN’s investment portfolio remained virtually unchanged at US$298m.

With the updated figures, including a higher PORT3 price/stake valuation and a slight change in FX rates since the write-up, OCN’s NAV now lands at £23.7/share. OCN is trading at a 55% discount to NAV. If the stake in PORT3 gets sold anywhere close to current trading levels, I would expect this discount to narrow markedly.

https://www.londonstockexchange.com/news-article/OCN/quarterly-update-q3-2023/16209983

OCN.L pitch from Palm Harbour Capital Q3 letter:

“Ocean Wilsons Holdings Limited is a Bermuda-based investment company with two principal subsidiaries, Ocean Wilsons Investments Limited (OWIL) and Wilson Sons Limited. The group wholly owns OWIL, which owns a collection of investment funds, and holds 56.58% of Wilson, Sons (PORT3 BS), one of the largest providers of maritime services in Brazil. Ocean Wilson trades at a considerable discount to its sum-of-theparts, which isn’t unusual for a holding company. However, we believe the announcement of a strategic review of its controlling stake in Brazilian listed Wilson, Sons (“WSON”) has the potential to unlock the discount and could lead to considerable upside. Furthermore, we believe the underlying fundamentals for WSON are improving. We see the potential for more than 100% upside in a liquidation scenario. Given the shareholder structure and recent events, we believe the probability of a liquidation has increased.

OWIL includes a diversified set of funds. Investment allocation seems reasonable but not exciting. The five-year annualized gross portfolio return is 4.9% which is translated to 3.7% post management and performance fees. They have clearly not done very well over the past years. Our only comment is that most of it is relatively liquid and probably a bit less volatile than the market. We could think of a lot of better uses for this money. As at the end of the second quarter the portfolio was valued at roughly $300 million.

WSON is one of the largest providers of maritime services in Brazil with activities including towage, container terminals, offshore oil and gas support services, small vessel construction, logistics and ship agency. WSON is the leading tugboat operator in the consolidated oligopolistic Brazilian market. Moreover, it operates Rio Grande and Salvador container terminals, the only dedicated container terminals in their respective regions. WSON also operates the Santo André logistic center, two leading shipyards of strategic importance located in Brazil’s largest port of Santos, and various offshore support bases. Finally, the company holds a 50% stake in an offshore support vessel company that despite recent challenges, is experiencing significantly improved utilization and increasing daily rates.

Our base case valuation is based on OCN investment portfolio reported figure at 30th June 2023 plus the market value of WSON stake, which we find reasonable based on both our cash flow forecasts and peer multiples. Based on the latest reported value, the investment portfolio is worth approximately $300 million (£6.9 per share), on which we apply a 25% haircut to adjust for illiquidity and a possible market fluctuation. On top of that, the market values WSON stake at $723 million at BRL 13.9 per share (£16.6 per share). Hence Ocean Wilson appears to trade at a 56% discount to NAV on a Sum-OfParts value of £21,9 per share. At this price level, investors buy a dominant and well-run towage and port facility business in Brazil and a well-diversified portfolio at >50% discount. In the meantime, OCN provides a growing 6% dividend yield to compensate investors while waiting for the market to recognize or the management to unlock the full value.”

Letter in full: https://www.palmharbourcapital.com/files/PHC%20Letter%20Q3_2023_FINAL_ENG.pdf

OCN shares are up 10% since mid-December. The spike on Dec 22 coincides with the press release by the Brazilian subsidiary (PORT3), indicating that its Board of Directors approved retention and non-compete plan for key executives.

This seems like a sign that OCN’s strategic review is progressing toward the sale of the Brazilian subsidiary – especially when the press release explicitly states that the change has been made in order to maximize the value of the company.

https://api.mziq.com/mzfilemanager/v2/d/8284de4a-426a-465a-beab-92abeabafc97/6c2e387c-e4e9-fef9-37e6-6c3c8b7a4cf0?origin=1

Although OCN shares are up +25% since the initial write-up in October, the discount to NAV has barely budged, narrowing only from 58% to 53%, as OCN’s NAV has also increased driven by higher PORT3 share price. I think material upside remains upon the sale of PORT3 and further narrowing of the discount.

A quick note on OCN setup in Palm Harbour’s Q4 letter:

“The second largest contributor was Ocean Wilson (+23.8% +107 bps), the Bermudabased investment company with port and tugboat operations in Brazil, which we introduced in our third quarter 2023 letter. Third quarter revenues of Wilson Sons were in line as the increases in container terminal, towage and offshore base revenues were offset by the decline in logistics revenues driven by lower freight rates. However, EBIT increased by 10%, driven by cost reductions. The offshore vessel joint-venture also contributed positively as we outlined last quarter. During the fourth quarter of 2023, Wilson Sons (PORT3 BS) share price increased by 24.8% (27.6% including dividend) while the latest reported portfolio value was roughly steady. As a result, the sum-of-parts value increased accordingly, keeping the discount at 52%. Ocean’s Wilson RNS reiterated that the strategic review of the Wilson Sons asset remains ongoing and that they have received several indicative non-binding offers. Given that the Wilson Sons market value (£19 per share at quarter-end) is above the value of Ocean Wilson (£11.85), the holding company, and the market assigns zero value to the investment portfolio (£5). We remain confident in the downside protection while waiting for management to close the discount.”

Full letter here: https://www.palmharbourcapital.com/files/PHC%20Letter%20Q4_2023_FINAL_ENG.pdf

About a week ago, Bloomberg reported that PSA International, the port operator owned by Singapore state investor Temasek Holdings, has shown interest in acquiring Wilson Sons. Moreover, the same report noted that several Chinese buyers have also expressed interest.

https://www.bloomberg.com/news/articles/2024-01-31/psa-is-said-to-show-interest-in-brazil-port-operator-wilson-sons?embedded-checkout=true

Another positive for the looming sale of Wilson Sons. PORT3 announced that its CFO has resigned effective March 13. Nothing was mentioned regarding the replacement, only that the CEO will “ensure the continuity of the financial agenda”. OCN continues to trade at a wide 48% discount to its portfolio value, assuming Wilson Sons gets sold at the current share price levels.

https://api.mziq.com/mzfilemanager/v2/d/8284de4a-426a-465a-beab-92abeabafc97/663fd05c-8e0f-3233-3ee9-9f8ca0ea7d0c?origin=1

OCN reported preliminary results for 2023 with hardly any information shared on the still-ongoing strategic review.

But interestingly, the press specified that OCN will review its Board composition after “our strategic review completes in 2024”. Not sure why such a sentence had to be included in the PR (it wasn’t there in the same PR last year), but this, coupled with the recent resignation of Wilson Sons’ CFO, might be a hint that the strategic review is bound to result in the sale of the Brazilian subsidiary (PORT3).

Financial performance was strong with PORT3 reporting record results across all divisions in 2023. Due to increased distributions from the subsidiary, OCN has increased its annual dividend from $0.70/share to $0.85/share (payable on June 14).

OCN’s investment portfolio NAV stood at US$311m at the end of Q4, which is a 4% increase compared to Q3.

The company continues to trade at a wide 51% discount to its sum of the parts. I expect this valuation gap to narrow if/when PORT3 stake gets monetized.

I closing down OCN.L position. The discount to NAV has narrowed to 44%, whereas the parent HAN.L (with a similar investment portfolio exposure except for the Brazilian port assets) current trades at a 47% discount.

Further upside from current levels could be seen if:

1) The Brazilian PORT3 subsidiary gets sold above the current trading prices, or

2) OCN.L takes any further steps (e.g. selling its investment portfolio) to actively reduced the discount.

Without point 2, even after the successful sale of PORT3 assets, the discount to NAV is likely to remain similar as that of its parent HAN.L

44% return in 7 months.

OCN post by Value & Opportunity

Quick take:

– The sale of PORT3 stake is imminent;

– It will be sold at a premium to market prices;

– OCN’s discount to NAV will subsequently narrow.

https://valueandopportunity.com/2024/09/30/ocean-wilsons-ocn-ln-deep-value-sum-of-the-parts-special-situation-with-a-catalyst/

The blogger never said why the discount to NAV should narrow. Have you changed your view that even after the successful sale of PORT3 assets, the discount to NAV is likely to remain similar as that of its parent HAN.L?

Hard to see why should OCN’s discount suddenly become much smaller than HAN’s. But the author also expects PORT3 to be sold above current prices

If PORT3 is sold for cash, OCN has a strong incentive to put the cash into their OWIL portfolio to earn some nice fees out of it (to my understanding they did not get any fee for “administering” PORT3. OWIL is not particularly profitable (after fee), hence discount could actually widen absent a large dividend distribution IMO.

Follow-up post from Value and Opportunity. TL;DR: Upside is lower due to a calculation error in the original post.

https://valueandopportunity.com/2024/10/03/ocean-wilsons-ocn-ln-update-error-in-the-nav-calculation/