Tidewater Midstream And Infrastructure (TWM.TO) – Large Asset Sale – Upside TBD

Current Price: C$1.03

Target Price: C$1.42

Upside: 40%

Expiration Date: Q4 2023

This idea was shared by Value9.

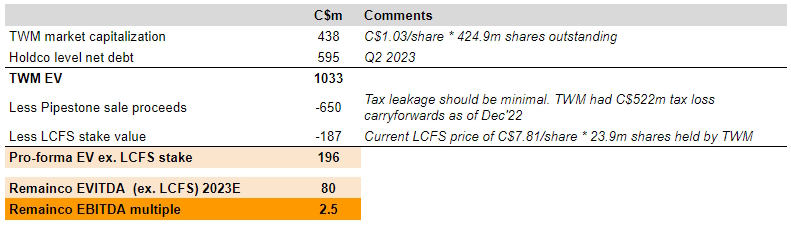

Last month Tidewater Midstream And Infrastructure sold its key midstream asset Pipestone for C$650m, equal to two-thirds of the company’s EV. The deal is set to close in Q4’23. Pro forma for the sale proceeds and excluding TWM’s public stake in LCFS, the remaining refinery and midstream assets are now trading at only 2.5x 2023E EBITDA, significantly below peer levels and the cost basis of the assets. The stock has barely budged on the news, which I believe has created a pretty compelling setup. I expect TWM shares to re-rate once the Pipestone sale closes, but there are also a few other potential catalysts down the road.

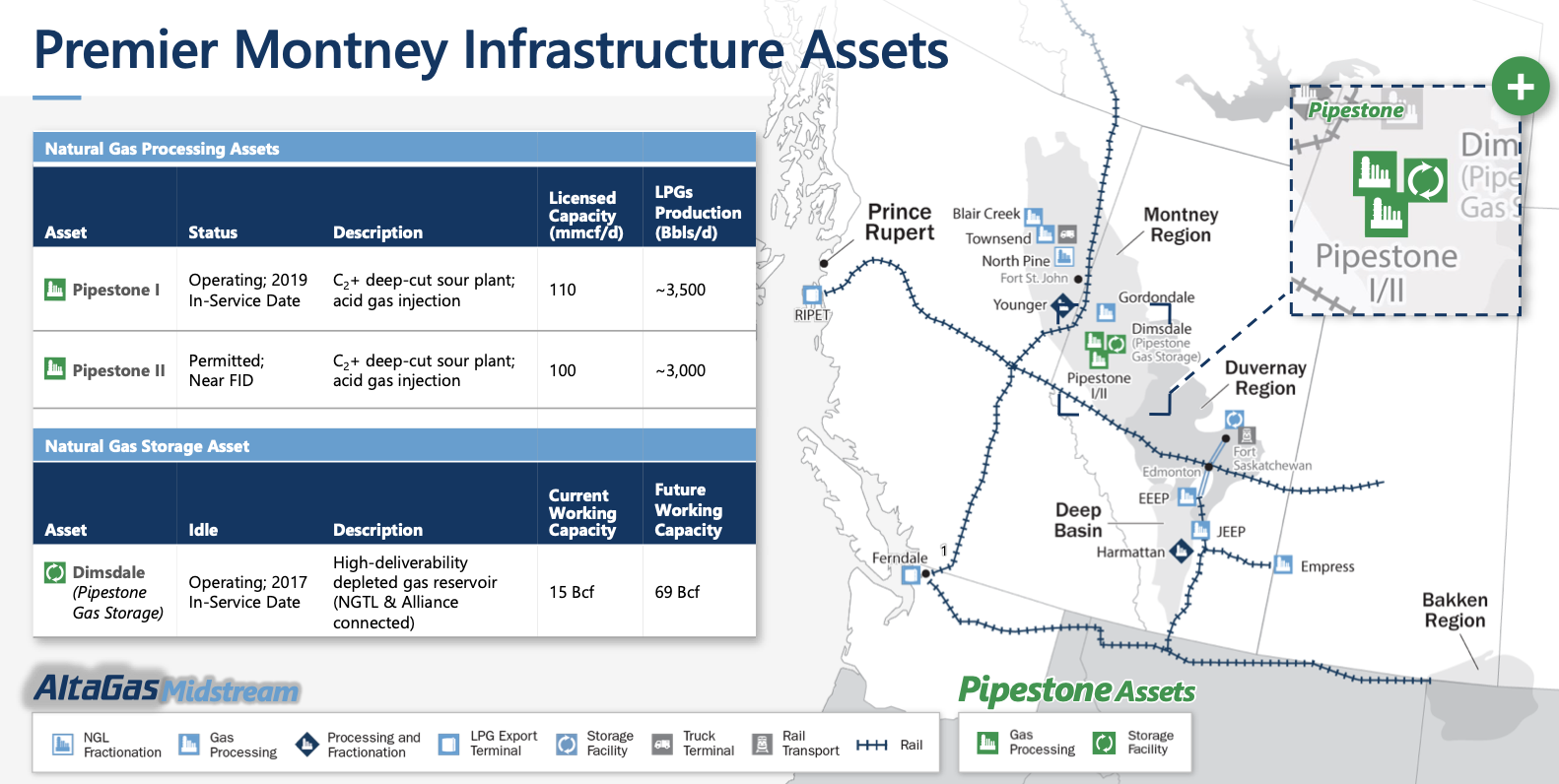

Pipestone, the asset that is being sold, is a high-quality sour gas plant with 110 MMcf/d throughput and 20,000 Bbl/d liquids handling capacity. The remaining TWM’s assets are Prince George Refinery in BC, a 69% stake in publicly listed Tidewater Renewables (LCFS.TO), and several midstream gas processing assets in Alberta.

This is how TWM will look like pro-forma for the sale:

Pipestone sale is likely to close successfully in Q4

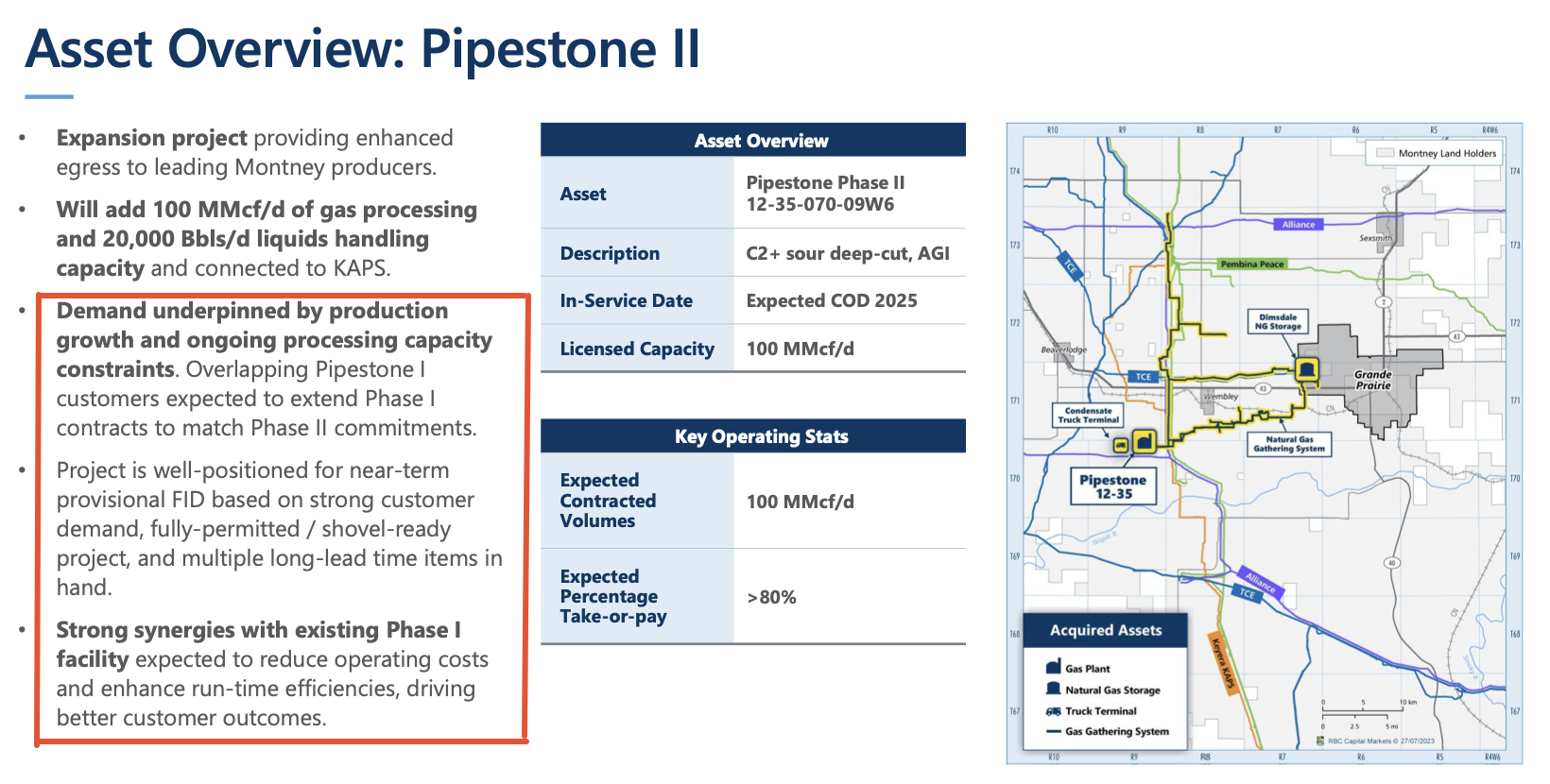

Pipestone is a high-quality asset that is 100% contracted with investment-grade tenants, has 63% of its revenue mix in take-or-pay contracts, and average contract term of 8.5 years. Together with the existing gas plant, TWM is also selling an expansion project Pipestone Phase II, which would double the plant’s throughput capacity, as well as two other interconnected terminal/storage facilities. The buyer of these assets is AltaGas, a large energy infrastructure company with a C$7bn market cap. The acquisition will strengthen AltaGas’ presence in the region, where it already has a nearby refinery and other midstream assets a bit further away.

The sale is conditioned on certain regulatory approvals, which I expect to be mostly customary – it is a rather small deal and will increase the buyer’s processing throughput capacity by only 10%.

A more interesting condition is a requirement for positive FID (final investment decision) on Pipestone II expansion project. FID is a critical milestone in large energy projects – in this stage owners evaluate and decide whether to proceed with the project or not. As I understand, AltaGas will review Pipestone II project economics, costs, profitability, supply availability, customer demand, technical challenges, etc. And then will decide whether Pipestone II investment makes sense. Any required permissions, financing, and engineering/design plans also need to be in place for FID to be completed. Overall, this is pretty much the last step before the construction stage can start.

So for the sale of Pipestone assets to close, AltGas must give a go-ahead for the expansion project. Is this likely? I think yes.

Pipestone II will basically be a replica of the currently operational Pipestone Phase I plant. The plants will be co-located and all of the FID-related aspects, e.g. availability of the input resources, customer demand, operational costs, regulatory environment, should be pretty similar or even identical for both assets. The engineering and design plans should also be very similar to the Phase I plant.

The FID process for the expansion is already in advanced stages, with the acquisition presentation stating that the project is “Near FID.” TWM has been considering this expansion already for a while and all of the required permits are ready. The key roadblock so far has been the financing due to the large project size and TWM’s already high leverage. Pipestone II expansion is expected to cost around C$300m.

Analysts were previously concerned about this cost estimate, given that another TWM’s project, the HDRD facility at LCFS, recently left a bad taste in investors’ mouths due to multiple delays and budget overruns. However, management has clearly stated that this is a completely different and much simpler project, and they are comfortable with the budget estimate. From Q1’23 conf. call:

Analyst: And then I guess, on the Pipestone 2 expansion, looks like you’re still evaluating that project. I guess just given this latest 30% overrun on the HDRD, can you comment on where the latest cost estimate for Pipestone 2 might be at today versus the previous $300 million marker? And maybe just remind us if any of the inflationary pressures can be recovered through customer contracts to perhaps maintain that 6x build multiple on the project?

TWM CEO: Yes, sure. So let me just differentiate a little bit on those 2 construction projects. HDRD is first of its kind. So we’ve got — engineering is new. You’ve got some fairly funky catalysts and some interesting metallurgy involved as opposed to looking at Phase 2 of Pipestone, which is really a replica of Phase 1. So any of the question marks that we went through on Phase 1 are now behind us. And basically, the engineering and construction are just going to be a lot simpler. So it makes us very comfortable in terms of our capital budget on Phase 2. And yes, we are still evaluating and working through things. And part of our structured process here is talking to partners as well as potential buyers.

[…]

And it’s not so much — it’s not a cash flow issue as much as it is — really a large project. Given the size of our company and the CapEx requirements for Phase 2, just in general, even with the economics being excellent, it’s a big project for the size of our company to do it on our own.

AltaGas is a very serious buyer with multiple midstream assets in the region. I am pretty sure the buyer has carried out full diligence on TWM’s Phase I plant before signing the binding agreement. In its acquisition presentation, the buyer has also signaled it’s pretty confident about the FID so far, given the strong customer demand in the region and synergies with the Phase I plant.

The risks of this deal getting derail due to FID for Pipestone II seem to be small, and the condition was probably put in just as a precaution. I expect the acquisition to proceed smoothly and close as expected in Q4.

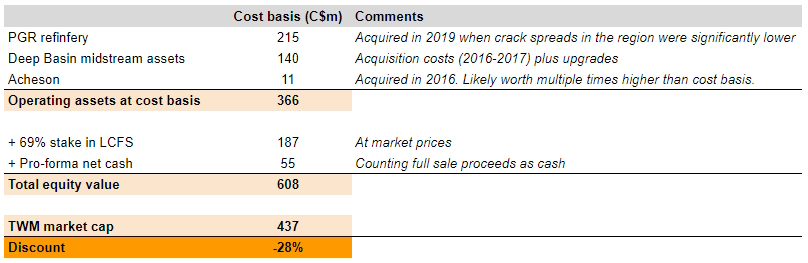

Remainco assets are undervalued on cost basis and EBITDA

As the table below illustrates the Remainco currently trades at a material discount to its sum of the parts valuation even if operating assets are marked just at their cost basis. As I elaborate below, the actual private market valuation of each of these assets is likely to be higher than the historical acquisition costs, even if it is hard to pinpoint to exact figures. At the very least, this indicates a good downside protection.

Prince George Refinery (PGR)

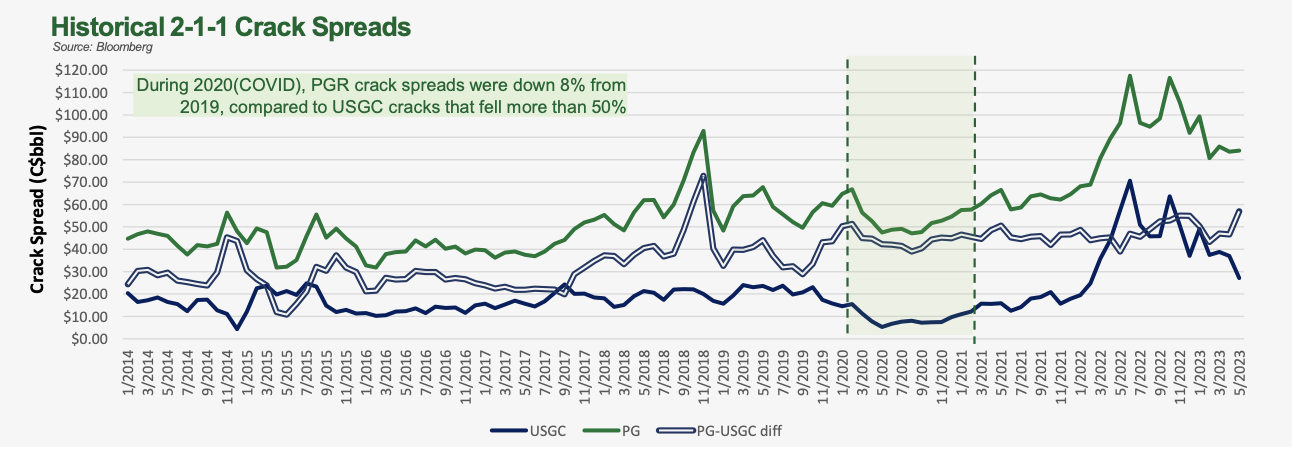

The refinery has 12,000 bbl/d capacity and mostly produces low-sulfur diesel and gasoline for the greater Prince George region in BC. The location is highly strategic with only one other refinery nearby. There’s a substantial undersupply of refining power in the area, which has resulted in elevated crack spreads and PGR usually operating at full capacity. The refinery also has onsite storage capacity in excess of 1 MMbbls and flexible logistics.

PGR was acquired in Oct’19 for C$215m or 2.9x EBITDA. The crack spreads were materially lower back in 2019 (around C$50-C$60/bbl vs C$85/bbl in Q2’23. At the time, management was boasting how opportunistic and cheap the acquisition was – the purchase was made at a few turns lower EBITDA multiple than peer valuations.

Deep Basin

This encompasses midstream assets with 780 MMcf/d processing capacity, including Brazeau River Complex gas processing and NGL fractionation facility as well as Ram River Gas Plant, a sour gas processing facility with sulfur handling solutions. These assets were purchased through several smaller acquisitions mostly during 2016. I’m sure I haven’t collected all the parts, but at least several different acquisition announcements indicate that the total cost basis should be higher than C$55m (here, here, here). The company has then spent an incremental C$85m+ upgrading the assets, expanding the capacity at BRC, building a fractionation facility, relocating the idled turbo expander, etc (here and here), bringing the total cost basis to C$140m.

Acheson blending terminal and propylene splitter

Acheson was acquired in 2016 for C$11m. The acquired assets included 33 mmcf/d processing capacity, 250km of related pipelines and 600 acres of heavy industrial land. At the time, TWM said that the land alone was estimated to be worth C$15m-C$30m and had been previously appraised to be worth C$50m in 2008. Since then, TWM has grouped certain other co-located assets with Acheson and made some other upgrades, including a newly built propylene splitter. Besides the retained 600 acres of industrial land, Acheson now boasts a six-fold higher 200 mmcf/d capacity and 800km+ pipeline network. The asset is now likely to be worth multiple times more what TWM paid in 2016.

Tidewater Renewables (LCFS.TO)

TWM holds a 68.85% stake in Tidewater Renewables. LCFS was IPO’ed in mid-2021, raising money to buy some midstream assets from TWM and start building a new renewable diesel/hydrogen facility, the first one of this kind in Canada. The midstream assets generate around C$40m annual EBITDA. The renewable facility, HDRD complex, has just finished the 2-year-long construction process and was supposed to start operating last month. Management expects it to generate C$90-C$115m annual EBITDA once fully ramped up. HDRD complex is co-located with TWM’s PGR refinery.

I am less confident in assessing the valuation of the Remainco assets from the earnings perspective as disclosures are limited. However, the figures I come up with point to the same direction – Remainco is materially undervalued.

Excluding LCFS operations, Remainco earnings mix will be heavily skewed towards the refinery. The 2022 consolidated EBITDA mix was 40% midstream, 40% refinery, and 20% LCFS. With the Pipestone sale, the majority of that 40% earnings from midstream will go.

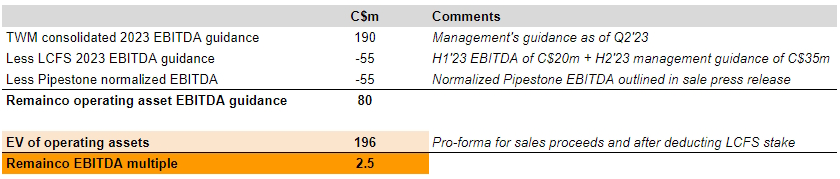

Estimating 2023 EBITDA guidance for the remaining TWM assets is a bit tricky, as the company does not segment the earnings and provides only consolidated EBITDA guidance. However, using some other available data points, I estimate EBITDA for the remaining refinery/midstream assets to be around C$80m. Calculations are illustrated in the table below.

It could be argued that this C$80m EBITDA figure is a bit too low and doesn’t reflect the actual earnings power of the assets. In H1’23, TWM’s PGR refinery had a major maintenance turnaround when the facility was offline for 6 weeks, whereas Brazeau River Complex was also shut-down for 3 weeks due to forest fires.

Pro-forma for the sale and excluding LCFS stake, the remaining assets now trade at 2.5x EBITDA. This looks too low vs peers. Refinery companies are trading at around 4xEBITDA (e.g. VLO, CVI, PARR), whereas midstream peers (e.g. OKE, AM, CEQP) trade at 7x-9x forward EBITDA multiples. TWM’s Pipestone gas plant was just sold for 8.5x 2024E EBITDA.

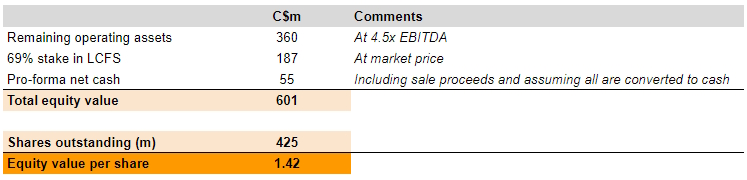

If TWM’s operating assets were to re-rate to 4.5x 2023E EBITDA, which seems reasonable given where peers trade, the stock would be worth C$1.42/share, implying a 40% upside from the current levels.

Private equity control and new management in place

Two private equity firms, Birch Hill (22.7%) and Kicking Horse Capital (4%), control 29% of TWM and have significant influence over its management. Last November, TWM had a major management shakeup when the previous CEO/founder resigned and TWM’s chairman was replaced by Thomas Dea, the president of Kicking Horse Capital.

The previous CEO/founder of TWM was not popular with shareholders due to his massive spending spree on various projects, which increased company’s debt and led to a highly dilutive equity financing at C$1.2/share last year. However, both Birch Hill and Kicking Horse Capital participated in the financing.

Soon after Dea took over as chairman, TWM announced a strategic review, which has now concluded with the sale of Pipestone. The presence of these two major shareholders significantly reduces the risk of further capital destruction at TWM and increases the likelihood that we will see other value realization events down the line.

Other paths of value realization

The main catalyst for TWM’s re-rating will be a successful Pipestone sale. But there are also a number of other ways to win here.

Due to 69% ownership of LCFS the company not only fully consolidates the financials but also provides guidance only on a consolidated basis. The added complexity, visually high LCFS debt, and elevated capex are likely a drag on TWM’s share price. Management seems to be well aware of this and during Q2’23 call said they are considering trimming LCFS ownership and deconsolidating the financials. Such a move would not only help investors to realize the value of the current LCFS stake but would also make the cheapness of the remaining operating assets much more evident. From the Q2 call:

Well, in my mind, a lot of the complexity comes from consolidating our results with LCFS, with the renewables business. We’ve always said that it is not our end goal to own 70% of the renewables business sort of as — in an ongoing way. And we also look at that asset as probably most investors look at it. We think we’re at the finish line. We think it’s tremendously undervalued, certainly relative to anything else in that space. But until we get the thing up and running and cash flowing on a steady basis, we’re probably going to see discount.

So I think that’s probably the easiest way to reduce some of the complexity in Tidewater Midstream is to get to a more normal holding position and to sort of stop — well, eventually stop consolidating those results. But I think that would go a long way to simplifying things, I’m not sure how long it will take, though.

Tidewater Renewables (LCFS) might also be undervalued. I don’t want to expand too much on this and confuse readers with the investment thesis in another publicly listed company, but I think the dynamics here are worth highlighting. LCFS is currently trading at just 4x the projected ramped-up EBITDA once its renewable diesel/hydrogen facility is fully online. Low valuation and investor skepticism regarding management’s projections are not surprising given several project delays and material budget overruns so far. LCFS has basically become a ‘show me’ story with investors waiting to see the real earnings power of the renewables facility rather than following management’s word on it. The market is now pricing in a very large execution risk. However, the project is no longer in the construction phase and was put online last month. If the earnings will eventually turn out to be closer to management’s projections, LCFS share price could skyrocket, giving a material positive boost for TWM as well. From Jan’23 TWM’s call (at the time LCFS was trading at C$11.4/share vs the current C$7.8/share):

Obviously, renewables currently has about $50 million of EBITDA. And these results, again, are consolidated into the Tidewater Midstream results. And again, that’s why you’ll see both debt, obviously, as well as our cash flow once it gets consolidated. But if you look at renewables as a stand-alone business and again, it trades on the TSX as well, it’s a — these renewables companies have tend to trade in the 10x multiple range.

Again, this is not guidance or anything. This is just where things are tending to trade in the renewable space. We’re going to have about $150 million of EBITDA there. That should be a considerable bump over the — what, $650 million EV enterprise value that it currently trades at. So we’re looking for to demonstrate that the facility works to demonstrate that the economics are as we model them, and we are hoping to see that, that gets revalued.

While management has so far stated that the proceeds from the sale of Pipestone will be used to repay debt and fund general corporate expenses, I think capital return to shareholders is not completely out of the cards yet (might be just wishful thinking on my side). TWM will receive half of the C$650m sale proceeds in cash and the other half in AltaGas stock. Taken in aggregate this more than covers the company’s current net debt, while at the same time, there is no need to repay the existing debt in full. Given that TWM has already completed maintenance turnarounds at its refinery and midstream assets in 2022 and 2023, there should be no significant short-term capital expenditure needs either.

Exiting the stake in AltaGas may take some time, especially if the sale terms include lock-up provisions. However, once that is done and TWM deleverages to more comfortable levels, there should still be a significant amount of proceeds available for distribution to shareholders. Both Birch Hill and Kicking Horse, two of TWM’s largest shareholders, are currently sitting on material losses on their investment in TWM and are highly incentivized to the shares upwards. Substantial capital return might be the best way to lift TVM’s share price, and it is something that the company can easily orchestrate given the size of Pipestone’s sale proceeds. I expect to hear more on this after the closing of the Pipestone sale. Management promised to update guidance and issue a strategic outlook once the deal is completed.

Potential risks

- The termination of Pipestone sale. AltaGas is definitely a credible buyer and, given the seemingly low risk regarding the Pipestone II FID decision, I believe the deal will proceed smoothly. However, even if the sale was to get terminated, the downside should be limited. Pre-announcement levels are only 6% below the current prices. One could argue that the pre-announcement price already incorporated some premium due to the ongoing strategic review, so the stock reaction could be steeper.

- Exposure to AltaGas stock price. Half of the C$650m Pipestone proceeds will come in the form of 12.5m AltaGas stock (around 4.4% stake) issued at C$26.07/share valuation (currently C$26.06/share). It’s not clear yet if the issued shares will include any lock-up requirements. Nonetheless, I believe any risk from the buyer’s stock volatility is minimal. AltaGas is a large midstream/utility company with a very stable share price over the last 2 years. Gradual disposal of AltGas stake in the open market should also be possible as the daily trading volume is around C$16m. A spin-off of the stake to shareholders could be another option.

- Execution risk at the new LCFS renewables facility. The market is currently pricing LCFS like the management’s projected earnings will mostly turn to nothing. I believe this is way too conservative and LCFS shares already reflect a pessimistic outlook. Meanwhile, good earnings and any material re-rating of LCFS should have a very positive effect on the TWM price.

- Management wasting sale proceeds on some other projects. I would be quite surprised by this given that the company has clearly changed course since the previous CEO/founder resigned and Kicking Horse took the chairman’s role last year. The strategic review and the Pipestone sale were the two big positive moves since then. I think it’s likely the current direction of value realization will prevail and we will see some further positive developments down the road.

Debt seems rather large 1.1 billion? Isn’t this an issue?

The C$1.1bn debt figure you noted includes the consolidated debt from LCFS. The holdco-level net debt is considerably lower at C$0.6bn, which would be entirely covered by the proceeds from the Pipestone sale.

Any recommendations for books on consolidation accounting? It seems as though understanding the consolidated accounts is one of the key’s to understanding the thesis better.

I do not think a full grasp of consolidation rules is key to understanding the thesis, but there should be plenty of online resources that could help with that. TWM provides some hold-co level figures (i.e. fully excluding LCFS financials) and I think these are the ones that investors should be looking at.

At risk of sounding ungrateful for what I still think is a good idea: presenting it as 2.5x EBITDA stub is rather optimistic. Your way, to its credit, does enable easier comparison with the peers, and does reflect what you’re exposed to IF they exit two other chunks of value:

1) you are removing from EV the value and earnings of a majority-owned subsidiary, just because it’s listed. The listing for sure enables easier exit from that sub than if it was unlisted, but unless they actually sell this you are not accessing the stub on 2.5x, Yous are accessing a mix of both.

2) you are not getting all cash for the sale. You are stuck with stock in the acquirer for some time.

I think a fairer way of looking at it would be proportionate ownership of the stub and the listed sub, plus the stake in the acquirer, with an appropriate SOTP discount that would indeed vanish once the other two were exited,

There are many ways to look at this and which one turns out to be fairer depends what will the company do with its public stakes in AltGas and LCFS. I find it easier to grasp the setup by positioning it as sum of the parts play with two stakes valued simply at market prices. But I fully understand where you are coming from. Assuming an additional holdco discount, operating assets would appear more expensive and the expected return would become smaller.

Why is the market so negative on LCFS? Trades at 3-4x 2024 fcf if management projections pan out.

Anyone here who knows more about this space? Are 30%+ ebitda margins reasonable for a renewable fuel refinery?

I like the idea. But i think a huge headwind is the horrible negative sentiment geared renewables right now. Especially Canadian ones – see AQN and BEP.

LCFS looks like it will kill this.

Tidewater reported quite solid Q3 earnings with a few positive updates and a few very minor setbacks. The thesis remains fully intact. The Pipestone asset sale is expected to close this quarter after which we should hear more updates on further plans for TWM remainco and capital allocation. Remainco is still very cheap trading at 1.9x-2.3x 2023E EBITDA and 32% discount to cost basis. The stock is expected to re-rate after the asset sale is completed. Meanwhile, optionality on the LCFS stake value inflection has gotten more interesting now that HDRD facility is finally online and is expected to ramp up during next year.

However, I’m a bit puzzled market’s reaction this earnings release and a 5% decline in TWM shares. It might’ve been due to the minor TWM 2023 EBITDA guidance cut, which resulted from additional HDRD launch delays. Nonetheless, delays are now in the past and the facility is online (I’ll provide more color below). So this price reaction seems a bit unwarranted in my eyes.

Key highlights from the earnings below.

First of all, the Pipestone sale is progressing as expected, with regulatory approvals already received. Management is positive that the FID decision will be finalized shortly. The process is in the final innings of the commercial contract arrangements as well as certain project-specific EPC (Engineering, Procurement, and Construction) contract negotiations. The asset sale is expected to close this quarter.

A nice positive is that management does not expect to launch any major growth projects for the remaining assets so far, which refers to my previous speculation that capital return is not completely out of the cards here yet.

Businesses are performing well across the board with PGR now showing record level throughput volumes after the recent turnaround. Crack spreads also remained high. Midstream assets have been performing great, except for the slight throughput slump at Ram River due to unexpected maintenance.

One small setback is that HDRD facility had some further delays before finally launching the commercial production on November 7. The launch was previously expected in mid-September. This delay resulted in the reduction of LCFS H2’23 EBITDA guidance from the previous C$35m-C$45m to C$25m-$35m. Consequently, TWM 2023 EBITDA guidance was also cut from C$190m-$210m to C$180m-$200m.

However, the positive surprise here was that the facility is already running at half of its capacity and the ramp up is expected to be very quick. On the LCFS call management noted that it’s a matter of weeks, not months. HDRD’s EBITDA generation projections at full capacity remained unchanged at C$90m-C$115m. It was once again highlighted that LCFS is undervalued – management expects the share price to rebound after HDRD facility ramps up and starts generating more substantial cashflows.

Management has also noted multiple times during the call that the value realization process is not finished yet with multiple options remaining. However, they want to wait for the HDRD ramp-up to see where the things (probably meaning LCFS share price) will settle. From TWM call:

A bit more color on the Q3 financials:

– Both revenues and consolidated adj. EBITDA is up by 10% QoQ to C$582m and C$48.6m, respectively.

– Operating income was at C$4.3m vs. a loss of -C$4.2m in the prior quarter.

– Consolidated net debt increased to C$953m from C$888.5m, meanwhile, deconsolidated net debt increased to C$618.9m from C$595.4m in Q2. This was mainly driven by increased working capital commitments related to PGR turnaround and delayed commercialization of the HDRD facility. With both of these events now behind us, management is confident that they will be able to delever quickly after the asset sale closes.

TWM Q3 press release – https://www.tidewatermidstream.com/news/?id=122569

TWM Q3 call – https://app.tikr.com/stock/transcript?cid=287432448&tid=287585303&e=1858817866&ts=2946168&ref=3no6ed

LCFS Q3 call – https://app.tikr.com/stock/transcript?cid=1674772948&tid=1674916507&e=1858087685&ts=2944996&ref=3no6ed

Any updates/news here, or are we still waiting?

No material updates that I have seen.

The transaction closed today 12/22

https://www.tidewatermidstream.com/investors/#title-news-and-events

The company has announced the closing of Pipestone along with an NCIB. https://www.tidewatermidstream.com/news/?id=122570

The announced NCIB for 10% of the public float sounds great, but we still need how serious will the company be about implementing it.

“Tidewater believes that following the closing of the Transaction the market price of the Common Shares may not reflect the Corporation’s intrinsic value and future prospects, and that the purchase of Common Shares may represent an appropriate use of the Corporation’s financial resources to enhance shareholder value.”

What do you make of the price action?

With deal now closed and stock still around its original level, is the investment thesis pretty much intact, or not? Don’t know the situation well, but if management has links to PE investors, wonder if they might hope to plan liquidity, distributions or other fundamental events.

Glb

The thesis has not changed and TWM’s operating business (excluding the LCFS and AltaGas stakes) remains cheap.

One of the catalysts I was looking for was the completion of the Pipestone sale, but unfortunately, that did not help the shares to re-rate.

These are the events/potential catalysts that I am looking for next:

1) TWM has announced a buyback for 10% of the public float but has not started implementing it. Any share repurchases should have a positive effect on the share price.

2) Q4 results (around mid-March) will show the company excluding Pipestone assets for the first time.

3) Together with Q4 results, I would also expect management to shed more light on the plan going forward and any further value realization steps that could be expected in the short term.

I intend to reassess the situation after Q4 results are out.

TWM seems to be moving in the right direction.

The company has swiftly disposed of all AltaGas’ shares received in Pipestone sale for C$340m. That’s C$15m above what was initially stated by the company/indicated in the write-up. Now these funds are sitting in cash on TWM’s balance sheet. Management did not provide any comments on how these funds will be used.

https://www.tidewatermidstream.com/news/?id=122571

New CEO, no mention of capital use, idk if we’ll see all the juicy Altagas capital any longer…

https://www.tidewatermidstream.com/news/?id=122572

A very strange and surprising announcement of leadership change at TWM. I have no idea what is happening behind the curtains. Does anyone have any guesses?

– CEO, CFO, and one more director stepped down;

– No explanation was given for the leadership change;

– The press release does not even mention or thank the outgoing CFO;

– The new CEO (Jeremy Baines) does not seem to have any experience in running public companies;

– The new CFO (Aaron Ames) has no experience with infrastructure asset companies.

A very strange reshuffling and I am puzzled about what is happening.

With the appointment of Mr. Baines as CEO of both Tidewater Midstream and Tidewater Renewables (as was the case with the previous CEO), the chances of any further value realization steps, e.g. split-off/divestment of Tidewater Renewables, have been reduced.

The direction the companies intend to take seems to be more towards continued investment in renewable projects.

“Under Mr. Baines, the organization will work to optimize operational performance of our Renewable Diesel Facility and continue to pursue our strong pipeline of renewable projects currently being reviewed”

The only positive was a vague mention of capital returns among other targets for the company:

“We are entering a new phase focused on operations, cash flow, prudent capital allocation, and return on capital, with safety remaining at the top of our list.”

Due to increased uncertainty, I have reduced my TWM position. I will reassess what to do with the rest of the position when we get some clarification on what is going on (maybe with Q4 results).

Press release – https://www.tidewatermidstream.com/news/?id=122572

Jeremy Baines – https://www.linkedin.com/in/jeremy-baines-499634152/

Aaron Ames – https://www.linkedin.com/in/aaronames/

An acquittance of mine worked with him at AltaGas. I’ll see if I can muster anything up.

Anyone have insight into the collapse of the LCFS share price?

I haven’t seen any news that could have driven this price action. The stock is quite illiquid, so the downward pressure could have been easily created by a few larger exits.

The sell-off coincided with the surprise management change – I commented on this on Jan 22. This affects both TWM and LCFS. But worth noting that LCFS is down only 10% from the levels in Nov-Dec. Other biodiesel producers (DAR) have also sold-off over the last few weeks.

Also – see this article for a discussion on the Renewable Diesel market, which got oversupplied at the end of 2023. https://www.spglobal.com/commodityinsights/en/market-insights/latest-news/agriculture/020124-us-rins-complex-collapses-in-2023-driven-by-oversupplied-biomass-based-diesel-market

Chevron idles two biodiesel plants

https://www.reuters.com/business/energy/chevron-idles-two-us-midwest-biodiesel-plants-profits-slip-2024-03-01/

10% buyback plan.

https://finance.yahoo.com/news/tidewater-midstream-infrastructure-ltd-announces-120000935.html

Now we need to wait and see if management will actually start implementing this buyback (a big IF, especially given the recent change in management). But if implemented, such a buyback would go a long way in pushing TWM shares upwards. To fill the buyback the company would need to buy 25% of the average daily volume for more than a year.

Impairment charge was horrendous. Stock clobbered today.

TWM thesis has fully fallen apart. In hindsight, the abrupt CEO change at the end of January was a clear indication that the setup was changing and it was time to start packing up. My comment on Jan 22 was spot on and I should have exited the position fully.

“A very strange and surprising announcement of leadership change at TWM. I have no idea what is happening behind the curtains <...> Due to increased uncertainty, I have reduced my TWM position. I will reassess what to do with the rest of the position when we get some clarification on what is going on (maybe with Q4 results).”

I am taking a loss on the rest of the position and moving on.

Value9, thank you again for sharing this idea. if you have a different view on the current situation, please let the board know.

Q4 results were very disappointing. Management has confirmed the suspicions that they will continue investing in renewable assets. TWM has started a new JV to build a new renewable diesel and SAF facility in British Columbia. This move doesn’t inspire much confidence, given how they’ve previously handled the HDRD renewable diesel project construction at LCFS (multiple delays and budget overruns). Admittedly, they do have a new CEO now, yet he still has to prove himself.

Any form of capital return won’t be a priority for the company going forward. Even the current 10% NCIB program is not expected to begin until the end of 2024 after the upcoming refinancing is completed. The CEO also mentioned potential tuck-ins, etc. during the conf. call.

Financial performance was lackluster, to say the least. Q4 EBITDA for the continued businesses stood at only C$11m vs C$34-C$36m during each of the first 3 quarters of 2023. The decline was explained by lower refining margins and diesel demand. The annual consolidated EBITDA came at C$163m, below the previous C$180m-C$200m guidance.

Forward guidance wasn’t provided, however, management did drop several pretty confusing/contradictory hints about the outlook. On one hand, management emphasized the focus on cost-cutting (in the range C$15m-C$20m) and noted that “consolidated cash flow and EBITDA in 2024 will materially exceed 2023 levels.” On the other hand, production volumes for the remaining downstream/mistream assets were guided down by 10%-18% for 2024. During Q4, TWM has also made a massive C$480m non-cash impairment on the midstream assets, explained by higher interest rates and the “idling of certain individual asset components due to current market crisis for certain commodities.” Given how the whole setup looks at this point, this comment from the CEO during the call wasn’t very comforting either:

“We have a huge focus on generating cash flow and reducing costs. It’s a different mindset than the previous management team did. They focused on headline EBITDA, which had caused them some problems, frankly, and that won’t be happening with this team.”

Considering the updated financials, the company now trades at 4.7x 2023 deconsolidated EBITDA and 18% discount to cost basis. TWM is no longer a special situation opportunity and given the company’s track record so far, I’m no longer willing to stay for the potential play on the expansion into renewables.