Ascential (ASCL.L) – Large Asset Sale & Special Dividend – 30% Upside

Current Price: £2.7

Target Price: £3.6

Upside: 33%

Expiration Date: Q1 2024

This is an interesting and potentially timely ‘large asset sale + large capital return’ setup. A number of similar situations have worked out pretty well on SSI.

Ascential is a UK-listed company that operates three distinct businesses: Product Design (offers subscription-based market research reports), Digital Commerce (provides e-commerce-related services and software), and Events. Last week, the company announced the sale of the first two segments for net cash proceeds of £1.2bn or 86% of ASCL’s current EV. These transactions are set to close in Q1’24.

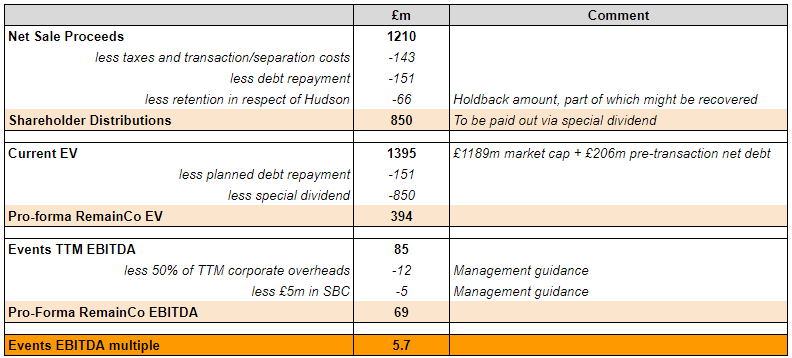

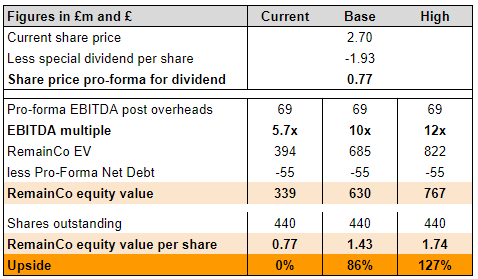

After closing, ASCL intends to distribute £850m (or £1.93/share) of the proceeds to equity holders via a special dividend. Pro-forma for this distribution and debt repayment, the remaining Events business currently trades at only 5.7x TTM EBITDA, which is substantially below peers and comparable industry transactions. I would expect ASCL shares to re-rate to a more reasonable 10-12x EBITDA once the disposals close. Such valuation would result in RemainCo trading at £1.43-£1.74/share or £3.36-£3.67/share including the planned special dividend.

The disposals of WSGN / Product Design and Digital Commerce businesses seem very likely to close without any issues. These transactions mark the culmination of the company’s break-up plan announced in Jan’23, whereby management decided to sell the Product Design segment and list the Digital Commerce business in the US. Shareholder approval should be easily obtained as the divestitures appear to value both businesses fairly. The risk of the acquirers walking away is also negligible. The WSGN / Product Design business is set to be acquired by Apax Partners, one of the largest private equity firms in Europe with over $65bn in AUM. Apax Partners has a longstanding history with Ascential, having previously acquired a controlling stake in the company in 2008 before subsequently listing the business in 2016. WSGN seems to have grown primarily under the PE firm’s ownership. Meanwhile, the Digital Commerce segment is set to be acquired by Omnicom, a large $15bn market cap company operating marketing and advertising agencies.

RemainCo / Events Business

Ascential’s Events business primarily encompasses two key events – Cannes Lions and Money 20/20.

Cannes Lions comprises the prestigious annual advertising/marketing festival, as well as several digital subscription-based platforms providing access to content/resources from the festivals, research on advertising/marketing trends, and workshops/seminars for creative professionals. The event generates revenues from delegate registration fees, award entry fees, and digital subscriptions/partnerships, each accounting for roughly a third of the total. Cannes Lions is the world’s largest and one of the oldest (organized since 1973) advertising and creative award shows.

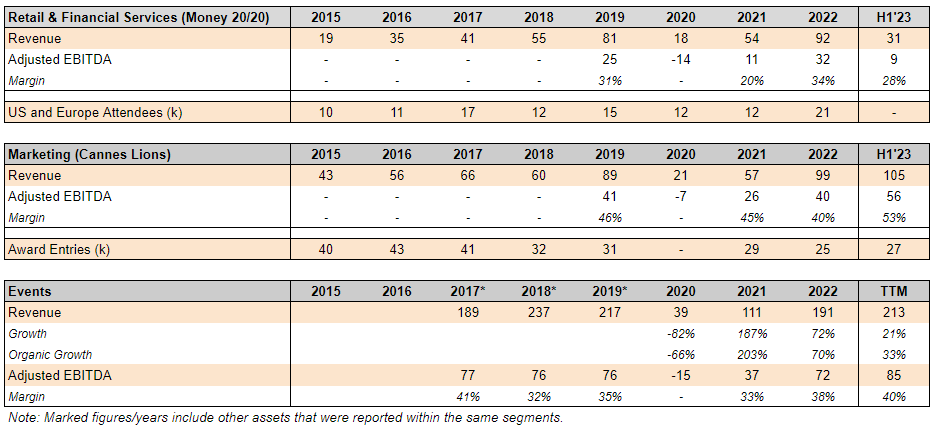

Cannes Lions’ sales grew steadily during the 2015-2019. This growth was driven by the launch of new digital offerings, such as Cannes Lions Digital Pass, and increasing revenues from commercial partnerships. The business has shown a strong operational performance rebound post-Covid, with revenue and EBITDA reaching or exceeding 2019 levels in 2022. This year’s sales for Cannes Lions are 40% above the 2019 levels. The recovery in operational performance is primarily attributed to the return of physical events, growing sponsorship revenues, and the expansion of subscription-based digital platform revenues. Cannes Lions delivered a 43% TTM EBITDA margin, broadly in line with the 46% back in 2019.

Money 20/20 is a fintech conference held annually in Europe and the US. Events include presentations and panel discussions featuring the largest fintech industry players. While Money 20/20 also offers digital subscriptions, the proportion of sales is much smaller (7%), and the majority of revenues are generated from the registration fees paid by attendees. Money 20/20 is renowned as the largest fintech industry event in Europe.

Money 20/20’s topline growth between 2015-2018 was largely propelled by the strong expansion of the European event (launched in 2016). ASCL also launched the Asian version in 2018-2019. Post-pandemic, Money 20/20 made a strong recovery with the resumption of in-person events, increased sponsorship revenues, and higher investment in the fintech sector. Pre-pandemic revenue and EBITDA levels were surpassed during 2022. This year revenue is 55% above the 2019 levels. Money 20/20’s TTM EBITDA margins reached 37%, compared to 31% in 2019.

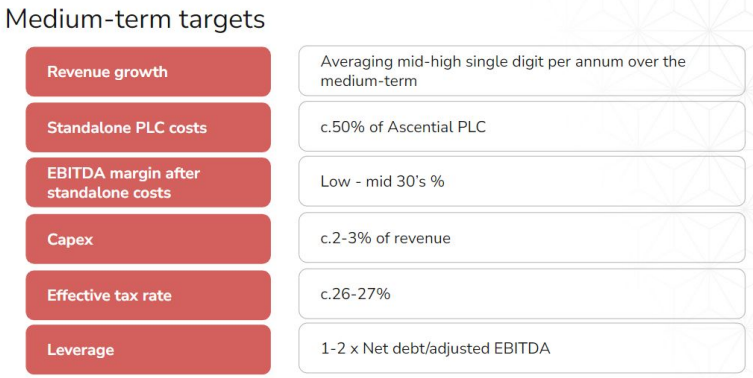

Management expects the growth of the events business to continue, however, it is set to slow down to mid-high single-digits over the medium-term. While Cannes Lions forward bookings are “ahead of” 2023 levels, management noted that forward bookings are not fully representative of expected Cannes Lions growth.

Part of the reason, when our advisers first looked at these results, the opening question to me, was aren’t you being a bit conservative in your growth rates, your sort of mid- to high single-digit growth rates? And the answer is the reason that we are doing this is to basically say we’re not expecting to grow every year, of course, at the sort of 25%. But we do think over the medium term, that sort of mid- to high single-digit growth for the Events business is the right place to pitch this at. We’re very conscious as we look into next year about the funding environment for Money20/20 and the health of the end markets within Marketing. That’s very much weighing on our sort of guidance as we will start to formulate it as we get towards the end of this year.

In terms of profitability, RemainCo is expected to generate low-to-mid 30s EBITDA margins after corporate overheads. This appears to be in line with the pre-COVID and TTM profitability levels after deducting a portion of corporate overhead. Management has stated that it expects to operate RemainCo with half of the pre-transaction central costs, along with an additional £5m in share-based compensation. On a TTM basis, this would result in £16m in pro-forma overhead burden and £69m in pro-forma stand-alone EBITDA for the RemainCo.

Peers trade materially higher

With £69m in pro-forma stand-alone EBITDA, this business currently trades at 5.7x EBITDA, which seems to be well below peer/transaction levels.

- EEX, a US-focused trade show organizer, trades at a 12.2x 2023E EBITDA multiple. The majority of EEX events have not yet rebounded to pre-Covid levels, however, operational performance is expected to improve markedly in 2023 and come closer to 2019 levels ($100m in 2023E EBITDA vs $57m in 2022 and $128m in 2019). EEX has exhibited a slower growth profile during 2016-2019 but boasts a more diversified events portfolio compared to Ascential’s Events business. EEX’s share price might also be elevated by the recent takeover rumors.

- INF.L, a larger and much more diversified events business, is currently trading at 12.8x 2023E EBITDA multiple. Similarly to EEX, INF’s operational performance has not yet fully recovered to pre-pandemic levels, primarily due to Covid lockdowns in China. While revenues are expected to fully rebound to 2019 levels already this year, EBITDA is still projected to come in c. 15% below pre-pandemic levels. The peer might deserve a valuation premium over ASCL’s Events business due to its size/scale – the largest exhibitions provider in the US and the second-largest in China, £11bn EV.

- Hyve Group, another B2B events organizer, was recently acquired at a 19.4x 2023E EBITDA (or 11.6x 2024E EBITDA). Although Hyve’s profitability was already near pre-Covid levels at the time of the acquisition, further profitability improvement was expected due to a recovery in China and expansion into other end-markets.

- Tarsus Group, a similarly-sized private B2B events business with operations in the US, Europe, and Asia, was recently acquired by INF.L at 10x 2023/2024 EBITDA.

Peer multiples, coupled with RemainCo’s capital-light business model, premium event brands, and pricing power (as indicated by solid organic growth rates), suggest that RemainCo could reasonably trade at 10-12x TTM EBITDA, which would result in £1.43-£1.74/share. Together with the special dividend of £1.93, that is £3.36-£3.67/share.

Although in a recent conference call, ASCL’s management stated that there are no ongoing takeover discussions related to the remaining business, the events business might still get sold shortly. Back in March, there were rumors that Providence Equity Partners, the acquirer of peer Hyve, was exploring bids for Ascential’s Events division (an interesting detail is that Hyve’s CEO had previously led Ascential’s Events segment from 2011 to 2016). Then in early October, Sky News reported that a consortium of buyers, consisting of Hyve Group and MediaLink, had approached Ascential with a takeover bid for the Events segment. While I not basing my thesis on this, given the increased M&A activity in this sector and the high quality of ASCL’s events assets, a potential sale of the RemainCo to another industry player or a financial buyer would not be surprising.

Additional upside from Hudson retention and WSGN earnout

There might also be incremental value coming from the £66m Hudson retention and £50m potential earn-out related to the sale of WSGN business.

The £66m (or £0.15/share) cash retention relates to the sold put option on one of ASCL’s investments – the supply/demand-side advertising platform provider Hudson MX. ASCL has been a minority shareholder and a preferred stock/debt holder since 2018. As part of Hudson’s Feb’23 equity/debt restructuring, ASCL increased its equity ownership from 8% to 36.5% (alongside a preferred stock investment), with the possibility to further raise its stake to 79% via a put option granted to the 51% shareholder MTII. Both companies have recently initiated Hudson sale process, with completion expected in H1’24. As part of the agreement between Ascential and MTII, ASCL will fund any shortfall between the £66m (i.e., the purchase price of MTII’s equity and debt instruments) and the proceeds received by MTII when/if Hudson is sold. If the sale is not completed by Apr’24, Ascential will need to pay the full amount to MTII. It is not yet clear if the sale can materialize, however, Omnicom Group, the buyer of ASCL’s Digital Commerce business, has recently confirmed its participation in the sale process. On top of the £66m cash retention, part of which might be released in case Hudson gets sold, ASCL’s common equity and preferred stock investments in Hudson might also result in incremental value.

WSGN earnout is a much longer-term shot – Ascential is entitled to a maximum £50m earn-out from the WSGN sale to Apax Partners. The earn-out would be payable by Apax Partners in case of WSGN’s IPO or disposal of the majority stake at a higher than 3.5x return on invested capital. Ascential would then receive 50% of the proceeds payable to all shareholders in excess of the 3.5x ROIC threshold, with the potential maximum payment capped at £50m.

Several more notes / risks

- One of the key uncertainties relates to potential taxation on the £850m special dividend. My understanding is that the majority of the distribution will be treated as a return of capital. Any taxation on this distribution would eat significantly into the upside. ASCL expects to provide further information on the timing, form, and quantum of the special dividend “in due course” after the pending transactions are completed.

- The transaction announcement mentions that a portion of the special dividend will be subject “to the completion of a refinancing of the Ascential Events business.” However, while the refinancing amount has not been specified, I do not expect this to be an issue given ASCL’s manageable debt burden (relative to both EV and EBITDA).

- Several of ASCL’s institutional investors have materially trimmed their stakes since the announcement of business disposals. These include the Capital Group Companies (from 5.1% to 2.4%) and Jupiter Fund Management (from 10% to 4.9%).

- ASCL’s Events business relies heavily on its two core events, which implies a higher risk of a significant negative impact on operational performance if either of the events underperforms. However, this risk is somewhat mitigated by the short-term nature of the setup with a focus on a share price re-rating after the completion of disposals and special dividend payout. All major events for the year have already taken place, with the next Cannes Lions and Money 20/20 Europe events scheduled only for Jun’24.

I own this so agree with the overall thesis but:

1) net debt is guided to c. £100m at year end not £55m (you may be using HY23 actual, but there are known outflows eg M&A/earnouts in H2).

2) I think there is material risk to Money20/20: Fintech mostly proved to be uneconomic / bubble. If I’m right both earnings and multiple need caution. They already guided that Money USA is down 8% in H2 2023, so ought to assume the 1H24 event will be too. Thankfully most of the earnings are from Cannes Lions.

3) I also take £5m share based compensation (guided) off their guided Adj EBITDA.

1) Ex-Locust, you are correct about net debt. In the latest conference call, management stated that a pro-forma net debt of £100m is expected at year-end (vs £55m I have used based on Q2 results). Thanks for spotting. Adjusting for this, the target prices are reduced by c. 0.1/share (i.e. 3% lower) and ASCL’s RemainCo is currently trading at 6.3x pro-forma EBITDA.

2) I agree that there is a risk of Money 20/20 underperforming next year given a softer fintech environment. While management has stated that forward bookings for the Europe event in 2024 are in line with 2023 levels, forward bookings might not be fully indicative of actual performance. However, the play here is more on a short-term share price re-rating after the completion of disposals and a special dividend payout, rather than an outright bet on Events valuation. But even if there is a short-term cut in outlook of Money 20/20, as you suggest, the majority of Events earnings are from Cannes Lions.

3) As for the stock-based compensation, I have deducted £5m in SBC to arrive at RemainCo pro-forma EBITDA (see the first table).

As was expected, today ASCL shareholders approved the sale of both divisions.

https://www.londonstockexchange.com/news-article/ASCL/results-of-general-meeting/16256602

ASCL completed the sale of its Digital Commerce division. As anticipated, the CEO has stepped down and transitioned to the new company. Ascential has appointed Philip Thomas as the new CEO and an executive director to the board.

The sale of the second division, WGSN, has received all regulatory clearances, and the transaction is expected to close at the beginning of February 2024.

Further updates regarding capital return are likely to be announced shortly thereafter.

https://www.londonstockexchange.com/news-article/ASCL/update-on-sale-processes-governance-and-financing/16272066

Isnt the deal derisked by now? Why has the stock not performed better (forced sellers given deal?)?

I think it’s a number of things.

1) many holders or potential buyers would pay intolerable tax if the capital return is a dividend. (Or some income funds would bizarrely prefer not to receive one huge divi!) So they have to sell before ex-date, or wait until after ex-date to buy. And it’s still unclear whether it will be a divi or a “capital gain” and with/without any mix-and-match.

2) it’s unappealing for a fund mgr to lock up 70%ish of their money for maybe 3 months while the market roars up. To put 1% of your fund in ASCL stub you have to sell nearly 4% of other stuff.

3) fear of a bad Hudson outcome

4) director selling (probably due to tax) = they are not currently in talks to sell Events. And maybe people worry that this is a bad signal about Hudson, or trading, etc but unless Mgmt wants to go to jail, it is NOT these things.

It has been trading up, remember +5% on the stock is like +20% on the stub.

I think Events (PLC) gets bid for immediately after a Hudson exit is signed (if it is!). This is a great investment.

Just to confirm – UK has no dividend WHT, correct?

@mmaher I’m not a tax expert by any means, but I think that you’re correct.

https://taxsummaries.pwc.com/united-kingdom/corporate/withholding-taxes

As per Ex-Locust comment above, ASCL’s CFO has sold GBP2.5m of her stake in the company at 2.88/share. Not a good sign. CFO should have intimate knowledge of any deliberations regarding the planned capital return (and potential taxation on it) as well as insights into the value of the remaining businesses. But at the same time, she might not have been allowed to sell if she was privy to any information that would negatively affect the share price upon disclosure.

I intend to wait for the closing of WSGN sale and capital return before reassessing the situation.

From the recent filing:

“On 4 January, Mandy Gradden sold 850,000 ordinary shares. This results in a remaining shareholding of 424,962 ordinary shares, in addition to share awards over 1.2m shares under the Company’s share plans. Therefore, her remaining shareholding significantly exceeds the Directors’ Shareholding guideline and her interests remain strongly aligned with shareholders.

https://otp.tools.investis.com/clients/uk/ascential2/rns/regulatory-story.aspx?cid=1295&newsid=1746271

That’s a significant sale and odd timing. Negative unless buying the remainco.

I think timing is a) have to trade before closed period; b) have to sell because 45% divi tax on c. 67% of the stock price is a catastrophe relative to 25% capital gains tax on only the gain.

Forgive me – I’m new to international investing. Do we know how taxes will affect Americans? Does the dividend tax get paid to the UK and will it be withheld? Do we get a US tax credit against that? (in other words, making this a better investment in the US than in the UK?)

It is not yet clear what kind of form will the return of capital take, so before knowing that it is hard to tell what the tax implications could be for US-based shareholders.

Not a tax expert, but seems to me this is an opportunity for US investors. No WH tax in the UK. We get to receive a dividend and if the stock drops by the amount the dividend, there is a tax arbitrage because ST capital loss tax rate > dividend tax rate. And then the RemainCo will probably rerate anyway.

A few remarks from my side:

1) I think you are double counting the planned debt repayment of 151m, which increases the RemainCo EV and its implied multiple

2) Additional bridge items include not only PF Net Debt of 100m but also deferred contingent considerations, leases, provisions, and interests in Infosum and Hudson. Therefore, I deriva an implied multiple of 7.0x which is higher but arguably still below peers’ values

Hello Renhelix, perhaps I can help? On your 1) I don’t think he is, though it appears twice in his table it’s in two separate sums? 2) all the deferred consideration is being paid out (so use the guided just over £100m PF net debt, don’t use that AND add deferred consideration) or are going with the disposal group. I believe but can’t prove that Infosum is going with the disposal group – anyway it reduces EV if kept. Leases are not really debt but reasonable people can differ on this. Provisions – apart from the Hudson-related ones, what provisions do you think remain with Events? I believe nothing is really left.

See Circular page 50. Re Infosum: £13.9m out of £PLC’s £24.9m investments are being disposed of. Leaves £11.0m of which Hudson was £10.3m (see HY23 note 10).

£3m provisions remain with Events, a rounding error.

That page also confirms all deferred consideration is going away.

Hey,

My understanding is that the 151m are for the disposed businesses and the 850m dividend is net of that. Deducting it again to receive the PF Events EV seems like double deducting to me.

Thanks for pointing out the page on the circular. Good to see that deferred contingent consideration is going away. We also should account for the preference shares of 87.7m in Hudson – this should at least have some value given that the last funding round occurred in Feb-23

1) No double counting, these are two separate calculations: the first one is showing how to arrive from sale proceeds to the £850m capital return figure, and the other estimates EV of RemainCo. That EV from my calculations needs to be higher by £50m as management indicated the expected EV by year-end of £100m

2) Cash is already deducted as a reserve for these items. If e.g. Hudson payment turns out to be lower than the reserved amount, this would result in incremental cash for the company on top of my calculations.

The second divestment has been successfully completed as WGSN sale closed yesterday. Management has reiterated the intention to return £850m to shareholders and will now determine the appropriate form of return. Potential options include a special dividend, a buyback, a tender process, or a combination of these. The decision will be taken in the coming weeks.

ASCL’s share price pro-forma for the capital return stands at £1.08/share. This implies around 8.4x EBITDA valuation. At 10x-12x multiple, the remainco would be worth £1.33-£1.64/share.

https://www.londonstockexchange.com/news-article/ASCL/completion-of-the-sale-of-wgsn/16314592

Share price has a spike up to GBP 3.40 and now is back down at just below GBP 3.00. Couldn’t find any news. Any body know why there was a bit of a spike?

ASCL reported 2023 figures today.

850m will be distributed via tender offer, special dividend and on-market buybacks during ’24 after AGM

Adj. EBITDA in line with projection when adjusted for PF corporate costs and increased SBC

They are quite cautious regarding Hudson MX proceeds and expect closing in H1-24, would not assume significant proceeds, maybe a few cents per share

ASCL reported 2023 results and provided details for the capital return program:

1) The £850m capital return will be split 3 ways and be carried out in the order listed below. These distributions will still need to be approved by shareholders, with a meeting expected in May.

– Tender offer for £300m at a maximum price of 331p. I am guessing the tender range will be 300-331p. This will leave c. 350m shares outstanding.

– Special dividend of at least £450m or £1.29/share (I have the company to clarify if this will be treated as return capital return or a dividend, and they said that full details will be issued in the coming weeks)

– Subsequent share buyback program for £100m. Assuming it gets fully filled at 181p (315p-129p dividend), the share count will be reduced further to 295m.

2) The sale of Hudson MX is in progress and is anticipated to be completed in Q2 2024. Could be a further £66m or £0.21/share (using post-tender and post- buyback share count).

3) Pro-forma net debt at year-end stands at £106m (in line with management’s guidance).

4) 2023 Adjusted EBITDA from continuing operations was £56.4m – this is expected to increase to £69m with 50% reduction in corporate overheads going forward.

Proforma for the tender offer/dividends/buybacks, RemainCo events business trades at a market cap of £534m and £640m EV. This business is set to earn £69m EBITDA. The 9.5x multiple is materially above the 6.3x when the write-up was posted, but I am tempted to wait for the commencement of the tender offer and maybe even payout of the special dividend.

How come the vast difference of the implied valuation of the RemainCo today vs at the beginning?

The stock price has increased.

It’s also because ASCL has a ton of cash. Therefore, small fluctuation in the current equity value has a disproportionally large impact on the remainco EV and the multiple.

Details of the tender offer and the additional capital return have been released. The important aspect is that the special dividend will not be treated as a return of capital and therefore will be taxed at the individual investor level as dividend. It might be worth moving ASCL shares to a tax-sheltered account before the dividend payout (beginning of June).

– Tender range is set at 315-331p per share. The company will repurchase £300m worth of shares or around 21% of the market cap. ASCL currently trades at the lower limit of the tender range.

– The meeting to approve the tender offer has been moved to an earlier date, April 22. Meanwhile, the tender will stay open from April 5 to May 3. The payment for tendered shares will be made on May 8.

In case the tender offer is undersubscribed, unallocated capital will be paid out as a special dividend so that the capital return via tender offer and special dividend equals £750 million.

– The final amount to be returned via a special dividend will be announced on May 8. The dividend will be paid on June 3.

– The £450m (+ what is left from the tender offer) special dividend will be treated as dividends and taxed accordingly at the investor level.

– The remaining £100m buyback authorization will kick in right after the special dividend is paid out.

Capital return announcement: https://www.londonstockexchange.com/news-article/ASCL/proposed-return-of-value-of-ps850m-to-shareholders/16406722

Tender offer circular: https://www.ascential.com/files/content-files/investor-docs/Circular%20for%20Tender%20Offer%20and%20Share%20Consolidation%20and%20Notice%20of%20General%20Meeting.pdf

Since the stock trades at the low end of the tender range, is there an opportunity here to buy the stock and tender, hoping the TO get done at a price higher than 315p?

It’s not worth it to play on the tender alone. Even though it’s a relatively large tender (21% of mcap), all of the event-driven investors involved here will be heading for the exit, so it is likely to be oversubscribed.

No withholding tax on dividends in the UK for foreigners, no?

I’m an Australian resident and use Interactive Broker. Received a notification from IB about the corporate action but nothing to act on in their Corporate Action Manager.

Checked the tender offer circular, and it turns out that Australia is a Restricted Jurisdiction, which means I can’t tender my shares. Anyone else in this situation? If so, what are you doing?

Hey guys, any reason why the stock is trading below the lower bound of the tender offer price here?

Tender is not for all shares, only ~21% as DT mentioned above. So the stock could trade lower post-tender. Given the thesis, it looks like the stock should be trading above the tender’s higher limit so I, for one, will not be tendering any shares.

Kind of my point, 750mn to be returned on a current market cap of less than 1.4bn, so yeah I would expect it to be well supported, maybe just function of market liquidity and someone wanted out. I was just checking I wasn’t missing anything. Thanks

As expected, shareholders approved the capital return program. As a reminder, the tender offer will expire on May 3, with payment scheduled for May 8. The special dividend will follow shortly after on June 3.

Any thoughts on whether to tender the shares? Too bad that the special dividend will not be treated as a return of capital.

I intend to participate in the tender at the upper limit. The £100m buyback will amount to 15% of the pro-forma capitalization (post-tender and post-dividend) and I expect it to put upward pressure on the share price.

And yes, ideally, ASCL position needs to be moved to a tax-sheltered account to avoid taxes on the dividend portion of the distribution.

So would the correct sequence here be to participate in the tender offer at the upper limit then buy shares again to take part in the special dividend/future price movements?

“Restricted Jurisdictions: means Australia, Canada, New Zealand, Kuwait, United Arab Emirates, Israel, Oman and any country, region or territory which is the subject of any comprehensive Sanctions (including, in each case and without limitation, Cuba, Iran, North Korea, Syria, Russia, the Crimea Region of

Ukraine, the so-called Donetsk People’s Republic and the so-called Luhansk People’s Republic)”

When is/was the deadline for tendering at IB? I haven’t received any notification about the tender, I don’t live in a restricted jursidiction

Deadline was 29.4.

Ascential announced results of the tender offer, which was oversubscribed and priced at the lower limit of 315p. This was kind of expected given where the shares were trading during the offer period. However, I find it positive that only a third of shareholders headed for the exist at 315p.

The next catalysts are the special dividend (shares will begin trading ex-dividend on 20th of May) and subsequent launch of the £100m buyback.

https://www.londonstockexchange.com/news-article/ASCL/tender-offer-results-and-special-dividend/16458696

Flurry of actions, dividend, 10for 17 consolidation. How have your thoughts regarding target/value shifted here?

You would need to divide the current stock price by 1.7 to arrive at the previous stock price before the consolidation.

So far we have:

– stock price at the time of the write-up = 270p

– dividend received (per old share) = 128.6p

=> remaining investment (per old share) = 141p

=> remaining investment (per new share) = 241p

This compares to the current price of 339p. So far a gain of 21%.

The company now has 206m shares and market cap/EV of £700m, which is close to my base case scenario (10x multiple of £69m EBITDA). However, I am continuing to hold shares as I think the £100m open market buyback will add further upward pressure for the stock price.

This math seems easy but confusing for me so thx DT. Just to be clear, new share PT is 393p?

As I explained above, the RemainCo already trades at my base case EV of £700m (using 10x EBITDA multiple for the remaining businesses). So I would not call out any specific share price target. I simply want to wait and see if there will be any effect from the £100m open market repurchases that the company is now committed to carry out.

The buyback kicked off without delay. Yesterday, ASCL repurchased around 94k shares at an average price of 324.25p/share. That’s £305k out of the £100m buyback program.

https://www.londonstockexchange.com/news-article/ASCL/transaction-in-own-shares/16505769

What might explain the very slow pace of buyback? At this pace It will take more than a year to fill the £100m quota.

Maybe management is doing it opportunistically and doesn’t consider the current valuation as cheap?

It’s been a pretty decent part of average daily trading volumes (5-12% depending on the day), and it has clearly helped push the prices up since the start on the 6th of June. Can the pace be faster? Maybe, but I am more than happy to wait and see for a couple of weeks whether the current pace is enough to push the price further.

ASCL has just shared a quick trading update with no surprises. Management is projecting double-digit growth in revenue for both the Marketing and Financial Technology divisions in the first half of 2024. The company continues to repurchase shares almost daily and are buying back 7%-25% of the total daily volume.

https://www.londonstockexchange.com/news-article/ASCL/capital-markets-event-and-trading-update/16521462

ASCL’s management noted that multiple parties are participating in the sales process of Hudson (the part that I considered as potential additional upside). They plan to provide a further update before the H1 2024 earnings release.

https://www.londonstockexchange.com/news-article/ASCL/update-on-the-hudson-mx-sale-process/16544458

Since the start of the buyback in the beginning of June, ASCL has so far repurchased £8.6m worth of shares (out of the £100m total planned).

The buyback pace has slowed down in July – this coincided with the shares approaching/crossing 350p mark. It seems that at the moment the company is not willing to repurchase shares above this price. At the same time this provides a nice support around the current levels while we wait for H1 results and any updates on Hudson sale (as per comment above).

Hi, dt, ASCL seems to have already hit your previous price target. Are we expecting any positive surprise from the H1 results and conf. call, or are we just considering the current position more as a free option (with buyback providing price support)?

I noted this in the May 21 comment:

“The company now has 206m shares and market cap/EV of £700m, which is close to my base case scenario (10x multiple of £69m EBITDA). However, I am continuing to hold shares as I think the £100m open market buyback will add further upward pressure for the stock price.”

The buyback has pushed the shares upwards already and we seem to have a floor at 350p, below this level the company seems to be eager to deploy cash to repurchases. So there seems to be little risk to wait for a further update on Hudson sale, which as per management will be provided with together Q2 results.

Story in the FT, £1bn deal (c. 500p/share)… fingers crossed…

Offer looks to be 568p share

ASCL is currently trading at just 1% below the 568p offer. Possibility of Informa raising offer price?

Read the release, there is possibly more if Hudson is sold before deal close.

Informa nears deal to buy Cannes Lions owner Ascential for £1bn

Acquisition would be the latest in the booming events industry

UK events group Informa is in advanced talks to acquire listed rival Ascential, which owns global conferences including advertising festival Cannes Lions, for about £1bn.

The events industry has bounced back strongly from the pandemic, exceeding pre-Covid levels as businesses flooded back to in-person conferences and awards shows.

In the latest deal in the booming events market, Informa is close to striking an agreement to acquire Ascential, according to two people familiar with the talks.

The deal could be announced as early as Wednesday when Informa, the events, digital marketing and academic publisher, is due to report its latest financial results. One person warned that the deal had not been signed and could still not happen. Informa declined to comment. Ascential did not immediately respond to a request for comment.

Ascential has recently simplified its business to be mainly focused on events, with additional revenues from associated subscription and advisory services. This has made it an easier acquisition for Informa, already the world’s biggest events company.

Ascential, which employs about 700 people, announced plans in March to return £850mn to shareholders after the £1.4bn sale of its digital commerce and trend forecasting divisions. Ascential was trading at 367p on Tuesday, giving it a market capitalisation of £749mn.

Informa’s shares have risen by about 14 per cent in the past year, giving the business a market capitalisation of £11.3bn on Tuesday afternoon. The company has grown every quarter since the low point reached during the pandemic, which shut down the global events industry.

Under Stephen Carter, former chief executive of communications regulator Ofcom, Informa has been active in expanding its business through acquisitions, including events group Tarsus from Charterhouse Capital Partners for $940mn in March last year.

The same month, Hyve was acquired by private equity group Providence Equity Partners for $580mn, and rival Cvent by Blackstone for $4.6bn, showing the extent of investor interest in the growing events industry.

Ascential is one of the few remaining events companies of any scale. Analysts at Peel Hunt said Ascential’s events were “prestigious ones, with longevity of growth, which should merit a premium valuation”.

Peel Hunt described Cannes Lions as the “Oscars” of the advertising industry. Ascential also owns Money20/20, a series of key events for the fintech sector held in Asia in April, Europe in June and the US in October.

Ascential held a two-day capital markets event at Cannes Lions this year, where it highlighted the potential for future growth, including M&A opportunities.

Peel Hunt said: “The company has divested many less-prestigious events over the years. This allows it to command premium pricing for delegates and large sponsorship deals, as well as build strong competitive moats.”

23 July 2024

ASCENTIAL PLC

Statement regarding possible offer for Ascential PLC (“Ascential”)

Following recent movement in Ascential’s share price, the Board of Ascential confirms that it has received a conditional proposal from Informa PLC (“Informa”) regarding a possible cash offer for the entire issued and to be issued share capital of Ascential at 568 pence per Ascential share (the “Proposal”).

The Proposal follows a number of approaches by Informa to Ascential in recent months.

Having carefully evaluated the Proposal, the Board is engaged in advanced discussions with Informa regarding the Proposal and confirms that it has informed Informa that it is minded to recommend the Proposal. There can be no certainty that any firm offer for Ascential will be made, nor as to the terms on which any firm offer might be made.

In accordance with Rule 2.6(a) of the Code, Informa is required, by not later than 5.00 p.m. (London time) on 20 August 2024 (being 28 days after today’s date), to either announce a firm intention to make an offer for Ascential in accordance with Rule 2.7 of the Code or announce that it does not intend to make an offer, in which case the announcement will be treated as a statement to which Rule 2.8 of the Code applies. This deadline can be extended with the consent of the Panel on Takeovers and Mergers (the “Panel”) in accordance with Rule 2.6(c) of the Code.

This announcement has been made without the prior agreement or approval of Informa.

A further announcement will be made as and when appropriate.

A much better outcome than I have expected. I have exited my ASCL position at 565p.

In total 70% return in half a year – one of the better outcomes for ideas posted on SSI.

While there is still a chance that Hudson disposal will result in additional payout for ASCL shareholders (net proceeds would come on top of 568p offer price), I am not willing to wait and risk this deal with Informa falling apart for one reason or another. ASCL’s valuation at the offer price is quite rich – RemainCo was trading at c. 6xEBITDA at the time of the pitch, compared to 17x currently.

Safe to say this puppy has panned out beyond our wildest dreams. Happy summer, ladies and gents.