Calumet Specialty Products (CLMT) – Discount to SOTP – 50%-200%+ Upside

Current Price: $16

Target Price: $24-$51

Upside: 50%-200%

Expected Timeline: 1-2 years

This idea was shared by Luis from LVS Advisory.

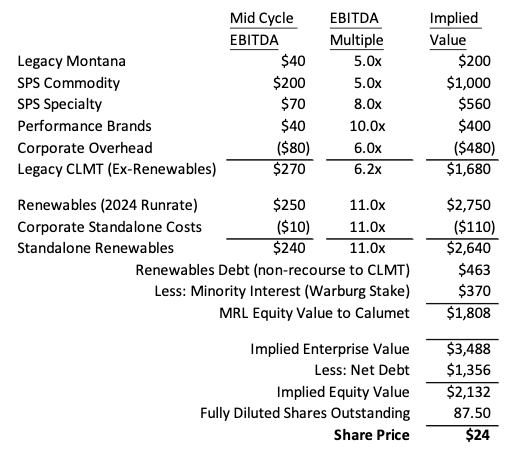

Calumet is a very interesting special situation with multiple of catalysts set to unfold during 2024. CLMT operates a well-established refinery/specialty chemicals business, however, the crown jewel of the company is its newly converted and fully operational renewable diesel/sustainable aviation fuel facility. Based on peer multiples and industry transactions, the sum-of-the-parts equity valuation of CLMT stands at $24-$51/share or 50%-200% above current prices.

There are 3 major near-term catalysts that could close this valuation gap:

- Monetization of the renewable diesel business: Management has initiated a strategic review for this segment and is actively pursuing a sale or IPO in the first half of the year.

- C-Corp conversion: CLMT is currently structured as an obscure master limited partnership (MLP) that doesn’t even pay dividends. This structure significantly restricts the pool of potential investors and the stock’s liquidity. The planned C-Corp conversion, which is anticipated to be finalized by mid-year, should attract a substantial influx of new investors and enhance liquidity, contributing to a re-rating of the stock.

- Securing financing for renewables plant expansion: Expanding the plant would significantly level up the business and double its EBITDA generation potential. CLMT is on the brink of securing a funding agreement with the Department of Energy (DOE) at exceptionally favorable terms. However, there should be plenty of other parties willing to finance this project, which boasts an estimated internal rate of return (IRR) of around 50%.

If these catalysts materialize as expected, it’s easy to see CLMT’s share price doubling by the end of 2024 or even tripling through 2025, particularly if the planned expansion of the renewable diesel plant progresses smoothly.

Calumet Background

Calumet is a specialty refining company with three reportable segments: Specialty Products & Solutions (“SPS”), Performance Brands (“PB”), and Montana/Renewables (“MRL”). As a refiner, Calumet purchases untreated feedstocks on the open market and refines them into fuels and specialty chemicals.

The SPS segment refines commodity fuel products (gasoline & diesel) as well as specialty chemicals that supply various consumer products including Vaseline, Chapstick lip balms, Hawaiian Tropic tanning lotions, and Johnson and Johnson baby oil. SPS’s commodity products account for a majority of segment volume and sales but a minority of segment earnings due to lower commodity margins. SPS’s specialty chemicals supply dozens of different consumer products and generally represent a small cost relative to the final product value sold; therefore, SPS’s specialty chemicals is a diversified and recurring business with relatively high switching costs.

The Performance Brands segment sells branded products to consumer and industrial end-markets. For example, the Royal Purple brand is a lubricant for cars that is sold in big box retailers like Home Depot. Because the PB segment owns the brands, it has pricing power and earns higher, double-digit EBITDA margins with relatively low capital requirements. PB is the highest quality business in Calumet’s portfolio; however, it serves relatively mature end-markets and is slow-growing.

The Montana/Renewables segment consists of two distinct assets both located at the Great Falls facility. There is a commodity refining train producing asphalt – this is the less sexy side of the segment. In addition, there is a refining train producing renewable fuels including renewable diesel, renewable naphtha, renewable hydrogen, and sustainable airline fuel (“SAF”). The renewable train started ramping up in 2023 after a successful multi-year plan to convert a legacy “dirty” commodity refiner into a “clean” renewable fuel that is completely net zero carbon. Much of the future value of Calumet lies in the potential value of the renewable refining asset that Calumet has just ramped up to production.

Calumet revealed the plan to reconfigure its Great Falls refinery into a renewable fuel refiner in 2021. Calumet spent ~$550 million over 2.5 years to reconfigure the plant. This capex was financed through multiple debt and equity raises from Oaktree, Stonebriar, and Warburg Pincus. Oaktree and Stonebriar provided secured debt financing secured against the equipment purchased. Warburg Pincus provided equity financing in the form of a $250m convertible preferred equity check which converts to 14% ownership of the renewable asset. These are all sophisticated investors with deep experience in the energy world and with expertise in renewables (Warburg has a track record in renewable energy). Importantly, Warburg’s check underwrote MRL at a $2.25 billion valuation.

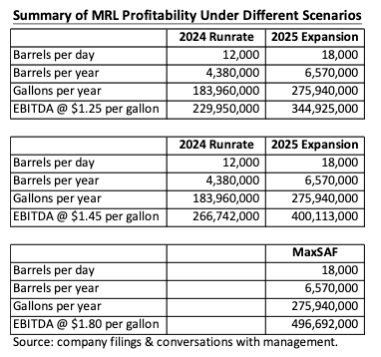

After a multi-year investment period, Calumet brought MRL online on-time and on-budget in Q2 2023. 2023 was a choppy year for MRL, the team had to work through a few operational issues, including a crack in the hydrogen tank, and refine less profitable treated feedstock. However, the renewable line was working at 100% by the end of the year and is expected to deliver EBITDA in the range of $230m – $270m from virtually no EBITDA in 2023. $250m of EBITDA on a $550m capex budget is a solid return on investment, especially considering the annual opex for the train is $10-$15m.

Today, MRL primarily produces renewable diesel (75% of volume). Renewable diesel (“RD”) is a large and growing market in North America which is decarbonizing the heavy trucking industry. However, Calumet’s plan is to expand the production from 12,000 barrels per day to 18,000 barrels per day in 2025 and convert the majority of the production volume to Sustainable Airline Fuel (“SAF”) which sells at a premium to renewable diesel and is therefore more profitable. MRL’s hydrocracker has a nameplate capacity of 25,000 barrels per day but due to permitting restrictions and a need to run at ~80% utilization, the actual production capacity is limited to 12,000 bpd today and 18,000 bpd after the debottlenecking expansion.

The plant currently produces 2,000 barrels per day of SAF (17% of volume). The plan to expand and convert a majority of the production to SAF is known as the “MaxSAF” plan. MaxSAF would require an additional investment of $300 to $400 million but could double the segment’s EBITDA from ~$250 million to $500 million within 3 years.

Sustainable Airline Fuel is a new and exciting market within renewable energy. SAF is made from low-carbon intensity feedstock such as tallow and vegetable oil and refined into high-cetane diesel fuel that can be used by legacy internal combustion engines. Therefore, the appeal of using SAF as part of the energy transition is that it does not require customers to invest in new infrastructure (storage tanks, specialized jet engines, pipelines, etc.). SAF sells at a premium to conventional jet fuel; however, the industry is pressed to find solutions to decarbonize their operations and SAF is currently the most viable tool. The airline industry has made a commitment to get to net zero emissions by 2025 and according to the materials released by IATA, the industry’s self-regulatory organization, SAF alone will account for 2/3 of the decarbonization goal.

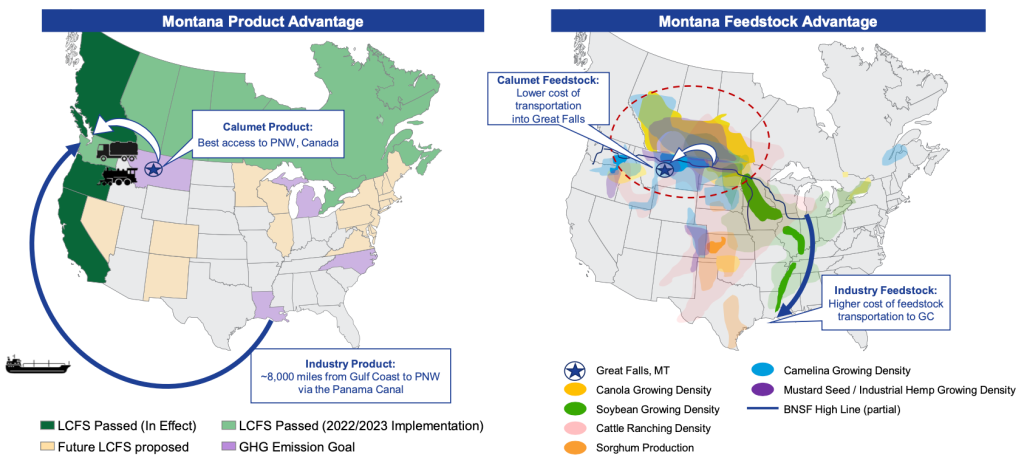

The market for SAF is more established in Europe where there are currently government mandates to blend a certain amount of SAF in all commercial flights. There are no such mandates in North America (yet) but there are several federal and local tax credits to incentivize production. The blender’s tax credit is a federal program (renewed by the Inflation Reduction Act) that pays refiners $1 per gallon sold. The EPA administers the renewable fuel standard program which pays refiners a premium based on the market value of RIN credits. In several states and Canadian provinces, there are local tax credits that stack on the top of the EPA and Federal credits. The California LCFS program is the most established local credit program but similar programs are coming to Oregon and Washington State as well as most of provincial Canada where Calumet currently sells 70% of its renewable fuel.

Calumet has several competitive advantages in selling RD and SAF. First, the refinery’s location in Great Falls, Montana, is strategically located near Canada, California, and the Pacific Northwest which are all major markets for renewable fuel. Calumet has low-cost shipping routes by rail and truck to these attractive geographic markets. The Great Falls location is also strategically located near large supplies of low-carbon intensity feedstocks that can be converted to fuel. Great Falls is in the heart of the corn belt (vegetable oil), near cattle farms (tallow), and has abundant supplies of camelina, to name a few. The feedstock and transportation advantages translate into a $0.40 per gallon cost advantage for Calumet vs. the industry average.

Great Falls is both an early mover in the SAF market and benefits from deep operational experience as a long-lived refiner. Today, Great Falls is the largest SAF producer in North America, a title that would be further sealed by the MaxSAF expansion. There is competing production coming online but the announced production wouldn’t scratch a dent in the large market for jet fuel. The Great Falls refinery is over 100 years old and has seasoned managers, many of whom have worked at the site for over 40 years. This is likely a contributing factor to why Calumet was able to deliver the reconfigured plant on-time and on-budget and bolsters confidence that the company will meet its production targets.

Putting it together, Calumet’s renewable fuel refinery at Great Falls is an exceptional asset in an exciting market. This specialty refiner would fetch a healthy valuation premium to legacy refining assets if sold.

Three short-term catalysts

The Calumet story gets more complicated. An M&A binge from 2011 to 2015 left the company over-levered and the debt ratio was pushed further by the MRL reconfiguration. The company has generated $284 million in EBITDA over the past 12 months vs. $1.4 billion of net debt on its balance sheet. With renewables online, the company should conservatively be able to generate over $400 million of EBITDA in 2024 which implies a more manageable leverage ratio of ~3.4x. Management’s near-term goal is to simultaneously de-lever the balance sheet and fund the MaxSAF expansion. The company is pursuing two paths to accomplish this: a loan from the Department of Energy and the monetization of the renewable fuel asset.

Calumet has been in the application process for a loan with the Department of Energy for 2 years to help finance MRL. Last year Calumet moved into the underwriting phase of the process and believes a decision will be reached by mid-2024. The loan would carry an interest rate tied to the 20 year treasury bond (~4.5%) and would provide between $500 and $1bn of total debt funding. This compares to the company’s current debt with coupons in the ~13% range.

Calumet is also running a strategic alternatives process for MRL. The process will result in either an outright sale of MRL or an IPO of ~20% of Calumet’s stake. I believe MRL is worth somewhere between $3 and $5 billion based on an 11x multiple on the expected $250m EBITDA for 2024 and the potential $500m EBITDA under MaxSAF. This valuation is supported by Warburg’s minority investment done at a $2.25bn valuation before the plant was fully commissioned. Assuming a $3bn IPO valuation, Calumet would be able to raise over $500m from the IPO.

Calumet has also announced that it will be converting from an MLP to a Delaware C-Corp by mid-2024. Calumet suspended its distribution in 2016 as a result of over-leverage and has not benefited from the MLP structure. Many investors, including passive indexers, are not able to own MLPs. Therefore, the conversion to a C-Corp will improve the stock’s liquidity and help bring new investors into the story, potentially lifting the valuation.

Insiders appear bullish as well. Calumet’s General Partner, the Heritage Group, owns over 15% of the company and agreed to receive out-of-the-money warrants as part of the compensation for converting to the C-Corp. There has also been insider buying from the management team. The CEO recently purchased long-dated out-of-the-money call options in the open market.

However, there are several key risk factors worth considering.

Risks

First, there is risk the financing from DOE and/or the MRL IPO doesn’t come through due to market conditions or other factors. If Calumet isn’t able to gain access to the capital markets and de-lever, the company may not be able to fund its MaxSAF plan and realize the full potential of its renewable asset. One mitigating factor is that there has been a recent trend of energy industry consolidation and there is also a great deal of interest in renewable energy assets from the large E&P companies. I believe that someone would be willing to step in and help finance Calumet’s renewable asset, but the price may not be as attractive in a tougher market.

Second, the economics of RD and SAF depend on a number of government subsidies. There is serious ‘stroke of the pen’ risk if, for example, a new Trump administration wants to de-fund renewable energy programs. A mitigating factor is that there are a number of programs from different regulating bodies. Congress controls the inflation reduction act, the EPA controls the renewable fuel standards, and states control their own programs. It is also worth noting that Calumet currently sells 70% of its renewable fuel to Canada.

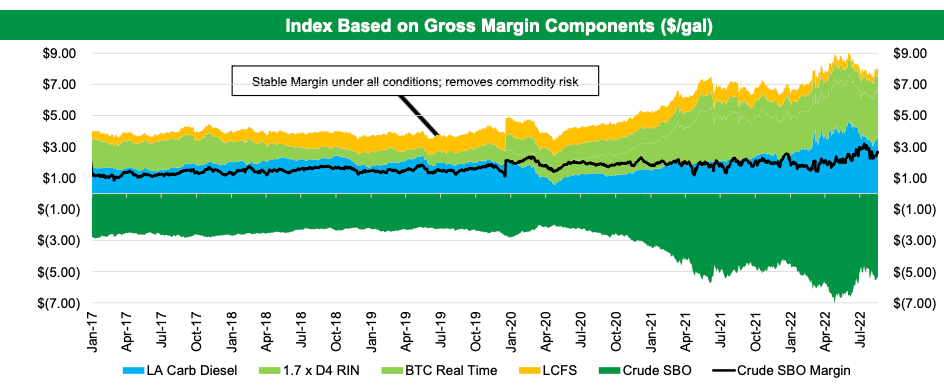

Third, RD and SAF are relatively new markets and the unit economics haven’t been proven over a full market cycle. Mitigating the risk of unknown or changing market unit economics, Calumet has provided a framework demonstrating consistent industry margins over the past 7-8 years showing that RD producers consistently generate profits of $1.50 to $2.50 per gallon even as different components of the inputs and outputs swing in price. Furthermore, Calumet has a $0.40 cost advantage vs. the industry average and can sell SAF at a $1 per gallon price premium vs. RD. Most RD facilities will not be able to easily convert production to SAF which should allow Calumet to earn excess profits for at least the medium term while the market for SAF continues to grow.

Fourth and finally, the non-MRL side of Calumet generates 2/3 of EBITDA from commodity markets that are currently earning above mid-cycle margins. If or when the cycle turns, legacy Calumet will see earnings decline. One aspect to making a bet on refiners is that there is no new refining capacity coming online in the US and much of the legacy capacity is converting to renewable energy or is shutting down. Therefore, some analysts believe the refiners could continue to earn above-cycle profits for longer than would be expected in a normal cycle. However, for conservative, I underwrote mid-cycle EBITDA in my assessment of valuation.

Valuation and a few other thoughts

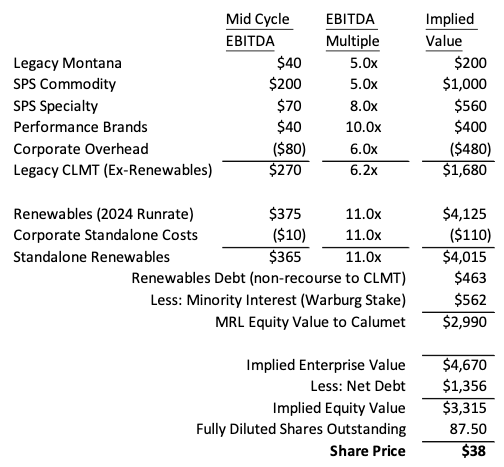

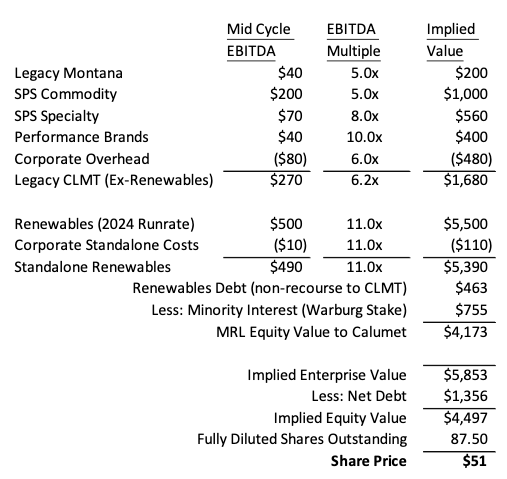

This brings us to the valuation portion of the analysis. Given the multiple hard catalysts that could crystallize the value of MRL, I have used a sum-of-the-parts methodology for valuation.

The valuation range is between $24 and $51 vs. the current share price of $16.

A few notes on the valuation assumptions:

- The company has estimated legacy CLMT’s mid-cycle EBITDA to be between $250 – $300 million and my estimate falls in the middle of that range;

- The 5x multiple for the commodity refinery assets is consistent with publicly traded refiner peers including VLO, MPC, DK, and DINO;

- The 8x multiple for SPS Specialty is consistent with publicly traded chemicals peers including EMN and BASF;

- The 10x multiple for Performance Brands is consistent with publicly traded specialty chemicals peers including PPG, VVV, and IFF. Aramco’s acquisition of Valvoline’s Global Products business is a good comp for PB;

- There are no good publicly traded comps for MRL. DAR and VLO have renewable diesel exposure but it is not a large share of their EBITDA. Chevron’s acquisition of Renewable Energy Group (“REGI”) at 10x EBITDA in 2022 is an OK comp. REGI is primarily a biodiesel which is an inferior market vs. renewable diesel. Therefore, MRL should carry a valuation premium over REGI;

- The diluted share count of 87.5m is the expected fully diluted share count post C-corp conversion, including 2m warrants with a $20 strike price.

Scenario 1: Calumet is valued on MRL’s 2024 run-rate EBITDA

Scenario 2: Calumet is valued on MRL’s 2025 expansion case EBITDA

Scenario 3: Calumet is valued on MRL’s 2025 MaxSAF expansion case EBITDA

Why the opportunity exists?

I believe there are several reasons explaining the large gap in price vs. value. First, the MLP structure limits the pool of potential buyers and does not provide the stock with enough trading liquidity for larger investors. Second, many investors are unfamiliar with the SAF market and do not fully buy into the narrative that MRL can generate $200m+ of EBITDA in 2024. Third, Calumet is highly levered and will depend on MRL ramping up quickly and/or access to the capital markets. High leverage is simply a risk many investors aren’t willing to take.

There are a few other risks and complexities. CLMT has a balance sheet liability associated with RIN credits which are expected to be written off pending a court judgement stemming from an EPA lawsuit. I don’t believe there is much risk here because the court has ruled in favor of CLMT and we are just waiting for the judgement.

Some investors are skeptical of the general partner, Heritage Group, given the poor track record of running Calumet historically. However, the Heritage Group recently sold HCCI and there are clear indications that they are serious about crystalizing the SOTP value of Calumet (c-corp conversion, ongoing strategic alternatives process, etc.).

At the end of the day, Calumet is a complex and messy asset as it exists today but there is clear value in the renewables business and there are multiple hard catalysts that will re-rate the stock and get investors paid.

Below are some excerpts from my conversation with Luis on CLMT:

SPS normalized EBITDA

– Question: How confident are you in your mid-cycle EBITDA for SPS (legacy CLMT ex-MRL). Management is guiding $250m-$300m, yet also noting that the 5-year average has been $257m, and that this number should was significantly lifted up by the tailwinds of the last 2 years. Hence, should the actual normalized EBITDA here be something closer to $210-$230m instead? What explains this higher $250m-$300m guided mid-cycle EBITDA at the moment?

– Answer: This is an area where I am still doing work. I had 2 detailed calls with IR where I went asset by asset and they gave me their range of “normalized” EBITDA and how they think about it and I took the low end of their range for every asset and that’s how I got to my numbers. I cross-referenced my numbers to CLMT’s historicals and believe I am within the right ballpark, if anything maybe a bit conservative. This is certainly one of the challenges because the 2020-2021 results are not very comparable and 2022 is too high. Pre-covid there was a lot of M&A and different accounting treatments, so difficult to have high confidence in these numbers without going asset by asset with management. As an aside, part of my thesis is that refining will continue to be capital-starved and will earn above the normal cycle average longer than most people expect – which anchors my view that the numbers I am using are conservative.

Fair multiple for MRL

– Question: How comfortable are you with the multiple on MRL in your valuation scenarios? Peers provided in management’s presentation kind of back it up, but most of those don’t seem very comparable. Also, what do you think about DAR? Management previously used to refer to it as a peer, but now it trades at 7x+ EBITDA and is no longer featured in the presentations. The most important reference is probably the REGI transaction at 13x (2022). However, the buyer was arguing that REGI will experience massive growth in the coming years and the multiple on 2025 EBITDA was projected to be around mid-high single digits. It’s quite unlikely that any buyer, and especially the stock market, would now look at MRL and write a check at a 12x multiple for post-expansion/Max SAF $500m EBITDA. This refers mostly refers to your 3rd valuation scenario. Thus, isn’t this scenario a bit too aggressive maybe?

– Answer: There are no good comparables to MRL. REGI is the closest but it is a lower-quality asset because biodiesel is an inferior market vs. renewable diesel. Further, I believe there should be a premium for MRL vs. other RD because of how well it is positioned for SAF and its geographic proximity to the best end-markets & feedstocks. Most of the public comps (DAR, VLO, etc.) deserve discounted multiples because they have exposure to lower-quality end markets or final products. If you want to be very conservative, you can assign a 10x multiple. I did run a bear scenario where I assigned a 10x multiple to MRL and lower multiples to the legacy asset. I think in my worst-case scenario my SOTP was $22 – $23 per share, still far above the current ~$16 price. At this price, you are taking more execution risk of MRL getting up to production vs. valuation risk IMO. You also have a structural discount due to CLMT still being an MLP and relatively low liquidity in the stock. I asked IR why energy analysts didn’t like CLMT’s story more and the response was” We still get basic questions about what SAF is and the unit economics. Analysts have never seen this kind of asset before so they inherently don’t fully trust it and discount our assumptions of unit economics until we show the numbers.

Financing

– Question: I’m not sure I get the financing risk correctly. Why is this such a big deal when the implied IRR on the expansion/MaxSAF investment is 50%-100%. With this IRR/timeline, the difference between getting the loan at 5% or low double-digit interest rates should not be an issue, isn’t it? Do you think trying the muni bonds (which they’ve tried and failed due to SVB bankruptcy-related turbulence last year) again this year could work?

– Answer: I agree. I believe there would be multiple parties including strategic & financial players willing to backstop the next stage of CLMT’s expansion. However, the DOE process represents the lowest cost of capital, so why not take free money?

Weak insider buying

– Question: With such a massive short-term inflection opportunity and tons of catalysts this year you’d think management would jump at every opportunity to buy the stock, especially during the drop to $14/share last year. Yet, the buying has been lackluster so far with barely any purchases last year. Everybody is talking about the recent LEAPs purchase from the CEO, yet that was only for $18k, so pretty negligible. This seems rather strange to me. Do you have any take on this?

– Answer: I view the CEO leap buy as bullish on the margin, obviously LEAPs are levered. There has pretty much only been net buying from insiders in recent years. More importantly, Heritage group agreed to accept more equity and warrants with a $20 strike as compensation for the C-corp conversion (and their tax bill). I view this as a bullish bet being made by Hertitage group and a view that the stoke will be way above $20 in the near future.

Management and the controlling shareholder:

– Question: What’s your take on management and The Heritage Group? The track record was quite poor before the recent transition to renewables started and I think that’s part of why the current discount persists even today – investors are waiting for the actual tangible results. Also, it’s quite difficult to read into the actual incentives/plan of The Heritage Group. The recent HCCI sale and the current strategy for CLMT suggest they’re willing to monetize everything and maybe even sell SPS/legacy eventually. However, they’ve done many missteps historically and the recent CMLT presentations hint at a potential M&A path for SPS following MRL IPO. Doesn’t this create a risk that the discount at SPS might persist even after the business split? On the other hand, Heritage agreed to relinquish board control and will have only 3/9 seats in the new C-corp structure, so I’m not really sure how to think about all this.

– Answer: Yeah, Heritage clearly has a poor track-record w CLMT. The rumor is that the family is in need of cash which is why they sold HCCI and are now positioning CLMT for monetization. They used to collect a nice dividend from CLMT but they can’t due to the over-leverage which is why they have been re-configuring the asset. My belief is that they will sell MRL to a strategic and IPO is a fall-back plan. They will then de-lever the legacy asset and resume the dividend or sell that asset as well. In regards to their track-record, much of the negatives can be associated with M&A decisions made by prior mgmt (and approved by heritage). What I view very positively is how well the MRL execution has gone so far. If you lay out what they said and what they have done since 2021, they have hit every milestone on time and on budget. The announcement of the C-corp conversion also proves that they are serious about getting the stock price higher and cleaning up the asset.

RINs Obligation:

– Question: More of a minor point, but do you have any view on CLMT’s RINs obligation, which is not exactly that small. There was some good news regarding the Small Refinery Exemption (SRE) litigation with EPA last year. I’m not really an expert in this field, yet does it really make sense to fully disregard RINs, when it’s not even clear if all/how much of this obligation will get eliminated if SRE is reinstated eventually?

– Answer: Double-edged sword because if CLMT owes the RIN liability, then the entire market will become forced buyers of RINs which would actually be a strong earnings catalyst for MRL (benefits from high RIN prices). However, based on my reading of the facts and discussions with the company, it looks like the Small Refinery Exemption will be granted in some form. There are some other quirks about the RIN market which would make it difficult for the RIN liability to actually result in a financial impairment – i.e. there is no market for cash settlement of RINs. IR also noted to me that investors and the sell side doesn’t understand how RINs work which contributes to the discount on CLMT’s stock. I spent some time learning about RINs but I am also still working on speaking with industry experts to better understand the dynamics here.

Eliminated SOTP slide:

– Question: Management has taken out their SOTP slide from the most recent investor decks in November and December. Quite strange given the ongoing IPO/sale plans for CLMT and other upcoming catalysts. Isn’t this slightly alarming or maybe at least suggests a changed outlook on the previous valuation estimates/targets?

– Answer: I don’t really read anything into this considering the company has an active strategic alternatives process ongoing. If anything, my guess is they don’t want the SOTP math to anchor bidders too much. However, they haven’t really had a non-lev fin conference presentation since that slide, so perhaps they haven’t had a good venue to discuss that side of the story in a few months.

Warburg Pincus investment:

– Question: One interesting point regarding investment is how clearly it has been communicated that both CLMT management and Warburg considered the actual fair value of MRL to be much higher than $2.25bn. Management mentioned this in the call, whereas the preferred stock has been structured so that the return on prefs is greater of 8% IRR or 1.35-1.4x MOIC. At 1.4x MOIC, the valuation would be $3.15bn.

– Answer: Yes, I would be surprised if MRL gets valued below $3bn based on the Warburg investment, barring changes to the macro environment.

Regulatory/tax credit risk:

– Question: CLMT is already selling a lot of RD to Canada. In case some bad developments happen to US subsidy programs, would it be possible for CLMT to increase exposure to Canada?

– Answer: Yes. Canada recently passed new legislation that provides tax credits for RD & SAF. It is important to keep in mind how large the market for RD & SAF is and how under-supplied the market currently is. This is a little cavalier but my assumption is that CLMT goes MaxSAF and the supply/demand dynamics won’t really matter for the next several years due to how out of balance the market is.

Interesting idea with excellent detail in writeup and Q&A. But that balance sheet is terrifying.

whats the downside scenario and implied px?

The real downside scenario is that we get a recession in the US which takes down the refining industry’s margins, if this happens before Calumet is able to monetize MRL it could stretch the leverage multiple. The second bear scenario would be that Calumet is unable to show MRL in the range of $1.25 – $1.45 EBITDA per gallon. We don’t see a clean quarter for MRL until Q1 2024 due to the operational issue they had in Q3. Many industry watchers are skeptical of CLMT’s ability to cash flow MRL; however, DAR and VLO have provided a similar EBITDA per gallon range for their Diamond Green Diesel project.

Being an MLP is this idea unsuitable for Canadian investors?

All non-resident investors will have a 10% withholding tax deducted by the broker when selling CLMT or any other MLP (on gross proceeds, rather than only the profit part). Not sure if that applies to tax-sheltered accounts as well.

However, if CLMT converts to C-Corp during the holding period, tax implications will likely change and non-resident shareholders will no longer be liable for paying withholding taxes upon sale. At the same, time the conversion event itself should not trigger any taxes as there will be no sale of the units. From the corporate transition press release:

Is my understanding correct?

https://www.bamsec.com/filing/119312523274581/3?cik=1340122

I’m pretty certain that I have bought and sold many MLPs before without incurring any withholding tax on the gross proceeds. I’m a non-US resident investor and I have filed an updated W8-BEN. This is news to me. Perhaps I need to review my old brokerage statements to confirm this for sure.

The withholding tax was introduced on Jan 1, 2023. Did you sell any after that date?

No, it was before. Thanks for the clarification!

Just for clarification, if I buy Calumet stock now, will I be liable for the withholding tax after they convert, since I bought before the conversion took place or will I be fine as long as I sell after the conversion took place?

I’m a german resident and use IB btw.

I think you should not get taxed if you sell post-conversion.

my only thought here is that CLMT is fairly well known on fintwit, but valuation hasn’t budged. Obviously if you are right on the fundamental setup it will just show that investors were too balky, but I have come to fear the fintwit curse.

I would be skeptical of CLMT if there wasn’t a hard catalyst but we have 2-3 solid catalysts for a re-rating. I think this lines up nicely despite the sentiment.

What’sup with cash flow? Quick look says last 3-years all negative FCF and negative cash flow from operations 2 years? is this the buildout of the renewables/SAF business?

The company has invested over $550m in capex for the renewable diesel facility. That asset is now starting to cash flow. I expect the company to show $250m+ in FCF for 2024.

Does the C-corp conversion come with any tax implications?

The GP will foot the tax bill and is getting compensated for that. There may be small tax leakage for minority unit holders but the details aren’t 100% known yet.

As Dalius mentioned above, this should be tax-free to unit holders. However, one area I haven’t gotten clarity on is if the c-corp conversion would trigger any UBT tax. It is possible that realizing a gain on the RIN liability due to the conversion could result in some UBT liability for retirement accounts but I am not sure.

Management expects the conversion to be tax-free for unit holders: “The associated merger is intended to be tax-free to unitholders subject to potential recapture for some unitholders as a result of the change in tax status from a partnership to a C-Corporation.”

I have received a a transcript of AlphaSense expert call on CLMT with a former Calumet’s VP. It was mostly focused on the SPS segment rather than Montana, with the gist being that CLMT’s specialties business has a pretty strong moat, pricing power, and good relationships with key customers. But it has historically suffered from a lack of focus from management, continuous acquisitions, etc. That might be changing now. Due to copyright, I am not able to share the whole document, but hopefully, no one will get hurt from a couple of excerpts below:

What would happen to the NAV if clean energy subsidies go away next year?

Calumet’s income flows through to you and if you’re a non-US person then aren’t you supposed to start filing tax returns in the US to report that income?

The long-term track record is worrying. The company hasn’t made any money in the last 20 years even if we exclude the recent $550m spent on the renewables segment and acquisitions. It reported EBITDAs but had no FCF conversion. It made distributions and acquisitions all from debt. Seemingly good things are always just around the corner. I wonder if the MaxSAF plan is yet another attempt to kick the can down the road.

DAR and VLO have done better and much better, respectively. I kind of doubt this difference can only be attributed to management or M&A. Given the leverage we can’t afford much impairment in the NAV.

There is stroke of the pen risk on the subsidies but it isn’t simple for them to all go away because they are controlled by 3-4 different regulatory bodies (Congress, EPA, states). We have visibility on the current subsidy programs through 2027 and most will likely be renewed.

The trackrecord on MRL is pretty good (delivered on time and on budget). TBD on if MRL will hit guided financial targets this year. The rest of CLMT’s business is generating cash right now but this could change if the economy suffers.

From minute 32 onwards, solid discussion on CLMT specifically. The previous episode also goes into more detail on SAF for those interested.

https://open.spotify.com/show/5OXBdcyxYWOEcN8Y2aO6v9

Hey ODC, this just links me to The Business Brew on Spotify. Can you specify the episode please? Thanks !!

The Pros and Cons of Being Public with Andrew Walker https://open.spotify.com/episode/3MZOFNPzathIku1X6Ag8zE

Kyle Mowery & Andrew Walker both discussed CLMT on their most recent Business Brew podcasts

The board has approved the C-corp conversion. The transaction is subject to the majority approval of common unit holders. In the coming months, the company will file an S-4 and announce a date for the shareholder meeting. The conversion is expected to close in 6 months and is expected to be tax-free.

As a side note, the company will announce Q4 earnings on February 23.

The conversion agreement: https://www.bamsec.com/filing/119312524031241/4?cik=1340122

CLMT has released Q4 results. I think these are rather in line with expectations. Both Q4 and the annual 2023 earnings were bad and down significantly YoY because MRL renewables facility was mostly offline during the year, whereas the specialty business margins have experienced ongoing normalization (yet are still above the mid-cycle levels now). Nonetheless, MRL renewables facility is now fully operational and is about to finish burning through the less profitable treated feedstock (expected in Q1’24). No additional details were mentioned in the press release or presentation regarding the run-rate MRL margins or further guidance, so I hope that more color was provided during the conf. call. I’ll read the transcript once it comes out a bit later.

Last year’s financials are now in the rearview mirror and the focus is on the upcoming 3 major catalysts this year. I like how upbeat management was about them in the earnings press release:

Luis, we would appreciate any additional insights or comments you may have on the earnings report.

Press release – https://www.bamsec.com/filing/119312524043574?cik=1340122

Presentation – https://calumetspecialty.investorroom.com/download/4Q+and+FY+2023+Earnings+Slide+Deck+vFINAL.pdf

A few highlights from the conf. call:

– Specialty business lost around $70m last year due to weather conditions (winter freeze and summer tornadoes). That’s a lot given the segment has generated $251m annual EBITDA last year. Some meaningful infrastructure improvements have already been made to increase reliability further on.

– Management’s comments on the C-Corp conversion:

– On DOE loan process:

– Management wants to see at least 1 or 2 quarters of strong operations at MRL in order to “capture proper value from a potential monetization”. Management expects that full potential of MRL will be demonstrated in the second quarter of this year, when the current margin headwinds subside and less expensive feedstock comes into play. Potential monetization is now expected more towards the second-half of the year.

– Margins have recently been under pressure across the entire RD sector. On top of that, MRL has to deal with the remaining expensive inventory, which has reduced the company’s flexibility of switching towards cheaper and more profitable feedstock:

– Margins inflection at MRL is now expected sooner than mid-year. March should be the first fully cleared month (cleared of expensive feedstock) and Q2 should be the first normal quarter for MRL.

– Interesting color on the SAF market and its future prospects (similar to what was discussed in the recent Business Brew podcast):

– CLMT will be refinancing all of the 2024 notes (9.25% interest) + $50m of 2025 notes (11% interest) through issuing $200m of new 2029 senior notes (9.25%).

– Management remains very excited about the MaxSAF plan and will provide more details on it in the next earnings call.

Thanks. These are great comments. I don’t think anything was surprising the in CLMT report. Everyone was expecting a bad Q4 due to the previously announced plant repairs. The good news is that everything has been on track since December and the overall outlook was upbeat.

The thing that really stuck out to me was the discussion of the DOE loan program. You could hear it in mgmt’s tone on the call that they are very excited about the progress they have made. Based on their comments, I am expecting an 8k on approval before the next earnings report.

I was slightly disappointed by the (lack of) discussion of MRL monetization on the call. Nothing new to report here but nothing jumped out (unlike DOE). It sounds like Mgmt is very focused on getting all the other ducks in line (c-corp, doe, stable mrl production) before they ramp up excitement on the prospect for MRL monetization. Everything is on track but the market needs to see them report “clean numbers” before the stock can re-rate.

“No change in our long-term deleveraging plan. We’ve said that we want to reduce $300 million to $400 million of outstanding debt. That continues to be the plan. [ Continued path and ] continues to be a minority sale of Montana Renewables and free cash flow.”

It appears that a complete sale is no longer under consideration, with a minority sale now being the more probable option, with the proceeds earmarked for deleveraging purposes. This situation brings to mind the Warburg transaction. While it did help with putting a value to MRL and initially boosted share prices, it didn’t generate sustained momentum in the stock.

I wouldn’t read that much into the comments. I believe everything is still on the table and very much in play, but potential acquirers/investors are waiting to see MRL’s unit economics show through. We are still ~6 months out from a monetization event.

DAR had its earnings call this morning and spent a considerable amount of time discussing trends at its DGD renewable diesel plant. The takeaway is that DGD saw depressed margins in Q4 of $0.81 EBITDA per gallon and expects margins to increase in 2024 as it takes advantage of lower feedstock prices. They also call out that biodiesel capacity is unprofitable at current prices and therefore expect some biodiesel capacity to come offline if prices don’t move higher. Finally, they were upbeat on the improved margin potential for SAF.

Quotes from the DAR call:

-Lower diesel prices, RINs and LCFS values and a lower of cost or market inventory valuation impacted DGD margins for the quarter. However, DGD had an impressive year with 1.25 billion gallons of renewable diesel sold at an EBITDA per gallon of $0.81, which is still above our 12-year-old investment case of $0.79 EBITDA per gallon

-Now DGD is performing well. And despite concerns about RIN markets and LCFS values, our outlook for this business remains very positive as decreasing fat prices are expected to bolster DGD margins. We are excited about entering the sustainable aviation fuel market in the near future and anticipate margins that are well within the expectations we have communicated.

-DGD has now worked through its pipeline of expensive fat and we’re seeing margins improve there back to where we think they should be for the year

-I’ll come back to you in April after I put a couple more months in the books here, and we see that truly the DGD can widen its margins out at the lower fat prices. And clearly, that’s how we see the business model tracking.

-clearly, the sustainable aviation piece is going to play a key role in widening those margins back at DGD. Clearly, Matt can comment on it later in the call here, we’re seeing some really nice demand. And it’s always the first movers and everybody doesn’t want to be the first mover here, but we’re close. The margins are much better than they are in standard, what I call road diesel or renewable diesel, and we’re excited. And we’ll do our best to get that plant online here sometime later this year and hopefully be up to full rate in ’25 there. And then once again, we’ve changed our business model with the first mover advantage to where we were several years ago

-And then the SAF margins. As Bob commented, we have a lot of interested parties. We are in the margin discussions. They’re complicated. It’s a very different business, selling [ SPK ] blending it with [ Jet A ] and so those things are happening. I’m confident here by the end of first quarter, I suspect we’ll have some deals done. Don’t know how much transparency we can provide at that time. But as we’ve said, the margins are $1 to $2 above renewable diesel

Question: Do you expect biodiesel capacity to turn off?

-what we do as a team every day is as we run an analysis industry-wide or whether it’s waste fats, whether it’s renewable diesel, whether it’s biodiesel, it’s refined soybean oil, crude soybean oil. And [ we were in all the fats and ] look at them. And clearly, what we’ve seen is if you’re in the biodiesel business and you’re running soybean oil today, you’re negative.

-I’d say we haven’t seen a significant reduction yet. I think this industry, as Randy alluded to, it’s largely egg-based and they do a very effective job at hedging and protecting margins for a certain period into the future. So when margins go negative, they don’t necessarily turn it off right away, but it’s something that you expect to see down the road

CLMT has completed the previously mentioned refinancing, raising $200m in 2029 9.25% First Lien Notes to repay the 2024 notes in full and prepay $50m on the 2025 11% Senior Notes. $390m of 2025 notes remain outstanding.

Does anyone know why CLMT is drifting lower every day?

CLMT just released a new slide deck. There is nothing really new in the presentation aside from couple of tables/charts on ow C-corp conversion will be carried out and how internalization of GP will result in 4.5% dilution for CLMT unitholders.

Here is the link: https://www.bamsec.com/filing/119312524073906?cik=1340122

I’m intrigued by the fact that they want to delever but yet are looking for opportunistic M&A. I understand both can work but buybacks would have sounded better to my ears.

I think this is just normal CLMT volatility – the stock has been drifting around $15 for the past two years. I would not read too much into these price swings.

Investors are now waiting for updates on C-corp conversion and DOE loan. The completion of the conversion is expected by mid-year. Meanwhile, the DOE loan update could be announced anytime.

https://calumetspecialty.investorroom.com/2024-04-16-Calumet-Announces-First-Quarter-2024-Operational-Update

seems positive

It’s positive, but all of this was expected and hardly any new details were shared.

The MRL facility has already reached full operating capacity at 12,000 barrels per day, and the remaining high-cost feedstock has been fully processed. Although the results for Q1 will be affected, management remains optimistic that they will “achieve stable and representative financial performance at Montana Renewables going forward.”

The language surrounding DOE loan discussions has remained unchanged, while the C-corp conversion is on track to be completed this quarter.

Can US tax residents buy and sell CLMT stock just like any other regular stock and pay taxes only on the profit? Or will they incur more taxes? Can someone clarify this to me? Thank you!

What special tax treatment are you thinking of? (I’m not a tax expert.)

Been digging in deep into this one. If anyone is interested, there is a detailed 30 page write up on this from 2022 investor letter: https://www.crossroadscap.io/investor-letters/2022-annual-letter

They also have an update from their 2023 letter (published april 2024): https://www.crossroadscap.io/investor-letters/annual-letter-to-investors-2023

Not saying I agree with their valuation but they see this going to $108 in their bull case scenario. They have been involved with the stock since it was around $3.

CLMT just released presentation and transcript from an investor day held on April 18. Not many new details, but the C-corp conversion date has now been set for June/July.

Slides: https://www.bamsec.com/filing/119312524100921?cik=1340122

Transcript: https://www.bamsec.com/filing/119312524125332?cik=1340122

CLMT reported Q1 results. As already known and expected, earnings were bad across the board due to MRL ramping up the capacity and burning through the old feedstock. Other segments also performed worse YoY, largely due to the normalization of the fuel market and a turnaround at Shreveport. MRL has turned profitable in March and reached the full operating capacity in April.

The overall picture regarding the upcoming near-term catalysts remains largely unchanged. C-corp conversion is on-track and is expected to complete in the next 60 days. The same positive communication regarding the DOE loan process continues, yet no additional details have been provided so far. Management has also reiterated the intention to demonstrate a full “clean” quarter of MRL’s operations (which should be this ongoing Q2) before proceeding with any MRL monetization initiatives.

Monetization of MRL remains among management’s key objectives. However, the uncertainty around the timeline has increased given the substantial pressures on the margins in the sector. Gross margins remain 50% below the normalized levels ($1/gallon vs $2/gallon). Management was previously guiding MRL’s EBITDA margin at $1.35/gallon, based on $2/gallon normalized gross margin and $0.65/gallon operating costs. Right now, the implied EBITDA margin seems to be somewhere closer to $0.15/gallon as the costs are currently at $0.85/share (although are eventually expected to drop as the facility “gains efficiencies”), while gross margin is around $1/share. So in the near future, MRL’s performance will stay far below the previously guided figures. It’s remains to be seen whether management will want to sell/monetize the asset at such a bad timing. There’s a risk the whole process might get delayed even more, until the market normalizes. During the conf. call management acknowledged the chance of potential delays “if the market is not supportive”. But conversely, they also suggested that there might be some potential buyers who take a long-term view and may not require ideal market conditions to engage with MRL:

Despite uncertainties around the monetization timeline for MRL, I remain optimistic about the other two near-term catalysts (the C-corp conversion and securing the DOE loan), which are likely to unlock significant value for CLMT in upcoming quarters.

In the conference call, management has provided some good color on how the C-corp is going to create value for unitholders:

And also some comments on the ongoing DOE loan and the upcoming MAX SAF expansion:

Any thoughts now? Is the conversion and DOE loan already priced in?

See the comment above for my latests thoughts on the name. I do not think anything has changed over the last few days. Or have I missed something?

nope you’re right

Legal counsel has sold some shares (11k – 167k value), but given a series of buys lately, i’m not reading too much into this

Looking at the materials on the MRL website they are locked into multi-year contracts for RD delivery with multiple offtakers (1 of which is obviously Shell which buys both SAF and RD). Doesn’t this mean they won’t be able to shift existing capacity to SAF for at least a couple years which at current margins basically means zero profits at MRL for the next couple of years?

Also, note RD margins have continued to deteriorate since Q1 and using their own calcs they imply negative margins for MRL now

Absent the DOE loan boosting SAF capacity isn’t CLMT basically fairly valued now?

Of course, if the management fails to obtain a DOE loan and the RD market continues to lag, CLMT in its current form will continue to struggle. That was clear from the very start, even before the weakness in the RD market was noticed.

However, part of the thesis outlined above is that MRL will be monetized one way or another. And I think any strategic buyer would be taking a longer term view and value MRL based on normalized margins rather than the current cyclical lows. The long-term opportunity for the company is still there; they just need to show that, even if it’s not in the next few quarters. Moreover, we may be surprised about developments in the RD market. For one, the players who were locked in the more expensive feedstock are slowly switching away from it, including MRL, and two, more news is coming regarding the biodiesel capacity shutting down. So, we should see some degree of pricing improvement in 2024; at least that seems to be the expectation of the industry players (see lvsadvisory comment on feb 28 regarding DAR’s earnings call).

Some recent biodiesel capacity closures:

– Chevron closed some of its biodiesel plants in March:

https://www.reuters.com/business/energy/chevron-idles-two-us-midwest-biodiesel-plants-profits-slip-2024-03-01/

– Vertex is converting its biodiesel facility back into fossil fuel production:

https://www.reuters.com/sustainability/climate-energy/vertex-energy-pauses-renewable-diesel-output-switch-back-fossil-fuels-2024-05-09/

CLMT filed a proxy for their C-corp conversion. The vote is scheduled for July 9. The conversion is expected to occur shortly after the vote. The move is expected to pull in a bunch of new institutional investors and get CLMT included in various indices.

The stock has been on a nice little run since the announcement of the proxy. However, it’s tough to predict how much steam is left in this. While the stock is up, margins are slipping, and figuring out MRL’s worth is getting trickier. Short term monetization catalyst is fading, unless management finds a long-term focused buyer soon. But that is a big if. It appears that unless you’re prepared to hold onto this for several years until the sector stabilizes, selling after the conversion might not be a bad idea.

Shell to Take Impairment Hit of Up to $2 Billion”The British energy giant announced on Friday that it expects to incur an after-tax impairment charge between $1.5 billion and $2 billion. This is primarily due to halting the construction of its biofuels facility in Rotterdam and the divestment of its chemicals refinery in Singapore.The decision to pause the construction of the Dutch biofuels plant, which was slated to be one of Europe’s largest with an annual production capacity of 820,000 metric tons of biofuels, stems from weak market conditions in Europe. The profitability of the project has been adversely affected by a significant drop in U.S. renewable fuel credit prices.”

https://www.wsj.com/articles/shell-to-take-impairment-hit-of-up-to-2-0-billion-86c19d7d

While it’s somewhat positive that the industry is reallocating capital away from renewables in response to current market conditions, an impairment write-down generally indicates that the impact is not just temporary, albeit the plant in this article is in Europe.

CLMT shareholders approved the C-corp conversion. Beginning tomorrow (July 11), Calumet will trade as a C-corp. The ticker will remain unchanged. Management remains confident that the conversion will lead to an influx of new shareholders. This should have a positive impact on the stock price.

The announcement came out after the market closed yesterday. The stock is already up by 5.5% today.

https://www.prnewswire.com/news-releases/calumet-specialty-products-partners-lp-unitholders-approve-conversion-to-a-c-corporation-302192548.html

Does anyone know the typical timeline for getting a DOE loan or how long it takes? I know mgt said it’s progressing well

New here to CLMT -> any reason for the big drop in the last 2 weeks? Was there an ex date that I missed?

A few things have weighed on CLMT’s share price over the past 2 weeks:

1) The renewable diesel industry margin has fallen through the floor. The most current number puts RD margin around $0.70 per gallon.

2) Trump is viewed as negative towards all clean energy and particularly negative towards CLMT because he may threaten the subsidies offered by the IRA bill.

3) No word on the DOE loan.

My reaction to these points:

1) While the RD margin matters, what matters more is the SAF market which is still drastically under-valued. I view MaxSAF as WHEN not IF and should still result in incremental EBITDA of at least $200m (a conservative figure). While it may be slow, a number of industry participants have already announced RD project cancellations and shut-ins. Biodisel projects are simply uneconomical today and should shut-in at a faster rate. My guess is there are players burning through feedstock inventory before shutting down which why the RD industry margin is dragging; however, I have asked around and can’t point to any specific players that are liquidating assets.

2) First, Trump hasn’t won yet so TBD. However, even if Trump wins the election, I believe the IRA will remain intact because most of the dollars benefit Republican states, and changing the IRA requires an act of Congress. A Trump presidency could even be a net positive for the non-MRL portion of CLMT because the refining sector could be supported by re-shoring & the approval of new energy infrastructure.

3) I continue to expect the DOE loan to come any day now. Based on my conversations with the company and other investors, management has staked their reputation on the DOE coming through.

Additional thoughts on the current CLMT setup:

I will concede that the CLMT setup is objectively worse today than when I pitched the stock 7 months ago because the RD market is just not a lucrative fallback plan if MaxSAF or DOE don’t come through. The recent decline in the stock feels overblown to me, however.

I believe the market is implying MRL’s total value today at less than $700m, which feels quite mispriced to me. In my opinion, the non-MRL segment is worth at least $2bn (270m mid-cycle EBITDA @ 8x blended multiple), and I believe MRL (assuming MaxSAF) is worth at least $2bn ($200m EBITDA @ 10x multiple), which implies a $25 share price, nearly a double from the current price of ~$13.

The only real question is how will MaxSAF get financed. A DOE loan would be in the neighborhood of $500 – $1bn of low interest proceeds that would paydown a significant portion of CLMT’s debt & fund MaxSAF. Again, I think DOE is coming. But if DOE doesn’t come, CLMT will likely pursue a partial IPO, a full sale of the company, or find a financial sponsor to fund the MaxSAF project. The non-DOE routes would be dilutive but still likely provide upside from here.

I heard Jeremy Raper wrote a post and sold out of this stock. I don’t want to rip off his content or anything but does anyone know and care to summarize at a high-level what is general thesis change was on this?

Raper is on SSI so he’ll see this. Regardless, he’s no stranger to premature exits so I wouldn’t worry about it. It’s more about opportunity cost for some.

Interesting (albeit a bit speculative) theory on DOE loan found on Twitter:

https://x.com/Zerosumgame33/status/1821599925173403689

Another valid point: https://x.com/KevinLMak/status/1821905824182145328

https://x.com/KevinLMak/status/1821905824182145328

Below some excerpts of the changed language in Q2 earnings release and conf. call vs Q1.

Looks positive in my eyes.

Q1 press release:

And then Q2 press release:

Back in Q1 conf. call:

Now contrast this with the talk few days ago:

Sounds promising!

This thing might be a coiled spring. Ryan from CrossRoads capital was on twitter spaces yesterday: Long conversation but definitely worth a listen:

Part 1: https://x.com/Zerosumgame33/status/1826407090279383230

Part 2: https://x.com/Zerosumgame33/status/1826413420520104409

Just listened to part 2 after seeing CDM Jr tweet in some sort of agreement. To say they’re insanely bullish is an understatement. LVS, what are your thoughts on the stated upside ($85-100 in 2 yrs?).

Also, what is a downside scenario? From what I’ve read without the loan they’d sell out and still should get mkt cap, but I imagine it trades down to $10 if not lower?

The ceo bought calls expiring in January with a strike of $20. This I addition to commentary latest quarter makes me think DOE loan is all but happening. Am I missing something?

CLMT options are pretty expensive ( implied vol >90%). The Jan 2025 $20 strike call currently costs $4.4.

Not sure whether CEO’s buying options vs common shares is indicative of higher or lower certainty/confidence re the company’s near future prospect.

He bought the calls in November of 2023. Sorry just wanted to clarify.

I don’t know that there is anything to read into this news. But posting in case it is relevant:

https://www.wastedive.com/news/fulcrum-bioenergy-chapter-11-bankruptcy-nevada/726555/

Is anyone able to give some color on the recent price volatility?

There’s been quite a bit of activity on X (though apparently not from the usual investing crowd).

There was the below hit piece on CLMT that came out on 9/8

https://substack.com/@randomguy5567/p-148658765

As much as I liked it, the run to $20 was prob (over) speculation on the DOE deal dropping really soon. It hasn’t come yet so excitement has dissipated and stock pulled back.

Open to less obvious ideas, I only answered since you asked for anyone 🤠

The DOE Loans Program Office posted a Draft Environmental Assessment and Mitigated FONSI for the Montana Renewables project. Not sure what this means for the timeline for the final EA, ROD and loan approval but its a good sign. Usually there is a 30-45 day public comment period after the draft EA is published.

https://www.energy.gov/lpo/ea-2275-draft-environmental-assessment-and-mitigated-fonsi-montana-renewables-llc-renewable

Oops I put this comment in the wrong place, but I’ll repeat the request.

How would you reply to the bearish notes in this hit piece that came out this week?

https://poorhomelessman.substack.com/p/calumet-inc-clmt-is-trash

side note – i’m long af, mean to be constructive

I have been mulling over the CLMT short article (linked above) over the past couple of days. It raises a lot of valid and logical points. This is not just a ‘hit piece’ – the guy who wrote it seems to know the industry very well. My main takeaway is that I understand way too little about dynamics of RD and SAF markets, MRL’s competitiveness /cost advantages as well as the viability and likely pay-off of the max-SAF project. And therefore I have decided to fully exit CLMT position and am closing it for the tracking portfolio.

The final straw that pushed me over the edge was the DOE document which indicated that max-SAF expansion would be operation only in 2028 (instead of 2025). While we might get a share price pop when (and if) DOE loan is announced, with the actual production 3 years away, the economics of max-SAF project will remain uncertain (as this depends on SAF crack spreads 3 years out) and therefore monetisation of MRL equally questionable.

Luis, thank you again for sharing CLMT pitch with SSI and let us know if you have any additional thoughts or counter-arguments to the issues raised on Poor’s Substack.

Below I am listing several arguments from the short pitch on viability of max-SAF project and MRL in general:

– The awaited recovery in RD crack spreads might never come – larger players are operating profitably at the current crack spread levels. The anchoring to historical crack spreads might be incorrect as this a young industry and capacity has increased significantly since pre-covid levels.

– The above point also raises the question on bull’s argument that MRL has strong cost advantage in feedstock due to proximity to agricultural areas.

– SAF market is likely to follow the same trend as RD. If economics will be attractive, industry will get oversupplied and spreads will drop. With MRL’s SAF production 3 years out, the economics might be unattractive from the start (exactly as happened with MRL’s conversion to renewable diesel).

– MRL is not in a better position than any other RD refinery to shift to SAF production. Actually, MRL is in inferior position as other RD producers already have the necessary two stage reactor designs for SAF production and MRL requires DOE loan to refurbish to two-stage reactor.

– Other RD producers can already switch to SAF production, but don’t do that fully because it is not economical.

If it is indeed a fact that there will be no DEO loan announcement before Oct 14, as PoorHomelessMan writes (I have not fact checked anything), then the options may be too richly priced, and selling options could be an idea. Both Puts and Calls.

So the ones expiring Friday this week to start out with. And possibly also the ones for Oct 18, though according to PoorHomelessMan there is at least in theory a chance of loan approval in the days Oct 15-18

Although both and calls are richly priced, wouldn’t selling puts be inconsistent with the view that there will be no DEO loan announcement by Oct 14?

wouldn’t investor be disappointed after Oct 14 and CLMT stock price fall as a result?

Yes, you are right. All else being equal, a later decision than what the market thinks, that is a negative for the stock, and a negative for the idea of selling puts.

The argument against the fairness of the high Implied Volatility is still valid argument, so that is a plus for the idea of selling puts (and calls).

An important question is how much the market participants care about a later decision. Do the players in the market care a lot about that, or they are more concerned about the actual outcome of the loan/no-loan decision.

IV is down since I posted, so less attractive idea now. Though if you look 12 months back, then IV is still high compared to the average

CLMT’s recent price appreciation seemed to have something to do with a sale and leaseback transaction with Stonebriar, which some interpret as implying that DOE loan is forthcoming, because the mention of a Eligible Capital Event (including a potential loan guarantee from the U.S. Department of Energy) in the agreement.

They also amended a previous sale and leaseback transaction to permit an early termination option, allowing MRL to repurchase its assets from Stonebriar at a decreasing price over time.

Any other relevant development?

DOE loan came in at $1.44bn. ripping aftermarket. I wonder if it sells off like after c-corp conversion (feels like the event traders will sell the news on this)

Anyone still looking at this name? DOE loan approved with a big pop over the weekend.

Yes. It is my largest position. Cheap. Lots of catalysts. Probably will split off Specialties form Montana Renewables which will unlock value. Management $31-56 per share estimate of intrinsic equity reasonable. Balance sheet derisked. Renewable diesel spread spiked by almost a third over past month. DOE loan alone v. previous borrowing costs brings value to $30ish; RD spreads hitting normal index margin would bring it closer to $40ish.

thoughts on prelim results + the ATM program?

They are focused on strengthening the balance sheet and deleveraging. They will tap the ATM slowly over time in a way that is minimally disruptive.

You jinxed it

Happy with the price I paid and the price I’ll get paid; I wish I had a thought on the path between the two but don’t and never seem to. But my imprecise effort was this: “Most people paying any attention to CLMT already own it. This could be a time when people sell the news. It is entirely possible that this goes to $30 or $40 per share via $20 as the news slowly percolates out to new investors.

How is the trade war affecting RD spread and CLMT’s future profitability?

Do you still believe that CLMT’s intrinsic value is above $31/share?

16% drop today to $15.50, with no news.

I believe it has something to do with fears that Trump’s freeze on disbursement related to green energy projects coming out of the infrastructure and energy bills could also impact CLMT. It’s a 90-day ban with a re-evaluation of all the grants and loans. Stripping already granted and contracted loans from various private entities does not seem entirely legal, so this may be a nice entry point for the brave hearted.

Here is a nice excerpt from the article linked below:

“Pavel Molchanov, managing director and equity research analyst at Raymond James & Associates, told Canary Media that “any attempt to cancel — that is to say, renege on — previously approved loans or grants,” as would be the case for freezing spending on obligated funds, “would immediately lead to lawsuits from the companies involved.” While the new administration can prevent future loans or grants from being authorized, “that is not the same thing as canceling existing ones.”

https://www.canarymedia.com/articles/policy-regulation/trump-orders-freeze-on-inflation-reduction-act-infrastructure-law-funding

UBS cut the target price to $20.5 from $24.. maybe it’s time to add some more?

And according to the FT Trump scraps plan to freeze federal loans and grants after backlash which should be positive for Calumet

Has anyone looked into how the tariffs will impact the company?

I think the risk of further delay or cancellation of the DOE loan is likely weighing on the stock more than tariffs: https://www.ogj.com/general-interest/government/article/55264167/calumet-reports-delay-in-government-loan-for-montana-renewable-fuels-plant

what exactly are their options if the DoE loan is modified substantially? eg if tranche 1 is approved but not tranche 2. doesnt that necessitate asset sales from – given crack spreads, etc – a position of relative weakness?

The entire Montana delegation is Republican and incoming DoE Secretary Chris Wright was asked specifically about his support for Calumet by Senator Daines, which he reacted positively too. The loan is closed and is legally binding. It is going to fund or face litigation and the wrath of the entire Montana Republican delegation. The stock as of late has been driven down by a campaign from an ignorant and corrupt analyst at UBS who upgraded CLMT on 1/12/25, the after CLMT pulled out of his conference, decided to exact revenge bad mouthing the company and spreading lies about its feedstock. impact of 45z and the DoE loan as retribution. Finally leading up to his downgrade despite CLMT confirming (language was not perfect but was what DoE would allow) the loan, less than a month after the update. His comments about 45z were a naked pretext, to create other issue besides loan since he didn’t have any issues with 45z a few weeks ago when he upgraded CLKT. It has Shorts and those with bearish option positions a nice return, but when loan funds they’ll feel the pain and the short covering should magnify any rebound. CLMT is a 35-40 stock over next two years and if management does its job will not be a company anymore with all its assets monetized, with MRL being the crown jewel worth $4-$5bn. Expect news of an asset sale by 2Q at the latest, with the most likely candidates being abel-Ray or Royal Purple.. RP does $25mm in EBITDA and is a 10x business.

‘expect news of an asset sale by 2Q at the latest’ – do you have any specific information they are pursuing non core asset sales or is this just pure speculation? if it is coming from the company it is as good as non-info, as they have a long long history of overpromising and under-delivering. if the loan is so money good, why would they pursue asset sales? they would only sell assets (presumably) if the loan, or bits of the loan (tranche 2) aren’t coming. i dont really have a strong view on the likelihood of that, but would argue for a highly levered entity that (hypothetically) lost the ability to finance its core development project and was stuck on RD, the equity environment in which they then tried to sell down other stuff would likely be…urgent.

it would be interesting to hear your view on what MRL is worth, today, with the considerably increased uncertainty around SAF. i would push back strongly against the idea MRL is worth anywhere close to $4bn in this environment – they would sell down a piece of equity there, almost double the Warburg Pincus mark, if they could, surely, maybe more than a piece (40%? 50% but no control), as it would solve all their financing headaches.

Management has made it clear that their mandate from the board is to monetize the assets and Todd has confirmed that in multiple calls. As to value of MRL, it’s a SAF play and there is no way for the airline industry to any meaningful CO2 reduction without SAF. If you don’t buy the IATA targets, then you should be short CLMT and DAR. At 300mm gallons MaxSAF $1.50 RD .+ 1.65 SAF premium and 70 cent cost per gallon you get $735mm of EBITDA. That’s slightly under 7x at $5bn valuation. MRL is arguably worth 8-10x, particularly given the massive synergies to a strategic such as Shell or BP, that would capture the $1.65 per gallon premium they are paying.

There is no way to probe the loan is funding and we will have the answer in a couple of weeks.

The asset sale decks are widely distributed among PE funds and at the right price sales will happen sooner rather than later. If you have conviction the other way then I assume you are short are going short.

To answer your question, despite its clearly rhetorical nature, you are conflating the unlocking of value by selling off the assets, with a liquidity driven asset sale. The mandate from the board is to unlock value and that was the point of the C-Corp conversion. The family got 2mm warrants at 20 and they want $40+. CLMT makes no sense as a long term standalone entity with $80 in corp costs. For the Fehsenfeld‘s to realize and monetize the value the company needs to be sold as SOTP is greater than the whole .MRL will likely sell a minority stake first then full sale. Todd has confirmed his job is to eliminate their jobs

thank you for your detailed comments, it was quite helpful. my questions were genuine, and not rhetorical. despite the aspersions cast, i am not short, or looking to short; perhaps contrary to your working assumption, not every divergent opinion or pushback against an investment thesis is driving by ‘the shorts’ or by ‘ignorant and corrupt analysis’ by some sell-side broker. Perhaps it is worth reflecting, occasionally, on the other side of the trade.

the reality is i have followed this stock, closely, for a number of years, and owned it for much of the post-COVID period. I am quite familiar with this management team (and Steve), having interacted with them and followed them over that period. there were many times, i am afraid to say, where they semi-promised asset sales or value realization events – only to fail to deliver, or to deliver against a much delayed timeline. you may wish to measure what this management team actually said – about through the cycle profitability in RD, for example, at the MRL asset – versus what it has actually delivered in performance. a couple of years ago when they did a small bond deal – i think just after the Warburg Pincus financing, they directly told me (Todd, this is), ‘that’s the last high yield bond deal we’ll ever do’ – that was at least two bond financings ago, and there will be more.

what im trying to get at is, if management here is telling you MRL is worth $4-5bn, because thats minimum 8-10x EV/EBITDA, and that Performance Brands would get 10x EBITDA, etc etc, then I wouldn’t believe it for a second (and neither should the market), they will have to print it to get credit for it.

now maybe that is part of the opportunity here and I’m willing to grant that incentives are better post C-Corp conversion. the company is going to have to prove it though, and actually monetize stuff, because even if the DOE fully comes through and even if MaxSAF proceeds at pace there will be no net cash flows coming out of the business for at least another 2yrs.

I can assure youI don’t get my values from management. The math on MRL at MaxSAF implies a $5.bn plus valuation. I just walked through how you get to $735mm of EBITDA on 300mm gallons of SAF. Whether you believe the SAF story is different and if SAF blending does not grow in the US from today ‘s levels then MRL is a stranded asset. I don’t believe that to be the case. Nod does Shell, BP, Phillips, Valero and Darling,

CLMT bought RP in 2012 for $333mm and it does approximately $25mm in EBITDA. At 10x its worth $250mm, which is in line for a performance/specialty chemicals business, particularly with RPs brand recognition.

As for being a HY issuer. I suspect Todd was saying that he isn’t raising incremental new HY debt. They will always have to refi and they are never going IG so will always be issuing HY/LL to pay off maturing loans. The Jan deal was a tack on to refi some 26s with 28s, not new capital.

We are so back: https://theelectricgf.com/2025/02/11/sen-daines-1-44-billion-federal-loan-to-calumet-back-on/

Montana Renewables’ $1.44 billion loan is back on after a federal funding freeze, according to Sen. Steve Daines.

The Republican lawmaker’s office said that the U.S. Department of Energy’s loan that was approved under the Biden Administration had been on hold, but was unfrozen after he “pressed the White House and highlighted its importance in securing our nation’s energy dominance.

https://theelectricgf.com/2025/02/11/sen-daines-1-44-billion-federal-loan-to-calumet-back-on/

Any news on this name? It seemed to jump on the idea that the loan was back on but has collapsed in the last 10 days since.

Calumet Announces Sale of Assets Related to Industrial Portion of its Royal Purple Business for $110 million: https://calumet.com/calumet-announces-sale-of-assets-related-to-industrial-portion-of-its-royal-purple-business/

Any new development that could explain CLMT’s continued decline in the recent two weeks?

Given the trade war between Canada and the U.S., wouldn’t this undermine one of CLMT’s key advantages—selling into a higher-priced market—by hindering its ability to export RD or SAF to Canada?

If the max-SAF expansion would be operational only in 2028, unless we believe that the trade war will last that long and produce permanent changes to tariffs, etc, shouldn’t its impact on CLMT’s cash flows and value be relatively small?

Based on my understanding, any duties will be implemented for a period of five years, until 2030:

“Final duties, which would be in place for five years and can be renewed every five years thereafter, could be imposed by September 2025 following a ruling by the Canadian International Trade Tribunal,” the company said.

https://www.dtnpf.com/agriculture/web/ag/news/business-inputs/article/2025/03/07/canada-launches-dumping-us-renewable

Specifically, British Columbia now requires renewable fuel to be produced in Canada to meets its lcfs now. That was press released Feb 28.

Down to $8+, from $22 on Jan 1. Anyone still holding?

Jeremy Raper, former CLMT bull, now likes it as a short.

https://x.com/puppyeh1/status/1909768625973870796