Liquidia (LQDA) – Drug Commercialization – 100%+ Upside

Current Price: $12.3

Target Price: $25+

Upside: 100%+

Estimated Timeline: 1 Year

This is a rather unusual pick for SSI. A pre-revenue pharma company at $1bn market cap. On top of that Liquidia’s stock has almost doubled over the last month after the company won a patent infringement lawsuit. You might think that the easy money in this situation has already been made and now the hard and uncertain part of commercialization remains. I think the opposite. Court decisions are inherently uncertain and the market is usually correct in pricing the risks. Arbitraging legal decisions is very hard. Yesterday’s verdict on SAVE/JBLU merger (which was as close to a slam-dunk as it gets) should be a dose of reality for anyone with a different opinion. Liquidia’s victory in the patent lawsuit removed the risk of further litigation, more years with no revenues, and zero from the equation. The company is now on a clear path to commercialization with an easy reference for the potential of its drug. If these efforts are successful (and there are reasons to think they will be), Liquidia’s share price could easily double again over the next year and even end up as a multi-bagger over a longer time frame.

Key points of the bullish thesis:

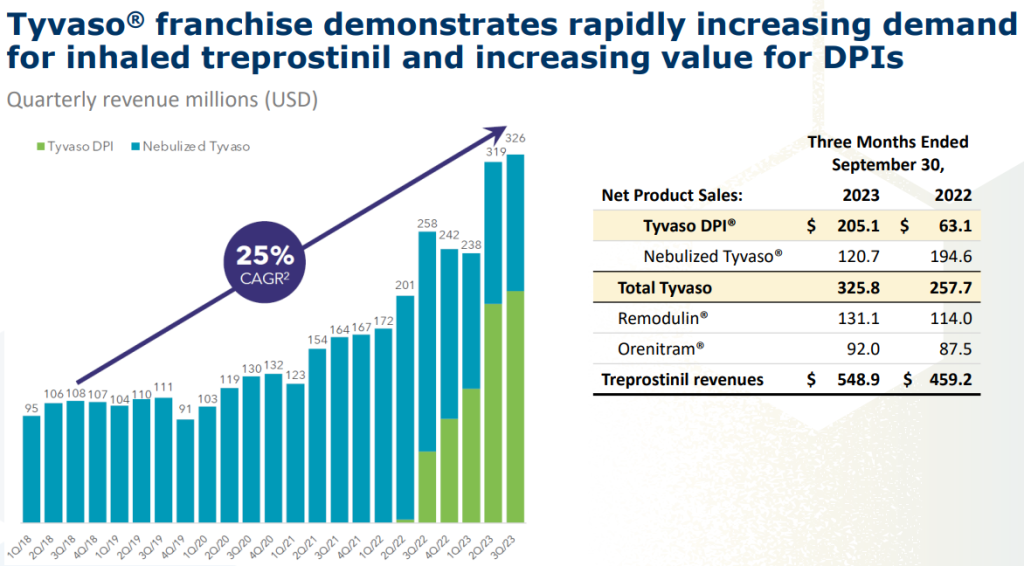

- United Therapeutics (UTHR) has a $10bn market cap. UTHR’s largest and fastest-growing drug is Tyvaso, which includes a generic active compound treprostinil, but has a proprietary delivery system/formulation. The drug already accounts for 50%+ revenues and has reached $1.3bn in run-rate revenues. Further UTHR growth is also expected to come from Tyvaso’s already-approved and to-be-approved indications. It could be easily argued that Tyvaso drug accounts for the vast majority of UTHR’s value.

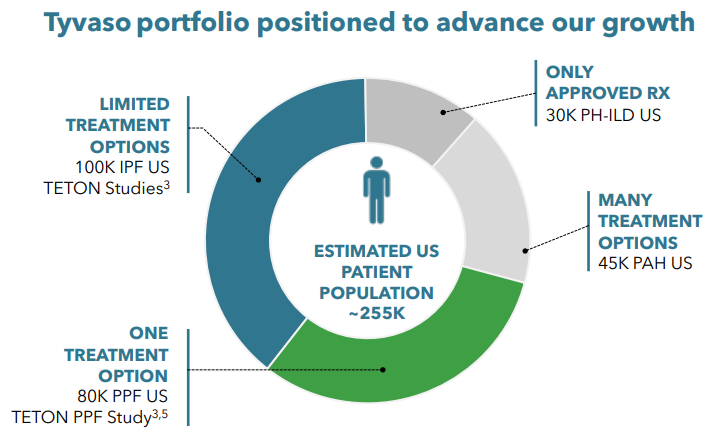

- Liquidia has received tentative FDA approval for its drug Yutrepia with the same active compound but with a more effective delivery system/formulation. Currently, Yutrepia and Tyvaso are the only approved drugs for certain pulmonary hypertension indications. Liquidia’s market cap is only $1bn.

- UTHR has blocked Liquidia’s commercialization efforts, and for the last 3 years the companies have been battling in a patent infringement lawsuit. Only due to this lawsuit FDA’s approval was tentative vs the full one. This culminated in Dec’23 with Liquidia’s victory. Yutrepia’s commercialization is set to begin in April 2024 or earlier, when the final procedural steps in the lawsuit are closed and the FDA grants full approval.

- LQDA’s Yutrepia is expected to quickly gain market share due to its superior delivery system/formulation, which allows for higher dosage and has fewer side effects. The sales force is onboarded and already hitting the ground. Commercial supply is available to meet 1st year’s demand. Management has been in active discussions with payers over the last couple of years. The company is fully funded to reach profitability. So all is set for a fast launch once Yutrepia is greenlighted.

- The market, which is currently targeted by UTHR alone, will be split between the two companies, and eventually, LQDA will take the lion’s share due to its superior treatment characteristics. The valuations of the two companies should shift accordingly.

- LQDA is run by Roger Jeffs, who was a co-CEO of United Therapeutics. He joined UTHR in its start-up phase and had an 18-year-long tenure, initially as director of R&D, then COO, and eventually co-CEO with the company’s founder/chairman. He was instrumental in bringing to market and commercializing Tyvaso along with 5 other rare disease drugs. He knows the market for Tyvaso/Yutrepia inside out and is well-positioned to lead Liquidia’s commercialization efforts. Roger has a 4% stake in LQDA ($37m in value) + 1.5m of in-the-money unvested options and stands to benefit immensely from the company’s growth.

- Adding further confidence in the success of Yutrepia’s commercialization, a prominent healthcare investor, Patient Square Capital, has just invested $75m for an almost 10% stake at $10.4/share (vs $12.4 currently).

- As soon as the first sales numbers start rolling with Q2 and Q3 financials, the market is likely to revalue Liquidia. Earlier catalysts between Jan-Apr include the finalization of procedural steps of the already concluded litigation, shift of FDA’s approval from tentative to full as well as FDA’s approval for adding additional indication to Yutrepia’s label.

I will elaborate on some of these points in the write-up below, but for additional reference, I would recommend reading through these two articles – both were posted before LQDA won the patent lawsuit, but have plenty of details that are still relevant.

- VIC article from Sep’23 – a quick read to get up to speed on the situation.

- Valorem Research from Dec’22 – you can skip the middle part which deals with the already-resolved litigation, but the intro and the second half are very informative and include discussions on commercialization growth and drug pricing impacts from the increased competition (btw, I am a subscriber and would recommend this blog to anyone interested in litigation-driven special sits).

Another good starting point is the recent Liquidia investor presentation and transcript.

Quick background on PAH, United Therapeutics and Tyvaso

Before we dive into Liquidia’s setup, below is some relevant background information on UTHR and its key drug Tyvaso.

PAH and PH-ILD: Pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD) are rare but severe conditions that affect the arteries in the lungs. In PAH, the arteries become narrowed, making it difficult for blood to flow smoothly to the lungs. This can lead to a buildup of pressure in the pulmonary arteries, which can strain the heart and eventually lead to heart failure. PH-ILD is a type of pulmonary hypertension that occurs in people who already have interstitial lung disease (ILD), a group of lung diseases that cause scarring and damage to the lungs.

Tyvaso (treprostinil): Tyvaso is a long-acting medication developed by United Therapeutics that contains treprostinil, a synthetic prostacyclin analog. Prostacyclin is a naturally occurring substance that helps relax blood vessels and improve blood flow. Compared to this naturally occurring substance, treprostinil offers more flexibility in administration, longer duration of action, and fewer side effects, making it a more favorable treatment option. Tyvaso was approved by FDA for the treatment of PAH in 2013 and for the treatment of PH-ILD in 2021. Tyvaso has become the company’s most profitable drug, accounting for over 53% of Q3 2023 revenues and showing the fastest growth. It is expected to remain a key driver of growth in the coming years. The majority of the rest of UTHR revenues are from injectable (Remodulin) and oral (Orenitram) treprostinil, also used to treat PAH. So in a way, the whole UTHR is built on treprostinil, which in its various formulations accounts for 90% of the company’s revenues.

Nebulized Tyvaso: Tyvaso is available in two formulations: nebulized and dry powder inhaler (DPI). They differ in how they deliver treprostinil to the lungs and in their convenience and portability. Nebulized Tyvaso is delivered into the lungs using a nebulizer, a device that atomizes the medication into a fine mist by breaking it down into tiny droplets using compressed air or oxygen. Nebulizer therapy has been the standard method of delivering treprostinil for many years (and naturally occuring prostacyclin from even earlier). However, nebulizer therapy can be inconvenient and time-consuming, and it may not be as effective as other delivery methods for some patients. Nebulizers are typically used for patients who have difficulty inhaling medication on their own.

Tyvaso DPI: A dry powder inhaler (DPI) formulation of Tyvaso, was launched by United Therapeutics in June 2022. DPIs deliver medication in the form of a dry powder. This powder is composed of tiny particles that are small enough to be easily aerosolized (turned into a fine mist) when the user inhales through the device. Once inhaled, these particles are deposited deep into the lungs, where they can be absorbed into the bloodstream and deliver the medication’s therapeutic effects. DPIs are easier to use, way smaller, more portable, and less likely to cause side effects than nebulizers. The launch of Tyvaso DPI has been a major success for United Therapeutics – just one year after the approval this new formulation is already contributing almost 2/3rds of Tyvaso revenues (see chart below from the recent Liquidia’s investor presentation) at $1bn projected run-rate revenues. As a result, DPIs are becoming increasingly popular for the treatment of PAH and PH-ILD and might expand this delivery method to a broader PH patient population.

Further growth: Aside from the already approved indications for PAH and PH-ILD, United Therapeutics sees further Tyvaso growth coming from the treatment of interstitial lung diseases IPF (idiopathic pulmonary fibrosis) and PPF (progressive pulmonary fibrosis). This would expand the potential patient population from 75k to 225k (from UTHR presentation). The company is currently running phase 3 trials for both indications. An approval would ultimately unlock additional markets for both United Therapeutics as well as Liquidia.

Liquidia’s victory in patent infringement lawsuit

LQDA developed a competing DPI formulation of treprostinil, called Yutrepia, and in Nov 2020 submitted a New Drug Application to the FDA for the treatment of PAH. However, UTHR filed a lawsuit against Liquidia, alleging that Yutrepia infringed on certain of its patents. The patents are related to the manufacturing and delivery of treprostinil, rather than the compound itself, which is considered to be a generic. FDA granted Yutrepia tentative approval in November 2021, but the approval was subject to a 30-month stay, which was triggered by the UTHR’s patent infringement lawsuit.

This sparked a lengthy legal battle between the two companies, with UTHR seeking to block Liquidia from bringing Yutrepia to market. In December 2023, Liquidia scored a victory when a federal court ruled that the allegedly infringed United Therapeutics patent was invalid, effectively clearing the way for Liquidia to start commercializing Yutrepia. Only a few procedural hurdles remain to fully close the patent dispute, lift the injunction, and secure final FDA approval. These are only procedural steps and are expected to progress smoothly, paving the way for Yutrepia’s commercial launch for PAH treatment as early as April 2024.

Additionally, Liquidia has also made progress in gaining approval for Yutrepia for the treatment of PH-ILD. The company filed an amendment to its NDA for Yutrepia, seeking to add PH-ILD to the label (UTHR wants to challenge this, but is unlikely to be successful). The FDA has set a PDUFA date on January 24, 2024 for the amendment. As this is just an addition to the label and UTHR’s Tyvaso has already been approved for this treatment, FDA’s decision is very likely to be granted. The same would likely follow for any other treatments that Tyvaso gets approved for.

Torelability at higher doses – the key differentiation between Tyvaso and Yutrepia

I am as far removed from being a pharmacological expert as any layman you might encounter on the street, but I think LQDA’s management explains the difference between Yutrepia and Tyvaso very well in the latest presentation (slides 7-14 + transcript). They are obviously biased, however, the arguments management presents are supported by the results of clinical studies. Yutrepia appears to have the strongest advantage over Tyvaso DPI in terms of tolerability at higher doses and titratability (ability to adjust dose precisely).

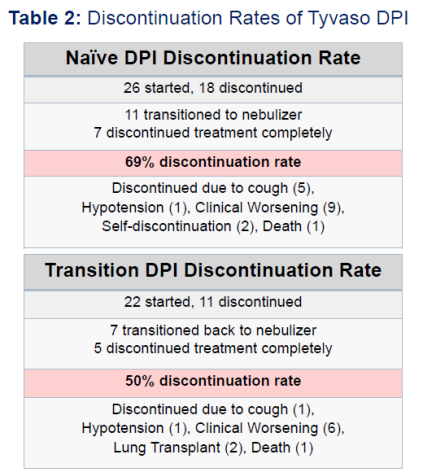

Larger doses of Tyvaso/Yutrepia are required as the illness progresses and correlate with improved effectiveness of the treatment. The key problem with Tyvaso DPI is that patients do not seem to be able to tolerate higher doses of the drug due to side effects. As a result, Tyvaso DPI has high discontinuation rates. The study in the slide below had the average time on therapy of only 3-6 months before patients discontinued or switched (back) to nebulized Tyvaso formulation. So it is not the drug, but rather the delivery method that is ineffective. Other studies have shown the median-time on Tyvaso and Tyvaso DPI to be around 2-3 years as the illness progresses and patients need to move to different kinds of treatments.

While that is bad news for patients, it is very good news for Liquidia. The patient population is rolling over every few years, meaning that Liquidia does not need to convince the existing Tyvaso DPI users to switch (which might be difficult) but can concentrate on new patients, who will have a choice between Tyvaso and Yureptia, or those patients that tried Tyvaso DPI but had to discontinue due to its side effects.

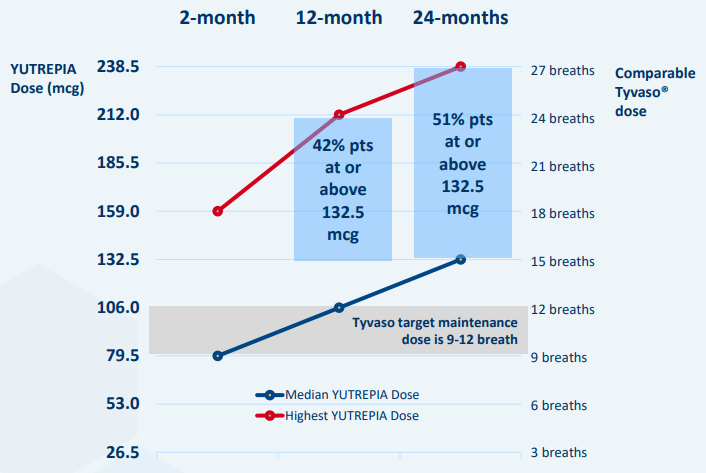

On top of that, Yutrepia is much better tolerated at significantly higher doses than what has been tried with Tyvaso.

“What we’ve learned, at least in PH patients, through this open-label extension study is that as patients progress over time, so here it’s showing 2 months, 12 months, 24 months, the doses on the left and the comparable breaths of TYVASO is on the right. The target breath dose is that gray bar. 9 to 12 breaths, that’s what’s in the indication label for TYVASO and TYVASO DPI.

You can see, over time, the blue bars’ median dose that were at 15 breaths equivalents, and at 24 months, 51% of patients are above 132.5 or 15 breath equivalents of TYVASO with a max dose now at 30 breaths equivalents. This is completely changing the therapeutic profile of inhaled treprostinil. So these are at levels in terms of dose that have never been seen before. This is the clinical value and utility of YUTREPIA.

Below are a few more excerpts from the call – management does a great job at explaining the differentiation of Yureptia and the market it is going to target:

“We’ve shown it’s titratable. Again, I showed you the curves where both the median dose and the max dose are increasing admirably over time. And then we’re trying to prolong the treatment. Again, it will help from — it will help the patients and will help from a revenue curve the longer we treat. So our goal with this type of profile is to be the best-in-class and first-in-choice prostacyclin.

And what does that mean? So that means we’re not just going to try to take the inhaled market. We’re going to go after the oral market. So when a physician decides to add a prostacyclin in pulmonary arterial hypertension, they add YUTREPIA, and that will delay the time for the need for a more onerous parenteral therapy. So dose matters. And again, I think this is well published data, and it’s across all routes, but I’ll just show you specifically for inhaled treprostinil first in PH and then I’ll show it too in PH-ILD.

<…>

Our label will encompass these higher doses. So if you look down to the dose titration described in the label, this is from our original submission. It included doses up to 24 breath equivalents of TYVASO. The competitive molecule only has 11 to 12 breaths as their target indicated dose.

So we’ll differentiate on the most critical aspect of the utility of a prostacyclin, and an inhaled prostacyclin in particular, as you’ve seen, by dose, and we’ll do it with a low-resistance device. Our product requires no refrigeration during the product lifetime and no loss of powder or required device orientation to deliver. So if you drop the device, no spillage. Theirs is more sensitive and could spill drug if dropped.”

Will Liquidia succeed in commercialization?

That’s probably the key question and the reason why UTHR sports a $10bn market cap and LQDA remains at only $1bn. Having a superior drug formulation by itself is not a guarantee of commercial success. Usually, there is a long and slow process from the start of commercialization and multi-billion dollar valuation. However, I think that we will see this play out at fast-forward speed for Liquidia.

Firstly, having Roger Jeffs leading the company is a real advantage. He knows the market, he knows the players and he is very well motivated financially (4% stake + options). Most importantly he knows the competition intimately from his 18-year-long tenure at United Therapeutics (as COO and then as co-CEO), where he was instrumental in developing and commercializing Tyvaso and 5 other rare disease drugs. He should have no problems replicating the same success for a superior drug.

Then, we have a strong sales team that has been already onboarded at Liquidia. While the current count of sales reps is only 50 (UTHR has a few hundred), the team has plenty of prior experience in the field and looks well-positioned to move fast. Additionally, it is highly encouraging to see Liquidia investing in its sales force and actively engaging with the market, even before the patent litigation had reached a resolution. If/when Yureptia starts taking market share from Tyvaso, and the word about it spreads, it should be fairly easy to expand the team and attract the best talent from United Therapeutics. This 50-strong starting team only needs to light the fuse.

So the other question is, are you — when will you be ready to launch? We’re ready now. So that’s the good news. So we have 50 sales reps that we onboarded in October. They’re very scientifically fluent and commercially capable. They have 10 years of rare disease experience on average, and about 60% to 70% of them have direct PAH experience, as you can see from companies at the bottom.

If not, they’re the superstars from the rare disease field and are used to these high-touch patients, and how to promote and sell into this space. As I said, we put them in the field early. That was a bit at risk, but we wanted them trained and ready to go. Scott’s had his team ready to go since January 1. So again, ready today. We’re just waiting on the final things to happen from a process standpoint.

Finally, UTHR appears to be pulling out all the stops to delay the inevitable commercialization of Yureptia, disregarding how unlikely these efforts are to prevail in court. VIC article also notes that back in 2020 UTHR supposedly offered $8/share for the licensing of Yureptia, but the offer was rejected by Liquidia (the PR on the received offer, but I was not able to confirm the $8/share figure). This gives additional confidence that LQDA is on to something big and might fully disrupt UTHR’s business.

Thoughts on pair trade: long LQDA, short UTHR

I am basing my whole thesis on the relative value of UTHR vs LQDA, rather than modeling what earnings/cash flows Yureptia might generate (albeit $1.3bn in Tyvaso high margin run-rate revenues and $0.9bn in TTM net income shows that the $10bn UTHR market cap at least makes sense directionally). My implicit assumption is that the market is correct regarding the total value of Tyvaso/Yureptia future sales and just that this value will shift from one company to the other. While there are many drawbacks to this kind of thinking, it helps to avoid various unknowns, such as how big is the total market, what else might disrupt the market for these drugs (e.g. Merck appears to be developing a new type of drug for PAH), or how much additional growth remains for the existing or to-be-approved indications. I do not think I would be able to assess these with any accuracy, so taking the easier approach kind of makes sense.

But should I then hedge my LQDA long with a short position in UTHR? I think this might backfire. From a quick look at UTHR share price (almost at all-time highs) it might seem that shareholders of United Therapeutics are completely oblivious to the pending commercialization of a superior competing drug. However, UTHR is already trading at an undemanding valuation of PE=10, with 15% revenue growth and high FCF conversion. So some negativity is already reflected in UTHR’s share price. The ongoing Phase 3 trials to add new indications to the label might expand the market further and leave sufficient room for continued growth for both companies, even if the thesis of Liquidia gaining market share proves correct. In other words, this is not necessarily a zero-sum game. And if Liquidia fails in commercialization, then I would likely lose on both legs of the hedged trade. So I am staying with the long-only position.

Thanks for this interesting idea. Is there any IP protection for Yutrepia? If LQDA doesn’t infringe on Tyvaso IP could UTHR do the same and improve Tyvaso tolerability by copying Yutrepia?

Yutrepia is enabled by their PRINT technology, which is proprietary: “Our manufacturing equipment and materials used in the production of our drug particles are proprietary and protected by our patent portfolio and trade secret know-how.” That’s from https://www.liquidia.com/products-and-pipeline/print-technology

As the compound is generic, all the IP for these drugs centers on the production of the compound and the delivery system. And like George explains, LQDA has proprietary PRINT micro- and nano-particle fabrication technology, which, is the key for the effectiveness and tolerability of Yutrepia. Even if competitors developed a similar technology (which will take years and which is protected by patents and trade-secrets), they would need to go through the whole process of trials and FDA approval and then finding a manufacturer, which could actually produce this. So it would be a lengthy process.

Why ignore the Merck product? If it’s a big as expected, it moves trip back from third line to fourth line therapy in pah shrinking the market for both Tyvaso and Yut. 1 key factor I have observed in serious rare disease is an unwillingness by hcp and patients to “rock the boat” for existing patients event for an incrementally improved product (see tracleeer vs letairis in pah). If you are then looking at new patient churn vs switch, the adoption of liquidia could be slowed considerably esp if merck’s product is newly introduced ahead of the trep products.

Further to mjc’s post, I found the following on Merck’s potential new drug:

https://www.merck.com/news/merck-receives-priority-review-from-fda-for-new-biologics-license-application-for-sotatercept-an-activin-signaling-inhibitor-to-treat-adults-with-pulmonary-arterial-hypertension-pah/

https://www.hcplive.com/view/fda-grants-priority-review-sotatercept-pulmonary-arterial-hypertension

The FDA has set a Prescription Drug User Fee Act (PDUFA) date of March 26, 2024.

https://www.clinicaltrialsarena.com/news/merck-sotatercept-pah/?cf-view

This site estimates a regulatory approval in the US within 370 days from the filling, which should happen in August 2024.

I have no pharmaceutical experience or knowledge. So would appreciate the wider community’s comments.

I am not ignoring the product that Merck is developing and have mentioned it in the write-up. As I explained, my approach is that the market is correct regarding the total value of Tyvaso/Yutrepia future sales and just that this value will shift from one company to the other. With $10bn market cap for UTHR valuation, the market does not seem the revenues from Tyvaso are falling off the cliff anytime soon.

If you believe that there are other drug/drugs that will disrupt the current duopoly of LQDA/UTHR (or will-be-duopoly) causing the pricing to go down, then having a hedged trade with long LQDA and short UTHR would position you better for the increased competition in the market.

And then in terms of Merck product specifically, from my read it is supposed to be an ‘add-on’, so it would be prescribed together with existing treatments for PAH.

“sotatercept would be the first non-vasodilator therapy for PAH and would provide a potentially disease-modifying add-on therapy for patients on standard background therapy.“

While sotatercept will indeed be an add on, it is expected to be added upstream of inhaled trep which would delay new patients from starting inhaled trep as their 3rd/4th option (behind PDE5, ERA, sotatercept, oral PCs?) which I do think could lead to a shrink of the inhaled PC space specifically in PH (not sure if sotatercept has an off-label role in the other trep markets). A gap in new patients following sotatercept launch would seem to hit Liquidia harder than UTHR as UTHR already has the patient base and historically switch between products for current patients is rare in PAH, so Liquidia will have to rely on new patient starts.

What impact do you think the introduction of a new competitor will have on the pricing and revenue for these products? It seems that you are generally assuming that LQDA will get a larger portion of the pie over time as the benefits of Yutrepia are revealed, but will the pie get smaller due to pricing pressure?

The short answer is that in duopoly markets the pricing pressure is minimal and the pie does not get smaller. The Valorem article, that I have linked in the write-up, has a whole section discussing this topic, see ‘PAH and PH-ILD commercialization growth’. https://www.valoremresearch.com/p/waiting-with-bated-breath-for-liquidia

Also superior properties of Yutrepia might even expand the population of patients that use inhaled treprostinil.

Management had the following comment when asked about pricing in the latest conference call. This kind of hints they will be competing on the superiority of the product rather than pricing.

“How are you guys thinking about pricing? Is this going to be a premium product, priced at parity or discount to TYVASO?

Yes. So obviously, it’s one of the areas of launch that we’ve been thinking about and strategizing and having a lot of discussions about. We’re not going to divulge our specific pricing strategy. I think our goal from day 1 has always been to make sure have — that patients have choice. Patients haven’t had choice in 20 years in this space, and we want to make sure that patients have the option to be able to get our product.

And we’re committed to that goal, and that is top of mind in all of our thinking. We have great relationships with the payers. We’ve had discussions with them over the last couple of years. They’ve obviously ramped up and are aware of the situation. And we are — like I said, our main commitment is to patients in PAH and PH-ILD, and we’re going to do what we need to do to make sure that they have access to our product.”

Is there actual conclusive evidence that Yutrepia is actually better? Was looking through the UTHR J.P. Morgan healthcare conference and they pointed out:

Summary:

Tyvaso DPI – Low Flow Device:

– First and only DPI that delivers to distal lungs for PAH

– No maximum label dose

– Deep lung delivery (this seems huge advantage)

– Room temperature delivery

– Very high patient satisfaction

– No cleaning required

– 1 breath per cartridge

Yutrepia – High Flow Device:

– Chaotic airflow. Gets stuck in the throat.

– Most of the drug does not get down to where it needs to go.

– Requires 3.3 times more powder for similar Treprositinil exposure compared to Tyvaso DPI.

Essentially Liquidia is saying their higher doses are tolerated better than tyvaso dpi. Uthr saying liquidia needs 3.3x the dose bc it does not get as deep into lungs. Feels like benefits are a bit murky if true? Not 100% sure I guess.

Of course UTHR would claim Tyvaso is more effective than Yutrepia, and they will always be able to find quotes from scientific papers to support these claims (especially when some of these scientific papers are from MannKind, which has developed the technology and licensed it to UTHR). Also, it is not a black vs white case – both treatments are effective to a certain degree and we are talking about reduction of side effects that allow the drug to be used longer and in higher doses. There might be certain advantages to the ‘low flow’ claim (which seems to be their key argument repeated across all seven slides), but Yutrepia is not only about higher-flow, it is also about much smaller particles. So you cannot take the ‘low-flow’ argument in isolation.

Also if we judge drugs’ relative efficacy just by the info presented in LQDA’s and UTHR’s presentations: LQDA’s arguments are founded on statistical info from recent studies, whereas UTHR slides are full of colorful pictures and large font titles rather than any stats. The question you should ask is why isn’t UTHR refuting the claims about higher Yutrepia’s efficacy with hard statical data in their presentations.

Lastly, while I am not in a position to refute the claims made by UTHR with any credibility (I am not an expert in the field), LQDA’s explanation of Yutrepia’s effectiveness seems more intuitively sound and therefore appears more credible in my eyes.

UTHR has always been excellent at crafting strong marketing messages. There is a case to make the Ventavis (inhaled iloprost) has superior efficacy in PAH, albeit less convenient than Tyvaso, but UTHR has owned the inhaled space going back to 2010s and clearly build a dominant market share for Tyvaso.

What revenue/share target do you think they need to grow their MC?

Back of envelope math as thought experiment.

$1.3B market size for trep (DPI + neb) currently based on UTHR revenue – do we know the % US and % PAH for space Liquidia would play in?

Assume 80% for each (aggressive) = 830M in sales at current pricing.

For a similar revenue/MC, we would want 200M/yr in revenue for supporting the current $1B Liquidia market cap (~25%) requiring a higher % share of NRx (33%+?) to account for high drop off of new patients on any inhaled

Where would you push back on this quick and dirty attempt?

UPDATES:

On cuts to current trep revenue:

– I missed the Tyvaso is US only via UTHR, so that could be pushed to 100% in my calcs

– Based on Liquida deck, they imply 33% of revenue is from PAH-ILD vs. PAH, but liquidia has a supplement into FDA to expand their label to include ILD so this could be in play and as ILD is a newer market for trep with fewer options this may be a more naive patient heavy segment (400 of 1.2B Q1-Q132023, https://www.liquidia.com/static-files/83cf40bb-70ba-4345-90ed-307e89e0bafb)

Still feels like the current MC expects a solid, albit not spectacular launch of 25%+ class share without ILD into an entrenched player (15-20% with ILD)

Okay this is all fair…I am not an expert in the field either. I guess now that the legal issues are behind LQDA, the real question is how well the marketing execution will go.

mjc, I am not sure I fully follow your math.

On revenues/mcap multiple, there seems to be plenty of room for LQDA upside given the 10x difference in market caps of both companies, even if LQDA only gains 20%-30% of the market (I think they will gain more).

Are there any news behind the sell off today?

Liquidia

LQDA

said Tuesday that United Therapeutics

UTHR

sought the dismissal of certain claims in a patent infringement under litigation in the US District Court for the District of Delaware over Liquidia’s proposed Yutrepia product.

The dismissal of the claims related to the so-called 793 Patent would mean only the claims related to the 327 Patent remain in the litigation, Liquidia said in a regulatory filing.

Liquidia has said the 327 Patent was not issued prior to its filing of both the original and amended new drug application for Yutrepia (treprostinil) inhalation powder, which is indicated for the treatment of pulmonary arterial hypertension.

Liquidia said it “does not believe that United Therapeutics is entitled to a statutory 30-month regulatory stay” on the US Food and Drug Administration’s final approval of Yutrepia.

No approval yet, stock down to $11 on premarket today.

https://finance.yahoo.com/news/liquidia-corporation-provides-drug-application-110000736.html

The FDA could not approve the NDA application on time, as they are still reviewing the addition of the PH-ILD indication as an amendment to the NDA. The request to amend the NDA was filed back in July of 2023, so it’s a bit strange that half a year was not enough to approve the amendment. On the other hand, management continues to prepare for commercialization on March 31, 2024, as the exclusivity for Tyvaso expires. Moreover, the FDA did not request any additional clinical data, which is somewhat reassuring. New PDUFA data has not been issued yet.

https://www.bamsec.com/filing/110465924006477?cik=1819576

Did they state a new PDUFA date would be issued? Typically that isnt the case, rather its just one of the cases the FDA missed the deadline and will rule when they choose to rule.

There won’t be a new PDUFA date.

How about playing this with out of the money call options at 1 year?

Assuming it only doubles, then you get about the same return (2.5x vs 2x) as owning stocks but with 100% risk.

UTHR continues the delay tactics and in a pretty unusual move has now sued the FDA, claiming the regulator bent the rules for LQDA. UTHR argues that allowing LQDA to attempt securing approval for the additional PH-ILD indication by filing an amendment to the already exiting NDA, instead of a completely new NDA, has allowed LQDA to avoid a potential stay of up to 30 months on the approval for PH-ILD. What this means is that if LQDA submitted a new NDA instead of an amendment, UTHR could have claimed patent infringement on PH-ILD, triggering the stay. UTHR argues LQDA’s case is not consistent with precedents and is now trying to force FDA to revert the process and compel LQDA to file a new NDA.

Suing the regulator seems like a pretty desperate attempt and confirms how threatened UTHR is by LQDA’s Yutrepia. The are two more important aspects:

– This legal maneuver primarily impacts the PH-ILD indication, leaving the approval for PAH indication unaffected. However, it is likely to cause additional delays for both approvals, as the FDA cannot approve the amended NDA until the PH-ILD issue is resolved. Unless LQDA removes the PH-ILD indication (leaving only PAH) in another amendment, the PAH approval could also face delays.

– Some people on fintwit suggest that UTHR’s attempt to trigger a stay on LQDA’s PH-ILD may be flawed, as it filed the 327 patent infringement only after the NDA amendment. Even if LQDA had submitted a new NDA, the stay might not have applied. This could mean that even if LQDA chooses to amend the current NDA again (removing PH-ILD), expedite PAH approval, and file a new NDA for PH-ILD, the delay on the additional indication might not be extensive. See here: https://twitter.com/sleepingbear84/status/1760288195323871305

Overall, apart from potential delays, the fundamental thesis remains unchanged. LQDA’s share price saw minimal reaction to these announcements.

On a separate note, UTHR has released its Q4 results, highlighting robust Tyvaso DPI sales with a 132% YoY growth. The increasing importance of delaying the rivals was evident during the call, where management just couldn’t stop talking about the competition. Also, some interesting tidbits were provided on the potential rival drug from Merck (PDUFA date on March 26), confirming my previous understanding that it’s more of an “add-on” than a prostacyclin replacement. From Q4 call:

UTHR’s Q4 call – https://app.tikr.com/stock/transcript?cid=36018&tid=2661045&e=1871704402&ts=3031732&ref=3no6ed

UTHR’s FDA lawsuit PR – https://ir.unither.com/press-releases/2024/02-21-2024-105511776

Volatile day: https://x.com/batmongoose/status/1764822548460564787?s=46&t=j0Zr78w5g6XVTLLyZ8G9Rw

Came across this update: https://news.bloomberglaw.com/ip-law/liquidia-cites-utcs-failed-appeal-in-push-for-yutrepia-approval

The latest LQDA’s conference call is well worth a read. It includes:

– A concise summary of the remaining legal procedural steps till Yutrepia’s approval for PAH and PH-ILD. On this front things are expected to start moving quickly after March 31;

– The recently denied UTHR request for rehearing of the ‘793 patent infringement case (as was expected);

– UTHR’s desperate attempts to impede the FDA’s approval of Yutrepia and why these are likely to fail;

– Clarification on the missed PDUFA date;

– Readiness for the launch of Yutrepia;

– Strategies to enter PAH and PH-ILD markets.

Some excerpts are provided below. Transcript: https://www.bamsec.com/transcripts/a1166678-91df-4566-8baa-5762b34ca3a8

A very short summary of the remaining legal steps:

A slightly longer version:

On UTHR’s attempts to impede FDA’s approval of Yutrepia and why these are likely to fail:

On missed PDUFA date:

Fully ready for launch:

Strategies to enter PAH and PH-ILD markets:

The FDA approved Merck’s PAH drug on March 26th.

https://www.reuters.com/business/healthcare-pharmaceuticals/us-fda-approves-mercks-blood-pressure-therapy-2024-03-26/

Any perspectives on LQDA’s reaction to Merck’s drug approval? If it doesn’t change the thesis, is this an opportunity to add?

I worked in PAH pharma for a couple years. Merck drug will be used earlier and for less severe PAH patients than UT/LQDA’s, so you could argue that could delay some new patients reaching the prostatcyclin line of therapy where the patient churn is high. That said, the Merck drug approval has been highly anticipated for the last 2 years so should be well priced in.

Judge Andrews amended a part of his previous judgement, finally clearing the way for FDA to approve Yutrepia for PAH indication. LQDA was up 5% in after-hours trading yesterday with a pretty substantial volume ($1.3m).

Things are about to progress fast from here on, with FDA approval just around the corner, UHTR’s exclusivity due to expire on March 31, and Yutrepia set to launch shortly after approval.

https://news.bloomberglaw.com/ip-law/liquidia-can-launch-yutrepia-lung-disease-drug-a-blow-to-utc

https://news.bloomberglaw.com/ip-law/utcs-losses-mount-in-bids-to-delay-liquidias-rival-lung-drug

Is there any sign of progress here?

https://twitter.com/fin_capital/status/1782761374646513728

Seems that the hearing is not perceived well by the markets.

Does anyone have context on how this hearing is different from the decision by Judge Andrews earlier this month?

Judge’s decision at the end of March related to the previous patent infringement litigation (patent 793).

The hearing now is regarding the new lawsuit on infringement patent 327 for PH-ILD. This lawsuit is widely regarded as just a delay-tactics by UTHR and a preliminary injunction is not likely to be granted.

Management covered it well in March conf call:

And for an update on what happened in the court hearing see this tweet https://twitter.com/fin_capital/status/1783119499501125892

I think the sell-off is unwarranted and have added to my position at $12.5.

How reconcile Soleus Capital (biotech fund) owning UTHR as its biggest position with LQDA long thesis above?

What would be the issue? Markets are made by people having different opinions. I’m sure there are lots of funds that own companies on opposite sides of issues – some make money, some lose money.

The issue is that as Soleus specializes in this area (“idiosyncratic…niche” biotech), has succeeded in it, and UTHR is a large position for them, they believe the probability of the LQDA thesis is insignificant (otherwise why own UTHR).

What assumptions allow for such belief?

As dt wrote in the last few sentences. It doesnt have to be a zero-sum game. There are still possibilities for both companies granting attractive returns in the future or both going down together. Liquidia Long is not necessarily a UTHR short thesis, at least it isnt intended to be as fair as I’m concerned, especially since UTHRs price is pretty depressed already and probably pricing in the new competition. At the same time Soleus longing UTHR doesnt have to mean they are short Liquidia. You will probably have to ask them directly, why they think UTHR is more attractive, might be interesting for the blog too.

thanks for your thoughtful response.

We just had a call with Jason Adair, Chief Business Officer of Liquidia. Very interesting. Makes us want to buy more.

What did he say?

He talked about the size of the PH-ILD market and its huge potential. He talked about the litigation and confirmed a lot of the thesis here on SSI. He made us a demonstration on the video-call of Liquidia’s device and explained to us how much better their system is vs UTHR’s. It was compelling.

Martine (CEO of United Therapeutics) talking about how amazing Roger Jeffs (CEO of Liquidia) is.

https://youtu.be/_pzEedBOIkk

A good one – “I have never met anyone who has turned so many impossibles into missions-accomplished.

Any thought about the insiders transactions on UTHR? The CEO restarted to sell under a 10b5-1 trading plan the 1th of March and the 25th of March the company announced an accelerated share repurchase program of $1B. I see also other insiders exercising their options, do you think they are using the buyback program to give liquidity for the insiders??

Well, I wouldn’t read too much into it. A large portion of the CEO’s compensation comes in stock, so he has been selling the compensation part through the trading plan for years. Meanwhile, his actual stake in the company more or less remained stable (8.1% last year vs 7.6% now). The stock is highly liquid, so I don’t think the buyback has anything to do with the liquidity demands of insiders. Moreover, not only the CEO but all insiders have consistently sold their equity comp in the open market for years without any issues.

Are we expecting some bad news here in the next few days? LQDA $10 Put options expiring in 3 days are trading for $0.45, which just seems insane. It would need to drop 20% just to break even on those options.

See the comment below. Judge Andrews might “issue a written ruling at any time” – actually this ruling was expected already couple of weeks ago. So I am guessing option premiums reflect this uncertainty and indicate risk that the ruling might be unfavorable for LQDA.

In Q1 call transcript LQDA’s management has again outlined the status of Yutrepia’s approval and ongoing legal challenges:

– FDA seems to be waiting for Judge Andrew decision on the lawsuit alleging infringement of the 327 patent.

– Judge Andrews has “heard oral arguments from both parties on April 23 regarding the preliminary injunction and may issue a written ruling at any time”.

So basically nothing new so far, but Judge Andrew’s decision should finally get the things rolling (but I have said the same about the April 1, when the UTHR’s exclusivity tied to PH-ILD expired – and that did not work out as expected).

Here are a couple of excerpts from the call:

And also:

Judge Andrew denies motion for preliminary injunction against Liquidia: https://storage.courtlistener.com/recap/gov.uscourts.ded.83482/gov.uscourts.ded.83482.96.0.pdf

Stock is up 15% AH to 14.5.

good news from a judge. up 15% AH. https://seekingalpha.com/news/4112064-liquidia-surges-after-united-therapeutics-request-for-preliminary-injunction-denied

LQDA will need to raise additional capital within the next year, but should be able to do so >$20/share after Yutrepia is on the market.

Is there a sense of how much they’ll need to raise?

They’re fine through the launch but may just need a bigger marketing ramp. TBD. But will be good problem to have.

Not so sure – I think the likelihood they simply sell the company is increasing with the market’s excitement about PAH.

Does anyone have any comments on the “likelihood of success” statement in the ruling pasted below? Sounds like this is not a done deal.

“Although Plaintiff has shown a likelihood of success as to infringement of claims 1, 6, 9, and 10 of the ‘327 patent,” Plaintiff has failed to show the Defendants’s obviousness challenge lacks substantial merit,” US District Judge Richard G. Andrews

A win for Liquidia, which already stipulated to infringement of claims 1, 6, 9 and 10. The judge agreed.

The raise may actually push price higher. Mathematically makes title sense but I have seen it happen in biotech. I am not a biotech expert though so could be wrong

So many events have happened since the initial thesis. What is a summary of the remaining risks in LQDA? Is it:

1) FDA approval does not occur, or occurs for only one indication (anyone know how (un)likely this is?)

2) Additional legal delay tactics from UTHR (hard to judge without a legal background but the latest lawsuit of Ip theft against an individual suggests they’ve exhausted their best legal tactics)

3) Execution stumbles in go-to-market (we’d likely get a nice re-rating from #1 first)

4) LQDA is unable to take market share from UTHR (also post any FDA approval-related boost)

5) Long term outcomes from Yutrepia are worse than Tyvaso

Overall, is it worth adding to one’s position here, or potentially reducing some exposure? I’m tempted to add but curious what others are doing.

Yes to all; would but already sized.

LQDA has already received tentative approval from the FDA for the PAH indication, so I don’t think the approval question regarding this indication is even relevant. The only reason for the delay in full approval was the inclusion of the PH-ILD indication into the same original NDA and the challenge from UTHR regarding the PH-ILD indication. With the legal battle seemingly over, I don’t think there are any impediments to the approval of both indications. The extent to which UTHR went shows that both indications are highly likely to be approved.

Concerning other points, I have nothing to add about further delay tactics – I am in the same boat as you regarding that. Market execution is clearly a risk that we have to live with, and we just need to wait and see how management handles the commercialization. On points 4 and 5, LQDA’s drug just seems to be a better solution not only on paper, but also from clinical evidence. Could that change after more and more patients are put on Yureptia? Could happen, but I do not think it is likely.

Considering all these points, I am not reducing exposure here – multiple catalyst are expected in short term.

Just noting that the spread is really blowing out, increasing by 9% today.

LQDA shares have been drifting lower over the past few weeks. After the denial of the preliminary injunction at the beginning of June, the market was expecting a quick FDA approval. I am not sure why we have a delay and probably this void of information is driving the stock lower. There is some chatter (on Twitter) that FDA might be insulted by the courts telling them what to do (the request for a 3-day notice by court before FDA issues final decision on Yureptia) or that FDA is delaying the approval until its own litigation with UTHR is resolved. As I understand all of these are just unsubstantiated guesses in a vacuum of any information or explanation for the delay.

As a reminder, UTHR previously sued FDA claiming that the regulator bent the rules for LQDA. The claimant argues that FDA allowed LQDA to seek approval for the additional PH-ILD indication by amending its existing NDA, instead of filing a completely new NDA. This seems like just another baseless delay tactic from UTHR and is not likely to have affect the eventual Yureptia’s approval. The key point is that LQDA’s amendment was filed in July 2023, when UTHR did not yet have the PH-ILD patent. UTHR’s patent was issued only four months later, in November 2023.

FDA is not legally obliged to wait until this lawsuit settles before issuing the approval for Yureptia. However, by choosing to entertain this butaforical lawsuit, FDA is setting a bad precedent that encourages suing the regulator to delay competitors.

We can only guess what’s happening behind the scenes or if the expected approval timeline has now materially changed. LQDA’s recent press release noted that the hearing for FDA/UTHR lawsuit is set for June 2025. I still do not think this date carries any relevance and there’s still a chance the approval could come any day over the following weeks.

Agree we can only guess but possibly in such a niche part of biotech it was related to Aerovate discontinuing development of its drug for pulmonary hypertension after it failed to meet endpoints in a stage II study. Stock dropped 95%.

A few days ago, FDA released their “Reply in Support of Federal Defendants’ Motion to Dismiss.” The judge will now take several weeks to make a decision. The document is accessible without requiring a PACER login (the link below). The agency has largely confirmed the earlier assessment that UTHR’s claims lack standing, as it did not possess the ‘327 patent when LQDA filed the PH-ILD amendment:

The FDA also presented several “not ripe” and “not fit” arguments, stating that UTHR’s claims of being harmed by LQDA’s choice to pursue an amendment instead of a new NDA are baseless due to the uncertainty of approval. While it is clear the agency used these arguments primarily to support the motion to dismiss the lawsuit, the frequent repetition of this point is a bit uncomfortable. Here are a few examples:

The market showed minimal reaction to this and the stock continues to hover around $12/share.

In addition to these lawsuit-related developments, LQDA filed an S-3 to register over 7m shares. Most of these shares are from one of the major shareholders, Patient Square Capital, a healthcare investment firm with $8 billion in assets under management. Patient Square Capital acquired nearly a 10% stake in a private placement in January 2024 at $10.442/share. According to its website, one of the founders, Adam Fliss, has 18 years of experience in law and government affairs. So they definitely are a well-informed perspective on the situation. The timing of this registration is intriguing and confirms that the conclusion may be approaching.

FDA’s reply: https://storage.courtlistener.com/recap/gov.uscourts.dcd.265262/gov.uscourts.dcd.265262.42.0.pdf

S-3 filing: https://storage.courtlistener.com/recap/gov.uscourts.dcd.265262/gov.uscourts.dcd.265262.42.0.pdf

I think the S-3 filing link is wrong above. Here is the link: https://www.liquidia.com/static-files/2ccbfb9e-4189-4cce-ab56-f4906c0246d4

So PSC registered the shares in preparation for a favorable conclusion? (so that they can start selling immediately after a positive event)

Or, If they are expecting a conclusion less favorable than currently priced, they would start selling once the registration becomes effective (i.e. about now)?

See below S-3 excerpt. It appears they were required to do this by early July (180 days from the January Private Placement). I’m not sure there is more to read into it than that.

In connection with the January 2024 Private Placement, on January 4, 2024, we entered into a registration rights agreement (the “Registration Rights Agreement”) with Legend. Pursuant to the Registration Rights Agreement, we agreed to file a shelf registration statement (the “Registration Statement”) with the SEC within 180 days following the date of entry into the Registration Rights Agreement to register the shares issued in the January 2024 Private Placement for resale and use our best efforts to cause the Registration Statement to be declared effective by the SEC or otherwise become effective under the Securities Act as soon as practicable after the filing thereof.

Sharing the excerpt below from Valorem Research – a fantastic substack for anyone interested in legal special sits. It is a much more educated take on the current litigation status at LQDA/UTHR/FDA than I would ever be able to make.

Interesting, thanks for sharing, dt. We’re back in legal decision territory. The FDA’s delay makes a lot of sense now. Does anyone have a good sense of what a negative outcome would entail? Is it a delay because of a court case?

If UTHR/FDA case does not get dismissed and proceeds to the trial, then I am guessing FDA will further delay approving the amended PAH/PH-ILD application for Yureptia till the trial outcome becomes clear.

In this case LQDA would likely retract the amendment and file a separate application for PH-ILD. Obviously, this would be a further delay to commercialization and LQDA shares would probably decline materially if the UTHR/FDA lawsuit is allowed to proceed to trial.

On a positive side – if UTHR/FDA case is dismissed, LQDA shares will spike upwards. So that’s the bet currently as I see it.

If LQDA eventually has to file a new separate application for PH-ILD, can LQDA also sue FDA for misguiding them? LQDA could have started the new application back in 2023, but didn’t do so because FDA told them an amendment was the way to go. So time is lost and LQDA is injured as a result of FDA’s mistakes.

Can they then ask FDA for some form of restitution, e.g., fast-track processing of the new application?

Thanks — if LQDA retracts the amendment and files PH-ILD separately, does this mean the FDA can move forward with PAH?

Snowball, I presume that could be an option; however, I’m not sure whether it would be a good idea to sue the agency when the approval for PH-ILD is still pending (in fact, for PAH as well).

On a separate note, I believe they should be able to move forward with the PAH indication if they file for PH-ILD separately.

Can approval of PAH indication alone support the current valuation?

I am not an expert but if we keep this simple, based on the timeline and the details provided:

1. Liquidia filed the amended NDA for YUTREPIA in July 2023.

2. At that time, the patent in dispute was the ‘793 patent.

3. The ‘793 patent was subsequently deemed invalid by the Patent Trial and Appeal Board (PTAB), and this decision was upheld by the Federal Circuit on December 20, 2023 (Liquidia).

4. The ‘327 patent was not issued until November 30, 2023, several months after Liquidia filed its amended NDA (Liquidia).

Given these facts, the amended NDA procedure followed by Liquidia should be valid in this case. The primary basis for United Therapeutics’ opposition at the time of the amended NDA filing, the ‘793 patent, was invalidated, and the ‘327 patent was not in existence at the time of the filing. Doesn’t this sequence support the validity of Liquidia’s amended NDA procedure?

You are correct to say that “Given these facts, the amended NDA procedure followed by Liquidia should be valid in this case.” That is also the position of FDA and LQDA. But now we wait for court decision as it does not seem FDA wants to proceed forward without it.

If UTHR’s case gets dismissed, and UTHR appeals (can they do that?), do you think FDA will also need to wait for the appeal process to complete?

I have seen a bunch of chatter, including on Valorem Research, about the prospect of SCOTUS issuing a grant-vacate-remand order after requesting a response to UTC’s pending petition. This happened a few days ago, so I am not quite short what is causing the stock to tank this morning other than general market selloff, but I am curious whether anyone thinks the risk/reward on the admin law has meaningfully shifted away from what was already known. What does a delay in launch look like for LQDA value? Presumably the selloff is less about ability to take share from UTHR – a delay as opposed to denial – and is more about longer period of cash burn, ramp?

risk of delay increased, reward remained the same

I asked Jason Adair of Liquidia about this petition this morning:

“We do not view this request for an appeal as causing any delay in FDA’s action. The FDA can issue its final action letter at any time. There are no legal or regulatory barriers to do so. This latest request for an appeal by UTHR to SCOTUS on the PTAB decision does not directly impact the FDA. Nor does this request for an appeal impact the case to dismiss the UTHR suit vs. FDA.”

Very ominous price action. A couple days ago, I thought it was maybe a fund getting blown out or flash crash of some kind. But this is day three, the price keeps heading lower on elevated volume. Meanwhile, UTHR just keeps ticking higher.

https://seekingalpha.com/news/4139368-liquidia-surges-after-sealed-document-as-investors-await-for-fda-yutrepia-decision

Liquidia (NASDAQ:LQDA) jumped 8% after a sealed document was filed as part of United Therapeutics (NASDAQ:UTHR) lawsuit against the Food & Drug Administration

Concealed filling by the FDA in the United lawsuit, I think we can expect a decision within days.

Interesting that UTHR share price hasn’t responded as drastically as LQDA.

decision tom or monday? seems like a decent bet here

Needham analyst thinks today. He wrote on Tuesday:

“The filed document is under seal and only available to be viewed by authorized persons, so the

contents of the filing are unclear. However, the sealed filing would be consistent with the 3-day advance notice that Judge Bates (judge presiding over case) implemented in late-March. He demanded that FDA provide 3-day advance notice to the court, during which it would review the merits of the case and reevaluate a potential prelim injunction, that was initially denied in late-March. The process was expected to include briefings by UTHR and responses by FDA and LQDA, before the judge made a decision. If this is the start of the 3-day process, we would expect a decision by Thursday/Friday this week.”

options seem priced for it

U.S. FDA Grants Tentative Approval of YUTREPIA™ (treprostinil) Inhalation Powder for Patients with Pulmonary Arterial Hypertension (PAH) and Pulmonary Hypertension Associated with Interstitial Lung Disease (PH-ILD)

August 19, 2024

U.S. FDA Grants Tentative Approval of YUTREPIA™ (treprostinil) Inhalation Powder for Patients with Pulmonary Arterial Hypertension (PAH) and Pulmonary Hypertension Associated with Interstitial Lung Disease (PH-ILD).

FDA confirmed that the amendment to add PH-ILD to the YUTREPIA NDA was proper and that application otherwise meets the requirements for approval under the Federal Food, Drug, and Cosmetic Act.

Final Approval of YUTREPIA for PAH and PH-ILD may occur after expiration of 3-year regulatory exclusivity for Tyvaso DPI on May 23, 2025.

FDA’s tentative approval is based upon all information submitted in the NDA, including the status of good manufacturing practices of the facilities used in the manufacture and testing of YUTREPIA.

MORRISVILLE, N.C., Aug. 19, 2024 (GLOBE NEWSWIRE) — Liquidia Corporation (NASDAQ: LQDA), a biopharmaceutical company developing innovative therapies for patients with rare cardiopulmonary disease, announced today that the U.S. Food and Drug Administration (FDA) has granted tentative approval of YUTREPIA™ (treprostinil) inhalation powder to treat adults with pulmonary arterial hypertension (PAH) and pulmonary hypertension associated with interstitial lung disease (PH-ILD). Tentative approval indicates that YUTREPIA has met all regulatory standards for quality, safety and efficacy required for approval in the United States but must await the expiration of regulatory exclusivity of a competing product before final approval can be granted.

Dr. Roger Jeffs, Ph.D., Chief Executive Officer of Liquidia, said: “We are pleased that the FDA agreed that our NDA amendment last July was proper, providing a clear path to full approval of YUTREPIA in both PAH and PH-ILD. However, we are disappointed and disagree with the FDA’s decision to simultaneously grant regulatory exclusivity to United Therapeutics for Tyvaso DPI that encompasses chronic use of essentially any dry-powder formulation of treprostinil in the approved indications for a three-year period for its new dosage form approved on May 23, 2022. We plan to take quick action to challenge the FDA’s broad grant of regulatory exclusivity and defend the ability for patients to have access to YUTREPIA with the least delay possible.”

Liquidia remains committed to addressing the unmet needs of PAH and PH-ILD patients and will seek final approval of YUTREPIA as early as possible.

https://investors.liquidia.com/news-releases/news-release-details/us-fda-grants-tentative-approval-yutrepiatm-treprostinil

-30% right now

Not an entirely positive outcome but -35% market response has got to be at least a 2x over reaction from an NPV perspective re May launch

Unfortunatel – Down to $9.90 pre market now

dt any thoughts on LQDA FDA announcement? thx so much in advance.

FDA’s decision is very disappointing. While every investor is fed up with delay after delay and never ending legal challenges, I think market’s reaction is overdone. 40% of market cap (or $400m) erased because commercialization has been pushed out by 9 months. I think this is a good buying opportunity for those betting on Yutrepia’s commercialization success.

I was very surprised to see “3-year regulatory exclusivity for Tyvaso DPI” expiring on May 23, 2025. I have not seen this mentioned elsewhere and it was not mentioned in UTHR’s 10-K, so if I understand correctly, this is a newly granted exclusivity. I am guessing FDA granted it to please UTHR and convince it to drop the lawsuit against the regulator. Any other thoughts on this?

If UTHR/FDA lawsuit is dropped, the path to final approval should be smoother. LQDA’s intentions to challenge FDA’s decision provides additional optionality for faster track to commercialization. However, I have no idea how speedy this process can be and what venues besides taking FDA to court (not a good option) LQDA has for this.

Also, couple members reached out noting the word “may” in the press release:

“Final Approval of YUTREPIA for PAH and PH-ILD may occur after expiration…”

This is a standard language for tentative drug approvals where ‘may’ is used instead of ‘will’ and I do not think it is indicative of FDA seeing any specific obstacles for Yutrepia.

Any views on funding/financing requirements?

LQDA had $133m of cash at the end of Q2 and has burned $50m in H1’24 (and $53m during the whole 2023) – so looks to be sufficient if commercialization begins in mid 2025.

what’s the worst risk here do you think? they gotta raise capital with extremely dilutive price ?

This opens the timing for the Supreme Court to get involved. Not sure the details of that case, but that could create more delays and if its related to the Chevron decision, the USSC could take it up just to shape regulatory power more.

which SCOTUS case you are referring to ? any link please

https://news.bloomberglaw.com/ip-law/united-therapeutics-takes-lung-drug-patent-fight-to-high-court

They haven’t granted review at this point, but at least one justice thought it was worth discussing.

If they do take it up (unlikely, but lots of unlikely things keep happening here), who knows when arguments or a decision would be.

Looks like UTHR lawsuit is working and being effective.

Why only 3 years? What happeneds after that? Seems risky.

it’s backdated exclusivity that ends in May 2025. Afterwards the FDA will grant final approval for Yutrepia (if we do not stumble upon other unknowns just around the corner).

Perhaps the three-year exclusivity period was intended to give the Supreme Court a chance to review the case before Yutrepia hits the market?

My guess this was more of a backroom deal with UTHR so that Tyvaso has market for itself for additional 9 months. Would not be surprised if we hear about UTHR dropping the lawsuit against FDA shortly. Just speculating.

I don’t think a backroom deal was likely.

If there were such a deal, LQDA would find out sooner or later, either via discovery or freedom of information request.

If such evidence emerged, FDA would be in big trouble legally and reputationally because such a deal harms LQDA’s interest for the benefit of FDA.

It’s more likely that we previously simply missed this risk, and FDA has always had this power to grant exclusivity (based on some existing rules that we simply weren’t aware of) .

It is highly likely that Martine was able to get the administration to provide political pressure to the FDA. There is really no other explanation as to how this went down. I spent 15 years in DC and can tell you that this happens all the time. There is no paper trail. This is Congressional leadership and/or a high level administration calling the head of the FDA and making it happen. Agency independence is a myth.

Yeah I agree with you Arquitos. Wondering what is your take on LQDA going forward?

UTHR just dropped their lawsuit against the FDA. I think LQDA files one against the FDA shortly. While there is a possibility of success there, it could take six months plus, so that doesn’t provide much relief. I don’t know how to ballpark odds of success there, but certainly lower than 50%.

Ultimately, LQDA gets full approval in May. The long term thesis is still intact. The stock will react to that prior to full approval, so while it could be sort of dead money until then, there will still be opportunities and optimism along the way.

I am not overly concerned about a capital raise. They’ll cut their expenses significantly by furloughing the salespeople. If they do need one, there will be ways to do it without diluting shareholders.

Thank you Arquitos for your valuable insights. Could you please provide a reference to UTHR dropping their lawsuit against the FDA?

https://www.courtlistener.com/docket/68267106/united-therapeutics-corporation-v-food-and-drug-administration/

I added the link here, but the comment needs to be approved by the moderator, so not showing yet. If you go to Court Listener and search Liquidia and FDA, you should find it though. You can also look at Pacer, but a lot of times you can access the documents for free at Court Listener.

Ultimately, LQDA gets full approval in May. – Arquitos

– But this is not guaranteed correct?

My understanding is that in May it has a 3-year period to start selling. After the 3 years, it’s up for renewal? Is my understanding accurate?

@madcap They may start selling after the FDA provides a full approval, which they may do after May 2025. The FDA will provide a new PDUFA date. Given the history, I would expect a speedy approval. There is no renewal. Once they are approved, they are good to sell indefinitely. It gets a little complicated from here on LQDA’s legal options, so well see what they end up doing. My guess is we’ll know in the next week or so.

Is it me, or is getting a whole new PDUFA date extremely risky?

Meaning right now this could be a Zero, if they don’t get approved. I think UTHR legal tactics are working. Am I wrong on thinking this?

Or, is this the FDA giving UTHR 9-months of exclusivity, before they now grant both companies the right to sell?

Does anybody have any thoughts on UTHR’s 50% rise in YTD stock?

I’m not trying to be over negatively, more of a devil’s advocate.

That’s a combination of:

– Tyvaso DPI growing 33% in Q1 and 92% in Q2 (the main competitor of Yutrepia)

– Legal wins against LQDA

Thanks, all. Anyone have thoughts on a pair trade at this point: long LQDA, short UTHR?

[Long LQDA+ short UTHR] is in fact a double LQDA long.

I think a proper paired trade should be [Long LQDA + long UTHR], to hedge the risk of UTHR getting its way.

Anyway, as a post-mortem analysis, without hindsight, for this trade, do you guys think we should have hedged with a UTHR long/call?

Quite right. Thank you for the correction, snowball

Liquidia Files Litigation to Challenge Regulatory Exclusivity Blocking Access to YUTREPIA™ (treprostinil) inhalation powder for Patients Suffering with PAH and PH-ILD

https://investors.liquidia.com/news-releases/news-release-details/liquidia-files-litigation-challenge-regulatory-exclusivity

Liquidia Files Litigation to Challenge Regulatory Exclusivity Blocking Access to YUTREPIA

https://liquidia.com/news-releases/news-release-details/liquidia-files-litigation-challenge-regulatory-exclusivity

New case link for those who want to follow along: https://www.courtlistener.com/docket/69066712/liquidia-technologies-inc-v-united-states-food-and-drug-administration/

I reading now that investors are suing LQDA for fraud??? This just compounds the problems at LQDA which is potentially strapped for cash until FY2025.

https://www.kxan.com/business/press-releases/accesswire/907123/an-investigation-has-been-opened-into-liquidia-corp-for-securities-fraud-and-the-schall-law-firm-is-asking-impacted-investors-to-participate/

This is just lawyers marketing their services – plenty of similar press releases with every larger share price decline.

A very educated take on the recent FDA’s decision and LQDA’s lawsuit from Valorem Research substack.

Shared with permission.

“There was quite a bit of Twitter action last week following the FDA’s decision to tentatively approve Yutrepia in both PAH and PH-ILD while simultaneously granting United Therapeutics an out-of-the-blue 3 year exclusivity period in both indications, further preventing Liquidia from selling Yutrepia until May of 2025.

The exclusivity was a surprise to everyone involved—including apparently both Liquidia’s and United Therapeutics’ management teams. United, for example, previously said in its 2021 Annual Report that it expected the Tyvaso exclusivity to terminate in March of 2024:

from United Therapeutics 2021 10-K

The basis for this new exclusivity originates in 21 C.F.R. § 314.108, which allows for additional 3-year exclusivity periods for NDAs containing New Clinical Investigations which are essential to the approval of the NDA.

from § 314.108

from 21 U.S.C. § 355(c)(3)(E)(iii)

These investigations must be new efficacy studies, and cannot be “bioavailability studies” (studies which merely demonstrate how much of the active ingredient is actually being absorbed by the patient). More specifically, under 314.108, “New Clinical Investigations” are defined as follows:

from § 314.108

The FDA, in its tentative approval, ruled that the United Therapeutics BREEZE Study, a relatively small and fast, 3 week, 51 patient 2022 study, whose primary objective “was to evaluate the safety and tolerability of treprostinil inhalation powder (TreT) in patients currently treated with treprostinil inhalation solution,” qualified as a new clinical investigation meriting a 3 year exclusivity ending in May of 2025. Importantly, the patients in the BREEZE study were already on stable doses of Tyvaso Inhaled Solution and switching to a corresponding dose of Tyvaso DPI. These were not treprostinil-naive patients.

On its face, this seems like the wrong decision, and more than a bit strange that the FDA raised this sua sponte years into the Yutrepia approval process.

UTHR filed an NDA for Tyvaso DPI for treatment of PAH and PH-ILD under section 501(b)(1) of the FDCA back in April of 2021. The NDA, which was approved in May of 2022, relied on (1) the UTHR TRIUMPH and INCREASE studies, (2) bioavailability data, and (3) the BREEZE study mentioned above. Notably, the TRIUMPH and INCREASE studies had already been submitted to the FDA in UTHR’s 2008 and 2020 Tyvaso Inhaled Solution and supplemental NDAs, respectively. In other words, the only new data which could be argued to be a new clinical investigation was the BREEZE study. Further still, because these were not treprostinil-naive patients in the BREEZE study, it seems that, if any exclusivity should be granted to UTHR at all, it should exclude any treprostinil-naive patients, thereby allowing Liquidia to immediately commercialize in a “new” PAH and PH-ILD patient population.

But despite these facial flaws, the path to victory for Liquidia here is not so clear. The BREEZE study did have secondary objectives—even if those objectives were not pursued in a rigorous manner, per Liquidia. Secondary objectives of the study “included evaluation of the systemic exposure and PK of treprostinil inhalation solution and TreT, 6MWD, device satisfaction and preference with the Preference Questionnaire for Inhaled Treprostinil Devices (PQ‐ITD), and the Pulmonary Arterial Hypertension‐Symptoms and Impact (PAH‐SYMPACT®) questionnaire.” Liquidia argues that these additional endpoints were “duplicative of prior studies” and notes that the BREEZE study “failed to produce clinically-valid findings because it was an open-label study with a number of patients too small to render statistically-significant results.”

In light of these apparently flaws, Liquidia filed suit on August 21 against the FDA in the District of D.C. The suit includes two counts against the FDA alleging the FDA’s decision to grant UTHR this new exclusivity exceeds the FDA’s statutory authority.

Whenever we’re looking at odds of success of a suit though, it’s critical to understand the standard of review for these decisions. We’ve talked previously about trial court vs. appellate court standards of review, and how those impact decisions. Here, at the trial court, we’re reviewing the FDA’s decision, the authority of which originates in the APA and FDCA to see if the decision was “arbitrary, capricious, an abuse of discretion, or otherwise not in accordance with law.”

That’s a high bar for Liquidia. The standard has oscillated in the past few decades between a deferential view of the standard and a “hard look” view. However, most recently, Justice Kavanaugh authored a decision in FCC v. Prometheus Radio Project returning to the deferential standard for the APA, stating that agency decisions would be respected if the agency acted within a “zone of reasonableness.” This new language injected by Justice Kavanaugh raises an already high burden on Liquidia. The FDA will lean on the secondary objectives of the BREEZE study, and given the deferential view, it is more likely than not that will be sufficient for the FDA to win here.

Is that what I think should happen? No. I think a carve out in the exclusivity for treprostinil-naive patients would have made the most sense. But what I think should happen doesn’t really matter, and I just don’t think I see the FDA amending the exclusivity; at least not in the 9-month timeline that matters to Liquidia. Liquidia cites no precedent in its complaint which establishes a precedent for the FDA to quickly amend and limit the exclusivity. Indeed, the AstraZeneca case Liquidia cites actually found that AstraZeneca did not demonstrate the FDA’s decision in that case was “arbitrary or capricious.” And while Liquidia asserts that the BREEZE study lacked “innovative change” because the study concluded that Tyvaso DPI patients “faced no worse outcomes for the first three weeks” and that adverse events were “consistent with studies of [Tyvaso Inhalation Solution] in patients with PAH,” Liquidia has failed to cite any precedent indicating that this limited but additional safety data contravenes the FDA’s discretion. The mere fact that the BREEZE study found adverse event rates were no worse than Tyvaso Inhaled Solution does not mean that the adverse event data was inconsequential.

Liquidia will move for immediate injunctive relief, but I’m not sure Liquidia will be able to show a likelihood of winning on the merits, nor will they likely be able to show irreparable harm, given the consequences to Liquidia are fairly easily measured in cash burn. Liquidia will argue the loss of market share constitutes irreparable harm, but without any market share currently, that argument is unlikely to be credited heavily by the Court.

For now, I’m sitting on the sidelines. Liquidia has a non-frivolous claim, and I don’t think the odds the FDA wins here are greater than 70% or so, but Liquidia ended the quarter with $133mm in cash, and with litigation expenses and commercialization ramp up, it seems that Liquidia will almost certainly need to raise additional capital by year end if the exclusivity is not imminently abridged. That’s not a bus I want to step in front of.”

Thank you DT/LionelHutz, quite helpful.

@Arquitos – any thoughts on the cash burn and potential equity dilution?

I’ll preface with, anything can happen. However, I am not as pessimistic re: equity dilution. They will furlough most of their salespeople and legal spend will likely be lower than the recent past. Plus, they will have funding options outside of a capital raise if they need it.

That being said, everything is a trade off on the capital raise side, so we’ll see…

Yes, royalty finance market for FDA-approved drugs is pretty well developed.

Royalty Pharma (RPRX) is one of the biggest players in this market. They can provide credit with royalty revenue as collateral, and they can also purchase a share of the revenues.

Is there anything that prevents UTHR from doing additional studies like the BREEZE study that could win additional periods of exclusivity?

As far as I know, NDA applicants don’t “win” exclusivity. In fact, they don’t need to tick a box or fill out a form to ask for it. FDA can grant or not grant exclusivity without the applicant asking specifically for it.

This is why it was so surprising to both LQDA and UTHR that FDA suddenly granted the exclusivity more than two years after the 2022 approval.

Does this make sense: the uncertainty surrounding Liquidia was at least the same or more in March 2024 considering the UTHR lawsuit with the FDA and the pending approval for PH-ILD. If Liquidia’s stock price was $14-$17 in March 2024, it would be inconsistent with a stock price of $9-$10 in March 2025 considering the lower level of uncertainty. Basically, if the uncertainty is the same or less, could we expect a high probability for the stock to get back to $14-$17 by March 2025?

Perhaps the only difference is risk around needing to raise given cash burn since March?

It was a lottery ticket back then, and now it is trading as discounted future cash flow.

Lottery-like stocks tend to be overpriced, which is a well-documented asset pricing anomaly.

I think the simplest explanation is that LQDA was over-priced in March 2024.