DMC Global (BOOM) — Large Asset Sale — 70% Upside

Current Price: $16.7

Target Price: $28+

Upside: 70%

Expected Timeline: TBD

DMC Global is a $330m market cap industrial products manufacturer operating three distinct businesses, each of which is a market leader in its niche. The company has recently announced intentions to divest two of its divisions and then focus on the core remaining segment. This strategic review seems to be a result of shareholder pressure:

“The strategic review process formalizes DMC’s ongoing efforts over the past several months to consider opportunities for unlocking shareholder value. <…>

Arcadia Products is a core division of DMC, and we are taking a very focused approach toward maximizing its differentiated business model and capitalizing on growth opportunities within its large addressable markets. Both DynaEnergetics and NobelClad are valuable, industry-leading businesses with strong margin profiles. However, the Board and management team are aligned with the view expressed by many DMC shareholders that the Company should seek to simplify its portfolio to drive improved shareholder value.”

Given the market-leading positions, solid historical EBITDA margins, and capital-light nature of the two to-be-divested segments, I think management will easily find buyers for these assets and close transactions by the end of the year. The net proceeds from the to-be-divested businesses are likely to be around the current EV of the whole company, meaning that investors are getting the core remaining division for free. Sum-of-the-parts valuation with what I believe are conservative multiples for each business indicates 70% upside. The downside appears limited – the company is trading at an already low valuation with the stock sitting at multi-year lows and below the pre-announcement levels.

I will admit upfront that my understanding of the three businesses and their drivers is rather limited and below is my best effort to shed some light on the situation. Having said that, there seems to be sufficient margin of safety to be wrong on certain aspects/valuations.

There was no 8K for the strategic review, just the press release. BOOM shares had a temporary boost from the announcement, but reverted back in two days. Thus I am hopeful, that this setup is flying under the radar and that this at least partially explains why the opportunity exists.

The three divisions of DMC Global are:

- Arcadia (42% of TTM revenues): provides exterior/interior framing systems, windows, curtain walls, and other building products for commercial buildings (79% of the segment’s sales), as well as doors and windows for ultra-high-end residential buildings (21%). BOOM holds a controlling 60% stake in the business and has an option to acquire the remaining 40%.

- DynaEnergetics (44%): manufactures perforating systems and related hardware used during the well drilling process in the oil and gas industry.

- NobelClad (15%): produces explosion-welded clad metal plates used in the construction of corrosion-resistant industrial processing equipment.

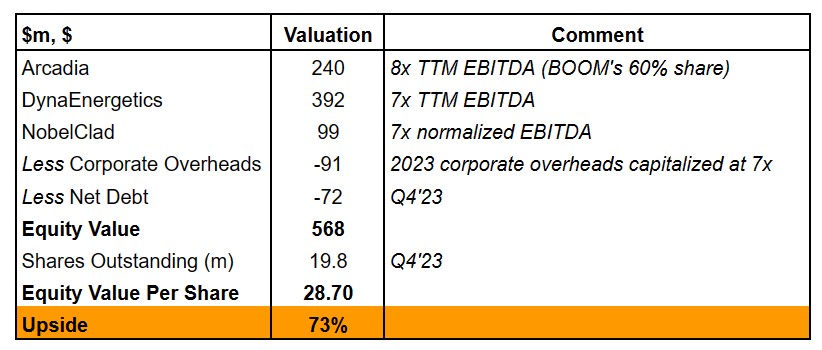

This is what the sum of the parts looks like for BOOM in its current state with three distinct businesses under the umbrella of the holding company.

Events leading to the strategic review

- Dec’21: BOOM acquired the controlling 60% stake in Arcadia for $283m (in cash and stock). As part of the transaction, the parties agreed to a put/call option whereby DMC could acquire the remaining 40% interest on Dec’24 for a higher $187m or 9.5x 3-year EBITDA (in line with the valuation of the acquisition of the controlling stake in 2021).

- Jan’23: BOOM’s long-time CEO unexpectedly announced his resignation. The interim co-CEO roles were taken over by the former CFO Michael Kuta and Chairman David Aldous. Kuta had previously announced his intentions to retire from the company but eventually agreed to postpone his retirement and become the interim co-CEO.

- Aug’23: Michael Kuta was appointed the permanent CEO of BOOM.

- Jan’24: BOOM announced a strategic review for its DynaEnergetics and NobelClad businesses.

BOOM/Arcadia pro-forma for the divestments

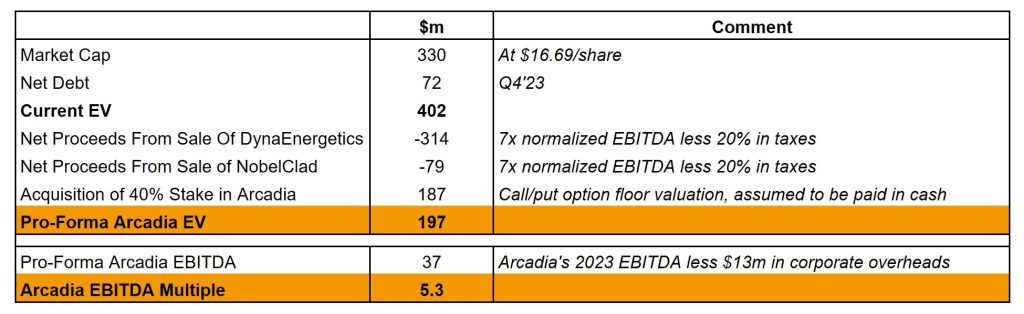

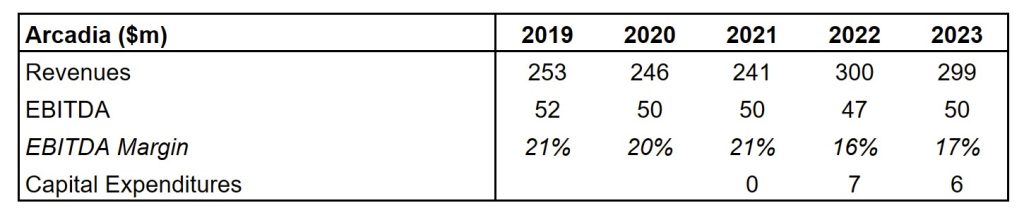

The sale of DynaEnergetics and NobelClad would transform the company from a business exposed primarily to energy end markets to a provider of commercial building products. Pro forma for the potential divestitures and assuming DMC acquires the remaining 40% in Arcadia, the business is currently trading at 5.3x EBITDA, which seems too low for a capital-light and highly cash flow-generative business with a long track record of growth.

After divestitures and the acquisition of Arcadia’s minority stake, BOOM would still be left with c. $140m excess cash (that’s assuming my valuation multiples for DynaEnergetics and NobelClad are directionally correct). While historically BOOM’s management spent only symbolical amounts on dividends/repurchases, things might be changing with the newly appointed CEO, restructuring of the business, and likely shareholder pressure.

DynaEnergetics – to be divested

This was the key business that DMC Global has been investing in and growing over the last decade. DynaEnergetics designs and manufactures perforating systems used by oil and gas exploration companies in the well-completion process. Perforating systems are used to fire plasma jets (i.e. high-temperature ionized gas streams) through the drill pipe, creating gaps in the formation and allowing oil and gas to flow into the well. Perforating systems constitute a very small portion (less than 2%) of total well completion costs.

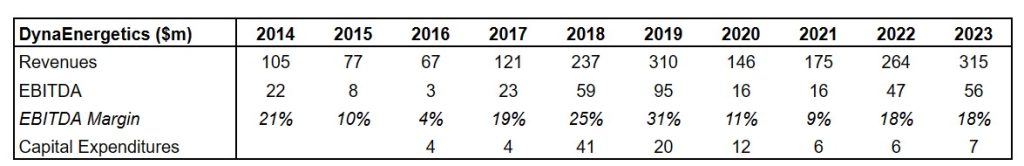

While the segment’s topline and profitability have historically fluctuated widely due to cyclicality in US well-completion activity (see chart below), over the last decade, DynaEnergetics’ management has grown the business from minimal EBITDA to $56m in 2023. This growth has been largely driven by market share gains, with DynaEnergetics currently holding an estimated 20% of the market. Management explains that customers prefer its products over competition as DynaEnergetics factory-assembled perforating systems are more efficient and require less working capital/crew compared to competitors’ on-site assembled perforating systems. From Nov’22 conference call:

We believe that we’re picking up market share. It’s driven by the performance of our products but also the performance of the company on having a fully integrated system where we take full responsibility for the performance of the perforating system and that’s different than a lot of the machine shops. And also what’s driving our revenue and our market share growth is our ability to deliver on time as well as the performance and safety of our equipment.

DynaEnergetics should have limited capex requirements going forward given major upgrades completed in recent years. Below are several quotes from the Dec’21 conference call:

From a capital allocation and capital standpoint. Again, these are businesses, I think, collectively that are in that 3% to 4% of sales in terms of capital long term for the businesses. And so the — on a longer-term basis, we see this as $15 million to $20 million on a consolidated basis for CapEx for all 3 of our businesses. So again, it’s probably in that 3% to 4% range.

[…]

We have completely upgraded our previous 2 businesses, NobelClad and DynaEnergetics. There’s some capital that we need to continue to invest in both. But the major expenditures taking place, and we feel we’re very positioned — very well positioned to serve the markets going forward at a reduced capital spend than what we’ve had historically because we took the hit early on in terms of the cash flow in making those investments.

Several aspects suggest that the business is currently operating at around mid-cycle levels and I think DynaEnergetics’ 2023 EBITDA of $56m is a good proxy for the segment’s normalized profitability.

- DynaEnergetics’ 2023 EBITDA margin of 18% is broadly in line with the segment’s average historical margins of 17% displayed during 2014-2023.

- While management anticipates a pickup in well completion activity in North America in 2024, DynaEnergetics’ topline is expected to remain flat going forward as the positive impact of potentially increasing well completion activity, cost reductions, and new product offerings will be (and already has been) offset by lower pricing partially due to the consolidation in the O&G space.

- Several of the ‘Big Four’ drilling services providers, HAL and BKR, expect North American O&G exploration activity levels to remain flat in 2024.

- Since dropping sharply during Covid, the US rig count has gradually increased through 2023 before plateauing/slightly decreasing and currently remains well below pre-Covid levels.

As for the valuation multiple in a sale scenario, we have several reference points:

- DynaEnergetics was acquired by BOOM back in 2007 for $97m or 1.7x cyclically high 2008 revenues ($59m). The business has grown substantially since then, driven by the shale oil industry boom and Dyna’s market share gains, with revenues increasing 5-fold since then.

- One of DynaEnergetics closest peers, GEODynamics (focuses on providing perforating systems), was acquired by OIS at 13.7x EBITDA and 2.9x sales back in 2018. Note that 2018/2019 was a cyclical peak, so the multiple paid was probably on the high end. EBITDA of GEODynamics (which is now Downhole Technologies segment at OIS) has moved downwards since then.

- UK-listed HTG:L (manufactures equipment used in well construction and completion) is currently trading at a 6x FY23E EBITDA. HTG generates 26% of revenues from perforating systems, with the rest coming from other equipment, such as premium connections, well construction, and completion accessories.

- DRQ, a publicly-listed manufacturer of equipment used in O&G drilling and production activities (such as subsea and surface wellheads, specialty connectors, and mudline hanger systems), is trading at 12.1x 2023 EBITDA.

Given these data points, coupled with DynaEnergetics’ solid mid-cycle margins, capital-light nature, market-leading position, and the fact that its products/services account for a tiny proportion of total well completion costs, I would expect DynaEnergetics to fetch at least a 7x EBITDA multiple in a sale. This would result in potential gross sale proceeds of $392m, which is equivalent to the entire enterprise value of BOOM.

Worth noting that DynaEnergetics has been involved in several patent litigations against its competitors (both as a defendant and plaintiff). In late 2022, DynaEnergetics received an unfavorable ruling in a lawsuit related to a patent covering its perforation gun components against several competitors, including G&H Diversified Manufacturing. Moreover, in Jan’23, a jury cleared DynaEnergetics’ competitor Hunting Titan in a patent infringement lawsuit. These developments could potentially have an impact on DynaEnergetics’ operational performance going forward given the importance of technology in the perforating system space.

NobelClad – to be divested

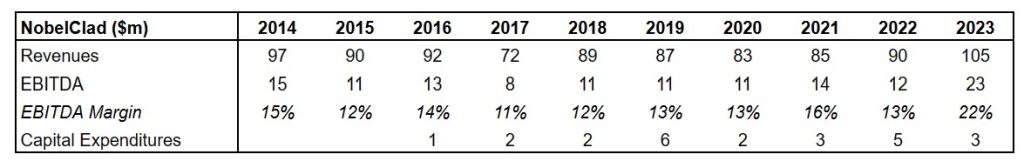

NobelClad produces explosion-welded specialty-clad metal plates, clad heads, and tube sheets made from titanium, stainless steel, aluminum as well as various base metals. The products are sold to a high number of diversified end markets, including oil and gas, transportation, chemical, and defense. Management estimates that the business has captured a 20% market share.

NobelClad has historically been a very stable business from a revenue/profitability perspective. Segment’s profitability has improved markedly in 2023 driven by a strong demand from the end-markets and a favorable shift in the business mix to higher-margin projects. BOOM’s management expects the segment’s EBITDA margins to moderate to Q1’23 levels (15%) in the current quarter. For valuation purposes, I apply the average EBITDA margins displayed during 2014-2022 on NobelClad’s 2023 revenues to arrive at $14m in normalized EBITDA.

Similarly to DynaEnergetics, NobelClad is expected to require low capital expenditures in the coming years (likely c. 3-4% of revenues) as management has highlighted that major investments into the business have already been made during previous years, including renewing NobelClad’s manufacturing facility in Europe.

Figuring out the multiple at which NobelClad could be sold is not straightforward as the segment does not have any directly comparable publicly-listed peers. However, ATI (specialty metal products used primarily in aerospace/defense as well as specialty alloys) is currently trading at 12.2x TTM EBITDA. Given NobelClad’s stable topline and profitability, solid margins, and minimal capex requirements, I would expect the business to fetch at least a 7x EBITDA multiple in a sale scenario.

Arcadia – retained as core business

This is the core segment that BOOM intends to focus on going forward. Arcadia provides architectural building products for several end markets:

- Commercial exteriors (69% of sales): framing systems, windows, curtain walls.

- Commercial interiors (10%): framing systems, aluminum doors, sliding systems.

- Ultra-high-end residential (21%): doors and windows for luxury homes.

BOOM has stated that the key commercial exteriors segment is the market leader in the Western and Southwestern US, where it holds a 10% market share (the industry is highly fragmented). While it might seem that this segment is largely exposed to the office real estate market, the business also serves a number of other real estate end-markets, such as airports, schools, government, and healthcare buildings. This has allowed the company to perform well throughout macroeconomic cycles and deliver strong growth over the last two decades. From Q1’23 earnings call:

No. Patrick, we’ve got a number of end-use markets there. We’ve got the commercial product side that has everything from storefronts to projects. We’ve got interiors, office interiors, we’ve got residential, high-end residential. In the commercial side, we’re in a number of different markets. Some of those are noncyclical airports, health care, those kinds of things. Some of them are countercyclical, institutional application, schools, dorms, libraries, government offices as well as those that are typical commercial. So we cover the gamut of those applications and the fact that we’re in so many markets, some of which are noncyclical, some of which are countercyclical, helps us be robust and resilient through the cycle.

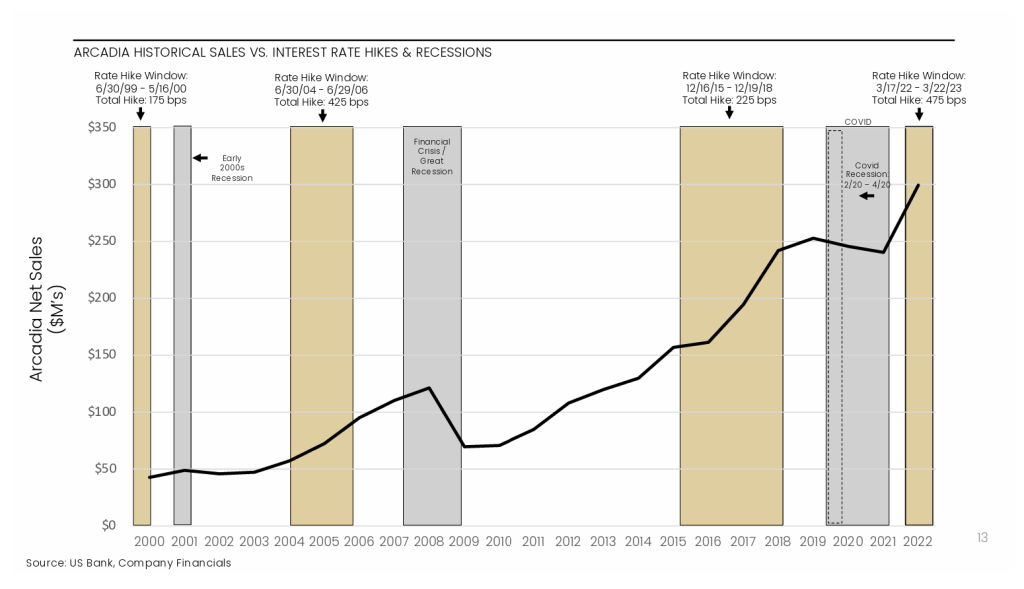

More recently, after a flattish 2020-2021, the growth resumed in 2022/2023, albeit margins were negatively affected. During the Q3’23 earnings call, management stated that the business should continue to display similar margins going forward. A potential boost to volumes and margins is expected from investments in painting and anodizing capacity (some of which are currently outsourced but will be brought in-house).

Like the other two DMC segments, Arcadia is a capital-light business – management guided for $10m in annual capex back in Dec’21 vs $300m in annual revenues and $50m in EBITDA. It is also highly cash-generative with c. 80-90% FCF conversion.

We have several reference points of where Arcadia could trade as a standalone entity (after the divestments of DynaEnergetics and NobelClad).

- The acquisition of the 60% controlling interest in the business back in Dec’21 valued the whole of Arcadia at $470m.

- The Dec’21 transaction was done at 8.6x TTM adjusted EBITDA of $55m.

- The call/put option to acquire/sell the 40% minority stake in Arcadia specifies that both sides have the right to buy/sell the remaining interest at the higher of 1) the value implied by BOOM’s 60% interest purchase price (implying a floor valuation of $187 million) and 2) the average EBITDA for the past two fiscal years plus the EBITDA forecast for the current year multiplied by an exit multiple of 9.5x. Thus both sides of the deal considered 9.5x EBITDA to be an appropriate valuation for this business.

- The call/put option will become exercisable in Dec’24 and BOOM’s management reiterated intentions to acquire the remaining stake in Arcadia at the previously agreed valuation (i.e. $470m). From Aug’23 conf call:

Question: First of all, great quarter we’re seeing deleveraging, Dyna’s doing great, and then you also have this Arcadia put next year. How do we look at — but you also have some really nice growth opportunities with Arcadia in markets that you’re just starting to look at or starting to penetrate, in Houston, Dallas. How do we look at a balance of deleveraging versus growth opportunities over the next 12 to 18 months?

Answer: Yes. So first of all, we feel like we’ve got a very clear and strong path on the put call and but definitely we know that that’s out there, so we’re going to balance the growth side with the investment on the Arcadia side. We do feel very bullish about generating cash flow, the remainder of this year and into 2024. So we feel pretty optimistic that we’re going to be able to balance that pretty well and be able to invest in Arcadia, continuing with investments this year, to put paint capacity in place and next year to put a second leg of capacity in and continue on in ’24 with investing in that business and, and also making some investments in Dyna, NobelClad.

- There are also several comps and industry transactions. While these are in somewhat different industry lines, they show that directionally the multiple is likely to land in the 8x-10x range. CRH sold its Oldcastle BuildingEnvelope business (provides architectural products, such as windows, doors, and curtain walls, primarily for commercial buildings) in 2022 for $3.5bn or 11.5x EBITDA. Meanwhile, EFCO Corporation, a manufacturer of windows, curtain walls, storefronts, and other products for commercial buildings, was acquired in 2017 at 0.8x revenues. Publicly-listed comps DOOR (produces interior and exterior doors and door systems, primarily for the residential end-market) and JELD (manufactures interior and exterior building products, including windows, interior/exterior doors, and wall systems) are currently trading at 8.6x and 6.5x TTM EBITDA. Another comp, PGTI, a manufacturer of impact-resistant doors and windows with a dominant market position in Florida, is currently getting acquired at 11x FY23 EBITDA.

Given these valuation reference points, I think it is reasonable to expect Arcadia to trade at least at 8x EBITDA. Counting in the full burden of corporate overheads ($13m on an annual basis + stock comp), would result in company earnings of $37m, and an EV of $300m. Any reduction in corporate overheads would have a large impact on value. With Arcadia remaining the only business for DMC Global, the holdco structure will no longer make any sense. So there will be plenty of potential savings to be realized from the simplification of the organizational structure if only management will be willing to proceed in this direction.

Capital Allocation

One of the key uncertainties is what BOOM’s management will do with the sale proceeds. BOOM’s latest investor presentation includes a slide that highlights the focus on maximizing stakeholder value (see below). The strategic review press release was even more specific and talked about ‘shareholder value’ instead of ‘stakeholder value’. However, the company has used similar language for a decade now – for instance, see this 2014 public letter from the ex-CEO. However, these talks resulted in very limited return of capital for shareholders and the stock price has not appreciated much either (flat since 2009). Dividends have still not been reintroduced after suspension in 2020 despite significant cash flow generation (and accumulation on the balance sheet) over the last few years. Coupled with the fact that management owns little stock and is compensated generously, this might explain why the market is skeptical of the setup.

However, there are reasons to think this time might be different.

- Judging from the wording of the press release, shareholders are pressuring management to realize the full value of the three operating divisions.

- The new CEO has been running the show since Aug’23. He previously wanted to retire, so his comeback to a new role might signal a change in strategy.

- Divestment of DynaEnergetics and NobelClad will mark the first time the company has disposed of any of its businesses over the last decade – a very clear change in corporate direction.

- Management has previously stated that its capital allocation priorities include continuing to repay debt, acquiring the remaining 40% stake in Arcadia, and investing in Arcadia (see quote below from Nov’23 conference call). However, after the divestitures the company would easily cover these capex needs and still be left with a large excess cash balance. That might prompt a change towards capital return to shareholders.

And in terms of how we allocate the capital, we are looking to continue to delever the balance sheet. So that’s going to be 1 area, but we’re also putting CapEx back into the business. So, for Arcadia, Mike mentioned the paint line where we’re going to be looking to do some industrial engineering. We’re also going to be looking at making some investments in the anodizing area as well, which will help broaden margins for the Arcadia business.

I wrote the “original” Twitter thesis (not this one!) on the day the strat review was announced. I’ve been following it closely for c. 3 years. Very nice writeup, thank you. I fundamentally agree with you. A few thoughts to aid others’ DD:

Arcadia:

A1: BOOM are going to buy the other 40% so better to value BOOM with 100% of Arcadia and with net debt higher by whatever they pay for it (likely $187m but NB $25m loan TO Arcadia founder will be repaid to BOOM). They have a debt facility for that.

A2: Conf call transcripts around/after the time they bought Arcadia laid out a path to adding 50%-100% to EBITDA. They’ve been very slow so far, which is why CEO was fired, but there is still a decent chance that the new paint capacity in 2024 and insourcing the anodising (with effect from early 2025) can add quite a bit to Arcadia’s current bottom line. Anodizing and the paint lines will cost c. $10m total, a rounding error, very fast payback indeed.

A3: So I think Arcadia is worth more than you do, and anyway I think Arcadia gets bought by one of the bigger players as soon as Dyna and Nobelclad are gone.

Nobelclad:

N1: recent order intake supports a c. $100m+ top line continuing, as per your use of 2023’s revenue for the forecast. But I’d use a higher margin than that delivered in a period with average revenues of only c. 90. Looking even longer back shows very clear operating leverage which implies (on say $100m revenue) Adj EBITDA of more like $17m.

N2: So I think Nobelclad is worth more than you do, but whether PE can pay a decent multiple I don’t know. It might need someone with some salesforce synergies, who is already selling into their client base, to pay a better multiple.

Dyna:

D1: sadly I don’t think 2023A can be treated as a good base year. Whole first half of 2023 preceded the (surprise to shareholders!) merger of their biggest 3 Permian clients which has killed their pricing (as they seem to price with volume-related discounts so the discount got massive). I think v unlikely this merged client switches to Titan or the worse competitors if Dyna get a few %age points of this pricing back, so I hope some of the decline can be recovered in ’24 or beyond… but would a bidder pay up for this?

D2: Dyna has massively taken market share since acquisition, and 2023 had its peak market share. That arguably justifies a premium valuation, as does its high margins and protected technology. BUT (and since I wrote my Twitter post it’s even worse), even good shale-focused oil service businesses seem to be trading for extremely low multiples. See Expro’s recent acqn, FET’s in Canada, and the frac sand acqn by Atlas Energy).

D3: I would prefer to see Dyna merged with e.g. Forum than sold for cash at 5-6x what I think is plausibly a suppressed ‘current runrate’ EBITDA. Selling Nobelclad for decent money would mean BOOM doesn’t need much cash from the Dyna exit. They could sell a chunk to FET and spin-merge the rest into it, which is also more tax-efficient. I do see plenty of mostly-cash bidders for BOOM, though – wireline companies like Ranger, Expro, maybe NOV, the Wilks bros perhaps, and private equity (which, having backed 3 of the 4 major perforation players plus tiny NCSM, knows the market).

Thanks for this. Would you mind sharing your original write up ? (If you don’t mind). Tried searching on Twitter but $BOOM just brings up loads of crypto spam. Best.

Thank you for the additional color on individual businesses – that is really helpful. As I indicated upfront, my expertise here is limited, but the company is cheap enough to compensate for any inaccuracies in valuation.

Just found your tweet as well – worth a read for anyone interested in the setup: https://twitter.com/ex_locust/status/1751954187942773058

So from the numbers in your thread:

– Dyna – “23e EBIT c. $54m, adding back $1-2m of litigation cost in Q1 that won’t recur. Broadly a midcycle year, good first half weaker second half. 8.5x EBIT because shale comps are so cheap. =$460m. Maybe get a bid premium but maybe not.”

– NobelClad – “23e EBIT probably >$16 but as it’s after a long run of $10m EBITs, I use $13m. 11x as it’s just a standard industrial business. = in round numbers $145m.”

– Arcadia – “Arcadia (100% of), $50m EBIT (watch out for deal-related amortisation!), 12x giving some credit for the higher profit that will come after raising the paint shop capacity and anodising lines. = $600m”

These EBIT multiples/valuations for each of the businesses seem to be higher than the 7x-8x EBITDA that I used in the write-up. However, directionally we arrive at a similar final value for the stand-alone Arcadia – i.e. if the sale of Dyna and Noble is successful, Arcadia is very cheap at current levels.

On your individual points:

A1: agree that funds will first be spent on buying out 40% of Arcadia and I included calculations for that in the table. But I think after the acquisition of Arcadia’s minority stake and divestiture of Dyna/Nobelclad , they will end up in net cash, rather than a net debt position.

A2: I was not aware the previous CEO was fired, or that he was fired because of underperformance at Arcadia. If the board had the guts to fire a long-standing CEO because of that, it is actually a pretty good sign.

A3: I referenced Arcadia’s value closer to the price of 2021 transaction, as EBITDA has not improved much since then. I have also loaded it with $13m of corporate overheads to arrive at a $300m valuation. I agree this figure could be way higher if Arcadia’s EBITDA starts growing or corporate overheads are eliminated.

N1/N2: If this is a duopoly business as per your tweet, then my multiple of 7x EBITDA is overly conservative.

D1: For Dyna I have relied on management’s guidance as well as commentary from Dyna’s customers, for 2024 revenues/margins. That might be too optimistic. Any idea what the customer concentration is currently for this business? 2023 report indicated that the largest customer accounted for 15% of revenues and 23% of receivables. So if the 3 merger Permian clients now account for a quarter of revenues, it does not seem to punitive.

D2: Expro bought Coretrax at 4.7x EBITDA and Atlas acquired Hi-Cruch at 3x EBITDA. I do not think Atlas acquisition is relevant, as Hi-Cruch is more of a service provider and supplier of commodity products. But Coretrax is definitely relevant and I missed this deal when looking at peers. Thanks for highlighting.

Btw, do you have a take on the new CEO (previous CFO)? Is he in this to sell all the assets and retire? Or will he start to build his own new empire on the back of Arcadia’s business?

I think CEO is indifferent between taking a very large cheque (he is young, won’t retire from work) and building Arcadia with add-ons. Could do both if he sells to PE in an MBO. I just think he’ll receive bids from the names you mentioned plus and shareholders will force a sale. This stock must be crawling with activists with still-small positions.

Ex-Locust,

Thanks for your detailed comment. Do you have a SOTP valuation based upon your thoughts?

It’s complicated because I run a couple of scenarios and, since my original tweet, some major changes in (esp Dyna) profits.

In round numbers:

Arcadia $667m at 100%. $300m revenue; I think revenue can grow but I leave that for the multiple and anyway maybe falling alu prices mean it doesn’t grow much in 2024. Add 2% margin to 2023’s for the anodising improvements that will benefit 2025 = AdjEBITDA around $56m. I take off SBC <$2m and 'real D&A' of c. $4m = say $50m real profits. I put that on say 13.5x = $667m (60% currently owned is $400m but I value the full 100%). It's just under 12x EBITDA. It's not conservative, but nor is it a full takeout valuation and it bakes some residential growth (paint lines) into the multiple that 'ought' to be in the earnings. I don't make an adjustment for the divis that will be paid to Arcadia minority as it's only 5x EBITDA, and that’s not particularly conservative, it assumes (as I believe) that there will be two decent bidders bidding against each other. I’m gutted to be selling Dyna at these kinds of valuations but it has to go for Arcadia to rerate / be bid for. Hence my preference, if it could be achieved, for a partial spin-merger into e.g. FET /

Nobelclad I still think c. $140m. Broadly normalised EBITDA c. $17m assuming, as I believe, that $100m revenue is the new normal or at least that bidders believe it is. Plot revenue vs. EBITDA since say 2013 is suggests $17m at $100m rev. Less $3m approx depreciation /capex is $14m real profits. So I’m saying someone would pay a 10% unlevered untaxed cash flow yield. I think it’s “worth” that, but can PE afford that if their senior debt costs 8%+… maybe not. But I think it sells to someone who has some ‘angle’ on it or lower cost of capital; and it’s a very scarce asset, it will never be sold again and there is no other peer for sale.

Less tax and banker fees on the sales: say $100m (25% on sale price), but I’ve little idea what the book value is of these divisions – not much ‘hard net assets’ but a lot of cumulated profits in each, so maybe I’m too conservative here. Can anyone help? It makes a big difference!

SUBTOTAL EV ex HEAD OFFICE = $967

Central costs -$120m. This assumes $12m/yr x10, but I really don’t think Arcadia remains listed ($12m vs Arcadia’s say $50m profit is a tasty synergy in its own right!).

SUBTOTAL EV WITH ARCADIA STAYING LISTED = $847

Minus $72m net debt, -$187m to buy the rest of Arcadia, +$25m the loan to Arcadia founder

TARGET MARKET CAP = $613 or $31/share. Get this probably this time next year, after the closing of the deals and evidence of Arcadia’s improving trajectory.

Overall perhaps my multiples are a bit punchy but on the other hand I think there’s $6/share of head office costs that would almost all disappear in a full take-private of Arcadia, and tax is probably less bad than I model. I can run ‘low’ cases for each asset and, SO LONG AS DYNA IS SOLD SO THE CONGLOMERATE DISCOUNT IS SMALL/NONE, then you “cannot lose money from here”. Famous last words. Actually, the last words are “DYOR”!

SORRY COPY PASTE GLITCH:

In round numbers:

Arcadia $667m at 100%. $300m revenue; I think revenue can grow but I leave that for the multiple and anyway maybe falling alu prices mean it doesn’t grow much in 2024. Add 2% margin to 2023’s for the anodising improvements that will benefit 2025 = AdjEBITDA around $56m. I take off SBC <$2m and 'real D&A' of c. $4m = say $50m real profits. I put that on say 13.5x = $667m (60% currently owned is $400m but I value the full 100%). It's just under 12x EBITDA. It's not conservative, but nor is it a full takeout valuation and it bakes some residential growth (paint lines) into the multiple that 'ought' to be in the earnings.

Dyna: $260m. 2023 Adj EBITDA 56m. Replace Q1 23a with Q124e guide, -6m. Then again for Q2, -$6m which is 7% off margin, as implied by Q1 guidance. Add 1m exceptional back to Q4. Add 2% tot total annual margin for automation + some pricing recovery vs that big client +6m = $50m EBITDA rounded. Take off $7m D&A = $44m real profit. I think it's worth a decent multiple and could plonit to HTG LN, OSI, HAL, Tetra, WFRD, DNOW, SBO AT to support 7-8x EBIT. But many other shale-focused stocks more like 5-6x EBIT and recent M&A has been very very cheap. I use 6x EBIT so $260m rounding down. It's only just over 5x EBITDA, and that’s not particularly conservative, it assumes (as I believe) that there will be two decent bidders bidding against each other. I’m gutted to be selling Dyna at these kinds of valuations but it has to go for Arcadia to rerate / be bid for. Hence my preference, if it could be achieved, for a partial spin-merger into e.g. FET / KLXE/Ranger.

Nobelclad I still think c. $140m. Broadly normalised EBITDA c. $17m assuming, as I believe, that $100m revenue is the new normal or at least that bidders believe it is. Plot revenue vs. EBITDA since say 2013 is suggests $17m at $100m rev. Less $3m approx depreciation /capex is $14m real profits. So I’m saying someone would pay a 10% unlevered untaxed cash flow yield. I think it’s “worth” that, but can PE afford that if their senior debt costs 8%+… maybe not. But I think it sells to someone who has some ‘angle’ on it or lower cost of capital; and it’s a very scarce asset, it will never be sold again and there is no other peer for sale.

Less tax and banker fees on the sales: say $100m (25% on sale price), but I’ve little idea what the book value is of these divisions – not much ‘hard net assets’ but a lot of cumulated profits in each, so maybe I’m too conservative here. Can anyone help? It makes a big difference!

SUBTOTAL EV ex HEAD OFFICE = $967

Central costs -$120m. This assumes $12m/yr x10, but I really don’t think Arcadia remains listed ($12m vs Arcadia’s say $50m profit is a tasty synergy in its own right!).

SUBTOTAL EV WITH ARCADIA STAYING LISTED = $847

Minus $72m net debt, -$187m to buy the rest of Arcadia, +$25m the loan to Arcadia founder

TARGET MARKET CAP = $613 or $31/share. Get this probably this time next year, after the closing of the deals and evidence of Arcadia’s improving trajectory.

Overall perhaps my multiples are a bit punchy but on the other hand I think there’s $6/share of head office costs that would almost all disappear in a full take-private of Arcadia, and tax is probably less bad than I model. I can run ‘low’ cases for each asset and, SO LONG AS DYNA IS SOLD SO THE CONGLOMERATE DISCOUNT IS SMALL/NONE, then you “cannot lose money from here”. Famous last words. Actually, the last words are “DYOR”!

So we are buying a commercial real estate construction-exposed company for 5x EBITDA – does not seem that attractive? And given the energy exposure of one of the assets to be divested and typical multiples for these energy services-esque businesses, aren’t our expected sale multiples too high?

Might be the case that the multiples for the to-be-sold businesses are too high, see comments by Ex-Locust as well. However, the Arcadia at 5x EBITDA is simply too low. They are diversified into multiple different markets, not concentrated just in the problematic office space. Management is willing to pay 10x run-rate EBITDA to buy out the minority stake. Also, the long-term growth record of the business is quite impressive.

Regardless of where exactly the multiples for the 3 businesses will land, I do not think we risk anything at the current prices while we wait for the outcome of the Dyna and NobelClad strategic review.

BOOM just entered into a cooperation agreement with Bradley Radoff. He’s a pretty known activist investor and has a solid track record in causing change in companies. Radoff is also involved in Guardion Health Sciences, which has been covered on SSI.

https://www.globenewswire.com/news-release/2024/03/15/2846948/0/en/DMC-Global-Enters-into-Cooperation-Agreement-with-Bradley-L-Radoff.html

Great development! So I guess it was Radoff who was exerting pressure on the board lately and catalyzed the recent strategic review.

From the strategic review announcement:

“However, the Board and management team are aligned with the view expressed by many DMC shareholders that the Company should seek to simplify its portfolio to drive improved shareholder value”

Does Radoff own shares? I can’t see him in the register..

Of course he does; what’s the point of bothering the company otherwise? From the cooperation agreement:

“Minimum Ownership. The Radoff Parties’ rights pursuant to Section 1 are subject to the Radoff Parties beneficially holding a Net Long Position equal to, or having aggregate net long economic exposure to, at least 2.0% of the then-outstanding Common Stock (the “Minimum Ownership Threshold”);”

I don’t see clearly why the valuation decreased this significantly in the first place (from 2021). Is it just that Arcadia didn’t grow as expected and due to its exposure to commercial real estate?

You’re correct regarding the key reasons, namely, the broader commercial real estate market downturn and Arcadia’s failure to achieve the previously-set aggressive growth targets. In Feb’22, management expected to double the business over the next 3-5 years, however, 2023 turned out to be flat. Coupled with declining margins (EBITDA margins have fallen from 20-21% in 2019-2021 to 16%-17% in 2022-2023) this explains most of the share price decline.

Arcadia’s margins were also impacted by elevated aluminum prices (key raw material) during H1’22, which led to a build-up of high-cost inventory. This high-cost inventory was sold down through mid-2023.

As for the share price decline during 2021, before the acquisition of Arcadia, it seems it was primarily driven by cyclical fluctuations in the O&G well completion activity and growing competition in the space. E.g. management noted that the Q2’21 revenue/earnings miss was partially driven by “irrational pricing for products and services”.

Q1 earnings are out and looks like a difficult quarter. Shares down ~5% after hours. Very briefly:

Year over year:

– WholeCo sales down 9%

– WholeCo Adj EBITDA down 17%

Arcadia

– Sales down 23%

– Adj EBITDA down 44%

DynaEnergetics

– Sales down 5%

– Adj EBITDA down 30%

NobelClad

– Sales up 22%

– Adj EBITDA up 75%

Q1 results were not great, but I do not think these change anything for thesis – which is the sale of the two businesses and an undervalued RemainCo on pro-forma basis. Both Arcadia (the RemainCo) and DynaEnergetics (one of the to-be-sold segments) have been pressured by industry wide slowdowns. Management thinks these is just a temporary fluctuations and is taking steps to address profitability of the segments. Nobelclad (the other to-be-sold-segment) continued to perform well.

Management did not share any further on strategic review aside that an update will be provided in the coming months.

Regarding Arcadia’s business (revenue drop of 23% YoY and 9% sequentially), management highlighted that the decline has been driven by Arcadia’s storefront business that tracks general commercial construction activity as opposed to Arcadia’s project business that is exposed to more stable end-markets. Activity started to pick up in April and management expects Arcadia’s performance to improve in the coming quarters. From the conference call:

Earnings release: https://www.bamsec.com/filing/3406724000073?cik=34067

Investor presentation: https://d1io3yog0oux5.cloudfront.net/_675b070116072ab331ee2d72c917040b/dmcglobal/db/2265/21635/pdf/Q1+24+Earnings+PPT.pdf

Conference call: https://www.bamsec.com/transcripts/2f1de56a-9883-46c0-82a2-3141b67670e9

Any insights on the price action today? -7% on what seems to be no news.

BOOM trades like an oil services company. Oil Svcs ETF, OIH, is -5% on the oil price fall (post OPEC meeting) and BOOM normally trades with higher beta to that index due to its financial leverage and fact that shale is more oil-price-dependent than are lower-cost/longer-cycle regions. More rationally, weaker oil prices also make it harder to sell Dyna for an acceptable price.

Thank you for this.

Thank you! Any additional thoughts after earnings from you ex-locust? wonder how the upside changes

Also trading on construction spend which came in as -0.1%. URI/AHT.l/HRI got wrecked today too, I believe, for the same reason. Probably reasonable to think that construction spend, good or bad, would affect Arcadia’s biz.

Any view on the Limited-Duration Stockholder Rights Plan announced today? Can someone explain in layman terms what are the consequences of that?

This looks like a poison pill me to me, probably one of the possible acquirers of DynaEnergetics or NobelClad is making a similar SOTP calculation like we do here, e. g. it might be cheaper to buy control of BOOM now and split the business up than to buy e. g. the DynaEnergetics or NobelClad division at fair price now.

Well, i guess it’s a clear statement by the company that the stock is significantly underprised, which probably partially justifies yesterday’s price move.

Yes, it’s a poison pill. Stops an investor from crossing a certain ownership threshold without triggering the pill/ rights. My understanding of this would be when someone is accumulating the stock, (sometimes openly) & management do not want them to gain a large or controlling stake at a deemed low level.

This week, BOOM announced a poison pill, preventing any investor from crossing the 10% ownership threshold (20% for passive investors). It’s a pretty interesting maneuver, given the ongoing strategic review and management’s previous intentions to divest two business divisions. While I am not exactly sure what to make of this, the move could indicate that: 1) management thinks that following the recent decline in stock price, the company is materially undervalued and may be vulnerable to opportunistic takeover attempts of activist strategies; and/or 2) management has already been made aware of a potential acquirer who had been quietly accumulating shares in the open market. Following the announcement, BOOM’s share price rose by 7%, partially offsetting a substantial decline earlier in the week caused by a downturn in the broader oil services sector. The stock remains cheap (at over 50% discount to my SoTP value) and I am keenly awaiting further updates on the strategic review, which management expects to provide in the upcoming months.

Anyone have thoughts about BOOM’s debt situation? Feels like upcoming FCF plus the divestitures should easily handle it, but if they decide to wait for better prices to divest or if sales soften, the debt could be a problem and this could help explain market sentiment?

I’m not worried at all and don’t think the market should be.

– liquidity is fine: They extended their bank facility to cover the Arcadia 40% payment Dec 2024 which is $162m ($187m net of the repayment of the $25m vendor loan).

– leverage is OK: Net debt at Q1 was $68m so add the Arcadia payment and you get $230m proforma net debt. LTM Adjusted EBITDA including 100% of Arcadia was >$110m so barely over 2x. Even with EBITDA likely lower in 24e than LTMq1, given very light capex requirements I don’t see this being at all problematic. And there will be material FCF in the rest of 2024 and beyond, I’m not modelling it myself but it’s obviously several 10s of $m annually so quickly paying down the debt. I’d worry a bit if leverage got to say 4x (even that isn’t scary on Arcadia or Nobelclad) but that would require EBITDA to more than halve from LTMq1 levels which won’t happen without recession.

Economy-wide general recession is indeed less likely, but what do you think about a recession in the US commercial real estate sector?

Office valuation is down, and office construction/renovation activities are down even more.

If I could predict recessions I wouldn’t be posting on this site, no disrespect to any of us.

Office is obviously challenged post Covid WFH but unless construction lags are ridic long I think we’ve already seen some of that impact.

Arcadia isn’t just office or even, I believe, remotely majority office. Big chunks in educational / healthcare / hotel / etc. The Wilson Partitions biz is mostly office but that’s not so big. And obviously a decent elite residential segment too.

Look at the census bureau categories of commercial construction, their different cyclicalities, and especially after deflating with eg GDP deflator you won’t conclude that Arcadia was on cyclically punchy earnings in 2022/23.

And the Architectural Billings Index which I believe is the best leading indicator of construction, is a bit weak but OK and not weakening.

Doesn’t mean Office doesn’t hurt 2024. But if it’s in the context of the debt question, I said I would only worry if EBITDA halved from LTMQ1; Arcadia wasn’t even half of that EBITDA so it’d have to go negative, both other segments held equal.

BOOM is financially levered and two of its units at least are highly or reasonably cyclical, so if you expect or fear recession I doubt this is one for you, plenty of other companies out there. Or chop the earnings to what you think they might be in a a recession, see whether you are happy to own it on those multiples of trough and leverage on trough, and invest accordingly.

Or short the bejesus out of any other office/commercial construction-related names that are NOT down hard/at all – Armstrong for example, Apogee though it’s impure.

Noted some language on the poison pill PR. I’m sure some of it is standard boilerplate, but thought it worth highlighting nonetheless. I have replaced the noted text in caps (as i can’t seem to underline here)

The Board, in consultation with its legal and financial advisors, adopted the Rights Plan IN RESPONSE TO THE ACCUMULATION OF THR COMPANY’S COMMON STOCK. The Rights Plan became effective on June 5, 2024 and will expire on June 4, 2025, unless earlier terminated.

The Rights Plan is intended to enable stockholders to realize the full value of their investment in DMC Global while reducing the likelihood that any entity, person or group gains control of the Company through open-market accumulation without paying all stockholders an appropriate control premium or providing the Board sufficient opportunity to make informed judgments and take actions that are in the best interests of all stockholders. The Rights Plan IS NOT INTENDED TO DEFER OFFERS and DOES NOT PRECLIDE THE BOARD FROM CONSIDERING OFFERS THAT RECOGNIZE THE FULL VALUE of the Company.

Looks like shareholder friendly language to me… if that makes sense. Would appreciate if anyone can add anything. I’ve increased my position.

https://ir.dmcglobal.com/news-events/press-releases/detail/153/dmc-global-adopts-limited-duration-stockholder-rights-plan

Steel Connect Offers $16.50 a Share for DMC Global: https://ir.steelconnectinc.com/static-files/da81795f-ef4b-4745-bed0-c1980b6ba530

The buyout offer from Steel Connect (at $16.5/share) is quite an interesting one:

– It seems that Steel Connect managed to accumulated almost the whole 10% stake in a single month since beginning of May. The purchases started after the Q1 results (and the drop in BOOM share price) and were done at an average price of $13/share.

– This kind of explains and puts into perspective the recently initiated poison pill.

– The 13D is rather strangely worded and seems to suggest that Steel Connect is ready to increase the bid from the current $16.5/share: “Steel Connect, among other things stated that it was submitting the Proposal in order to facilitate constructive discussions with the Board, with the goal of entering into a mutually agreeable transaction that is in the best interests of all stockholders”

– Steel Connect (and Warren Lichtenstein) has reputation of being a shrewd/opportunistic dealer. So this offers puts a floor on the valuation of the business.

– 13D filing also notes that the offer: “would provide stockholders with a superior return as compared to the sale of individual business units”. I do not see how this could be the case as the 3 businesses under BOOM’s umbrella operate in different industries and instead of synergies, are currently trading with a holdco discount. So if the whole company as it stands now is worth at least $16.5/share, then the sum of the parts should be higher than that. This is probably the key reason why Lichtenstein wants to acquire BOOM now, when the share price is still depressed after Q1 results and the offer can presented as if coming at a 25% premium to the prevailing market prices.

– I think management will quickly reject the offer as undervaluing.

DT

In your 3rd bulletpoint, do you mean $16.5 or $13.5? I don’t see any reference to a bid at $13.5.

I’m surprised the stock has rallied significantly more. It appears the market doesn’t view Lichtenstein as credible. I do view it as more likely that he is interested in druming up interest in BOOM and eventually selling his shares than in actually buying the company, but either way, I would have expected the stock to rally significantly more than $1.

Did Lichtenstein have a history of not following through with an offer?

I wasn’t able to find any cases where Lichtenstein dropped the deal. Regarding wide spread, I guess the market thinks it’s very likely the offer will just get rejected.

By the way, management has released a statement saying they will consider the offer.

https://ir.dmcglobal.com/news-events/press-releases/detail/154/dmc-global-comments-on-steel-connects-unsolicited

@ Tom – It’s $16.5. It was a typo in my comment, now corrected.

@snowball – have a look at the case of SPLP’s attempt to buy out STCN minorities at a very low price point and then screwing them through preferred issuance/dilution (covered a bit here http://ssi.wpdeveloper.lt/2021/04/steel-connect-stcn-going-private/).

So Lichtenstein will not overpay on his purchases and if he is willing to pay $16.5/share for BOOM, then it must be a bargain at this price. That’s the point I was trying to make.

BOOM just brought on a new independent director, Simon Bates. The press release played up his M&A background and experience in selling businesses. Sounds great at first glance, but the move also raises questions about whether management is struggling with the current sale process. So, mixed feelings about this one for now.

“He previously was CEO of Argos North America, one of the largest U.S. cement and ready-mix concrete producers, from October 2022 to January 2024, when Argos was sold to Summit Materials. He also served as president, CEO and director of GCP Applied Technologies Inc., from October 2020 to October 2022, when the company was acquired by Saint-Gobain. GCP was a leading global provider of construction products, including high-performance specialty construction chemicals and building materials.”

The appointment comes as part of BOOM’s previous cooperation agreement with activist Bradley Radoff to appoint a director “with expertise and experience in the building products sector.”

https://www.bamsec.com/filing/3406724000109?cik=34067

Any news or just getting rekt on small caps dieing?

Earnings to be released after close. I suppose the market is getting nervous..

BOOM has released its Q2 results. Performance has been in line with the trends seen in the previous quarter. Softness persists across all segments and management anticipates that to continue for the next few quarters. On a positive note, Q2 results were slightly better than previously expected, with sales and EBITDA coming either above guidance or near the upper range across all business lines.

The most important highlight was the discussion about the ongoing strategic review at the end of the conference call. Management has hinted pretty clearly that despite market softness, they are not pulling back and still intend to divest Dyna/NobelClad, even if at a bit lower price than previously expected. So the “two segments sale + cheap RemainCo” thesis remains fully intact.

No comments were made regarding the pending takeover offer from SteelConnect at $16.5/share. I continue to think that at $12.9/share BOOM remains substantially undervalued and sun of the parts will be unlocked with divestitures.

From the conf. call:

BOOM’s updated historical performance:

At trailing adj. EBITDA numbers, BOOM’s sum-of-the-parts valuation would be around $20/share (using 8x for Arcadia, 6x for Dyna, and 7x for NobelClad). However, this might be too conservative and I would be more inclined to stick to my previous target of $24/share as of Q1. This valuation gap is primarily driven by a steep 55% decline in Dyna’s earnings in Q2 due to softness in US well completion activity. The industry is clearly in a downturn, with TTM adj. EBITDA margins at 13.6% compared to the historical industry average of 17%. Management expects this softness to continue for the second half of the year but anticipates some margin improvement from cost reductions and operational improvements. While the outlook for Arcadia and NobelClad also remains weak-ish, management expects NobelClad to turn around in Q4 and have a “really good year” in 2025.

I didn’t listen to the audio of the call, but from the transcript text alone it is not clear what the CEO meant by “Yes”. He could simply be acknowledging to the analyst that “yes, I understand your question now”, instead of “yes, we are doing what you’ve just described, willing to take a lower price just to simplify our business”.

and what he said following “yes”, about maximizing shareholder value, is very evasive boilerplate statement, not hinting at any direction.

“Yes. The viewpoint is, again, we’re looking at a wide range of options to maximize shareholder value. And so that’s maximizing shareholder value is the key.”

$15.50 down to $11.50 over the last 3 weeks, any company-specific catalyst for this weakness?

See my comment above regarding Q2 results (which were released on Aug 1). Oil services sector is down c. 10% in August, so that might have added to the sell-off in BOOM as well. Not aware of any other developments.

Steel Partners stepping it up, may tender.

Really low-balling Nobelclad and Dynaenergetics. Their stake + $185m…wow. Just over $200m today for the two businesses.

https://ir.steelconnectinc.com/static-files/d23496d3-12e2-4f84-912a-ab335ae9b918

Yes that’s ridiculously too cheap for those 2 businesses! And I read it as ‘stock plus cash to equal $185’ not ‘$185 cash plus the stock’. But it’s interesting that current mcap at $13/share $260m + $70m net debt +$188m for the Arcadia minority – $25m loan repayment from Arcadia founder – $185m from Steel Partners, assuming no tax which should be right on such a puny sale price, = only $308m for 100% of Arcadia (they paid $470m) and 100% of the current central cost. Arcadia gets bid for once Dyna and Nobelclad are gone (see yet more M&A in the wider space recently – Tecnoglass strategic review) so those head office costs ought to be on a multiple of 1-2.

Their price for Dyna + Nobelclad will be the “Russian Front” negotiating tactic, intended to make the ‘less worse’ alternative of $16.50 appear better than it is.

Sounds like going long STCN might be another good play here. Thoughts?

Sounds interesting. Could you share your valuation?

If you’re thinking about buying STCN with hopes that they’ll successfully acquire BOOM, I wouldn’t bet on it with the current offer. BOOM’s management has been reluctant to engage, and it seems unlikely that’ll change if STCN just keeps pushing the same deal. STCN might go for the tender, but I doubt they’d scoop up many shares that way (and honestly, I wouldn’t be shocked if the stock traded above the tender price).

As dt mentioned above, Lichtenstein is known for being a shrewd player, so I wonder if he’d be willing to raise the offer enough to get BOOM’s management approval. Given BOOM’s current undervaluation, maybe? It wouldn’t be surprising if they launched a tender offer and then raised the price later on. So I like BOOM, but not sure about STCN.

BOOM turns over its total shares outstanding every 3-4 months.

For new shareholders whose cost bases are low, why wouldn’t they happily surrender their shares at $16.5 if STCN launches a tender?

A lot of the trading volume is the same shares changing hands multiple times, algo trading and etc. I think most of the BOOM shareholders have remained the same over the last few months.

Reply from the board today: https://ir.dmcglobal.com/news-events/press-releases/detail/158/dmc-global-board-responds-to-steel-connect

I’m a bit surprised about where this is trading. The offer seems legit and I also think the board reply is reasonable (not the usual entrenched board saying “we have concerns about financing, this offer is way too low, I want to keep my overpaid job, etc.”). I also like the involvement of Radoff.

Doesn’t seem unlikely that the board is actually considering selling itself and in that case the $16.50 seems like it could be a floor price. Market is strongly suggesting that the process breaks down or that the company will only do a half-baked strategic review. Although that’s still a real possibility I guess I’m a bit more optimistic.

Stifel set new price target of $17 down from $19.

Maintains Buy

https://www.investing.com/news/company-news/stifel-cuts-dmc-global-target-to-17-maintains-buy-rating-93CH-3620137

Question for this group. Wouldn’t a tender offer by StCN trigger the recently enacted poison pill provisions added to BOOM’s bylaws?

Arcadia’s president resigned effective immediately. Seems pretty strange given the ongoing strategic review and pressure from STCN. Any thoughts?

The language in the PR, about Chilcoff’s release of claims against the company, seems unusual:

“The departure was effective immediately, and DMC Global is expected to finalize a separation agreement with Mr. Chilcoff that includes severance benefits. These benefits are contingent on his signing and not revoking a release of claims against the company and its subsidiaries. Additionally, his adherence to certain covenants is required as part of the agreement.”

I’m not a lawyer, but isn’t signing release of claims typical as part of severance / separation agreement when one’s employment ends?

Hi @AFPond

But it’s rarely mentioned in such details in a press release for an amicable departure.

BOOM by name boom by nature

We’re screwed

– big miss on Q3 in Arcadia and Dyna.

– both sale processes cancelled

– Chairman leaves immediately

– material writedown in Arcadia reflecting lack of confidence in immediate rebound.

I guess now we know why Arcadia boss left immediately…

https://ir.dmcglobal.com/news-events/press-releases/detail/159/dmc-global-provides-business-and-strategic-review-update

A major drop after the announcement today. Better price, but longer for the thesis to work out? Will there be more pressure on management to accept the Steelcase offer?

Think there’s a couple of takeaways:

– Steel Connect may revise down its offer and become even more aggressive. May also draw the attention of others

– Cancelling the strategic review for certain assets in the current context implies the entire company is now in play. Appointment of James O’Leary (who brings significant M&A experience – his last 2 chairmanships resulted in sales/ mergers and he’s also a senior advisor to private equity) supports this view

Interesting point on the entire company being in play. I think the resignation of Chilcoff who joined in 2023 may have contributed. With him gone, the company may want to reconsider things…

This is clearly a ‘kitchen sink’ quarter: throw out the Arcadia CEO and a bunch of board members, lower forecasts and write down everything you can get your hands on: goodwill, inventory and receivables. Then the new board can start with a blank slate. I wouldn’t be surprised if we are now at the point of maximum pessimism: all bad news and no clear catalyst in sight. Yet Radoff still has a board seat and owns the stock and Lichtenstein is still circling the company, the pressure is still on. And, as you noted, the new chairman has a history of selling out.

Also note what the PR DIDN’T say: “we concluded the strategic review”, or something like that. They just stopped marketing their two subsidiaries.

Perhaps this is all a prelude to making a revised Liechtenstein bid for the entire company palatable. That’s the optimistic view, at least. Could also just be a total trainwreck 🙂

Just some rambling here, but after some thought, this is what feels ‘off’ here.

Usually, when a hostile buyer shows up threatening a tender offer, a company does all they can to prop UP the stock price. Presentations touting future prospects, press releases stating the bid undervalues the company, a small buyback program, you name it.

Yet here it is exactly the other way around. Liechtenstein reiterates the threat of a hostile tender offer and a few weeks later the company drops a massive turd of a press release that basically seems designed to make the stock drop as much as possible. Why on earth would you do that? I’m sure there is a reason for it. I’m not sure I will like that reason.

This was a really bad update from DMC global. There is no sugarcoating it.

– The business is performing worse than expected and the company will miss the guidance figures it gave just 2 months ago: “The results reflect weaker-than-expected sales at both Arcadia Products, DMC’s architectural building products business, and DynaEnergetics, DMC’s energy products business.” Large write-down on Arcadia’s side. Only NobelClad’s business seems to be moving in line with expectations and will “deliver another strong quarter”, but it is the smallest of the three.

– Strategic review to sell DynaEnergetics and NobelClad concluded empty. From the way the update is phrased it seems that no reasonable offers have been received: “given the challenges of the last several months for DMC, including macroeconomic factors such as weakness and volatility in the energy market, the Board believes that prioritizing stability, simplification and internal improvement will better serve DMC’s stockholders”.

– Put/call option for the remaining 40% Arcadia’s business becomes exercisable in a month and the company will likely need to come up with $187m to fund it. That might be difficult with no improvement in Arcadia’s operations and the business still being tied together with NobelClad and DynaEnergetics.

While the resignation/change of chairman might indicate disagreement between the board members relating to the concluded strategic review, I do not think it will have any impact, at least in the short term. Majority (7 out of 8) board members remained, group wide CEO (Michael Kuta) is also the same.

I am not putting any hopes in the offer from Steel Connect. The response from DCM’s board (Sep 19) clearly showed that it was Steel Connect (and not DMC’s management) that refused to move the discussions any forward. While I do not know what what the actual Steel Connect’s play book was, I would be quite surprised if they come back with another offer that has chances to turn into a binding agreement. But Steel Connect might still drum up pressure on BOOM’s management.

The business-sale catalyst is out of the window for now and the special situation angle of this idea has evaporated. However, on normalized earnings of the three segments, BOOM is actually quite cheap.

For now I am maintaining my bag-holder position in BOOM. Hopefully management will shed some more light on the situation during Q3 call (probably first week of November) and will be able to make a more informed decision.

Management needs to come up with a clear plan to show to shareholders (but probably will not happen in Q3 call). Otherwise, the board members might struggle to get re-elected next year. Radoff already has one representative on the board (Simon Bates) and might pressure for further change in the company.

“The response from DCM’s board (Sep 19) clearly showed that it was Steel Connect (and not DMC’s management) that refused to move the discussions any forward.”

I don’t know if I agree with that. Steel Connect refused to move forward _on the terms suggested by the board_. But, as demonstrated yesterday, the board was overplaying their hand. As far as I am concerned the board should have bent over and accepted the $16.50 the moment it was on the table (easy to say in hindsight, of course).

I think Liechtenstein sincerely wants to buy the company, or part of it. He’s a major asshole but imho he’s making the DMC board look like clowns. Buy a decent block of the company, make some public lowball offers, judge correctly that nobody else is in contention, refuse to budge while the board is running the company into the ground so you can pick it up even cheaper. From his perspective, I think this is going really well and I kind of admire what he is doing.

Now it’s the perfect time for Liechtenstein to make a hostile tender offer, maybe at $13/share.

At least for us it will bring the special situation angle back to life…

writser – I hope you are right and we will see another bid from Lichtenstein shortly.

My conclusion that Lichtenstein was just playing some kind of games (maybe just drumming up more attention to the company) stemmed solely from this request:

“Steel Connect has demanded the details of all offers and indications of interest provided by the other participants in the process. ”

To my knowledge, such information is always confidential, so management would not be able to comply with such an unusual requirement even if they wanted to start engaging with Steel Connect.

Did Lichtenstein have a history of doing this? Making bids just to raise his and his firm’s public profile?

Related to this topic, I am suspecting that the Landon consortium in the TBNK bid has some incentive for such a maneuver, to debut Blue Hill to the public stage.

I have not tracked his history fully so cannot tell if there have been good precedents for the current situation. However, to get a sense of his opportunism, have a look at 2020-2022 Lichtenstein’s attempts to cash out STNC’s minority shareholders at a low-ball price, covered here: http://ssi.wpdeveloper.lt/2021/04/steel-connect-stcn-going-private/

i don’t know if I’m right! But Liechtenstein does have a history of stuffing industrials in NOL shells. He bought HNH (NYSE:HNH) a few years back, SL Industries (NYSE:SLI), JPS Industries (OTC:JPST).

And a lot of the stuff BOOM overlaps with SPLP. Here are some of SPLP’s segments from their latest 10-K:

Joining Materials – The Joining Materials business primarily fabricates precious metals and their alloys into brazing alloys. Brazing alloys are used to join similar and dissimilar metals, as well as specialty metals and some ceramics, with strong, hermetic joints.

Tubing – The Tubing business manufactures a wide variety of stainless and low carbon steel tubing products. The Tubing business manufactures some of the world’s longest continuous seamless stainless steel tubing coils, serving primarily the petrochemical and oil and gas infrastructure markets. We believe that the Tubing business is also a leading manufacturer of mechanical and fluid-carrying welded low carbon tubing used for diverse industries, including the automotive, heavy truck, heating, cooling and oil and gas markets.

Building Materials – The Building Materials business manufactures and supplies products primarily to the commercial construction and building industries. It manufactures fasteners, adhesives and fastening systems for the U.S. commercial low-slope roofing industry, which are sold to building and roofing material wholesalers, roofing contractors and private label roofing system manufacturers, and a line of engineered specialty fasteners for the building products industry for fastening applications in the remodeling and construction of homes, decking and landscaping.

Steel Energy – The Energy business provides completion, recompletion and production services to exploration and production companies in the oil and gas business. The services provided include well completion and recompletion, well maintenance and workover, flow testing, down hole pumping, plug and abandonment, well logging and perforating wireline services. The Energy segment primarily provides its services to customers’ extraction and production operations in North Dakota and Montana in the Bakken basin, Colorado and Wyoming in the Niobrara basin, Texas in the Permian basin and New Mexico in the San Juan basin.

Sounds to me like Nobelclad, Arcadia and Dyna would fit pretty well in these respective segments. Also, buying a $10m 10% stake in an illiquid company just to drum up interest, well, I don’t know if that’s a good idea ..

Again, the guy is an asshole and he has screwed people over before. But these assets seem like a good fit for him.

After reading @dt and @writser’s comments above, I feel a little bit more optimistic now (but my gut feeling is probably worth nothing).

I am actually OK’s with Liechtenstein making low-ball offers.

I try not to factor my historical cost basis into my thinking, and I shouldn’t, because it’s irrelevant. Liechtenstein’s potential low ball offer may be lower than my historical cost, but what should matter is whether the offer will be significantly higher than the current market price.

If yes (I don’t know), then it’s a good opportunity to add to my position.

How difficult is it for BOOM to come up with $187m within one month?

Are we expecting a major dilution event or raising very expensive debt? Note that BOOM’s market cap is less than $200m.

Re David Aldous’s resignation as chairman and the disagreement between the board members, do we think Aldous was the one supporting the Steel Connect bid or the one against it?

1. I think if they wanted to raise capital in the short term they would not have issued this PR in this way (?).

2. Aldous was on board since 2013 and was interim CEO for a short stint. The other leaver also had a long tenure. The new chairman has only been on the board for a few months and has a track record of selling companies. If there was a conflict about the bid (not saying there was) I think it is likely the old guard was against it.

Boom already have the debt facility in place for the 187m, relax. even if that evaporated they can delay payment even if it is Put to them .

Activist investor Voss Capital reported a 5.9% stake in BOOM, though it’s only a 13G filing – meaning they’re not planning to get active just yet. Still, the growing lineup of prominent activists, including Radoff (who already has a board seat) and STCN (in a way), is a plus. If any of them decides to amplify pressure on management, pushing for changes will be easier.

https://www.bamsec.com/filing/119380524001300?cik=34067

BOOM’s Q3 earnings were as expected – weak, in line with the sentiment of the recent update. Q4 guidance looks similarly bleak, with expected 18% YoY revenue drop and a 70% decline in EBITDA.

Management has ruled out selling any divisions under current market conditions, opting instead to address operational issues and wait for a better time before considering value-maximizing moves. Unless the activists (Radoff, Voss Capital, and/or STCN) step in, the event-driven angle for this case is off the table.

The new chairman kind of subtly hinted that the sale could be reconsidered down the line. He kicked off the conference call by emphasizing his experience with selling Kaydon Corporation (industrials peer) and his private equity background. He also added that he has engaged with shareholders extensively in recent months and he knows how they “think and feel right now”. This could indicate that activists are already engaging closely with the board, making additional immediate pressure less likely.

Fundamentally, BOOM remains attractively priced, trading at 5x 2024E EBITDA guidance. The current headwinds largely stem from macro and cyclical factors – higher interest rates and sluggish commercial construction impacting Arcadia, and declining well completions affecting DynaEnergetics. Management noted similar trends among peers and said that things might get a bit easier once the elections passes. There are also some legacy issues at Arcadia from its family-business days that have resulted in certain supply chain disruptions. The chairman said these issues are easily fixable, though it will take time. Overall, the new chairman seems pretty competent and had left a good impression from the call.

I know that thesis shift is not ideal. However, I think that BOOM’s current valuation and recent context with activists involvement make it worthwhile to hold on for a couple more quarters to see how things unfold before re-evaluating.

CEO decided to retire end of month. I think this just to show the morale within the firm isn’t great. With no immediate catalyst I feel this is a very tricky investment. Yes its cheap, but it can stay cheap for a long time. We are essentially waiting for the industry trends to change…

https://seekingalpha.com/news/4287128-dmc-global-ceo-michael-kuta-to-retire

(extremely!?) optimistic tweet from @brokenmoats:

$BOOM inept management on the way out and former $BMC CEO stepping in as interim CEO “My priority is putting the Company on a path toward enhanced value for our stakeholders.” Steel Connect acquisition back on?? Offered $16.50 two months ago (stock closed just above $8 today)

New 13D filed by Lichtenstein / Steel Partners. References a letter to the board but edgar link not working. Does anyone have the letter ?

Dropping a bamsec link below. TLDR – STCN continues to play a clever game. Buyout offer is no longer mentioned, but Lichtenstein makes it very clear he’s interested in BOOM at current prices. He wants a rights offering and has also demanded BOOM to remove the poison pill, arguing it’s “not in the best interests of stockholders” to limit investor purchases while “the company’s stock is facing a precipitous decline.”

STCN has also proposed to finance Arcadia’s stake purchase through convertible preferreds.

Overall, continued pressure is good, but in line with previous updates, buyout seems unlikely in the short-term.

https://www.bamsec.com/filing/92189524002643/2?cik=34067

thanks

BOOM can elect to issue convertible preferred stocks to the Munera family to pay for 80% of the consideration when the family exercises their put option.

So BOOM is not under any immediate liquidity pressure to raise capital and can choose to issue preferred stocks to Munera instead of to STCN, if management feels that the former is more friendly.

“The Option Purchase Price payable in connection with the exercise of the Put Option shall be paid, at DMC’s option, (i) in cash or (ii) 20% in cash and 80% in shares of DMC Series A Preferred Stock priced at the Option Share Issue Price (the “Put Consideration”), subject to compliance with applicable law and stock exchange rules, unless DMC and the Munera Member mutually agree that the Put Consideration shall be paid in the form of cash or a combination of DMC Common Stock priced at the Option Share Issue Price and cash, in which case the Put Consideration shall be paid in the manner so agreed. “

If BOOM funds 80% of the $187m with convertible preferred stocks (issued to either Munera or STCN), it can be very dilutive, given the current market cap of only $150m.

I am assuming that the convertible preferred stocks’ strike price will be determined by the weighted average price of BOOM in the past 3 months prior to issuance (I saw the terms somewhere in the agreement document but forgot the exact number).

Anyone understands how this convertible preferred stock works? How is the initial conversion rate or nominal value of the preferred stock determined?

“Each Holder shall have the right at any time, at its option, to convert, subject to the terms and provisions of this Section 7, any or all of such Holder’s shares of Series A Preferred Stock at an initial conversion rate of one fully paid and nonassessable share of Common Stock, subject to adjustment as provided in this Section 7, per share of Series A Preferred Stock (the “Conversion Rate”). “

This seems to be quite a positive development – DMC got a two year extension to buyout 40% of Arcadia in exchange for $2.5m payment. So no dilution for the moment being and management has 7 more quarters to stabilize the business:

“Under the Amendment, New Arcadia has agreed not to exercise its Put Option or Transfer (or propose to Transfer) its Units to a Third Party until on or after September 6, 2026, in exchange for the Company’s: (i) payment of a $2.5 million fee to the Munera Member; (ii) agreement to provide monthly updates on the Arcadia business to the directors that the Munera Member has appointed to the Arcadia board of directors; and (iii) agreement that if the Company is acquired, the Company will be deemed to have exercised its Call Option to acquire all of the Munera Member’s interests in Arcadia, with payment of the purchase price to be made in connection with the closing of the sale of the Company. The Company continues to have the right to exercise its Call Option beginning December 23, 2024.”

In the press release management commented: