Marlowe (MRL:L) – Large Asset Sale & Capital Return – 50%+ Upside

Current Price: £5.06

Target Price: £7.7

Upside: 50%+

Expected Date: H2 2024

This situation is somewhat similar to the BOOM case that I shared earlier this week – divestiture of a large part of the business will transform the company and the pro-forma RemainCo seems cheap. However, MRL’s setup is in more advanced stages as the asset sale has already been signed and management promised to pay out a large special dividend from the asset sale proceeds.

Marlowe is a roll-up in the UK’s compliance services and software industry. The company has two distinct business segments, each holding a market-leading (top 3) position within its niche. Marlowe has just concluded a strategic review and announced a large asset sale with net proceeds expected at £405m, equal to 58% of the current EV. The company will return ‘in excess of’ £150m (or 30%+ of the current market cap) to equity holders with most of the remaining proceeds allocated to fully retire outstanding debt. The RemainCo is trading at 5.7x FY23 EBITDA, which looks too cheap given the business quality and peer/transaction multiples, that fall in the range of 11x-14x.

I am expecting MRL shares to re-rate once the sale transaction closes and capital is returned to shareholders.

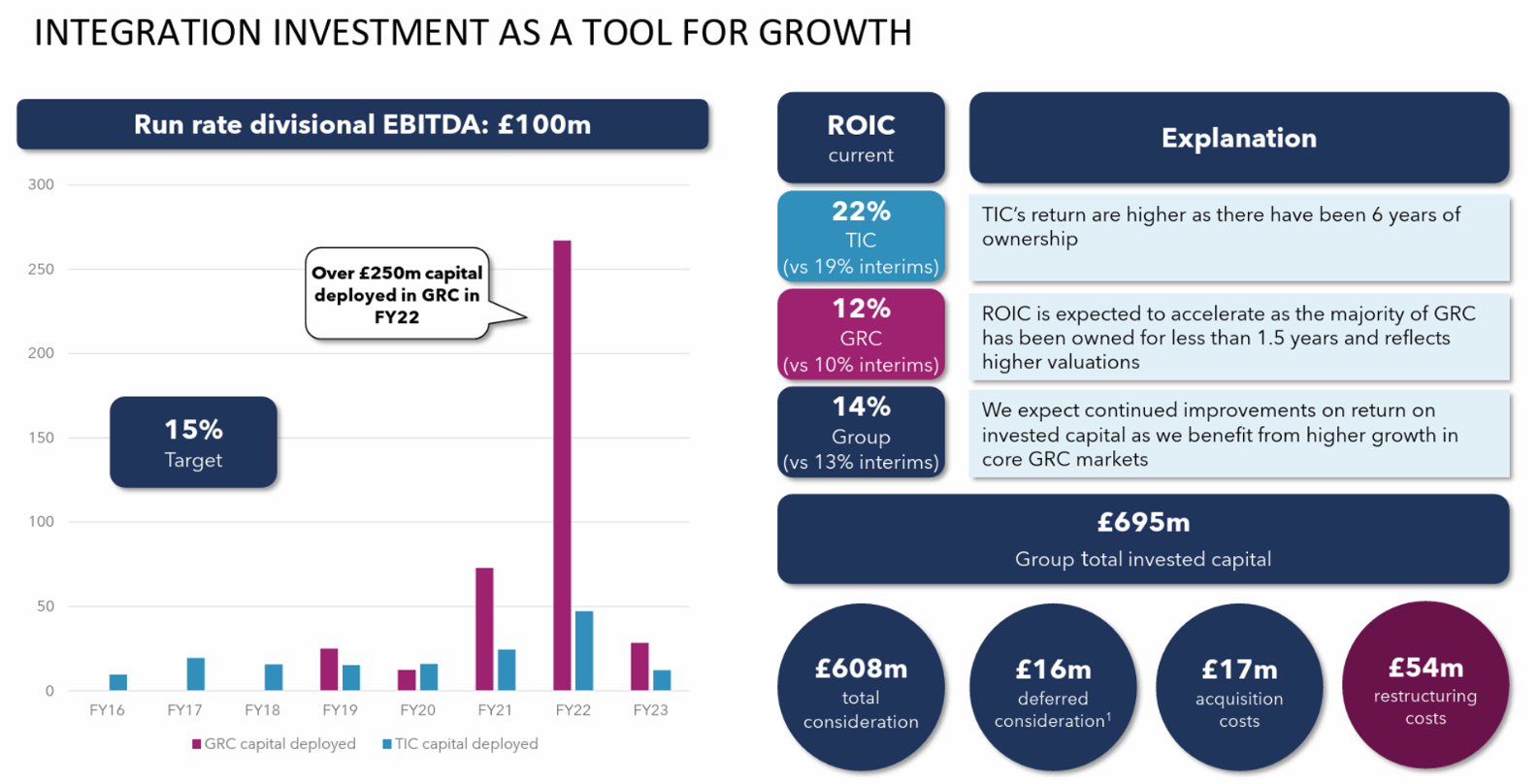

But that is not all. The key part of the re-rating thesis is that this asset disposal marks a major positive change in the company’s direction. Since its founding in 2015, MRL has been a roll-up machine, spending nearly £700m on over 80 acquisitions. MRL’s share price is at the same level as it was back in 2018 with valuation multiple depressed due to empire-building fears and messy financials with never-ending acquisitions, integration, and restructuring costs, that impact the visibility of the real FCF generation power of MRL. E.g., acquisition and restructuring costs in FY23 (ending September) were £24m, almost half of the £57m unlevered FCF. This will change now.

Management is separating the still-to-be-scaled assets (which the buyer will be able to continue growing through M&A), and will finally focus on crystalizing the FCF generation of the remaining businesses, which was said to have already reached a significant scale. This seems like a sensible and investor-friendly decision, particularly when one-third of the market cap will get returned to shareholders and RemainCo will be left with zero debt.

As a confirmation of this tide change, CEO Alex Dacre will resign from MRL and will go on to lead the divested businesses under the new owner. Dacre is a co-founder of the company and has a 5% stake. He is a sort of a deal addict with background mostly in M&A, so it seems this was simply a natural step for him to follow the assets that hold greater M&A growth potential. As I understand he was the architect of MRL’s strategy and direction so far. The chairman (who is also a co-founder) and the board had a limited role in steering the company.

The two current segments of MRL are:

- Governance, Risk & Compliance (GRC, 40% of revenues): provides consulting services and software to businesses. The segment has 4 divisions – employment law/HR, health & safety, compliance software and occupational health. MRL is now selling the first three sub-segments and will retain only the Occupational Health (OH, workplace-related health monitoring) business, which accounts for around half of segment’s revenues.

- Testing, Inspection & Certification (TIC, 60% of revenues): provides testing and certification services for businesses, with a focus on fire safety, water quality, and air hygiene. TIC will remain as the core business contributing 75% of the RemainCo revenues.

Both businesses are very stable and sticky, with strong FCF conversion and the majority of revenues (c. 80%) are recurring.

With the asset sale announcement, the company has stated:

The Group’s ongoing focus following the Divestment will be centered upon driving organic growth across its market leading businesses in the attractive TIC and OH markets whilst delivering margin expansion and strong cash generation.

This aligns with management’s message during conference on Nov’23, where they explained that TIC had already reached a large enough scale and that the segment’s focus would shift to organic growth:

Our TIC division has now reached unique scale in the U.K. We’ve successfully delivered our inorganic growth aspirations and are now focused on organic initiatives whilst completing integration programs and driving the margin accretion that is possible with the scale that we’ve achieved over the last 7 years. In the future, there remains significant M&A opportunity, but for the near to medium term, our focus is an organic one.

I also find it a bit intriguing that in the sale announcement management emphasized retiring all of MRL’s existing debt. This might indicate ongoing preparations for the eventual sale of the RemainCo. Even before the launch of the strategic review last year, rumors were circulating that MRL had been exploring the sale of TIC segment for around £650m (equivalent to the current EV of the company). Nothing panned out of these rumors, but management might revisit this option in the near future. Nonetheless, this is a pure speculation on my side and the important thing is that RemainCo sale is not even needed to win here.

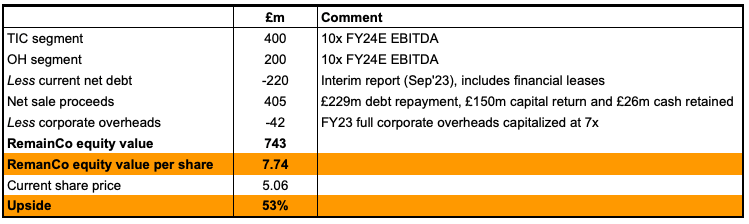

The table below shows how the valuation of MRL RemainCo post-divestiture.

Note: proceeds from the asset sale might be subject to taxes. Assuming that gains above net assets are taxed at 25%, the tax liability would be c. £30m.

More background on MRL’s business can be found in VIC write-ups from Dec’22 and Aug’23.

GRC asset divestiture

The GRC asset divestiture marks the culmination of the strategic review launched by MRL’s management back in Nov’23. The assets are getting acquired by Inflexion Private Equity, a sizable (c. £8bn in AUM) European PE firm that has a track record of investments in the compliance services/software industry, including Alcumus (focused on UK and NA) and CMO (geographically diversified but has some exposure to UK). Alcumus is a particularly noteworthy case as Inflexion bought it for £92m in 2015 and then exited the investment at “over £600m” in 2022. Since then, the PE firm has re-taken a minority stake in Alcumus again.

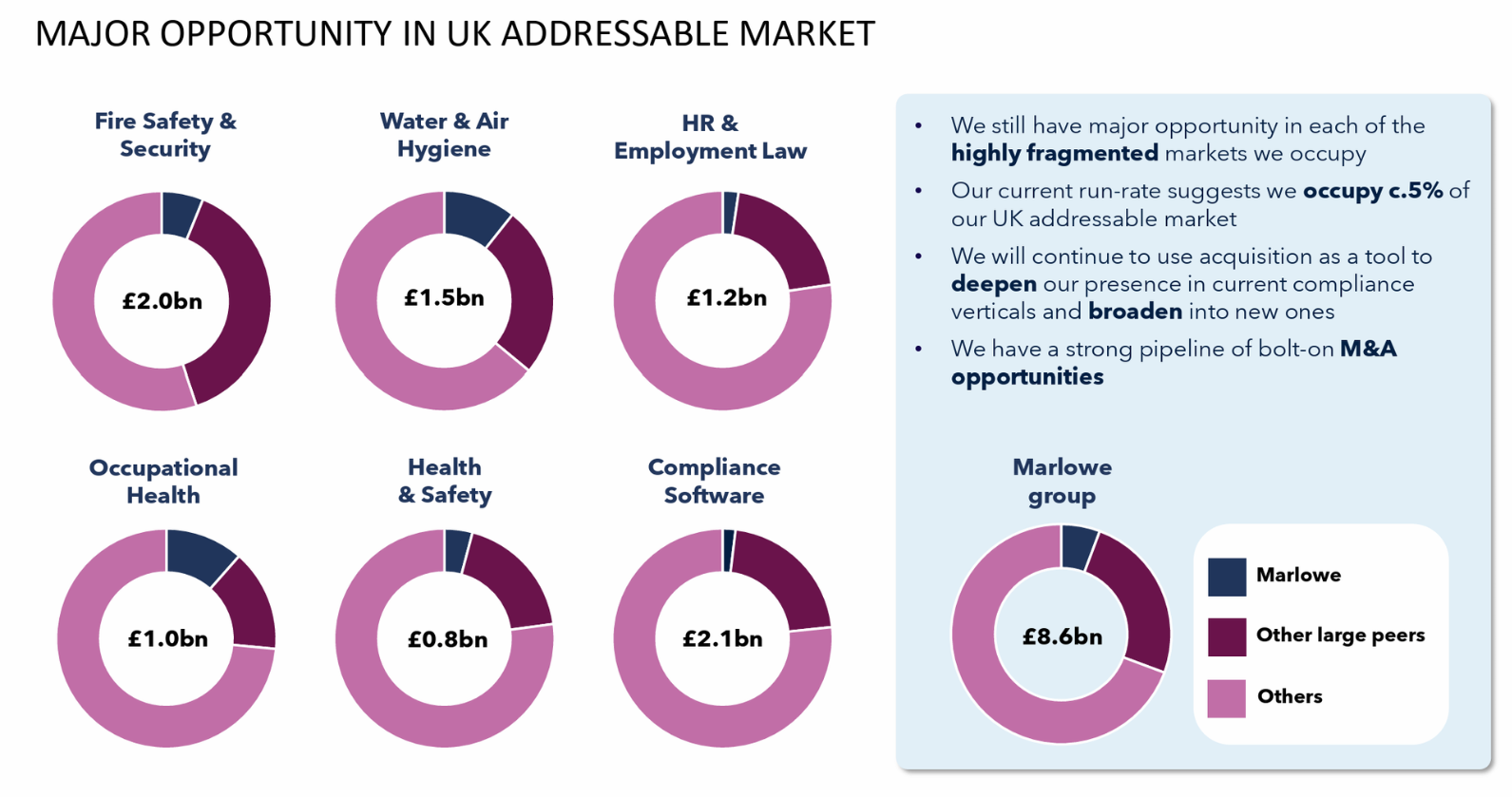

The transaction will require approvals from several UK regulators, but I don’t expect any objections. The transaction size is relatively small, while the UK’s GRC services market is highly fragmented. Despite being among the largest players in their respective industries, MRL’s to-be-divested businesses (HR & Employment Law, H&S, and Compliance Software) hold only single-digit-sized market shares. This is represented in the slide below.

Shareholder approval is not required. The closing timeline has not been specified, but I’d expect the divestiture to be completed by mid/late 2024.

RemainCo – Testing, Inspection & Certification business (TIC)

MRL’s TIC business comprises two sub-segments: Fire Safety & Security and Water & Air Hygiene. The Fire Safety & Security business provides design, installation, and monitoring services, such as fire alarm system servicing/maintenance, statutory inspections, and emergency lighting system servicing, to help businesses ensure compliance with fire safety and security regulations. The Water & Air Hygiene division provides water testing/monitoring, disease risk assessment, disinfection/cleaning, as well as air quality testing/monitoring services to assist businesses in complying with relevant water and/or air quality regulations.

The majority of TIC’s revenues are recurring (c. 80%) and are typically based on 3-5 year contracts (average customer tenure is 12 years). TIC is the largest provider of property safety and compliance services in the UK, with a top 3 market position in both sub-segments. Services provided by TIC are non-discretionary (i.e. required by law) and generally comprise a small portion of customers’ total costs basis.

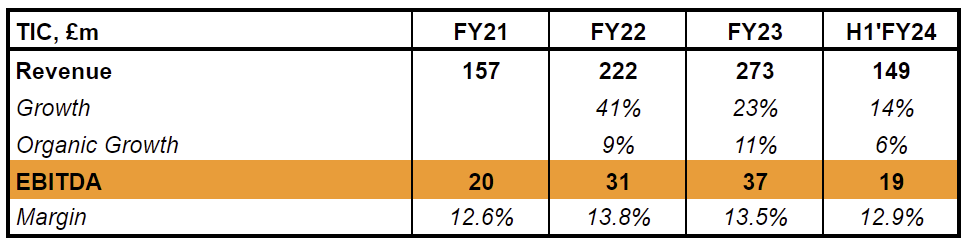

Note: growth metrics for TIC segment haven’t been disclosed prior to FY22 as the current way of segment reporting has been started only in FY22.

While TIC’s growth so far has been primarily fueled by M&A (over 50 acquisitions completed since 2016 and 5 during FY23), the segment has also seen some organic growth due to market share gains and broader industry expansion. TIC’s M&A strategy has revolved around pursuing both bolt-on and larger platform-type acquisitions, followed by restructuring/integration of these businesses.

TIC generated £38m EBITDA on a TTM basis, however, it’s worth noting that segment’s EBITDA margin in H1’FY24 (12.9%) was a bit depressed. Management noted that the decline is temporary and is a result of increasing outsourced subcontractor spending within the Fire Safety & Security sub-segment. TIC’s full-year TIC FY24 margins are expected to rebound to FY23 levels (13.5% EBITDA margin) as the number of in-house service providers is increased and integration programs are finished. Over the medium-term, management expects TCI’s EBITDA margins to reach high teens:

I’ve alluded to the fact that in the first half, there was a slight compression on margin as a result of the increased outsourced subcontractor spent to support the significant organic growth that we’ve delivered in recent periods. That’s a temporary point. So we don’t need to outsource that spend going forward, and we’re in the process of building up in-house resources, which means we can then deliver work at more attractive margins. So over the medium term, on a post-IFRS 16 basis, we do see this as a high teens EBITDA business. And in very rough terms, half of that increase comes from efficiency and service delivery efficiencies out in the field and the other half comes from the operational gearing that we’re enjoying in the back office.

So for TIC’s earnings, I’m assuming £300m of revenues (vs £149m in H1) and 13.5% EBITDA margin, which translates into £40m of segment level EBITDA.

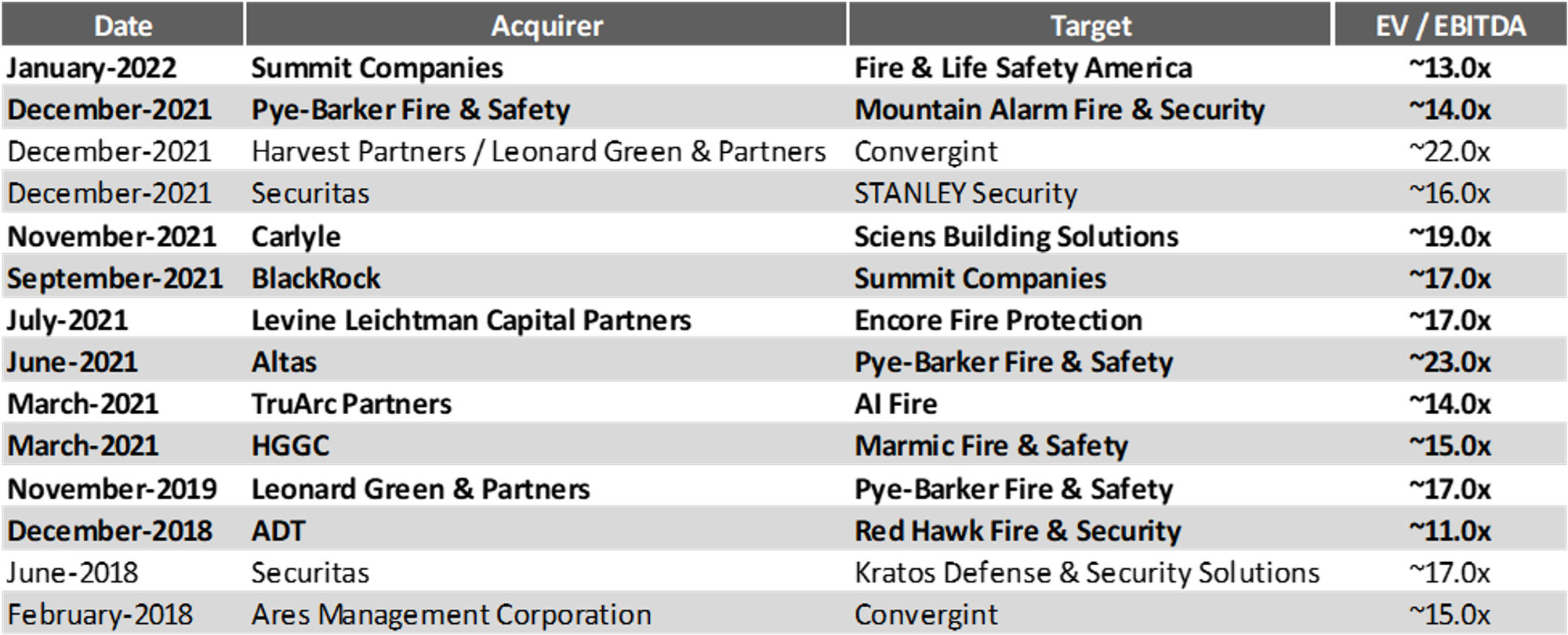

What is the reasonable multiple for this business? There are several reference points listed below, which suggest that a multiple of 10x EBITDA should be conservative enough.

- According to management, TIC business has been performing acquisitions at an average 8x pre-synergy EBITDA multiple (see Apr’22 conference call). MRL’s management has stated that roll-ups included smaller bolt-on acquisitions at c. 5x EBITDA and larger platform-type acquisition at c. 8.6x.

- Media reports from Jun’23 suggested that the TIC business could fetch £650m in a sale scenario, implying a 17.6x FY23 segment-level EBITDA multiple. However, the credibility of this rumored price tag remains uncertain, as there have been no further developments in the direction of TIC’s sale since then.

- APG, a roll-up providing primarily design, installation, inspection, and service of fire protection, is currently trading at 14.4x TTM EBITDA and 12.8x 2024E EBITDA. While APG is one of TIC’s closest publicly-listed peers, APG likely deserves a premium given its materially larger size and geographical reach (operates in North America, Europe and APAC).

- Other testing, inspection, and certification industry players BVI:PA, ITRK:L, and SGSN:SW are trading at 12x, 12x, and 13.5x TTM EBITDA multiples. While the offerings of these peers include fire safety and air/water quality-related services, they are also much larger and more diversified.

- A number of industry transactions have been done at 14x+ EBITDA multiples, including APG buying Chubb ($3.1bn or 14.6x EBITDA in 2022, provider of fire safety and security services), Macquarie acquiring PTSG ($265m or 15.6x 2018 EBITDA in 2019, provider of fire and electrical compliance services), Charterhouse Capital scooping up Amtivo (17x EBITDA, 2022, ISO certification services) and Intertek buying SAI Global Assurance (15.5x FY21E EBITDA, 2021, provider of quality management, environmental management and occupational health/safety compliance services).

- There is also a list of transactions in the fire and life safety industry (bolded in the table below), showing acquisition multiples in the range of 11x-20x+ EBITDA over the recent years.

RemainCo – Occupational Health (OH)

MRL’s Occupational Health business provides workplace-related health monitoring, surveillance, assessment, and other services to allow employers to comply with health and safety regulations. This division has grown primarily via 10 acquisitions completed since 2022, most notably Optima Health (acquisition price of £135m, completed in 2022) and TP Health (£14.5m, 2022). The majority of the segment’s revenues come from recurring, multi-year inflationary linked contracts. Management has noted that OH is the clear market leader in the UK.

MRL has not provided the historical financial performance of the business, however, the asset sale press release implies that the segment generated c. £107m in revenues and £20m in FY23 EBITDA (calculated as the difference between total GRC and sold asset figures). This compares to £91m and £19m in pro-forma OH revenues and EBITDA respectively that management hinted at the time of the Optima Health acquisition in Jan’22, suggesting that EBITDA contribution from the 10 acquisitions has so far been limited. However, following the completion of integration activities, management expects the business to generate mid-to-high single-digit organic growth with EBITDA margins of approximately 20% – see quotes below from Nov’23 conference call:

In terms of the medium-term targets for Occupational Health, we do see this as a mid to high single-digit organic growth play. And if you look at the long-term trend that Optima has delivered, it’s in that range organically and over time we do see getting the margins to around 20%, so slightly lower than other GRC activities, but very strong for the sector. In the second half of this financial year, we’re in the final stages of a major integration program within Occupational Health. We’ve essentially brought 10 businesses together over the course of the last 14 months, the health work business, the TP Health business, integrating into Optima, and that’s been a very successful program.

[…]

We now have one brand, the Optima brand. We have one operating platform. We have one digital platform. And we have largely integrated service delivery, consolidated systems, and a single optimized organizational structure. As a result of that single structure, we’re now at a stage where we’re able to realize further synergies via the removal of a significant number of duplicated roles in the coming months. And going into FY’25, that program will be complete and the focus will shift from integration to organic initiatives.

I am assuming EBITDA for OH segment will stay flat at £20m. Given OH’s sticky and recurring revenue base, market-leading position, and solid EBITDA margins, I think the segment deserves a 10x EBITDA multiple.

Other Points and Risks

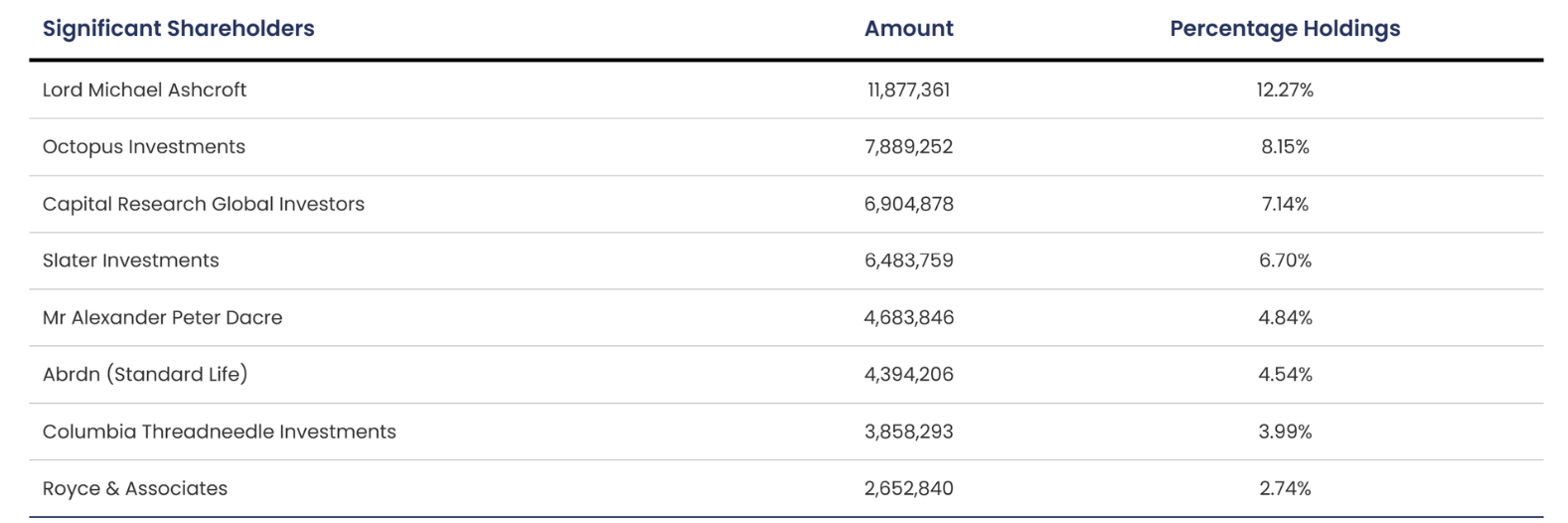

- MRL was co-founded by Lord Michael Ashcroft (owns 12%) and current CEO Alex Dacre (owns 5%). Under Dacre’s leadership, MRL has grown from £47m in revenues in FY17 to £466m in FY23, driven primarily by a ton of acquisitions. The stock has been a home-run for those who invested in 2015, generating 8x-9x returns. I do not think there are any material risks associated with the leadership change. Both co-founders are still involved in MRL and collectively own a sizeable 16% stake. It’s fair to think they will exert reasonable efforts to ensure that the new CEO is well-qualified and capable.

- I think the risk of the pending transaction breaking is minimal. However, the potential downside in case the asset divestment fails is a bit difficult to predict. While the downside to pre-announcement levels stands at 15%, MRL’s share price had jumped significantly several days before the news, suggesting that the actual loss could be higher (c. 30%).

- The M&A activity was initially focused on the TIC segment until FY19. Since then MRL refocused on the GRC industry (see slide below).

- MRL’s major shareholders are provided below:

- The transaction will require approval from the Secretary of State for the Department of Business, Energy, and Industrial Strategy under the UK’s National Security and Investment Act. This approval is required in certain more sensitive sectors, based on national security grounds. MRL falls into that category. However, I don’t expect any issues on this front given that Inflexion already owned another and even larger industry player Alcumus (and still retains a minority stake), so buying MRL’s assets shouldn’t raise any alarms. It’s very rare for a merger to get blocked on national security grounds and most of such cases have involved Chinese buyers (see here).

WHO is the author here?

me

I looked at this after the deal announcement not before so I have little light to shed on the true business quality. There are some replies by me on Twitter making some points similar to the below. (@ex_locust)

1. Your Remainco EBITDA is £56m. *Two* brokers including house broker have published £47m. Maybe they are slowplaying H2 but more likely there is a hidden profit warning in RemainCo in H2 which may also impact views on biz quality/multiple.

2. Read the 1H call transcript. A) OH lost a big customer late that half and its margins were falling/underperforming the bit they sold. B) TIC: the reasons given for margin recovery in H2 to make FY14 margin = FY23 look ambitious, they seem not to have achieved it.

3. I don’t disagree with your comparable multiples BUT… take off D&A (brokers say remainco is c. £13m but I scarcely see how that can be true given the implied depreciation in what they’ve sold and that most of the leases are surely in TIC) and £1m of lease interest and 1-2m SBC then tax it, you get very very punchy “unlevered P/E” which I personally wouldn’t pay for a biz whose organic growth and margins “properly adjusted for exceptionals” remain unproven.

4. There was indeed a story on Sky that TIC was for sale (the £650m was just someone’s hypothesis on industry multiples) but on roughly 21 Feb there was a Bloomberg story saying it had been bid for for only £300m. Seems too low for me, read other stuff written in the Twitter threads I replied to / by authors. But maybe it’s true.

5. There was a material but not massive short seller base, I think worried by poor FCF conversion, roll up disguising weak real performance. I have no view but you should all be aware and do your own work.

Even with all my concerns I think it’s an OK case. Thanks again SSI.

Ex-Locust, thank you for your active discussion. Sharing my thoughts on some of the points you raised:

– Regarding your comments on RemainCo EBITDA/margins (points 1 and 2): my EBITDA estimates are based solely on management’s guidance, which implies margin recovery in both segments. This recovery is expected to be driven by lower outsourcing subcontractor spending in the TIC business and ongoing M&A integration in the OH segment. You might be correct in pointing out that these estimates are too optimistic, but even at a £47m EBITDA that you have referenced, the RemainCo is still cheap.

– On the significant customer loss in the OH segment, MRL’s management has hinted that the expected revenue impact is £4m-£5m, translating to a c. £1m-£2m decline in EBITDA. I did not mention this in the write-up as it seems relatively insignificant in the context of the ongoin strategic review and segment’s overall profitability.

– I somehow missed the Bloomberg report on the bid valuing TIC at £300m. Not sure about the credibility of the rumored price tag, but, as you pointed out, it appears quite low (approximately 8x TTM segment-level EBITDA).

– As you suggest, the key bear thesis points have centered around poor cash flow generation/conversion amid never-ending acquisitions. But part of these concerns have been lifted with the sale of substantial assets of the company and the change of strategic direction of the business (away from roll-ups). The RemainCo will be a ‘show-me’ story and we will see whether the elimination of the previously-non-ending restructuring/acquisition costs will result in FCF generation, as per management’s intentions.

Why didn’t they sell the remainco during the whole process? That appears odd.

What is the levered FCF yield for 2025 for remainco?

How many shares does the remainco management own atm?

any insights on these?

1. Your guess is as good as mine. It’s possible the rumors were false, and management never intended to sell the company, or perhaps they simply didn’t receive a sufficiently attractive offer. The latter scenario seems more likely, but the fact that they’ve now chosen to leave RemainCo debt-free is intriguing and suggests the possibility of revisiting of the sale option.

2. MRL does not break down cash flow generation by segments and also does not provide company-level FCF guidance. With the decision to pause M&A activities, the growth in RemainCo will slow down. However, once all integration/restructuring activities are completed, expenses should significantly decrease as well. The FCF conversion potential of the RemainCo is high, so estimating UFCF for FY25 at around £40m-£45m seems reasonable (£60m EBITDA after overheads, and £15m to £20m for capex and taxes). This implies 11%-13% yield post-capital return, which seems too high given the setup and business quality of the RemainCo.

3. As of March ’23, management, excluding Dacre, owned 0.3% (1.2m shares). Their total compensation amounted to £0.7m in FY23. However, the two co-founders, Dacre and Lord Ashcroft, collectively own 16%.

Super dumb question but price is £5.06 above but I can only find approx prices 100 times greater, around £510 range. Want to confirm before buying wrong stock.

UK stock prices are quoted in pence vs pound: ‘Currency in GBp (0.01 GBP)’

The stock has seen quite a bit of shorting in the past. Do you expect there to be kitchen sinking coming from the new remainco management?

What does “kitchen sinking” mean in this context?

the company has never given guidance on granular level, so new mgt may reset implied expectations and/or give guidance that misses sell/buyside estimates.

Nice investment thesis. I like it.

What do you think about the possibility of Dacre selling his stake?

Dacre will go with the sold company, and most of his wealth is in Marlowe. I think the next Marlowe’s results will not be good because there will still be a lot of legacy restructuring costs, so a possible sale of Dacre’s stake could hit the Marlowe shareholders’ trust.

I can only speculate on this topic. Dacre might decide to sell and I think market/shareholders are at least to some extent expecting it. His departure has already been announced, so any share disposals should be market neutral. However, if he does not sell and continues to hold, that’s a big positive, isn’t it?

I like this idea and the research and write up is excellent.

The one area that gives me pause is the downside potential and the fact that a government agency is involved. It seems entirely logical that the threat of the deal not getting approved is low, but there has been increasing levels of government related rulings that appear to be entirely politically driven among western governments. I think the real question is, “is there any political advantage to be gained by blocking, or otherwise delaying the approval of this transaction?”. Pretty hard question to answer I suppose, but seeing all the politically driven interference I’m not sure cold hard logic and rationality is necessarily the appropriate lens through which to view these things anymore.

Thank you for the insights. I agree it’s one of the risks, albeit I think it’s pretty minor. The National Security and Investment Act covers 17 sensitive areas of the economy. So the scope is diverse and it’s not like the requirement for this approval automatically implies potential issues or anything.

This is not a merger in the semiconductor or telecom space with a Chinese buyer (e.g. Newport Wafer case or Vodafone/CK Hutchinson). This is just a rather small sale of software/business consulting assets. And the buyer is a European entity that is already involved in the same sector in the UK. I find it hard to imagine this transaction would trigger national security concerns.

By the way, just last November, UK government was looking to lessen the intervention in mergers on national security basis in order to be more ‘business-friendly’. Although it seems more of a ‘soft’ power rebalancing, it’s still a move in the opposite direction than you were referring to, and is positive for the MRL deal.

https://www.theguardian.com/business/2023/nov/13/uk-plans-u-turn-on-powers-to-halt-company-takeovers-on-national-security-grounds

https://uk.practicallaw.thomsonreuters.com/w-041-5142?transitionType=Default&contextData=(sc.Default)&firstPage=true

Regarding your note of “seeing all the politically driven interference” – I would appreciate if you could point to any other cases with non-Chinese buyers that faced issues on national security grounds.

I don’t know much about any of this, but already I’m seeing that Nippon Steel’s proposed acquisition of U.S. Steel has brought up “national security concerns”. So that would be one topical example.

This morning MRL has issued several very positive updates regarding board changes and the return of capital:

– Following the completion of the divestiture and repayment of debt facilities, MRL expects the net cash position to be £220m. Not only this removes the tax-related uncertainty from the asset sale, but management’s projection is also almost 20% higher than I’ve estimated in the write-up. This additional cash translates to £0.36 per MRL share.

– Management reiterated the planned capital return of £150m (almost 30% of the market cap). The method through which this will be executed will be decided upon at a later stage.

– Return of capital is expected to begin during the first half of fiscal 2025. As I understand, the company has adjusted its fiscal year ending from September (previously) to March as the press release states the year will now begin on April 1. If that is correct, then £150m is expected to be returned to shareholders till October 2024.

– Lord Ashcroft (co-founder and owner of a 12% stake) has been appointed as a non-executive director. This is a positive step towards strengthening the alignment of management and shareholder interests.

Charles Skinner, one of non-executive directors who has been in the role since the company’s formation, has stepped down;

With the updated net-cash figure, my sum of the parts value has increased to £8.10/share, offering 52% upside from the current levels.

Any update on this one?

Haven’t seen any updates from the company lately. The asset sale is probably still in process and earnings are coming out late June.

Could late June earnings be most likely distribution announcement – of around 150p?

It’s difficult to determine the exact timing, but it should be completed before October. The Board is currently evaluating the best approach to facilitate the return of capital and will announce further details.

Dumb question coming up – the “return of capital” will be taxed as such correct, and not a dividend? For US investors in particular?

I’m UK not US but if they do any of the cash-return as a divi, you’re divi-taxed on that. I have no idea whether they will do all divi, all buyback/’return’, or a mixture like ASCL LN did.

Trading update today:

1) £430 million Divestment expected to complete on 31 May 2024 (all approvals received)

2) £1.55 Special dividend per share (£150 million)

3) £75 million share buy-back to be launched after special dividend payment

4) FY24 results in line with market spectations

https://polaris.brighterir.com/public/marlowe/news/rns_widget/story/xjdve1x

Just noticed VIC writeup from same date:

https://valueinvestorsclub.com/idea/Marlowe_plc/8081388947

MRL’s co-founder and non-executive director, Lord Michael Ashcroft, has increased his ownership stake to 15.8% (up from 12.3% as of April 1). The company also announced that the departing CEO, Alex Dacre, “no longer holds a notifiable interest,” suggesting that his ownership stake is now below 3%, down from 4.8% as of April 1.

https://www.londonstockexchange.com/news-article/MRL/director-pdmr-shareholding-holding-s-in-company/16486215

49m guided EBITDA for RemainCo minus 10m lease cost (assume 90% of Fy23 total lease cost of 11.2m since most leases should be in TIC as pointed above) minus 1.6m SBC (1H24 x2) gives you actual EBITDA pre IFRS 16 (believing integration costs are one off) of 30m, or 9x current pre IFRS 16 EV of 322m GBP (552m mcap minus 230m net debt – I assume the 230 net debt does not include lease liabilities as I believe is the case from reconciling with the pre-divestment net debt excluding leases). Doesn’t seem that cheap?

I believe your pre-IFRS 16 EBITDA estimate for MRL’s RemainCo is too conservative. MRL has not provided a breakdown of lease liabilities by segment. However, judging by the increase in lease liabilities during FY20-22 (from £14.3m to £22.6m; and reaching £26.7m as of Sep’23), when the company was pursuing acquisitions predominantly in the GRC business, it seems likely that the share of total lease expenses attributable to the sold GRC segment should be much greater than 10%. Assigning a 30% share of FY23 lease expenses to the GRC business and deducting SBC, I arrive at £40m in RemainCo TTM EBITDA. This implies an 8x multiple.

The closest, yet much larger, publicly listed comp APG is trading at 16x TTM adj. EBITDA. Other larger peers BVI, ITRK, and SGSN are trading at 13x adj. EBITDA multiples. On pre-IFRS 16 basis, excluding lease payments from adj. EBITDA, these peers are trading at 14-19x multiples.

A number of industry transactions have been completed above 14x EBITDA multiples, while MRL itself has been performing acquisitions at an average 8x pre-synergy EBITDA multiple. In that sense, I think MRL is pretty cheap and the fact that Lord Ashcroft is buying shares adds confidence in that regard. There’s also a pretty solid catalyst in sight (capital return equal to 40% of market cap), which could help to re-rate the stock.

Also, note that the FY24 EBITDA is backward-looking and does not account for any margin improvements that management expects in both remaining segments. As stated previously, the margin recovery is expected to be driven by lower outsourcing subcontractor spending in the TIC business and ongoing M&A integration in the OH segment.

I meant 37m not 30m. According to a VIC poster the company confirmed my 10m lease figure for RemainCo. So 9x.

Also the difference vs APG is that I believe APG does not have all these restructuring costs or the risk of a major recent integration like Optima going bad.

I meant 37m EBITDA, not 30m, sorry. So you can derive it from the 49m mgmt EBITDA minus 10m capex and 1.6m SBC. That is 9x pre IFRS 16 remainco EV.

Update on Completion of Divestment, Special Dividend Timetable and Board Changes:

https://polaris.brighterir.com/public/marlowe/news/rns/story/x8yn5ew

A couple of positive updates from MRL:

– The GRC asset sale has been completed.

– £1.55/share dividend will be paid on July 5. The record date is June 14 and the ex-dividend date is June 13.

– £75m buyback program (18% of the pro-forma capitalization) will commence right after the dividend is paid.

– Executive chairman has resigned and Lord Aschcroft has taken over as a non-exec Chairman. One more step towards strengthening the alignment of management and shareholder interests.

The stock has moved upwards a bit following the news and now trades 20% above the write-up levels. Nonetheless, plenty of upside still remains and I expect the capital return to accelerate the re-rating of MRL.

The stock now trades ex-dividend (£1.55/share).

Does IBKR take an extra day to pay out the dividend?

Marlowe has been surprisingly aggressive with its recently launched £75m buyback program. The company has already repurchased 3.5m shares (3.6% of outstanding) since July 5. But that’s only £15m out of the £75m, with plenty of buyback capacity still remaining. In one day, on July 10, the company bought 2.1m of shares, which was almost all of the float during that day. As expected, this seems to have created significant upward pressure on the stock price, with MRL share price increasing 6% over the last week. I anticipate further upward pressure as management continues plowing cash into stock buybacks. MRL remains cheap at 7.4x FY24 EBITDA.

https://polaris.brighterir.com/public/marlowe/news/rns/story/rndgvpx

After the £75m is exhausted in a month or so, will they have potential for more ammunition or other catalysts? Or what’s left after that will be just a longer-term undervaluation play?

Hi DT,

So the rough math is that the stock has paid out £1.55, and now trades at £4.54. Adding that back gets you to a pre-distribution price of about £6 and your taret is £7– is that still correct?

Will be easier if you calculate it the other way round. Valuing each segment at 10x EBITDA before corp overheads results in target price of c. £6. That’s post dividend, i.e. corresponds to the current trading prices.

I’m leery of buying before they step down the bb program, as then what is the catalyst?

MRL released preliminary annual results for the fiscal year ending March 2024. In terms of financial performance, there were no surprises. The share price reaction has also been muted. RemainCo’s revenue grew by 8% YoY in FY24. However, profitability was affected by strategic review costs and temporary margin pressures (temporarily increased use of subcontractors, changes in revenue mix, etc.). Adj. EBITDA margin came in at 12.2%, down from 13.4% last year. Management expects mid-single-digit revenue growth next year and significant margin improvement. Not sure what they mean with “significant”, given that the targeted adj. EBITDA margin in the mid-term has been reiterated at 15%.

The RemainCo seems overcapitalized given its stable, highly-recurring revenues (80%) based on non-discretionary customer spend and underpinned by regulatory and insurance requirements. The company should have around £42m of net cash, following the recent buybacks. The business has historically been growing mostly through M&A, however, management had previously hinted that significant scale has already been reached. Therefore, additional capital return on top of the current £75m program is not out of the cards. From the recent preliminary results:

“The Board anticipates that the remaining net cash proceeds of the Divestment and the Group’s strong cash generation will be used either to return further capital to shareholders or, when appropriate, invest in bolt-on acquisition opportunities across TIC and Occupational Health in due course.”

The aggressive buyback pace continues. The company has already repurchased £38m worth of shares since July 5. In total MRL has repurchased almost 10% of its market cap in less than 3 weeks and on some days these repurchases contribute the whole almost the whole trading volume. No idea, how that is possible and why this has hardly any effect on the share price. Clearly there is someone of the other side of the line aggressively selling the stock.

Any other thoughts on this?

MRL is one of those less liquid stocks that have to use SETSqx (see introduction below).

If you look at MRL’s “trade recap” log on LSEG website (see link below), almost all of the MRL trades were “off-book”, i.e., they were not on the order book.

https://www.londonstockexchange.com/stock/MRL/marlowe-plc/trade-recap

“Stock Exchange Electronic Trading Service: Quotes and Crosses (SETSqx) is a trading service for securities less liquid than those traded on SETS. The auction uncrossings are scheduled to take place at 8am, 9am, 11am, 2pm and 4:35pm. There are 2 types of order book model for SETSqx depending on whether the security has registered market makers providing non-electronic quotes. An execution in the final auction will set the security’s closing price for the day and generate a closing price crossing session, which provides a further trading opportunity to execute business at the closing auction price.”

Thanks, but these off-book trades (which are most of the trades), still do not explain volume discrepancies.

Apparently, trading volumes reported by yahoo finance (which is what I was looking at before) differ from the ones shown on the page of London Stock Exchange. No idea why there is a difference – for some days yahoo/LSE numbers match, and on the others they don’t.

If we assume LSE numbers are the correct ones, MRL repurchases still accounted for almost half of the total trading volume since July 9.

Take 07/24 as example, MRL announced that “the Company has purchased 79,000 ordinary shares of 50 pence each in the capital of the Company (the “Shares”) in the market at a volume weighted average price of 449.27 pence per Share through Cavendish Capital Markets Limited (“Cavendish”). ”

LSEG website shows that the trade was executed on 16:30:57 and was marked as “off book” instead of UT (uncrossing trade) or PT (closing price crossing section trade).

The closing auction cleared on 16:35:00 with a closing price of 449.00, and a volume of only 411 shares (marked as UT). Note that LSE closing auction can end as late as 16:35:00 (or any random time within the last 30 seconds).

So the block of shares was clearly pre-negotiated by Cavendish with some large shareholders and intentionally executed and reported before the closing price was known but after the order book “went dark” (closing auction started on 16:30:00).

The buyback orders were not placed on the market in regular trading sessions, or participating in the closing auctions, and I guess that’s why they didn’t have immediate impacts on the share price.

Good to know, thanks snowball. I just bought 100 shares today at 450p to test this out but it shows zero volume. What does that say about each day of zero volume? I see volume as low as 197 shares so I don’t think it’s a minimum threshold issue.

Also I figured my trade would go through at an “uncrossing” but it did at 10:12:47 eastern US time. I’m just trying to learn how this works.

Welcome to AIM / SETSqx 🙂 You have been AIMed.

(this or similar is what I have been told all the times I ask about how this “exchange” works)

I saw two off-book trades of 100 shares @450p reported for 15:12:11 (or US 10:12:11). You can find them on LSEG “trade recap” log for MRL.

The uncrossings or auctions take place five times a day, but between them you can still trade as usual (but difficult to fill your orders unless you bid/ask more aggressively).

And you also get a chance to execute at the closing price in the closing price crossing session.

Ashcroft is clearing his estate. MRL will probably be next. See this filing from Gusbourne, another of this holdings: https://www.gusbourne.com/uploads/document/file/127/RNS.pdf

“You will have seen that as the majority shareholder of Impellam Plc I announced that I wanted to review strategic options with regard to my shareholding. That objective has now been achieved and is of public record. Now at the tender age of 78 I am reviewing my future options and would now like to conduct a similar exercise with regard to Gusbourne.

At this time I have an interest in 40,628,009 shares representing 66.76 per cent. of the issued share capital of Gusbourne. In addition a company 100 per cent. owned by me holds a £20m long term secured deep discount bond.

I am flexible as to the outcome. It may be a sale. It may be a strategic merger with a similar company. It may be a capitalisation or restructuring of all or part of my debt.”

Thanks, had not seen this. Agree, it’s a very positive sign, especially with him stressing his age as the reason for the Gusbourne strategic option. The same reasons should apply for MRL as well.

SSI member jrallen has asked above – what’s the catalyst after MRL’s buyback program ends? (as the company seems to be filling it out rather quickly). So here we go, the next catalyst will be Ashcroft selling the remaining MRL business. Worth noting, that Ashcroft’s 17% stake in MRL is worth more than 2-fold his 67% stake in Gusbourne.

I’m missing something obvious here so please correct me. Being such a large holder of Gusbourne, it makes sense they find strategic options/sell the company. But he “only” owns 17% of MRL so why would this imply a strategic option?

Partly because he’s the co-founder and current non-executive Chairman of the company, he’s more than just a regular shareholder. Given that he’s monetizing his other investments, it could be argued that MRL might also be considered for monetization.

What does Ashcroft mean by “my debt”? The £20m bond he owns?

or the debt he (or his holding company) owes others (with or without the Gusborne shares as collateral)?

“It may be a capitalisation or restructuring of all or part of my debt.”

“Marlowe plc (“Marlowe”, and, together with its subsidiaries, the “Group”), the UK leader in business-critical services which assure regulatory compliance, announces that it intends to demerge its Occupational Health division from Marlowe to form Optima Health plc (“Optima Health”) as an independent company and to make an application for the entire issued share capital of Optima Health to be admitted to trading on the AIM market of London Stock Exchange plc by way of an introduction (the “Demerger”).”

Marlowe announced demerger of its two operating segments into two listed companies. Current shareholders will receive 1 Optima Health share for every owned Marlowe share.

While I would have preferred a sale of the Occupation Health segment I think this is a very positive move as the two businesses were not really related to each other and it might be easier for market to value them as separate entities. Several takeaways from the demerger announcement:

– The spin-off will be completed rather swiftly, with OH segment set to start trading already on Sep 26. No shareholder approval will be required.

– Very positive comment regarding additional buybacks for post-demerger MRL: “Following the conclusion of the Demerger and conditional on shareholders approving further share buybacks at Marlowe’s upcoming Annual General Meeting, the Group intends to continue with this programme at levels which increase value to Marlowe shareholders. These buybacks will be funded by utilising Group cash balances, which will be retained by Marlowe following the Demerger.”

– “The Optima Health executive management team will be subscribing for new ordinary shares in Optima Health following the Demerger and immediately prior to Admission at an Optima Health equity valuation of £225 million” – while it has not been disclosed how much of the new stock management is buying, but £225m equity valuation equates to 12x EBITDA for OH division. Will see if OH will be trading anywhere close to these levels after demerger.

– The negative takeaway is that MRL was probably unable to find a buyer for the OH segment at appropriate price and therefore chose to list it separately instead.

The financial profiles of the two companies:

If OH is valued at £225m (that’s still a big ‘if’), then pro-forma for the demerger MRL currently trades at only £175m. That’s way too low for a business that is growing, produces £30m+ in EBITDA post corporate overheads, still has £35m of net cash for the buybacks and is looking to increase repurchases further.

After further loss in scale as a result of the demerger, it is possible that both stocks (in particular the new OIH stock) will see very little trading liquidity, hence no way for large/small shareholders and management to cash out via the stock market.

I think the only ways for such low (or nearly zero) liquidity stocks to re-rate are take-private or asset sales/liquidation events.

Or if they are paying very high dividends, e.g., >15% yield.

That is likely to be the case and most probably OIH will sell-off following the split – I would be very positively surprised if OIH actually trades at the indicated £225m valuation (at which management will apparently be buying new shares).

In itself this split into two listed companies does not create any value, but we get a chance that market participants will value the streamlined businesses at more favorable multiples. Also the remaining buyback authorization at MRL will pack a bigger punch (i.e. higher portion of pro-forma market cap).

anyone know what pro forma cash / net debt is currently?

For my calculations I have used net cash figure of £35m, i.e. the amount that still remains under the buyback authorization.

MRL provided an update on the demerger of its Occupational Health division – Optima Health will begin trading on Sep 26.

The strange part of the announcement is this one:

“Admission of Optima Health, with an anticipated market capitalisation on Admission of approximately £190 million, is expected to take place…”

Contrast this with a higher number mentioned in previously in a slightly different context:

“The Optima Health executive management team will be subscribing for new ordinary shares in Optima Health following the Demerger and immediately prior to Admission at an Optima Health equity valuation of £225 million.”

I have no idea why the expected market cap (which might be indicated for spin-off tax purposes only) is different from the equity valuation at which management is buying new shares.

Nonetheless, the previous figure did look a bit stretched. The £190m capitalization, at 10.5x EBITDA, is close to what I’ve assumed in the write-up above, but I wouldn’t be surprised if Optima sells-off below the £190m valiaution once the trading begins.

https://www.londonstockexchange.com/news-article/MRL/further-re-demerger-of-optima-health/16678669

Looks like MRL shares halted on the LSE

I guess that’s the demerger process going into effect. Haven’t seen any additional news or announcements so far.

Anyone find the Optima Health ticker?

I couldn’t find it myself

It’s here: https://www.londonstockexchange.com/stock/OPT/optima-health-plc/company-page

As expected the stock sold-off quite sharply upon listing and Optima Health currently trades at GBP130m market capitalization (way below the 190m and 225m figures suggested previously by management).

On combined based (MRL+OPT) we are still at pretty much the same levels (470p+ per share) as before the demerger.

I see that on IBKR, but not with some other brokers.

As always after a split-off prices take a while to stabilize.. Marlowe trades around 325 – 335 GBp, while Optima is currently at 151 GBp.. which adds up to.. 480 GBp 😀

Are you able to trade OPT on IBKR. It shows up but essentially “blank” on the brokerage

Ditto for me. I believe that in the press release, MRL disclosed that it will take up to 10 days to deliver the actual shares. I am guessing what we currently have are tracking shares. Could be wrong.

got it. wanted to get out of OPT but guess that’s not possible. Didn’t want to sell pre-spin because of taxes haha.

For those when-issued OPT shares currently being traded, where do the sellers get their OPT shares for settlement? Just brokers making a market?

Apologies for my ignorance, but what do you think is the reason the market started buying MRL, causing it to rise 50% from today’s low?

Not sure how many trades happened at that ±220p level. It was probably a very minimal amount. So it was more of a brief glitch than a real reference point for the price. MRL and OPT combined are now at same levels as pre-demerger MRL. So it’s not really a +50%

Is this a current fair summary of the valuation today for Marlowe?

Mcap 277m – 35m net cash = 242m EV

Segment Adj EBITDA for TIC 35m – 50% of HQ costs 2m – 70% of Lease cash cost 10m = 23-24m EBITDA after leases (I believe TIC has the majority of the leases between TIC and OH, so allocated 70% of the continuing ops lease cash cost above to TIC)

Implies 242 / 23.5 = 10.3x EV/EBITDA

Seems expensive? And this is before all of the restructuring costs etc

With capex of 14m in FY24 split equally between TIC and OH + 25% tax rate would bring the 10x EV/EBITDA to 20x EV/FCF (assuming neutral NWC and D&A = capex for tax effects) for RemainCo MRL. I.e. (23.5 – 7) x (1-25%) = 12m FCF => 242 / 12 = ~20x

Will the calculation also suggest that OPT is cheap at its current market cap?

Nope also 10x plus EV/EBITDA with minimal actual FCF after all the restruturing

Especially if you also consider some duplication of listing and directors salary costs after the spin

I have sold down OPT part of the position (the spin-off) at £1.6/share. I continue to hold MRL. The company is buying back stock on a daily basis and, by my count, still has £30m left for further repurchases.

At the current pace of about £0.5m/ trading day, £30m will last about 3 months.

Wondering who has been selling to the company, because almost all trading volumes have been off-book block trades and it’s very difficult for retailer investors to buy/sell MRL.

MRL has stopped buying back shares since 11/15 (last reported). Have they run out of quota? or entering a blackout period?

Not sure what the true reason is, but they still have quite a lot of buyback capacity left—around 67% has been utilized so far. It could be due to a blackout period ahead of an announcement or simply a temporary pause.

A very familiar name to SSI members, Oasis Management Company, has just disclosed a 5% stake in MRL, via a cash-settled total return swap.

MRL recently reported half-year results (ending September 30). This is the first report focusing solely on the remaining TIC segment, following the OH segment carve-out. Results and the outlook were in line with expectations.

Management is guiding for MRL’s EBITDA in FY25 to be £36m (£40m TIC segment EBITDA less £4m in corporate overheads). RemainCo currently has £30.8m in net cash. After deducting lease liabilities, this drops to £9.2m.

With these figures company currently trades at 7.6x FY25 adjusted EBITDA, which seems cheap for this business. Peers trade at teen adj. EBITDA multiples and a number of industry transactions were previously completed above 14x EBITDA.

Management is targeting 15% adj. EBITDA margins for the TIC segment in the medium term (compared to 12.3% for FY25). At that improved margin level, MRL would be trading at a 6x multiple (based on the same FY25 revenue guidance). If the company achieves its guidance and re-rates to 10-12x adjusted EBITDA, the potential upside could be 60-90%.

For now, management plans to focus on margin expansion and organic growth, with the possibility of executing attractive bolt-on acquisitions in the fragmented TIC market.

Even without any immediate catalysts, I continue to like MRL due to a combination of reasons: 1) cheap and good business, undervalued compared to peers and industry deals; 2) share buybacks; 3) involvement of Lord Ashcroft, who could eventually push for a sale; 4) and the recent entry of Oasis Management (5% stake), which could also ramp up pressure on the management.

Although share buybacks have been on hold since November 18, management has been very positive about them in recent annual results. So I think repurchases are likely to resume soon. With £24m (8.5% of the market cap) remaining in the current authorization, these buybacks could help to push up the share price (even though that hasn’t really been working that well so far).

Buybacks are back, today 500 000 shares. Besides Lord Ashcroft has been adding shares and now owns 18.11% of the company

Ashcroft hasn’t been adding. His stake increased in percentage terms purely because of shrinkage in MRL’s total shares outstanding.

“Lord Ashcroft PCMG PC remains beneficially interested in an unchanged 15,310,170 Ordinary Shares, now representing 18.11 per cent. of the Group’s issued ordinary share capital.”

I am closing my position in Marlowe. The key reason for this decision is that, contrary to my expectations, the ongoing open market buybacks have had no impact on the MRL share price.

When Optima Health was spun off in September 2024, MRL still had £30m allocated for buybacks. To date, half of this allocation has been used, but it has had no effect on the share price. On some days, these buybacks have represented a significant portion of the total trading volume. As the buyback allocation is exhausted in the coming months, I am concerned that, without the support of these buybacks, MRL shares may begin to decline.

While the company still appears undervalued based on management’s guidance (trading at 7.6x EBITDA versus peers in the teens), once the buyback program is fully utilized, the story will shift toward re-rating and margin improvement—which doesn’t particularly excite me. Additionally, my expectations that Oasis or Lord Ashcroft would push the company into action have not materialized.

Together with Optima Health spin-off (which I exited in Oct) and special dividend in Jun’24, this position delivered 26% return in a year.

I am very curious what Oasis’s game place may be. A special situation fund like Oasis rarely enters into a very illiquid position without a controllable exit route.

April 28 update:

“Marlowe, the leader in business-critical services, is pleased to announce that it has now returned an aggregate of £72 million to Group shareholders pursuant to the share buyback programme announced by the Company on 22 May 2024 to return up to £75 million (the “Programme”).

The Group announces that on conclusion of the Programme it intends to return up to an additional £15 million to shareholders by way of on-market purchases of ordinary shares of 50 pence each in the capital of the Company (“Ordinary Shares”) from the date of this announcement (the “Additional Programme”).”

“The Group’s continuing operations are expected to deliver FY25 revenue of approximately £305.0 million and adjusted EBITDA1 of approximately £32.5 million (after £4.2 million of head office costs), both in line with market expectations2. Adjusted profit before tax1 is expected to be ahead of market expectations2 at approximately £18.5 million.

At 31 March 2025, Marlowe had a net cash position (excluding IFRS lease liabilities) of approximately £22 million, reflecting strong cash generation ahead of market expectations in the period and progress made on the share buyback programme which returned an aggregate of £66 million to Marlowe shareholders over the course of FY25. As at 31 March 2025, the Group’s £50m debt facility remained undrawn.”

“Marlowe plc notes press speculation and confirms that it is in discussions with Mitie Group plc (“Mitie”) regarding a possible offer for the entire issued and to be issued share capital of Marlowe.”

Under the terms of the Acquisition, each Marlowe Shareholder will be entitled to receive for each Marlowe Share 1.1 New Mitie Shares and 290 pence in cash,

· Based on Mitie’s closing share price of 160 pence as of 4 June 2025 (being the latest practicable date prior to this announcement), the Acquisition represents a total implied value of 466 pence per Marlowe Share, valuing the entire issued and to be issued ordinary share capital of Marlowe at approximately £366 million.

Looks like I was not patient enough and exited this one too soon (see comment on Jan 31).

4 additional months of waiting would have resulted in +35%.

But at least glad to see that the whole thesis worked out fully in the end.