Performance – May 2024

SSI tracking portfolio was down -0.8% in May 2024. A detailed performance breakdown is provided below.

Below you will find a more detailed breakdown of tracking portfolio returns by individual names as well as elaborations on names exited during the month.

TRACKING PORTFOLIO -0.8% IN MAY

Disclaimer: These are not actual trading results. Tracking Portfolio is only an information tool to indicate the aggregate performance of special situation investments published on this website. See full disclaimer here.

The chart below depicts the returns of SSI Tracking Portfolio since the start of 2017.

![]()

PERFORMANCE SPLIT MAY 2024

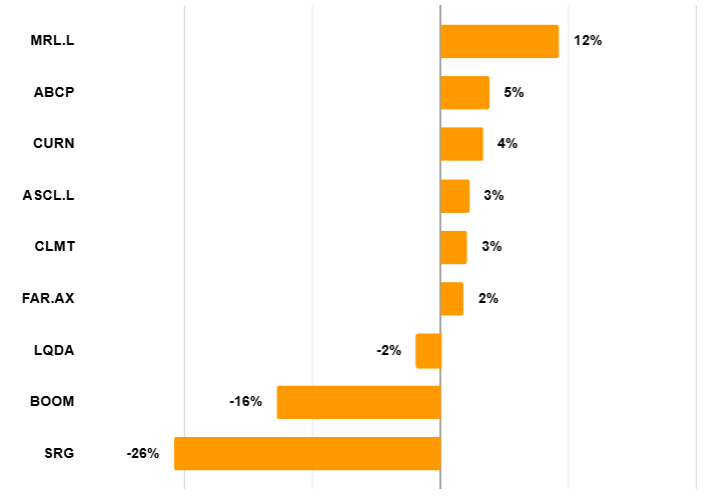

The graph below details the individual MoM performance of all SSI Portfolio ideas that were active during the month of May 2024.

PORTFOLIO IDEAS CLOSED IN MAY

Seritage Growth Properties (SRG) -14% in c. 2 years

Seritage Growth Properties owns interests in former Sears and Kmart properties throughout the U.S. SRG had planned to convert these retail locations into more valuable real estate, such as office space or multi-family apartments. However, poor execution and COVID-19 disrupted their plans. As a result, the company decided to start an orderly liquidation process to repay large $1.44bn loan to Berkshire Hathaway and then potentially realize value for the equity holders. Management had initial expected distribution for equity holders to be in range of $18.50- $29/share (vs. position open price of $8.08/share). This was adjusted to $14-$20/share as of Q3 2023. Then in April’24 adjusted again to $11-$17/share. The final drop in the bucket was May’s announcement that the expected property sale prices are materially lower than communicated just a few weeks ago without providing any explanation for the cut. SRG shares fell by 33% upon this announcement. Management has completely lost the trust of the market, and it is hard to have any confidence in their guidance anymore (on new property value numbers NAV is c. $7-$11/share). Given the remaining high leverage, and misaligned incentives (large compensation) the risk/reward is no longer attractive. The position was closed with a 14% loss in approximately two years.

Archive Of Monthly Performance Reports

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020