Carnarvon Energy (CVN:AX) – Strategic Review – 60% Upside

Current Price: A$0.19

Target Price: A$0.30+

Upside: 60%+

Expected Timeline: H2 2024

This idea was shared by Jeremy Raper (aka Puppyeh).

Carnarvon Energy is a quintessential deep value, forgotten equity, trading today just slightly above it’s cash + capex carry (~18c versus 19c current price), despite owning a substantial stake in the most meaningful O&G discovery in Australia over the last 30 years (the Dorado discovery). CVN also presents one of the most attractive special situation setups currently on the market. Group of activists, who have recently overhauled the board, are shopping the company and its assets. Last year’s partial monetization underscores the value of the remaining CVN’s assets. This should be a high-IRR outcome from here with a clear shot to at least 30c in total value. Downside is well protected with cash and carry backing the majority of the share price today.

Background: the Bedout Basin, Dorado/Pavo

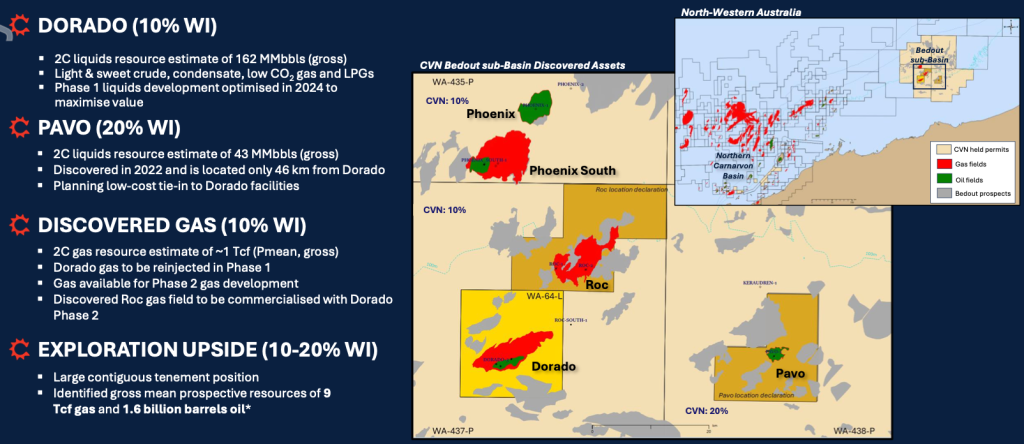

Carnarvon owns a portfolio of minority interests in Bedout Basin (100km+ from the Northwestern coast of Australia). CVN’s key assets today are its 10% stake in the Dorado, and its 20% stake in the Pavo.

Note that the operator in both assets is Aussie oil major Santos (80% at Dorado and 70% at Pavo, respectively); and that CVN used to own an additional 10% in each asset but sold down partially to CPC, the Taiwanese national oil company, last year for a total price of US$146mm.

In 2018, the Dorado constituted ‘the largest oil discovery in the North West shelf of Australia in the last 30 years’ (see here). Since discovery, Santos/Carnarvon have spent considerable amounts to develop and quantify the resources, across not just Dorado but also the latest discoveries at Pavo and Roc (I am lumping all three assets together given their geographical connection and the fact that CVN transacted on this basis last time around).

Despite all of that, CVN’s share price has declined 70% post Dorado discovery (2018). This has been mostly a function of lethargic development pace and malicious ex-management team, which destroyed a lot of shareholder value through self-dealing, very high G&A expense and etc.

Recent events: activism and launch of the monetization process

In December 2023, two major shareholders Nero Resources and Collins Street (collectively owned 12% at the time) joined forces and orchestrated an overhaul of the board. With adults in charge, CVN’s strategic priorities were swiftly changed to preserve balance sheet, “significantly” reduce G&A and explore sale or further asset divestitures. The new CEO, Mr Huizenga, has been amply incentivized with 7.5mm performance that only vest at 30c a share over a 20 day VWAP period.

Fast forward to today, the situation is getting pretty spicy. The sale process is in full swing and a number of very recent developments only strengthen the idea that value (i.e. north of 30c) will be realized. Investment bankers have begun to seek bids for CVN and its assets. CVN put out a new deck that to my mind reads basically like a pitch deck for a sale: it highlights the SoTP valuation of the equity, using very similar assumptions to those I envisage (CPC valuations on the rest of Dorado, plus a bit more for the residual Pavo stake), and results in a total value of something like 33c a share.

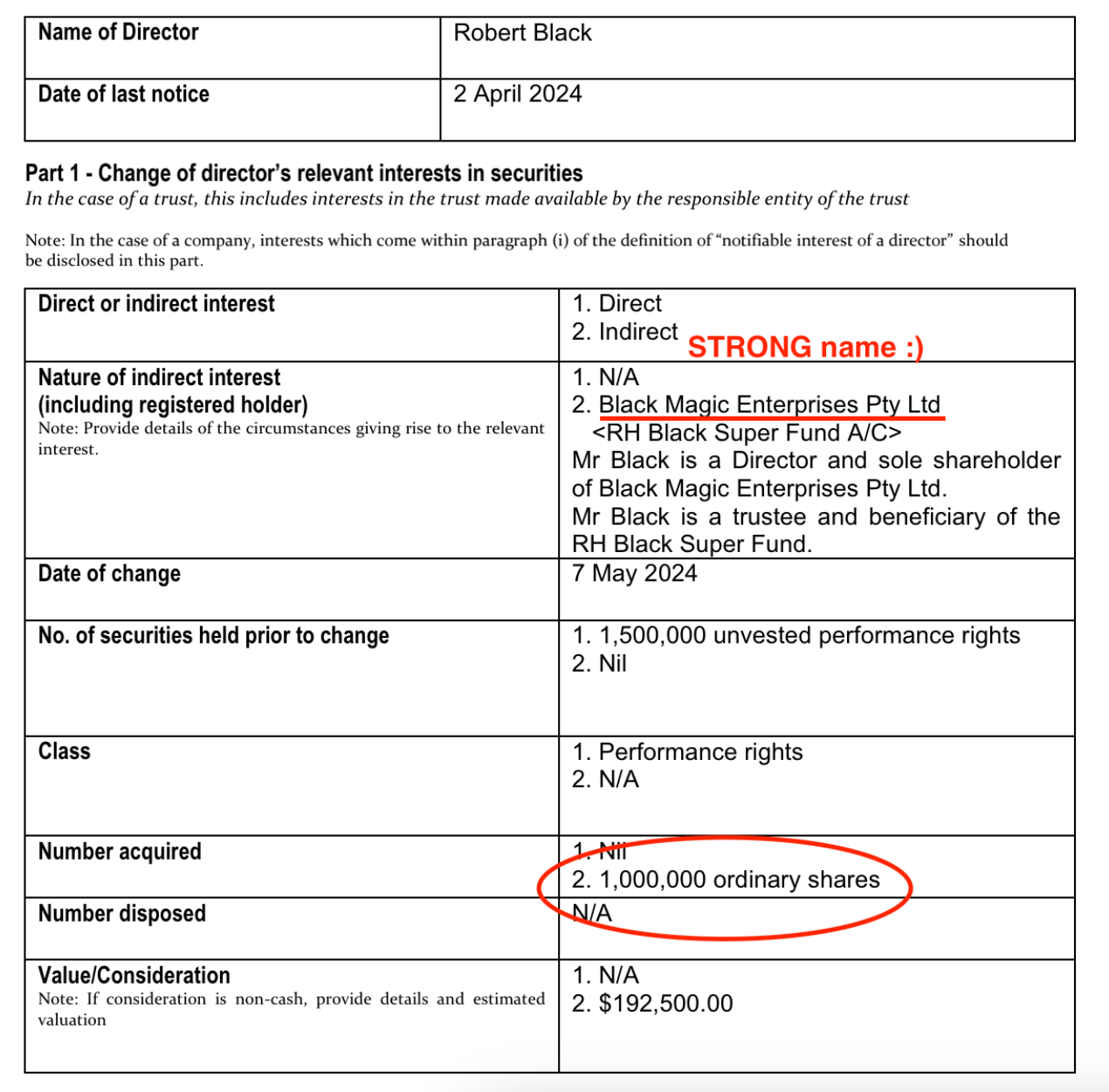

I believe anything close or north of 30c a share would get the blessing of this board for a transaction – hence marketing of this nature. That certainly seems achievable, and the Board appears further to be reshuffled to shop the asset and company, formally, given a Cap Markets guy not only is being brought on to Chair the thing (notice the curious placement of the finance guys, Rusty and Robert Black, well ahead of the CEO and CFO in the lineup!!):

…but also said capital markets gentleman has not been shy about buying shares in the open market. If someone behind ‘Black Magic Enterprises’ is hoovering shares in the market, I can only imagine good things will happen:

Collins Street, one of the key driving activists behind the board coup and the new value-maximizing direction, has also been buying substantial new blocks of stock in the 19c range. It now owns 8.82% stake vs 6.9% in December (at the time of the board overhaul).

I would expect, at or around the timing of FID (Final Investment Decision), Dorado and residual assets to have been comprehensively shopped and probably transacted – and for CVN shareholders to realize around 30c or slightly more of total value. Meanwhile, cash interest accrual almost fully covers SG&A expenses, resulting in minimal cash leak.

Regulatory risk and delays to FID

One of the main risks here has been regulatory delays to Dorado’s FID based on cultural heritage concerns. This delay has been stretching for 2 years and has been attributed by Santos – the operator, and thus arbiter of when the FID is taken – to the issues with investing in Australian O&G assets. The main one being regulatory red tape from ongoing environmental and Native Title challenges to hydrocarbon exploitation. Santos had form in this complaint: the construction of an undersea pipeline to another one of their development assets, Barossa Valley (a >$5bn project), was previously held up in the courts because the Australian High Court decided that the cultural heritage of the under-sea habitats had not been properly considered before the relevant development permits had been granted. Other developers, such as Woodside, have faced similar issues (e.g. at their Scarborough development). The general consensus is that a project like Dorado would face similar concerns. That could be an impediment to both FID and getting new money come in to acquire and develop assets of this type.

And yet, these regulatory issues – whilst they most certainly affect the timeline to market for the underlying asset – should not, I believe, affect our ability to extract value for the CVN shareholder (at least not from this price). The main reason for this is simply that CPC has already acquired stake in the same asset, knowing full well the Native Title/regulatory risk, and that the asset was pre-FID. Then, in Jan’24, the High Court found Native Title challenge to Santos’ Barossa Valley gas pipeline to be completely without merit. This has been a huge positive for both Santos and, clearly CVN, as it makes the job of either progressing Dorado to FID, or simply selling it to a third party – both hugely accretive to the equity – so much easier. Santos’ FID for Dorado was reiterated for end of 2024;

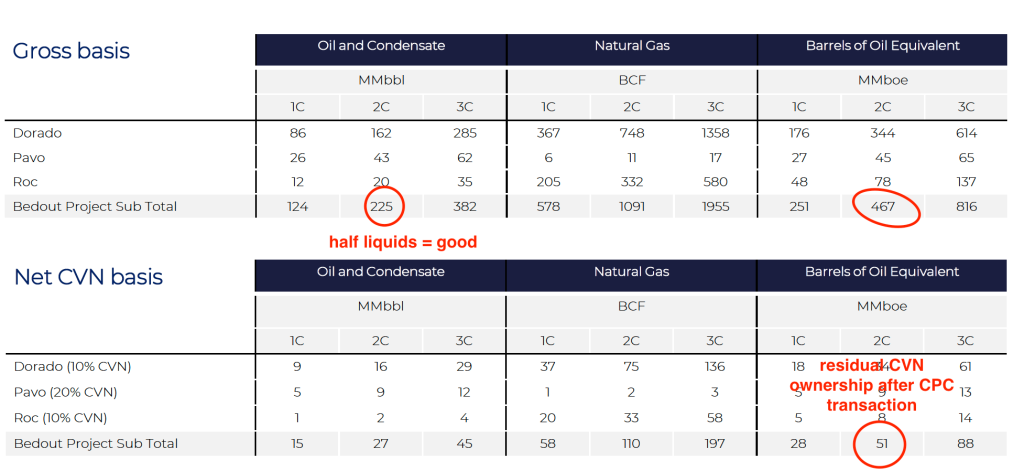

World-class O&G assets

CVN suggests the 2C gross contingent resources across the Bedout Basin assets constituted 467mm barrels of oil equivalent, with basically half of that number being liquids (ie much more valuable):

Of course, we are talking about ‘contingent’ resources (2C), not ‘proven and probable’ (2P) resources, as these assets are yet to have taken FID yet, though Santos and CVN are guiding a decision on this front in 2024. Note also that, whilst I am hardly an O&G expert, I have consulted with a number of specialists who uniformly conclude this is truly a world-class discovery, not just for its size and scale – enough to support a 10-15 year life producing 60k-100k barrels a day, on the first phase alone, from merely a fraction of the total resource mapped thus far – but also for the characteristics of the field. Dorado is located at a pretty shallow depth (70-100m), with high quality reservoirs that apparently allow for simplified oil field design; and meanwhile the oil produced is of a low sulfur content that actually provides for premium pricing versus market standard grades.

Moreover, the later Pavo, and Roc, discoveries theoretically speak to the potential for a gargantuan amount of additional resource to be discovered, and added, later on through further drilling and exploration. The main attraction of this particular basin (the Bedout Basin) as opposed to nearby, older basins (Carnarvon Basin and Bonaparte Basin) is the fact that this particular area was underexplored for many years and thus offers a fertile patch for exploration, in a historically Tier 1 area of a Tier 1 geography (Australia). You can read a little more about the history of the development, here.

Without going into too much detail on the more speculative additional resources – that is, what is unproven beyond Dorado/Pavo/Roc, through the last round of monetization – it is at least worth considering what CVN thinks could be under the water. Recall that the gross 2C Contingent Resource at the three currently defined discoveries, Dorado, Pavo, and Roc, is around 467mm BOE today. But CVN thinks there may be up to 3.3 billion BOE – that is, 8x the current 2C profile – in further hydrocarbons available (noting that CVN owns generally 10-20% stakes in most of the areas).

It is certainly not my intention to accord wallops of value for speculative, as-yet-unproven hydrocarbons that may well require many millions to proven, let alone exploit. And yet I believe it is important to demonstrate some of the context here: this is an incredibly oil-rich find, in a highly-prospective region; yet it is housed in an equity currently valuing all of this hard, and soft, optionality, at almost zero value.

A few odds and ends

- While CVN is making noises about being able to fund its share of development costs for Dorado, I do not believe any of the core shareholders really want to sign up for another half-decade (or more) of investment before production, and think a third-party sale to a strategic with multi-decade duration makes far more sense as a value-creating exit strategy. I am perhaps less sanguine on the oil price than some, but really not much has changed re the third party value of the Dorado/Pavo assets from price moves; and indeed the main factors – Santos advancing to FID or not; and native title restrictions/risks around development – have both receded, substantially, in the last 3-6 months.

- Nero Resources (one of the activists) is an interesting entity: based in Perth and specializing in mining-related investments, they have an amazing long-term track record, based (according to their website at least) largely upon a deeper understanding of the underlying geological quality of their assets.

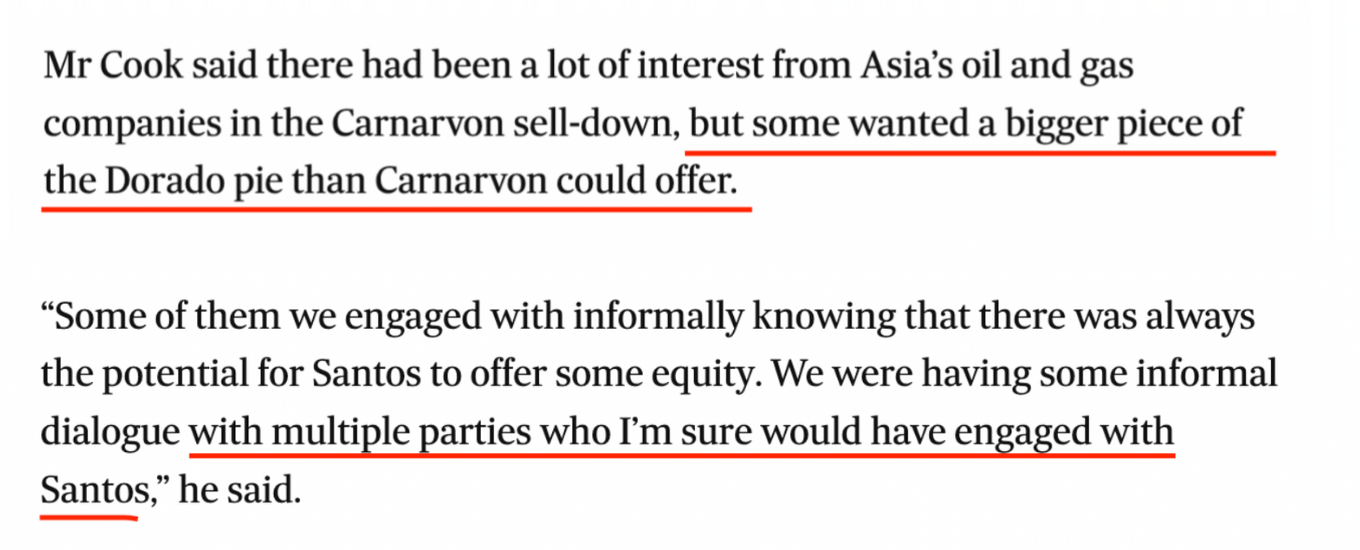

- CPC, at the time they acquired their stake in Bedout, appeared quite interested in acquiring a much bigger stake (as were other Asian acquirers) than the 10% piece of Dorado/Pavo that CVN was willing to sell – suggesting an obvious ‘quick win’ would be just to go back to them and offer them a second bite. Here is what CVN’s CEO had to say about the process last year:

How would you compare and contrast the prospects of this one with $OEL.AX (Ideas Elsewhere) which has tanked and appears to have traded all the way down to net cash despite having material insider ownership and incentives to sell?

I ask from the perspective of someone who can’t reliably value this business but is looking at incentives and cash for downside protection.

Given the declines in 1P reserves of 35% 2022:2023, the geologic differences per field, risk of reserves (in FY 2023, OEL spent US$21MM on GC-21 and yielded nothing), low well count of 3.0 gross, the market could be valuing OEL as “no asset sale” with the G&A drag of $6.4MM/yr consuming the remaining reserve value. Perhaps the best value for management is to ride out the cash flow.

The main issue (and that should really have been mentioned in the write-up) is that Santos clearly doesn’t want to develop/operate Dorado, and they will aim at selling-down a large part of their ownership in Dorado after FID is finalized.

So you have a situation where prospective buyers have no clarity as to who is going to operate this field, and you also have a potential glut of selling in Dorado interests. On the one hand it limits the universe of possible buyers, and on the other hand it puts a ceiling on the price CVN could get

That being said I agree downside is well protected here

Seems like a pretty important point. Without knowing who is going to develop the field why would anyone buy the WI unless they can do so at a big discount. Seems like it is priced to reflect that risk. Unless someone has insight into Santos’ plans. Or the buyer would be interested in taking out Santos’ also.

whilst no doubt it could have garnered more discussion in the writeup, keep in mind CPC – the Taiwanese – bought their stake when Santos’ position on the asset was just as uncertain (if not more so, actually). at that time we were even further away from FID; Santos was still trying to divest a stake; AND there was the indigenous challenge re Barossa in play. since then, the indigenous challenge has been struck down by the High Court; oil prices are higher (a little); Santos has tried to merge with Woodside and failed; and now needs to progress to FID if they have any hope of selling down their stake in the project (a much more meaningful size). that is to say, the only way out for Santos, is to go deeper in.

i would agree – in general – that it seems difficult to expect a bumper price in the current context. On the other hand I also expect STO to bite the bullet and move to FID in the next six months – even if only to open up optionality for themselves – and even if you simply get what CPC last paid this is a 50% return from current with no downside.

I don’t see it. Sure the MC is protected by cash and carry. But those numbers are fuzzy. The business is burning cash and even at these post cost-cutting rates, they still have about 2 years of cash left. Really have to hope this thing gets sold and fast. I think that’s just too much hopium required (even with the incentives)

I see this pitch as more speculation than certainty. Very complicated. This is why I (correctly) stayed away from Spirit a few months ago. Just too many moving parts and inherent risk. I hope I’m wrong.

How do you get 2 years of cash left? They barely burnt any cash last quarter thanks to interest income received on their cash balance (-1.12m for exploration vs +1.017m for operating activities, note that operating activities include corporate overheads)

True. My error – a miscalculation using old balance sheet and cash flows.

It looks like CVN is doing some housecleaning. The company announced that it has monetized and exited its biorefinery business interests. As I understand, these were tiny, probably insignificant assets? Management reiterated that this was done as part of their strategy to maximize the value of the Dorado project and Bedout Basin assets.

https://cdn-api.markitdigital.com/apiman-gateway/ASX/asx-research/1.0/file/2924-02821496-6A1213243

Story unchanged with yesterday’s new/dip correct?

https://www.energy-pedia.com/news/australia/canarvon-energy-provides-dorado-update-196821

JR, DT,………Buehler?

https://www.upstreamonline.com/field-development/fid-delayed-as-fpso-options-re-evaluated-for-australian-oil-project/2-1-1679403

i exited my position here yesterday post the announcement that FID would be pushed back to ‘2025’. most concerning was the lack of guidance when in 2025 that would occur; surely if it were early or even in 1H of 2025, that would have been stated. so, i am no longer willing to give this another 12+ months as clearly i was too cavalier wrt Santos’ ability to progress this project to FID. since getting to FID appears now the sine qua non of the CVN sales process, even though at 19c (where i sold my shares) downside was in my mind minimal, there is still a large opportunity cost in waiting for the eventual sale/FID tandem which may be only further pushed back if STO is sold.

16c is basically below cash, or thereabouts, so hard to see much downside from these levels and not sure id sell it there. but i did exit the position for all of the above reasons, slightly higher.

Maybe I’m not seeing the big picture, but doesn’t this news make the asset more valuable? Albiet with a longer time to realization of the value.

By reducing the costs (assuming you believe management) and making the time to first oil shorter – wouldn’t that raise the value of the asset in the eyes of an acquirer?

I agree. Delays in FID are not so uncommon. For those who longer-term investors, I do not see this press release as a significant issue:

– “These opportunities are expected to considerably improve the project’s economics and reduce the time to first oil”;

– “Carnarvon estimates that the overall CAPEX prior to first oil will be below the previous guidance of ~US$2 billion”;

– “up-front capital expenditure savings are expected to be material to the Company”.

is DT or anyone still involved in this?

I’m no longer involved, but continue to monitor the situation. I think the outlook for the case has worsened since July.

– Oil prices have slumped – WTI is down over 16% since July and more than 20% since Dorado’s stake was sold to CPC in August 2023.

– No encouraging updates on FID from either CVN or Santos so far.

– Media reports suggest Santos’ CEO is “wary about the $US2 billion-plus Dorado oil project and has warned the company’s WA division needs to wear the costs of a big decommissioning pipeline”. HotCopper chatter says this might just be an excuse to delay the project.

– Dorado wasn’t mentioned in Santos’ latest FCF guidance slide, even though other development projects were. One analyst brought it up on the recent conference call, but the response was vague. Other comments on Dorado were not inspiring, plus, the CEO confirmed Santos would look to divest part of its stake before moving forward with FID.

Presentation https://www.santos.com/wp-content/uploads/2024/08/2024-Half-year-results.pdf

Anyone want to revisit this at 0.1c? We are basically at cash. As per the latest presentation, this is basically the floor valuation that we’ve seen on this co.

So Enterprise Value is a $1.0Mn at the moment….

My 2 cents:

Management appears to be initiating a capital return program, intending to distribute up to A$0.07 per share to shareholders. This represents a significant return, potentially up to 70% of the current share price (assuming no taxes), driven by ongoing delays in the Dorado project and a lack of immediate alternative value-realization opportunities.

Following this capital return, Carnarvon Energy is expected to retain at least A$62 million in cash, equivalent to approximately A$0.034 per share. This means the remaining equity ‘stub’ would trade just below its cash backing.

However, there’s a critical caveat: management plans to deploy this remaining cash towards advancing the Dorado project, including exploration drilling (with a return to drilling expected in 2026) and progressing Dorado to its Final Investment Decision (FID). There are also indications that additional debt may be raised to fund these future project requirements. Consequently, the value of the post-dividend ‘stub’ effectively becomes an optionality play on management’s ability to successfully execute these development plans.

Ya that’s a fair shout. The funny thing about the earmarked capital is if its invested, then in my little head, you need to assign an enterprise value of some sort to the Dorado stake. At that point, the equity shouldn’t be a nil since there is progression on development (perhaps I’m missing something here).